|

市場調查報告書

商品編碼

1692486

北美垃圾袋:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Trash Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

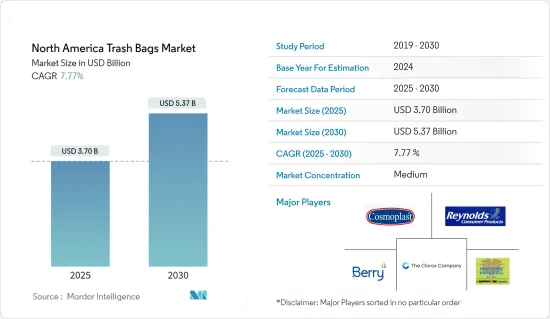

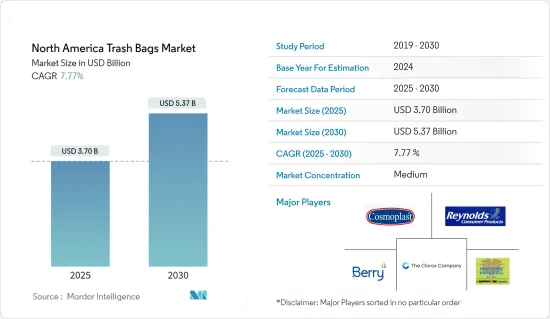

北美垃圾袋市場規模預計在 2025 年達到 37 億美元,預計到 2030 年將達到 53.7 億美元,預測期內(2025-2030 年)的複合年成長率為 7.77%。

垃圾袋通常由聚乙烯製成,這意味著它們堅固、輕便,並且可以安全地容納垃圾而不會洩漏或溢出。因此,它被用於北美市場的各種終端用戶行業,包括住宅、商業和工業。

主要亮點

- 垃圾袋強制令導致垃圾袋使用量增加,雷諾消費品等垃圾袋製造商的垃圾袋生產能力已超過規定值。

- 總體而言,北美垃圾袋市場正在適應新的法規和程序,儘管它們給市場相關人員帶來了一些挑戰。如果市場公司能夠生產出符合新規則要求的永續垃圾袋,這些規則將為市場成長提供新的途徑。

- 由於終端用戶產業的需求不斷增加,預計預測期內垃圾袋市場將會成長。然而,北美一些地區已經通過法律,禁止將草坪和庭院垃圾丟棄在垃圾掩埋場。永續和生物分解性的樹脂是市場成長的主要驅動力。

- 隨著全球打擊塑膠生產的努力活性化,美國各州和城市正在紛紛禁止使用一次性塑膠袋,而一次性塑膠袋是最普遍的污染源之一。由於一次性塑膠的禁令和法規對該地區的垃圾袋銷售產生了積極影響,因此這些禁令和法規最終可能會將垃圾袋納入禁令範圍。因此,雖然禁止使用一次性塑膠袋可能在短期內有助於垃圾袋的銷售,但從長遠來看,這可能會減緩市場成長。

- 比賽結束後,一些公司和政府採取了各種措施來增加該地區的垃圾袋使用量或獲得競爭優勢。例如,根據美國人口普查局 2022 年度州和國家人口統計數據,美國居住人口在 2022 年增加了 0.4%。此外,移民和國際移民是經濟成長恢復到疫情前水準的主要原因。

北美垃圾袋市場趨勢

住宅領域佔據主要市場佔有率

- 所調查的市場中的住宅部門排放了大量廢物。因此垃圾袋在消費者群體中的普及率較高。在市場上營運的公司正專注於開發用於家庭廢棄物管理的創新產品,進一步推動該領域的成長。

- 此外,美國人在購買食物時往往相當衝動。根據美國環保署估計,美國家庭平均每年產生約19.36噸食物廢棄物,是世界上產生量最高的國家之一(資料來源:此類案例導致垃圾袋需求量龐大)。

- 此外,哥倫比亞大學的一項研究發現,美國20% 的垃圾是由衣服和報紙等不易腐爛的物品組成的。庭院剪下的草(13.3%)以及食物和其他有機物(14.9%)也構成了美國垃圾的很大一部分。

- 此外,全部區域住宅率的提高也有望對研究市場的成長產生正面影響。例如,根據美國人口普查局的數據,2022 年 6 月私人住宅竣工量經季節性已調整的的年率為 136.5 萬套。這比5月修正後的估計值143.1萬戶下降了4.6%。不過,與去年同期相比,這一數字比2021年6月的130.5萬輛銷量高出4.6%。

- 根據美國人口普查局的數據,美國總人口正在大幅成長,這意味著新冠疫情期間出現了復甦的早期跡象。根據美國人口普查局2022年12月發布的《2022年全國和各州人口估計及增減因素》顯示,在經歷了2020年至2021年的歷史最低變化率之後,2022年美國居住人口增加約0.4%,即1,256,003人,達到333,287,557人。美國總人口的成長將導致該國產生更多的垃圾,並導致市場大幅成長。

美國佔有很大的市場佔有率

- 美國各城市和州正朝著零廢棄物政策邁進。全國約有 11 個州通過了禁止使用一次性塑膠購物袋的禁令,7 個州通過了禁止使用發泡聚苯乙烯容器的禁令,還有更多城市正在考慮禁止其他一次性食品和包裝。

- 《資源保護與回收法》(RCRA)是一部公共法,為危險和無害固態廢棄物的妥善管理提供了框架。該法案概述了國會授權的廢棄物管理計劃。根據美國環保署的數據,塑膠是都市固態廢棄物(MSW)中成長最快的部分。所有重要的都市固體廢物類別中都含有塑膠。

- 儘管美國僅佔世界人口的 4%,但卻排放了全球 12% 以上的都市固態廢棄物(MSW)。除此之外,工業製程(主要是家用產品製造)會產生大量廢棄物。採礦、製造和農業等活動會產生工業固態廢棄物,這些廢棄物雖然追蹤不多,但卻占到美國廢棄物總量的 97%(資料來源:美國PIRG 教育基金)。

美國環保署負責監管家庭和工業廢棄物,廢棄物保護公民免受廢棄物處理危害。它還致力於節約能源和自然資源,減少和消除廢棄物,並清理不當處理的廢棄物。預計這將推動垃圾袋市場的成長。

北美垃圾袋產業概況

北美垃圾袋市場較為分散,主要參與者包括 Berry Global Inc.、Riverside Paper Co. Inc.、The Clorox Company(Glad Products Company)、Cosmoplast Industrial Company LLC 和 Reynolds Consumer Products Inc.(Hefty)。市場上的公司正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 9 月,Novolex Holdings LLC 宣布將投資 1,000 萬美元,提高其位於印第安納州北弗農的回收廠的聚乙烯薄膜(包括塑膠購物袋)的回收能力。對回收和再利用機械的投資將使該公司每年能夠生產約 2800 萬磅再生材料,這些材料將用於製造由工業廢棄物和消費後再生材料製成的商品。該工廠是該公司兩個世界級的薄膜回收中心之一。

擁有 Hefti 的雷諾消費品公司於 2022 年 5 月推出了具有高級功能的新型中小型垃圾袋系列。我們一心一意地將客戶放在第一位,從而實現了這個目標。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

- 製造商最近使用特定化學組合和香料的趨勢

第5章市場動態

- 市場促進因素

- 考慮到各種促進廢棄物管理的舉措,美國繼續在需求方面引領市場

- 可堆肥和Oxo生物分解性袋的需求不斷成長

- 市場挑戰

- 製造商和消費者面臨塑膠購物袋使用制裁帶來的供應挑戰和價格波動

第6章 整體垃圾袋市場的重要考察

- 買家購買偏好趨勢(短期(0-2年)、中期(2-4年)、長期(4-6年))

第7章市場區隔

- 按最終用戶

- 住宅

- 商業的

- 工業的

- 按國家

- 美國

- 加拿大

第8章競爭格局

- 公司簡介

- Berry Global Inc.

- Riverside Paper Co. Inc.

- The Clorox Company(Glad Products Company)

- Cosmoplast Industrial Company LLC

- Hefty(Reynolds Consumer Products Inc.)

- Novolex Holdings LLC

- International Plastics Inc.

- Poly-America LP

- Four Star Plastics

- Neway Packaging Corporation

- All American Poly

- Aluf Plastics

- Petoskey Plastics Inc.

- Inteplast Group

第9章投資分析

第10章 市場展望

The North America Trash Bags Market size is estimated at USD 3.70 billion in 2025, and is expected to reach USD 5.37 billion by 2030, at a CAGR of 7.77% during the forecast period (2025-2030).

Trash bags, typically made of polyethylene, are tough and light and hold garbage securely without leakage or spillover. So, they are used in many different end-user industries in the North American market, such as residential, commercial, and industrial.

Key Highlights

- Trash bag mandates have increased the use of trash bags, which is aided by trash bag manufacturers such as Reynolds Consumer Products, which use more than the mandated content in the production of trash bags.For instance, according to the company, Reynolds Consumer Products' Hefty compostable trash bags are made from 50% recycled plastic.

- Overall, the trash bag market in North America has been adapting to the new regulations and procedures, even though they are causing some challenges for market players. These rules gave the market new ways to grow if market players came up with sustainable trash bags that met the requirements of the new rules.

- The trash bags market is expected to grow in the forecast period, owing to the increasing demand from end-user industries. However, a few regions of North America have passed laws banning the disposal of lawn and garden waste in landfills. Sustainable and biodegradable resins are significant factors in the market's growth.

- Bans on single-use plastic bags, one of the most pervasive sources of pollution, are affecting states and cities across the United States as efforts to combat global plastic production pick up. As the single-use plastic ban and regulations are positively impacting sales of trash bags in the region, eventually these bans and regulations will start to include trash bags within these bans. This means that the bans on single-use plastic bags might help trash bags in the short term, but they are likely to slow the growth of the market in the long term.

- After COVID-19, several businesses and governments used a variety of initiatives to boost the usage of trash bags in the region or obtain a competitive advantage. For example, the US resident population expanded by 0.4% in 2022, according to the US Census Bureau's Vintage 2022 state and national population statistics. Also, the number of people moving in and out of the country and international migration are the main reasons why growth is getting back to what it was before the pandemic.

North America Trash Bags Market Trends

Residential Sector Holds Major Market Share

- The residential sector of the market studied generates a significant amount of waste. Therefore, the penetration of trash bags is substantial in the consumer segment. The players operating in the market focused on innovative product development for domestic waste management, further boosting the segment's growth.

- Moreover, Americans are often quite impulsive in terms of their food purchases. The United States Environmental Protection Agency estimates that the average US household produces around 19.36 metric tons of food waste per year, one of the highest amounts worldwide (source: such instances lead to a major demand for trash bags).

- Also, a study from Columbia University found that 20% of US trash is made up of things that don't last long, like clothes and newspapers. Yard trimmings (13.3%) and food and other organic materials (14.9%) also make up a big part of US trash.

- Moreover, the increasing rate of residential construction across the North American region is also expected to positively impact the studied market's growth. For instance, as per the US Census Bureau, in June 2022, privately owned housing completions were at a seasonally adjusted annual rate of 1,365,000. This was 4.6 percent below the revised May estimate of 1,431,000. However, compared to the previous year's period, this was 4.6 percent above the June 2021 rate of 1,305,000.

- According to the US Census Bureau, there has been significant growth in the entire US population, signifying an early indication of recovery amid the COVID-19 pandemic. After a historically low rate of change between the years 2020 and 2021, the US resident population rose by around 0.4%, or 1,256,003, to 333,287,557 in 2022, as per the US Census Bureau's Vintage 2022 national and state population estimates and components of change released in December 2022. Because of this increase in the United States' total population, there will be more trash in the country, which will help the market grow a lot.

United States Holds Significant Market Share

- US cities and states are taking strides toward a zero-waste policy. Around 11 states in the country have passed bans on single-use plastic bags, seven states have passed bans on expanded polystyrene containers, and more cities are considering bans on other single-use food wares and packaging.

- The Resource Conservation and Recovery Act (RCRA) is the public law that creates the framework for the proper management of hazardous and non-hazardous solid waste. The law describes the waste management program mandated by Congress. According to the United States Environmental Protection Agency, plastics have been a rapidly growing part of municipal solid waste (MSW). Plastic is found in all significant MSW categories.

- The United States produces more than 12% of the planet's municipal solid waste (MSW), though it is home to only 4% of the world's population. Apart from this, there is a large amount of waste created by industrial processes, mostly in the household product manufacturing industry. Activities like mining, manufacturing, and agriculture create industrial solid waste, which is poorly tracked but may account for up to 97% of America's total waste (source: US PIRG Education Fund).

The Environmental Protection Agency of the United States regulates household and industrial waste in order to protect citizens from the hazards of waste disposal. It also seeks to conserve energy and natural resources, reduce and eliminate waste, and clean up waste that has been improperly disposed of. This is likely to promote the growth of the trash bag market.

North America Trash Bags Industry Overview

The North American trash bags market is moderately fragmented with the presence of major players like Berry Global Inc., Riverside Paper Co. Inc., The Clorox Company (Glad Products Company), Cosmoplast Industrial Company LLC, and Reynolds Consumer Products Inc. (Hefty), among others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain a sustainable competitive advantage.

In September 2022, Novolex Holdings LLC announced an investment of USD 10 million to boost the capacity to recycle polyethylene films, including plastic bags, at its North Vernon, Indiana, recycling facility. The investment in recycling and recovery machinery would allow the company to produce nearly 28 million pounds of recycled material per year, which would be used to create goods built with post-industrial or post-consumer recycled content. The factory is one of the company's two world-class film recycling centers.

Reynolds Consumer Products Inc., which owns Hefty, released a new line of small and medium trash bags with high-end features in May 2022. This was done with a single-minded focus on putting the customer first.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of The Impact of COVID-19 on the Market

- 4.5 Recent Developments on the Attempts Made by Manufacturers to Use Specific Chemical Combinations and Fragrances

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 United States Continues to Lead the Market in Terms of Demand and Considering the Various Initiatives Undertaken to Promote Waste Disposal

- 5.1.2 Growing Demand for Compostable and Oxo-biodegradable Bags

- 5.2 Market Challenges

- 5.2.1 Manufacturers and Consumers are Dealing With Fluctuating Prices Due to Material Supply Challenges and Sanctions on Use of Plastic Bags

6 PREMIUM INSIGHTS ON THE OVERALL TRASH BAGS MARKET

- 6.1 Trends in Buyers Purchase Preferences (short Term (0-2 Years), Mid Term (2-4 Years), Long Term (4-6 Years))

7 MARKET SEGMENTATION

- 7.1 By End User

- 7.1.1 Residential

- 7.1.2 Commercial

- 7.1.3 Industrial

- 7.2 By Country

- 7.2.1 United States

- 7.2.2 Canada

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Berry Global Inc.

- 8.1.2 Riverside Paper Co. Inc.

- 8.1.3 The Clorox Company (Glad Products Company)

- 8.1.4 Cosmoplast Industrial Company LLC

- 8.1.5 Hefty (Reynolds Consumer Products Inc.)

- 8.1.6 Novolex Holdings LLC

- 8.1.7 International Plastics Inc.

- 8.1.8 Poly-America LP

- 8.1.9 Four Star Plastics

- 8.1.10 Neway Packaging Corporation

- 8.1.11 All American Poly

- 8.1.12 Aluf Plastics

- 8.1.13 Petoskey Plastics Inc.

- 8.1.14 Inteplast Group