|

市場調查報告書

商品編碼

1906904

北美塑膠瓶蓋及封蓋市場:市佔率分析、產業趨勢、統計及成長預測(2026-2031)North America Plastic Caps And Closures - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

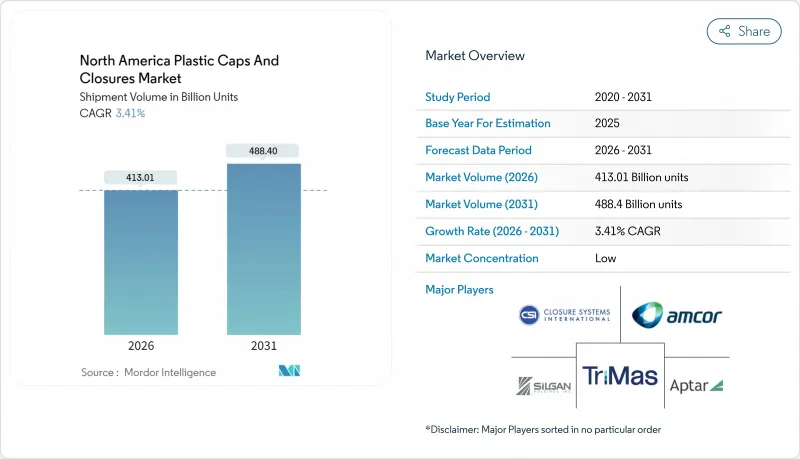

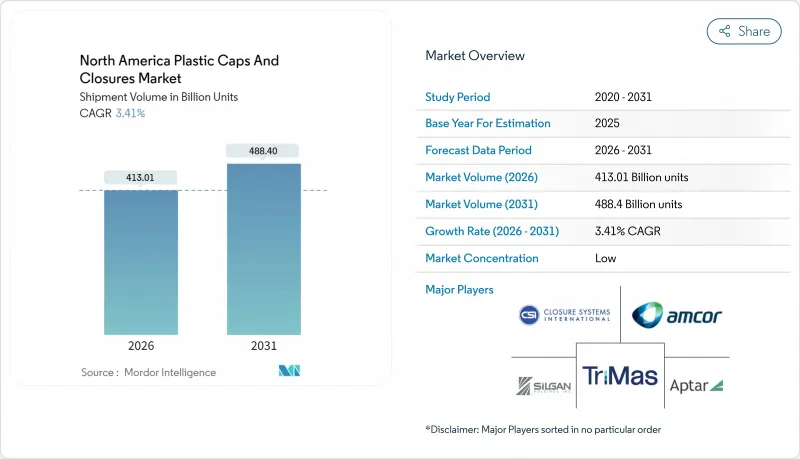

預計北美塑膠瓶蓋和封蓋市場將從 2025 年的 3,993.9 億個成長到 2026 年的 4,130.1 億個,到 2031 年將達到 4,884 億個,2026 年至 2031 年的複合年成長率為 3.41%。

這一成長反映了市場在保護產品品質以及滿足飲料、食品、藥品和個人保健產品領域嚴格的安全性和永續性要求方面所發揮的作用。新型機能飲料的產品推出、不斷成長的電商藥品銷售額以及各州層面的再生材料含量強制令持續推動著對專用高性能蓋子與封口裝置的需求。同時,品牌擁有者傾向於選擇符合循環經濟目標的互鎖式、單一材料和兒童安全型解決方案。原生樹脂價格上漲和氣候變遷導致的供應中斷帶來的成本壓力,促使製造商實現生產自動化並整合再生材料,以保持競爭力。產業相關人員也積極尋求併購,並採用基於人工智慧的缺陷檢測系統,以提高效率並實現規模經濟。

北美塑膠瓶蓋及封蓋市場趨勢及洞察

瓶裝飲料和機能飲料的需求激增

強化水、清爽型無酒精調飲和含咖啡因的運動飲料持續滲透零售管道,推動了對瓶蓋的需求,而不僅限於傳統的補水飲品類別。高階定位促使廠商投資研發耐壓防竄改瓶蓋,這些瓶蓋能夠維持高達四倍體積的二氧化碳,同時也能幫助品牌在貨架上脫穎而出。飲料開發商還需要能夠保護敏感膳食補充劑成分並符合美國食品藥物管理局(FDA) 補充劑標籤標準的瓶蓋。此外,墨西哥消費者支出的成長也帶動了當地飲料生產的發展,從而推動了對輕便耐用瓶蓋的需求。由於製造商需要與填充商合作,以確保在高速填充過程中扭矩和密封性能的一致性,因此供應鏈的可靠性仍然至關重要。

品牌所有者推廣可連接/相容電子商務的瓶蓋

隨著直接面對消費者的配送模式興起,亞馬遜的ISTA-6合規性已成為個人保健產品和飲料新品上市的必備條件。因此,品牌商優先考慮使用可牢固固定在瓶頸上的繫繩式瓶蓋,以減少洩漏並防止瓶蓋在運輸紙箱中遺失。 Aptar的Future Desktop就是一個很好的例子,它將安全的鎖定機制與100%聚乙烯材質結合,以便於家庭回收。食品零售商同樣青睞繫繩式瓶蓋設計,這種設計簡化了自動化封蓋生產線,並減少了因瓶蓋和瓶子不匹配而造成的停機時間。取得專利的鉸鏈設計允許多次開合循環,而不會影響防篡改性能或消費者使用便利性。

原生樹脂的生產者延伸責任制(EPR)成本

包括加州在內的四個州,根據原生樹脂的使用量向生產商收取回收費,這直接增加了瓶蓋的成本。儘管生產商正在轉向使用再生和生物基材料以降低這些費用,但PCR聚丙烯的市場供應仍然有限。不同司法管轄區的收費系統各異,使得在多個州運營的灌裝商難以合規,而報告要求也增加了額外的行政負擔。缺乏必要監管資源的小型加工商面臨的負擔最大,這可能會加速產業整合,導致資產出售給大型公司。

細分市場分析

截至2025年,聚乙烯仍將佔據塑膠瓶蓋和封蓋市場41.98%的最大佔有率,主要得益於其成本效益和加工靈活性。然而,聚對苯二甲酸乙二醇酯(PET)將以6.45%的複合年成長率實現最快成長,因為品牌所有者將永續性承諾與單一聚合物包裝相結合。 PET瓶蓋憑藉其固有的可回收性和成熟的回收網路,正在幫助飲料和個人護理行業實現材料循環利用。結晶控制和添加劑包裝的創新提高了耐熱性,使得熱填充果汁成為可能,不會影響密封性能。 Origin Materials公司最近成功展示了一種與標準填充線相容的聚酯樹脂瓶蓋,表明加工商現在擁有了一種可大規模生產的替代方案。

製造商們也尋求將消費後PET含量目標設定為25%,以避免因生產者延伸責任制(EPR)而受到附加稅,這推動了對食品級再生顆粒的需求。同時,聚丙烯憑藉其卓越的抗應力開裂性能,在嚴苛的化學和製藥應用領域仍佔有一席之地。生物基聚合物雖然仍屬於小眾市場,但在需要強制堆肥的地區,它們正引起監管機構的注意。這些變化共同造就了由整體擁有成本和可回收性指標所驅動的多元化材料選擇格局。

由於瓶口通用,螺旋蓋容器長期以來一直是標準配置,並保持著46.85%的市場佔有率(截至2025年)。然而,隨著線上藥局直接向消費者配送處方藥的興起,兒童安全蓋(CRC)預計將超越所有其他類別,到2031年複合年成長率將達到5.55%。美國食品藥物管理局(FDA)更嚴格的法規強制要求某些非處方膳食補充劑粉末必須使用兒童安全蓋,這進一步擴大了潛在市場。 Berry World的選擇性開啟設計體現了其持續研發的成果,將雙重安全機制與成人易用性完美結合。

對於個人護理乳液和家用清潔劑劑而言,由於其流量控制功能可減少浪費,按壓式瓶蓋正日益受到青睞;而在乳製品等需要快速使用和經濟成型的行業,卡扣式和推入式瓶蓋解決方案仍然可行。在各種瓶蓋上嵌入QR碼,用於支援真偽驗證和回收流程,已成為直銷通路的一項增值差異化優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 瓶裝飲料和機能飲料的需求激增

- 品牌所有者推廣合作/歐盟相容瓶蓋

- 過渡到使用單一材料PP瓶蓋,以便於回收。

- 線上藥品和營養補充品市場的快速成長推動了對CRC的需求。

- 人工智慧驅動的在線連續視覺系統可降低缺陷率和成本。

- 市場限制

- 原生樹脂的生產者延伸責任制(EPR)成本

- 立式袋的興起,以及用接頭取代螺旋蓋的趨勢

- 美國和加拿大強制規定再生聚酯(rPET)含量,正在擠壓原生聚丙烯(PP)的需求。

- 飲料品牌測試可重複密封的鋁蓋

- 供應鏈分析

- 監管環境

- 技術展望

- 地緣政治情勢的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 材料

- 聚乙烯(PE)

- 聚對苯二甲酸乙二醇酯(PET)

- 聚丙烯(PP)

- 其他成分

- 按類型

- 螺紋式

- 自動販賣機

- 沒有螺絲

- 兒童安全

- 按最終用戶行業分類

- 飲料

- 瓶裝水

- 軟性飲料

- 烈酒

- 其他飲料

- 食物

- 製藥和醫療保健

- 化妝品和盥洗用品

- 家用化學品

- 其他行業

- 飲料

- 透過製造程序

- 射出成型

- 壓縮成型

- 3D列印/快速原型製作

- 其他製造程序

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Silgan Holdings Inc.

- Amcor plc

- AptarGroup Inc.

- Closure Systems International Inc.

- TriMas Corporation

- Guala Closures SpA

- Tetra Pak Group

- O.Berk Company LLC

- BERICAP Holding GmbH

- Pano Cap Canada Ltd

- Erie Molded Plastics Inc.

- Crown Holdings Inc.

- Phoenix Closures Inc.

- Mold-Rite Plastics LLC

- Comar LLC

- Husky Technologies

- SACMI Imola SC

- Sonoco Products Company

- Plastipak Holdings Inc.

- Albea Group

第7章 市場機會與未來展望

The North America plastic caps and closures market is expected to grow from 399.39 billion units in 2025 to 413.01 billion units in 2026 and is forecast to reach 488.4 billion units by 2031 at 3.41% CAGR over 2026-2031.

This growth reflects the market's role in safeguarding product quality across beverages, food, pharmaceuticals, and personal-care items while meeting rigorous safety and sustainability expectations. Functional beverage launches, e-commerce-driven pharmaceutical sales, and state-level recycled-content mandates continue to steer demand for specialized, high-performance closures. At the same time, brand owners favor tethered, mono-material, and child-resistant solutions that align with circular-economy goals. Cost pressures from virgin-resin fees and climate-related supply disruptions push manufacturers to automate production and integrate recycled feedstocks, ensuring competitive resilience. Industry participants also pursue mergers and AI-enabled defect-inspection systems to enhance efficiency and secure scale advantages.

North America Plastic Caps And Closures Market Trends and Insights

Demand Surge for Bottled and Functional Beverages

Enhanced waters, relaxation mocktails, and caffeinated sports drinks continue to penetrate retail channels, lifting closure volumes beyond traditional hydration categories. Premium positioning drives investments in pressure-resistant, tamper-evident designs that preserve carbonation up to 4 volumes of CO2 while supporting brand shelf differentiation. Beverage formulators also require closures that protect sensitive nutraceutical ingredients and comply with U.S. Food and Drug Administration supplement labeling. In addition, Mexican consumer spending growth bolsters regional beverage production, amplifying unit demand for lightweight yet robust caps. Supply-chain reliability remains essential as manufacturers coordinate with fillers to deliver consistent torque and seal performance during high-speed bottling.

Brand-Owner Push for Tethered / E-commerce-Ready Closures

Direct-to-consumer shipping has made Amazon ISTA-6 compliance a gating requirement for personal-care and beverage launches. Brand owners therefore prioritize tethered formats that stay attached to the neck finish, mitigate leakage, and avoid cap loss inside shipping cartons. Aptar's Future Disc Top exemplifies this, pairing a secure lock with 100% polyethylene construction that simplifies curbside recycling. Grocery retailers likewise favor tethered designs because they streamline automated capping lines and cut downtime tied to cap-to-bottle mismatches. Patented hinge geometries now support multiple open-close cycles without compromising tamper evidence or consumer convenience.

Extended Producer Responsibility (EPR) Fees on Virgin Resin

California and three other states now levy producer-funded recycling fees that climb with virgin resin intensity, directly raising closure unit costs. Producers have begun shifting portfolios toward recycled or bio-based feedstocks to blunt fee exposure, yet the market supply of PCR polypropylene remains limited. Fee schedules differ by jurisdiction, complicating compliance for multi-state fillers, while reporting obligations create new administrative tasks. Smaller converters lacking regulatory staff face the greatest burden, potentially accelerating consolidation as they sell assets to scale players.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward PP Mono-Material Caps for Easier Recycling

- On-Line Pharma and Nutraceutical Boom Fuels CRC Demand

- Rise of Stand-Up Pouches with Fitments Replacing Screw Caps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene retained the largest 41.98% slice of the plastic caps and closures market in 2025 on the back of cost efficiency and versatile processing. Nevertheless, polyethylene terephthalate marked the quickest advance at a 6.45% CAGR as brand owners linked sustainability pledges with single-polymer packaging streams. PET closures now leverage intrinsic recyclability and mature reclaim networks to close material loops in beverage and personal-care segments. Innovations in crystallinity control and additive packages lift heat-resistance, enabling hot-fill juices without sacrificing seal integrity. Origin Materials recently demonstrated polyester resin closures compatible with standard filling lines, signaling scale-ready alternatives for converters.

Manufacturers also explore post-consumer PET content targets of 25% to sidestep EPR levies, pushing demand for food-grade recycled pellets. Meanwhile, polypropylene holds ground in aggressive chemical and pharma uses because of superior stress-crack resistance. Bio-based polymers, though niche, gain regulatory attention where compostability mandates apply. Together, these shifts create a mosaic of material choices that hinge on total-cost-of-ownership and recyclability metrics.

Threaded formats, long the default due to universal neck compatibility, secured 46.85% share in 2025. Yet child-resistant closures outpaced all categories at 5.55% CAGR through 2031 as e-commerce pharmacies shipped increasing prescription volumes directly to consumers. Tightening FDA guidance now requires CRCs on certain over-the-counter nutraceutical powders, further broadening addressable volumes. Berry Global's selectively openable design illustrates ongoing R&D, merging dual-input safety with adult-friendly ergonomics.

Dispensing variants hold appeal in personal-care lotions and household cleaners where controlled flow minimizes waste. Snap-fit and press-on solutions remain useful in dairy products needing quick application and economical tooling. Across closure types, embedded QR codes supporting authenticity verification and recycling instructions emerge as value-added differentiators in direct-to-consumer channels.

The North America Plastic Caps and Closures Market Report is Segmented by Material (Polyethylene, PET, Polypropylene, and More), Type (Threaded, Dispensing, and More), End-User Industry (Beverage, Food, Pharmaceutical and Healthcare, Cosmetics and Toiletries, and More), Manufacturing Process (Injection Molding, Compression Molding, 3-D Printing, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

List of Companies Covered in this Report:

- Silgan Holdings Inc.

- Amcor plc

- AptarGroup Inc.

- Closure Systems International Inc.

- TriMas Corporation

- Guala Closures SpA

- Tetra Pak Group

- O.Berk Company LLC

- BERICAP Holding GmbH

- Pano Cap Canada Ltd

- Erie Molded Plastics Inc.

- Crown Holdings Inc.

- Phoenix Closures Inc.

- Mold-Rite Plastics LLC

- Comar LLC

- Husky Technologies

- SACMI Imola S.C.

- Sonoco Products Company

- Plastipak Holdings Inc.

- Albea Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand surge for bottled and functional beverages

- 4.2.2 Brand-owner push for tethered / e-commerce-ready closures

- 4.2.3 Shift toward PP mono-material caps for easier recycling

- 4.2.4 On-line pharma and nutraceutical boom fuels CRC demand

- 4.2.5 AI-enabled in-line vision lowers defect rates and costs

- 4.3 Market Restraints

- 4.3.1 Extended Producer Responsibility (EPR) fees on virgin resin

- 4.3.2 Rise of stand-up pouches with fitments replacing screw caps

- 4.3.3 U.S./Canada rPET content mandates squeeze virgin PP demand

- 4.3.4 Beverage brand trials of aluminium crown re-seals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Geopolitical Scenarios

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By Material

- 5.1.1 Polyethylene (PE)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Polypropylene (PP)

- 5.1.4 Other Materials

- 5.2 By Type

- 5.2.1 Threaded

- 5.2.2 Dispensing

- 5.2.3 Unthreaded

- 5.2.4 Child-Resistant

- 5.3 By End-user Industry

- 5.3.1 Beverage

- 5.3.1.1 Bottled Water

- 5.3.1.2 Soft Drinks

- 5.3.1.3 Spirits

- 5.3.1.4 Other Beverages

- 5.3.2 Food

- 5.3.3 Pharmaceutical and Healthcare

- 5.3.4 Cosmetics and Toiletries

- 5.3.5 Household Chemicals

- 5.3.6 Other Industries

- 5.3.1 Beverage

- 5.4 By Manufacturing Process

- 5.4.1 Injection Molding

- 5.4.2 Compression Molding

- 5.4.3 3-D Printing / Rapid Prototyping

- 5.4.4 Other Manufacturing Process

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Silgan Holdings Inc.

- 6.4.2 Amcor plc

- 6.4.3 AptarGroup Inc.

- 6.4.4 Closure Systems International Inc.

- 6.4.5 TriMas Corporation

- 6.4.6 Guala Closures SpA

- 6.4.7 Tetra Pak Group

- 6.4.8 O.Berk Company LLC

- 6.4.9 BERICAP Holding GmbH

- 6.4.10 Pano Cap Canada Ltd

- 6.4.11 Erie Molded Plastics Inc.

- 6.4.12 Crown Holdings Inc.

- 6.4.13 Phoenix Closures Inc.

- 6.4.14 Mold-Rite Plastics LLC

- 6.4.15 Comar LLC

- 6.4.16 Husky Technologies

- 6.4.17 SACMI Imola S.C.

- 6.4.18 Sonoco Products Company

- 6.4.19 Plastipak Holdings Inc.

- 6.4.20 Albea Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment