|

市場調查報告書

商品編碼

1851889

立式袋:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Stand-Up Pouches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

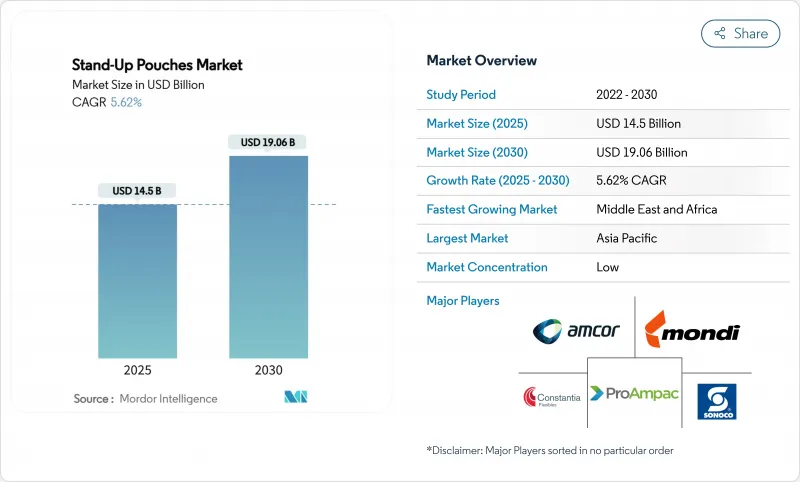

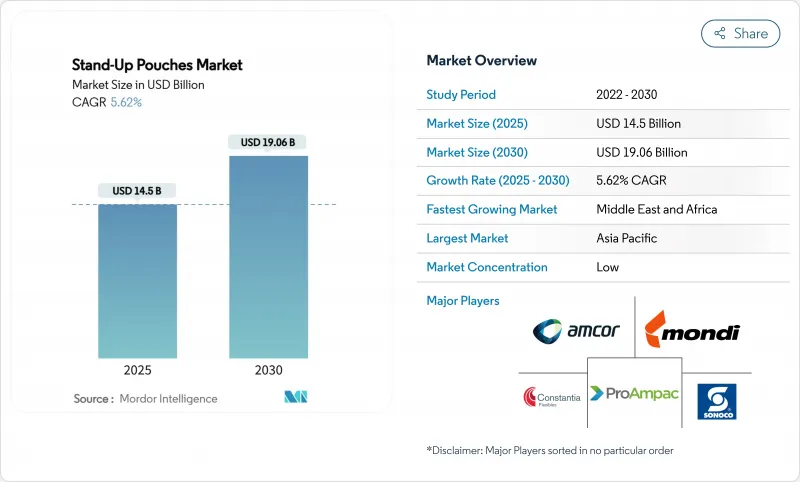

預計到 2024 年,吸嘴袋市場規模將達到 145 億美元,到 2030 年將達到 190.6 億美元,2025 年至 2030 年的複合年成長率為 5.62%。

對輕巧、可重複密封且外觀精美的包裝日益成長的需求,正推動著這一成長勢頭。歐洲的監管改革、東亞機能飲料的創新,以及北美寵物食品品牌從硬質包裝轉向軟包裝,都在加速軟包裝的普及。率先採用單一材料、可回收的包裝形式,為製造商帶來了成本和聲譽優勢;同時,熱填充蒸餾性能的提升,也為食品、飲料和家居用品等終端應用領域開闢了新的可能性。亞太地區的生產規模、拉丁美洲的技術進步,以及以安姆科、蒙迪和索諾科主導的積極併購活動,正在重新定義追求效率和循環經濟的企業之間的競爭格局。

全球立式袋市場趨勢與洞察

歐盟迅速轉向使用單一材料可回收包裝袋結構

歐盟的《包裝廢棄物法規》於2025年2月生效,要求所有消費包裝到2030年必須可回收,其中塑膠的消費後回收率必須達到30%。生產商正迅速從多層鋁箔結構過渡到與路邊回收系統相容的單層聚乙烯薄膜。安姆科的Liquiflex AmPrima包裝袋符合這些標準,與傳統複合材料相比,二氧化碳排放減少了79%,用水量減少了84%。早期採用者可以享受更低的生產者延伸責任費和更佳的貨架吸引力,而後期採用者則面臨更高的研發成本和貨架破損風險。隨著加工商獲得新的密封技術許可並在不影響阻隔性的前提下降低薄膜厚度,帶吸嘴包裝袋市場正在蓬勃發展。

東亞地區即飲機能飲料的蓬勃發展推動了熱填充裝袋的發展

東亞消費者正逐漸接受蛋白奶昔、維生素凝膠和代餐飲料等便利食品。熱填充填充(85°C以上)的特性使加工業者能夠省去防腐劑,延長常溫保存期限,並提供營養豐富的配方。森永株式會社的「in Jelly Energy Long Life」能量膠袋在日本的防災物資貨架上使用了五年之久,充分展現了其優異的阻隔性和蒸餾性能。一家韓國新興企業推出了一款針對千禧世代女性的單一蛋白粉吸嘴包裝,使其年銷售額較去年同期成長三倍。這些突破性創新推動了東南亞便利商店和高階健身房對吸嘴包裝袋的廣泛應用,為吸嘴包裝袋市場帶來了新的成長動力。

美國多層複合材料的回收管道有限

美國需要360億至430億美元的基礎建設投資,才能在2030年前將塑膠回收率提高到61%。在材料回收設施能夠識別和分離軟性複合材料之前,品牌商對擴大多層包裝袋的生產規模持謹慎態度。因此,生產商正在加速推動單一材料包裝袋的生產,但過渡成本和舊設備的風險暫時減緩了吸嘴包裝袋市場的成長。

細分市場分析

2024年,塑膠材質的吸嘴袋佔據了71.89%的市場佔有率,這主要得益於加工商對聚乙烯密封性、聚丙烯熱穩定性和PET透明度的青睞。受監管和消費者需求的推動,可生物分解吸嘴袋的年複合成長率預計到2030年將達到7.14%,但目前仍主要面向小批量產品。 Accredo Packaging公司生產的甘蔗基樹脂吸嘴袋可直接投入使用,每個吸嘴袋可減少43克二氧化碳排放。同時,Amcor公司的AmFiber紙基阻隔複合材料則瞄準了尋求無鋁保存期限的零食生產商。特製的EVOH阻隔層和尼龍紮帶層繼續為對氧氣敏感的填充物提供保護,但成本上升正推動市場轉型為高價值營養補充品產品線。預計到2028年,可生物分解吸嘴袋的市場規模將超過10億美元,但塑膠吸嘴袋仍是食品和飲料核心產品的主要支撐。不斷演變的回收設計指南正在刺激快速的實驗,使塑膠成為吸嘴袋市場生存和創新的畫布。

預計到2024年,圓底袋的市佔率將達到38.66%,主要得益於成熟的成型設備和廣泛的應用。然而,由於角底袋底部穩定性更佳,無需二次包裝即可支援更大的填充量,因此預計其複合年成長率將達到5.77%。 K型封口和Delta封口等不同封口方式尤其受到需要防篡改保護的製藥灌裝商的青睞。餐飲服務採購商對2公升和5公升的角底袋(用於醬料和調味品)的需求量很大,他們認為角底袋可以提高托盤利用率,並且與高密度聚乙烯(HDPE)瓶相比,排放減少了79%。然而,技術挑戰——主要是1公升以上規格產品在高溫高壓蒸餾過程中的頂部空間管理——減緩了歐洲湯品生產線的轉型步伐。目前正在進行的關於側邊折角形狀和瓶蓋排氣方面的研發,旨在最大限度地減少壓力差,預計將推動帶嘴袋市場佔有率的成長。

區域分析

到2024年,亞太地區將佔據38.68%的吸嘴袋市場佔有率,這主要得益於中國的大型加工廠、日本的熱填充研發以及韓國的優質化策略。預計聚乙烯供應過剩將促使到2025年新增500萬噸產能。安姆科收購位於古吉拉突邦的Phoenix Flexibles公司,將擴大其在印度價值2,000萬美元的醫療包裝細分市場的業務,並加速在地化生產。

北美憑藉著完善的食品加工基礎設施和以寵物為中心的消費文化,支撐著穩定的需求。然而,基礎設施缺口龐大,到2030年,需要400億美元用於材料回收設施的現代化。即將實施的25%樹脂關稅加劇了成本壓力,但也刺激了區域內對樹脂的投資和再生樹脂的測試。加之加州2026年可回收物含量強制令,這些政策正推動吸嘴袋市場朝向單一材料聚乙烯(PE)蒸餾形式發展。

歐洲在帶吸嘴包裝袋市場推行可回收設計法規方面處於領先地位。 Amcor、Mondi 和 Bischof+Klein 等先驅者已將符合 30% PCR 標準的 PP 和 PE 單層包裝袋商業化,與 PET/Alu/OPE 三層層級構造相比,可減少 79% 的二氧化碳排放。北歐的補充裝計畫證明,當低碳包裝與便利的線上購買結合時,消費者接受度可以迅速提高。

拉丁美洲已成為產能熱點地區:巴西食品產業成長了7.2%,百事公司正在投資2.4億美元維修一家工廠,計劃於2025年運作三台八通道袋裝灌裝機。墨西哥和哥倫比亞正在擴大循環包裝投資的稅額扣抵抵免,以吸引跨國加工商,並根據美墨加協定條款開闢對美國的出口通道。

中東和非洲將以8.84%的複合年成長率實現最快成長,主要得益於無菌牛奶、風味水和無鋁包裝果汁的需求。 SIG Prime 55在肯亞的投入使用以及利樂公司在奈及利亞的促銷宣傳活動降低了市場進入門檻。節能高效的滅菌技術和經濟實惠的安裝方案是提升該地區吸嘴袋市場佔有率的關鍵因素。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟快速過渡到可回收的單一材料包裝袋結構

- 東亞地區即機能飲料的蓬勃發展推動了熱填充吸嘴袋的發展

- 北美寵物濕食品包裝從金屬罐過渡到殺菌袋

- 非洲無菌乳製品分銷的成長為無鋁包裝袋提供了支持

- 易於傾倒的補充裝產品引領北歐美妝電商市場

- 隨著硬質包裝向軟包裝的轉換加速,巴西的軟包裝生產線投資激增。

- 市場限制

- 美國多層複合材料的回收管道有限。

- 不穩定的EVOH和尼龍樹脂價格給亞太地區的加工商帶來壓力。

- 品牌所有者對再生材料轉型的擔憂

- 歐洲1公升以上湯料包裝的蒸餾頂部空間不足

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 地緣政治情境的影響評估

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 聚對苯二甲酸乙二醇酯(PET)

- 聚乙烯(PE)

- 聚丙烯(PP)

- 乙烯 - 乙烯醇共聚物(EVOH)

- 其他塑膠

- 紙

- 金屬箔

- 可生物分解和可堆肥材料

- 塑膠

- 依產品類型

- 圓底/圓底

- K 封

- 犁/角底

- 其他產品類型

- 透過使用

- 食物

- 烤肉

- 零嘴零食

- 寵物食品

- 糖果甜點

- 其他食物

- 飲料

- 個人護理和化妝品

- 醫療保健和製藥

- 寵物護理

- 其他應用

- 食物

- 透過分銷管道

- 直銷

- 間接銷售

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor Plc

- Mondi plc

- Sonoco Products Company

- Constantia Flexibles GmbH

- ProAmpac LLC

- Smurfit WestRock

- Swiss Pac USA

- Winpak Ltd

- Uflex Limited

- Glenroy Inc.

- Flair Flexible Packaging Corp.

- Sealed Air Corp.

- Huhtamaki Oyj

- Bischof+Klein SE

- Interflex Group

- DoyPak Solutions

- Clondalkin Group

第7章 市場機會與未來展望

The spouted pouches market size reached USD 14.5 billion in 2024 and is forecast to expand to USD 19.06 billion by 2030, reflecting a 5.62% CAGR during 2025-2030.

Rising demand for lightweight, resealable, and visually engaging packaging underpins this growth momentum. Regulatory reforms in Europe, functional-beverage innovation in East Asia, and a rigid-to-flexible packaging shift among North American pet food brands are accelerating volume adoption. Early moves toward mono-material, recyclable formats give manufacturers cost and reputation advantages, while improvements in hot-fill and retort performance broaden end-use possibilities across food, beverage, and household categories. Production scale in Asia-Pacific, technology upgrades in Latin America, and a vibrant M&A pipeline led by Amcor, Mondi, and Sonoco are redefining competitive boundaries as companies chase efficiency and circularity.

Global Stand-Up Pouches Market Trends and Insights

Rapid Shift to Mono-Material Recyclable Pouch Structures in EU

The European Union Packaging and Packaging Waste Regulation effective February 2025 requires all consumer packs to be recyclable by 2030 and to contain 30% post-consumer recycled content for plastics. Producers are quickly moving from multi-layer aluminum structures to mono-material polyethylene films that remain compatible with curbside recycling streams. Amcor's Liquiflex AmPrima pouch meets these criteria and reports a 79% reduction in carbon emissions alongside an 84% cut in water use against legacy laminates. Brand owners adopting early see lower extended producer responsibility fees and improved shelf-appeal messaging, while late movers face R&D cost spikes and possible shelf-space loss. The pivot strengthens the spouted pouches market as converters license new sealing technologies and downgauge films without compromising barrier integrity.

On-the-Go Functional Beverage Boom in East Asia Spurring Hot-Fill Pouches

East-Asian consumers are embracing protein shakes, vitamin gels, and meal-replacement drinks in portable portions. Hot-fill tolerance beyond 85 °C allows processors to skip preservatives, extend ambient shelf life, and deliver nutrient-dense formulas. Japan's disaster-preparedness aisle now features Morinaga Seika's five-year "in Jelly Energy Long Life" pouch, validating extreme barrier and retort performance expectations. Start-ups in South Korea triple their year-over-year sales by marketing single-serve spouts for protein mixes targeting female millennials. These breakthroughs inspire adoption in Southeast-Asian convenience stores and premium gyms, giving the spouted pouches market fresh volume pipelines.

Limited Recycling Streams for Multi-Layer Laminates in United States

The U.S. requires USD 36-43 billion in infrastructure upgrades to lift plastics recycling rates to 61% by 2030. Until material recovery facilities can recognize and separate flexible laminates, brand owners hesitate to scale multilayer pouches. Producers are therefore accelerating mono-material development, but transition costs and legacy equipment risks temporarily slow the spouted pouches market.

Other drivers and restraints analyzed in the detailed report include:

- Migration from Metal Cans to Retort Pouches for Wet Pet Food in North America

- Growth of Aseptic Dairy Distribution in Africa Favoring Aluminum-Free Pouches

- Volatile EVOH & Nylon Resin Prices Squeezing APAC Converters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic structures controlled 71.89% of the spouted pouches market in 2024 as processors valued polyethylene's sealability, polypropylene's heat stability, and PET's clarity. Biodegradable options record a 7.14% CAGR through 2030 on regulatory and consumer pull, yet still address small-run SKUs. Accredo Packaging's sugarcane-derived resin pouch offsets 43 grams of CO2 per unit while offering drop-in machinability. Meanwhile, Amcor's AmFiber paper-based barrier laminate targets snack producers searching for aluminum-free shelf life. Specialty EVOH barriers and nylon tie layers continue to protect oxygen-sensitive fillings, but cost spikes reposition them toward high-value nutraceutical lines. The spouted pouches market size for biodegradable grades is projected to cross USD 1 billion by 2028, yet plastics will still anchor core food and beverage volumes. Evolving design-for-recycle guidelines stimulate rapid experimentation, positioning plastics as both incumbent and innovation canvas in the spouted pouches market.

Round-bottom (Doyen) pouches enjoyed 38.66% revenue share in 2024, leveraging mature forming equipment and broad application adoption. Corner-bottom designs, however, climb at 5.77% CAGR due to improved base stability that supports larger fill volumes without secondary cartons. K-seal and delta-seal variants appeal to pharmaceutical fillers needing tamper-evident integrity. Foodservice buyers pursue 2-L and 5-L corner-bottom pouches for sauces and condiments, citing pallet efficiency and 79% emission savings over HDPE bottles. Nonetheless, technical challenges-chiefly head-space management during retort for SKUs exceeding 1 L-slow migration in European soup lines. Continuous R&D in gusset geometry and cap venting aims to minimize pressure differentials, promising to unlock new spouted pouches market share gains.

The Spouted Pouches Market Report is Segmented by Material Type (Plastic, Paper, and More), Product Type (Doyen/Round Bottom, K-Seal, Plow/Corner Bottom, Other Product Types), Application (Food, Beverage, Personal Care and Cosmetics, Healthcare and Pharmaceuticals, Pet Care, Other Application), Distribution Channel (Direct Sales, Indirect Sales), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 38.68% share of the spouted pouches market in 2024, underpinned by China's large-scale converting facilities, Japan's hot-fill R&D, and South Korea's premiumization playbook. Expected polyethylene oversupply-5 million tons of new capacity in 2025-pressures film pricing, offering converters raw-material leverage but compressing margins. Amcor's acquisition of Phoenix Flexibles in Gujarat extends reach into India's USD 20 million medical-packaging niche and accelerates localized production.

North America leverages entrenched food-processing infrastructure and pets-first culture to anchor steady demand. Infrastructure gaps loom large, with a USD 40 billion funding requirement to modernize material recovery facilities before 2030. Imminent 25% resin tariffs amplify cost pressures yet are stimulating regional resin investment and recycled resin trials. Coupled with California's 2026 recyclable-content mandate, such policies push the spouted pouches market toward mono-material PE retort formats.

Europe stands at the regulatory vanguard, compelling design-for-recycling across the spouted pouches market. Early adopters-Amcor, Mondi, and Bischof + Klein-already commercialize PP and PE single-web pouches that satisfy the 30% PCR threshold and deliver 79% CO2 cuts versus PET/Alu/OPE triplex structures. Nordic refill programmes prove that consumer uptake can be rapid when lower-carbon packaging meets online convenience.

Latin America emerges as a capacity hotspot. Brazil registers 7.2% food-industry growth, and PepsiCo's USD 240 million plant upgrade will commission three eight-lane pouch fillers in 2025. Mexico and Colombia extend tax credits for circular-packaging investments, attracting multinational converters and opening export corridors into the United States under USMCA provisions.

The Middle East and Africa experiences the fastest CAGR at 8.84%, led by aseptic milk, flavored water, and fruit nectar packed in aluminum-free pouches. SIG's Prime 55 installation in Kenya and Tetra Pak's promotional campaigns in Nigeria lower entry barriers. Energy-efficient sterilization and fitment affordability remain success factors poised to grow regional share within the spouted pouches market.

- Amcor Plc

- Mondi plc

- Sonoco Products Company

- Constantia Flexibles GmbH

- ProAmpac LLC

- Smurfit WestRock

- Swiss Pac USA

- Winpak Ltd

- Uflex Limited

- Glenroy Inc.

- Flair Flexible Packaging Corp.

- Sealed Air Corp.

- Huhtamaki Oyj

- Bischof + Klein SE

- Interflex Group

- DoyPak Solutions

- Clondalkin Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid shift to mono-material recyclable pouch structures in EU

- 4.2.2 On-the-go functional beverage boom in East Asia spurring hot-fill spouted pouches

- 4.2.3 Migration from metal cans to retort pouches for wet pet food in North America

- 4.2.4 Growth of aseptic dairy distribution in Africa favouring aluminium-free pouches

- 4.2.5 Nordic beauty e-commerce driving refill pouch SKUs with easy-pour features

- 4.2.6 CapEx surge in Brazilian pouch-filling lines accelerating rigid-to-flexible switch

- 4.3 Market Restraints

- 4.3.1 Limited recycling streams for multi-layer laminates in the U.S.

- 4.3.2 Volatile EVOH and nylon resin prices squeezing APAC converters

- 4.3.3 Brand-owner concerns over recycled-content migration

- 4.3.4 Retort head-space failures in >1-L European soup packs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Geopolitical Scenario Impact

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Polyethylene Terephthalate (PET)

- 5.1.1.2 Polyethylene (PE)

- 5.1.1.3 Polypropylene (PP)

- 5.1.1.4 Ethylene Vinyl Alcohol Copolymer (EVOH)

- 5.1.1.5 Other Plastics

- 5.1.2 Paper

- 5.1.3 Metal Foil

- 5.1.4 Biodegradable and Compostable Materials

- 5.1.1 Plastic

- 5.2 By Product Type

- 5.2.1 Doyen / Round Bottom

- 5.2.2 K-Seal

- 5.2.3 Plow / Corner Bottom

- 5.2.4 Other Product Types

- 5.3 By Application

- 5.3.1 Food

- 5.3.1.1 Baked Food

- 5.3.1.2 Snacked Food

- 5.3.1.3 Pet Food

- 5.3.1.4 Confectionery

- 5.3.1.5 Other Food

- 5.3.2 Beverage

- 5.3.3 Personal Care and Cosmetics

- 5.3.4 Healthcare and Pharmaceuticals

- 5.3.5 Pet Care

- 5.3.6 Other Application

- 5.3.1 Food

- 5.4 By Distribution Channel

- 5.4.1 Direct Sales

- 5.4.2 Indirect Sales

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor Plc

- 6.4.2 Mondi plc

- 6.4.3 Sonoco Products Company

- 6.4.4 Constantia Flexibles GmbH

- 6.4.5 ProAmpac LLC

- 6.4.6 Smurfit WestRock

- 6.4.7 Swiss Pac USA

- 6.4.8 Winpak Ltd

- 6.4.9 Uflex Limited

- 6.4.10 Glenroy Inc.

- 6.4.11 Flair Flexible Packaging Corp.

- 6.4.12 Sealed Air Corp.

- 6.4.13 Huhtamaki Oyj

- 6.4.14 Bischof + Klein SE

- 6.4.15 Interflex Group

- 6.4.16 DoyPak Solutions

- 6.4.17 Clondalkin Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment