|

市場調查報告書

商品編碼

1851812

延展實境(XR):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Extended Reality (XR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

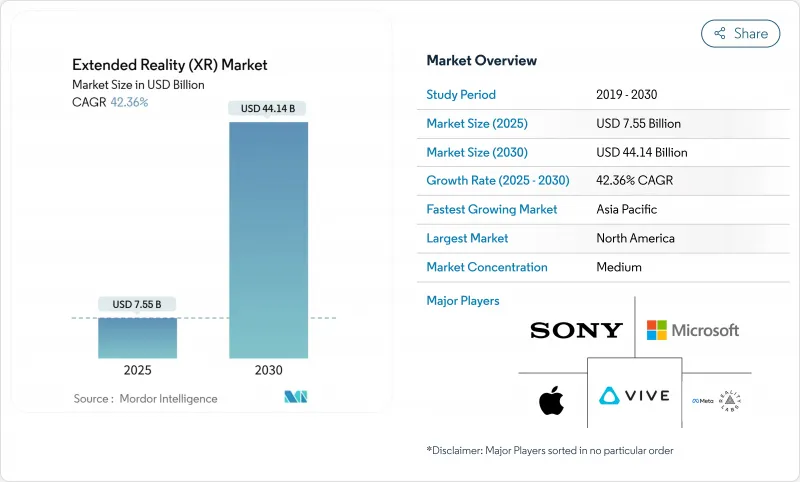

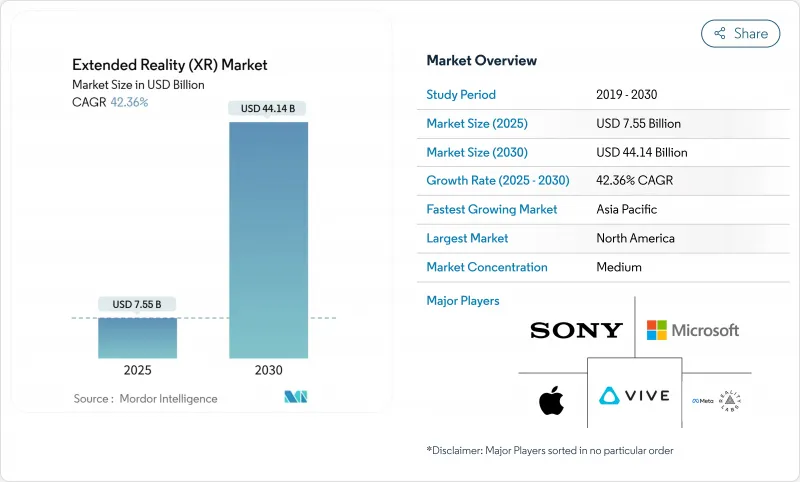

預計到 2025 年,延展實境(XR) 市場將達到 75.5 億美元,到 2030 年將達到 441.4 億美元,複合年成長率為 42.36%。

XR技術在製造業、醫療保健、國防等領域的快速企業應用,使其超越了消費娛樂,從遊戲新奇玩意轉變為關鍵任務生產力工具。第五代行動網路與邊緣運算的結合消除了延遲障礙,使得毫秒精度的可視化在工廠和手術室等場所實用化。嵌入空間運算的人工智慧可實現培訓內容的個人化,而即時分析則形成回饋閉迴路,進一步提升了可衡量的效益。美國兩國政府的資助,以及OpenXR等開放標準的推動,正在加速生態系統的成熟,並緩解人們對廠商鎖定的擔憂。供應鏈限制和零件價格上漲仍然是阻礙因素,但隨著新的半導體產能和替代材料來源投入生產,這些因素正在逐步緩解。

全球延展實境(XR)市場趨勢與洞察

擴大5G覆蓋範圍和邊緣運算可產生協同效應

低於 20 毫秒的延遲使得多人 VR 協作擺脫了背包的束縛,愛立信、AT&T、Dreamscape 和高通的試驗都證明了這一點。中國鋼鐵集團的 5G 虛擬工廠參觀整合了來自 85 個生產節點的即時數據,證明了其在重工業領域的價值。 DHL 的智慧眼鏡試驗展示了即時揀貨指導在物流的優勢。隨著運算向網路邊緣轉移,設備重量減輕,提高了輪班期間的舒適度。因此,通訊業者正在用戶 50 公里範圍內部署微型資料中心,以保持身臨其境型吞吐量。

XR正擴大被整合到數位雙胞胎和工業4.0框架中。

和碩的 PEGAVERSE 基於 NVIDIA Omniverse 建造了五個虛擬工廠,透過遠距離診斷和場景測試來減少停機時間和差旅時間。BASF的 AR 工廠方案將感測器數據與身臨其境型視覺化相結合,以簡化風險識別流程。西門子和SONY推出了售價 4,750 美元的 SRH-S1 工程頭戴式顯示器,實現了像素級精確的設計協作。 OpenUSD 對齊技術將 CAD、PLM 和物聯網資料整合到單一空間層。因此,平台供應商可以透過訂閱模式而非一次性授權費來實現視覺化功能的獲利。

高傳真光學元件和處理器的初始成本很高

鎵和鍺的短缺導致光學元件價格上漲高達25%。 Meta旗下的Reality Labs預計2024年第四季XR硬體銷售額將達到11億美元,但自2020年以來累計虧損600億美元,凸顯了盈利的挑戰。中小企業缺乏資金或明確的投資報酬率,因此猶豫不決。雲渲染的XR技術雖然可以減輕設備重量,但會帶來延遲方面的權衡,使其應用範圍僅限於5G訊號覆蓋良好的區域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大5G覆蓋範圍和邊緣運算可產生協同效應

- XR正擴大被整合到數位雙胞胎和工業4.0框架中。

- 企業對身臨其境型遠距培訓的需求日益成長

- 空間感測器在大眾市場智慧型手機中的整合

- 政府資助與元宇宙相關的研究和開發

- 採用開放式XR標準可減少廠商鎖定。

- 市場限制

- 高傳真光學元件和處理器的初始成本很高

- 使用者暈動症和人體工學限制

- 眼動追蹤和手部追蹤分析中的資料隱私漏洞

- 內容編寫工具的生態系支離破碎

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 報價

- 硬體

- 軟體

- 服務

- 依設備類型

- 頭戴式顯示器(有線、獨立式)

- 抬頭顯示器

- 手持行動裝置

- 其他

- 透過技術

- 虛擬實境(VR)

- 擴增實境(AR)

- 混合實境(MR)

- 按最終用戶行業分類

- 遊戲與娛樂

- 醫療保健和生命科學

- 工業和製造業

- 零售與電子商務

- 教育和培訓

- 航太/國防

- 建築、工程與施工

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Meta Platforms Inc.(Reality Labs)

- Sony Group Corp.

- Microsoft Corp.

- Apple Inc.

- HTC Corp.(Vive)

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc.(Google XR)

- Pico Interactive Inc.(ByteDance)

- Varjo Technologies Oy

- Magic Leap Inc.

- Nvidia Corp.

- Unity Technologies Inc.

- Vuzix Corp.

- Lenovo Group Ltd.

- Snap Inc.

- Niantic Inc.

- Ultraleap Ltd.

- HP Inc.

- Immersion Corp.

第7章 市場機會與未來展望

The Extended Reality market reached USD 7.55 billion in 2025 and is projected to deliver USD 44.14 billion by 2030, reflecting a 42.36% CAGR.

Rapid enterprise adoption across manufacturing, healthcare, and defense now outpaces consumer entertainment, turning XR from a gaming novelty into a mission-critical productivity tool. Five-generation mobile networks paired with edge computing have erased latency barriers, making millisecond-accurate visualization practical on factory floors and in surgical suites. Artificial intelligence embedded in spatial computing personalizes training content while real-time analytics close feedback loops, further raising measurable returns. Government funding in the United States and China, coupled with open standards such as OpenXR, is accelerating ecosystem maturity and reducing vendor lock-in worries. Supply chain constraints and component price inflation remain headwinds but continue to ease as new semiconductor capacity and alternative material sourcing enter production.

Global Extended Reality (XR) Market Trends and Insights

Expanding 5G Coverage and Edge Computing Synergy

Sub-20 ms latency now enables multi-user VR collaboration without tethered backpack PCs, as trials by Ericsson, AT&T, Dreamscape, and Qualcomm have shown. China Steel Corporation's 5G-enabled virtual factory tours integrate live data from 85 production nodes, proving value for heavy industry. DHL smart-glasses pilots illustrate logistics gains from real-time pick guidance. Device weight drops as compute moves to the network edge, boosting shift-length comfort. Telcos therefore place micro-data-centers within 50 km of users to sustain immersive throughput.

Increased Integration of XR into Digital Twin and Industry 4.0 Frameworks

Pegatron's PEGAVERSE builds five virtual factories on NVIDIA Omniverse for remote diagnostics and scenario testing, lowering downtime and travel. BASF's AR-enabled plant planning links sensor data with immersive visualization to streamline hazard identification. Siemens and Sony priced the SRH-S1 engineering headset at USD 4,750 to deliver pixel-accurate design collaboration. OpenUSD alignment lets disparate CAD, PLM, and IoT feeds merge into a single spatial layer. Platform vendors thus monetize subscription-based visualization rather than one-off license fees.

High Upfront Costs of High-Fidelity Optics and Processors

Gallium and germanium shortages have inflated optics prices by up to 25%. Meta's Reality Labs has accumulated USD 60 billion losses since 2020 while selling USD 1.1 billion in Q4 2024 XR hardware, underscoring profitability challenges. Smaller firms hesitate without capital or clear ROI. Cloud-rendered XR lightens devices yet introduces latency trade-offs that limit usage to well-served 5G zones.

Other drivers and restraints analyzed in the detailed report include:

- Rising Enterprise Demand for Immersive Remote Training

- Mass-Market Smartphone Integration of Spatial Sensors

- User Motion-Sickness and Ergonomic Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Meta Platforms Inc. (Reality Labs)

- Sony Group Corp.

- Microsoft Corp.

- Apple Inc.

- HTC Corp. (Vive)

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Alphabet Inc. (Google XR)

- Pico Interactive Inc. (ByteDance)

- Varjo Technologies Oy

- Magic Leap Inc.

- Nvidia Corp.

- Unity Technologies Inc.

- Vuzix Corp.

- Lenovo Group Ltd.

- Snap Inc.

- Niantic Inc.

- Ultraleap Ltd.

- HP Inc.

- Immersion Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding 5G coverage and edge computing synergy

- 4.2.2 Increased integration of XR into digital twin and Industry 4.0 frameworks

- 4.2.3 Rising enterprise demand for immersive remote-training

- 4.2.4 Mass-market smartphone integration of spatial sensors

- 4.2.5 Government funding for metaverse-related Rand

- 4.2.6 Adoption of open XR standards lowering vendor lock-in

- 4.3 Market Restraints

- 4.3.1 High upfront costs of high-fidelity optics and processors

- 4.3.2 User motion-sickness and ergonomic limitations

- 4.3.3 Data-privacy gaps in eye- and hand-tracking analytics

- 4.3.4 Fragmented content-authoring tool ecosystem

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Device Type

- 5.2.1 Head-Mounted Displays (Tethered, Stand-alone)

- 5.2.2 Head-Up Displays

- 5.2.3 Handheld and Mobile Devices

- 5.2.4 Others

- 5.3 By Technology

- 5.3.1 Virtual Reality (VR)

- 5.3.2 Augmented Reality (AR)

- 5.3.3 Mixed Reality (MR)

- 5.4 By End-user Industry

- 5.4.1 Gaming and Entertainment

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Industrial and Manufacturing

- 5.4.4 Retail and E-commerce

- 5.4.5 Education and Training

- 5.4.6 Aerospace and Defense

- 5.4.7 Architecture, Engineering and Construction

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Meta Platforms Inc. (Reality Labs)

- 6.4.2 Sony Group Corp.

- 6.4.3 Microsoft Corp.

- 6.4.4 Apple Inc.

- 6.4.5 HTC Corp. (Vive)

- 6.4.6 Qualcomm Technologies Inc.

- 6.4.7 Samsung Electronics Co. Ltd.

- 6.4.8 Alphabet Inc. (Google XR)

- 6.4.9 Pico Interactive Inc. (ByteDance)

- 6.4.10 Varjo Technologies Oy

- 6.4.11 Magic Leap Inc.

- 6.4.12 Nvidia Corp.

- 6.4.13 Unity Technologies Inc.

- 6.4.14 Vuzix Corp.

- 6.4.15 Lenovo Group Ltd.

- 6.4.16 Snap Inc.

- 6.4.17 Niantic Inc.

- 6.4.18 Ultraleap Ltd.

- 6.4.19 HP Inc.

- 6.4.20 Immersion Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment