|

市場調查報告書

商品編碼

1906140

歐洲休閒車:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

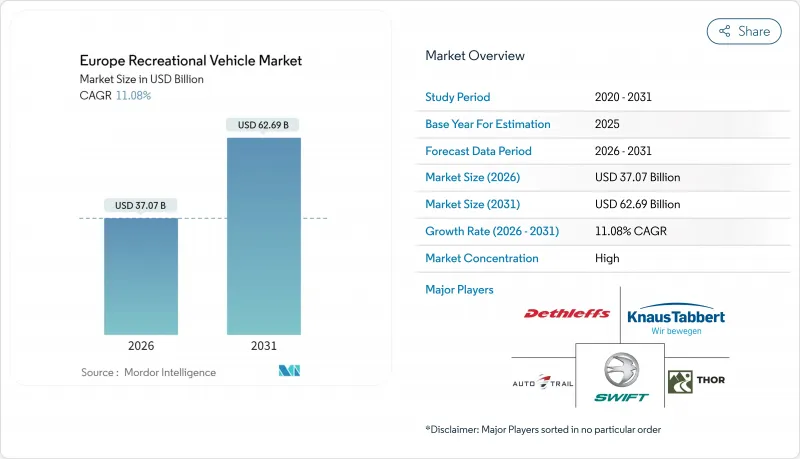

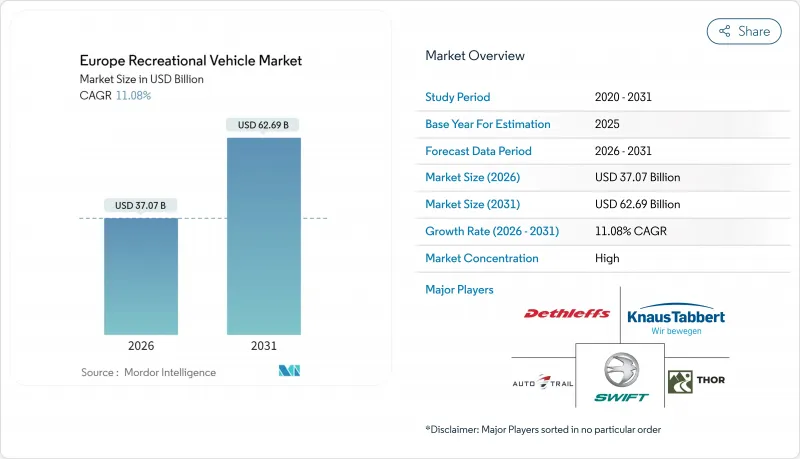

歐洲休閒車(RV)市場預計將從 2025 年的 333.8 億美元成長到 2026 年的 370.7 億美元,預計到 2031 年將達到 626.9 億美元,2026 年至 2031 年的複合年成長率為 11.08%。

這一強勁的成長動能反映了疫情後復甦以及歐洲休閒模式結構性變化所展現的產業韌性。市場擴張得益於監管方面的利好,特別是歐洲議會核准到2028年將B類駕照的適用範圍擴大至4.25噸級旅居車,這將使數百萬新增駕駛員得以進入該行業。

歐洲休閒車市場趨勢與洞察

疫情後,國內和歐洲內部旅遊業激增

歐洲的露營活動正達到前所未有的水平,德國2024年的露營夜數預計將達到4,290萬住宿,比疫情前的2019年增加19.9%。國內旅遊的持續成長反映了歐洲休閒偏好的根本性轉變,以本地為中心的旅行方式已從疫情期間的無奈之舉演變為一種更受歡迎的生活方式選擇。這一趨勢並非德國獨有,挪威的露營地也迎來了住宿人數的顯著成長,比去年同期成長顯著。露營活動持續活性化至2025年,尤其與以往露營在德國住宿中佔據主導地位的歷史水準相比,顯示這是一種結構性需求,而非疫情帶來的暫時性因素。旅遊業的這種重塑為房車需求提供了持續的推動力,涵蓋了從適合城市探索的緊湊型露營車到支持長途國內旅行的大型旅居車等所有車型。

房車共享和租賃平台的快速擴張

歐洲房車共享生態系統正快速成熟。 Roadsurfer 於 2025 年 4 月成功完成由 Avelina Capital 領投的 3000 萬歐元資金籌措,尤其是其計劃將車隊規模從 8500 輛擴大到 10000 輛,印證了該行業的加速成長。此輪融資反映出機構投資者認可點對點房車平台已克服最初的信任障礙並實現了規模化。值得注意的是,該平台正在向東歐市場擴張。 Ruuts 透過 API 整合瞄準這些市場,提供歐洲主要房車的接入,並覆蓋先前服務不足的地區。共享經濟模式滲透到房車所有權模式中,正在產生雙重市場效應:它使首次使用者更容易獲得房車,同時為個人車主創造了基於使用量的收入來源,有效地將潛在市場擴展到傳統所有權模式之外。

高昂的初始購買成本和保險費用

歐洲房車價格飆漲,導致各細分市場的購買力都受到擠壓。價格上漲的原因包括價值鏈中斷、底盤短缺以及製造商為應對疫情期間需求激增而漲價。此外,由於需要特殊維修,更高的重置成本和保險費用也進一步加重了消費者的財務負擔。儘管中階市場買家擴大選擇二手車和租賃,但年輕買家和首次購車者仍面臨許多障礙,儘管需求強勁,但市場成長仍受到限制。即使庫存有所調整,持續高企的價格仍然凸顯了結構性成本的上升,收入成長或採用其他所有權模式對於維持房車的可負擔性至關重要。

細分市場分析

到2025年,旅居車將繼續保持其主導地位,佔據歐洲房車(休閒車)市場53.72%的佔有率,這反映出歐洲消費者偏好無需依賴外部設施、提供全面便利的自主型移動生活解決方案。這一細分市場的主導地位主要源自於其對55至75歲富裕消費者的吸引力,這些消費者更注重舒適性和便利性,而非行動限制。然而,露營車將展現出最高的成長率,到2031年複合年成長率將達到11.62%,這主要得益於年輕消費者對「露營車生活」文化的追捧以及都市區白領對靈活工作旅行解決方案的需求。拖曳式房車和第五輪拖曳式房車佔據了小規模但穩定的細分市場,受到那些希望擁有一輛獨立牽引車用於日常使用的消費者的青睞。彈出式和折疊式露營車構成了入門級市場,吸引著注重價格的買家和季節性用戶。

法規環境支持這種細分市場,歐盟型式認證框架(2018/858 號法規)為多階段車輛認證提供了清晰的路徑,既方便了露營車改裝,也確保了安全標準。 A 型旅居車價格較高,但受到都市區低排放區法規的限制,而 B 型露營車則受益於更高的都市區交通便利性和停車柔軟性。

到2025年,柴油內燃機(ICE)動力傳動系統將佔據歐洲休閒車(RV)市場91.10%的佔有率,這反映了該細分市場歷來依賴柴油引擎在重型應用中卓越的扭力特性和燃油效率。汽油內燃機(ICE)車型的市佔率將保持小規模,主要集中在輕型露營車領域,因為汽油引擎在這些領域具有重量優勢。然而,在歐盟日益嚴格的排放氣體法規和不斷完善的充電基礎設施的推動下,電池式電動車(BEV)車型將以36.91%的複合年成長率快速成長至2031年。混合動力解決方案將處於過渡階段,既能滿足關注續航里程的消費者的需求,又能為都市區提供減少排放氣體的優勢。

挪威在汽車電氣化領域處於領先地位,純電動車在乘用車市場佔有率高達96%,並對商用車和休閒車領域產生了連鎖反應。製造商們正大力投資電氣化解決方案,Truma公司已任命博世電氣解決方案部門的Joachim Weckwerth博士擔任產品開發負責人,這充分體現了其對電氣化的戰略承諾。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 疫情後,國內和歐洲內部旅遊業激增

- 房車共享和租賃平台的快速擴張

- 55-75歲年齡層的人雖然年齡成長,但經濟條件優越,這推動了高階市場的需求。

- 超過3000個歐盟露營地升級到「互聯住宿」標準

- 歐盟B類車輛牌照的重量限制提高到4.25噸,允許更大的樓層平面圖。

- 廂型車改裝車的興起,為「隨時隨地工作」的數位遊牧者提供了便利

- 市場限制

- 高昂的初始購買成本和保險費用

- 利率波動導致資金籌措困難

- 由於2021-22年度庫存過剩,價格下跌

- 透過在都市區設立低排放氣體區來限制柴油房車的通行

- 價值/價值鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模和成長預測(價值和數量)

- 按類型

- 拖曳式房車

- 旅行拖車

- 五輪拖車

- 彈出式/折疊式露營車

- 旅居車

- A級

- B級(露營車)

- C級

- 拖曳式房車

- 透過推進和燃料

- 柴油內燃機

- 汽油內燃機

- 油電混合車

- 電池式電動車

- 依所有權類型

- 個人所有者

- 租賃和共享車輛

- 按銷售管道

- OEM特許經銷商

- 直接面對消費者的線上銷售

- 汽車租賃公司網路

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 挪威

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Erwin Hymer Group(Thor Industries)

- Trigano SA

- Auto Trail VR LTD

- Knaus Tabbert AG

- Hobby-Fendt Caravan GmbH

- Swift Group Ltd.

- Rapido Group

- Adria Mobil doo

- Dethleffs GmbH & Co. KG

- Rimor Motorhomes

- Eura Mobil GmbH

- Burstner GmbH

- Laika Caravans SpA

- Westfalia Mobil GmbH

- Globe-Traveller RV Sp. z Oo

- Malibu GmbH & Co. KG

- Benimar SL

- Challenger(Trigano)

- Possl Group

- Pilote Groupe

The Europe Recreational Vehicle market is expected to grow from USD 33.38 billion in 2025 to USD 37.07 billion in 2026 and is forecast to reach USD 62.69 billion by 2031 at 11.08% CAGR over 2026-2031.

This robust growth trajectory reflects the sector's resilience following post-pandemic recovery and structural shifts in European leisure patterns. The market's expansion is underpinned by regulatory tailwinds, particularly the EU Parliament's approval of extending B-license eligibility to 4.25-tonne motorhomes by 2028, which will unlock access for millions of additional drivers.

Europe Recreational Vehicle Market Trends and Insights

Post-pandemic Surge in Domestic and Intra-Europe Tourism

European camping activity has reached unprecedented levels, with Germany recording 42.9 million camping overnight stays in 2024, representing a 19.9% increase compared to 2019 pre-pandemic levels. This sustained elevation in domestic tourism reflects a fundamental shift in European leisure preferences, where proximity-based travel has evolved from pandemic necessity to preferred lifestyle choice. The trend extends beyond Germany, with Norway's camping sites witnessing a rise in guest nights, marking significant year-over-year growth. The persistence of elevated camping activity well into 2025 suggests this represents structural demand rather than temporary pandemic-driven behavior, particularly as camping accounts for most German guest overnight stays compared to historical levels. This tourism reorientation creates sustained tailwinds for RV demand across vehicle segments, from compact campervans enabling urban-adjacent exploration to larger motorhomes supporting extended domestic touring.

Rapid Expansion of RV-sharing and Rental Platforms

The European RV-sharing ecosystem has matured rapidly. The sector's growth acceleration is evidenced by Roadsurfer securing EUR 30 million from Avellinia Capital in April 2025, specifically for fleet expansion from 8,500 to 10,000 vehicles. This capital deployment reflects institutional recognition that peer-to-peer RV platforms have overcome initial trust barriers and achieved operational scale. Notably, platforms are expanding eastward, with Ruuts targeting Eastern European markets through API integrations, providing access to major European RVs, and addressing previously underserved regions. The sharing economy's penetration into RV ownership patterns creates dual market effects: democratizing access for first-time users while generating utilization-based revenue streams for private owners, effectively expanding the addressable market beyond traditional ownership models.

High Upfront Purchase and Insurance Costs

European RV prices have surged, straining affordability across market segments. This increase stems from supply chain disruptions, chassis shortages, and manufacturers leveraging pandemic-driven demand. Rising insurance premiums, driven by higher replacement values and specialized repair needs, add to the financial burden. Middle-market buyers increasingly opt for used vehicles or rentals, while younger and first-time buyers face barriers, limiting market growth despite strong demand. Even with inventory corrections, persistent high prices highlight structural cost inflation, necessitating income growth or alternative ownership models to sustain accessibility.

Other drivers and restraints analyzed in the detailed report include:

- Ageing but Affluent 55 to 75 Cohort Boosting Premium Demand

- EU B-license Weight Limit Rising to 4.25 t Enabling Larger Floorplans

- Volatile Interest-rate-driven Financing Squeeze

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motorhomes maintained their dominant position with a 53.72% share of the Europe recreational vehicle market in 2025, reflecting European consumers' preference for self-contained mobile living solutions that provide comprehensive amenities without external dependencies. The segment's leadership stems from its appeal to the affluent 55-75 demographic, prioritizing comfort and convenience over mobility constraints. However, campervans are experiencing the fastest growth at 11.62% CAGR through 2031, driven by younger demographics embracing van life culture and urban professionals seeking flexible work-travel solutions. Travel and fifth-wheel trailers occupy smaller but stable niches, appealing to consumers who prefer to maintain separate towing vehicles for daily use. Pop-up and folding campers represent the entry-level segment, attracting price-sensitive buyers and seasonal users.

The regulatory environment supports this segmentation evolution, with EU type-approval frameworks under Regulation 2018/858 providing clear pathways for multi-stage vehicle approvals that facilitate campervan conversions while maintaining safety standards. Class A motorhomes command premium pricing but face headwinds from urban low-emission zone restrictions, while Class B campervans benefit from improved urban accessibility and parking flexibility.

Diesel ICE powertrains command 91.10% share of the Europe recreational vehicle market in 2025, reflecting the segment's traditional reliance on diesel's superior torque characteristics and fuel efficiency for heavy vehicle applications. Petrol ICE variants maintain a smaller presence, primarily in lighter campervan applications where weight considerations favor gasoline engines. However, battery-electric variants are surging at a 36.91% CAGR through 2031, driven by tightening EU emission regulations and expanding charging infrastructure. Hybrid-electric solutions occupy a transitional position, offering compromise solutions for range-anxious consumers while providing emission benefits for urban access.

Norway leads electric adoption with 96% BEV share in passenger cars, creating spillover effects into commercial and recreational vehicle segments. Manufacturers are investing heavily in electric solutions, with Truma appointing Dr. Joachim Weckwerth from Bosch's Electric Solutions division to lead product development, signaling a strategic commitment to electrification.

The Europe Recreational Vehicle Market Report is Segmented by Type (Towable RVs, Motorhomes), Propulsion and Fuel (Diesel ICE, Petrol ICE, Hybrid-Electric, Battery-Electric), Ownership Model (Private Owners, Rental and Sharing Fleets), Sales Channel (OEM-Franchised Dealers, and More), and Country (Germany, United Kingdom, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Erwin Hymer Group (Thor Industries)

- Trigano SA

- Auto Trail VR LTD

- Knaus Tabbert AG

- Hobby-Fendt Caravan GmbH

- Swift Group Ltd.

- Rapido Group

- Adria Mobil d.o.o.

- Dethleffs GmbH & Co. KG

- Rimor Motorhomes

- Eura Mobil GmbH

- Burstner GmbH

- Laika Caravans S.p.A.

- Westfalia Mobil GmbH

- Globe-Traveller RV Sp. z O.o.

- Malibu GmbH & Co. KG

- Benimar SL

- Challenger (Trigano)

- Possl Group

- Pilote Groupe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-Pandemic Surge In Domestic And Intra-Europe Tourism

- 4.2.2 Rapid Expansion Of RV-Sharing And Rental Platforms

- 4.2.3 Ageing But Affluent 55 to 75 Cohort Boosting Premium Demand

- 4.2.4 Upgrade Of More Than 3,000 EU Campsites To "Connected-Stay" Standards

- 4.2.5 EU B-License Weight Limit Rising To 4.25 t Enabling Larger Floorplans

- 4.2.6 Emergence Of "Work-From-Anywhere" Digital-Nomad Van Conversions

- 4.3 Market Restraints

- 4.3.1 High Upfront Purchase And Insurance Costs

- 4.3.2 Volatile Interest-Rate-Driven Financing Squeeze

- 4.3.3 Oversupply-Led Price Depreciation Of 2021-22 Inventory

- 4.3.4 Urban Low-Emission Zones Curbing Diesel RV Access

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecast (Value (USD) and Volume (Units))

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth-Wheel Trailers

- 5.1.1.3 Pop-up/Folding Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Class A

- 5.1.2.2 Class B (Campervans)

- 5.1.2.3 Class C

- 5.1.1 Towable RVs

- 5.2 By Propulsion and Fuel

- 5.2.1 Diesel Internal Combustion Engine

- 5.2.2 Petrol Internal Combustion Engine

- 5.2.3 Hybrid-Electric

- 5.2.4 Battery-Electric

- 5.3 By Ownership Model

- 5.3.1 Private Owners

- 5.3.2 Rental and Sharing Fleets

- 5.4 By Sales Channel

- 5.4.1 OEM-Franchised Dealers

- 5.4.2 Direct-to-Consumer Online

- 5.4.3 Rental Agency Networks

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Norway

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Erwin Hymer Group (Thor Industries)

- 6.4.2 Trigano SA

- 6.4.3 Auto Trail VR LTD

- 6.4.4 Knaus Tabbert AG

- 6.4.5 Hobby-Fendt Caravan GmbH

- 6.4.6 Swift Group Ltd.

- 6.4.7 Rapido Group

- 6.4.8 Adria Mobil d.o.o.

- 6.4.9 Dethleffs GmbH & Co. KG

- 6.4.10 Rimor Motorhomes

- 6.4.11 Eura Mobil GmbH

- 6.4.12 Burstner GmbH

- 6.4.13 Laika Caravans S.p.A.

- 6.4.14 Westfalia Mobil GmbH

- 6.4.15 Globe-Traveller RV Sp. z O.o.

- 6.4.16 Malibu GmbH & Co. KG

- 6.4.17 Benimar SL

- 6.4.18 Challenger (Trigano)

- 6.4.19 Possl Group

- 6.4.20 Pilote Groupe