|

市場調查報告書

商品編碼

1906257

電動工具:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Power Tools - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

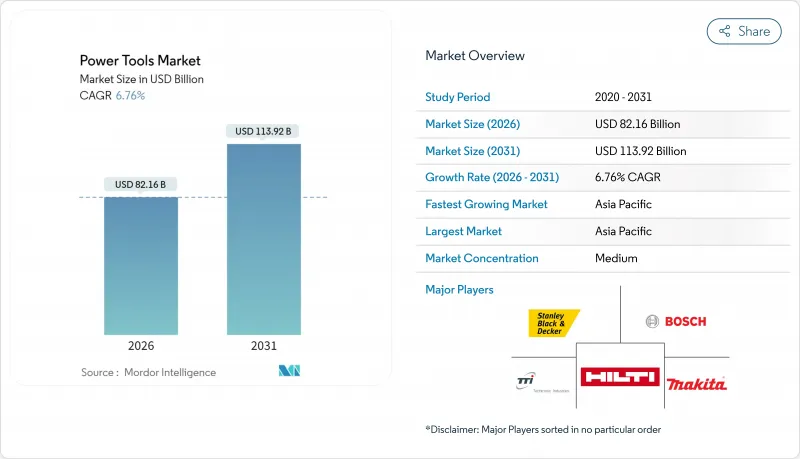

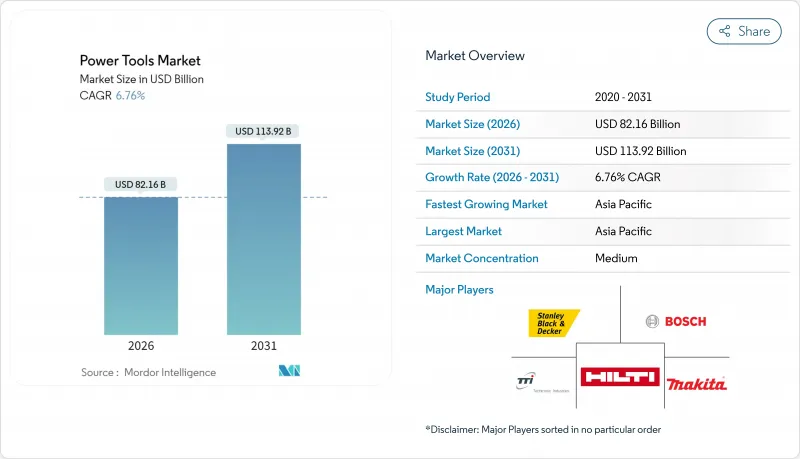

預計電動工具市場將從 2025 年的 769.6 億美元成長到 2026 年的 821.6 億美元,到 2031 年將達到 1,139.2 億美元,2026 年至 2031 年的複合年成長率為 6.76%。

基礎設施建設規劃的擴展、快速的都市化以及向無線技術的轉變,在供應鏈逐步恢復正常的同時,也支撐著市場需求。無線技術正在重新定義工作場所的生產力,而主要城市日益嚴格的排放法規正在加速從氣動和汽油動力設備向電池動力平台的過渡。新興經濟體中DIY參與度的提高以及電子商務的普及正在擴大消費群,而亞洲和歐洲的智慧製造激勵措施正在推動工廠對高精度、互聯工具系統的投資。市場競爭強度仍然適中,主要企業透過差異化的電池生態系統來捍衛市場佔有率,而中國新進入者則利用在地化生產和積極的定價策略。

全球電動工具市場趨勢與洞察

向高功率密度鋰離子電池平台過渡

電池化學技術的進步使能量密度每年持續提升 5-7%,讓承包商既能享受有線工具的運作時間,又能體驗無線工具的便攜性。得偉 (DEWALT) 的無工作台電池結構在減輕重量的同時,功率提升了 50%,使屋頂工和電工能夠攜帶更輕的工具包,而無需犧牲扭矩。

北美和歐洲施工機械的電氣化

鑑於排放法規和生命週期成本的降低,美國和加拿大66%的建築經理預計將在兩年內實現工地全面電動化。歐洲市政當局也正在追求類似的目標,沃爾沃等汽車製造商已承諾在2030年實現全電動車型陣容。行動快速充電器的廣泛普及也緩解了里程焦慮。都市區計劃擴大指定使用電池供電或有線電動工具,這給氣壓和液壓工具市場帶來了壓力,而燃油動力工具在缺乏電網的偏遠地區仍然是小眾市場。已部署全電動車隊的承包商報告稱,二氧化碳排放量減少了高達60%,工期縮短了30%,證明了他們投資的有效性。

鋰和鈷價格的波動正在推高無線產品的零件成本。

美國加徵關稅已將中國產鋰離子電池的整體關稅稅率提高至2025年的58%,這將對原始設備製造商(OEM)的利潤率和零售價格造成壓力。電池組件佔高功率無線工具成本的30%至40%,現貨價格上漲迫使製造商在澳洲和非洲等地尋求替代採購協議,以確保供應並穩定價格。

細分市場分析

在電動工具市場,到2025年,電動工具將佔總銷量的63.02%。隨著鋰離子電池組的性能逐漸接近有線產品,預計到2031年,無線電動工具細分市場將以7.24%的複合年成長率成長。氣動工具將在已有壓縮空氣系統的領域中保持其市場地位,油壓設備將服務於需要超高扭矩的細分市場,例如橋樑張緊。由於都市區噪音和排放氣體法規的限制,引擎驅動的設備僅限於離網建築工地和林業作業。由於多品牌電池聯盟帶來的成本降低和充電基礎設施簡化,無線電動工具市場規模預計將快速成長。然而,由於原料價格波動以及發展中地區快速充電技術的普及程度有限,價格敏感型用戶仍將繼續青睞有線產品。

改良的人體工學設計、無刷驅動和韌體更新如今已成為高階無線產品的差異化優勢。博世的 Professional 18V 系統和牧田的 LXT 可互換電池組充分展現了生態系統的一致性如何確保客戶忠誠度。車隊管理人員也支持這項轉型,他們讚賞無線作業環境帶來的停機時間減少和安全性提升。

到2025年,鑽頭和緊固工具將佔電動工具市場收入的31.88%,這反映出它們在建築工地和組裝線上的廣泛應用。衝擊扳手和衝擊起子將以7.78%的複合年成長率成長,這主要得益於汽車和航太行業日益嚴格的緊固規範,這些規範要求精確的扭矩控制和數據採集以實現可追溯性。切割和銑削工具仍將保持強勁勢頭,博世推出的硬質合金刀片的使用壽命是雙金屬刀片的20倍,深受大規模生產中木工的青睞。

手部振動症候群 (HAVS) 法規正在推動電鎚的重新設計,博世的 GSH 18V-5 無線電錘結合了 8.5 焦耳的衝擊能量和變速控制功能,有效降低了振動。熱風槍和無線黏合工具等新興品類正在推動室內裝修和電子產品維修領域的需求,從而開拓了傳統建設業以外的市場。儘管價格競爭日益激烈,但高階無刷產品的全面供應正幫助頂級品牌保持在電動工具市場的佔有率。

區域分析

預計到2025年,亞太地區將佔全球電動工具收入的39.55%,年複合成長率達7.61%。這主要得益於中國升級改造計畫帶來的25%的資本支出成長,以及印度「印度製造」計劃吸引了許多國內外原始設備製造商(OEM)。在地化的電池組生產和不斷成長的可支配收入正在推動無線產品的普及,而成熟且創新驅動的日本市場則透過高階無刷機型實現了產品差異化。

北美是電動工具市場技術先進但成長緩慢的地區。美國租賃協會 (ARA) 預測,到 2024 年,設備租賃收入將達到 773 億美元,證實了市場需求的持續強勁。然而,對中國製造電池徵收的關稅推高了採購成本,並促使企業將生產轉移到墨西哥。在墨西哥,電動工具進口正以兩位數的速度成長,供應鏈也正在進行重組以規避關稅。

歐洲電動工具市場在不同地區呈現不同的發展趨勢。西方市場面臨租賃管道飽和和嚴格的手振動症候群(HAVS)法規的挑戰,而東歐則受益於歐盟的資金支持和新的製造能力。歐盟81億歐元的智慧工廠投資舉措(IPCEI)正在推動智慧工廠投資,並創造對互聯精密工具的需求。遵守環保法規的壓力促使電動工具更受青睞,主要原始設備製造商(OEM)透過低振動認證和可回收包裝來凸顯自身優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北美和歐洲施工機械車隊的電氣化

- 亞洲電子商務的普及正在推動DIY文化的擴張。

- 汽車輕量化需要高精度,這推動了無刷工具的應用。

- 政府對智慧製造的獎勵(例如「中國製造2025」、歐盟的IPCEI)

- 向鋰離子電池平台過渡,實現高功率密度無線工具

- 建築公司中模組化、訂閱式按需工具程式的普及

- 市場限制

- 鋰和鈷價格的波動推高了無線工具零件的成本。

- 西歐成熟租賃通路的飽和

- 監管機構對臂部振動綜合症 (HAVS) 的擔憂限制了重型拆除工具的採用。

- 新興市場仿冒品供應分散,侵蝕品牌溢價。

- 價值/供應鏈分析

- 監理與行業政策展望

- 技術展望

- 產業吸引力—五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 分銷通路分析

第5章 市場規模與成長預測

- 按操作模式

- 電

- 無線

- 有線

- 氣壓

- 油壓

- 引擎驅動

- 電

- 依產品

- 鑽孔和緊固工具

- 鋸子/切割工具

- 研磨和拋光工具

- 材料去除工具(砂光機等)

- 拆除工具(破碎機、風鎬)

- 衝擊扳手和衝擊起子

- 射釘槍和訂書機

- 其他(熱風槍、熱熔膠槍、攪拌器、專用工具)

- 最終用戶

- 建築和基礎設施

- 車

- 航太/國防

- 能源與發電

- 造船、航運和鐵路

- 製造業(電子、金屬加工、木工等)

- 住宅/DIY

- 其他(公共產業、採礦等)

- 按銷售管道

- 離線

- 直接面向行業/分銷商

- 量販店/家居建材商店

- 線上

- 電子商務市場

- 公司內部數位商店

- 離線

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 秘魯

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(丹麥、芬蘭、冰島、挪威、瑞典)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東協(印尼、泰國、菲律賓、馬來西亞、越南)

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 土耳其

- 埃及

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合作、產品發布)

- 市佔率分析

- 公司簡介

- Stanley Black & Decker Inc.

- Robert Bosch GmbH

- Techtronic Industries Co. Ltd.

- Makita Corporation

- Hilti Corporation

- Atlas Copco AB

- Ingersoll Rand Inc.

- Snap-on Incorporated

- Apex Tool Group

- Emerson Electric Co.

- Husqvarna AB

- Honeywell International Inc.

- KYOCERA Corporation

- Festool GmbH

- Cummins Inc.(Tool segment)

- Hitachi Koki(HiKOKI)

- Illinois Tool Works(ITW)

- Ridgid(Emerson)

- Baier Power Tools

- Positec Tool Corporation

- Panasonic Life Solutions

- CEMBRE SpA

- CSUN Power Tools*

第7章 市場機會與未來展望

The Power Tools market is expected to grow from USD 76.96 billion in 2025 to USD 82.16 billion in 2026 and is forecast to reach USD 113.92 billion by 2031 at 6.76% CAGR over 2026-2031.

Expanding infrastructure programs, rapid urbanization, and the shift toward cordless technologies sustain demand even as supply chains normalize. Cordless electrification is redefining job-site productivity, while stricter emissions rules in major cities accelerate the replacement of pneumatic and gas-powered units with battery platforms. Rising DIY participation and e-commerce access in emerging economies widen the consumer base, and smart manufacturing incentives in Asia and Europe stimulate factory-floor investments in high-precision, connected tool systems. Competitive intensity remains moderate; leaders safeguard their share through differentiated battery ecosystems, whereas new Chinese entrants leverage localized production and aggressive pricing.

Global Power Tools Market Trends and Insights

Shift to Lithium-ion Battery Platforms Enabling Higher Power Density Cordless Tools

Cell chemistries continue to raise energy density by 5-7% annually, giving contractors similar runtime to corded equivalents with the benefit of untethered mobility. DEWALT's tabless cell architecture boosts power 50% while shedding weight, allowing roofers and electricians to carry lighter packs without sacrificing torque.

Electrification of Construction Equipment Fleet in North America & Europe

Sixty-six percent of construction managers in the United States and Canada now expect fully electric jobsites within two years, citing emissions caps and lower lifetime running costs. European municipalities pursue similar goals; OEMs such as Volvo pledge all-electric line-ups by 2030 while mobile fast-charging rollouts shrink range anxiety. Urban projects increasingly specify battery or corded-electric tools, pressuring pneumatic and hydraulic segments yet leaving a niche for engine-driven units on remote sites lacking grid access. Contractors adopting all-electric fleets report up to 60% CO2 savings and 30% shorter project timelines, reinforcing the payback narrative.

Volatility in Lithium & Cobalt Prices Inflating Cordless BOM Cost

US tariffs have lifted the composite duty on Chinese lithium-ion batteries to 58% in 2025, pressuring OEM margins and retail prices. Battery inputs account for 30-40% of high-power cordless tool cost; spikes in spot prices force manufacturers to negotiate alternate offtake deals in Australia and Africa to secure supply and smooth pricing.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart Manufacturing

- DIY Culture Expansion Fueled by E-commerce Penetration in Asia

- Saturation of Mature Rental Channels in Western Europe

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric formats captured 63.02% of 2025 revenue in the power tool market, with cordless sub-segments expanding at 7.24% CAGR through 2031 as lithium-ion packs approach corded performance parity. Pneumatic tools retain footholds where compressed-air systems already exist, and hydraulic devices address ultra-high-torque niches such as bridge tensioning. Engine-driven equipment is relegated to off-grid construction and forestry operations due to urban noise and emissions limits. The power tools market size for cordless solutions is projected to widen sharply as multi-brand battery alliances cut ownership costs and simplify charging infrastructure. However, raw-material pricing swings and limited fast-charging availability in developing regions keep corded units relevant for price-sensitive users.

Enhanced ergonomics, brushless drives, and firmware updates now differentiate premium cordless products. Bosch's Professional 18V System and Makita's LXT interchangeable packs highlight how ecosystem consistency locks in customer loyalty. Fleet managers appreciate the reduced downtime and safety gains derived from cable-free worksites, reinforcing the transition.

Drilling and fastening tools accounted for 31.88% of 2025 revenue in the power tool market, reflecting their ubiquity across construction and assembly lines. Impact drivers and wrenches register an 7.78% CAGR thanks to automotive and aerospace tightening specifications that require exact torque and data capture for traceability. Sawing and cutting remain resilient; carbide-tipped blades introduced by Bosch offer 20x life versus bi-metal alternatives, appealing to high-volume carpenters.

Regulations targeting HAVS prompt redesigns in demolition hammers; Bosch's cordless GSH 18V-5 balances 8.5 J impact energy with adaptive speed control to mitigate vibration exposure. Emerging categories such as heat guns and cordless glue tools gain traction in decor and electronics rework, expanding the addressable universe beyond traditional construction trades. Collectively, premium brushless offerings underpin power tools market share retention for tier-one brands despite price competition.

The Power Tools Market is Segmented by Mode of Operation (Electric, and Others), by Product (Drilling & Fastening Tools, and Others), by End-User (Construction & Infrastructure, and Others), by Sales Channel (Offline and Online), and by Region (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 39.55% of 2025 global revenue in the power tool market and is poised for a 7.61% CAGR, anchored by China's 25% capital-investment hike under its upgrading plan and India's Make in India incentives that draw both domestic and foreign OEMs. Localized battery pack production and rising disposable incomes spur cordless adoption, while Japan's mature yet innovation-centric market relies on premium brushless models to differentiate offerings.

North America constitutes a technologically advanced yet slower-growing region in the power tools market. The American Rental Association expects equipment rental revenue to climb to USD 77.3 billion in 2024, reinforcing a substantial recurring demand base. Nevertheless, tariffs on Chinese batteries inflate procurement costs, motivating near-shoring in Mexico, where tool imports surge double digits and supply chains reconfigure to sidestep duties.

Europe shows divergent trajectories in the power tools market: Western markets see rental channel saturation and strict HAVS regulation, whereas Eastern Europe benefits from EU funding and fresh manufacturing capacity. The EU's EUR 8.1 billion IPCEI initiative stimulates smart-factory investments, generating demand for connected precision tools. Environmental compliance pressure favors electric models, and leading OEMs differentiate through low-vibration certifications and recyclable packaging.

- Stanley Black & Decker Inc.

- Robert Bosch GmbH

- Techtronic Industries Co. Ltd.

- Makita Corporation

- Hilti Corporation

- Atlas Copco AB

- Ingersoll Rand Inc.

- Snap-on Incorporated

- Apex Tool Group

- Emerson Electric Co.

- Husqvarna AB

- Honeywell International Inc.

- KYOCERA Corporation

- Festool GmbH

- Cummins Inc. (Tool segment)

- Hitachi Koki (HiKOKI)

- Illinois Tool Works (ITW)

- Ridgid (Emerson)

- Baier Power Tools

- Positec Tool Corporation

- Panasonic Life Solutions

- CEMBRE S.p.A.

- CSUN Power Tools*

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Construction Equipment Fleet in North America & Europe

- 4.2.2 DIY Culture Expansion Fueled by E-commerce Penetration in Asia

- 4.2.3 Automotive Light-weighting Demands Higher Precision, Driving Brushless Tools Adoption

- 4.2.4 Government Incentives for Smart Manufacturing (e.g., Made-in-China 2025, EU IPCEI)

- 4.2.5 Shift to Lithium-ion Battery Platforms Enabling Higher Power Density Cordless Tools

- 4.2.6 Surge in Modular, Subscription-based Tool-on-Demand Programs Among Contractors

- 4.3 Market Restraints

- 4.3.1 Volatility in Lithium & Cobalt Prices Inflating Cordless Tool BOM Cost

- 4.3.2 Saturation of Mature Rental Channels in Western Europe

- 4.3.3 Regulatory Noise Around Hand-Arm Vibration Syndrome (HAVS) Limiting Heavy Demolition Tool Uptake

- 4.3.4 Fragmented Counterfeit Supply in Emerging Markets Undercutting Brand Premiums

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Industry Policies Outlook

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Distribution Channel Analysis

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Mode of Operation

- 5.1.1 Electric

- 5.1.1.1 Cordless

- 5.1.1.2 Corded

- 5.1.2 Pneumatic

- 5.1.3 Hydraulic

- 5.1.4 Engine-Driven

- 5.1.1 Electric

- 5.2 By Product

- 5.2.1 Drilling & Fastening Tools

- 5.2.2 Sawing & Cutting Tools

- 5.2.3 Grinding & Polishing Tools

- 5.2.4 Material Removal Tools (sanders, etc.)

- 5.2.5 Demolition Tools (Breakers, Jackhammers)

- 5.2.6 Impact Drivers & Wrenches

- 5.2.7 Nailers & Staplers

- 5.2.8 Others (heat guns, glue guns, mixers, speciality tools)

- 5.3 By End-user

- 5.3.1 Construction & Infrastructure

- 5.3.2 Automotive

- 5.3.3 Aerospace & Defense

- 5.3.4 Energy & Power Generation

- 5.3.5 Shipbuilding, Marine & Railways

- 5.3.6 Manufacturing (Electronics, Metalworking, Wood Work, etc.)

- 5.3.7 Residential / DIY

- 5.3.8 Others (Utilities, Mining, etc.)

- 5.4 By Sales Channel

- 5.4.1 Offline

- 5.4.1.1 Direct Industrial/ Distributor

- 5.4.1.2 Mass Retail / Home Centers

- 5.4.2 Online

- 5.4.2.1 E-commerce Marketplaces

- 5.4.2.2 Brand-Owned Digital Stores

- 5.4.1 Offline

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Peru

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Kuwait

- 5.5.5.5 Turkey

- 5.5.5.6 Egypt

- 5.5.5.7 South Africa

- 5.5.5.8 Nigeria

- 5.5.5.9 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Product Launches)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)}

- 6.4.1 Stanley Black & Decker Inc.

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Techtronic Industries Co. Ltd.

- 6.4.4 Makita Corporation

- 6.4.5 Hilti Corporation

- 6.4.6 Atlas Copco AB

- 6.4.7 Ingersoll Rand Inc.

- 6.4.8 Snap-on Incorporated

- 6.4.9 Apex Tool Group

- 6.4.10 Emerson Electric Co.

- 6.4.11 Husqvarna AB

- 6.4.12 Honeywell International Inc.

- 6.4.13 KYOCERA Corporation

- 6.4.14 Festool GmbH

- 6.4.15 Cummins Inc. (Tool segment)

- 6.4.16 Hitachi Koki (HiKOKI)

- 6.4.17 Illinois Tool Works (ITW)

- 6.4.18 Ridgid (Emerson)

- 6.4.19 Baier Power Tools

- 6.4.20 Positec Tool Corporation

- 6.4.21 Panasonic Life Solutions

- 6.4.22 CEMBRE S.p.A.

- 6.4.23 CSUN Power Tools*

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment