|

市場調查報告書

商品編碼

1766200

外包半導體組裝與測試市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Outsourced Semiconductor Assembly and Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

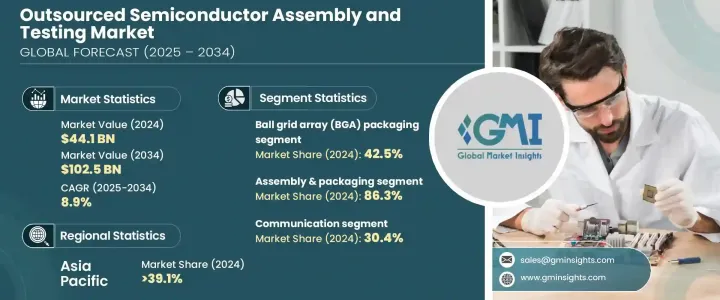

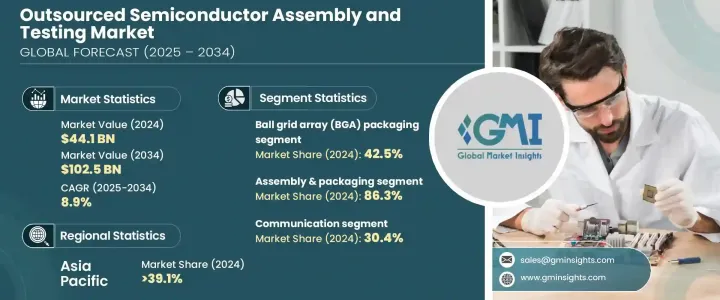

2024年,全球外包半導體封裝測試市場規模達441億美元,預計2034年將以8.9%的複合年成長率成長,達到1,025億美元。這一成長主要源於消費性電子產業的擴張,包括智慧型手機、穿戴式裝置和智慧家居設備,以及對經濟高效且專業的封裝測試解決方案日益成長的需求。隨著電子產業不斷追求設備小型化和效能提升,OSAT服務的需求也日益成長,以確保產品的可靠性和效率。

隨著現代半導體封裝和測試的複雜性不斷增加,越來越多的公司將這些作業外包,以控制內部生產帶來的高昂成本。這一趨勢導致對OSAT基礎設施的大量投資,尤其是在多個行業對這些服務的需求持續成長的情況下。對成本最佳化的日益關注,使得許多半導體公司(包括主要的行業領導者)都依賴外包封裝和測試服務。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 441億美元 |

| 預測值 | 1025億美元 |

| 複合年成長率 | 8.9% |

透過外包這些關鍵職能,半導體製造商可以避免與內部營運相關的巨額資本支出。這些支出通常包括新建或擴建設施、購買昂貴設備以及聘用大量專業團隊。外包使公司能夠將資源重新分配到核心研發、產品開發和其他高優先領域,同時降低管理內部組裝線的複雜性和營運成本。

2024年,組裝和封裝市場規模達382億美元,預計複合年成長率將達9.1%。該領域尤其受到人工智慧 (AI)、高效能運算和其他創新半導體技術的進步的推動,這些技術需要專業的封裝和測試服務。隨著半導體裝置日益複雜和微型化,對高度精密的組裝和封裝解決方案的需求也持續成長。 3D封裝、系統級封裝 (SiP) 和多晶片模組 (MCM) 等先進封裝技術的整合,對於確保尖端裝置的可靠性和性能至關重要,從而推動了該領域的成長。

2024年,消費性電子市場規模達113億美元,預估複合年成長率為10.2%。這一成長主要源自於市場對更小、更有效率、功能更強大的電子設備日益成長的需求。隨著手機、平板電腦、穿戴式裝置和其他攜帶式裝置的不斷發展,製造商越來越依賴外包半導體組裝和測試服務,以滿足對小型化和性能的嚴格要求。隨著這些設備變得越來越緊湊和複雜,它們需要先進的封裝解決方案來確保高效能、熱管理和更高的可靠性。

2024年,美國外包半導體封裝測試市場規模達107億美元,複合年成長率為9.2%。美國政府正努力透過《晶片法案》(CHIPS Act)等措施來促進國內半導體生產,旨在減少對全球供應鏈的依賴,並促進本土製造業的發展。各大公司正獲得大量投資,以提升其封裝測試能力,進而鞏固美國在OSAT(封測外包半導體製造)市場的關鍵地位。

外包半導體封裝測試市場的知名公司包括日月光科技控股股份有限公司、安靠科技股份有限公司、南茂科技股份有限公司、力成科技股份有限公司及京元電子股份有限公司。為了鞏固其在外包半導體封裝測試市場的地位,各公司正在大力投資尖端技術和先進的基礎設施。許多OSAT供應商正致力於提升其在高階封裝解決方案方面的能力,以滿足日益成長的複雜半導體產品需求。與半導體公司建立策略合作夥伴關係和協作對於擴展服務範圍和提高營運效率也至關重要。此外,各公司正在採用自動化技術來簡化生產流程、降低成本並加強品質控制。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 5G基礎設施的擴展

- 汽車電子技術的進步

- 消費性電子產品的普及

- 對經濟高效的製造解決方案的需求

- 小型化和先進封裝技術

- 陷阱與挑戰

- 嚴格的品質和可靠性標準

- 高資本投資要求

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- Pestel 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按服務類型,2021 年至 2034 年

- 主要趨勢

- 組裝和包裝

- 測試

第6章:市場估計與預測:依包裝類型,2021 年至 2034 年

- 主要趨勢

- 球柵陣列(BGA)封裝

- 晶片級封裝(CSP)

- 堆疊晶片封裝

- 多晶片封裝

- 四方扁平和雙列直插式封裝

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 溝通

- 消費性電子產品

- 汽車

- 運算和網路

- 工業的

- 其他

- 服務

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- ASE Technology Holding Co. Ltd

- Amkor Technology Inc.

- Powertech Technology Inc.

- ChipMOS Technologies Inc.

- King Yuan Electronics Co. Ltd

- Formosa Advanced Technologies Co. Ltd

- Jiangsu Changjiang Electronics Technology Co. Ltd

- UTAC Holdings Ltd

- Lingsen Precision Industries Ltd

- Tongfu Microelectronics Co.

- Chipbond Technology Corporation

- Hana Micron Inc.

- Integrated Micro-electronics Inc.

- Tianshui Huatian Technology Co. Ltd

The Global Outsourced Semiconductor Assembly and Testing Market was valued at USD 44.1 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 102.5 billion by 2034. This growth is primarily driven by the expansion of the consumer electronics sector, which includes smartphones, wearables, and smart home devices, as well as the increasing demand for cost-effective and specialized packaging and testing solutions. As the electronics industry continues to miniaturize devices and enhance performance, there is a growing need for OSAT services to ensure product reliability and efficiency.

With the complexity of modern semiconductor packaging and testing, more companies are outsourcing these operations to manage the high costs associated with in-house production. This trend has led to significant investments in OSAT infrastructure, especially as the demand for these services continues to rise across multiple industries. The growing focus on cost optimization has led many semiconductor companies, including major industry leaders, to rely on outsourcing assembly and testing services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $44.1 Billion |

| Forecast Value | $102.5 Billion |

| CAGR | 8.9% |

By outsourcing these essential functions, semiconductor manufacturers can avoid significant capital expenses associated with in-house operations. These expenses often include building or expanding facilities, purchasing expensive equipment, and employing large teams of specialized workers. Outsourcing allows companies to redirect resources toward core R&D, product development, and other high-priority areas while reducing the complexity and overhead involved in managing in-house assembly lines.

The assembly and packaging segment was valued at USD 38.2 billion in 2024, with projections indicating a robust growth rate of 9.1% CAGR. This segment is particularly driven by advancements in artificial intelligence (AI), high-performance computing, and other innovative semiconductor technologies that demand specialized packaging and testing services. As semiconductor devices become increasingly complex and miniaturized, the need for highly sophisticated assembly and packaging solutions continues to rise. The integration of advanced packaging techniques, such as 3D packaging, system-in-package (SiP), and multi-chip modules (MCM), has become critical to ensuring the reliability and performance of cutting-edge devices, thereby driving growth in this sector.

The consumer electronics segment was valued at USD 11.3 billion in 2024 and is estimated to grow at a CAGR of 10.2%. This growth is fueled by the increasing demand for smaller, more efficient, and highly functional electronic devices. With the continuous evolution of mobile phones, tablets, wearables, and other portable gadgets, manufacturers are relying heavily on outsourced semiconductor assembly and testing services to meet the rigorous demands of miniaturization and performance. As these devices become more compact and sophisticated, they require advanced packaging solutions that ensure high performance, thermal management, and enhanced reliability.

U.S Outsourced Semiconductor Assembly and Testing Market generated USD 10.7 billion in 2024 with a CAGR of 9.2%. The U.S. government is making efforts to bolster domestic semiconductor production through initiatives like the CHIPS Act, aimed at reducing reliance on global supply chains and boosting local manufacturing. Major companies are receiving significant investments to enhance their packaging and testing capabilities, reinforcing the U.S. as a key player in the OSAT market.

Prominent companies in the Outsourced Semiconductor Assembly and Testing Market include ASE Technology Holding Co. Ltd, Amkor Technology Inc., ChipMOS Technologies Inc., Powertech Technology Inc., and King Yuan Electronics Co. Ltd. To strengthen their presence in the outsourced semiconductor assembly and testing market, companies are investing heavily in state-of-the-art technologies and advanced infrastructure. Many OSAT providers are focusing on increasing their capabilities in high-end packaging solutions to cater to the growing demand for sophisticated semiconductor products. Strategic partnerships and collaborations with semiconductor companies are also pivotal for expanding service offerings and improving operational efficiency. Additionally, companies are embracing automation to streamline production processes, minimize costs, and enhance quality control.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and Definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Expansion of 5G infrastructure

- 3.3.1.2 Advancements in automotive electronics

- 3.3.1.3 Proliferation of consumer electronics

- 3.3.1.4 Demand for cost-effective manufacturing solutions

- 3.3.1.5 Miniaturization and advanced packaging technologies

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 Stringent quality and reliability standards

- 3.3.2.2 High capital investment requirements

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market estimates and forecast, by Service Type, 2021 – 2034 (USD million)

- 5.1 Key trends

- 5.2 Assembly & Packaging

- 5.3 Testing

Chapter 6 Market estimates and forecast, by Packaging Type, 2021 – 2034 (USD million)

- 6.1 Key trends

- 6.2 Ball grid array (BGA) packaging

- 6.3 Chip scale packaging (CSP)

- 6.4 Stacked die packaging

- 6.5 Multi chip packaging

- 6.6 Quad Flat and Dual-inline Packaging

Chapter 7 Market estimates and forecast, by Application, 2021 – 2034 (USD million)

- 7.1 Key trends

- 7.2 Communication

- 7.3 Consumer electronics

- 7.4 Automotive

- 7.5 Computing and networking

- 7.6 Industrial

- 7.7 Others

- 7.8 Services

Chapter 8 Market estimates and forecast, by Region, 2021 – 2034 (USD million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company profiles

- 9.1 ASE Technology Holding Co. Ltd

- 9.2 Amkor Technology Inc.

- 9.3 Powertech Technology Inc.

- 9.4 ChipMOS Technologies Inc.

- 9.5 King Yuan Electronics Co. Ltd

- 9.6 Formosa Advanced Technologies Co. Ltd

- 9.7 Jiangsu Changjiang Electronics Technology Co. Ltd

- 9.8 UTAC Holdings Ltd

- 9.9 Lingsen Precision Industries Ltd

- 9.10 Tongfu Microelectronics Co.

- 9.11 Chipbond Technology Corporation

- 9.12 Hana Micron Inc.

- 9.13 Integrated Micro-electronics Inc.

- 9.14 Tianshui Huatian Technology Co. Ltd