|

市場調查報告書

商品編碼

1850115

南美作物保護:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)South America Agrochemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

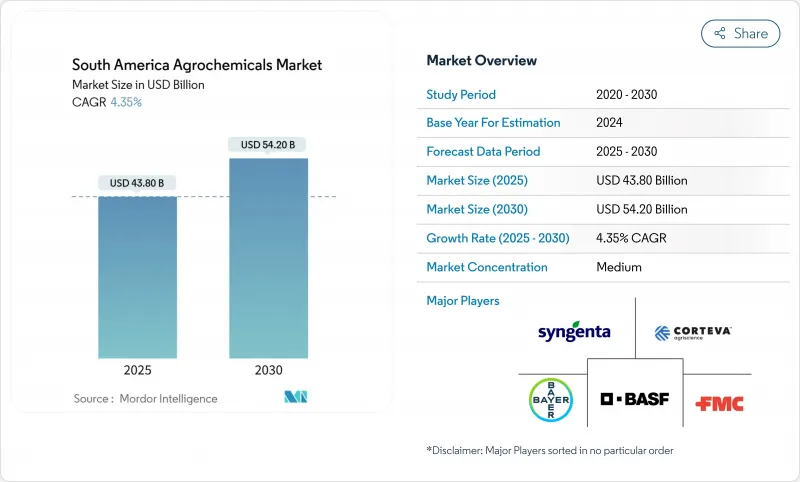

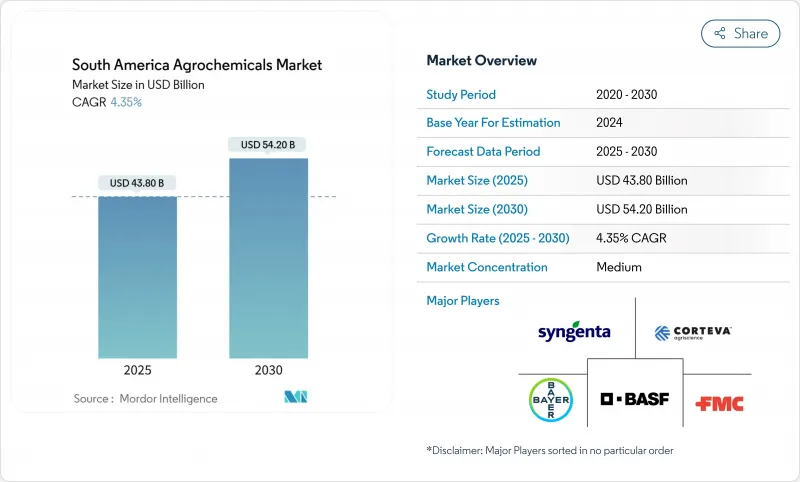

預計到 2025 年,南美洲作物保護市場價值將達到 438 億美元,到 2030 年將達到 542 億美元,在市場估算和預測期內的複合年成長率為 4.35%。

該地區的擴張主要得益於其在大豆、玉米和特色園藝領域的領先地位,以及生物技術作物、精準施藥工具的日益普及和向生物解決方案的快速轉型。巴西保持著國內市場的領先地位,而南美其他地區則正經歷著最快的成長,這得益於其向高價值作物和現代投入體系的多元化發展。化學肥料佔據主導地位,反映了土壤養分匱乏的現狀,而助劑則因精準施藥和生物化學整合而迅速成長。市場競爭異常激烈,前四大供應商佔據了大部分市場佔有率,但大量生物技術新興企業和數位平台的湧現正在重塑市場格局。儘管長期種植面積的擴大和對碳排放相關投入品的需求推動了南美農化市場的發展機遇,但外匯波動、更嚴格的農藥殘留法規和物流缺口仍然抑制著短期內的成長勢頭。

南美洲作物保育市場趨勢與洞察

基因改造作物增加了對農藥的需求

阿根廷在2024年核准了五種生物技術作物,將核准簡化為六個月週期,鞏固了其作為全球第三大生物技術作物種植國的地位,種植面積達2500萬公頃。巴西的Intacta2 Xtend性狀已覆蓋該國30%的大豆種植面積,刺激了對Glyphosate、麥草畏和草銨膦組合除草劑的需求。阿根廷HB4耐旱小麥的商業化正在推動針對新型除草劑耐受性組合的配套作物保護配方的發展。生物技術在全部區域的發展迫使農業化學品供應商設計輪作方案,以最大限度地提高產量並降低抗藥性。因此,產品組合增強了投入品的特許權使用費,提高了每公頃的終身價值,並鞏固了南美洲農業化學品市場的高階地位。

用於最佳化藥物利用的精準農業平台

巴西擁有875家提供農業解決方案的深度科技公司,涵蓋人工智慧機器人、微生物學和遙感探測領域。 Solinftec公司的太陽能機器人SOLIX能夠自主巡田,識別雜草並建議精準噴灑,在保持產量的同時減少除草劑的使用。先正達的CROPWISE人工智慧平台已繪製了7000萬公頃的地圖,並將養分、病蟲害和天氣資料集中起來,用於指導性田間規劃。高光譜遙測感測器現在可以即時預測氮鉀含量,從而實現變數施肥和穩定劑的施用,減少徑流。儘管實施成本仍然很高,但勞動力短缺和投入品價格上漲正促使農民尋求技術驅動的效率提升方案。這些工具加強了作物健康狀況與投入需求之間的回饋循環,從而維持了農業化學品市場對優質添加劑、微量元素和生物促效劑的需求。

重新登記及加強殘留物法規

智利第47/2024號法令將於2025年5月生效,該法令加強了殘留限量,提高了配方商和出口商的合規成本。巴西修訂後的農藥法加快了核准速度,同時加強了環境監管,給小型註冊商帶來了挑戰。秘魯繼續批准在歐洲被禁用的農藥,破壞了安第斯貿易路線沿線的監管一致性。巴西大豆病害菌株中殺菌劑抗性的蔓延也迫使當局重新評估作用機制輪換要求。這些措施加在一起,增加了數據生產成本,延長了市場准入時間,並可能延遲新進入者的活動,對處於轉型期的南美農藥市場造成了壓力。

細分市場分析

2024年,化肥佔據了南美農業化學品市場42%的佔有率,這主要得益於熱帶土壤養分貧瘠以及提高油籽產量的戰略舉措,尤其是在巴西,種植者每公頃在化肥上的投入高達335美元。作物保護產品仍是第二大類別,其主要促進因素是濕潤氣候下持續存在的雜草和病蟲害問題,以及基因改造作物對除草劑產生抗藥性。

助劑市場發展迅猛,預計到2030年複合年成長率將達到6.0%,這得益於可最佳化液滴大小並減少漂移的數位化噴霧圖。如今,產品創新主要圍繞著整合包裝。 ICL在收購Nitro1000和Orion雙線FA1500施用器後推出固氮接種劑,顯示化學和生物製劑可以同時使用,呈現融合趨勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 市場促進因素

- 基因改造作物增加了對農藥的需求

- 擴大大豆和玉米的種植面積

- 為農業投入品提供農村信貸補貼

- 與碳權掛鉤的高效肥料的興起

- 生物作物保護混合物的使用

- 精密農業平台,最佳化化學品施用

- 市場限制

- 重新登記並加強殘留標準

- 商品價格波動會抑制支出

- 進口流量中的內陸物流瓶頸

- 除草劑抗藥性增加,轉換成本上升

- 技術展望

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 依產品類型

- 肥料

- 氮

- 磷酸

- 鉀

- 特殊肥料

- 殺蟲劑

- 除草劑

- 殺蟲劑

- 消毒劑

- 生物農藥

- 佐劑

- 植物生長調節劑

- 肥料

- 透過使用

- 農作物

- 糧食

- 豆類和油籽

- 水果和蔬菜

- 非農作物類

- 草坪和觀賞草

- 其他非農作物類

- 農作物

- 按地區

- 巴西

- 阿根廷

- 其他南美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Syngenta

- Bayer Crop Science

- BASF SE

- Corteva Agriscience

- Nutrien Ltd

- FMC Corporation

- Yara International ASA

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- ICL Group Ltd.

第7章 市場機會與未來展望

The South America Agrochemicals Market size is estimated at USD 43.80 billion in 2025, and is anticipated to reach USD 54.20 billion by 2030, at a CAGR of 4.35% during the forecast period.

Expansion rests on the region's leadership in soybean, corn, and specialty horticulture, reinforced by rising genetically modified crop adoption, precision-application tools, and a rapid shift toward biological solutions. Brazil retains the largest national position and the rest of South America is delivering the fastest growth as they diversify into high-value crops and modern input systems. Fertilizers dominate, reflecting nutrient-depleted soils, while adjuvants post the quickest gains on the back of precision spraying and biological-chemical integration. Competitive intensity is high because the top four suppliers hold the majority share, though a wave of biological start-ups and digital platforms is recalibrating power balances across the South America agrochemicals market. Currency swings, tighter residue rules, and logistics gaps still temper near-term momentum even as long-run acreage expansion and carbon-linked input demand lift the opportunity curve of the South America agrochemicals market.

South America Agrochemicals Market Trends and Insights

GM-crop driven pesticide demand surge

Argentina cleared five new genetically engineered crops in 2024, streamlining approvals to six-month cycles and reinforcing its status as the world's third-largest GM grower with 25 million hectares . Brazil's Intacta2 Xtend trait already spans 30% of national soybean acreage and stimulates demand for herbicide stacks that combine glyphosate, dicamba, and glufosinate. HB4 drought-tolerant wheat commercialized in Argentina is boosting complementary crop-protection formulations tailored for novel herbicide-tolerance packages. Region-wide, biotech expansion pushes agrochemical suppliers to design rotation programs, mitigating resistance while maximizing yield gains. The resulting product bundles strengthen input loyalty, enlarge lifetime value per hectare, and reinforce the premium tier of the South America agrochemicals market.

Precision-ag platforms optimizing chemical rates

Brazil hosts 875 deep-tech firms with agricultural solutions, including AI robotics, microbiology, and remote sensing. Solinftec's solar-powered SOLIX robot autonomously scouts fields to identify weeds and recommends surgical spraying, cutting herbicide volumes while preserving yields. Syngenta's CROPWISE AI platform already maps 70 million ha, centralizing nutrient, pest, and weather data for prescriptive field plans. Hyperspectral sensors now predict nitrogen and potassium levels in real-time, allowing variable-rate fertilizer and stabilizer placement that curbs runoff. Adoption cost hurdles persist, yet mounting labor shortages and input price spikes push growers toward tech-enabled efficiency. These tools tighten the feedback loop between crop status and input need, sustaining the consumption of premium-grade adjuvants, micronutrients, and bio-stimulants within the South America agrochemicals market.

Tighter re-registration and residue limits

Chile imposed stricter maximum residue limits through Decree 47/2024, effective May 2025, raising compliance costs for formulators and exporters. Brazil's updated pesticide law accelerates approvals yet heightens environmental oversight, challenging small registrants. Peru continues to authorize chemistries banned in Europe, fracturing regulatory alignment across Andean trade routes. Wider fungicide resistance in Brazilian soybean pathotypes also presses authorities to revise mode-of-action rotation mandates. Together, these measures lift data-generation expenses, extend market-entry timelines, and may delay newer activities, weighing on the South America agrochemicals market during the transition period.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of soybean and corn acreage

- Biological crop-protection blends adoption

- Commodity-price volatility curbing spend

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fertilizers secured a 42% share of the South America agrochemicals market in 2024, underpinned by nutrient-poor tropical soils and a strategic push to lift oilseed yields, especially in Brazil, where growers spend USD 335/hectare on fertilizer inputs. Pesticides remain the second-largest category, driven by persistent weed and pest pressure in humid climates and by widening herbicide-tolerance stacks in GM crops.

Adjuvants exhibit the fastest trajectory at a 6.0% CAGR through 2030, benefiting from digital spray maps that reward droplet-size optimization and drift reduction. Product innovation now revolves around integrated packages. ICL's launch of nitrogen-fixing inoculants after acquiring Nitro 1000 and Orion's dual-line FA 1500 applicator, able to deliver chemical and biological inputs concurrently, illustrates the convergence trend.

The South America Agrochemicals Market Report is Segmented by Product Type (Fertilizers, Pesticides, and More), by Application (Crop-Based and Non-Crop-Based), and Geography (Brazil, Argentina, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Syngenta

- Bayer Crop Science

- BASF SE

- Corteva Agriscience

- Nutrien Ltd

- FMC Corporation

- Yara International ASA

- UPL Limited

- Sumitomo Chemical Co., Ltd.

- ICL Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 GM-crop driven pesticide demand surge

- 4.2.2 Expansion of soybean and corn acreage

- 4.2.3 Subsidized rural credit for agri-inputs

- 4.2.4 Rise of carbon-credit-linked efficiency fertilizers

- 4.2.5 Biological crop-protection blends adoption

- 4.2.6 Precision-ag platforms optimizing chemical rates

- 4.3 Market Restraints

- 4.3.1 Tighter re-registration and residue limits

- 4.3.2 Commodity-price volatility curbing spend

- 4.3.3 Inland logistics bottlenecks on import flows

- 4.3.4 Herbicide resistance escalating switch costs

- 4.4 Technological Outlook

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Force Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Fertilizers

- 5.1.1.1 Nitrogenous

- 5.1.1.2 Phosphatic

- 5.1.1.3 Potassic

- 5.1.1.4 Specialty Fertilizers

- 5.1.2 Pesticides

- 5.1.2.1 Herbicides

- 5.1.2.2 Insecticides

- 5.1.2.3 Fungicides

- 5.1.2.4 Bio-pesticides

- 5.1.3 Adjuvants

- 5.1.4 Plant Growth Regulators

- 5.1.1 Fertilizers

- 5.2 Application

- 5.2.1 Crop Based

- 5.2.1.1 Grains and Cereals

- 5.2.1.2 Pulses and Oilseeds

- 5.2.1.3 Fruits and Vegetables

- 5.2.2 Non-Crop Based

- 5.2.2.1 Turf and Ornamental Grass

- 5.2.2.2 Other Non-crop Based

- 5.2.1 Crop Based

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Syngenta

- 6.4.2 Bayer Crop Science

- 6.4.3 BASF SE

- 6.4.4 Corteva Agriscience

- 6.4.5 Nutrien Ltd

- 6.4.6 FMC Corporation

- 6.4.7 Yara International ASA

- 6.4.8 UPL Limited

- 6.4.9 Sumitomo Chemical Co., Ltd.

- 6.4.10 ICL Group Ltd.