|

市場調查報告書

商品編碼

1907269

油漆和塗料:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

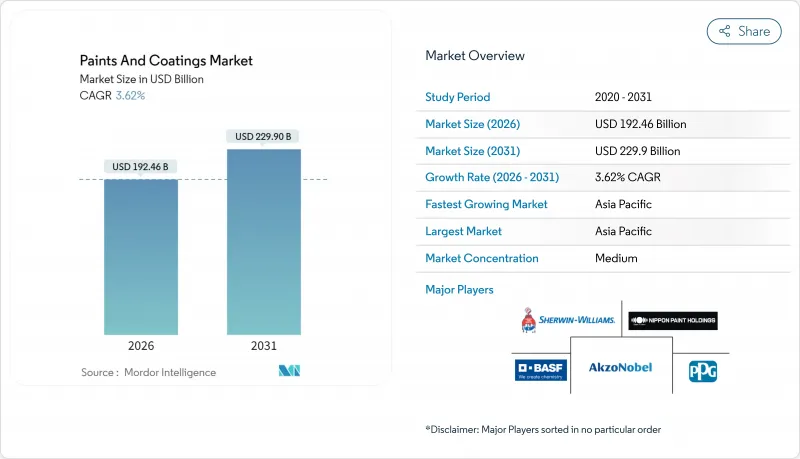

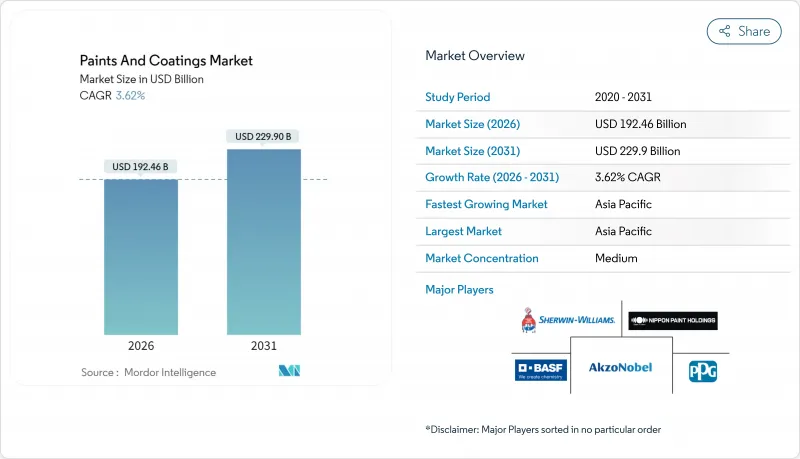

預計到 2026 年,油漆和塗料市場規模將達到 1,924.6 億美元,高於 2025 年的 1,857.4 億美元。

預計到 2031 年將達到 2,299 億美元,2026 年至 2031 年的複合年成長率為 3.62%。

儘管原料成本波動劇烈,且環保法規日益嚴格,但住宅、基礎設施建設和永續產品創新帶來的穩定需求支撐著這一逐步擴張的趨勢。亞太地區兼具結構性優勢、快速的都市化、大規模資本計劃和不斷擴大的工業生產,所有這些因素都推動著區域消費以遠超成熟經濟體的速度成長。在技術方面,向低VOC水性化學品的轉型仍然是最具影響力的趨勢,政府排放上限和消費者對環保規格的偏好進一步強化了這一趨勢。同時,製造商正在將配色、工廠排產和品管流程數位化,以緩解勞動力短缺並加快產品上市速度。全球塗料產業的競爭日益激烈,前12位的供應商正透過收購和剝離來建構更精簡的產品組合,實現規模經濟。

全球油漆和塗料市場趨勢及洞察

全球住宅建設活動激增

諸如《北美基礎設施投資與就業法案》等立法正將資金投入道路、橋樑和公共產業,從而推動了新建和維修資產對防護和裝飾塗料的需求。同時,亞太地區各國政府繼續優先發展經濟適用住宅項目,刺激了住宅開工和室內粉刷週期。多個經濟體的歷史低房屋抵押貸款利率正在提振翻新預算,並推動了對符合綠色建築認證標準的優質零VOC牆面塗料的需求成長。供應商正積極回應,推出快乾水性塗料系列,這些塗料在滿足嚴格的室內空氣品質標準的同時,也保證了施工速度。這些因素共同作用,將在預測期內鞏固油漆和塗料行業的穩定銷售基礎。

汽車產量增加

預計輕型車產量將於2024年復甦,並在2026年恢復疫情前的成長軌道。中國、印度和東南亞預計將佔據新增產能的大部分。現代汽車修理廠擴大採用水性底塗層和低溫烘烤透明塗層,以縮短工期並減少排放,從而推動了原廠配套(OEM)和修補漆生產線之間的技術融合。樹脂配方商、噴漆房製造商和汽車製造商之間的戰略聯盟正在加速整合塗裝平台的普及,從而降低單位塗料的能耗。這種持續的產能擴張正在顯著提升工業塗料的消費量,並推動塗料市場的發展趨勢。

全球嚴格的VOC法規

加州南海岸空氣品質管理區定期執行第1113號規則,強制不合規產品重新配方或撤離市場,這增加了中小型供應商的研發成本。在歐洲,修訂後的CLP法規將增加內分泌干擾物的標籤要求,要求生產商審查其原料組合併更新安全資料表。在中國,擬議的統一建築規範將把VOC限量擴大到底漆和密封劑等輔助材料,進一步增加了合規的複雜性。總而言之,這些法規正在擠壓油漆和塗料行業的利潤空間,並凸顯快速產品開發平臺的重要性。

細分市場分析

預計到2025年,丙烯酸類化學品將佔油漆和塗料行業的35.78%,並在2031年之前保持3.98%的複合年成長率。這主要得益於其優異的耐候性、保色性和低VOC含量,能夠滿足建築和輕工業的需求。配方師不斷改進交聯結構,以增強其耐磨性和抗污性,從而延長DIY使用者和專業油漆工的維護週期。新興市場的都市化推動了這一成長,乳化乳膠漆在住宅室內市場佔據主導地位。製造商正在擴大區域反應器產能,以縮短前置作業時間並實現顏色系列的本地化,這一策略增強了其相對於溶劑型塗料的競爭優勢。

隨著跨國公司將產品組合重點轉向盈利的丙烯酸分散體平台,樹脂市場正逐步整合。醇酸樹脂在金屬和木器塗料領域仍佔有一席之地,但由於大豆油價格波動,其利潤率面臨壓力。環氧樹脂在重度維護應用領域的需求穩定,但2025年實現的價格穩定反映的是產能平衡而非結構性復甦。聚氨酯和聚酯樹脂分別佔據耐磨地板材料和粉末塗料等特定性能領域,但其需求尚未像丙烯酸樹脂那樣廣泛。整體而言,丙烯酸樹脂仍將是塗料和油漆市場配方師成長策略的基石。

本塗料市場報告按樹脂類型(丙烯酸樹脂、醇酸樹脂、聚氨酯樹脂、環氧樹脂等)、技術類型(水性塗料、溶劑型塗料、粉末塗料、UV固化塗料)、終端用戶行業類型(建築、汽車、木材、防護塗料等)以及地區(亞太地區、北美、歐洲、南美、中東和非洲)進行分析。市場預測以美元以金額為準。

區域分析

預計到 2025 年,亞太地區將佔全球收入的 46.21%,並在 2031 年前保持 4.91% 的強勁複合年成長率。該地區油漆和塗料市場規模受益於持續的特大城市發展、工業回流以及公共基礎設施投資的持續擴張,這些因素共同推動了對防護性和裝飾性塗料的需求。

北美地區受益於聯邦政府資助的交通走廊建設和房屋抵押貸款利率穩定推動下的住宅維修週期加速成長。對符合ESG(環境、社會和管治)標準的房產需求不斷成長,加速了經認證的低排放量室內塗料的普及,為水性塗料製造商在塗料行業中贏得市場佔有率提供了機會。歐洲正經歷逐步復甦,主要經濟體正著手解決住宅短缺問題,並推動與歐盟綠色交易相關的節能維修計畫。然而,修訂後的CLP法規收緊了標籤框架,導致整個供應鏈成本上升。

預計南美洲將出現選擇性成長,其中巴西將引領成長。剪切機司收購BASF裝飾塗料部門後,其門市網路迅速擴張,使承包商更容易獲得品牌塗料。中東和非洲地區預計將在大型企劃和資源主導基礎設施的推動下實現早期成長,但與亞太地區相比,政治風險和資金籌措限制了需求。嚴酷的沙漠和沿海氣候促使人們使用高性能聚矽氧烷和氟聚合物面漆來保護資本資產。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球住宅建設活動激增

- 汽車產量不斷擴大

- 亞太地區城市人口快速成長

- 政府對綠建築(低VOC)的獎勵措施

- 人工智慧驅動的色彩匹配平台的崛起

- 市場限制

- 全球對揮發性有機化合物(VOC)的監管非常嚴格

- 二氧化鈦原料價格波動

- 水性體系的乾燥和固化時間延長

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 樹脂

- 丙烯酸纖維

- 醇酸樹脂

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他樹脂類型

- 科技

- 水溶液

- 溶劑型

- 粉末塗裝

- 紫外光固化塗層

- 終端用戶產業

- 建築學

- 車

- 木頭

- 保護塗層

- 一般工業

- 運輸

- 包裝

- 地區

- 亞太地區

- 中國(包括台灣)

- 印度

- 日本

- 印尼

- 澳洲和紐西蘭

- 韓國

- 泰國

- 馬來西亞

- 菲律賓

- 孟加拉

- 越南

- 新加坡

- 斯里蘭卡

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 比荷盧經濟聯盟

- 俄羅斯

- 土耳其

- 瑞士

- 斯堪地那維亞國家

- 波蘭

- 葡萄牙

- 西班牙

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 科威特

- 埃及

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 阿爾及利亞

- 摩洛哥

- 其他非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems Ltd.

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DAW SE

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Russian Paints Company

- SK Kaken Co. Ltd

- The Sherwin-Williams Company

第7章 市場機會與未來展望

Paints And Coatings Market size in 2026 is estimated at USD 192.46 billion, growing from 2025 value of USD 185.74 billion with 2031 projections showing USD 229.9 billion, growing at 3.62% CAGR over 2026-2031.

Steady demand from residential construction, infrastructure upgrades and sustainable product innovation underpins this moderate expansion even as raw-material costs swing sharply and environmental regulations tighten. Asia-Pacific holds structural advantages, rapid urban migration, large-scale capital projects and expanding industrial output, that collectively fuel regional consumption at a noticeably faster rate than mature economies. Across technologies, the migration to low-VOC water-borne chemistries remains the single most influential trend, reinforced by government emission caps and customer preference for greener specifications. Simultaneously, producers are digitizing color-matching, plant scheduling and quality-control workflows to mitigate labor shortages and compress time-to-market. Competitive intensity is rising as the top dozen suppliers pursue targeted acquisitions and divestitures that create leaner portfolios and unlock scale efficiencies in the global paints and coatings industry.

Global Paints And Coatings Market Trends and Insights

Surge in Global Residential Construction Activity

North American legislation such as the Infrastructure Investment and Jobs Act is funneling capital toward roads, bridges and utilities, lifting demand for protective and decorative coatings on both new and renovated assets. In parallel, Asia-Pacific governments continue to prioritize affordable housing programs that stimulate fresh residential starts and interior repaint cycles. Historically low mortgage rates in several economies have revived remodeling budgets, channeling incremental gallons into premium zero-VOC wall finishes that qualify for green-building credits. Suppliers are responding with fast-dry water-borne lines that meet stringent indoor-air benchmarks without sacrificing application speed. Combined, these factors reinforce a stable base of volume for the paints and coatings industry during the forecast window.

Expanding Automotive Production Volumes

Light-vehicle output rebounded in 2024 and is projected to regain its pre-pandemic trajectory by 2026, with China, India and Southeast Asia capturing the lion's share of incremental capacity additions. Modern body shops increasingly specify water-borne basecoats and low-temperature bake clearcoats to cut cycle times and VOC emissions, strengthening technology convergence between OEM and refinish lines. Strategic partnerships among resin formulators, spray-booth makers and carmakers are accelerating the adoption of integrated coating platforms that lower energy use per unit sprayed. This ongoing production expansion delivers a meaningful uplift to industrial consumption boosts the paints and coatings market trends.

Stringent Global VOC Regulations

California's South Coast Air Quality Management District periodically tightens Rule 1113, forcing reformulation or withdrawal of non-compliant products and raising research and development costs for smaller suppliers. Europe's upcoming CLP amendments add endocrine-disruptor labeling, obliging producers to review raw-material portfolios and update safety data sheets. China's proposed unified architectural standard will extend VOC limits to auxiliary materials such as primers and sealers, broadening compliance complexity. Collectively, these regulations compress margins in the paints and coatings industry and elevate the importance of agile product-development pipelines.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urban Population Growth in APAC

- Government Incentives for Green Building (Low-VOC)

- Longer Drying/Curing Times for Water-Borne Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic chemistries delivered 35.78% paints and coatings industry share in 2025 and are projected to post a 3.98% CAGR through 2031, underpinned by proven weatherability, color retention and low-VOC credentials that meet architectural and light-industrial demands. Formulators continue to refine cross-linked structures that boost scrub resistance and stain blocking, giving do-it-yourself and professional painters longer service intervals. Growth momentum stems from emerging market urbanization where acrylic emulsion paints dominate new housing interiors. Producers are scaling regional reactor capacity to shorten lead times and localize color assortments, a strategy that enhances competitiveness against solvent-borne rivals.

The resin landscape is gradually consolidating as multinationals streamline portfolios toward high-margin acrylic dispersion platforms. Alkyds maintain niche relevance in metal and wood finishes but face margin pressure from soybean-oil price fluctuations. Epoxy demand remains steady in heavy-duty maintenance; however, price stability achieved in 2025 reflects balanced capacity rather than a structural upswing. Polyurethane and polyester systems occupy specialized performance niches, abrasion-resistant floors and powder coatings respectively, yet lack the broad-based volume of acrylics. Overall, acrylics will continue to anchor formulators' growth strategies across the paints and coatings market.

The Paints and Coatings Report is Segmented by Resin (Acrylic, Alkyd, Polyurethane, Epoxy, and More), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV-Cured Coating), End-User Industry (Architectural, Automotive, Wood, Protective Coating, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 46.21% of worldwide sales in 2025 and is tracking a robust 4.91% CAGR to 2031. The region's paints and coatings market size benefits from ongoing megacity development, industrial reshoring and sustained public infrastructure outlays that collectively require ever larger volumes of protective and decorative finishes.

North America is buoyed by federally funded transport corridors and an accelerating residential remodeling cycle boosted by stable mortgage rates. The push for ESG-aligned assets cats up adoption of certified low-emission interior paints, positioning water-borne suppliers for incremental share gains in the paints and coatings industry. Europe shows a measured recovery as major economies work through housing shortages and energy-retrofit pipelines tied to the EU's Green Deal; however, tightening labeling frameworks under the updated CLP regulation add costs across supply chains.

South America provides selective upside, headlined by Brazil where Sherwin-Williams' purchase of BASF's decorative unit instantly enlarges store footprints and gives contractors easier access to branded formulations. The Middle-East and Africa offer early-stage growth premised on mega-projects and resource-driven infrastructure, yet political risk and financing limitations restrain volume relative to Asia-Pacific. Harsh desert and coastal climates underpin specification of high-performance polysiloxane and fluoropolymer topcoats that protect capital assets.

- Akzo Nobel N.V.

- Asian Paints

- Axalta Coating Systems Ltd.

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Berger Paints India

- Chugoku Marine Paints, Ltd.

- DAW SE

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NATIONAL PAINTS FACTORIES CO. LTD.

- Nippon Paint Holdings Co., Ltd.

- NOROO Paint & Coatings co.,Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Russian Paints Company

- SK Kaken Co. Ltd

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Global Residential Construction Activity

- 4.2.2 Expanding Automotive Production Volumes

- 4.2.3 Rapid Urban Population Growth in APAC

- 4.2.4 Government Incentives for Green Building (Low-VOC)

- 4.2.5 Emergence of AI-Driven Colour-Matching Platforms

- 4.3 Market Restraints

- 4.3.1 Stringent Global VOC Regulations

- 4.3.2 Volatility in Titanium-Dioxide Feedstock Prices

- 4.3.3 Longer Drying/Curing Times for Water-Borne Systems

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Wood

- 5.3.4 Protective Coating

- 5.3.5 General Industrial

- 5.3.6 Transportation

- 5.3.7 Packaging

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China (Including Taiwan)

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 Indonesia

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 South Korea

- 5.4.1.7 Thailand

- 5.4.1.8 Malaysia

- 5.4.1.9 Philippines

- 5.4.1.10 Bangladesh

- 5.4.1.11 Vietnam

- 5.4.1.12 Singapore

- 5.4.1.13 Sri Lanka

- 5.4.1.14 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Benelux

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Switzerland

- 5.4.3.9 Scandinavian Countries

- 5.4.3.10 Poland

- 5.4.3.11 Portugal

- 5.4.3.12 Spain

- 5.4.3.13 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Chile

- 5.4.4.5 Rest of South America

- 5.4.5 Middle-East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Kuwait

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Algeria

- 5.4.6.4 Morocco

- 5.4.6.5 Rest of Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints

- 6.4.3 Axalta Coating Systems Ltd.

- 6.4.4 BASF

- 6.4.5 Beckers Group

- 6.4.6 Benjamin Moore & Co.

- 6.4.7 Berger Paints India

- 6.4.8 Chugoku Marine Paints, Ltd.

- 6.4.9 DAW SE

- 6.4.10 Hempel A/S

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd

- 6.4.14 Masco Corporation

- 6.4.15 NATIONAL PAINTS FACTORIES CO. LTD.

- 6.4.16 Nippon Paint Holdings Co., Ltd.

- 6.4.17 NOROO Paint & Coatings co.,Ltd.

- 6.4.18 PPG Industries, Inc.

- 6.4.19 RPM International Inc.

- 6.4.20 Russian Paints Company

- 6.4.21 SK Kaken Co. Ltd

- 6.4.22 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment