|

市場調查報告書

商品編碼

1906975

中東和非洲油漆塗料:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Middle-East And Africa Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

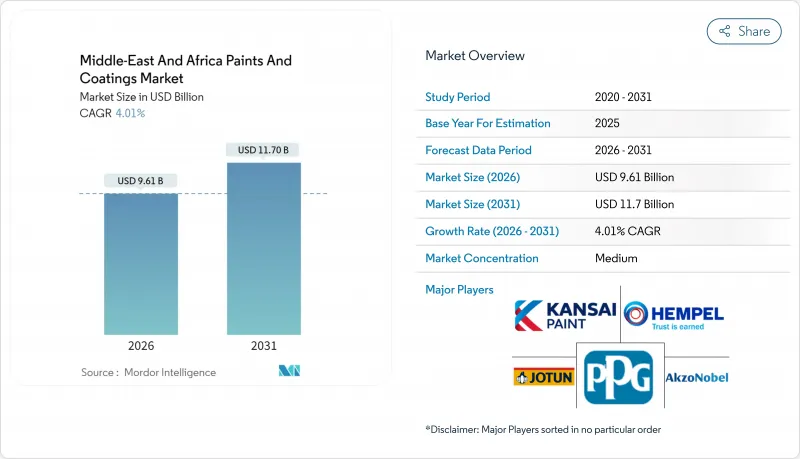

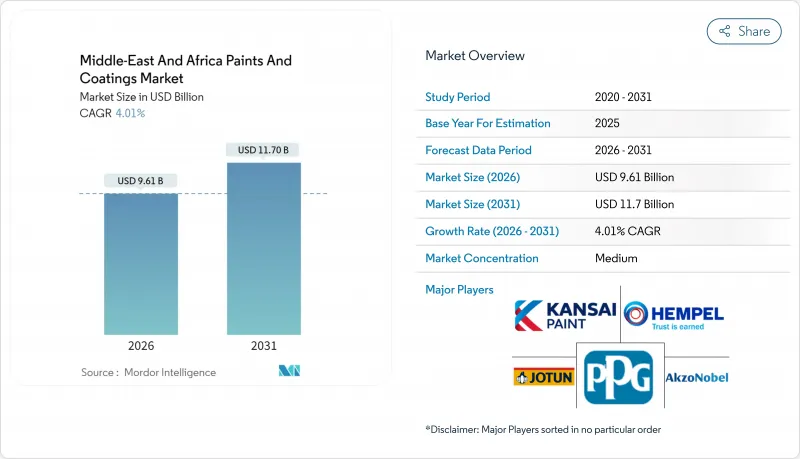

預計中東和非洲油漆和塗料市場將從 2025 年的 92.4 億美元成長到 2026 年的 96.1 億美元,到 2031 年將達到 117 億美元,2026 年至 2031 年的複合年成長率為 4.01%。

沿岸地區和北非地區強勁的住宅和旅遊建設計劃、工業本地化政策以及基礎設施現代化是支撐需求的關鍵促進因素。開發商為遵守杜拜市政府對新建建築的總揮發性有機化合物(TVOC)含量上限,並指定使用低VOC水性塗料系統,這表明市場對優質、耐用且環保配方的需求明顯增加。由於液化天然氣(LNG)大型企劃和石化聯合企業需要耐化學腐蝕、耐鹽霧和耐紫外線的高性能環氧樹脂和聚氨酯塗料系統,防護塗料的需求也十分旺盛。然而,佔配方成本約三分之二的石化原料價格波動較大,在原油價格高企期間持續擠壓利潤空間。此外,由於汽車組裝量下降,南非和伊朗的汽車噴漆市場也出現疲軟。儘管面臨這些不利因素,但隨著跨國公司擴大區域產能,靈活的本地製造商加強分銷網路,行業整合的勢頭正在增強。競爭格局仍保持適度多元化,並日益趨向技術主導。

中東及非洲油漆塗料市場趨勢及分析

海灣合作理事會國家和紅海地區旅遊業主導的建築熱潮

海灣國家政府正投資興建世界一流的機場、主題樂園和海濱度假村,以實現經濟多元化並吸引國際觀光。阿勒馬克圖姆國際機場的擴建、伊瑪爾地產公司毗鄰的酒店區以及沙烏地阿拉伯的紅海計劃都需要大量的耐褪色外牆塗料、防污船舶塗料和符合LEED認證標準的內牆乳膠漆。開發商需要能夠承受沙粒磨損、高鹽濕度和極端晝夜溫差的塗料系統,這促使配方師在塗料中添加陶瓷顆粒、紫外線吸收劑和防腐顏料。隨著計劃競標文件中對低VOC(揮發性有機化合物)標準的要求日益嚴格,能夠本地化生產水性塗料配方和著色劑的製造商在規格方面獲得了優勢。因此,旅遊業的蓬勃發展同時推動了建築塗料和防護塗料兩個細分市場的成長,從而為中東和非洲塗料市場的長期銷售量成長提供了保障。

公共大型企劃規劃(NEOM、盧賽爾、世博城)

NEOM的多叢集開發項目正分階段推進,需要採用自清潔建築幕牆塗料、抗菌內牆飾面以及可降低冷卻負荷的太陽能反射屋頂膜。在卡達,北田液化天然氣擴建計劃將重工業規格作為首要任務,該計畫要求自然氣處理廠採用耐高溫環氧酚醛襯裡,儲氣球採用耐腐蝕聚氨酯面漆。計畫於2028年完工的阿拉伯聯合大公國魯瓦伊斯LNG接收站也仰賴能夠抵禦硫化氫侵蝕的厚膜防腐蝕系統。這些計劃週期長達六至八年,供應商可從中受益於可預測的訂單安排,證明在該地區投資樹脂配製和著色是合理的。這些大型企劃進一步鞏固了中東和非洲塗料市場的優質化趨勢,為技術領導企業帶來了利潤成長的機會。

南非和伊朗汽車組裝速度放緩

由於電力短缺導致鋼板沖壓產能停滯,南非2024年的汽車產量預計將有所下降,進而降低了整車製造商對底漆、底塗層和透明塗層的需求。伊朗的組裝也因零件短缺和電力限制等因素而縮減產量。此外,由於車輛更換週期延長,修補漆的需求也在下降。供應商正將業務拓展至工業維護和建築塗料領域,但重新培訓銷售團隊和調整混配工廠以適應大批量裝飾塗料的生產需要時間。儘管南非政府目前鼓勵電動車的生產,但汽車產業對塗料的短期需求仍然疲軟,限制了中東和非洲油漆塗料市場的成長。

細分市場分析

預計到2025年,丙烯酸塗料將成為中東和非洲塗料市場的主要收入來源,佔整個市場33.98%。丙烯酸塗料具有良好的柔軟性、保色性和成本效益,因此在沙烏地阿拉伯和蘇丹等高溫和紫外線照射地區的室外石材塗料和室內乳化塗料生產線中廣泛應用。聚氨酯塗料預計將以4.28%的年複合成長率,這主要得益於液化天然氣運輸船、化學品儲存槽和高流量地板材料等小批量應用的需求,在這些應用中,耐磨性和耐化學性使其價格溢價合理。隨著下游石化一體化進程的推進,當地二異氰酸酯原料供應量增加,中東和非洲聚氨酯塗料市場規模預計將穩定擴大。環氧樹脂在沿岸地區的煉油廠和管線沿線市場需求強勁。同時,聚酯樹脂在鋁合金窗框和家用電器粉末塗料領域市場佔有率不斷成長,提高了耐刮擦性和塗料轉移效率。特殊樹脂(例如用於高層建築自清潔建築幕牆的氟聚合物和用於耐熱煙囪的矽酮)的成長速度較慢,反映了全部區域樹脂化學日益多樣化的趨勢。

隨著永續性法規日益嚴格,丙烯酸樹脂的市場佔有率預計將逐漸下降,因為聚氨酯-環氧樹脂混合材料在嚴苛的應用環境中具有更優的生命週期成本優勢。然而,裝飾塗料配方生產商不斷創新,將氧化石墨烯、中空玻璃珠和生物基塑化劑等成分融入丙烯酸樹脂中,從而在住宅和中型商業計劃中保持了市場佔有率。跨國公司正利用全球研發資源,對配方進行在地化改造,以進行加速老化測試。同時,區域領導者正利用低成本進口散裝丙烯酸乳膠,以更低的價格捍衛其市場佔有率。這些趨勢意味著,樹脂的選擇仍然是中東和非洲塗料市場競爭的關鍵領域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 海灣合作理事會和紅海地區旅遊業主導的建築熱潮

- 公共大型企劃規劃(NEOM、盧賽爾、世博城)

- 產業本地化政策促進了OEM塗料需求。

- 非洲主要經濟體的城市住宅需求正在復甦

- 利用透氣礦物塗層修復文化遺產的資金籌措

- 市場限制

- 南非和伊朗汽車組裝速度放緩

- 與原油價格相關的原物料價格波動

- 貿易制裁限制了原料流入伊朗

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依樹脂類型

- 丙烯酸纖維

- 醇酸樹脂

- 聚氨酯

- 環氧樹脂

- 聚酯纖維

- 其他(矽膠、乙烯基、氟樹脂)

- 透過技術

- 水溶液

- 溶劑型

- 粉末塗裝

- 紫外光固化塗料

- 按最終用戶行業分類

- 大樓

- 車

- 工業木材

- 保護塗層

- 運輸

- 一般工業

- 包裝

- 按地區

- 沙烏地阿拉伯

- 卡達

- 科威特

- 阿拉伯聯合大公國

- 伊朗

- 伊拉克

- 奈及利亞

- 南非

- 土耳其

- 坦尚尼亞

- 肯亞

- 阿爾及利亞

- 摩洛哥

- 埃及

- 其他中東和非洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Akzo Nobel NV

- Al-Tabieaa Company

- Atlas Peintures

- Axalta Coating Systems

- Basco Paints

- BASF SE

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE(Caparol)

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings

- PACHIN

- PPG Industries Inc.

- Qemtex

- RPM International Inc.

- Saba Shimi Aria

- Terraco Holdings Limited

- The Sherwin-Williams Company

- Thermilate Middle East

- Wacker Chemie AG

第7章 市場機會與未來展望

The Middle-East and Africa Paints and Coatings Market is expected to grow from USD 9.24 billion in 2025 to USD 9.61 billion in 2026 and is forecast to reach USD 11.7 billion by 2031 at 4.01% CAGR over 2026-2031.

Solid residential and tourism-oriented construction pipelines, industrial localization mandates, and infrastructure modernization across the Gulf and North Africa are the foremost forces sustaining demand. A shift toward premium, durable, and environmentally safer formulations is clearly visible as developers specify low-VOC water-based systems to comply with Dubai Municipality's TVOC ceiling for new buildings. Protective coating consumption also stays robust because LNG megaprojects and petrochemical complexes require high-performance epoxy and polyurethane systems resistant to chemicals, salt spray, and UV radiation. However, the volatile cost of petrochemical feedstocks, which account for roughly two-thirds of formulation costs, continues to compress margins during crude price spikes, and the automotive repaint segment softens in South Africa and Iran as assembly volumes retreat. Despite these headwinds, consolidation gains momentum, with multinationals scaling regional capacity while agile local producers strengthen distribution reach, leaving the competitive field moderately fragmented but increasingly technology-driven.

Middle-East And Africa Paints And Coatings Market Trends and Insights

Tourism-Led Construction Boom Across GCC and Red Sea

Gulf governments are investing in world-scale airports, theme parks, and waterfront resorts to diversify their economies and attract international visitors. The Al Maktoum International airport expansion, Emaar's adjacent hospitality districts, and Saudi Arabia's Red Sea Project collectively require large volumes of fade-resistant exterior paints, anti-fouling marine coatings, and LEED-compliant interior emulsions. Developers require coating systems that can tolerate sand abrasion, saline humidity, and sharp diurnal temperature swings, prompting formulators to embed ceramic microspheres, UV absorbers, and rust-inhibiting pigments. As project tender documents increasingly specify low-VOC thresholds, manufacturers that localize water-borne blending and tinting capacity capture specification advantages. The tourism boom, therefore, elevates both architectural and protective sub-segments simultaneously, underpinning long-term volume visibility across the Middle East and Africa paints and coatings market.

Public Megaproject Pipelines (NEOM, Lusail, Expo City)

NEOM's multi-cluster development progresses in phases, requiring self-cleaning facade coatings, antimicrobial interior finishes, and solar-reflective roof membranes that can lower cooling loads. In Qatar, the North Field LNG build-out requires heat-resistant epoxy phenolic linings for gas processing trains and corrosion-resistant polyurethane topcoats for storage spheres, keeping heavy-duty industrial specifications at the forefront. The UAE's Ruwais LNG terminal, scheduled for 2028, also relies on high-build anti-corrosion systems capable of withstanding hydrogen-sulfide exposure. Because these projects extend six to eight years, suppliers benefit from predictable call-off schedules that justify regional resin synthesis and tinting investments. Such megaproject pipelines reinforce the premiumization trend within the Middle East and Africa paints and coatings market, unlocking margin headroom for technology leaders.

Automotive Assembly Slowdown in South Africa and Iran

South Africa's 2024 vehicle output declined amid power shortages that disrupted steel stamping capacity, resulting in reduced demand for OEM primer, basecoat, and clearcoat. Iranian assemblers similarly trimmed production as part shortages and electricity curbs converged, causing refinish volumes to contract as vehicle replacement cycles extended. Suppliers diversify toward industrial maintenance and architectural lines, but retraining sales teams and recalibrating mixing plants for higher-volume decorative grades takes time. Although South Africa's government now incentivizes electric vehicle production, near-term coatings demand in the automotive sector industry remains subdued, shaving incremental growth from the Middle East and Africa paints and coatings market.

Other drivers and restraints analyzed in the detailed report include:

- Industrial Localization Policies Lifting OEM Coatings Demand

- Urban Housing Rebound in Key African Economies

- Volatile Crude-Linked Raw-Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acrylic segment generated the largest revenue in 2025, accounting for 33.98% of the Middle-East and Africa paints and coatings market. Its flexibility, color retention, and cost efficiency underpin widespread use in exterior masonry and interior emulsion lines across hot, high-UV geographies such as Saudi Arabia and Sudan. Polyurethane, although smaller in volume, is forecast to compound at 4.28%, driven by LNG vessels, chemical storage tanks, and high-traffic flooring, where abrasion and chemical resistance justify premium pricing. The Middle East and Africa paints and coatings market size for polyurethane systems is projected to widen steadily as downstream petrochemical integration supplies local diisocyanate feedstocks. Epoxy enjoys strong uptake around Gulf refineries and pipeline corridors, whereas polyester gains share within powder coating for aluminum window frames and household appliances, improving scratch resistance and transfer efficiency. Specialty resins, including fluoropolymers for self-cleaning skyscraper facades and silicones for heat-stable stacks, expand albeit from a low base, reflecting the progressive diversification of resin chemistries across the region.

The acrylic share is expected to erode modestly as sustainability regulations intensify and polyurethanes, epoxies, and hybrid chemistries deliver superior lifecycle costs in aggressive service environments. Nevertheless, decorative formulators continue to innovate within acrylic by integrating graphene oxide, hollow glass beads, and bio-based plasticizers, thereby sustaining relevance in mass housing and mid-tier commercial projects. Multinationals leverage global research and development to localize weathering-accelerated formulas, while regional champions exploit cost-advantaged bulk acrylic latex imports to defend share in budget lines. These dynamics ensure that resin choice remains a critical battlefield within the Middle East and Africa paints and coatings market.

The Middle-East and Africa Paints and Coatings Market Report is Segmented by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV-Cured Coating), End-User Industry (Architectural, Automotive, Industrial Wood, Protective, and More), and Geography (Saudi Arabia, Qatar, Kuwait, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Al-Tabieaa Company

- Atlas Peintures

- Axalta Coating Systems

- Basco Paints

- BASF SE

- Beckers Group

- Crown Paints Kenya PLC

- DAW SE (Caparol)

- Hempel A/S

- Jazeera Paints

- Jotun

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- Nippon Paint Holdings

- PACHIN

- PPG Industries Inc.

- Qemtex

- RPM International Inc.

- Saba Shimi Aria

- Terraco Holdings Limited

- The Sherwin-Williams Company

- Thermilate Middle East

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tourism-led construction boom across GCC and Red Sea

- 4.2.2 Public megaproject pipelines (NEOM, Lusail, Expo City)

- 4.2.3 Industrial localisation policies lifting OEM coatings demand

- 4.2.4 Urban housing rebound in key African economies

- 4.2.5 Heritage-site restoration funding for breathable mineral paints

- 4.3 Market Restraints

- 4.3.1 Automotive assembly slowdown in South Africa and Iran

- 4.3.2 Volatile crude-linked raw-material prices

- 4.3.3 Trade sanctions limiting raw-material inflows into Iran

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Others (Silicone, Vinly, Fluoropolymer)

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV-cured Coating

- 5.3 By End-user Industry

- 5.3.1 Architectural

- 5.3.2 Automotive

- 5.3.3 Industrial Wood

- 5.3.4 Protective

- 5.3.5 Transportation

- 5.3.6 General Industrial

- 5.3.7 Packaging

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 Qatar

- 5.4.3 Kuwait

- 5.4.4 United Arab Emirates

- 5.4.5 Iran

- 5.4.6 Iraq

- 5.4.7 Nigeria

- 5.4.8 South Africa

- 5.4.9 Turkey

- 5.4.10 Tanzania

- 5.4.11 Kenya

- 5.4.12 Algeria

- 5.4.13 Morocco

- 5.4.14 Egypt

- 5.4.15 Rest of Middle-East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Al-Tabieaa Company

- 6.4.3 Atlas Peintures

- 6.4.4 Axalta Coating Systems

- 6.4.5 Basco Paints

- 6.4.6 BASF SE

- 6.4.7 Beckers Group

- 6.4.8 Crown Paints Kenya PLC

- 6.4.9 DAW SE (Caparol)

- 6.4.10 Hempel A/S

- 6.4.11 Jazeera Paints

- 6.4.12 Jotun

- 6.4.13 Kansai Paint Co. Ltd.

- 6.4.14 National Paints Factories Co. Ltd.

- 6.4.15 Nippon Paint Holdings

- 6.4.16 PACHIN

- 6.4.17 PPG Industries Inc.

- 6.4.18 Qemtex

- 6.4.19 RPM International Inc.

- 6.4.20 Saba Shimi Aria

- 6.4.21 Terraco Holdings Limited

- 6.4.22 The Sherwin-Williams Company

- 6.4.23 Thermilate Middle East

- 6.4.24 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment