|

市場調查報告書

商品編碼

1851942

非洲農藥:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Africa Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

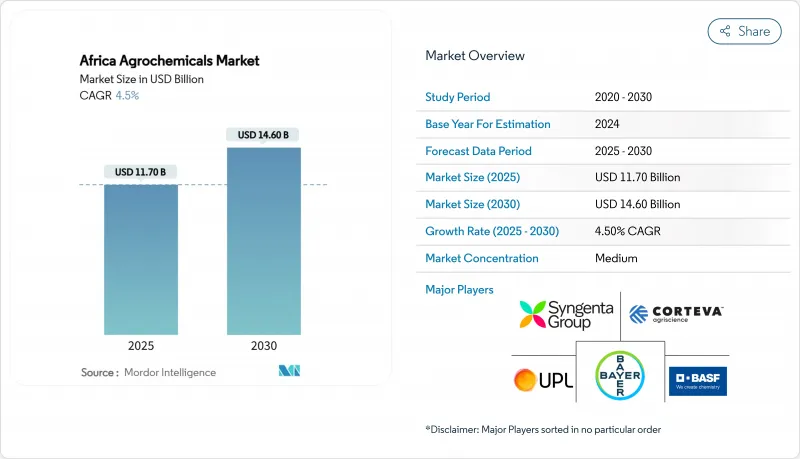

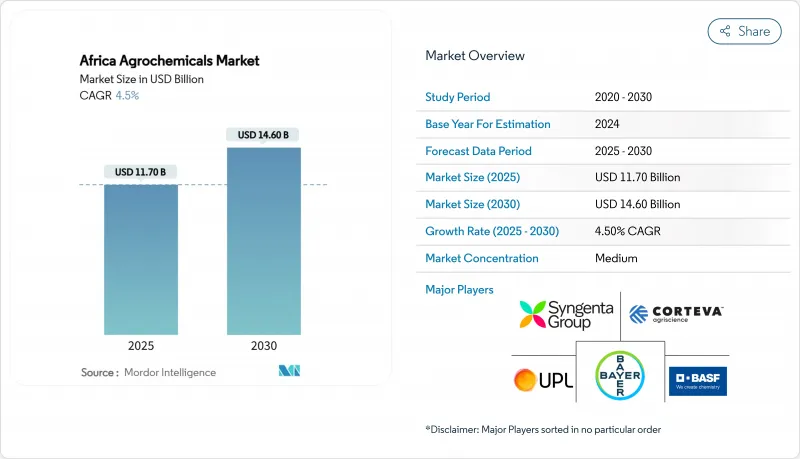

預計到 2025 年,非洲農藥市場規模將達到 117 億美元,到 2030 年將達到 146 億美元,年複合成長率為 4.5%。

預計到2024年,化肥將佔據市場主導地位,市場佔有率高達51%,這主要受非洲普遍存在的土壤養分流失問題的推動。隨著農民採用精準施肥方法,植物生長調節劑預計將以6.90%的複合年成長率達到最高成長。市場成長的促進因素包括病蟲害日益增加、人口成長導致糧食需求增加以及政府補貼改善了小農戶的取得途徑。高昂的投入成本和各地區監管的不一致限制了解決農業產量差異的努力。市場參與企業正在建立本地生產設施、開發創新分銷網路,並建立以精準化學解決方案為永續產品線。此外,各國政府正在擴大倉儲取貨融資和機械化支持計劃,這些措施也有助於推動農業化學品市場的需求。

非洲農藥市場趨勢與洞察

氣候相關病蟲害增加

不穩定的氣候模式導致秋尺蛾等入侵蟲在多個非洲國家廣泛蔓延,嚴重影響玉米產量。穀物種植區的獨腳金雜草持續侵染,影響作物產量,促使農民實施綜合化學防治方案。肯亞、加納和衣索比亞已建立緊急應變通訊協定,區域組織正在協調害蟲監測網。農業相關企業正加速研發針對害蟲幼蟲的精準殺蟲劑,數位監測平台則為農民提供即時預警。這些因素推動了非洲農藥市場的持續成長,而對種子處理和農民教育計畫的投資進一步增強了這一成長勢頭。官民合作關係正在改善農民獲得新型作物保護方案的途徑。

人口成長加速導致的糧食需求缺口

由於小農戶農藥使用量低於建議水平,農業生產力仍受到限制。在奈及利亞、衣索比亞和坦尚尼亞,人口向都市區遷移造成了嚴重的限制,導致農業勞動力減少。政府措施包括透過國內化肥生產和投資灌溉基礎設施來提高產量。埃塞俄比亞的灌溉擴建計劃專注於提高低地地區的生產力並減少對進口的依賴。不斷成長的糧食需求持續推動非洲化肥、農藥和植物生長調節劑市場的發展。不斷擴大的農業經銷商網路和行動諮詢服務正在幫助農民更好地獲取投入品和知識。為了適應不斷變化的氣候條件,農民擴大採用氣候適應型農藥解決方案。

高昂的農藥價格令小農戶難以負擔。

在內陸國家,運輸成本佔最終零售價格的50%之多,而衣索比亞的化肥價格近年來大幅上漲。肯亞提案通過2025年財政法案對農藥徵收16%的增值稅,可能會顯著增加生產成本。奈及利亞在2024年中期經歷了創紀錄的食品通膨,迫使家庭將收入的很大一部分用於食品支出,從而減少了可用於農業投資的資金。農民往往轉向收取高利息的非正規貸款機構,形成債務循環,限制了非洲農藥市場的成長。因此,價格承受能力的挑戰降低了有效農作物保護產品的使用率,導致產量不足和糧食安全問題持續存在。

細分市場分析

至2024年,化學肥料將佔非洲農業化學品市場佔有率的51%,有效解決普遍存在的土壤養分缺乏問題,並支持不同農業生態學區域的農業生產力。雖然氮肥仍然是作物生產的關鍵,但磷肥和鉀肥正透過均衡營養計畫得到越來越廣泛的應用。數位補貼電子代金券和倉庫自提信貸系統降低了經濟門檻,確保了及時施肥。

植物生長調節劑的複合年成長率將達到6.9%,這主要得益於人們擴大採用能夠提高植物抗逆性、促進根系發育和提升產量潛力的營養物質。農藥在非洲仍將佔據重要地位,其中除草劑由於勞動力短缺和雜草抗藥性問題而成為主要需求。受氣候相關病蟲害爆發的影響,殺蟲劑的需求將會增加,而殺菌劑在園藝領域的應用也將擴大。助劑雖然市佔率較小,但其重要性日益凸顯,因為精準噴霧設備需要更先進的配方才能實現更好的葉面覆蓋和更簡單的罐混。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 氣候變遷導致害蟲壓力增加

- 人口成長加劇了糧食需求缺口

- 政府對引種進化肥料和農藥的補貼計劃

- 機械化和精密農業技術的引入將提高投入效率

- 擴大倉儲融資規模可釋放營運資金投入

- 自有品牌農產品零售連鎖店的出現有助於改善最後一公里配送

- 市場限制

- 高昂的投入成本令小農戶難以承受。

- 嚴格而詳細的監管核准時間表

- 假農藥的氾濫損害了農民的信任。

- 透過有機和無殘留出口作物計劃減少合成農藥的使用

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 肥料

- 氮

- 磷肥

- 鉀

- 殺蟲劑

- 除草劑

- 殺蟲劑

- 消毒劑

- 佐劑

- 植物生長調節劑

- 肥料

- 透過使用

- 穀物和穀類

- 豆類和油籽

- 水果和蔬菜

- 經濟作物(甘蔗、棉花等)

- 按地區

- 埃及

- 摩洛哥

- 阿爾及利亞

- 肯亞

- 坦尚尼亞

- 衣索比亞

- 南非

- 尚比亞

- 辛巴威

- 奈及利亞

- 迦納

- 剛果民主共和國

- 其他非洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- BASF SE

- FMC Corporation

- UPL Limited

- Yara International ASA

- Sumitomo Chemical Co., Ltd.

- Gowan Company(Isagro Srl)

- Rovensa SA(Partners Group)

- Sasol Limited

- Twiga Chemical Industries Ltd.(AJ Group)

- OCP Group

- Indorama Corporation

- Albaugh LLC

第7章 市場機會與未來展望

The Africa agrochemicals market size reached USD 11.7 billion in 2025 and is projected to grow at a CAGR of 4.5% to USD 14.6 billion by 2030.

Fertilizers dominated the market with a 51% share in 2024, driven by widespread soil nutrient depletion across Africa. Plant growth regulators exhibited the highest growth rate at 6.90% CAGR, as farmers adopt precision application methods. The market growth is supported by increasing pest challenges, growing food demand from population expansion, and government subsidy programs that improve access for smallholder farmers. High input costs and inconsistent regulations across regions limit efforts to close the agricultural yield gap. Market participants are establishing local manufacturing facilities, developing innovative distribution networks, and creating sustainable product lines with precision chemical solutions. Additionally, governments are expanding warehouse-receipt financing systems and mechanization support programs, which drive increased demand in the agrochemicals market.

Africa Agrochemicals Market Trends and Insights

Climate-driven Rise in Pest and Disease Pressure

Variable weather patterns have increased the spread of invasive pests like fall armyworm across multiple African nations, significantly impacting maize yields. Striga weed infestations in cereal-growing regions continue to affect harvests, leading farmers to implement integrated chemical control programs. Kenya, Ghana, and Ethiopia have established emergency response protocols, while regional organizations coordinate pest surveillance networks. Agricultural companies have accelerated the development of precision insecticides targeting pest larvae, and digital monitoring platforms provide real-time alerts to farmers. These factors drive sustained growth in the Africa agrochemicals market. The market gains additional momentum through investments in seed treatment chemicals and farmer education programs. Public-private partnerships are improving farmer access to new crop protection solutions.

Population Growth Accelerating Food-demand Gap

Agricultural productivity remains limited as smallholder farmers use agrochemicals below recommended levels. Nigeria, Ethiopia, and Tanzania experience significant constraints due to urban migration, reducing the agricultural workforce. Government initiatives include investments in domestic fertilizer production and irrigation infrastructure to improve yields. Ethiopia's irrigation expansion program focuses on increasing lowland productivity and decreasing import dependence. Growing food demand continues to drive the African agrochemicals market for fertilizers, pesticides, and plant growth regulator products. The expansion of agricultural dealer networks and mobile advisory services helps improve farmers' access to inputs and knowledge. Farmers increasingly adopt climate-resilient agrochemical solutions to address changing weather conditions.

High Agrochemical Prices Unaffordable to Smallholders

Transport costs in landlocked countries account for up to 50% of final retail prices, while Ethiopia experienced significant increases in fertilizer prices in recent years. Kenya's proposed 16% VAT on agrochemicals through the 2025 Finance Bill may substantially increase production costs. Nigeria's record-high food inflation in mid-2024 forced households to spend most of their income on food, reducing funds available for farm investments. Farmers often turn to informal lenders charging high weekly interest rates, creating debt cycles that limit growth in the Africa agrochemicals market. The resulting affordability issues reduce the adoption of effective crop protection products, leading to suboptimal yields and continued food security challenges.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidy Programs for Fertilizer and Pesticide Adoption

- Expansion of Warehouse-receipt Financing Unlocking Working-capital for Inputs

- Fragmented and Stringent Regulatory Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers held 51% of the Africa agrochemicals market share in 2024, addressing widespread soil nutrient deficiencies and supporting agricultural productivity across various agroecological zones. Nitrogen-based formulations remain essential for cereal production, while phosphatic and potassic fertilizers gain adoption through balanced nutrition programs. Digital subsidy e-vouchers and warehouse-receipt credit systems reduce financial barriers and enable timely fertilizer application.

Plant growth regulators demonstrate a 6.9% CAGR, driven by increased adoption of nutrients that improve stress tolerance, root development, and yield potential. Pesticides maintain significant volume across Africa, with herbicides dominating due to labor shortages and resistant weed populations. Insecticide demand increases in response to climate-related pest outbreaks, while fungicide use expands in horticultural regions. Adjuvants, though a smaller segment, grow in importance as precision spraying equipment requires advanced formulations for improved leaf coverage and simplified tank mixing.

The African Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators), by Application (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, and Commercial Crops), and by Geography (Egypt, Morocco, Tanzania, South Africa, and More). The Report Offers the Market Size and Forecasts in Terms of Value (USD).

List of Companies Covered in this Report:

- Bayer AG

- Syngenta Group

- Corteva Agriscience

- BASF SE

- FMC Corporation

- UPL Limited

- Yara International ASA

- Sumitomo Chemical Co., Ltd.

- Gowan Company (Isagro S.r.l.)

- Rovensa S.A (Partners Group)

- Sasol Limited

- Twiga Chemical Industries Ltd. (AJ Group)

- OCP Group

- Indorama Corporation

- Albaugh LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Climate-driven Rise in Pest and Disease Pressure

- 4.2.2 Population Growth Accelerating Food-demand Gap

- 4.2.3 Government Subsidy Programs for Fertilizer and Pesticide Adoption

- 4.2.4 Mechanizsation and Precision-ag Adoption Boosting Input Efficiency

- 4.2.5 Expansion of Warehouse-receipt Financing Unlocking Working-capital for Inputs

- 4.2.6 Emergence of Private-label Agro-retail Chains Improving Last-mile Distribution

- 4.3 Market Restraints

- 4.3.1 High Input Prices Unaffordable to Smallholders

- 4.3.2 Fragmented and Stringent Regulatory Approval Timelines

- 4.3.3 Proliferation of Counterfeit Agrochemicals Eroding Farmer Trust

- 4.3.4 Organic and Residue-free Export Crop Programs Curbing Synthetic Usage

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.1.1 Nitrogenous

- 5.1.1.2 Phosphatic

- 5.1.1.3 Potassic

- 5.1.2 Pesticides

- 5.1.2.1 Herbicides

- 5.1.2.2 Insecticides

- 5.1.2.3 Fungicides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.1.1 Fertilizers

- 5.2 By Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Commercial Crops (Sugarcane, Cotton, and Others)

- 5.3 By Geography

- 5.3.1 Egypt

- 5.3.2 Morocco

- 5.3.3 Algeria

- 5.3.4 Kenya

- 5.3.5 Tanzania

- 5.3.6 Ethiopia

- 5.3.7 South Africa

- 5.3.8 Zambia

- 5.3.9 Zimbabwe

- 5.3.10 Nigeria

- 5.3.11 Ghana

- 5.3.12 DR Congo

- 5.3.13 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Syngenta Group

- 6.4.3 Corteva Agriscience

- 6.4.4 BASF SE

- 6.4.5 FMC Corporation

- 6.4.6 UPL Limited

- 6.4.7 Yara International ASA

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 Gowan Company (Isagro S.r.l.)

- 6.4.10 Rovensa S.A (Partners Group)

- 6.4.11 Sasol Limited

- 6.4.12 Twiga Chemical Industries Ltd. (AJ Group)

- 6.4.13 OCP Group

- 6.4.14 Indorama Corporation

- 6.4.15 Albaugh LLC