|

市場調查報告書

商品編碼

1906868

菲律賓可再生能源市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)Philippines Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

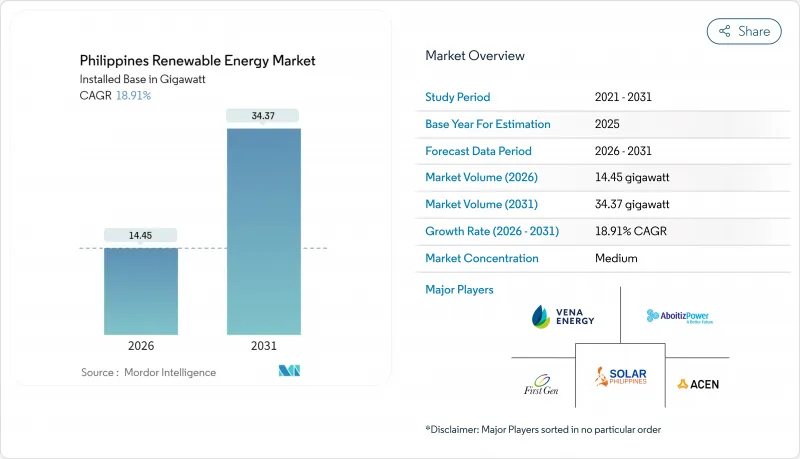

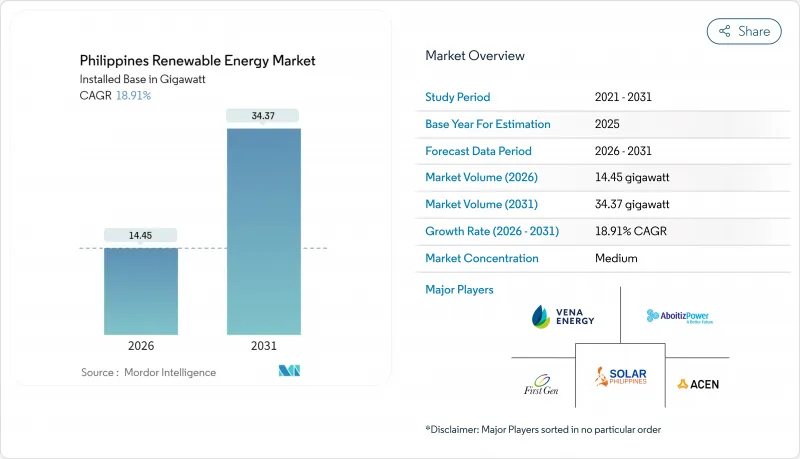

菲律賓可再生能源市場在 2025 年的價值為 12.15 吉瓦,預計將從 2026 年的 14.45 吉瓦成長到 2031 年的 34.37 吉瓦,在預測期(2026-2031 年)以 18.91% 的複合預測期(2026-2031 年)以 18.91% 的複合年成長率成長。

政策強制推行的投資組合標準、太陽能和風能發電成本的下降、零售電價的上漲以及新建燃煤發電廠建設的禁令,共同加速了菲律賓從火力發電向新能源的轉型。儘管煤炭在2022年仍佔電力供應的60%,但在氣候投資基金(CIF)提供的5億美元優惠資金支持下,提前退役的燃煤電廠將取代900兆瓦的老舊發電容量,並為新的綠色計劃騰出空間。併網型資產,特別是ACEN的600兆瓦巴丹太陽能發電廠和Solar Philippines的3.5吉瓦Terra太陽能綜合體,正獲得先發優勢並吸引機構資本。同時,企業購電市場蓬勃發展,資料中心和24小時運作流程外包(BPO)園區紛紛簽署長期購電協議,以對沖菲律賓地區最高的零售電費。

菲律賓可再生能源市場趨勢與洞察

可再生組合標準(RPS)和上網電價補貼(FIT)

2024年,可再生能源配額標準將重設為11%,預計2030年將提高到35%,屆時配電公司必須從清潔能源生產商購買三分之一的電力。雖然上網電價補貼政策曾幫助早期計劃啟動,但最新的綠色能源競標計畫已成為主要的採購管道,2024年已授予3.4吉瓦的裝置容量。儲能競標計劃於2025年進行。能源監理委員會(ERC)於2024年6月發布的通告取消了大部分外資所有權限制,並簡化了夥伴關係結構。 《創造、改革和能源法案》(CREATE Act)規定的七年所得稅免稅期,以及之後10%的稅率,增強了財政競爭力,使菲律賓成為東南亞最有利於新建可再生能源項目的地區之一。

對太陽能和風能發電設施的投資減少

自2010年以來,全球太陽能組件價格已下降89%,伊羅戈斯北省和邦阿西楠省大型太陽能發電廠的平準化度電成本(LCOE)已降至每千瓦時披索菲律賓比索以下。 ACEN的巴丹電廠將於2024年第四季投入運作,電價低於每瓦0.60美元,比國內歷史基準價格低25%。同時,美國國家再生能源實驗室(NREL)預測,隨著浮體式平台技術的成熟,到2050年離岸風力發電成本將降至每兆瓦時34美元。製造商天合光能和維斯塔斯正在將雙面組件和5兆瓦以上的風力發電機組整合到菲律賓供應鏈中,加速效率提升。

擁擠的電網和有限的輸電能力

在規劃的258個輸電計劃中,截至2024年僅有75個完工,另有58個項目延期長達九年。 TransCo公司估計,擁塞將使終端用戶電費增加披索/千瓦時,這將在很大程度上抵消可再生能源的成本優勢。能源監管委員會(ERC)延長了第三組資本支出凍結期,導致2吉瓦太陽能和風能併網合約被凍結,預計2024年北伊羅戈走廊的非離峰時段時段棄電率將達到12%。

細分市場分析

水力發電仍是山區電力供應的基礎,預計2025年將佔菲律賓裝置容量的41.20%。菲律賓水力發電可再生能源市場預計將透過現有水壩的維修和擴建而擴大,但其成長速度低於太陽能和風能。受聖貝納迪諾和東維薩亞斯潮汐能和波浪先導工廠運作的推動,海洋能預計到2031年將以114.2%的複合年成長率成長。如果浮體式平台被證明具有商業性可行性,這一細分領域可望改變沿海電力供應格局。根據美國國家可再生能源實驗室(NREL)的研究,菲律賓擁有42.86吉瓦的離岸風力發電技術潛力,其中93%適合採用浮體式風力渦輪機。這表明,一旦成本與陸上標準趨於一致,離岸風電將在長期內佔據主導地位。

菲律賓的太陽能發電發展穩步推進。光是ACEN的Terra Solar計劃(菲律賓太陽能計畫的一部分)預計裝置容量就將超過4吉瓦,隨著呂宋島電網的不斷完善,這將鞏固島上的領先地位。風力發電廠主要集中在伊羅戈斯-帕奈走廊沿線,該地區季風平均風速可達每秒7.5公尺。地熱發電量穩定在約1.5吉瓦,巴克曼地區的現有井正在升級改造為雙回圈。生質能源的貢獻小規模,而以360兆瓦的卡拉延水電站為代表的抽水蓄能發電則扮演重要的平衡角色。然而,自2010年以來,尚無新的專案完成資金籌措。整體而言,多樣化的新增裝置容量增強了可再生能源產業應對能源供應和燃料價格波動的能力。

菲律賓可再生能源市場報告按技術(太陽能、風力發電、水力發電、生質能源、地熱能和海洋能)和最終用戶(公共產業、商業和工業以及住宅)進行細分。市場規模和預測以裝置容量(吉瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 可再生能源促進標準(RPS)和上網電價補貼(FIT)

- 太陽能和風力發電機資本支出(CAPEX)呈下降趨勢

- 電力需求不斷成長,零售價格高企

- 來自業務流程外包/資訊科技中心的企業間購電協議(PPA)

- 日本國際協力機構資助的輸電網強化計劃

- 抗災島嶼微電網項目

- 市場限制

- 擁擠的電網和有限的輸電能力

- 區域經濟特區競標監理方面的不確定性

- 颱風相關保險費用上漲

- 與土地改革區相關的土地使用糾紛

- 供應鏈分析

- 監管環境

- 技術展望(混合式、浮體式、儲能式)

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- PESTEL 分析

第5章 市場規模與成長預測

- 透過技術

- 太陽能(光伏和聚光太陽能)

- 風力發電(陸上和海上)

- 水力發電(小規模、大型、抽水蓄能)

- 生質能源

- 地熱

- 海洋能源(潮汐能和波浪能)

- 最終用戶

- 電力公司

- 商業和工業

- 住宅

第6章 競爭情勢

- 市場集中度

- 策略性措施(併購、合資、資金籌措、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- Aboitiz Power Corporation

- ACEN Corporation

- Solar Philippines Power Project Holdings Inc.

- Vena Energy

- First Gen Corporation

- Energy Development Corporation(EDC)

- SN Aboitiz Power Group

- Alternergy Holdings Corp.

- Trina Solar Co. Ltd.

- Vestas Wind Systems A/S

- Solenergy Systems Inc.

- Solaric Corp.

- National Power Corporation(NPC-PSALM)

- Philippine Geothermal Production Company Inc.

- Meralco PowerGen Corp.

- Siemens Gamesa Renewable Energy

- Nexif Energy

- Kepco Philippines Holdings

- Enfinity Global Inc.

- Sharp Energy Solutions

第7章 市場機會與未來展望

The Philippines Renewable Energy Market was valued at 12.15 gigawatt in 2025 and estimated to grow from 14.45 gigawatt in 2026 to reach 34.37 gigawatt by 2031, at a CAGR of 18.91% during the forecast period (2026-2031).

Policy-mandated portfolio standards, falling solar and wind equipment costs, rising retail tariffs, and a moratorium on new coal plants are collectively accelerating the shift away from thermal generation. Coal still supplied 60% of electricity in 2022; yet, imminent retirements backed by USD 500 million of concessional capital from the Climate Investment Funds will displace 900 MW of aging capacity, creating headroom for new green projects. Grid-ready assets, notably ACEN's 600 MW Bataan solar farm and Solar Philippines' 3.5 GW Terra Solar complex, are capturing first-mover scale advantages and attracting institutional capital. At the same time, the corporate power-purchase market is booming as data centers and 24/7 business-process outsourcing campuses sign long-term offtake contracts to hedge against the country's region-leading retail tariffs.

Philippines Renewable Energy Market Trends and Insights

Renewable Portfolio Standards & Feed-in Tariffs

The Renewable Portfolio Standard was reset to 11% in 2024 and is expected to increase to 35% by 2030, forcing distribution utilities to contract a third of their supply from clean generators. Feed-in tariffs helped seed initial projects; however, the latest Green Energy Auction Program rounds are now the principal procurement channel, with 3.4 GW awarded in 2024, and storage-linked bids are scheduled for 2025. The Energy Regulatory Commission's June 2024 circular removed most foreign-ownership caps, simplifying partnership structures. Seven-year income-tax holidays followed by a 10% rate under the CREATE Act sharpen fiscal competitiveness, placing the Philippines among Southeast Asia's most favorable jurisdictions for greenfield renewables.

Declining Solar-PV & Wind Turbine Capex

Global module prices have fallen by 89% since 2010, pushing utility-scale solar levelized costs below PHP 2.50/kWh in Ilocos Norte and Pangasinan. ACEN's Bataan plant commissioned in 4Q 2024 at under USD 0.60 per watt, 25% under the prior domestic benchmark, while NREL projects offshore-wind costs sliding to USD 34 /MWh by 2050 as floating-platform learning curves mature. Manufacturers Trina Solar and Vestas are integrating bifacial modules and turbines exceeding 5 MW into the Philippine supply chain, accelerating efficiency gains.

Grid congestion & limited transmission capacity

Only 75 of 258 planned transmission projects were completed by 2024, leaving 58 schemes delayed up to nine years. TransCo estimates that congestion adds PHP 0.80/kWh to end-user bills, nullifying much of the cost advantage of renewables. ERC's deferral of Group 3 capex frozen interconnection for 2 GW of solar and wind contracts, and curtailment in the Ilocos Norte corridor reached 12% during off-peak hours in 2024.

Other drivers and restraints analyzed in the detailed report include:

- Rising Electricity Demand & High Retail Tariffs

- Corporate PPAs from BPO/IT Hubs

- Regulatory Uncertainty around CREZ Auctions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydropower accounted for 41.20% of the installed capacity in 2025 and remains the cornerstone of electricity generation in mountainous regions. The Philippines' renewable energy market size for hydropower is expected to expand as retrofits upgrade existing dams, although growth is moderate compared to solar and wind additions. Ocean energy, while starting from a negligible baseline, is projected to compound at a rate of 114.2% per year through 2031, thanks to tidal and wave pilot plants in San Bernardino and Eastern Visayas. This niche could transform coastal supply if floating platforms prove commercially viable. The National Renewable Energy Laboratory maps 42.86 GW of offshore wind technical potential, 93% of which is suited for floating turbines, indicating long-term marine dominance once costs converge with onshore benchmarks.

The expansion of solar energy in the Philippines is relentless; ACEN's Solar Philippines' Terra Solar projects alone will surpass 4 GW when Luzon's power grid is reinforced, thereby solidifying Luzon's dominance. Wind farms cluster along the Ilocos and Panay corridors where monsoon speeds average 7.5 m/s. Geothermal output remains steady at about 1.5 GW, with binary-cycle upgrades at Bacman leveraging existing wells. Bioenergy plays a modest role, and pumped storage, exemplified by the 360 MW Kalayaan plant, supplies vital balancing; however, no new schemes have reached financial close since 2010. Overall, diversified additions underpin the new renewable industry's resilience against fluctuations in energy supply and fluctuations in fuel prices.

The Philippines Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Aboitiz Power Corporation

- ACEN Corporation

- Solar Philippines Power Project Holdings Inc.

- Vena Energy

- First Gen Corporation

- Energy Development Corporation (EDC)

- SN Aboitiz Power Group

- Alternergy Holdings Corp.

- Trina Solar Co. Ltd.

- Vestas Wind Systems A/S

- Solenergy Systems Inc.

- Solaric Corp.

- National Power Corporation (NPC-PSALM)

- Philippine Geothermal Production Company Inc.

- Meralco PowerGen Corp.

- Siemens Gamesa Renewable Energy

- Nexif Energy

- Kepco Philippines Holdings

- Enfinity Global Inc.

- Sharp Energy Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renewable Portfolio Standards & Feed-in Tariffs

- 4.2.2 Declining Solar-PV & Wind Turbine Capex

- 4.2.3 Rising Electricity Demand & High Retail Tariffs

- 4.2.4 Corporate PPAs from BPO/IT Hubs

- 4.2.5 Grid Upgrades via JICA-funded Projects

- 4.2.6 Disaster-resilient Island & Micro-grid Programs

- 4.3 Market Restraints

- 4.3.1 Grid Congestion & Limited Transmission Capacity

- 4.3.2 Regulatory Uncertainty around CREZ Auctions

- 4.3.3 Typhoon-driven Insurance Cost Escalation

- 4.3.4 Land-use Conflicts with Agrarian Reform Lands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Hybrid, Floating, Storage)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Aboitiz Power Corporation

- 6.4.2 ACEN Corporation

- 6.4.3 Solar Philippines Power Project Holdings Inc.

- 6.4.4 Vena Energy

- 6.4.5 First Gen Corporation

- 6.4.6 Energy Development Corporation (EDC)

- 6.4.7 SN Aboitiz Power Group

- 6.4.8 Alternergy Holdings Corp.

- 6.4.9 Trina Solar Co. Ltd.

- 6.4.10 Vestas Wind Systems A/S

- 6.4.11 Solenergy Systems Inc.

- 6.4.12 Solaric Corp.

- 6.4.13 National Power Corporation (NPC-PSALM)

- 6.4.14 Philippine Geothermal Production Company Inc.

- 6.4.15 Meralco PowerGen Corp.

- 6.4.16 Siemens Gamesa Renewable Energy

- 6.4.17 Nexif Energy

- 6.4.18 Kepco Philippines Holdings

- 6.4.19 Enfinity Global Inc.

- 6.4.20 Sharp Energy Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Developing Floating PV Parks in Calm Backwaters