|

市場調查報告書

商品編碼

1906086

OSAT(外包半導體封裝測試)市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Outsourced Semiconductor Assembly And Test (OSAT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

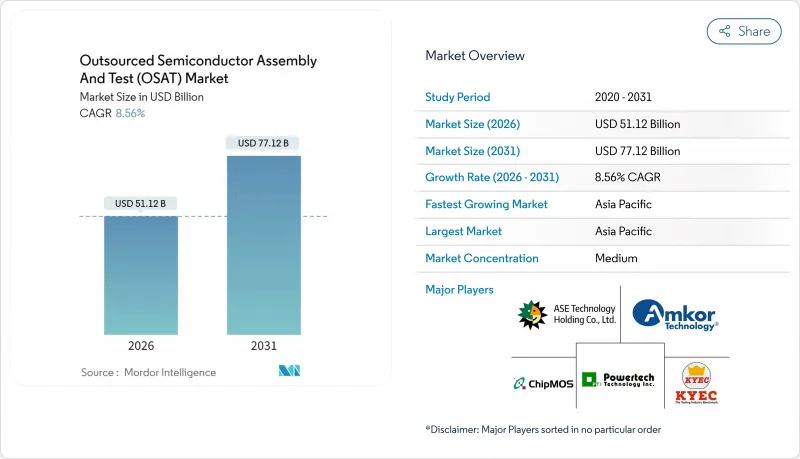

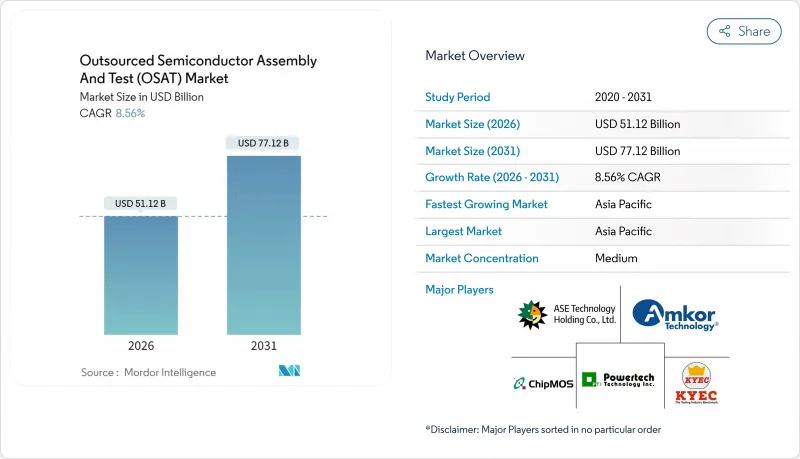

2025 年 OSAT(外包半導體組裝和測試)市值為 470.9 億美元,預計到 2031 年將達到 771.2 億美元,而 2026 年為 511.2 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 8.56%。

人工智慧、高效能運算和汽車電氣化的持續進步正在推動對先進封裝技術和安全關鍵型測試流程的需求,從而擴大專業後端服務供應商的潛在市場。亞太地區的供應商憑藉其成熟的生態系統保持定價權,而北美和歐洲受政策主導的產能擴張則引發了全球供應鏈分配結構的重組。混合晶片架構提升了異質整合的重要性,並推動了對扇出型晶圓級和2.5D/3D平台的策略性投資。同時,日益嚴格的貿易法規和永續性促使客戶將部分工作負載轉移到地理位置分散、單位吞吐量能耗更低的地區。由於晶圓代工產能持續緊張,小型晶圓廠半導體公司繼續將後端流程外包,這進一步鞏固了半導體組裝和測試外包市場在下一個規劃週期中的結構性重要性。

全球OSAT(半導體外包組裝與測試)市場趨勢與洞察

每車半導體含量快速成長

汽車製造商正轉向軟體定義平台,這推高了每輛車的半導體元件成本,並加速了對高可靠性封裝的需求。大眾集團與安森美半導體在牽引逆變器領域的合作凸顯了碳化矽裝置的日益普及,這類裝置需要耐熱的功率封裝。 Imec 的汽車晶片專案得到了日月光、寶馬和博世的支持,展示了價值鏈各環節在標準化晶片封裝方面的合作,以確保功能安全合規性。獲得 AEC-Q100 和 ISO 26262 認證的 OSAT 供應商已與電動車供應商簽訂了新的設計訂單和多年產能協議。

5G主導的對先進射頻封裝的需求

商用5G基地台部署正將無線電前端推進毫米波頻段,這需要低損耗基板、共形屏蔽和緊湊的SiP封裝。 GlobalFoundries整合Finwave Semiconductor的E型MISHEMT標誌著新型氮化鎵裝置的商業化部署,這些裝置需要特殊的射頻封裝,預計2026年完成量產認證。 6G測試平台已將共封裝光元件納入研發計劃,促使OSAT公司擴展其混合訊號組裝能力和先進的散熱解決方案。

與主要晶圓代工廠和整合裝置製造商進行垂直整合

台積電的「晶圓製造2.0」策略整合了封裝與測試流程,提供承包服務,削弱了獨立OSAT廠商的產能。三星也採取了類似的策略,而英特爾則擴展了其代工服務,涵蓋了先進的中介層裝置。這些措施壓縮了第三方廠商在高利潤領域的市場佔有率,迫使OSAT廠商專注於汽車安全和光電等細分領域。

細分市場分析

預計2026年至2031年間,測試領域的複合年成長率將達到10.35%,成長超過封裝領域,但其基數較小。人工智慧和高效能運算設計需要系統級測試覆蓋,以檢驗晶片互連延遲、動態熱感節流以及深度學習工作負載在不同電壓下的性能。為此,半導體組裝和測試市場已將自適應機器學習演算法更多地整合到自動化測試設備(ATE)中,以縮短測試時間並提高故障定位精度。

2025年,封裝業務仍佔總營收的76.80%,但其產品結構轉向扇出型面板級封裝、2.5D中介層封裝及共封裝光學元件。隨著客戶整合供應商,OSAT(外包半導體組裝測試)集團提供整合夾具設計、最終測試和物流的承包解決方案。愛德萬測試在其V93000系列產品中加入了人工智慧分析功能,連續第六年組裝測試設備領域第一名。

2025年,球柵陣列(BGA)技術在主流消費和工業平台(優先考慮機械強度)中仍將維持23.85%的市場佔有率。然而,隨著行動處理器和人工智慧加速器向高密度封裝層遷移,扇出型晶圓級封裝(FAP)將以11.02%的複合年成長率成長。這一趨勢強化了半導體組裝和測試外包市場,因為只有少數供應商能夠處理大尺寸面板而不出現產量比率波動。

日月光(ASE)斥資2億美元拓展310mm x 310mm玻璃面板生產線,顯示其有意投資於具成本效益的大面積製造設備。穿透矽通孔(TSV)和玻璃通孔(TGV)等技術在高頻寬記憶體堆疊中廣泛應用。 FC-BGA基板受益於先進製程節點的採用,彌合了有機層壓基板和用於網路ASIC的矽中介層之間的差距。

半導體組裝和測試 (OSAT) 市場按服務類型(封裝、測試)、封裝類型(球柵陣列、晶片級封裝等)、應用(通訊、家用電子電器、汽車、計算和網路等)、技術節點(28nm 及以上、16/14nm、10/7nm 等)和地區(北美、中東、歐洲、亞太地區)。

區域分析

預計到2025年,亞太地區將維持其在半導體組裝和測試市場收入中72.90%的佔有率,並在2031年之前保持9.45%的複合年成長率。台灣、中國大陸和韓國由於接近性晶圓代工廠和基板製造商,一直是該叢集的核心參與者,但不斷升級的貿易緊張局勢促使其向馬來西亞、越南和菲律賓等地多元化發展。印度加快了激勵措施,核准了凱因斯科技公司在古吉拉突邦4.13億美元的工廠以及塔塔電子公司在阿薩姆邦投資30億美元的封裝和測試綜合體的建設。

由於《晶片技術創新法案》(CHIPS Act)的資助,北美重新獲得了其戰略重要性。安姆科(Amcor)在亞利桑那州破土動工興建先進封裝工廠,為美國國內的汽車和人工智慧客戶提供產品。德克薩斯)投資600億美元建造了多個晶圓廠和後端設施,而天水(Skywater)以9300萬美元收購了英飛凌(Infineon)位於奧斯汀的晶圓廠,從而實現了全國範圍內的產能冗餘。

歐洲已從利基研發轉向大規模生產。 Silicon Box 已獲得歐盟核准,將在義大利建造一座價值 13 億歐元(14.7 億美元)的面板級晶圓廠,目標是每年生產超過 1 億個 SiP 單元。泰雷茲、Radial 和富士康正在探索建立一個面向國防和航太用戶的法國 OSAT 聯盟。安森美半導體已在捷克共和國投資 20 億美元建造一條碳化矽生產線,以確保電動車計劃的本地供應。中東和非洲地區作為新興市場持續成長,以色列和阿拉伯聯合大公國正在探索相關政策框架以吸引下游投資者。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 每車半導體含量快速成長

- 5G主導對先進射頻封裝的需求

- Chiplet 架構需要異質整合以實現 AI/HPC

- 晶圓代工廠產能短缺推動了輕晶圓廠外包模式的興起

- 根據美國《晶片法案》和歐盟《晶片法案》,促進本地OSAT(外包組裝、測試和封裝)設施的擴張。

- 永續性需求推動晶圓級扇出技術的應用

- 市場限制

- 與主要晶圓代工廠和IDM公司進行垂直整合

- 集中資本投資和較長的設備採購前置作業時間

- 對先進設備的地緣政治出口管制

- 先進包裝技術領域技術純熟勞工短缺

- 價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按服務類型

- 包裝

- 測試

- 按包裝類型

- 球柵陣列(BGA)

- 晶片級封裝(CSP)

- 四方扁平封裝/雙列在線連續(QFP/DIP)

- 多晶片模組(MCM)

- 晶圓層次電子構裝(WLP)

- 扇出型封裝(FO-WLP/FO-BGA)

- 系統級封裝(SiP)

- 矽通孔(2.5D/3D TSV)

- 覆晶(FC-BGA/FC-CSP)

- 透過使用

- 溝通

- 家用電子電器

- 車

- 運算與網路

- 產業

- 其他用途

- 依技術節點

- >28 奈米

- 16/14 nm

- 10/7 nm

- 5奈米或更小

- 傳統(90-65 奈米)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 荷蘭

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 台灣

- 韓國

- 日本

- 新加坡

- 馬來西亞

- 印度

- 亞太其他地區

- 中東和非洲

- 中東

- 以色列

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ASE Technology Holding Co., Ltd.

- Amkor Technology, Inc.

- Jiangsu Changjiang Electronics Technology Co., Ltd.

- Siliconware Precision Industries Co., Ltd.

- Powertech Technology Inc.

- King Yuan Electronics Co., Ltd.

- Tongfu Microelectronics Co., Ltd.

- Tianshui Huatian Technology Co., Ltd.

- UTAC Holdings Ltd.

- Unisem(M)Berhad

- Hana Micron Inc.

- ChipMOS Technologies Inc.

- Formosa Advanced Technologies Co., Ltd.

- Chipbond Technology Corporation

- Lingsen Precision Industries, Ltd.

- Suchi Semicon Pvt. Ltd.

- Nepes Corporation

- Silicon Box Pte. Ltd.

- Shinko Electric Industries Co., Ltd.

- Carsem(M)Sdn. Bhd.

- SFA Semicon Co., Ltd.

- Stats ChipPAC Pte. Ltd.

- Orient Semiconductor Electronics, Ltd.

- Integra Technologies LLC

- Anam Semiconductor Inc.

第7章 市場機會與未來展望

The outsourced semiconductor assembly and test market was valued at USD 47.09 billion in 2025 and estimated to grow from USD 51.12 billion in 2026 to reach USD 77.12 billion by 2031, at a CAGR of 8.56% during the forecast period (2026-2031).

Sustained progress in artificial intelligence, high-performance computing, and automotive electrification raised demand for advanced packages and safety-critical test flows, thereby widening the total addressable opportunity for specialized backend service providers. Asia-Pacific suppliers preserved pricing leverage owing to mature ecosystems, yet policy-driven capacity build-outs in North America and Europe began to reshape global supply allocation. Hybrid chiplet architectures elevated the importance of heterogeneous integration, motivating strategic investments in fan-out wafer-level and 2.5D/3D platforms. Meanwhile, tighter trade controls and sustainability mandates encouraged customers to shift part of the workload to geographically diversified sites that can demonstrate lower energy use per unit throughput. As foundry capacity remained strained, fab-lite semiconductor companies continued to outsource backend steps, reinforcing the structural relevance of the outsourced semiconductor assembly and test market in the next planning cycle.

Global Outsourced Semiconductor Assembly And Test (OSAT) Market Trends and Insights

Soaring Semiconductor Content Per Vehicle

Automotive OEMs transitioned toward software-defined platforms, lifting semiconductor bill-of-materials per car and intensifying demand for high-reliability packages. Volkswagen Group's traction inverter partnership with onsemi highlighted the rising adoption of silicon carbide devices that need thermally robust power packages.Imec's Automotive Chiplet Program, supported by ASE, BMW, and Bosch, illustrated cross-value-chain alignment on standardized chiplet packaging for functional safety compliance. OSAT providers that qualify to AEC-Q100 and ISO 26262, therefore, captured new design wins and secured multiyear capacity reservations with electric-vehicle suppliers.

5G-Led Demand for Advanced RF Packages

Commercial 5G base-station roll-outs moved the radio front-end into millimetre-wave territory, necessitating low-loss substrates, conformal shielding, and compact SiP footprints. Finwave Semiconductor's E-mode MISHEMT integration at GlobalFoundries signalled commercial deployment of novel gallium-nitride devices that require specialised RF packaging, with mass qualification targeted for 2026. The pipeline for 6G testbeds already incorporates co-packaged optics, urging OSAT firms to expand mixed-signal assembly capabilities and advanced thermal solutions.

Vertical Integration by Leading Foundries and IDMs

TSMC's Wafer Manufacturing 2.0 strategy integrated packaging and testing flows, offering turnkey services that reduced addressable volume for stand-alone OSAT companies. Samsung pursued a similar path, while Intel grew its foundry services to include advanced interposers. These moves compressed third-party share in high-margin segments and obliged OSAT firms to double down on niches such as automotive safety or photonics.

Other drivers and restraints analyzed in the detailed report include:

- AI/HPC Chiplet Architectures Needing Heterogeneous Integration

- Foundry Capacity Shortages Driving Fab-Lite Outsourcing

- Cap-Ex Intensity and Long Equipment Lead-Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Testing captured a 10.35% CAGR forecast for 2026-2031, a pace outstripping packaging's expansion yet starting from a smaller base. AI and high-performance computing designs demanded system-level test coverage that verifies chiplet interconnect latency, dynamic thermal throttling, and deep-learning workload performance under varied voltages. The outsourced semiconductor assembly and test market responded by integrating adaptive machine-learning algorithms in automatic test equipment, cutting test time while improving fault isolation.

Packaging retained 76.80% of 2025 revenue, but its composition evolved toward fan-out panel-level, 2.5D interposer, and co-packaged optics lines. As customers consolidated suppliers, OSAT groups bundled turnkey offerings that merge fixture design, final test, and logistics. Advantest secured its sixth consecutive leadership in assembly test equipment after adding AI-enabled analytics to its V93000 series.

Ball grid array technology maintained a 23.85% share in 2025 by serving mainstream consumer and industrial platforms that value mechanical robustness. However, fan-out wafer-level packages expanded at 11.02% CAGR as mobile processors and AI accelerators transitioned to high-density redistribution layers. This trend strengthened the outsourced semiconductor assembly and test market because only a limited pool of vendors can process larger panel formats without yield drift.

ASE's USD 200 million panel-level expansion to 310 mm X 310 mm glass panels illustrated a cap-ex commitment toward cost-effective, large-area builds. Through-silicon-via and through-glass-via variants proliferated in high-bandwidth memory stacks. FC-BGA substrates benefited from advanced node adoption, bridging the gap between organic laminates and silicon interposers for networking ASICs.

Outsourced Semiconductor Assembly and Test (OSAT) Market is Segmented by Service Type (Packaging, and Testing), Packaging Type (Ball Grid Array, Chip-Scale Package, and More), Application (Communication, Consumer Electronics, Automotive, Computing and Networking, and More), Technology Node (>=28 Nm, 16/14 Nm, 10/7 Nm, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific retained 72.90% share of outsourced semiconductor assembly and test market revenue in 2025 and posted a 9.45% CAGR outlook through 2031. Taiwan, China, and South Korea anchored the cluster owing to proximity to foundries and substrate makers, yet escalating trade frictions prompted diversification into Malaysia, Vietnam, and the Philippines. India accelerated incentive programmes, endorsing Kaynes Technology's USD 413 million plant in Gujarat and Tata Electronics' USD 3 billion Assam package-test complex.

North America regained strategic weight following the CHIPS Act funding. Amkor broke ground on an advanced packaging facility in Arizona designed to supply domestic automotive and AI customers. Texas Instruments earmarked USD 60 billion for multiple wafer fabs and corresponding backend capacity, while SkyWater's USD 93 million acquisition of Infineon's Austin fab added sovereign redundancy.

Europe moved from niche R&D toward scaled production. Silicon Box obtained EU approval for a EUR 1.3 billion (USD 1.47 billion) panel-level plant in Italy, targeting >100 million SiP units per year. Thales, Radiall, and Foxconn explored a French OSAT alliance to serve defence and aeronautics users. Onsemi committed USD 2 billion to a silicon-carbide line in the Czech Republic, assuring local supply for e-mobility projects. The Middle East and Africa remained an emerging frontier, with Israel and the UAE assessing policy frameworks to attract backend investors.

- ASE Technology Holding Co., Ltd.

- Amkor Technology, Inc.

- Jiangsu Changjiang Electronics Technology Co., Ltd.

- Siliconware Precision Industries Co., Ltd.

- Powertech Technology Inc.

- King Yuan Electronics Co., Ltd.

- Tongfu Microelectronics Co., Ltd.

- Tianshui Huatian Technology Co., Ltd.

- UTAC Holdings Ltd.

- Unisem (M) Berhad

- Hana Micron Inc.

- ChipMOS Technologies Inc.

- Formosa Advanced Technologies Co., Ltd.

- Chipbond Technology Corporation

- Lingsen Precision Industries, Ltd.

- Suchi Semicon Pvt. Ltd.

- Nepes Corporation

- Silicon Box Pte. Ltd.

- Shinko Electric Industries Co., Ltd.

- Carsem (M) Sdn. Bhd.

- SFA Semicon Co., Ltd.

- Stats ChipPAC Pte. Ltd.

- Orient Semiconductor Electronics, Ltd.

- Integra Technologies LLC

- Anam Semiconductor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring semiconductor content per vehicle

- 4.2.2 5G-led demand for advanced RF packages

- 4.2.3 AI/HPC chiplet architectures needing heterogeneous integration

- 4.2.4 Foundry capacity shortages driving fab-lite outsourcing

- 4.2.5 U.S. CHIPS and EU Chips Acts incentivising local OSAT build-out

- 4.2.6 Sustainability mandates pushing wafer-level fan-out adoption

- 4.3 Market Restraints

- 4.3.1 Vertical integration by leading foundries and IDMs

- 4.3.2 Cap-ex intensity and long equipment lead-times

- 4.3.3 Geopolitical export controls on advanced tools

- 4.3.4 Skilled-labour shortages in advanced packaging engineering

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Packaging

- 5.1.2 Testing

- 5.2 By Packaging Type

- 5.2.1 Ball Grid Array (BGA)

- 5.2.2 Chip-Scale Package (CSP)

- 5.2.3 Quad Flat / Dual-Inline (QFP/DIP)

- 5.2.4 Multi-Chip Module (MCM)

- 5.2.5 Wafer-Level Packaging (WLP)

- 5.2.6 Fan-Out Packaging (FO-WLP / FO-BGA)

- 5.2.7 System-in-Package (SiP)

- 5.2.8 Through-Silicon Via (2.5D/3D TSV)

- 5.2.9 Flip-Chip (FC-BGA / FC-CSP)

- 5.3 By Application

- 5.3.1 Communication

- 5.3.2 Consumer Electronics

- 5.3.3 Automotive

- 5.3.4 Computing and Networking

- 5.3.5 Industrial

- 5.3.6 Other Applications

- 5.4 By Technology Node

- 5.4.1 >=28 nm

- 5.4.2 16/14 nm

- 5.4.3 10/7 nm

- 5.4.4 5 nm and below

- 5.4.5 Legacy (90-65 nm)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Netherlands

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Taiwan

- 5.5.4.3 South Korea

- 5.5.4.4 Japan

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 India

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Israel

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Saudi Arabia

- 5.5.5.1.4 Turkey

- 5.5.5.1.5 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ASE Technology Holding Co., Ltd.

- 6.4.2 Amkor Technology, Inc.

- 6.4.3 Jiangsu Changjiang Electronics Technology Co., Ltd.

- 6.4.4 Siliconware Precision Industries Co., Ltd.

- 6.4.5 Powertech Technology Inc.

- 6.4.6 King Yuan Electronics Co., Ltd.

- 6.4.7 Tongfu Microelectronics Co., Ltd.

- 6.4.8 Tianshui Huatian Technology Co., Ltd.

- 6.4.9 UTAC Holdings Ltd.

- 6.4.10 Unisem (M) Berhad

- 6.4.11 Hana Micron Inc.

- 6.4.12 ChipMOS Technologies Inc.

- 6.4.13 Formosa Advanced Technologies Co., Ltd.

- 6.4.14 Chipbond Technology Corporation

- 6.4.15 Lingsen Precision Industries, Ltd.

- 6.4.16 Suchi Semicon Pvt. Ltd.

- 6.4.17 Nepes Corporation

- 6.4.18 Silicon Box Pte. Ltd.

- 6.4.19 Shinko Electric Industries Co., Ltd.

- 6.4.20 Carsem (M) Sdn. Bhd.

- 6.4.21 SFA Semicon Co., Ltd.

- 6.4.22 Stats ChipPAC Pte. Ltd.

- 6.4.23 Orient Semiconductor Electronics, Ltd.

- 6.4.24 Integra Technologies LLC

- 6.4.25 Anam Semiconductor Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment