|

市場調查報告書

商品編碼

1690925

美國垃圾袋:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)United States Trash Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

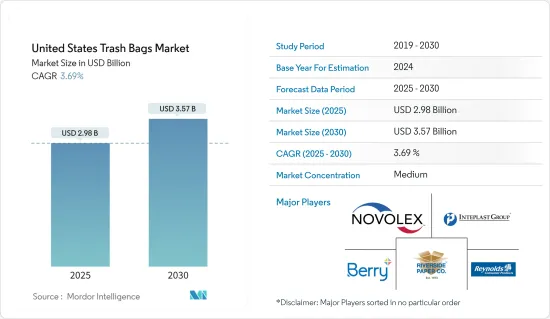

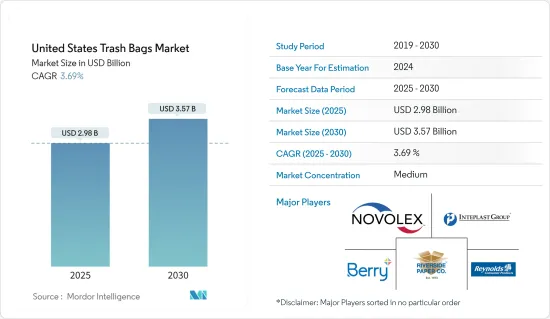

美國垃圾袋市場規模預計在2025年為29.8億美元,預計到2030年將達到35.7億美元,預測期內(2025-2030年)的複合年成長率為3.69%。

關鍵亮點

- 垃圾袋用於廢棄物和垃圾的分類、儲存、清除和處理。塑膠垃圾袋重量輕,非常適合收集未收集的垃圾或潮濕的垃圾,例如食物垃圾。它們也非常適合包裹垃圾以減少氣味。垃圾袋通常用於襯在垃圾桶、垃圾桶和垃圾容器中。每個家庭和企業都會使用垃圾袋來丟掉食物垃圾和廢紙。垃圾袋採用低密度聚乙烯材質,質地細膩,富有彈性,防水、透氣。

- 消費者的購買力增強,對於方便、無味、性價比高的垃圾袋收集垃圾的需求,有意擴大垃圾袋的市場規模。隨著城市人口的不斷增加,以及食品、飲料和醫藥行業的擴張,垃圾袋的需求量龐大。這些需求以及企業和家庭的需求預計將在未來幾年推動市場成長。

- 國內越來越多的住宅設施鼓勵在家中使用垃圾桶。再加上人們對清潔和衛生的日益關注,垃圾袋的需求也隨之增加。垃圾袋在醫院和宿舍中也被廣泛使用,因為它們在商店中很容易買到,而且價格便宜。

- 然而,各國政府和相關監管機構正在發布塑膠禁令,以減少塑膠足跡。這可能會導致禁止使用塑膠,這可能會對垃圾袋市場產生重大影響。禁止使用塑膠垃圾袋將鼓勵製造商開發生物分解性或可回收的垃圾袋以協助其商業活動,從而促進市場成長。

- 因此,消費者需求的增加和政府對環保、易處理的垃圾袋的措施將推動市場成長。人們對環保產品的認知預計將推動一次性垃圾袋的需求。

- 輸液治療和技術創新公司百特國際公司宣布,其垃圾袋回收靜脈試驗計畫第一階段已於 2023 年 12 月成功完成。該試驗計畫與芝加哥領先的綜合學術醫療系統西北醫學院合作,將超過 6 噸(12,000 磅)的靜脈注射廢棄袋從垃圾掩埋場轉移出來,並重新利用,足以運往整個芝加哥市。這是在美國啟動的首個試驗計畫。

美國垃圾袋市場趨勢

住宅領域佔據最大市場佔有率

- 美國經濟的快速成長主要由住宅產業推動。許多城市和州的就業機會不斷增加、產業日益多樣化,住宅需求不斷增加,房價也不斷上漲。人口結構的變化也影響市場的成長。

- 隨著嬰兒潮世代達到退休年齡,其中許多人縮小住房規模或離開家,住宅需求正在轉向全國各地的不同地點和房產。這種全國性的住宅成長趨勢為垃圾袋創造了成長機會,垃圾袋是每個家庭用來保持衛生和清潔的工具。

- 據美國永續包裝公司 Revolution 稱,美國家庭平均每年產生 18 磅垃圾。每年有 1000 億個塑膠袋被丟棄並最終進入垃圾掩埋場。這意味著對堅固、耐用且環保的家用垃圾袋的需求強勁。

- 廢棄物方式很大程度上受到政府政策和措施的影響。這對垃圾袋市場產生了重大影響。美國政府正在製定立法,加強廢棄物管理責任,解決隨著美國住宅空間擴大而產生的日益嚴重的垃圾和污染問題。

- 隨著美國人口的成長,獨棟住宅逐漸轉向多用戶住宅。多戶住宅又稱為住宅、住宅和四戶住宅。它們的命名主要基於單位數量。這就是該地區的人們願意投資建造多戶住宅的原因。 2017年此類建築支出為804億美元,預計2023年將增加至1,192.7億美元。

- 因此,美國居住空間的擴大、人口的成長以及當地日益嚴重的食物垃圾和其他垃圾問題,對垃圾袋產生了持續的需求。此外,政府推行使用生物分解性袋子的計畫也推動了該地區市場的成長。

預計商業領域將呈現最高的成長率。

- 零售、便利商店、醫療保健、食品服務、飯店和辦公大樓是商業領域的關鍵機構,佔據了很大的市場佔有率。根據美國人口普查局的數據,2023年美國零售和食品服務總銷售額將首次達到8.33兆美元,高於2018年的5.99兆美元。

- 美國雜貨店出售的食品約有 30% 被丟棄。美國零售業每年產生約160億磅食物廢棄物。零售業浪費的食物大約相當於銷售食物利潤的兩倍(根據美國農業部的數據)。近年來,各組織越來越注重管理和減少廢棄物。雖然有些組織滿足於擁有廢棄物清除和處理系統,但更積極主動的組織會在廢棄物管理方面投入更多精力。

- 如果未能處理針頭和其他尖銳物體,公眾和廢棄物處理工人可能會面臨健康風險。如果廢棄針頭的容器在垃圾車中被打開或被意外傾倒在回收中心,廢棄物處理工人可能會面臨針刺傷害和感染的風險。這意味著對能夠承受鋒利邊緣並降低處理時受傷風險的高品質垃圾袋的需求強勁。

- 提供各種一次性容器內襯的網站數量的增加導致對這些產品的需求增加。此外,一次性垃圾袋和其他各種產品的網路零售越來越受歡迎,因為它具有成本效益,並且不需要花費大量時間來購買產品。預計預測期內網上銷售將推動一次性垃圾袋的成長。

- 美國在醫療保健方面的支出比其他國家都多,約佔GDP的18%。領先的研究估計,大約 30% 的醫療保健支出被視為浪費。儘管人們努力減少過度治療、改善照護並解決過度付款問題,但醫療保健領域仍存在大量浪費。生物危害廢棄物放置在紅色袋子或容器中,傳染性廢棄物放置在塑膠袋中。這些因素導致了對垃圾袋的需求。

- 商業機構,包括擁有四個或更多單元的多用戶住宅和住宅商業建築,可以使用透明塑膠片材布將可回收物品收集到垃圾箱中。這些塑膠內襯雖然本身不可回收,但由於其方便性,現在已被商業機構所接受。商業場所並不禁止使用透明垃圾袋,但回收商可以拒絕接受。

美國垃圾袋產業概況

美國垃圾袋市場處於半靜態。市場的主要企業有 Berry Global Inc.、Hefty(Reynolds Consumer Products LLC)、Inteplast Group、Novolex 和 Riverside Paper Co.。市場參與企業正專注於透過併購、夥伴關係、產能擴張和產品創新等策略措施來擴大市場。

- 2024 年 4 月,Revolution、Sustainable Loop Plastic Solutions 宣布推出環保 Dailygood Bags 作為日常垃圾袋。與不使用再生材料的垃圾袋不同,Dailygood Bags 可由高達 97% 的再生塑膠樹脂製成,因此極為環保。

- 2023 年 11 月,Hefty Ultra Strong 垃圾袋的創造者雷諾茲消費品公司宣布推出適用於食品飲料和非食品飲料行業的 Hefty Ultra Strong Fabuloso 香味高廚房垃圾袋。這些垃圾袋具有牢固的閉合裝置,並經過 Arm & Hammer 的連續防臭塗層處理。有多種尺寸可供容納 13 個高廚房容器和 30 加侖散裝容器。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 可堆肥袋和生物分解性袋的需求不斷增加

- 提高員工衛生意識

- 市場問題

- 限制使用塑膠垃圾袋

第6章重要考察

- 買家購買偏好

- 短期(0-2年)

- 中期(2-4年)

- 長期(4-6年)

- 主要廠商及品牌映射

- 主要零售商和品牌映射

第7章市場區隔

- 按最終用戶

- 住宅

- 商用

- 工業的

第8章競爭格局

- 公司簡介

- Berry Global Inc.

- Riverside Paper Co.

- Fast Bags Corp.(BAGUPS)

- Hefty(Reynolds Consumer Products LLC)

- International Plastics Inc.

- Novolex

- Inteplast Group

- Neway Packaging Corporation

- AR-BEE Transparent Products Inc.

- Universal Plastic Bag Co.

第9章投資分析

第10章:投資分析市場的未來

The United States Trash Bags Market size is estimated at USD 2.98 billion in 2025, and is expected to reach USD 3.57 billion by 2030, at a CAGR of 3.69% during the forecast period (2025-2030).

Key Highlights

- Trash bags are used to sort, store, remove, and dispose of waste or garbage. Plastic trash bags are lightweight and great for uncollected or wet rubbish, as is often the case with food waste. They are also great for wrapping trash to reduce odor. Trash bags are commonly used to line litter bins, waste compartments, or receptacles. They are used in every home and business, whether to throw away kitchen scraps or used paper. They are made of low-density polyethylene, which is delicate, flexible, waterproof, and airtight.

- The purchasing power of consumers has increased the demand for convenient, odor-resistant, and cost-effective trash bags for collecting garbage, intentionally increasing the market size of trash bags. The growing number of people living in cities is creating a significant need for garbage bags owing to the expanding food, beverage, and pharmaceutical sectors. This need and demand from businesses and households will likely drive the market growth over the next few years.

- The increase in housing facilities in the country encourages the usage of garbage bins in homes; this, along with the growing attention to cleanliness and hygiene, has increased the need for trash bags. Also, trash bags have become more prevalent in hospitals and dorms because they are easy to find and cheap to buy in stores.

- However, governments and related regulatory bodies are imposing plastic bans to reduce the plastic footprint. The resulting prohibition of plastic usage may drastically affect the trash bag market. The bans on plastic trash bags allow manufacturers to develop biodegradable or recyclable trash bags to support their business activities, thereby boosting the market's growth.

- Thus, increasing consumer demand for eco-friendly and easy-to-dispose trash bags and government initiatives will boost market growth. Awareness of environment-friendly products is expected to boost the demand for disposable garbage bags.

- Baxter International Inc., an innovator in infusion therapy and technologies, announced the successful completion of phase 1 of its intravenous pilot program for trash bag recycling in December 2023. In partnership with Northwestern Medicine, Chicago's leading integrated academic health system, the pilot program diverted more than 6 tons (12,000 pounds), equivalent to enough IV trash bags to cross the entire city of Chicago, from landfill to reuse for a second life. This was the first pilot program to be launched in the United States.

United States Trash Bags Market Trends

The Residential Sector Holds the Largest Market Share

- The country's fast-growing economy mainly drives the residential sector. Many cities and states with strong job growth and diversified industries are seeing increased housing demand, resulting in higher prices. The country's changing demographics also influence the market's growth.

- As the boomers hit retirement age, with many downsizing or moving away from their homes, the housing demand is shifting to different locations and properties throughout the country. This residential growth trend throughout the country creates growth opportunities for trash bags used in every house to maintain hygiene and cleanliness.

- According to the United States-based sustainable packaging firm Revolution, the average American family produces 18 pounds of waste. Every year, 100 billion plastic bags are thrown away and end up in landfills. This implies a robust demand for strong, durable, eco-friendly trash bags for residential purposes.

- The way waste is handled is significantly influenced by government policies and measures. This has a significant impact on the trash bags market. The government has introduced legislation to promote responsibility for waste management and deal with the increasing garbage and pollution issues with the growing residential space in the United States.

- With the growing population in the United States, people are shifting from single-family residents to multi-family residential areas. Multi-family homes are called duplexes, triplexes, and quadplexes. They are mainly named after the number of units they comrise. Thus, people in the region are spending money on constructing multi-family living spaces. The cost of this type of construction was USD 80.40 billion in 2017, which increased to USD 119.27 billion in 2023.

- Thus, the growing residential space in the United States, the growing population, and increasing problems of food waste and other garbage in the locality create a constant demand for trash bags. In addition, following government plans to use biodegradable bags also boosts the growth of the market in the region.

The Commercial Sector is Expected to Witness the Highest Growth Rate

- Retail, convenience stores, healthcare, food service, hospitality, and office buildings are critical establishments within the commercial sector that constitute a significant market share. As per the US Census Bureau, in 2023, total retail and food service sales reached USD 8.33 trillion for the first time in the United States, an increase from USD 5.99 trillion in 2018.

- About 30% of the food in American grocery stores is thrown away. The US retail sector generates about 16 billion pounds of food waste annually. Wasted food from the retail sector is valued at about twice the profit from food sales (according to the US Department of Agriculture). Recently, organizations have become more conscious of managing and reducing their waste. Although some organizations are satisfied with having a trash removal or disposal system, the more proactive organizations are putting more effort into managing their waste.

- The public and waste workers may be exposed to health risks from negligent disposal of needles and other sharp objects. Discarded needles may cause waste workers to be exposed to the risk of needlestick injuries or possible infections if containers are opened in a garbage truck or mistakenly thrown into recycling centers. This implies a strong demand for high-quality trash bags that can bear the sharpness and decrease the risk of injuries while handling.

- The increasing number of websites offering a variety of disposable bin liners has increased the demand for these products. In addition, online retailing of disposable garbage bags and various other products is growing in popularity as it is cost-effective and time-saving to purchase products. Online sales are expected to drive the growth of disposable trash bags during the forecast period.

- The United States spends more on healthcare than any other country, with costs accounting for around 18% of the GDP. Prior studies estimated that approximately 30% of healthcare spending might be considered waste. Despite efforts to reduce overtreatment, improve care, and address overpayment, substantial waste in the healthcare sector still remains. Biohazard waste is kept in red bags and containers, whereas infectious waste is kept in plastic bags. Such factors contribute to the demand for trash bags.

- For commercial establishments, including multi-family dwellings of four or more units and non-residential commercial buildings, the use of clear plastic sheeting for collecting recyclables in trash bins is permitted. These plastic liners are not recyclable per se but are now accepted for convenience in commercial operations. Commercial establishments are not prohibited from using clear trash bags, but recyclers may choose not to accept them.

United States Trash Bags Industry Overview

The US trash bag market is semi-consolidated. The major players in the market include Berry Global Inc., Hefty (Reynolds Consumer Products LLC), Inteplast Group, Novolex, and Riverside Paper Co. The market players are concentrating on expanding their reach with strategic initiatives such as mergers and acquisitions, partnerships, capacity expansions, and product innovations.

- April 2024: Revolution, Sustainable Loop Plastic Solutions, unveiled the introduction of Dailygood Bags, which are eco-friendly heavy-duty trash bags made for regular use. Unlike trash bags that are made without recycled material, Dailygood Bags can be made with up to 97% recycled plastic resin, which has a much lower environmental impact.

- November 2023: Reynolds Consumer Products, the creator of Hefty Ultra Strong trash bags, announced the launch of Hefty Ultra Strong Fabuloso Scented Tall Kitchen Trash Bags across the food, beverage, and non-food industries. The bags are made with secure fit closure and have continuous odor control by Arm & Hammer. They are available in sizes of 13 tall kitchen containers and 30 gallons of big-capacity containers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Compostable and Oxo-biodegradable Bags

- 5.1.2 Growing Awareness About Hygiene Among People

- 5.2 Market Challenges

- 5.2.1 Restrictions on Using Plastic Trash Bags

6 PREMIUM INSIGHTS

- 6.1 Trends in Buyers' Purchase Preferences

- 6.1.1 Short-term (0-2 Years)

- 6.1.2 Mid-term (2-4 Years)

- 6.1.3 Long-term (4-6 Years)

- 6.2 Major Manufacturers and Brand Mapping

- 6.3 Major Retailers and Brand Mapping

7 MARKET SEGMENTATION

- 7.1 By End User

- 7.1.1 Residential

- 7.1.2 Commercial

- 7.1.3 Industrial

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Berry Global Inc.

- 8.1.2 Riverside Paper Co.

- 8.1.3 Fast Bags Corp. (BAGUPS)

- 8.1.4 Hefty (Reynolds Consumer Products LLC)

- 8.1.5 International Plastics Inc.

- 8.1.6 Novolex

- 8.1.7 Inteplast Group

- 8.1.8 Neway Packaging Corporation

- 8.1.9 AR-BEE Transparent Products Inc.

- 8.1.10 Universal Plastic Bag Co.