|

市場調查報告書

商品編碼

1801803

包裝用發泡聚苯乙烯市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Expanded Polystyrene for Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

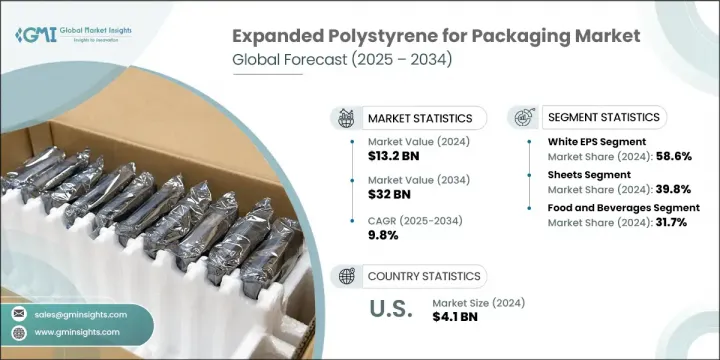

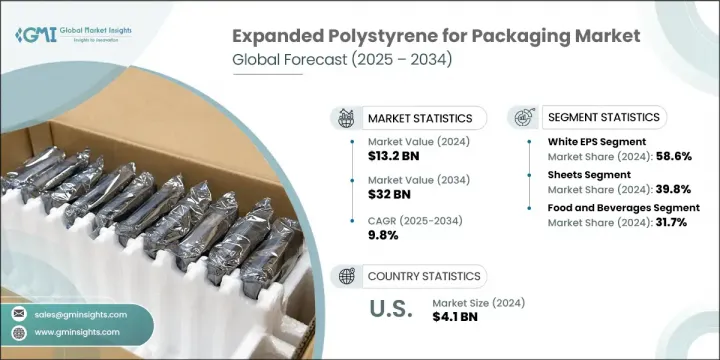

2024年,全球包裝用發泡聚苯乙烯市場規模達132億美元,預計到2034年將以9.8%的複合年成長率成長,達到320億美元。市場對輕質、減震且隔熱性能高的包裝材料的需求推動了這個市場的成長。發泡聚苯乙烯有助於在長途運輸過程中保護貨物(尤其是易腐爛貨物),保持結構完整性並保鮮。人們對即食食品和便利食品解決方案的日益成長的偏好也推動了對高效可靠包裝形式的需求成長。

蓬勃發展的電子商務活動和快速送貨上門服務持續推動 EPS 包裝市場的擴張。隨著越來越多的消費者轉向在線購買食品雜貨、電子產品和藥品等商品,他們更加重視輕質且具有足夠韌性的包裝,以保護運輸途中的貨物。製造商和物流供應商越來越青睞 EPS,因為它能夠滿足這些要求,並支援經濟高效的運輸。這種材料的可靠性、強度重量比和絕緣性能使其成為滿足現代配送和交付需求的各個行業的關鍵選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 132億美元 |

| 預測值 | 320億美元 |

| 複合年成長率 | 9.8% |

2024年,白色EPS仍是表現最佳的市場區隔市場,市場估值達77億美元。由於其價格實惠、可靠性高、適用於各種包裝應用,白色EPS廣受青睞。從快速消費品和農產品到電子產品和家用電器,白色EPS依然佔據主導地位。成型和表面技術的進步提高了其與高速自動化包裝系統的兼容性。雖然外觀簡單,但白色EPS廣泛應用於大批量、成本敏感且注重速度和功能的包裝領域。

2024年,EPS片材市場規模達52億美元。這些片材具有優異的抗衝擊性、重量輕且經濟實惠。它們通常採用模切或泡棉背襯層壓工藝,以增強電子產品、機械設備和消費性電器包裝的結構保護。這些行業對客製化和保護性包裝的需求不斷成長,確保了EPS片材在未來幾年仍將是首選材料。

美國包裝用發泡聚苯乙烯市場在2024年創收41億美元,預計2034年的複合年成長率為9%。美國蓬勃發展的食品和飲料產業持續推動EPS的使用,尤其是在冷鏈物流和保溫應用領域。線上購物趨勢進一步擴大了對EPS保護性包裝的需求。市場參與者目前正在探索生物基替代品和永續回收方案,以應對日益成長的環境問題。對輕量化包裝的重視,有助於減少運輸排放並降低成本,這正在推動創新,為美國市場開闢新的成長途徑。

影響全球包裝用發泡聚苯乙烯市場的關鍵參與者包括 BASF SE、KANEKA CORPORATION、Alpek SAB de CV、TotalEnergies、Synthos、Dart Container Corporation、無錫興達泡棉塑膠、玉井化成株式會社、杜邦、Styrotech, Inc.、Vers00,A、Mmerkak0000,000) 大樓。 EPS 包裝市場的領先公司正在實施一系列產品創新、區域擴張和永續發展計劃,以保持競爭優勢。許多公司正在投資開發回收和生物基 EPS 解決方案,以順應全球環保趨勢。與物流公司和快速消費品公司的策略合作夥伴關係使他們能夠滿足不斷變化的包裝需求。生產自動化和客製化 EPS 模具優先考慮,以滿足來自線上零售和冷鏈供應鏈的大量需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 食品飲料產業需求不斷成長

- 電子商務和送貨上門服務的快速擴張

- 建築業的成長

- 成本效益和多功能應用

- 可回收性和技術進步

- 產業陷阱與挑戰

- 環境問題和監管壓力

- 永續包裝替代品

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 歷史價格分析(2021-2024)

- 價格趨勢促進因素

- 區域價格差異

- 價格預測(2025-2034年)

- 定價策略

- 新興商業模式

- 合規性要求

- 永續性措施

- 永續材料評估

- 碳足跡分析

- 循環經濟實施

- 永續性認證和標準

- 永續性投資報酬率分析

- 全球消費者情緒分析

- 專利分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 黑色的

- 灰色的

- 白色的

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 工作表

- 托盤和蛤殼

- 泡沫冷卻器

- 杯子和碗

- 包裝花生

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 黑色的

- 灰色的

- 白色的

- 餐飲服務

- 黑色的

- 灰色的

- 白色的

- 衛生保健

- 黑色的

- 灰色的

- 白色的

- 電子和電器

- 黑色的

- 灰色的

- 白色的

- 建築和施工

- 黑色的

- 灰色的

- 白色的

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Alpek SAB de CV

- BASF SE

- Cellofoam

- Dart Container Corporation

- DuPont

- Engineered Foam Products

- Epsilyte LLC

- Flint Hills Resources

- Foam Holdings, Inc.

- Foam Products Corporation

- Foamcraft USA, LLC

- Geofoam International LLC

- Harbor Foam

- KK Nag Pvt. Ltd.

- KANEKA CORPORATION

- Michigan Foam Products LLC

- Poliestireno de San Luis SA de CV

- Storopack

- Styropek

- Styrotech, Inc.

- Synthos

- Tamai Kasei Corporation

- TotalEnergies

- Versalis SpA

- Wuxi Xingda Foam Plastic

The Global Expanded Polystyrene for Packaging Market was valued at USD 13.2 billion in 2024 and is estimated to grow at a CAGR of 9.8% to reach USD 32 billion by 2034. This market growth is being driven by the need for lightweight, shock-absorbing packaging materials that offer high insulation properties. EPS helps protect goods-especially perishables-during long-distance transport by maintaining structural integrity and preserving freshness. The rising preference for ready-to-eat meals and convenient food solutions is also prompting increased demand for efficient and reliable packaging formats.

Surging e-commerce activities and rapid doorstep delivery services continue to influence the expansion of the EPS packaging market. As more consumers shift toward purchasing items like groceries, electronics, and pharmaceuticals online, there is a stronger emphasis on packaging that is lightweight yet resilient enough to protect goods in transit. Manufacturers and logistics providers increasingly favor EPS as it checks these boxes and supports cost-effective shipping. The material's reliability, strength-to-weight ratio, and insulation capabilities make it a key choice across sectors responding to modern distribution and delivery needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.2 Billion |

| Forecast Value | $32 Billion |

| CAGR | 9.8% |

White EPS remained the top-performing segment in 2024 with a market valuation of USD 7.7 billion. This variant is widely preferred for its affordability, proven reliability, and suitability across diverse packaging applications. From FMCG and agricultural produce to electronics and household appliances, white EPS continues to dominate. Advances in molding and surface technology have improved its compatibility with high-speed automated packaging systems. Although it appears simple, white EPS is widely utilized in high-volume, cost-sensitive packaging environments that prioritize speed and functionality.

The EPS sheets segment generated USD 5.2 billion in 2024. These sheets offer excellent impact resistance, are lightweight, and are known for being highly economical. They are often die-cut or laminated with foam backings to enhance structural protection in packaged electronics, machinery, and consumer appliances. The rising demand for tailored and protective packaging in these sectors ensures that EPS sheets will remain a preferred material in the years to come.

United States Expanded Polystyrene for Packaging Market generated USD 4.1 billion in 2024, registering a CAGR of 9% through 2034. The country's robust food and beverage industry continues to drive EPS usage, especially in cold chain logistics and insulation applications. Online shopping trends further amplify demand for EPS-based protective packaging. Market players are now exploring bio-based alternatives and sustainable recycling options to respond to increasing environmental concerns. Emphasis on lighter packaging that reduces shipping emissions and lowers costs is prompting innovations, creating new avenues for growth in the US.

Key players shaping the Global Expanded Polystyrene for Packaging Market include BASF SE, KANEKA CORPORATION, Alpek S.A.B. de C.V., TotalEnergies, Synthos, Dart Container Corporation, Wuxi Xingda Foam Plastic, Tamai Kasei Corporation, DuPont, Styrotech, Inc., Versalis S.p.A., Michigan Foam Products LLC, Engineered Foam Products, Foamcraft USA, LLC, and Styropek. Leading companies in the EPS packaging market are implementing a mix of product innovation, regional expansion, and sustainability initiatives to maintain a competitive edge. Many are investing in the development of recyclable and bio-based EPS solutions to align with global eco-conscious trends. Strategic partnerships with logistics firms and FMCG companies allow them to address evolving packaging needs. Automation in production and customized EPS molds are being prioritized to meet high-volume demand from online retail and cold-chain supply chains.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Packaging type trends

- 2.2.2 Material trends

- 2.2.3 Application trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand in food and beverage industry

- 3.2.1.2 Rapid expansion of e-commerce and home delivery services

- 3.2.1.3 Construction industry growth

- 3.2.1.4 Cost-effectiveness and versatile applications

- 3.2.1.5 Recyclability and technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Environmental concerns and regulatory pressure

- 3.2.2.2 Substitution by sustainable packaging alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability roi analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Black

- 5.3 Grey

- 5.4 White

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Sheets

- 6.3 Trays & clamshells

- 6.4 Foam coolers

- 6.5 Cups & bowls

- 6.6 Packaging peanuts

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food and beverages

- 7.2.1 Black

- 7.2.2 Grey

- 7.2.3 White

- 7.3 Foodservice

- 7.3.1 Black

- 7.3.2 Grey

- 7.3.3 White

- 7.4 Healthcare

- 7.4.1 Black

- 7.4.2 Grey

- 7.4.3 White

- 7.5 Electronics and electrical appliances

- 7.5.1 Black

- 7.5.2 Grey

- 7.5.3 White

- 7.6 Building and constructions

- 7.6.1 Black

- 7.6.2 Grey

- 7.6.3 White

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alpek S.A.B. de C.V.

- 9.2 BASF SE

- 9.3 Cellofoam

- 9.4 Dart Container Corporation

- 9.5 DuPont

- 9.6 Engineered Foam Products

- 9.7 Epsilyte LLC

- 9.8 Flint Hills Resources

- 9.9 Foam Holdings, Inc.

- 9.10 Foam Products Corporation

- 9.11 Foamcraft USA, LLC

- 9.12 Geofoam International LLC

- 9.13 Harbor Foam

- 9.14 K. K. Nag Pvt. Ltd.

- 9.15 KANEKA CORPORATION

- 9.16 Michigan Foam Products LLC

- 9.17 Poliestireno de San Luis S.A. de C.V.

- 9.18 Storopack

- 9.19 Styropek

- 9.20 Styrotech, Inc.

- 9.21 Synthos

- 9.22 Tamai Kasei Corporation

- 9.23 TotalEnergies

- 9.24 Versalis S.p.A.

- 9.25 Wuxi Xingda Foam Plastic