|

市場調查報告書

商品編碼

1852119

印度瓷磚市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)India Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

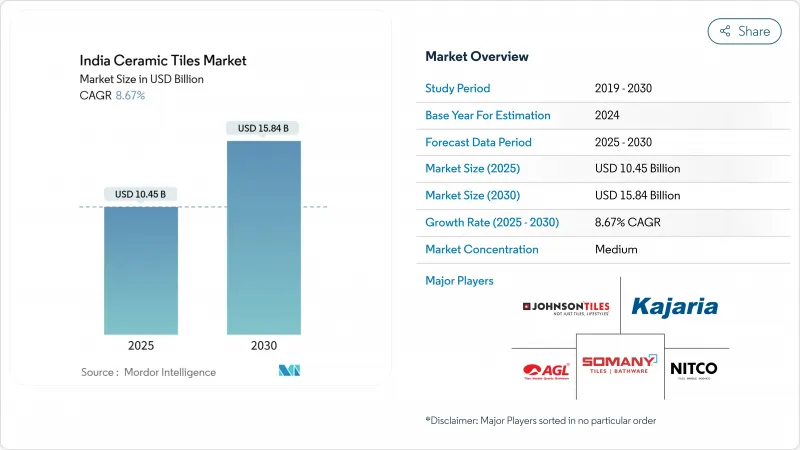

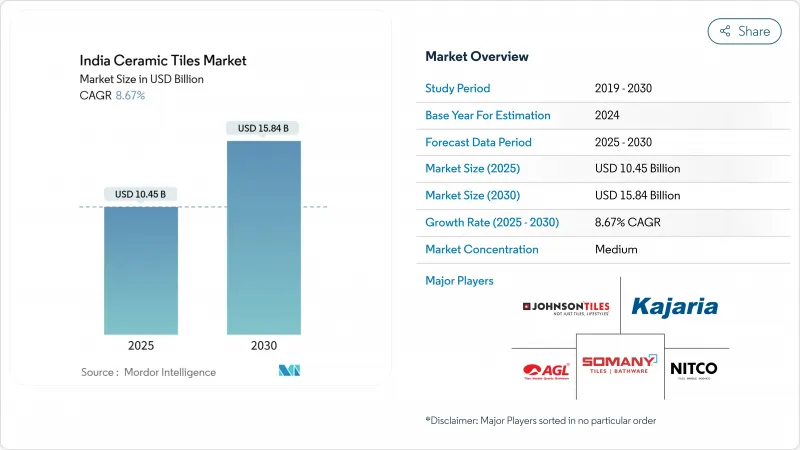

預計到 2025 年,印度瓷磚市場規模將達到 104.5 億美元,到 2030 年將達到 158.4 億美元,2025 年至 2030 年的複合年成長率為 8.67%。

在經濟適用房項目、智慧城市計畫和私人房地產投資的推動下,強勁的需求支撐著該國大規模都市化過程中的紙巾銷售穩步成長。莫爾比生產基地的持續技術升級、天然氣管道的擴建以及氫氣窯爐的投入使用,正在降低單位成本,使紙巾製造商能夠在價格分佈和中端價格分佈展開激烈競爭。大尺寸板材、數位噴墨印刷和薄層砂漿鋪貼系統的應用,為建築師和業主拓展了設計選擇。出口量(尤其是對美國和波灣合作理事會國家的出口)的同步成長,為公司帶來了新的收入來源,但蒙德拉港的反傾銷調查和物流瓶頸問題也帶來了一些不確定性。

印度瓷磚市場趨勢與洞察

經濟適用房和智慧城市計劃激增

PMAY-U 2.0承諾投入1000萬盧比(約1205億美元)資金,新建1000萬套永久性住房,從而為陶瓷地板材料和牆壁材料解決方案創造穩定的訂單來源。該計劃整合了印度標準局(BIS)的品質標準,引導採購傾向於能夠穩定生產的正規工廠,從而支持印度瓷磚市場的逐步整合。同時,智慧城市計畫正向5151個都市更新計劃注入20.5億盧比(約247億美元)的資金,並常規指定在交通樞紐、濱水步道和公共住宅走廊等區域使用優質陶瓷瓷磚和釉藥玻化磚。這兩項措施加起來,每年將使建築面積達到7億至9億平方米,即使出口訂單疲軟,也能提振國內消費。能夠使其產品系列符合地方政府競標規範的供應商將獲得優先供應商地位,並具有更高的運轉率可預測性。政府支出也將鼓勵對北方邦和安得拉邦等區域叢集的配套投資,從而將印度的瓷磚市場進一步滲透到內陸地區。

城市中階的翻新熱潮

預計到2024年,都會家庭的人均可支配收入將超過5,000美元,這將推動一波以生活方式主導的房屋翻新浪潮,包括廚房、浴室和客廳的整修。與大規模新建工程不同,翻新訂單更傾向於精心設計的圖案、小批量生產和快速物流,從而提升了具有數位噴墨圖案的品牌產品淨利率。電商目錄、擴增實境房間視覺化工具和網主導設計部落格加速了消費者的發現,而宅配直達則省去了多層分銷加價。齋浦爾、哥印拜陀和維傑亞瓦達等二線城市也加入了升級改造的行列,業主們正在對已有20年歷史的建築進行現代化改造。金融機構提供利率為個位數的10年期房屋維修貸款,進一步刺激了消費。總體而言,維修工程為印度瓷磚市場注入了反週期韌性,即使整體房屋開工量出現波動,計劃也能繼續進行。

天然氣價格波動

2022年初至2023年中期,印度再氣化廠的液化天然氣現貨價格加倍,擠壓了與固定天然氣合約掛鉤的窯爐的息稅折舊攤銷EBITDA獲利率)。一些沒有避險的小型業者被迫停產15天,以避免虧損出貨。儘管與卡達和俄羅斯簽訂的長期管道合約在一定程度上恢復了市場的透明度,但交易員報告稱,遠期曲線仍比新冠疫情前的平均水平高出20%。不穩定的投入成本環境限制了新建棕地能的開發,尤其是日產能低於1萬平方公尺的非正規企業。雖然一些邦已經推出了紓困措施,但核准仍然零散。這種波動性凸顯了氫氣摻混和電氣化窯爐的戰略價值。

細分市場分析

預計到2030年,磁磚市場規模將達到58億美元,年複合成長率(CAGR)為8.2%。釉藥磁磚的價格比磁磚低8-12%,但其成長速度更快,年複合成長率達到9.01%,這主要得益於中等收入住房和色彩豐富的浴室配色。無釉陶土磚在倉庫貨架上逐漸佔有一席之地,因為在這些地方,防滑性能比美觀更為重要。馬賽克瓷磚雖然銷售額佔比不到5%,但在精品酒店和泳池平台等應用領域卻能獲得較高的利潤,因此吸引了許多手工新興企業的注意。到2024-2025年,至少有九家Morbi工廠將恢復素燒工藝,並為歐洲園林景觀設計師生產20毫米厚的戶外瓷磚。

預計到2024年,地板材料應用將以76.31%的市佔率佔據主導地位,並有望在2030年之前以9.14%的複合年成長率引領市場成長。此細分市場的優勢源於瓷磚相比其他地板材料更優異的性能,例如耐用性、易於維護性和適用於各種應用場景的設計靈活性。牆面應用是第二大細分市場,主要由浴室和廚房維修推動,瓷磚在這些應用中具有防潮性和美觀性。屋頂應用仍屬於專業領域,主要滿足特定的建築要求和地理偏好,瓷磚在這些應用中具有隔熱性能。

預計到2024年,瓷磚將以76.31%的市場佔有率主導地面鋪裝應用市場,並在2030年之前以9.14%的複合年成長率引領成長,這反映了瓷磚在住宅和商業建築計劃中作為地板材料的基礎性作用。此細分市場的優勢源自於磁磚相比其他地板材料更優異的性能,包括耐用性、易於維護性和適用於各種應用情境的設計彈性。牆面鋪裝應用是第二大市場細分領域,主要由浴室和廚房維修推動,瓷磚在這些應用中具有防潮性和美觀性。屋頂鋪裝應用仍屬於專業領域,主要滿足特定的建築要求和地理偏好,瓷磚在這些應用中具有隔熱性能優勢。

陶瓷磚憑藉其與豪華乙烯基瓷磚(LVT)和石材複合材料(SPC)地板材料的競爭優勢,正受益於此細分市場的發展。區域偏好影響應用模式,與以地板材料鋪裝為主的北印度相比,南印度更傾向於將陶瓷磚用於牆壁材料。這種應用組合的變化為製造商提供了機遇,使其既能保持在核心地板材料領域的主導,又能開發適用於新應用場景的專用產品。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 經濟適用房和智慧城市計劃激增

- 城市中階的裝潢熱潮

- 轉向大尺寸尺寸板材磁磚

- 莫爾比叢集的氫能窯爐降低了能源成本

- 小型建築商的數位噴墨大規模客製化

- 薄層砂漿覆蓋系統的應用日益普及

- 市場限制

- 天然氣價格波動

- 主要出口目的地的反傾銷稅

- 蒙德拉港物流瓶頸

- 商業領域轉向LVT/SPC地板

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察最新市場趨勢與創新

- 深入了解最新的產業動態(新產品發布、策略舉措、投資、合作、合資、擴張、併購等)

第5章 市場規模及成長預測(單位:美元)

- 依產品類型

- 陶瓷瓷磚

- 釉藥陶瓷磚

- 無釉陶瓷磚

- 馬賽克瓷磚

- 其他(裝飾性、圖案性、手工製作)

- 透過使用

- 地面

- 牆

- 屋頂

- 最終用戶

- 住宅

- 商業的

- 飯店業(飯店、度假村)

- 零售空間

- 辦公室和設施

- 衛生保健

- 教育設施

- 交通樞紐(機場、捷運、客運站)

- 其他商業用戶

- 依建築類型

- 新建工程

- 翻新和更換

- 透過分銷管道

- 磁磚和石材專賣店

- 家居建材商店

- 線上零售

- 直接向供應商銷售

- 按地區

- 印度北部

- 南印度

- 西印度群島

- 東印度

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Kajaria Ceramics Ltd

- Somany Ceramics Ltd

- H&R Johnson(India)

- Asian Granito India Ltd

- Nitco Ltd

- Orient Bell Ltd

- RAK Ceramics India

- Exxaro Tiles Ltd

- Varmora Granito

- Simpolo Ceramics

- Johnson Pedder

- Murudeshwar Ceramics(Naveen)

- Pavit Ceramics

- Grindwell Norton(Saint-Gobain India)

- Astral Tiles

- Cera Sanitaryware Ltd

- Capron Granito

- Metro City Tiles

- Itaca Ceramics

- Regent Granito

第7章 市場機會與未來展望

The India ceramic tiles market size stood at USD 10.45 billion in 2025 and is forecast to reach USD 15.84 billion by 2030, expanding at an 8.67% CAGR during 2025-2030.

Strong demand from affordable-housing schemes, smart-city programs and private real-estate investments is underpinning a steady sales trajectory as the nation urbanizes at scale. Continuous technology upgrades inside the Morbi production hub, wider natural-gas pipeline coverage and the arrival of hydrogen-ready kilns are lowering unit costs, allowing organized manufacturers to compete aggressively in premium and mid-market price bands. Adoption of large-format slab tiles, digital-inkjet printing and thin-set overlay systems is widening design possibilities for architects and homeowners alike. Parallel growth in export volumes, particularly to the United States and Gulf Cooperation Council (GCC) countries, adds another earnings layer, even as anti-dumping probes and logistics bottlenecks at Mundra port inject near-term uncertainty.

India Ceramic Tiles Market Trends and Insights

Surging Affordable-Housing & Smart-City Projects

PMAY-U 2.0's commitment to build an additional 10 million pucca homes backed by INR 10 lakh crore (USD 120.5 billion) creates a durable order pipeline for ceramic flooring and wall solutions. The program's integration of BIS quality standards tilts procurement toward organized plants capable of consistent output, supporting gradual consolidation inside the India ceramic tiles market. Simultaneously, the Smart Cities Mission funnels INR 2.05 lakh crore (USD 24.7 billion) into 5,151 urban-renewal projects that routinely specify premium porcelain or glazed vitrified tiles for transit hubs, waterfront promenades and public-housing corridors. Together these two schemes collectively demand 700-900 million m2 of annual built-up area, magnifying domestic consumption even if export orders soften. Suppliers that align product portfolios with local municipal tender specifications gain preferred-vendor status and longer visibility on capacity utilization. Government outlays also encourage regional clusters-like Uttar Pradesh and Andhra Pradesh-to court ancillary investments, nudging the India ceramic tiles market deeper into hinterland districts.

Urban Middle-Class Renovation Boom

Disposable incomes in metro households crossed USD 5,000 per capita in 2024, prompting a lifestyle-driven refurbishment wave in kitchens, bathrooms and living rooms. Unlike bulk new-build contracts, renovation orders favor curated patterns, smaller batch volumes and quick-turn logistics, elevating margins for branded SKUs with digital-inkjet motifs. E-commerce catalogues, augmented-reality room visualizers and influencer-led design blogs accelerate consumer discovery, and direct-to-home parcel deliveries cut out layers of distribution mark-ups. Tier-2 cities such as Jaipur, Coimbatore and Vijayawada are joining the upgrade trend as property owners modernize two-decade-old structures. Financial institutions have extended ten-year home-improvement loans at single-digit interest, further lubricating spend. Collectively, renovations inject counter-cyclical resilience into the India ceramic tiles market because projects proceed even when macro housing starts wobble.

Natural-Gas Price Volatility

Spot LNG at the Indian regasification gate doubled between early-2022 and mid-2023, squeezing EBITDA margins for kilns calibrated on fixed gas contracts. Smaller operators, lacking hedging lines, were forced into 15-day shutdowns to avoid loss-making dispatches. Although long-term Qatar and Russian pipeline deals restored some visibility, traders report forward curves still 20% above pre-COVID averages. The precarious input cost environment dissuades fresh brownfield capacity, particularly for unorganized units under 10,000 m2/day. Several states have floated relief rebates, but approvals remain piecemeal. The volatility underscores why hydrogen blending and electrified kilns hold strategic value.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward Large-Format Slab Tiles

- Morbi Clusters' Hydrogen-Ready Kilns Cut Energy Cost

- Anti-Dumping Duties in Key Export Destinations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The India ceramic tiles market size for porcelain registered USD 5.8 billion, and segment CAGR is forecast near 8.2% through 2030 as designers replace granite with polished porcelain in airport concourses. Glazed ceramic tiles, priced 8-12% lower, are accelerating faster at 9.01% CAGR on the back of mid-income housing and chromatic bathroom palettes. Unglazed quarry tiles keep a foothold in warehouse aisles where slip rating standards trump aesthetics. Mosaic variants, though sub-5% of revenue, fetch premium margins in boutique hospitality and pool decking applications, drawing interest from artisanal startups. During 2024-2025 at least nine Morbi plants retooled biscuit firing to produce 20 mm outdoor porcelains aimed at European landscaping contractors.

Floor applications dominate with 76.31% market share in 2024 and lead growth projections at 9.14% CAGR through 2030, reflecting the fundamental role of flooring in both residential and commercial construction projects. This segment's strength derives from ceramic tiles' superior performance characteristics compared to alternative flooring materials, including durability, maintenance ease, and design versatility across diverse applications. Wall applications represent the secondary market segment, driven by bathroom and kitchen renovations where ceramic tiles provide moisture resistance and aesthetic appeal. Roofing applications remain specialized, serving specific architectural requirements and regional preferences where ceramic tiles offer thermal performance advantages.

Floor applications dominate with 76.31% market share in 2024 and lead growth projections at 9.14% CAGR through 2030, reflecting the fundamental role of flooring in both residential and commercial construction projects. This segment's strength derives from ceramic tiles' superior performance characteristics compared to alternative flooring materials, including durability, maintenance ease, and design versatility across diverse applications. Wall applications represent the secondary market segment, driven by bathroom and kitchen renovations where ceramic tiles provide moisture resistance and aesthetic appeal. Roofing applications remain specialized, serving specific architectural requirements and regional preferences where ceramic tiles offer thermal performance advantages.

The segment benefits from ceramic tiles' competitive positioning against luxury vinyl tile (LVT) and stone plastic composite (SPC) flooring, which are gaining traction in commercial applications but remain limited by durability concerns in high-traffic environments. Regional preferences influence application patterns, with South India showing stronger adoption of ceramic tiles for wall applications compared to North India's floor-focused usage. The application mix evolution suggests opportunities for manufacturers to develop specialized products for emerging use cases while maintaining leadership in core flooring applications.

The India Ceramic Tiles Market Report is Segmented by Product Type (Porcelain Tiles, Glazed Ceramic Tiles, and More), Application (Floor, Wall, Roofing), End-User (Residential, Commercial), Construction Type (New Construction, Renovation and Replacement), Distribution Channel (Specialty Stores, Home Improvement Stores, and More), and Geography (North India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Kajaria Ceramics Ltd

- Somany Ceramics Ltd

- H&R Johnson (India)

- Asian Granito India Ltd

- Nitco Ltd

- Orient Bell Ltd

- RAK Ceramics India

- Exxaro Tiles Ltd

- Varmora Granito

- Simpolo Ceramics

- Johnson Pedder

- Murudeshwar Ceramics (Naveen)

- Pavit Ceramics

- Grindwell Norton (Saint-Gobain India)

- Astral Tiles

- Cera Sanitaryware Ltd

- Capron Granito

- Metro City Tiles

- Itaca Ceramics

- Regent Granito

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging affordable-housing & Smart-City projects

- 4.2.2 Urban middle-class renovation boom

- 4.2.3 Shift toward large-format slab tiles

- 4.2.4 Morbi clusters' hydrogen-ready kilns cut energy cost

- 4.2.5 Digital-inkjet mass customization for small builders

- 4.2.6 Rising adoption of thin-set overlay systems

- 4.3 Market Restraints

- 4.3.1 Natural-gas price volatility

- 4.3.2 Anti-dumping duties in key export destinations

- 4.3.3 Logistics bottlenecks at Mundra port

- 4.3.4 Commercial shift to LVT/SPC flooring

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Porcelain Tiles

- 5.1.2 Glazed Ceramic Tiles

- 5.1.3 Unglazed Ceramic Tiles

- 5.1.4 Mosaic Tiles

- 5.1.5 Others (Decorative, Patterned, Handmade)

- 5.2 By Application

- 5.2.1 Floor

- 5.2.2 Wall

- 5.2.3 Roofing

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality (Hotels, Resorts)

- 5.3.2.2 Retail Spaces

- 5.3.2.3 Offices & Institutions

- 5.3.2.4 Healthcare

- 5.3.2.5 Educational Facilities

- 5.3.2.6 Transport Hubs (Airports, Metro, Bus Terminals)

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Renovation and Replacement

- 5.5 By Distribution Channel

- 5.5.1 Specialty Tile & Stone Stores

- 5.5.2 Home Improvement & DIY Stores

- 5.5.3 Online Retail

- 5.5.4 Direct Sales to Contractors

- 5.6 By Geography

- 5.6.1 North India

- 5.6.2 South India

- 5.6.3 West India

- 5.6.4 East India

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Kajaria Ceramics Ltd

- 6.4.2 Somany Ceramics Ltd

- 6.4.3 H&R Johnson (India)

- 6.4.4 Asian Granito India Ltd

- 6.4.5 Nitco Ltd

- 6.4.6 Orient Bell Ltd

- 6.4.7 RAK Ceramics India

- 6.4.8 Exxaro Tiles Ltd

- 6.4.9 Varmora Granito

- 6.4.10 Simpolo Ceramics

- 6.4.11 Johnson Pedder

- 6.4.12 Murudeshwar Ceramics (Naveen)

- 6.4.13 Pavit Ceramics

- 6.4.14 Grindwell Norton (Saint-Gobain India)

- 6.4.15 Astral Tiles

- 6.4.16 Cera Sanitaryware Ltd

- 6.4.17 Capron Granito

- 6.4.18 Metro City Tiles

- 6.4.19 Itaca Ceramics

- 6.4.20 Regent Granito

7 Market Opportunities & Future Outlook

- 7.1 Green hydrogen-fired kilns reach commercial scale

- 7.2 Tile-as-a-Service subscription models for retail chains