|

市場調查報告書

商品編碼

1850209

作物保護:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

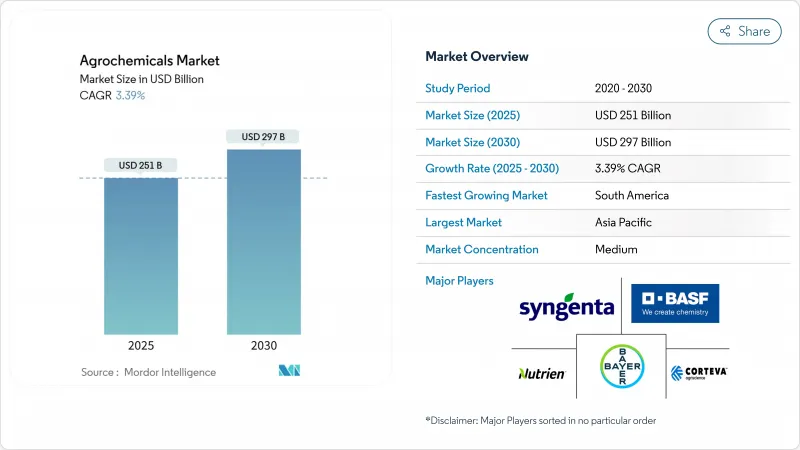

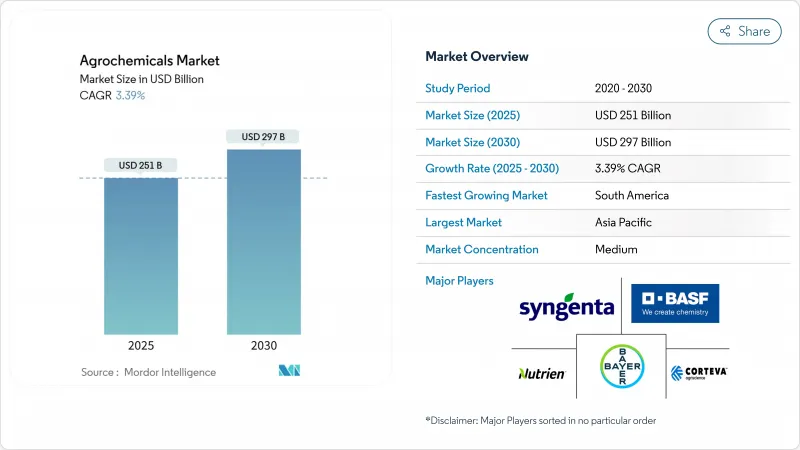

預計到 2025 年,農業化學品市場規模將達到 2,510 億美元,到 2030 年將成長至 2,970 億美元,複合年成長率高達 3.39%。

成長的驅動力來自糧食大國持續的化肥需求、生物農作物保護產品的快速普及以及提高投入利用效率的精密農業工具的廣泛應用。同時,歐盟的「從農場到餐桌」指令要求到2030年將化學農藥的使用量減半,中國定期限制化肥出口,以及主要進口市場日益嚴格的殘留物監管,都迫使種植者加快產品組合的轉型,轉向毒性更低的化學品和數位化諮詢服務。生物製藥正迅速擴大規模,這得益於目前30個國家實施的農藥稅收制度以及巴西和印度簡化的註冊流程;而具有全新作用機制的高階除草劑則有助於應對高成本抗性雜草的出現。隨著學名藥蠶食成熟藥物的利潤空間,以及新的「投入即服務」模式鼓勵基於效果而非數量的定價,競爭日益激烈,這預示著未來十年農化市場將以技術整合和永續性為特徵。

全球作物保護市場趨勢與洞察

抗除草劑雜草的增加刺激了對優質除草劑的需求

目前,全球超過2.7億英畝的土地受到抗除草劑雜草的侵襲,促使種植者尋求具有全新作用機制的優質除草劑。 FMC公司的Dodirex Active是30年來首個採用全新作用機制的除草劑,首次在秘魯註冊,專門用於防治水稻田中的抗性禾本科雜草,預計將於2025年8月上市。美國環保署(EPA)的2024年抗性管理架構強化了雜草綜合管理通訊協定,並為創新配方提供了監管支援。住友化學公司在阿根廷註冊的Rapidisil,協助犁地系統的發展,並爭取實現每年1000億日圓(約6.5億美元)的保護性犁地除草劑銷售額。由於抗性雜草每年在全球整體造成超過150億美元的產量損失,種植者仍願意為此支付高價。

整合人工智慧驅動的輸入即服務經營模式

數位農業平台正在取代傳統的僅銷售產品的分銷模式,將農藝諮詢、變數配方和基於效果的保證捆綁在一起。拜耳的 CROPWISE 平台目前整合了田間感測器、氣象資料和衛星影像,以最佳化噴灑和施肥計畫。BASF和 Agmatix 正在應用機器學習診斷技術,在大豆胞囊線蟲出現明顯症狀之前檢測出其脅迫,從而保護產量並減少化學物質用量。先正達和 Taranis 的合作計畫為零售商提供人工智慧驅動的田間巡查服務,指導他們進行精準的投入,並將一次性銷售轉化為持續收入。這些服務可以將每英畝化學品用量減少高達 20%,使農化市場在盈利和永續性目標之間取得平衡。

加速歐盟、巴西和中國淘汰劇毒農藥的步伐

監管機構正在縮短被認定為有毒活性成分的寬限期,迫使製造商減記庫存並加快產品改進進程。歐盟最新提案將禁止在敏感棲息地使用某些有機磷酸鹽,而巴西將核准標準與歐盟接軌,並計劃在2026年前淘汰約200種遺留分子。BASF於2024年關閉了其草銨膦工廠,並累計了與監管收緊預期相關的減損損失。中國的政策優先發展低毒殺菌劑和生物農藥,預計2025年,商業化產量將達到9萬噸。

細分市場分析

到2024年,化肥將佔作物保護市場收入的46.0%,這反映了其在為穀物和油籽提供大量營養元素方面發揮的關鍵作用。然而,天然氣價格的波動推高了氨的成本,擠壓了氮肥生產商的利潤空間,這預示著市場將轉向高效技術,例如尿素酶抑製劑和控制釋放被覆劑可在不影響產量的情況下將施用量降低15-25%。由於新興經濟體的施用量趨於穩定,化肥作物保護市場規模的複合年成長率將低於整體市場,僅2.3%。因此,種植者優先考慮那些除了產量之外還能帶來額外價值的產品,例如優質聚合物包衣產品和與碳權額度掛鉤的產品。

生物製劑領域(包括微生物製劑、植物製劑、費洛蒙製劑和生化產品)預計在2024年將成長14.7%,到2030年達到250億美元。在該領域中,生物殺蟲劑市場預計將以15.2%的複合年成長率成長,這主要得益於歐洲更嚴格的殘留物法規和巴西的快速核准程序。因此,綜合蟲害管理方案擴大採用化學和生物防治方法輪換,這使得供應商能夠交叉銷售其專有菌株和添加劑。先正達生物製品公司和富美實公司等領導企業正積極聚焦這一領域,並加速併購以填補其產品組合的空白。除草劑、殺菌劑、添加劑和植物生長調節劑仍然很重要,但隨著生物製藥蠶食部分銷售量並佔據更高的利潤率,它們在農藥市場中的總佔有率預計將略有下降。

區域分析

亞太地區將在2024年維持最高的收入,佔農業化學品市場的48.5%。中國生產全球50%的活性成分,但國內環境法規目前優先考慮低毒性產品線,刺激了對生物農藥產能的投資。印度的合約開發和受託製造公司已獲得多年期合約,填補了西方產品線的空白,推動了兩位數的銷售成長。日本將加快採用控制釋放肥料以實現排放目標,而澳洲將平衡肥料需求與應對氣候變遷導致的乾旱。數位土壤檢測和政府補貼計畫將促進均衡營養,從而強化基本的消費模式。

南美洲是成長最快的地區,預計到2030年將以4.4%的複合年成長率成長。巴西的生物技術市場預計到2024年將達到50億雷亞爾(10億美元),主要集中在大豆和棉花領域。物流瓶頸依然存在,巴西62%的農用道路品質欠佳,推高了成本,促使製劑廠更加區域化。阿根廷的犁地面積超過90%,支撐了對Rapidicil等殘留型除草劑的需求。氣候變化,特別是乾旱,正在推動微量元素和節水產品的銷售,為農業化學品市場的適應性技術創造了穩健的商業前景。

儘管北美和歐洲農業發展日趨成熟,但它們仍然是創新中心。美國正在反對對加拿大鉀肥提案關稅,該關稅可能使農場成本每噸增加100美元,促使人們對生物氮替代和鉀溶解微生物產生了興趣。加拿大正在推廣4R營養管理認證,將貸款機構的獎勵與最佳肥料使用實踐掛鉤。歐洲的「從農場到餐桌」策略要求到2030年將農藥使用量減少50%,並推動加速生物認證和數位化可追溯性系統的建置。中東和非洲在較小的基數上分別成長了3.4%和4.1%,這主要得益於主權糧食安全投資、水耕技術的普及以及再生沙漠農業實踐。總而言之,這些動態表明,農業化學品市場正保持著適度的銷售成長軌跡,並輔以高價值產品的替代品。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 抗除草劑雜草的增加推動了對優質除草劑的需求

- 整合人工智慧驅動的輸入即服務經營模式

- 由於農藥稅收制度,生技藥品迅速成長。

- 氮高效利用產品的碳權貨幣化

- 緩釋肥料正逐漸成為主流

- 垂直和室內農場的作物多樣化

- 市場限制

- 加速歐盟、巴西和中國淘汰高毒性活性物質的進程

- Glyphosate價格波動擠壓生產商利潤

- 監管資料包成本不斷上漲

- 北美地區長期有激進訴訟風險

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 肥料

- 氮

- 磷酸

- 鉀

- 殺蟲劑

- 除草劑

- 殺蟲劑

- 消毒劑

- 生物農藥

- 佐劑

- 植物生長調節劑

- 肥料

- 透過使用

- 農作物

- 糧食

- 豆類和油籽

- 水果和蔬菜

- 非農作物類

- 草坪和觀賞草

- 其他非農作物類

- 農作物

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Syngenta Group

- Bayer Crop Science AG

- BASF Agricultural Solutions

- Corteva Agriscience

- Nutrien Ltd

- Yara International ASA

- Mosaic Company

- CF Industries Holdings

- UPL Ltd

- FMC Corporation

- Sumitomo Chemical AgroSolutions

- Nufarm Ltd

- K+S AG

- ICL Group

- OCP Group

- Albaugh LLC

- OCI Global

- RovensaNext

- Bharat Rasayan Ltd

- Helm AG

第7章 市場機會與未來展望

The agrochemicals market reached USD 251 billion in 2025 and is forecast to rise to USD 297 billion by 2030, translating into a steady 3.39% CAGR.

Growth is supported by sustained fertilizer demand in large grain economies, rapid penetration of biological crop-protection products, and wider deployment of precision-agriculture tools that lift input-use efficiency. At the same time, the European Union's Farm to Fork mandate to halve chemical pesticide use by 2030, China's periodic fertilizer export curbs, and increasingly stringent residue limits in major import markets are forcing producers to accelerate portfolio shifts toward low-toxicity chemistries and digital advisory services. Biologicals are scaling quickly on the back of pesticide-tax regimes now active in 30 countries and streamlined Brazilian and Indian registration pathways, while premium herbicides with novel modes of action address the costly rise of resistant weeds. Competitive intensity is growing as generics erode margins on mature molecules and new "input-as-a-service" models reward outcome-based pricing over product volume, setting the stage for a decade defined by technology integration and sustainability credentials within the agrochemicals market.

Global Agrochemicals Market Trends and Insights

Escalating Herbicide-Resistant Weeds Spur Premium Herbicide Demand

Herbicide-resistant weeds now infest more than 270 million acres worldwide, pushing growers toward premium actives that deliver novel modes of action. FMC's Dodhylex active, the first new herbicide mode in three decades, secured its inaugural registration in Peru and targets resistant grass weeds in rice, with a commercial launch slated for August 2025. The United States Environmental Protection Agency's 2024 resistance-management framework reinforces integrated weed-management protocols, giving regulatory support to innovative formulations. Sumitomo Chemical's Rapidicil registration in Argentina underpins the competitive race to serve no-till systems, aiming for JPY 100 billion (USD 0.65 billion) in annual sales from conservation-tillage herbicides. Growers' willingness to pay remains strong because resistant weeds impose yearly global yield losses above USD 15 billion.

Convergence of AI-Enabled Input-as-a-Service Business Models

Digital farming platforms are displacing traditional product-only distribution by bundling agronomic advice, variable-rate prescriptions, and outcome-based guarantees. Bayer's CROPWISE platform now integrates field sensors, weather data, and satellite imagery to fine-tune spraying and fertilizing schedules. BASF and Agmatix apply machine-learning diagnostics to detect soybean cyst nematode stress before visual symptoms appear, protecting yields while cutting chemical load. Syngenta's tie-up with Taranis equips retailers with AI-powered scouting to drive precise input placement, converting one-time sales into subscription revenue. These services reduce chemical intensity per acre by up to 20%, aligning profitability with sustainability imperatives in the agrochemicals market.

Accelerating Phase-Outs of High-Toxicity Actives in EU, Brazil, and China

Regulators are shortening grace periods for active ingredients flagged for toxicity, forcing manufacturers to write off inventory and accelerate reformulation pipelines. The European Union's latest proposal eliminates certain organophosphates from sensitive habitats, while Brazil aligns approval criteria with the EU, removing nearly 200 legacy molecules by 2026. BASF shuttered its glufosinate plant in 2024, booking impairment charges linked to the tighter regulatory outlook. Chinese policies prioritize low-toxicity fungicides and biopesticides, expecting commercial volumes of 90,000 metric tons by 2025.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Biologicals Pushed by Pesticide-Tax Regimes

- Carbon-Credit Monetization of Nitrogen-Efficiency Products

- Volatile Glyphosate Pricing Squeezes Formulator Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers accounted for 46.0% of 2024 revenue inside the agrochemicals market, reflecting their indispensable role in macronutrient delivery to grains and oilseeds. Yet volatile natural gas prices inflated ammonia costs, squeezing margins for nitrogen producers and signaling a pivot toward efficiency technologies such as urease inhibitors and controlled-release coatings that reduce application rates by 15-25% without yield loss. The agrochemicals market size for fertilizers is forecast to expand at just 2.3% CAGR, slower than the overall market because of plateauing application rates in developed economies. Producers, therefore, emphasize premium polymer-coated lines and carbon-credit-linked offerings that capture value beyond volume.

The biological segment, encompassing microbials, botanicals, pheromones, and biochemicals, grew 14.7% in 2024 and is projected to reach USD 25 billion by 2030. Within that total, the agrochemicals market size for bio-insecticides is on track to advance at 15.2% CAGR, buoyed by European residue-limit tightening and Brazilian fast-track registrations. As a result, integrated pest-management programs now mix chemical and biological tools in single-season rotations, enabling suppliers to cross-sell proprietary strains and adjuvants. Major players such as Syngenta Biologicals and FMC pivot aggressively toward this space, accelerating mergers and acquisitions to fill portfolio gaps. Herbicides, fungicides, adjuvants, and plant growth regulators remain critical; and their combined share of the agrochemicals market is projected to decline slightly as biologicals cannibalize volume while fetching higher margins.

The Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, Adjuvants, and Plant Growth Regulators), by Application (Crop-Based and Non-Crop-Based), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained the highest regional revenue in 2024, accounting for 48.5% within the agrochemicals market, supported by intensive cultivation across China and India. China manufactures 50% of the worldwide active-ingredient output, yet domestic environmental rules now favor low-toxicity lines, stimulating investment in biopesticide capacity. India's contract development and manufacturing organizations secure multiyear deals that fill Western pipeline gaps, driving double-digit revenue growth. Japan accelerates the adoption of controlled-release fertilizers to meet emission targets, the Australia balances fertilizer demand with climate-induced drought adjustments. Government subsidy programs promoting digital soil testing and balanced nutrition enhance baseline consumption patterns.

South America is the fastest-growing territory, expanding by 4.4% CAGR through 2030. Brazil's biological market hit BRL 5 billion (USD 1 billion) in 2024, with uptake concentrated in soybean and cotton. Logistics bottlenecks persist; 62% of Brazilian agricultural roads are below optimal quality, raising costs and encouraging localized formulation plants. Argentina's no-till acreage exceeds 90%, underpinning demand for residue-compatible herbicides such as Rapidicil. Climate volatility, especially drought, boosts micronutrient and water-efficiency product sales, shaping a resilient business case for adaptive technologies within the agrochemicals market.

North America and Europe, though mature, remain innovation hubs. The United States contends with tariff proposals on Canadian potash that could raise farmer costs by USD 100 per ton, prompting interest in biological nitrogen replacement and potassium-solubilizing microbes. Canada promotes 4R nutrient-stewardship certification, linking lender incentives to fertilizer best practices. Europe's Farm to Fork strategy mandates 50% pesticide cuts by 2030, triggering accelerated biological approvals and digital traceability systems. The Middle East and Africa grew 3.4% and 4.1%, respectively, propelled by sovereign food-security investments, hydroponic adoption, and reclaimed desert farming, albeit from smaller bases. Collectively, these dynamics keep the agrochemicals market on a path of gradual volume growth complemented by higher-value product substitution.

- Syngenta Group

- Bayer Crop Science AG

- BASF Agricultural Solutions

- Corteva Agriscience

- Nutrien Ltd

- Yara International ASA

- Mosaic Company

- CF Industries Holdings

- UPL Ltd

- FMC Corporation

- Sumitomo Chemical AgroSolutions

- Nufarm Ltd

- K+S AG

- ICL Group

- OCP Group

- Albaugh LLC

- OCI Global

- RovensaNext

- Bharat Rasayan Ltd

- Helm AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating herbicide-resistant weeds spur premium herbicide demand

- 4.2.2 Convergence of AI-enabled Input-as-a-service business models

- 4.2.3 Surge in biologicals pushed by pesticide-tax regimes

- 4.2.4 Carbon-credit monetization of nitrogen-efficiency products

- 4.2.5 Mainstream expansion of controlled-release fertilizers

- 4.2.6 Crop diversification in vertical and indoor farms

- 4.3 Market Restraints

- 4.3.1 Accelerating phase-outs of high-toxicity actives in EU, Brazil and China

- 4.3.2 Volatile glyphosate pricing squeezes formulator margins

- 4.3.3 Rising Regulatory data-package costs

- 4.3.4 Chronic activist litigation risk in North America

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Fertilizers

- 5.1.1.1 Nitrogenous

- 5.1.1.2 Phosphatic

- 5.1.1.3 Potassic

- 5.1.2 Pesticides

- 5.1.2.1 Herbicides

- 5.1.2.2 Insecticides

- 5.1.2.3 Fungicides

- 5.1.2.4 Bio-pesticides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.1.1 Fertilizers

- 5.2 By Application

- 5.2.1 Crop-based

- 5.2.1.1 Grains and Cereals

- 5.2.1.2 Pulses and Oilseeds

- 5.2.1.3 Fruits and Vegetables

- 5.2.2 Non-crop-based

- 5.2.2.1 Turf and Ornamental Grass

- 5.2.2.2 Other Non-crop-based

- 5.2.1 Crop-based

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle East

- 5.3.6 Africa

- 5.3.6.1 South Africa

- 5.3.6.2 Egypt

- 5.3.6.3 Rest of Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Syngenta Group

- 6.4.2 Bayer Crop Science AG

- 6.4.3 BASF Agricultural Solutions

- 6.4.4 Corteva Agriscience

- 6.4.5 Nutrien Ltd

- 6.4.6 Yara International ASA

- 6.4.7 Mosaic Company

- 6.4.8 CF Industries Holdings

- 6.4.9 UPL Ltd

- 6.4.10 FMC Corporation

- 6.4.11 Sumitomo Chemical AgroSolutions

- 6.4.12 Nufarm Ltd

- 6.4.13 K+S AG

- 6.4.14 ICL Group

- 6.4.15 OCP Group

- 6.4.16 Albaugh LLC

- 6.4.17 OCI Global

- 6.4.18 RovensaNext

- 6.4.19 Bharat Rasayan Ltd

- 6.4.20 Helm AG