|

市場調查報告書

商品編碼

1826563

全球瓷磚市場按類型、應用、最終用途領域、飾面、建築類型和地區分類-預測至2030年Ceramic Tiles Market by Type (Porcelain, Ceramic), Application (Floor Tiles, Internal Wall Tiles, External Wall Tiles), End-use Sector (Residential, Non-residential), Finish (Matt, Gloss), Construction Type, and Region - Global Forecast to 2030 |

||||||

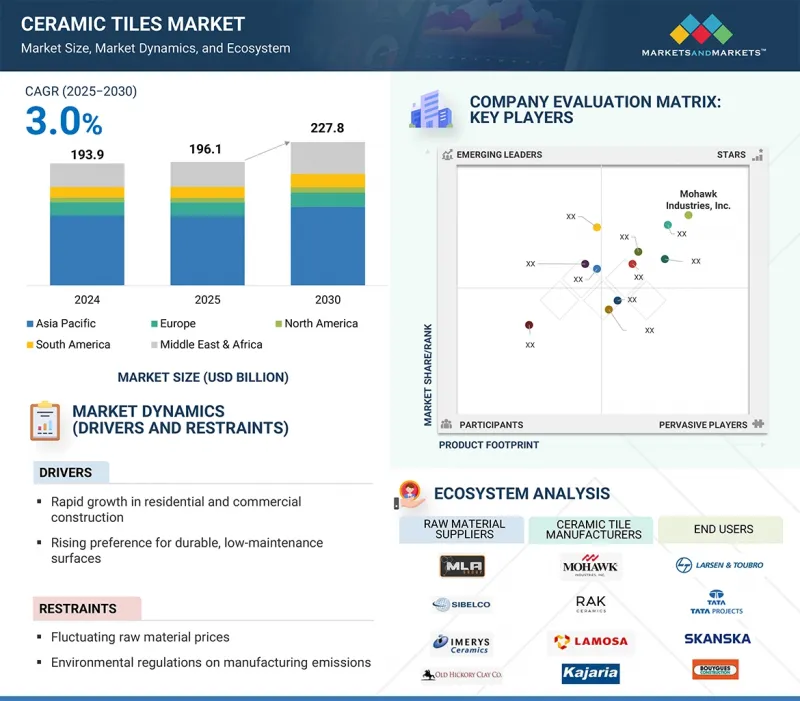

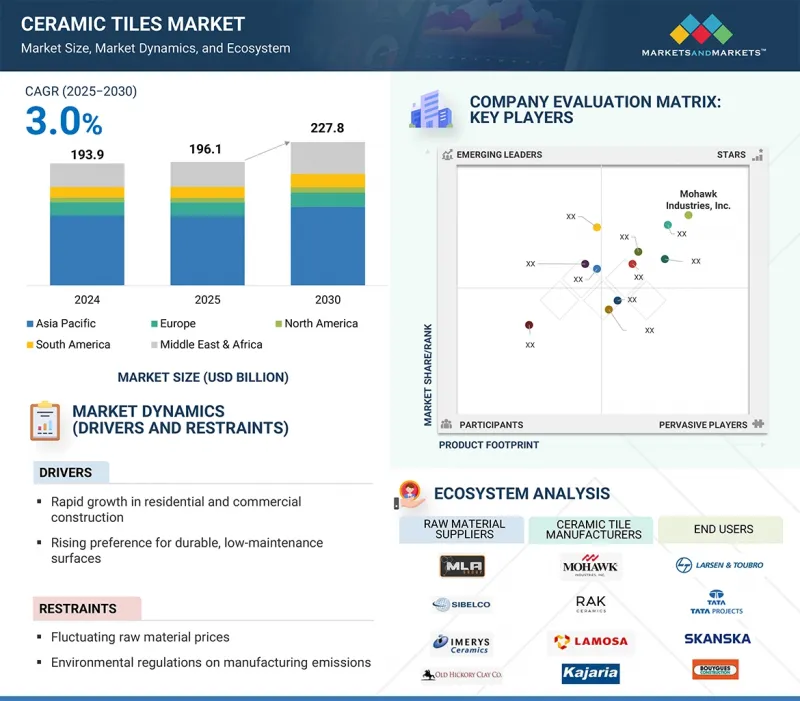

全球磁磚市場規模預計將從 2025 年的 1,962 億美元增至 2030 年的 2,278 億美元,預測期內的複合年成長率為 3.0%。

| 調查範圍 | |

|---|---|

| 調查年份 | 2021-2030 |

| 基準年 | 2024 |

| 預測期 | 2025-2030 |

| 單元 | 100萬美元,100萬平方公尺 |

| 部分 | 類型、應用、最終用途部門、地區 |

| 目標區域 | 北美、亞太地區、歐洲、中東和非洲、南美 |

由於採用製造業技術進步、都市化發展、基礎設施建設以及消費者對耐用、時尚、低維護建築材料的需求不斷成長,瓷磚市場正在不斷擴張。此外,對永續建築方法的日益關注以及家庭收入的不斷成長也進一步推動了市場的成長。

按類型分類,預計瓷質磚在預測期內將佔據主要市場佔有率。

瓷質磚在耐用性、防水性和多功能性方面均優於陶瓷磁磚。瓷質磚由緻密的粘土製成,並經過高溫燒製而成。這些磁磚孔隙率更低,更耐潮、防污、耐磨,非常適合人流量大的區域以及室內外使用。其強度和耐用性吸引了尋求長期地板材料和表面解決方案的消費者。

按應用分類,地板材料產業在 2024 年佔據了主要市場佔有率。

2024年,地板材料瓷磚佔據了瓷磚市場的主導地位。這種優勢源自於其固有的耐用性和易於維護的特性,使其成為人流量大區域的首選。地板瓷磚具有防潮、防污和防刮擦的特性,特別適用於注重耐用性和衛生性的廚房、浴室和商業空間。

根據最終用途細分,預計住宅細分市場將在預測期內佔據最大的市場佔有率。

由於對美觀實用的地板材料和牆面產品的需求強勁,住宅領域引領著瓷磚市場。瓷磚因其耐用性、易於維護和豐富的設計風格而廣受歡迎。這些瓷磚是廚房、浴室和客廳等空間的理想選擇。由於消費者希望翻新和客製化自己的居住空間,家居裝修趨勢顯著推動了瓷磚需求。此外,瓷磚價格實惠且可得性,使其成為許多家庭的理想選擇。打造舒適時尚的居家環境正推動市場的發展。

按地區分類,預測期內中東和非洲的成長率最高。

中東和非洲是瓷磚成長最快的市場。中東和非洲的建築業蓬勃發展,沙烏地阿拉伯和阿拉伯聯合大公國等國正在進行大型計劃。這些國家正在大力投資基礎建設、城市擴張和大型計劃,包括豪華多用戶住宅、商業設施和公共建築。建設活動的激增推動了對瓷磚的需求,瓷磚因其耐用性、美觀性和多功能性而備受推崇。該地區致力於都市區現代化和生活水準的提高,這進一步增強了瓷磚市場。

本報告對全球瓷磚市場進行了分析,提供了關鍵促進因素和限制因素、競爭格局和未來趨勢的資訊。

目錄

第1章 引言

第2章調查方法

第3章執行摘要

第4章 主要發現

- 瓷磚市場為企業帶來誘人機遇

- 磁磚市場按類型分類

- 磁磚市場按應用分類

- 按最終用途分類的瓷磚市場

- 按地區和類型分類的瓷磚市場

- 各國瓷磚市場

第5章 市場概況

- 介紹

- 市場動態

- 驅動程式

- 抑制因素

- 機會

- 任務

第6章 產業趨勢

- 影響客戶業務的趨勢/中斷

- 定價分析

- 主要企業按類型分類的平均銷售價格

- 各地區平均銷售價格趨勢

- 價值鏈分析

- 生態系分析

- 技術分析

- 主要技術

- 互補技術

- 鄰近技術

- 專利分析

- 介紹

- 調查方法

- 瓷磚專利

- 貿易分析

- 出口情況(HS 代碼 6904)

- 進口情形(HS 代碼 6904)

- 出口情況(HS 代碼 6907)

- 進口情形(HS 代碼 6907)

- 大型會議和活動(2025-2026)

- 關稅和監管格局

- 海關分析

- 監管機構、政府機構和其他組織

- 磁磚市場監管

- 波特五力分析

- 主要相關利益者和採購標準

- 案例研究分析

- 投資金籌措場景

- 生成式人工智慧/人工智慧對磁磚市場的影響

- 總體經濟指標

- 介紹

- GDP趨勢與預測

- 工業(含建築業)增加價值(佔GDP的百分比)

第7章 瓷磚市場(按表面處理)

- 介紹

- 墊

- 光澤

第8章 瓷磚市場(按建築類型)

- 介紹

- 新建築

- 維修

第9章 瓷磚市場(按應用)

- 介紹

- 地板材料

- 內壁

- 外牆

- 其他用途

第10章 瓷磚市場類型

- 介紹

- 瓷

- 陶瓷製品

第 11 章 瓷磚市場(依最終用途)

- 介紹

- 住房

- 非住宅

第12章 瓷磚市場(按地區)

- 介紹

- 亞太地區

- 中國

- 印度

- 日本

- 越南

- 泰國

- 印尼

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 義大利

- 其他歐洲國家

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 中東和非洲

- 海灣合作理事會國家

- 土耳其

- 埃及

- 伊朗

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

第13章競爭格局

- 概述

- 主要參與企業的策略

- 市佔率分析

- 收益分析

- 公司估值及財務指標

- 產品/品牌比較

- 企業評估矩陣:主要企業(2024年)

- 公司評估矩陣:Start-Ups/中小企業(2024 年)

- 競爭情境和趨勢

第14章:公司簡介

- 主要企業

- MOHAWK INDUSTRIES, INC.

- GRUPO LAMOSA

- RAK CERAMICS

- SIAM CEMENT PUBLIC COMPANY LIMITED

- PRISM JOHNSON LIMITED

- KAJARIA CERAMICS

- PAMESA CERAMICA

- SOMANY CERAMICS LIMITED

- CERAMICA CARMELO FIOR

- CEDASA GROUP

- ASIAN GRANITO INDIA LTD. (AGL)

- 其他公司

- STN CERAMICA

- PT ARWANA CITRAMULIA TBK

- CERSANIT SA

- LASSELSBERGER GROUP GMBH

- NITCO

- WHITE HORSE CERAMIC INDUSTRIES SDN BHD

- CERAMIC INDUSTRIES LIMITED

- KALE GROUP

- ELIZABETH GROUP

- SAUDI CERAMICS

- INTERCERAMIC

- VICTORIA PLC

- HALCON CERAMICAS

- PORTOBELLO SA

- VIGLACERA CORPORATION

- Start-Ups/技術供應商

- TILES WALE

- KORE ITALIA

- SACMI GROUP

第15章:鄰近市場與相關市場

- 介紹

- 豪華乙烯基瓷磚(LVT)市場

- 市場定義

- 市場概況

- 豪華乙烯基瓷磚(LVT)市場類型

- 豪華乙烯基瓷磚(LVT)市場(按最終用途)

- 豪華乙烯基瓷磚(LVT)市場(按分銷管道)

- 豪華乙烯基瓷磚(LVT)市場(按產品類型)

第16章 附錄

The global ceramic tiles market size is projected to grow from USD 196.2 billion in 2025 to USD 227.8 billion by 2030, at a CAGR of 3.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million)/ Volume (Million square meters) |

| Segments | Type, Application, End-use sector, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The ceramic tiles market is expanding due to technological innovations in manufacturing, urbanization, infrastructure development, and increasing consumer demand for durable, stylish, and low-maintenance building materials. Additionally, the focus on sustainable construction practices and rising household incomes are further propelling market growth.

By type, porcelain segment to account for major market share during forecast period

Porcelain tiles outshine ceramic tiles in the market because of their superior durability, water resistance, and versatility. They are made from denser clay and fired at higher temperatures. These tiles are less porous and more resistant to moisture, stains, and wear, making them perfect for high-traffic areas and both indoor and outdoor uses. Their strength and longevity attract consumers looking for long-term flooring and surface solutions.

By application, flooring segment accounted for major market share in 2024

In 2024, the flooring segment dominated the ceramic tiles market. This dominance is due to the inherent durability and ease of maintenance, which make them a preferred choice for high-traffic areas. Their resistance to moisture, stains, and scratches makes them especially advantageous for kitchens, bathrooms, and commercial spaces where durability and hygiene are vital.

By end-use sector, residential segment to account for the largest market share during forecast period

The residential sector leads the ceramic tiles market because of the strong demand for attractive and functional flooring and wall options in homes. People often choose ceramic tiles for their durability, easy upkeep, and wide variety of designs. These tiles are perfect for spaces like kitchens, bathrooms, and living rooms. The rising trend of home renovation projects significantly boosts demand, as consumers aim to refresh and customize their living areas. Additionally, the affordability and accessibility of ceramic tiles make them an attractive choice for many households. The focus on creating comfortable and stylish home interiors propels the market forward.

By region, Middle East & Africa to register highest growth rate during forecast period

The Middle East & Africa is the fastest-growing market for ceramic tiles. The construction sector in MEA is thriving, with significant projects underway in countries like Saudi Arabia and the UAE. These nations are investing heavily in infrastructure development, urban expansion, and large-scale projects. These include luxury residential complexes, commercial spaces, and public facilities. This surge in construction activity drives high demand for ceramic tiles, valued for their durability, aesthetic appeal, and versatility. The region's focus on modernizing urban areas and enhancing living standards further strengthens the ceramic tiles market.

By Company: Tier1: 40%, Tier 2: 25%, Tier3: 4: 35%

By Designation: C-Level: 35%, Director Level: 30%, Others: 35%

By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, South America: 5%, and Middle East & Africa: 5%.

Companies Covered:

Mohawk Industries Inc. (US), Grupo Lamosa (Mexico), Pamesa Ceramica (Spain), RAK Ceramics (UAE), Siam Cement Public Company Limited (Thailand), Kajaria Ceramics (India), Ceramica Carmelo For (Brazil), and others are key players in the ceramic tiles market.

Research Coverage

The market study examines the ceramic tiles industry across various segments. It aims to estimate the market size and growth potential in different segments based on type, application, end-use sector, finish, construction type, and region. The study also provides a detailed competitive analysis of key market players, including their company profiles, insights into their products and services, recent developments, and major growth strategies to strengthen their position in the ceramic tiles market.

Key Benefits of Buying Report

The report is expected to assist market leaders and new entrants in approximating the revenue figures of the overall ceramic tiles market, along with its segments and sub-segments. It aims to help stakeholders understand the competitive landscape, gain insights to enhance their business positions, and develop appropriate go-to-market strategies. Additionally, the report seeks to provide stakeholders with an understanding of the market's dynamics, including key drivers, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Urbanization and infrastructure development, increasing population), restraints (Volatile raw material prices), opportunities (Strong demand from Asia Pacific, rising demand in emerging markets), and challenges (Intense competition) influencing the growth of the ceramic tiles market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the ceramic tiles market

- Market Development: Comprehensive information about lucrative markets - the report analyses the ceramic tiles market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ceramic tiles market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mohawk Industries Inc. (US), Grupo Lamosa (Mexico), Pamesa Ceramica (Spain), RAK Ceramics (UAE), Siam Cement Public Company Limited (Thailand), Kajaria Ceramics (India), Ceramica Carmelo For (Brazil) among others in the ceramic tiles market. The report also helps stakeholders understand the pulse of the ceramic tiles market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RISKS ASSESSMENT

- 2.9 RESEARCH LIMITATIONS

- 2.10 GROWTH RATE ASSUMPTIONS/FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CERAMIC TILES MARKET

- 4.2 CERAMIC TILES MARKET, BY TYPE

- 4.3 CERAMIC TILES MARKET, BY APPLICATION

- 4.4 CERAMIC TILES MARKET, BY END-USE SECTOR

- 4.5 CERAMIC TILES MARKET, BY REGION AND TYPE

- 4.6 CERAMIC TILES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Aesthetic appeal and functional durability fuel demand for large-format tiles

- 5.2.1.2 Increasing population & urbanization

- 5.2.1.3 Growing investments in construction industry

- 5.2.1.4 Rising number of renovation activities

- 5.2.1.5 Increasing industrialization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Increasing regulations, tariffs, and anti-dumping measures

- 5.2.2.3 Combined effect of recession and Russia-Ukraine conflict in Europe

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising trend of office-to-residential conversion

- 5.2.3.2 Introduction of 3D tiles and digital printing technologies

- 5.2.3.3 Rapidly progressing organized retail sector

- 5.2.3.4 Increase in demand from emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Extremely competitive market

- 5.2.4.2 Gas crisis in different regions

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Digital printing

- 6.5.1.2 Spray drying

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Adhesives and grouts

- 6.5.2.2 Smart tiles

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 3D printing

- 6.5.3.2 Germ-free tiles

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PATENT ANALYSIS

- 6.6.1 INTRODUCTION

- 6.6.2 METHODOLOGY

- 6.6.3 PATENTS RELATED TO CERAMIC TILES

- 6.7 TRADE ANALYSIS

- 6.7.1 EXPORT SCENARIO (HS CODE 6904)

- 6.7.2 IMPORT SCENARIO (HS CODE 6904)

- 6.7.3 EXPORT SCENARIO (HS CODE 6907)

- 6.7.4 IMPORT SCENARIO (HS CODE 6907)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 TARIFF ANALYSIS

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.3 REGULATIONS IN CERAMIC TILES MARKET

- 6.9.3.1 EN 14411 - (CE Certification for Ceramic tiles)

- 6.9.3.2 ANSI A137

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 THREAT OF NEW ENTRANTS

- 6.10.2 THREAT OF SUBSTITUTES

- 6.10.3 BARGAINING POWER OF SUPPLIERS

- 6.10.4 BARGAINING POWER OF BUYERS

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 CASE STUDY 1: DEAKINBIO'S SUSTAINABLE BIO-BASED TILES

- 6.12.2 CASE STUDY 2: DESIGN WITH 1M X 1M LARGE PORCELAIN TILES

- 6.12.3 CASE STUDY 3: ENHANCED OUTDOOR SPACES WITH OUTDOOR PORCELAIN TILES

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 IMPACT OF GEN AI/AI ON CERAMIC TILES MARKET

- 6.14.1 INTRODUCTION

- 6.15 MACROECONOMIC INDICATORS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.15.3 INDUSTRY (INCLUDING CONSTRUCTION), VALUE ADDED (% OF GDP)

7 CERAMIC TILES MARKET, BY FINISH

- 7.1 INTRODUCTION

- 7.2 MATT

- 7.3 GLOSS

8 CERAMIC TILES MARKET, BY CONSTRUCTION TYPE

- 8.1 INTRODUCTION

- 8.2 NEW CONSTRUCTION

- 8.3 RENOVATION

9 CERAMIC TILES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FLOORING

- 9.2.1 LOW MAINTENANCE REQUIREMENTS AND HIGH DURABILITY TO DRIVE DEMAND

- 9.3 INTERNAL WALLS

- 9.3.1 WIDE-SCALE USE IN HOMES, OFFICES, HOSPITALS, AND LABORATORIES TO DRIVE MARKET

- 9.4 EXTERNAL WALLS

- 9.4.1 USE OF CERAMIC TILES IN EXTERIOR CLADDINGS TO DRIVE MARKET

- 9.5 OTHER APPLICATIONS

10 CERAMIC TILES MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 PORCELAIN

- 10.2.1 LOW WATER ABSORPTION RATE OF 0.5% OR BELOW TO DRIVE DEMAND

- 10.3 CERAMIC

- 10.3.1 ASSOCIATED COST-EFFECTIVENESS AND DURABILITY TO FUEL DEMAND

11 CERAMIC TILES MARKET, BY END-USE SECTOR

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

- 11.2.1 EXPANDING RESIDENTIAL SECTOR TO DRIVE DEMAND

- 11.3 NON-RESIDENTIAL

- 11.3.1 INCREASING SPENDING ON CONSTRUCTION OF OFFICES AND OTHER COMMERCIAL & INSTITUTIONAL SPACES TO FUEL DEMAND

- 11.3.1.1 Commercial

- 11.3.1.2 Institutional and healthcare spaces

- 11.3.1.3 Public facilities

- 11.3.1 INCREASING SPENDING ON CONSTRUCTION OF OFFICES AND OTHER COMMERCIAL & INSTITUTIONAL SPACES TO FUEL DEMAND

12 CERAMIC TILES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Expanding construction industry to drive demand

- 12.2.2 INDIA

- 12.2.2.1 Government-led initiatives to promote sanitation and infrastructure development to fuel demand

- 12.2.3 JAPAN

- 12.2.3.1 Government initiatives and private investments to revitalize construction industry to drive demand

- 12.2.4 VIETNAM

- 12.2.4.1 Easy availability of raw materials to drive market

- 12.2.5 THAILAND

- 12.2.5.1 Economic stability and increasing residential construction to fuel demand

- 12.2.6 INDONESIA

- 12.2.6.1 High growth of construction industry to propel market

- 12.2.7 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Rise in non-residential construction to drive demand

- 12.3.2 UK

- 12.3.2.1 Decline in residential and non-residential construction projects to hamper demand

- 12.3.3 FRANCE

- 12.3.3.1 Bleak prospects for market growth due to housing crisis

- 12.3.4 RUSSIA

- 12.3.4.1 Growing construction industry to drive market

- 12.3.5 SPAIN

- 12.3.5.1 High export of ceramic tiles to fuel market growth

- 12.3.6 ITALY

- 12.3.6.1 Increase in new non-residential surface construction to fuel market growth

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 High infrastructure development and technological advancements to drive market

- 12.4.2 CANADA

- 12.4.2.1 Rising spending on residential and non-residential construction activities to fuel demand

- 12.4.3 MEXICO

- 12.4.3.1 Slow growth of construction industry due to slow economic recovery to hamper market growth

- 12.4.1 US

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 UAE

- 12.5.1.1.1 Rise in construction activities to drive market

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Government-led initiatives for infrastructure development to propel market

- 12.5.1.3 Other GCC countries

- 12.5.1.1 UAE

- 12.5.2 TURKEY

- 12.5.2.1 Rising use of advanced tile production technologies to drive market

- 12.5.3 EGYPT

- 12.5.3.1 Increasing investments in reconstruction activities to drive market

- 12.5.4 IRAN

- 12.5.4.1 Delayed construction projects to restrain demand

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 High adoption of porcelain tiles and recovery of construction industry to fuel market growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Rising public-private partnerships in construction industry to drive demand

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- 13.3 MARKET SHARE ANALYSIS

- 13.4 REVENUE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT/BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Type footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End-use sector footprint

- 13.7.5.6 Finish footprint

- 13.7.5.7 Construction type footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: KEY STARTUP/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIOS AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 MOHAWK INDUSTRIES, INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses & competitive threats

- 14.1.2 GRUPO LAMOSA

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses & competitive threats

- 14.1.3 RAK CERAMICS

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.3.4 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses & competitive threats

- 14.1.4 SIAM CEMENT PUBLIC COMPANY LIMITED

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Brands offered

- 14.1.4.4 Recent developments

- 14.1.4.5 Expansions

- 14.1.4.6 MnM view

- 14.1.4.6.1 Right to win

- 14.1.4.6.2 Strategic choices

- 14.1.4.6.3 Weaknesses & competitive threats

- 14.1.5 PRISM JOHNSON LIMITED

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses & competitive threats

- 14.1.6 KAJARIA CERAMICS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Expansions

- 14.1.6.4 MnM view

- 14.1.6.4.1 Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses & competitive threats

- 14.1.7 PAMESA CERAMICA

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 Expansions

- 14.1.7.5 MnM view

- 14.1.8 SOMANY CERAMICS LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.8.4 MnM view

- 14.1.9 CERAMICA CARMELO FIOR

- 14.1.9.1 Business overview

- 14.1.9.2 Products/solutions/services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Expansions

- 14.1.9.4 MnM view

- 14.1.10 CEDASA GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/solutions/services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.4 MnM view

- 14.1.11 ASIAN GRANITO INDIA LTD. (AGL)

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Deals

- 14.1.11.3.3 Expansions

- 14.1.11.4 MnM view

- 14.1.1 MOHAWK INDUSTRIES, INC.

- 14.2 OTHER PLAYERS

- 14.2.1 STN CERAMICA

- 14.2.2 PT ARWANA CITRAMULIA TBK

- 14.2.3 CERSANIT S.A.

- 14.2.4 LASSELSBERGER GROUP GMBH

- 14.2.5 NITCO

- 14.2.6 WHITE HORSE CERAMIC INDUSTRIES SDN BHD

- 14.2.7 CERAMIC INDUSTRIES LIMITED

- 14.2.8 KALE GROUP

- 14.2.9 ELIZABETH GROUP

- 14.2.10 SAUDI CERAMICS

- 14.2.11 INTERCERAMIC

- 14.2.12 VICTORIA PLC

- 14.2.13 HALCON CERAMICAS

- 14.2.14 PORTOBELLO S.A.

- 14.2.15 VIGLACERA CORPORATION

- 14.3 STARTUPS/TECHNOLOGY PROVIDERS

- 14.3.1 TILES WALE

- 14.3.2 KORE ITALIA

- 14.3.3 SACMI GROUP

15 ADJACENT & RELATED MARKET

- 15.1 INTRODUCTION

- 15.2 LUXURY VINYL TILES MARKET

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.2.3 LUXURY VINYL TILES MARKET, BY TYPE

- 15.3 LUXURY VINYL TILES MARKET, BY END-USE SECTOR

- 15.4 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL

- 15.5 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE

- 15.5.1 LUXURY VINYL TILES MARKET, BY REGION

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

List of Tables

- TABLE 1 CERAMIC TILES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 AVERAGE SELLING PRICE OF CERAMIC TILES OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/SQUARE METER)

- TABLE 3 AVERAGE SELLING PRICE TREND OF CERAMIC TILES, BY REGION, 2021-2024 (USD/SQUARE METER)

- TABLE 4 ROLES OF COMPANIES IN CERAMIC TILES ECOSYSTEM

- TABLE 5 CERAMIC TILES: KEY PATENTS

- TABLE 6 EXPORT DATA RELATED TO HS CODE 6904-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 IMPORT DATA RELATED TO HS CODE 6904-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 EXPORT DATA RELATED TO HS CODE 6907-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 IMPORT DATA RELATED TO HS CODE 6907-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 CERAMIC TILES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 TARIFF RELATED TO HS CODE 6907

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SPECIFICATIONS RELATED TO CERAMIC TILES

- TABLE 17 CERAMIC TILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE SECTOR

- TABLE 19 KEY BUYING CRITERIA FOR CERAMIC TILES IN END-USE SECTORS

- TABLE 20 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 21 INDUSTRY (INCLUDING CONSTRUCTION), VALUE ADDED (% OF GDP)

- TABLE 22 CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 23 CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 24 CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (MILLION SQUARE METER)

- TABLE 25 CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 26 CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 27 CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 28 CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 29 CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 30 CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 31 CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 32 CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 33 CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 34 CERAMIC TILES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 35 CERAMIC TILES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 36 CERAMIC TILES MARKET, BY REGION, 2021-2023 (MILLION SQUARE METER)

- TABLE 37 CERAMIC TILES MARKET, BY REGION, 2024-2030 (MILLION SQUARE METER)

- TABLE 38 ASIA PACIFIC: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 39 ASIA PACIFIC: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (MILLION SQUARE METER)

- TABLE 40 ASIA PACIFIC: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 42 ASIA PACIFIC: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 43 ASIA PACIFIC: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (MILLION SQUARE METER)

- TABLE 44 ASIA PACIFIC: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 46 ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 48 ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 50 ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 51 ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 52 ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 54 CHINA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 55 CHINA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 56 CHINA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 57 CHINA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 58 CHINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 59 CHINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 60 CHINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 61 CHINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 62 INDIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 63 INDIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 64 INDIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 65 INDIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 66 INDIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 67 INDIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 68 INDIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 69 INDIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 70 JAPAN: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 71 JAPAN: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 72 JAPAN: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 73 JAPAN: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 74 JAPAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 75 JAPAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 76 JAPAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 77 JAPAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 78 VIETNAM: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 79 VIETNAM: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 80 VIETNAM: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 81 VIETNAM: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 82 VIETNAM: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 83 VIETNAM: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 84 VIETNAM: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 85 VIETNAM: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 86 THAILAND: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 87 THAILAND: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 88 THAILAND: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 89 THAILAND: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 90 THAILAND: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 91 THAILAND: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 92 THAILAND: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 93 THAILAND: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 94 INDONESIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 95 INDONESIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 96 INDONESIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 97 INDONESIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 98 INDONESIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 99 INDONESIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 100 INDONESIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 101 INDONESIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 102 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 104 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 106 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 108 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 110 EUROPE: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 111 EUROPE: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (MILLION SQUARE METER)

- TABLE 112 EUROPE: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 113 EUROPE: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 114 EUROPE: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 115 EUROPE: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (MILLION SQUARE METER)

- TABLE 116 EUROPE: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 117 EUROPE: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 118 EUROPE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 119 EUROPE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 120 EUROPE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 121 EUROPE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 122 EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 123 EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 124 EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 125 EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 126 GERMANY: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 127 GERMANY: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 128 GERMANY: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 129 GERMANY: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 130 GERMANY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 131 GERMANY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 132 GERMANY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 133 GERMANY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 134 UK: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 135 UK: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 136 UK: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 137 UK: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 138 UK: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 139 UK: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 140 UK: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 141 UK: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 142 FRANCE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 143 FRANCE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 144 FRANCE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 145 FRANCE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 146 FRANCE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 147 FRANCE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 148 FRANCE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 149 FRANCE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 150 RUSSIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 151 RUSSIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 152 RUSSIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 153 RUSSIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 154 RUSSIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 155 RUSSIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 156 RUSSIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 157 RUSSIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 158 SPAIN: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 159 SPAIN: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 160 SPAIN: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 161 SPAIN: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 162 SPAIN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 163 SPAIN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 164 SPAIN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 165 SPAIN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 166 ITALY: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 167 ITALY: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 168 ITALY: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 169 ITALY: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 170 ITALY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 171 ITALY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 172 ITALY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 173 ITALY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 174 REST OF EUROPE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 175 REST OF EUROPE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 176 REST OF EUROPE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 177 REST OF EUROPE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 178 REST OF EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 179 REST OF EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 180 REST OF EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 181 REST OF EUROPE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 182 NORTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 183 NORTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (MILLION SQUARE METER)

- TABLE 184 NORTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 186 NORTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 187 NORTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (MILLION SQUARE METER)

- TABLE 188 NORTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 190 NORTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 191 NORTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 192 NORTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 194 NORTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 195 NORTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 196 NORTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 197 NORTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 198 US: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 199 US: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 200 US: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 201 US: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 202 US: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 203 US: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 204 US: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 205 US: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 206 CANADA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 207 CANADA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 208 CANADA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 209 CANADA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 210 CANADA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 211 CANADA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 212 CANADA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 213 CANADA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 214 MEXICO: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 215 MEXICO: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 216 MEXICO: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 217 MEXICO: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 218 MEXICO: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 219 MEXICO: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 220 MEXICO: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 221 MEXICO: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 222 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (MILLION SQUARE METER)

- TABLE 224 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 226 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (MILLION SQUARE METER)

- TABLE 228 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 230 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 232 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 234 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 236 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 238 GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 239 GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 240 GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 241 GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 242 GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 243 GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 244 GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 245 GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 246 UAE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 247 UAE: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 248 UAE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 249 UAE: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 250 UAE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 251 UAE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 252 UAE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 253 UAE: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 254 SAUDI ARABIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 255 SAUDI ARABIA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 256 SAUDI ARABIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 257 SAUDI ARABIA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 258 SAUDI ARABIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 259 SAUDI ARABIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 260 SAUDI ARABIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 261 SAUDI ARABIA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 262 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 263 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 264 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 265 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 266 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 267 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 268 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 269 OTHER GCC COUNTRIES: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 270 TURKEY: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 271 TURKEY: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 272 TURKEY: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 273 TURKEY: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 274 TURKEY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 275 TURKEY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 276 TURKEY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 277 TURKEY: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 278 EGYPT: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 279 EGYPT: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 280 EGYPT: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 281 EGYPT: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 282 EGYPT: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 283 EGYPT: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 284 EGYPT: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 285 EGYPT: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 286 IRAN: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 287 IRAN: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 288 IRAN: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 289 IRAN: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 290 IRAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 291 IRAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 292 IRAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 293 IRAN: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 296 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 297 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 298 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 299 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 300 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 301 REST OF MIDDLE EAST & AFRICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 302 SOUTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 303 SOUTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2021-2023 (MILLION SQUARE METER)

- TABLE 304 SOUTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 305 SOUTH AMERICA: CERAMIC TILES MARKET, BY COUNTRY, 2024-2030 (MILLION SQUARE METER)

- TABLE 306 SOUTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 307 SOUTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2021-2023 (MILLION SQUARE METER)

- TABLE 308 SOUTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 309 SOUTH AMERICA: CERAMIC TILES MARKET, BY APPLICATION, 2024-2030 (MILLION SQUARE METER)

- TABLE 310 SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 311 SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 312 SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 313 SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 314 SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 315 SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 316 SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 317 SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 318 BRAZIL: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 319 BRAZIL: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 320 BRAZIL: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 321 BRAZIL: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 322 BRAZIL: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 323 BRAZIL: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 324 BRAZIL: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 325 BRAZIL: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 326 ARGENTINA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 327 ARGENTINA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 328 ARGENTINA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 329 ARGENTINA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 330 ARGENTINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 331 ARGENTINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 332 ARGENTINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 333 ARGENTINA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 334 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 335 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2021-2023 (MILLION SQUARE METER)

- TABLE 336 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 337 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 338 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (USD MILLION)

- TABLE 339 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2021-2023 (MILLION SQUARE METER)

- TABLE 340 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 341 REST OF SOUTH AMERICA: CERAMIC TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 342 CERAMIC TILES MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2020-JUNE 2025

- TABLE 343 CERAMIC TILES MARKET: DEGREE OF COMPETITION, 2024

- TABLE 344 CERAMIC TILES MARKET: REGION FOOTPRINT, 2024

- TABLE 345 CERAMIC TILES MARKET: TYPE FOOTPRINT, 2024

- TABLE 346 CERAMIC TILES MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 347 CERAMIC TILES MARKET: END-USE SECTOR FOOTPRINT, 2024

- TABLE 348 CERAMIC TILES MARKET: FINISH FOOTPRINT, 2024

- TABLE 349 CERAMIC TILES MARKET: CONSTRUCTION TYPE FOOTPRINT, 2024

- TABLE 350 CERAMIC TILES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 351 CERAMIC TILES MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 352 CERAMIC TILES MARKET: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 353 CERAMIC TILES MARKET: DEALS, JANUARY 2020-JULY 2025

- TABLE 354 CERAMIC TILES MARKET: EXPANSIONS JANUARY 2020-JULY 2025

- TABLE 355 CERAMIC TILES MARKET: OTHER DEVELOPMENTS JANUARY 2020-JULY 2025

- TABLE 356 MOHAWK INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 357 MOHAWK INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 358 MOHAWK INDUSTRIES, INC.: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 359 MOHAWK INDUSTRIES, INC.: DEALS, JANUARY 2020-JULY 2025

- TABLE 360 MOHAWK INDUSTRIES, INC.: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 361 MOHAWK INDUSTRIES, INC.: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 362 GRUPO LAMOSA: COMPANY OVERVIEW

- TABLE 363 GRUPO LAMOSA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 GROUPO LAMOSA: DEALS, JANUARY 2020-JULY 2025

- TABLE 365 RAK CERAMICS: COMPANY OVERVIEW

- TABLE 366 RAK CERAMICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 RAK CERAMICS: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 368 RAK CERAMICS: DEALS, JANUARY 2020-JULY 2025

- TABLE 369 RAK CERAMICS: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 370 RAK CERAMICS: OTHER DEVELOPMENTS, JANUARY 2020-JULY 2025

- TABLE 371 SIAM CEMENT PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 372 SIAM CEMENT PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 SIAM CEMENT PUBLIC COMPANY LIMITED: BRANDS OFFERED

- TABLE 374 SIAM CEMENT PUBLIC COMPANY LIMITED: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 375 PRISM JOHNSON LIMITED: COMPANY OVERVIEW

- TABLE 376 PRISM JOHNSON LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 PRISM JOHNSON LIMITED: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 378 KAJARIA CERAMICS: COMPANY OVERVIEW

- TABLE 379 KAJARIA CERAMICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 KAJARIA CERAMICS: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 381 KAJARIA CERAMICS: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 382 PAMESA CERAMICA: COMPANY OVERVIEW

- TABLE 383 PAMESA CERAMICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 384 PAMESA CERAMICA: DEALS, JANUARY 2020-JULY 2025

- TABLE 385 PAMESA CERAMICA: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 386 SOMANY CERAMICS LIMITED: COMPANY OVERVIEW

- TABLE 387 SOMANY CERAMICS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 388 SOMANY CERAMICS LIMITED: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 389 SOMANY CERAMICS LIMITED: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 390 CERAMICA CARMELO FIOR: COMPANY OVERVIEW

- TABLE 391 CERAMICA CARMELO FIOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 392 CERAMICA CARMELO FIOR: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 393 CERAMICA CARMELO FIOR: EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 394 CEDASA GROUP: COMPANY OVERVIEW

- TABLE 395 CEDASA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 396 CEDASA GROUP: PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 397 ASIAN GRANITO INDIA LTD. (AGL): COMPANY OVERVIEW

- TABLE 398 ASIAN GRANITO INDIA LTD. (AGL): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 399 ASIAN GRANITO INDIA LTD. (AGL): PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 400 ASIAN GRANITO INDIA LTD. (AGL): DEALS, JANUARY 2020-JULY 2025

- TABLE 401 ASIAN GRANITO INDIA LTD. (AGL): EXPANSIONS, JANUARY 2020-JULY 2025

- TABLE 402 STN CERAMICA: COMPANY OVERVIEW

- TABLE 403 PT ARWANA CITRAMULIA TBK: COMPANY OVERVIEW

- TABLE 404 CERSANIT S.A.: COMPANY OVERVIEW

- TABLE 405 THE LASSELSBERGER GROUP: COMPANY OVERVIEW

- TABLE 406 NITCO: COMPANY OVERVIEW

- TABLE 407 WHITE HORSE CERAMIC INDUSTRIES SDN BHD: COMPANY OVERVIEW

- TABLE 408 CERAMIC INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 409 KALE GROUP: COMPANY OVERVIEW

- TABLE 410 ELIZABETH GROUP: COMPANY OVERVIEW

- TABLE 411 SAUDI CERAMICS: COMPANY OVERVIEW

- TABLE 412 INTERCERAMIC: COMPANY OVERVIEW

- TABLE 413 VICTORIA PLC: COMPANY OVERVIEW

- TABLE 414 HALCON CERAMICAS: COMPANY OVERVIEW

- TABLE 415 PORTOBELLO S.A.: COMPANY OVERVIEW

- TABLE 416 VIGLACERA CORPORATION: COMPANY OVERVIEW

- TABLE 417 TILES WALE: COMPANY OVERVIEW

- TABLE 418 KORE ITALIA: COMPANY OVERVIEW

- TABLE 419 SACMI GROUP: COMPANY OVERVIEW

- TABLE 420 LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 421 LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 422 LUXURY VINYL TILES MARKET, BY TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 423 LUXURY VINYL TILES MARKET, BY TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 424 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (USD MILLION)

- TABLE 425 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (USD MILLION)

- TABLE 426 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2020-2023 (MILLION SQUARE METER)

- TABLE 427 LUXURY VINYL TILES MARKET, BY END-USE SECTOR, 2024-2030 (MILLION SQUARE METER)

- TABLE 428 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2020-2023 (USD MILLION)

- TABLE 429 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2024-2030 (USD MILLION)

- TABLE 430 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2020-2023 (MILLION SQUARE METER)

- TABLE 431 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL, 2024-2030 (MILLION SQUARE METER)

- TABLE 432 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 433 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (USD MILLION)

- TABLE 434 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2020-2023 (MILLION SQUARE METER)

- TABLE 435 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE, 2024-2030 (MILLION SQUARE METER)

- TABLE 436 LUXURY VINYL TILES MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 437 LUXURY VINYL TILES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 438 LUXURY VINYL TILES MARKET, BY REGION, 2020-2023 (MILLION SQUARE METER)

- TABLE 439 LUXURY VINYL TILES MARKET, BY REGION 2024-2030 (MILLION SQUARE METER)

List of Figures

- FIGURE 1 CERAMIC TILES MARKET SEGMENTATION

- FIGURE 2 CERAMIC TILES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 6 CERAMIC TILES MARKET

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 PORCELAIN TO BE LARGEST SEGMENT IN 2025 AND 2030

- FIGURE 9 FLOORING TO DOMINATE AMONG APPLICATIONS IN 2030

- FIGURE 10 RESIDENTIAL SECTOR TO LEAD CERAMIC TILES MARKET IN 2025

- FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE IN CERAMIC TILES MARKET

- FIGURE 12 MARKET IN INDIA, INDONESIA, AND THAILAND TO GROW AT HIGH RATE DURING FORECAST PERIOD

- FIGURE 13 PORCELAIN SEGMENT TO LEAD MARKET IN 2025 AND 2030

- FIGURE 14 FLOORING TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- FIGURE 15 RESIDENTIAL END-USE SECTOR TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 CHINA AND PORCELAIN TILES LED RESPECTIVE SEGMENTS IN CERAMIC TILES MARKET IN 2024

- FIGURE 17 CERAMIC TILES MARKET IN INDIA PROJECTED TO GROW AT HIGHEST CAGR

- FIGURE 18 CERAMIC TILES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 POPULATION GROWTH TREND, 2014-2024

- FIGURE 20 INCREASING URBAN POPULATION TREND, 1999-2030

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 AVERAGE SELLING PRICE OF CERAMIC TILES OFFERED BY KEY PLAYERS, BY TYPE, 2024 (USD/SQUARE METER)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF CERAMIC TILES, BY REGION, 2021-2024 (USD/SQUARE METER)

- FIGURE 24 CERAMIC TILES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 CERAMIC TILES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 MAJOR PATENTS RELATED TO CERAMIC TILES, 2015-2024

- FIGURE 27 EXPORT DATA RELATED TO HS CODE 6904-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- FIGURE 28 IMPORT DATA RELATED TO HS CODE 6904-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA RELATED TO HS CODE 6907-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- FIGURE 30 IMPORT DATA RELATED TO HS CODE 6907-COMPLIANT PRODUCTS, 2020-2024 (USD MILLION)

- FIGURE 31 CERAMIC TILES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA, BY END-USE SECTOR

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO

- FIGURE 35 IMPACT OF GEN AI/AI ON CERAMIC TILES MARKET

- FIGURE 36 FLOORING SEGMENT TO DOMINATE MARKET SHARE IN 2025 AND 2030

- FIGURE 37 PORCELAIN SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 RESIDENTIAL SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 INDIA TO BE FASTEST-GROWING CERAMIC TILES MARKET DURING FORECAST PERIOD

- FIGURE 40 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: CERAMIC TILES MARKET SNAPSHOT

- FIGURE 42 MIDDLE EAST & AFRICA: CERAMIC TILES MARKET SNAPSHOT

- FIGURE 43 CERAMIC TILES MARKET SHARE ANALYSIS, 2024

- FIGURE 44 CERAMIC TILES MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024

- FIGURE 45 CERAMIC TILES MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 46 CERAMIC TILES MARKET: FINANCIAL MATRIX, 2024 (EV/EBITDA RATIO)

- FIGURE 47 CERAMIC TILES MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 48 CERAMIC TILES MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 49 CERAMIC TILES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 50 CERAMIC TILES: COMPANY FOOTPRINT

- FIGURE 51 CERAMIC TILES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 52 MOHAWK INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 53 GRUPO LAMOSA: COMPANY SNAPSHOT

- FIGURE 54 RAK CERAMICS: COMPANY SNAPSHOT

- FIGURE 55 SIAM CEMENT PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- FIGURE 56 PRISM JOHNSON LIMITED: COMPANY SNAPSHOT

- FIGURE 57 KAJARIA CERAMICS: COMPANY SNAPSHOT

- FIGURE 58 SOMANY CERAMICS LIMITED: COMPANY SNAPSHOT

- FIGURE 59 ASIAN GRANITO INDIA LTD. (AGL): COMPANY SNAPSHOT