|

市場調查報告書

商品編碼

1906984

歐洲塑膠瓶蓋和封蓋:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

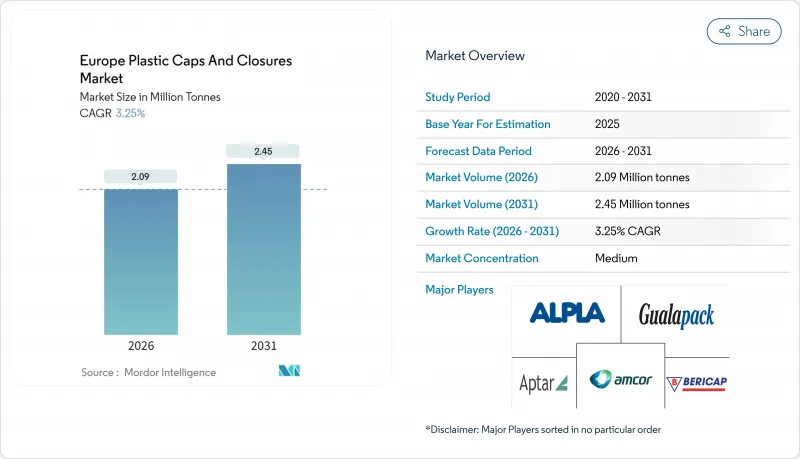

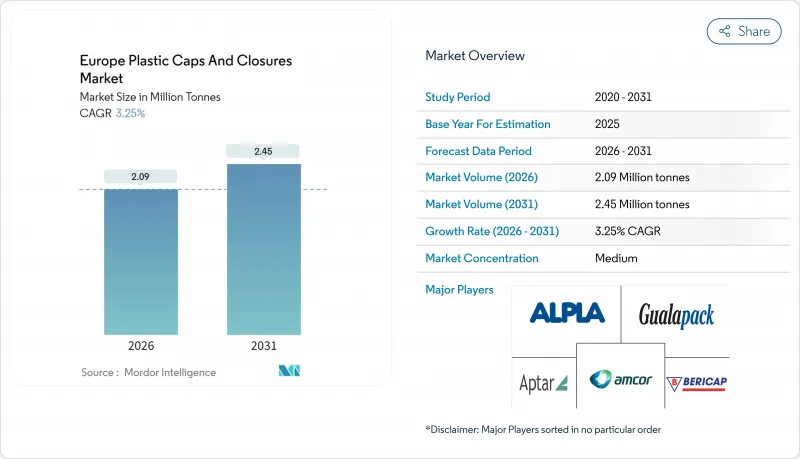

2025 年歐洲塑膠瓶蓋和封蓋市場價值為 202 萬噸,預計到 2031 年將達到 245 萬噸,高於 2026 年的 209 萬噸。

預計在預測期(2026-2031年)內,該產業將以3.25%的複合年成長率成長。包裝和包裝廢棄物法規(PPWR)的監管力度,以及對再生材料含量要求的不斷提高,正在推動該行業銷量穩步成長。

輕量化項目將每個瓶蓋的樹脂用量減少了15-20%,品牌所有者對其供應鏈碳足跡的審查日益嚴格,以及酒類和化妝品包裝的高階化趨勢,都有助於維持市場需求的韌性。據估計,全部區域用於改造繫繩式維修的資本投資高達3億歐元,這正在加速技術更新換代,使擁有先進射出成型能力的製造商受益。同時,由於再生樹脂短缺和押金返還計劃(DRS)的推出,飲料容器轉向鋁製替代品,這將限制成長空間,但不會影響整體成長軌跡。競爭強度仍然適中,材料創新和智慧封蓋功能是關鍵的差異化因素。

歐洲塑膠瓶蓋及封蓋市場趨勢及分析

輕量化需求推動材料創新

塑膠包裝法規 (PPWR) 迫使加工商在保持性能的前提下降低樹脂重量,推動聚合物共混物的試驗和精密模具設計的更新。這些努力已成功將瓶蓋平均重量降低至 0.8 克,且未影響性能。樹脂價格波動已對加工商的毛利率造成壓力,使其跌破 8%,促使主要企業進行垂直整合並建立內部回收循環以穩定供應。 PET 的輕量化進展,得益於可實現 0.8 毫米側壁厚度的取向技術,與此聚合物類別 4.39% 的複合年成長率 (CAGR) 相符。 ISO 11469 和 EN 13427 的合規要求增加了研發難度,並鞏固了擁有深厚材料專業知識的現有企業的市場佔有率。中期來看,預計輕量化將使該聚合物類別的預期複合年成長率提高約 0.8 個百分點。

捆綁式總量控制重塑生產經濟。

自2024年7月起,所有容量小於3公升的飲料容器都必須使用繫繩式瓶蓋,這意味著歐洲約有1350條填充生產線需要維修(每條生產線的成本為15萬至30萬歐元)。利樂公司已投資3億歐元,並計劃在2024年中期交付超過120億個符合標準的瓶蓋。統一標準EN 17665:2022+A1:2023提供了清晰的合規路徑,鼓勵射出成型鉸鏈解決方案,並減少監管方面的不確定性。消費者調查顯示,基於環保效益,消費者對新標準的接受度高達73%,降低了品牌擁有者的轉型風險。短期實施將使市場需求成長1.2個百分點,同時也將增加小型競爭對手的資金門檻。

立式袋改變了家用化學品包裝方式

由於可節省 60% 的材料且貨架展示效果出色,軟包裝正從硬質 HDPE 瓶手中奪取清潔劑和清潔產品市場 15-20% 的年市場佔有率。德國和法國的品牌商試點計畫發現,中低價位 SKU 的消費者對軟包裝袋的接受度高達 68%。到 2030 年,家用化學品瓶蓋的需求量可能會下降 8-12%,隨著加工商轉向使用吸嘴袋的配件,整體複合年成長率 (CAGR) 將降低 0.7 個百分點。

細分市場分析

聚丙烯憑藉其優異的耐化學性和高成本績效,將在2025年繼續保持其在歐洲塑膠瓶蓋市場的領先地位,市佔率將達到44.38%。此細分市場利用成熟的供應物流和射出成型基礎設施,為飲料、食品和家用化學品產業提供大量產品。即使樹脂價格波動,透過輕量化措施,每單位產品可減少10-15%的聚丙烯用量,確保成本優勢。

聚對苯二甲酸乙二醇酯(PET)重量輕、阻隔性能優異,尤其適用於繫繩蓋和無菌乳製品應用,預計將成為成長最快的細分市場,到2031年複合年成長率將達到4.28%。隨著回收成分的增加,特別是化學回收獲得監管部門核准,歐洲PET塑膠蓋和封蓋市場規模預計將同步成長。低密度聚乙烯(LDPE)和高密度聚乙烯(HDPE)將在需要軟性分配應用和耐化學腐蝕性的細分市場中保持其地位,而聚氯乙烯(PVC)則因永續性壓力而持續失去市場佔有率。

由於通用相容性和高速生產線效率,標準螺帽在單位經濟性方面將繼續保持優勢,到 2025 年將佔據 47.10% 的最大市場佔有率。然而,隨著特殊形狀螺帽的普及,預計螺帽在歐洲的市場佔有率將略有下降。

受藥品生產能力擴張以及膳食補充劑和醫用大麻產品安全標準不斷提高的推動,預計到2031年,兒童安全瓶蓋的複合年成長率將達到4.32%。精準計量機制的分配瓶蓋將推動個人保健產品和電商補充裝生態系統的新需求。按扣式瓶蓋和運動專用瓶蓋滿足了人們隨時隨地飲用的需求,而帶有嵌入式認證晶片的防篡改密封蓋則為高階烈酒提供了仿冒品解決方案。

歐洲塑膠瓶蓋和封蓋市場報告按材料類型(例如,聚對苯二甲酸乙二醇酯 (PET)、聚丙烯 (PP))、產品類型(例如,螺旋蓋、按扣蓋)、製造類型(例如,射出成型、壓縮成型、吹塑成型)、終端用戶行業(例如,飲料、食品、藥和醫療保健)以及地區進行分析。市場預測以噸為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟包裝和包裝廢棄物法規要求減輕重量

- 在2024年歐盟指令截止日期前,繫留式容量蓋的滲透率很高。

- 乳製品即飲生產線對阻隔性性無菌蓋的需求日益成長

- 品牌所有者正在逐步過渡到使用再生瓶蓋

- 精釀烈酒的蓬勃發展推動了對優質防篡改瓶蓋的需求。

- 電子商務補充裝形式的快速成長需要密封封裝

- 市場限制

- 立式袋正逐步佔領家用化學品市場。

- 押金返還制度鼓勵飲料生產商改用鋁罐。

- 全大陸範圍內供不應求

- 現有PET生產線的繫繩帽改造需要高資本投入。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章 市場規模與成長預測

- 依材料類型

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 聚氯乙烯(PVC)

- 其他材料

- 依產品類型

- 螺帽

- 卡扣式帽

- 分配蓋

- 兒童安全帽

- 防篡改蓋

- 其他產品類型

- 透過製造方法

- 射出成型

- 壓縮成型

- 吹塑成型

- 按最終用戶行業分類

- 飲料

- 食物

- 製藥和醫療保健

- 化妝品和盥洗用品

- 家用化學品

- 其他行業

- 按國家/地區

- 德國

- 英國

- 西班牙

- 法國

- 義大利

- 斯洛維尼亞

- 奧地利

- 瑞士

- 匈牙利

- 克羅埃西亞

- 羅馬尼亞

- 希臘

- 俄羅斯

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BERICAP GmbH and Co. KG

- Guala Closures Group

- Pelliconi and CSpA

- UNITED CAPS Luxembourg SA

- Closure Systems International Europe GmbH

- AptarGroup Inc.

- Amcor plc

- ALPLA Werke Alwin Lehner GmbH and Co KG

- Georg Menshen GmbH and Co. KG

- Weener Plastics Group

- Tetra Pak International SA

- Coral Products PLC

- Greiner Packaging International GmbH

- Logoplaste

- Pano Cap Europe Ltd.

第7章 市場機會與未來展望

The Europe plastic caps and closures market was valued at 2.02 million tonnes in 2025 and estimated to grow from 2.09 million tonnes in 2026 to reach 2.45 million tonnes by 2031, at a CAGR of 3.25% during the forecast period (2026-2031).Regulatory momentum under the Packaging and Packaging Waste Regulation (PPWR) drives steady volume expansion as recycled-content mandates tighten.

Lightweighting programs that trim 15-20% resin per cap, heightened brand-owner scrutiny of supply-chain carbon footprints, and premiumization of spirits and cosmetics packaging collectively sustain demand resilience. Capital expenditure on tethered-cap retrofits, estimated at EUR 300 million across the region, accelerates technology refresh cycles and favors manufacturers with advanced injection-molding capabilities. Meanwhile, recycled-resin shortages and deposit-return-scheme (DRS) roll-outs channel beverage volumes into aluminum alternatives, tempering upside but not derailing the overall growth trajectory. Competitive intensity remains moderate, with material innovation and smart-closure functionality serving as primary differentiation levers.

Europe Plastic Caps And Closures Market Trends and Insights

Lightweighting mandates drive material innovation

The PPWR compels converters to shave resin weight while safeguarding performance, prompting polymer-blend experimentation and precision-mold design updates that collectively cut average cap weight to 0.8 g without performance loss. Converter gross margins, already under pressure from resin volatility, narrow below 8%, pushing tier-one players toward vertical integration and captive recycling loops for supply security. PET-oriented lightweighting gains align with a 4.39% CAGR for that polymer class, aided by orientation technologies that permit 0.8 mm sidewalls. ISO 11469 and EN 13427 compliance hurdles elevate R&D thresholds and consolidate share in favor of incumbents with deep materials expertise. Over the medium term, lightweighting is expected to add roughly 0.8 percentage points to the forecast CAGR.

Tethered cap compliance reshapes production economics

From July 2024, every beverage container up to 3 L must feature a tethered closure, triggering retrofits on roughly 1,350 European bottling lines priced at EUR 150,000-300,000 each.Tetra Pak's EUR 300 million investment delivered more than 12 billion compliant caps by mid-2024. Harmonized standard EN 17665:2022+A1:2023 offers a clear compliance pathway that favors injection-molded hinge solutions and mitigates regulatory ambiguity. Consumer research shows 73% acceptance based on environmental benefits, easing brand-owner transition risks. Short-term implementation lifts demand by 1.2 percentage points but also raises capital barriers for smaller competitors.

Stand-up pouches disrupt household chemical packaging

Flexible packaging captures 15-20% annual share from rigid HDPE bottles in detergents and cleaners, courtesy of 60% material savings and strong shelf appeal.Brand-owner trials in Germany and France verify 68% consumer acceptance for pouches in budget and mid-tier SKUs. Closure demand in household chemicals could decline 8-12% through 2030, trimming the overall CAGR by 0.7 percentage points as converters pivot toward spouted pouch fitments.

Other drivers and restraints analyzed in the detailed report include:

- Aseptic packaging evolution in dairy RTD segment

- Brand-owner shift toward recycled-content caps

- Deposit-return schemes favor alternative packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene leads the Europe plastic caps and closures market with 44.38% share in 2025 due to versatile chemical resistance and attractive cost-to-performance ratios. The segment serves beverages, food, and household chemicals at scale, capitalizing on established supply logistics and mature injection-molding infrastructure. Lightweighting initiatives that cut PP usage by 10-15% per unit lock in cost advantages even as resin prices fluctuate.

Polyethylene terephthalate follows as the fastest mover at a 4.28% CAGR through 2031, propelled by lightweight profiles and robust barrier characteristics that align with tethered-cap and aseptic dairy applications. The Europe plastic caps and closures market size for PET is projected to climb in tandem with its recycled-content credentials, especially as chemical recycling gains regulatory approvals. LDPE and HDPE retain relevance in flexible dispensing and chemical-resistant niches, while PVC continues to lose ground under sustainability pressure.

Standard screw caps maintain the largest footprint at 47.10% of 2025 volumes as universal compatibility and high-speed line efficiency keep per-unit economics compelling. The Europe plastic caps and closures market share for screw caps, however, is likely to edge lower as specialized formats proliferate.

Child-resistant closures enjoy a 4.32% CAGR through 2031, buoyed by expanding pharmaceutical capacity and tightening safety codes across nutraceuticals and cannabis products. Dispensing closures experience renewed momentum in personal-care and e-commerce refill ecosystems, leveraging precision dosing mechanisms. Snap-on and specialty sports caps address on-the-go beverage needs, while tamper-evident seals embed authentication chips to curb counterfeits in premium spirits.

The Europe Plastic Caps and Closures Market Report is Segmented by Material Type (Polyethylene Terephthalate (PET), Polypropylene (PP), and More), Product Type (Screw Caps, Snap-On Caps, and More), Manufacturing Type (Injection Molding, Compression Molding, Blow Molding), End-User Industry (Beverage, Food, Pharmaceutical and Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Tonnes).

List of Companies Covered in this Report:

- BERICAP GmbH and Co. KG

- Guala Closures Group

- Pelliconi and C. S.p.A.

- UNITED CAPS Luxembourg S.A.

- Closure Systems International Europe GmbH

- AptarGroup Inc.

- Amcor plc

- ALPLA Werke Alwin Lehner GmbH and Co KG

- Georg Menshen GmbH and Co. KG

- Weener Plastics Group

- Tetra Pak International S.A.

- Coral Products PLC

- Greiner Packaging International GmbH

- Logoplaste

- Pano Cap Europe Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweighting mandates from EU Packaging and Packaging-Waste Regulation

- 4.2.2 High adoption of tethered caps ahead of 2024 EU directive deadline

- 4.2.3 Growing demand for high-barrier, aseptic-ready closures in dairy RTD lines

- 4.2.4 Brand-owner shift toward recycled-content caps

- 4.2.5 Craft spirits boom driving premium, tamper-evident closures

- 4.2.6 Rapid growth of e-commerce refill formats requiring leak-proof closures

- 4.3 Market Restraints

- 4.3.1 Stand-up pouches encroaching on household-chemical SKUs

- 4.3.2 Deposit-return schemes steering beverage players to aluminum cans

- 4.3.3 Lack of continent-wide rPET/rHDPE food-grade supply

- 4.3.4 High capital intensity for tethered-cap retrofits in legacy PET lines

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Material Type

- 5.1.1 Polyethylene Terephthalate (PET)

- 5.1.2 Polypropylene (PP)

- 5.1.3 Low-Density Polyethylene (LDPE)

- 5.1.4 High-Density Polyethylene (HDPE)

- 5.1.5 Polyvinyl Chloride (PVC)

- 5.1.6 Other Materials

- 5.2 By Product Type

- 5.2.1 Screw Caps

- 5.2.2 Snap-On Caps

- 5.2.3 Dispensing Closures

- 5.2.4 Child-Resistant Closures

- 5.2.5 Tamper-Evident Closures

- 5.2.6 Other Product Types

- 5.3 By Manufacturing Type

- 5.3.1 Injection Molding

- 5.3.2 Compression Molding

- 5.3.3 Blow Molding

- 5.4 By End-User Industry

- 5.4.1 Beverage

- 5.4.2 Food

- 5.4.3 Pharmaceutical and Healthcare

- 5.4.4 Cosmetics and Toiletries

- 5.4.5 Household Chemicals

- 5.4.6 Other Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Spain

- 5.5.4 France

- 5.5.5 Italy

- 5.5.6 Slovenia

- 5.5.7 Austria

- 5.5.8 Switzerland

- 5.5.9 Hungary

- 5.5.10 Croatia

- 5.5.11 Romania

- 5.5.12 Greece

- 5.5.13 Russia

- 5.5.14 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BERICAP GmbH and Co. KG

- 6.4.2 Guala Closures Group

- 6.4.3 Pelliconi and C. S.p.A.

- 6.4.4 UNITED CAPS Luxembourg S.A.

- 6.4.5 Closure Systems International Europe GmbH

- 6.4.6 AptarGroup Inc.

- 6.4.7 Amcor plc

- 6.4.8 ALPLA Werke Alwin Lehner GmbH and Co KG

- 6.4.9 Georg Menshen GmbH and Co. KG

- 6.4.10 Weener Plastics Group

- 6.4.11 Tetra Pak International S.A.

- 6.4.12 Coral Products PLC

- 6.4.13 Greiner Packaging International GmbH

- 6.4.14 Logoplaste

- 6.4.15 Pano Cap Europe Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment