|

市場調查報告書

商品編碼

1851918

垃圾袋:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)Trash Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

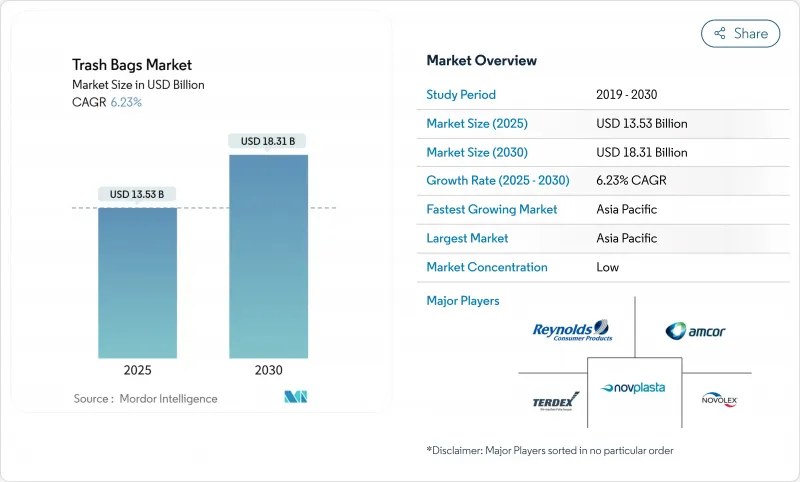

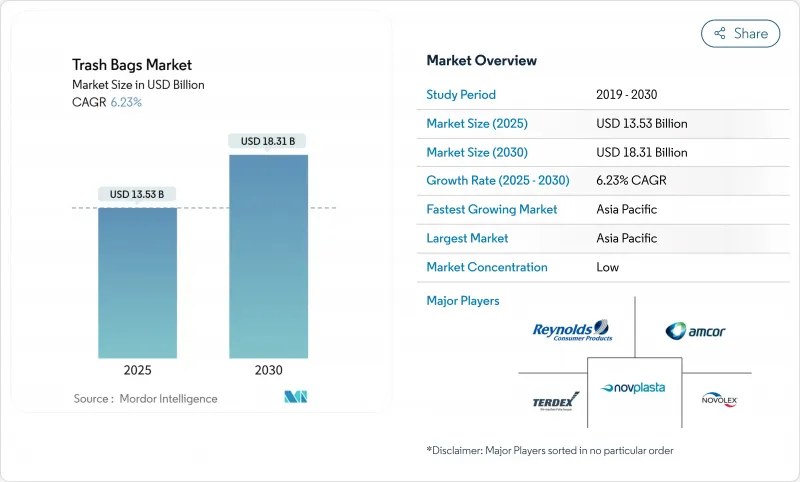

預計到 2025 年,垃圾袋市場規模將達到 135.3 億美元,到 2030 年將達到 183.1 億美元,年複合成長率為 6.23%。

快速的都市化推動了城市固態垃圾量的激增,而按量付費(PAYT)模式和更嚴格的生產者責任制規則正在重新定義產品規格,從而刺激了對優質合規垃圾袋的需求。亞太地區仍然是最大的消費市場,受益於不斷壯大的中產階級和日益完善的基礎設施。北美和歐洲等成熟市場正面臨一次性塑膠法規的壓力,加速再生和生物基薄膜的轉型。同時,乙烯價格的波動持續擠壓加工商的利潤空間,加速了製造商之間的整合。

全球垃圾袋市場趨勢與洞察

大量城市廢棄物的產生以及無縫收集的必要性

都市固態垃圾量預計在2023年達到21億噸,到2050年將達到38億噸。目前,各城市正在指定使用與自動駕駛垃圾車相容的防穿刺統一垃圾袋,這推動了垃圾袋市場的成長。先導計畫顯示,物聯網賦能的垃圾桶結合人工智慧路線最佳化技術,使燃料消耗降低了28%,收集效率提高了41.5%。這種轉變正在推動對能夠在高溫氣候下保持形狀並能承受長期儲存劣化的薄膜的需求。

疫情後以衛生為中心的消費行為

2024年,醫院減少了2.641億磅廢棄物掩埋,並採用了68%的永續採購方式。為了滿足這項需求,諸如採用蛋殼製成的EGU袋等高階產品於2025年上市。旅館業的類似趨勢正在推高平均售價,從而支撐機構市場9.67%的複合年成長率。

禁止使用一次性塑膠製品和生產者延伸責任制

加州SB 54法案規定,到2032年一次性塑膠的使用量必須減少25%,並要求每年投入5億美元用於清理工作。不列顛哥倫比亞省和歐盟的類似規定將處置成本轉嫁給生產商,迫使他們投資再生材料和可堆肥替代品。合規的複雜性增加了成本,限制了低利潤供應商的市場准入,並抑制了垃圾袋市場的短期成長。

細分市場分析

預計到2024年,住宅市場將佔總銷售額的64.34%,並在2030年之前以9.67%的複合年成長率成長,主要成長動力來自醫療保健、酒店和教育等機構用戶。醫院的永續採購政策和更嚴格的感染控制通訊協定正在推動垃圾袋市場對抗菌和防漏內襯的需求。機構買家更注重性能和合規性而非價格,傾向於選擇採用再生材料和生物基材料製成的高階產品。住宅市場的需求主要受銷售主導,並受惠於按量付費方案和品牌忠誠度,但價格敏感度也對其有所限制。

企業需求的成長促使供應商不斷改進其產品規格,並力求簽訂多年合約。同時,家庭垃圾袋使用者也擴大更換香味型和加固型垃圾袋,推高了平均單價。隨著市政府實施差異化垃圾收集流程,這兩類使用者群體都在使用經過認證的、顏色編碼的垃圾袋,進一步擴大了垃圾袋市場。

到2024年,低密度聚乙烯(LDPE)將以38.67%的市佔率引領垃圾袋市場。然而,生物基塑膠,例如聚乳酸(PLA)和聚羥基脂肪酸酯(PHA),預計將達到10.54%的複合年成長率。這主要得益於企業淨零排放承諾和投資,例如NatureWorks在泰國投資3.5億美元建設的PLA工廠。在分解速度較慢的潮濕熱帶地區,可堆肥塑膠的市場佔有率仍然較低,但監管激勵措施正在縮小成本差距。同時,高密度聚乙烯(HDPE)和線性低密度聚乙烯(LLDPE)薄膜正在整合消費後回收樹脂,以保持其市場競爭力。

設備升級和認證障礙阻礙了材料的快速轉化,而不斷上漲的掩埋附加稅和生產者責任延伸費則持續削弱化石基樹脂的成本優勢。能夠將循環利用成分與機械強度相結合的供應商,最有希望抓住不斷成長的永續垃圾袋市場。

區域分析

預計到2024年,亞太地區將貢獻全球40.65%的收入,並在2030年之前以8.12%的複合年成長率成長。在韓國和日本,人工智慧分類機器人正在提高再生高密度聚乙烯(HDPE)的供應量,但熱帶氣候使可堆肥袋的推廣應用面臨挑戰。各國不同的回收禁令和目標要求全球供應商採取靈活的籌資策略。

北美成熟的基礎設施正隨著加州SB 54等生產者責任延伸法案(EPR)的實施而不斷發展,推動環保部門轉向使用可回收和生物基內襯材料。目前,已有6000個社區實施了按量付費(PAYT)計劃,強制要求使用符合認證標準的包裝袋,從而維持了穩定的包裝袋需求,並促進了更高價值的產品組合。包括Glad公司於2025年4月推出的雙倍強度包裝袋在內的高階創新產品,旨在滿足注重衛生的家庭的需求。

歐洲的循環經濟議程正在推動積極的再生材料含量強制規定。德國的回收池和法國的押金返還制度代表全部區域在減少廢棄物方面的進展。像Cyca Flex這樣的包裝集團現在銷售100%可回收薄膜,其中至少含有5%的消費後再生材料,這鞏固了歐洲作為永續標準標竿的地位。

其他好處

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 都市區廢棄物產生量大,亟需無縫收集

- 疫情後以衛生為中心的消費行為

- 市政計量收費(PAYT)模式的興起

- 日益成長的線上購物需求對防漏襯墊的需求

- 生質塑膠與低密度聚乙烯/線性低密度聚乙烯原料的價格持平

- 人工智慧分類機提升了再生高密度聚乙烯的供應量

- 市場限制

- 禁止使用一次性塑膠製品和生產者延伸責任制

- 乙烯價格波動導致壓力轉換器利潤率下降

- 潮濕氣候下可堆肥垃圾袋的性能差異

- 在零售連鎖店擴大可重複使用/填充站的試點使用範圍

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 最終用戶

- 住宅

- 設施(HoReCa、醫療保健、教育)

- 商業和工業

- 依材料類型

- 高密度聚苯乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 線型低密度聚乙烯(LLDPE)

- 生物基/生物分解性塑膠(PLA、PBAT、PHA)

- 按容量/袋子尺寸

- 最多 10 加侖

- 13-30加侖

- 30-55加侖

- 55加侖或更多

- 按銷售管道

- 零售(超級市場、便利商店、線上)

- B2B/機構採購

- 分銷和批發

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲、紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor Plc

- Reynolds Consumer Products(Hefty)

- The Clorox Company(Glad)

- Novolex Holdings LLC

- Inteplast Group Ltd.

- Poly-America LP

- Pack-It BV

- Kemii Garbage Bag Co. Ltd.

- Cosmoplast Industrial Co. LLC

- Luban Packing LLC

- International Plastics Inc.

- Novplasta sro

- Terdex GmbH

- Simplehuman LLC

- Ruffies/Pactiv Evergreen

- WasteZero Inc.

- Al-Sinai Plastic Factory

- Abu Dawood Group(Pekoe)

- Thai Plastic Bag Industry Co. Ltd.

- Crown Poly Inc.

第7章 市場機會與未來展望

The trash bags market size is valued at USD 13.53 billion in 2025 and is projected to reach USD 18.31 billion by 2030, advancing at a 6.23% CAGR.

Rapid urbanization is swelling municipal solid-waste volumes, while pay-as-you-throw (PAYT) schemes and stricter producer-responsibility rules are redefining product specifications and boosting demand for premium, compliant liners. Asia-Pacific remains the largest regional consumer, benefitting from expanding middle-class populations and infrastructure upgrades. Mature markets in North America and Europe, pressured by single-use-plastic curbs, are accelerating shifts toward recycled and bio-based film grades. At the same time, volatile ethylene pricing continues to squeeze converter margins, reinforcing consolidation among producers.

Global Trash Bags Market Trends and Insights

High-Urban Waste Generation and Need for Seamless Collection

Municipal solid-waste volumes reached 2.1 billion t in 2023 and are on track for 3.8 billion t by 2050. Cities now specify puncture-resistant, uniform liners compatible with automated trucks, spurring growth of the trash bags market. IoT-enabled bins paired with AI route optimization have cut fuel use 28% and lifted collection efficiency 41.5% in pilot projects. These shifts increase demand for films that hold shape in high-heat climates and resist extended storage degradation.

Hygiene-Centric Consumer Behaviour Post-Pandemics

Hospitals diverted 264.1 million lb of waste from landfills in 2024, and 68% adopted sustainable purchasing rules, pushing institutional buyers toward antimicrobial, odor-neutralizing liners. Premium SKUs such as eggshell-infused EGU bags debuted in 2025 to capture this demand. Similar trends in hospitality are lifting average selling prices and underpinning the institutional segment's 9.67% CAGR.

Single-Use-Plastic Bans and Extended-Producer Responsibility

California's SB 54 compels a 25% cut in single-use plastics by 2032 and requires USD 500 million in annual cleanup funding. Similar mandates in British Columbia and the EU shift disposal costs to producers, forcing investments in recycled content and compostable alternatives. Compliance complexity elevates costs and limits access for low-margin suppliers, restraining near-term expansion of the trash bags market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of PAYT Municipal Fee Models

- Expansion of Online Grocery Demanding Leak-Proof Liners

- Volatile Ethylene Prices Squeezing Converter Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Institutional users-healthcare, hospitality and education-propelled 9.67% CAGR to 2030, even as the residential segment retained 64.34% of 2024 revenue. Hospitals' sustainable procurement policies and stricter infection-control protocols are driving demand for antimicrobial, leak-proof liners in the trash bags market. Institutional buyers value performance and compliance over price, supporting premium SKUs with recycled or bio-based content. Residential demand remains volume-driven, buoyed by PAYT programs and brand loyalty but constrained by price sensitivity.

The institutional upsurge encourages suppliers to refine spec-based offerings and secure multi-year contracts. At the same time, household buyers increasingly trade up to scented or reinforced bags, expanding average unit values. As city governments introduce differentiated collection streams, both user groups are turning to certified color-coded liners, further enlarging the trash bags market.

LDPE held the largest 38.67% trash bags market share in 2024 thanks to price and process familiarity. Yet bio-based plastics such as PLA and PHA are poised for 10.54% CAGR, catalyzed by corporate net-zero pledges and investments like NatureWorks' USD 350 million PLA plant in Thailand. Compostable grades still lag in humid tropics where degradation rates slow, but regulatory incentives are narrowing cost gaps. HDPE and LLDPE films, meanwhile, are integrating post-consumer resin to maintain market relevance.

Equipment upgrades and certification hurdles are tempering a swift material shift, yet rising landfill levies and EPR fees continue to erode the cost advantage of fossil-based resins. Suppliers that can merge circular content with mechanical strength are best positioned to capture the expanding trash bags market size for sustainable variants.

The Trash Bags Market Report is Segmented by End-User (Residential, Institutional, Commercial and Industrial), Material Type (HDPE, LDPE, LLDPE, Bio-based/Biodegradable Plastics), Capacity/Bag Size (Up To 10 Gallon, 13-30 Gallon, 30-55 Gallon, Above 55 Gallon), Sales Channel (Retail, B2B/Institutional Procurement, Distribution/Wholesale), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 40.65% of global revenue in 2024 and is on track for an 8.12% CAGR to 2030, driven by urban sprawl in China and India and widening middle-class consumption. AI-enabled sorting robots in South Korea and Japan are lifting recycled-HDPE availability, while tropical climates complicate compostable-bag deployment. Diverse national bans and recycling targets require flexible sourcing strategies for global suppliers.

North America's mature infrastructure is evolving under EPR legislation such as California's SB 54, prompting a pivot to recycled and bio-based liners. PAYT programs in 6,000 communities now dictate certified bag sizes, underpinning stable unit demand and supporting a higher-value mix. Premium innovations, including Glad's 2X stronger bags launched in April 2025, cater to hygiene-aware households.

Europe's circular-economy agenda is spurring aggressive recycled-content mandates. Germany's reuse pools and France's incoming deposit-return schemes exemplify region-wide momentum toward waste reduction. Packaging groups such as Saica Flex now market 100% recyclable films with minimum 5% PCR, consolidating Europe's position as a bellwether for sustainable standards.

- Amcor Plc

- Reynolds Consumer Products (Hefty)

- The Clorox Company (Glad)

- Novolex Holdings LLC

- Inteplast Group Ltd.

- Poly-America LP

- Pack-It BV

- Kemii Garbage Bag Co. Ltd.

- Cosmoplast Industrial Co. LLC

- Luban Packing LLC

- International Plastics Inc.

- Novplasta s.r.o.

- Terdex GmbH

- Simplehuman LLC

- Ruffies / Pactiv Evergreen

- WasteZero Inc.

- Al-Sinai Plastic Factory

- Abu Dawood Group (Pekoe)

- Thai Plastic Bag Industry Co. Ltd.

- Crown Poly Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High-urban waste generation and need for seamless collection

- 4.2.2 Hygiene-centric consumer behaviour post-pandemics

- 4.2.3 Rise of pay-as-you-throw (PAYT) municipal fee models

- 4.2.4 Expansion of on-line grocery demanding leak-proof liners

- 4.2.5 Bioplastic price parity with LDPE/LLDPE feedstocks

- 4.2.6 AI-enabled robotic sorters boosting recycled-HDPE supply

- 4.3 Market Restraints

- 4.3.1 Single-use-plastic bans and extended-producer?responsibility

- 4.3.2 Volatile ethylene prices squeezing converter margins

- 4.3.3 Compostable-bag performance gaps in humid climates

- 4.3.4 Growing refill/reuse station pilots in retail chains

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End-user

- 5.1.1 Residential

- 5.1.2 Institutional (HoReCa, Healthcare, Education)

- 5.1.3 Commercial and Industrial

- 5.2 By Material Type

- 5.2.1 High-Density Polyethylene (HDPE)

- 5.2.2 Low-Density Polyethylene (LDPE)

- 5.2.3 Linear Low-Density Polyethylene (LLDPE)

- 5.2.4 Bio-based/Biodegradable Plastics (PLA, PBAT, PHA)

- 5.3 By Capacity / Bag Size

- 5.3.1 Up to 10 Gallon

- 5.3.2 13 - 30 Gallon

- 5.3.3 30 - 55 Gallon

- 5.3.4 Above 55 Gallon

- 5.4 By Sales Channel

- 5.4.1 Retail (Supermarkets, Convenience, Online)

- 5.4.2 B2B / Institutional Procurement

- 5.4.3 Distribution / Wholesale

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor Plc

- 6.4.2 Reynolds Consumer Products (Hefty)

- 6.4.3 The Clorox Company (Glad)

- 6.4.4 Novolex Holdings LLC

- 6.4.5 Inteplast Group Ltd.

- 6.4.6 Poly-America LP

- 6.4.7 Pack-It BV

- 6.4.8 Kemii Garbage Bag Co. Ltd.

- 6.4.9 Cosmoplast Industrial Co. LLC

- 6.4.10 Luban Packing LLC

- 6.4.11 International Plastics Inc.

- 6.4.12 Novplasta s.r.o.

- 6.4.13 Terdex GmbH

- 6.4.14 Simplehuman LLC

- 6.4.15 Ruffies / Pactiv Evergreen

- 6.4.16 WasteZero Inc.

- 6.4.17 Al-Sinai Plastic Factory

- 6.4.18 Abu Dawood Group (Pekoe)

- 6.4.19 Thai Plastic Bag Industry Co. Ltd.

- 6.4.20 Crown Poly Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment