|

市場調查報告書

商品編碼

1906913

拉丁美洲油漆和塗料:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Latin America Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

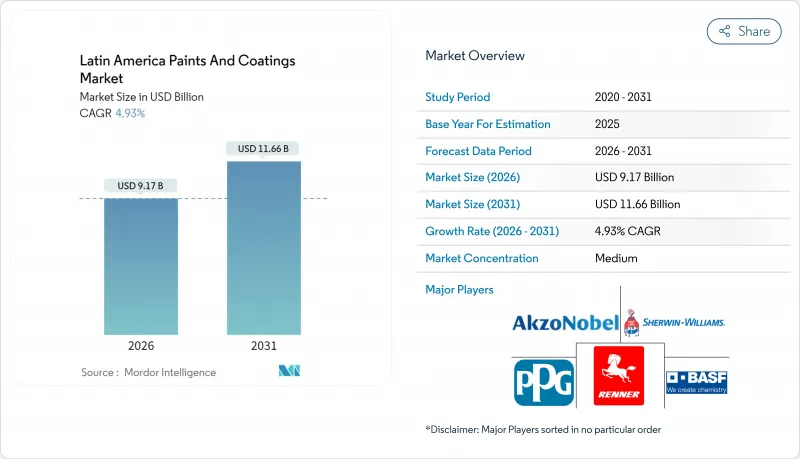

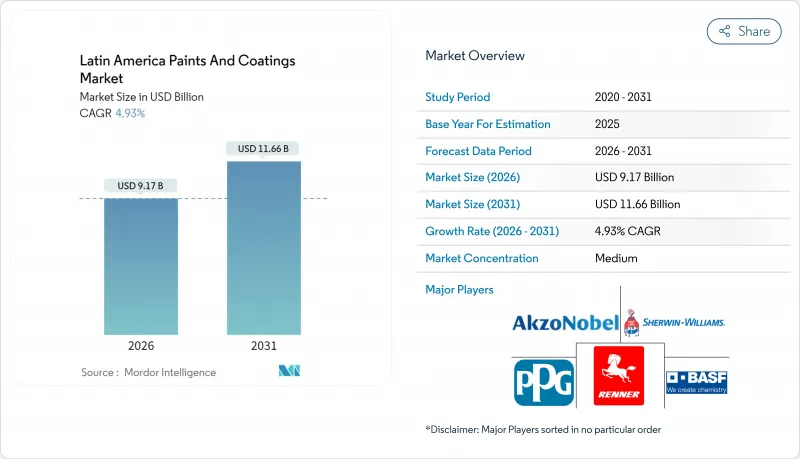

預計到 2026 年,拉丁美洲油漆和塗料市場價值將達到 91.7 億美元。

這意味著從 2025 年的 87.4 億美元成長到 2031 年的 116.6 億美元,2026 年至 2031 年的複合年成長率為 4.93%。

這一擴張與多個國家建設活動的復甦、汽車生產的加速以及基礎設施的升級改造相吻合。巴西憑藉多元化的產業基礎支撐著市場需求,而墨西哥則透過近岸外包投資和出口導向製造走廊的建設,正加速發展。產品系列升級至低揮發性有機化合物(VOC)和紫外線固化技術,有助於供應商在石化產品價格波動的情況下維持利潤率。隨著跨國公司擴大其本地生產和分銷網路,競爭日益激烈。同時,本地專業企業正利用其成本柔軟性和緊密的客戶關係來維持市場佔有率。

拉丁美洲油漆和塗料市場趨勢及洞察

住宅和商業建設活動復甦

拉丁美洲建築支出正逐步恢復至疫情前水平,推動了建築塗料市場的銷售量成長。巴西東北部新建住宅計劃以及墨西哥城商業建築的複工復產,擴大了基本客群。開發商為滿足更嚴格的建築規範,指定使用低VOC(揮發性有機化合物)內牆塗料,促使塗料製造商加速水性塗料的創新研發。隨著消費者信心的恢復,零售翻新週期縮短,對具有防污性能的高階內牆塗料的需求也隨之增加。製造商正透過在靠近快速發展的區域城市的地方建立調色工廠,最佳化其供應鏈。

汽車產業需求不斷成長

隨著全球汽車製造商(OEM)將生產基地遷至墨西哥以享受美墨加協定(USMCA)的關稅優惠,墨西哥的汽車組裝量正接近歷史最高水準。這一激增帶動了OEM底塗層和碰撞修復漆的需求,進而推動了拉丁美洲塗料市場的發展。溫度控管塗料對於電動車電池外殼至關重要,這催生了一個利潤豐厚的新細分市場。巴西的汽車產業叢集正吸引創紀錄的投資,其中包括豐田22.2億美元的生產線現代化改造計畫和Stellantis 27.4億美元的產能擴張計畫。塗料供應商正簽署多年供應協議,在組裝廠附近設立配色實驗室。

石化原料成本波動

與石腦油相關的原物料價格波動正給樹脂和溶劑買家的毛利率帶來壓力。在阿根廷和智利,貨幣貶值加劇了進口單體成本的上升,迫使混煉企業透過遠期合約和現貨貨物互換進行避險。一些區域性企業正在後向整合整合,以穩定原料成本。同時,那些透過混合回收溶劑來降低波動性的企業面臨著品質穩定性方面的挑戰以及批次不合格的風險。利潤率的壓力正在推動行業整合,因為小規模的製造商正尋求增強自身的財務實力。

細分市場分析

預計到2025年,丙烯酸塗料將佔拉丁美洲塗料市場銷售額的43.78%,其豐富的規格涵蓋室內、室外和防護塗料。配方柔軟性,可快速調節光澤度、耐擦洗性和色彩精準度,即使在日益嚴格的環保法規下,該細分市場仍保持優勢。聚氨酯化學品雖然基數較小,但由於OEM透明塗層性能和工業資產耐久性的需求不斷成長,預計將以5.91%的複合年成長率成為市場成長最快的產品。丙烯酸-聚氨酯混合塗料兼具硬度和柔軟性,為高階市場提供了有力支撐。

供應商正在探索生物基多元醇,以使他們的聚氨酯產品組合符合永續性目標,但價格平衡仍面臨挑戰。環氧樹脂在地板材料,而乙烯基樹脂和VAE乳液則用於對氣味要求較高的特殊裝飾塗料領域。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 住宅和商業建設活動復甦

- 汽車產業需求不斷成長

- 增加基礎設施現代化計劃

- 透過工業擴張創造需求

- 熱帶城市強制要求使用冷屋頂塗料

- 市場限制

- 石化原料成本波動

- 更嚴格的VOC和HAP排放法規

- 物流瓶頸和貨櫃短缺

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依樹脂類型

- 丙烯酸樹脂

- 環氧樹脂

- 醇酸樹脂

- 聚酯纖維

- 聚氨酯

- 其他樹脂類型(乙烯基樹脂、VAE 等)

- 透過技術

- 水溶液

- 溶劑型

- 粉末塗裝

- 紫外線固化型

- 按最終用戶行業分類

- 建築學

- 產業

- 車

- 木頭

- 包裝

- 運輸

- 按地區

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 其他拉丁美洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Akzo Nobel NV

- Allnex Gmbh

- Axalta Coating Systems LLC

- BASF SE

- Benjamin Moore & Co.

- Iquine

- Jotun

- Lanco Paints

- Pintuco SA

- PPG Industries Inc.

- Renner Herrmann SA

- The Sherwin-Williams Company

- WEG

第7章 市場機會與未來展望

Latin America Paints And Coatings Market size in 2026 is estimated at USD 9.17 billion, growing from 2025 value of USD 8.74 billion with 2031 projections showing USD 11.66 billion, growing at 4.93% CAGR over 2026-2031.

The expansion aligns with resurgent construction activity, accelerating automotive output, and multi-country infrastructure renewal. Brazil anchors demand through its diversified industrial base, while Mexico gains momentum from near-shoring investments and the build-out of export-oriented manufacturing corridors. Portfolio upgrades toward low-VOC and UV-cured technologies help suppliers defend margins in the face of petrochemical price swings. Competitive intensity rises as multinationals deepen local manufacturing and distribution footprints, whereas regional specialists leverage cost agility and intimate customer ties to hold share.

Latin America Paints And Coatings Market Trends and Insights

Resurgent Residential and Commercial Construction Activity

Construction spending recovers to pre-pandemic levels, lifting architectural sales volumes across the Latin America paints and coatings market. New housing projects in Brazil's Northeast and the restart of delayed commercial towers in Mexico City widen the customer base. Developers specify low-VOC interior paints to meet stricter building codes, prompting formulators to accelerate water-borne innovation. Retail repaint cycles shorten as consumer confidence rebounds, boosting demand for premium interior finishes with stain-blocking features. Producers optimize supply chains by staging tinting facilities closer to fast-growing secondary cities.

Growing Demand from Automotive Industry

Vehicle assembly in Mexico approaches historical peaks as global OEMs relocate platforms to capitalize on USMCA tariff advantages. The surge lifts OEM basecoat volumes and refinish demand for collision repair, enlarging the Latin America paints and coatings market. Electric-vehicle battery housings require thermal-management coatings, creating new high-margin niches. Brazil's automotive cluster attracts record inbound capital, including Toyota's USD 2.22 billion line modernization and Stellantis' USD 2.74 billion capacity upgrade. Coating suppliers lock in multi-year supply contracts by offering color-matching labs adjacent to assembly plants.

Petrochemical Feedstock Cost Volatility

Naphtha-linked raw-material swings compress gross margins for resin and solvent purchasers. Currency depreciation in Argentina and Chile exacerbates imported monomer bills, pushing formulators to hedge through forward contracts and spot cargo swaps. Some regional players pursue backward integration into resin synthesis to stabilize input cost. Others blend recycled solvents to temper volatility but face consistency challenges that can trigger batch rejects. Margin pressure feeds consolidation as smaller producers seek larger balance sheets.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Infrastructure Modernization Projects

- Industrial Expansion Creating Demand

- Stricter VOC and HAP Emission Norms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems generated 43.78% of revenue in 2025, anchoring the Latin America paints and coatings market through broad specification in interior, exterior, and protective segments. The formulation versatility allows quick tweaking of sheen, scrub resistance, and tint accuracy, keeping the class entrenched despite rising environmental scrutiny. Polyurethane chemistries, though smaller in base, chart the steepest 5.91% CAGR as OEM clear-coat performance and industrial asset durability needs intensify. Hybrid acrylic-polyurethane blends blend hardness with flexibility, supporting the premium segment.

Suppliers seek bio-based polyols to align polyurethane lines with sustainability targets, but price parity remains elusive. Epoxies retain stronghold in floor and marine systems where chemical resistance overrides color retention concerns. Alkyds shrink slowly, confined to price-sensitive consumer segments yet shielded by compatibility with existing spray equipment. Polyester resins serve powder coatings for appliances and metal furniture, while vinyl and VAE emulsions fill specialized decor niches that prize low odor.

The Latin America Paints and Coatings Market Report is Segmented by Resin Type (Acrylics, Epoxy, Alkyd, Polyester, Polyurethane, and More), Technology (Water-Borne, Solvent-Borne, Powder Coating, UV Cured), End-User Industry (Architectural, Industrial, Automotive, Wood, and More), and Geography (Brazil, Mexico, Argentina, Colombia, Chile, Peru, Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Allnex Gmbh

- Axalta Coating Systems LLC

- BASF SE

- Benjamin Moore & Co.

- Iquine

- Jotun

- Lanco Paints

- Pintuco S.A.

- PPG Industries Inc.

- Renner Herrmann S.A.

- The Sherwin-Williams Company

- WEG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Resurgent residential and commercial construction activity

- 4.2.2 Growing demand from automotive industry

- 4.2.3 Increasing infrastructure modernisation projects

- 4.2.4 Industrial expansion creating demand

- 4.2.5 Cool-roof coating mandates in tropical cities

- 4.3 Market Restraints

- 4.3.1 Petrochemical feedstock cost volatility

- 4.3.2 Stricter VOC and HAP emission norms

- 4.3.3 Logistics bottlenecks and container shortages

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylics

- 5.1.2 Epoxy

- 5.1.3 Alkyd

- 5.1.4 Polyester

- 5.1.5 Polyurethane

- 5.1.6 Other Resin Types (Vinyl and VAE, etc.)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV Cured

- 5.3 By End-user Industry

- 5.3.1 Architectural

- 5.3.2 Industrial

- 5.3.3 Automotive

- 5.3.4 Wood

- 5.3.5 Packaging

- 5.3.6 Transportation

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Colombia

- 5.4.5 Chile

- 5.4.6 Peru

- 5.4.7 Rest of Latin America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Allnex Gmbh

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 BASF SE

- 6.4.5 Benjamin Moore & Co.

- 6.4.6 Iquine

- 6.4.7 Jotun

- 6.4.8 Lanco Paints

- 6.4.9 Pintuco S.A.

- 6.4.10 PPG Industries Inc.

- 6.4.11 Renner Herrmann S.A.

- 6.4.12 The Sherwin-Williams Company

- 6.4.13 WEG

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment