|

市場調查報告書

商品編碼

1851709

定位服務:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Location Based Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

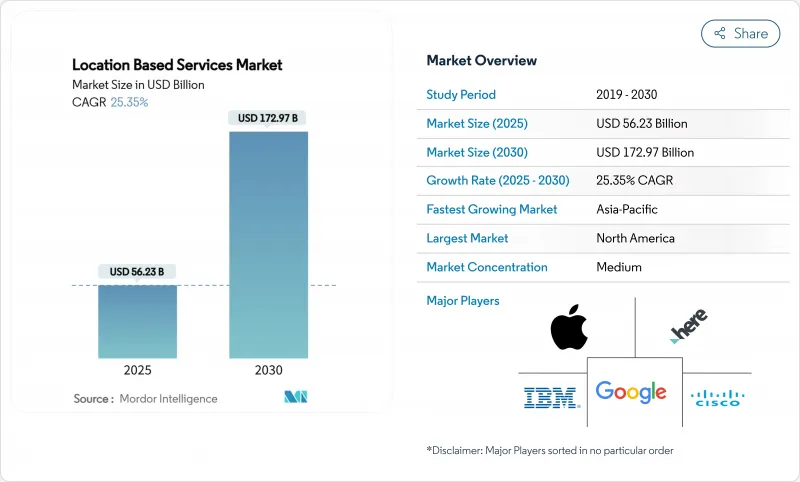

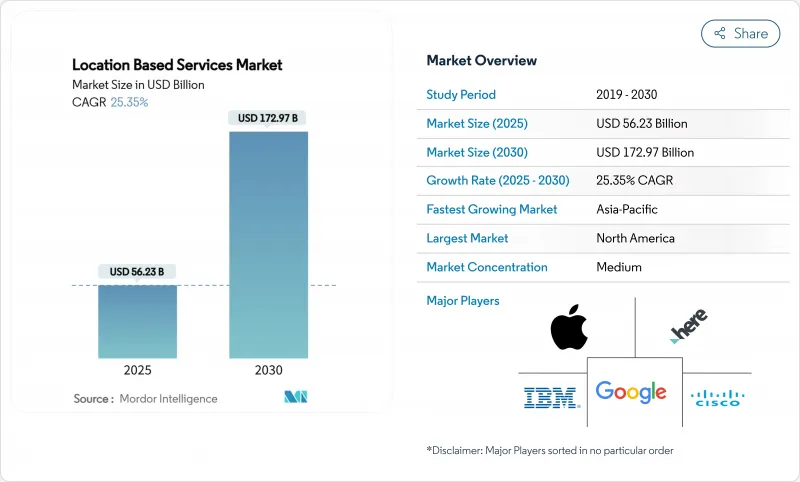

預計到 2025 年,定位服務市場規模將達到 562.3 億美元,到 2030 年將達到 1,729.7 億美元,年複合成長率為 25.35%。

這一積極發展趨勢得益於5G網路切片技術的推出(可確保亞米級定位精度)、強制執行高級移動定位資訊的緊急呼叫指令,以及依賴即時定位系統的數位雙胞胎物流中心的興起。不斷成長的在地化廣告預算、公分級衛星的普及以及人工智慧主導的室內定位技術,都在拓展定位應用場景,促使企業將位置智慧融入行銷、安全和工業自動化工作流程。因此,市場參與企業正轉向多模態定位引擎,這些引擎融合了GPS、UWB、BLE、Wi-Fi FTM和感測器融合技術,以提供無縫的室內外覆蓋。併購、高價值夥伴關係和合規支出正在推動產業整合,而隱私法規則正在塑造以明確同意為基礎的商業模式。

全球定位服務市場趨勢與洞察

在超當地語系化廣告預算正在爆炸性成長

負責人計劃在2025年將超過20%的預算分配給本地宣傳活動,高於2024年的46%。谷歌地圖每年透過廣告創造111億美元的收入。採用基於位置的推播通知的零售商報告稱,店內轉換率大幅提升,驗證了收入成長的假設。更精細的位置定位也實現了動態創新最佳化,使品牌能夠向細分市場推送客製化訊息。因此,定位服務市場正持續受到廣告科技平台、出版商和品牌的青睞,他們都希望將線上意圖與線下購買路徑連接起來。

經合組織市場中關於電子911和反洗錢緊急情況準確性的要求

歐洲電子通訊法典規定所有智慧型手機必須配備自動定位定位(AML)功能,在87%的緊急情況下,能夠提供50公尺以內的呼叫者座標。英國的經驗表明,與基地台定位(Cell-ID)相比,AML的定位精度提高了4000倍,縮短了反應時間,並有望在10年內挽救7500人的生命。目前已有超過30個國家採用了AML,美國也在加強E-911的垂直定位精度要求。因此,電信業者必須升級其定位核心網路和切換應用程式介面(API),從而推動對混合式全球導航衛星系統(GNSS)、Wi-Fi和感測器輔助解決方案的投入。合規預算直接擴大了定位服務市場,因為通訊業者將先進的定位中間件嵌入其網路核心網路和終端用戶應用程式中。

消費者對位置隱私的抵抗情緒日益高漲

研究表明,71% 的用戶只有在獲得明確同意後才會共用位置資訊。 GDPR 強制要求資料最小化,CCPA 則強制要求使用者選擇退出,從而將持續追蹤的範圍減少了高達 30%。印度的 DPDP 法案引入了額外的同意機制,並強制服務提供者投資於差分隱私和聯邦學習模型,這增加了工程成本。這些變化減緩了資料收集速度,並抑制了定位服務市場中某些廣告收入來源。

細分市場分析

到2024年,隨著企業將設計、部署和支援外包給託管服務專家,服務收入將佔總收入的47.5%。然而,軟體預計將實現26.8%的複合年成長率,凸顯了人工智慧分析如何將原始數據轉化為業務行動。大型第三方物流公司整合數位雙胞胎指揮中心,顯示承包工程套件為何能吸引高額合約。同時,隨著超寬頻(UWB)錨點和藍牙低功耗(BLE)閘道器在醫療機構中日益普及,硬體業務也保持著積極的成長動能。

隨著 Mapbox 的 MapGPT 和 TomTom 的 Azure 整合使汽車製造商無需更換車載設備即可推廣無線升級,軟體訂閱定位服務市場規模正在穩步擴大。服務整合商透過捆綁硬體、雲端儀表板和分析功能,降低了客戶的整體擁有成本,並提高了對經常性收入的可見度。

儘管全球導航衛星系統(GNSS)生態系統日趨成熟,室外定位仍佔據主導地位,但室內部署正在迅速擴張。預計到2024年,室外定位服務市佔率將達到68.6%,而室內定位市場將逐漸趨於融合,到2030年複合年成長率(CAGR)將達到28.6%。醫院、購物中心和機場正在部署低功耗藍牙(BLE)和超寬頻(UWB)標籤,以縮短資產搜尋週期並引導訪客。

混合解決方案可在 GPS、5G、Wi-Fi 和藍牙之間實現無縫切換,從而保持使用者體驗。標準化聯盟不斷完善精度基準,降低校準成本,釋放潛在需求,並擴大定位服務的整體市場。

區域分析

北美地區將在2024年佔據最大的市場佔有率,達到36.8%,這主要得益於支援AML功能的智慧型手機的廣泛普及和強大的雲端基礎設施。 HERE Technologies與AWS達成的10億美元合作等高價值交易,充分體現了該地區的規模優勢。聯邦政府對E-911緊急呼叫系統的最後期限確保了營運商的持續投資,而汽車製造商正在試驗車道級高清地圖,以實現L3級自動駕駛。

亞太地區預計將以25.8%的複合年成長率實現最快成長,到2030年將擁有21億獨立行動用戶,並為GDP貢獻8,800億美元。中國、韓國和日本獨立部署5G網路將促進基於網路的定位應用程式介面(API)的發展,而像GAGAN這樣的衛星增強系統(SBAS)衛星群將與全球導航衛星系統(GNSS)互補,用於精密農業。各國政府正在支持平衡創新與隱私的資料管治框架,促進國內生態系統的構建,並擴大全部區域的定位服務市場規模。

歐洲透過嚴格的隱私保護指南,穩步推動基於位置的服務發展,從而增強了消費者的信任。從2022年起,所有智慧型手機都將強制使用反洗錢功能,這將推動通訊業者和公共安全應答中心(PSAP)進行後端升級。專注於隱私權保護的新興企業正積極採用差分隱私技術,以滿足GDPR的要求,並豐富服務的多樣性。南美洲和中東/非洲地區仍在發展中,但已展現出巨大的潛力。巴西正在航空領域推廣基於位置的服務(SBAS)技術,海灣地區的智慧城市專案正在大型購物中心部署藍牙低功耗(BLE)行動商務信標。非洲區域航空組織正在合作開發SatNav-Africa SBAS項目,為未來的精密農業和交通運輸服務奠定基礎。這些努力共同擴大了定位服務市場的地理覆蓋範圍。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 市場定義與研究假設

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在地化廣告預算正在爆炸性成長

- 經合組織市場中關於電子911和反洗錢緊急情況準確性的要求

- BLE、UWB 和感測器融合在室內定位領域的崛起

- 5G網路切片實現亞計量位置服務

- 「數位雙胞胎」物流樞紐的激增需要即時定位系統(RTLS)。

- 基於衛星的增強技術(SBAS、多GNSS)可實現公分級精度

- 市場限制

- 消費者對位置隱私的抵抗情緒日益高漲

- 法規碎片化(GDPR、CCPA、印度DPDP法案)

- 室內地圖標準化的缺失增加了整合成本。

- 密集城區射頻訊號多路徑效應及干擾

- 價值鏈分析

- 關鍵法規結構評估

- 關鍵相關人員影響評估

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素的影響

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 按位置類型

- 室內的

- 戶外的

- 核心技術

- GPS/A-GPS

- Wi-Fi 與 WLAN 三角定位

- Bluetooth Low Energy(BLE)

- 超寬頻(UWB)

- RFID和NFC

- 透過使用

- 導航與地圖繪製

- 基於位置的廣告和促銷

- 資產和車隊追蹤

- 緊急服務和公共

- 遊戲與擴增實境

- 社群媒體與互動

- 按最終用戶行業分類

- 零售和快速消費品

- 運輸與物流

- 醫療保健和生命科學

- 電信和資訊技術服務

- 石油、天然氣和能源

- 政府/公共部門

- 製造業和工業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Google LLC(Alphabet Inc.)

- Apple Inc.

- Cisco Systems, Inc.

- IBM Corporation

- HERE Global BV(Nokia Corporation)

- Microsoft Corporation

- Ericsson AB

- Alcatel-Lucent Enterprise International Limited(ALE International)

- Hewlett Packard Enterprise Company(Aruba Networks)

- Zebra Technologies Corporation

- Maxar Technologies Inc.

- Esri Global Inc.

- Qualcomm Technologies Inc.

- Garmin Ltd.

- TomTom NV

- Baidu Inc.

- IndoorAtlas Ltd.

- Sewio Networks sro

- Ubiquicom Srl

- HID Global Corporation(ASSA ABLOY AB)

- Teldio Corporation

- Creativity Software Ltd.

- GL Communications Inc.

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The location-based services market size equals USD 56.23 billion in 2025 and is forecast to advance at a 25.35% CAGR, reaching USD 172.97 billion by 2030.

This brisk trajectory stems from 5G network-slicing deployments that guarantee sub-meter accuracy, mandatory emergency-call regulations that enforce Advanced Mobile Location, and the rise of digital-twin logistics hubs that depend on real-time location systems. Intensifying hyper-local advertising budgets, centimeter-grade satellite augmentation, and AI-driven indoor positioning all expand addressable use cases, prompting enterprises to embed location intelligence across marketing, safety, and industrial automation workflows. Market participants therefore focus on multi-modal positioning engines that blend GPS, UWB, BLE, Wi-Fi FTM, and sensor fusion to deliver seamless indoor-outdoor coverage. Mergers, high-value partnerships, and compliance spending drive consolidation, while privacy regulation shapes commercial models toward explicit-consent engagement.

Global Location Based Services Market Trends and Insights

Explosion of hyper-local advertising budgets

Marketers plan to allocate 20%-plus of budgets to local campaigns in 2025, up from 46% in 2024, as geofencing proves effective for foot-traffic uplift. Google Maps already monetizes USD 11.1 billion annually through ad placements. Retailers adopting location-triggered push notifications report sharp increases in in-store conversions, validating the revenue-expansion thesis. Greater location granularity also supports dynamic creative optimization, letting brands tailor messages to micro-markets. As a result, the location-based services market gains sustained demand from advertising technology platforms, publishers, and brands eager to link online intent with offline purchase paths.

Mandates for e-911 and AML emergency accuracy in OECD markets

The European Electronic Communications Code requires AML on all smartphones, delivering caller coordinates within 50 m for 87% of emergencies . The UK experience shows a 4,000-fold accuracy boost versus Cell-ID, cutting response times and potentially saving 7,500 lives over 10 years. More than 30 nations have adopted AML, while the US is tightening E-911 vertical-accuracy rules. Telcos must therefore upgrade positioning cores and hand-off APIs, fueling spending on hybrid GNSS, Wi-Fi, and sensor-assisted solutions. Compliance budgets directly expand the location-based services market as operators embed advanced location middleware within network cores and end-user apps.

Heightened consumer push-back on location privacy

Surveys show 71% of users will only share location after explicit consent. GDPR mandates data-minimization, while CCPA imposes opt-out mechanics, reducing always-on tracking coverage by up to 30%. India's DPDP Act introduces extra consent layers, compelling providers to invest in differential-privacy and federated-learning models that add engineering cost. These shifts slow data-collection velocity, tempering certain advertising revenue streams inside the location-based services market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Indoor Positioning via BLE, UWB and Sensor Fusion

- 5G Network Slicing Enabling Sub-meter Latency LBS

- Regulatory fragmentation (GDPR, CCPA, India DPDP Act)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services represented 47.5% of 2024 revenue as enterprises outsourced design, deployment, and support to managed-service experts. Software, however, is forecast to log a 26.8% CAGR, underscoring how AI analytics convert raw pings into business actions. Large 3PLs integrating digital-twin command centers illustrate why turnkey suites attract premium subscriptions. Meanwhile, hardware growth stays positive as UWB anchors and BLE gateways proliferate in healthcare campuses.

The location-based services market size for software subscriptions climbs steadily as Mapbox's MapGPT and TomTom's Azure integrations let automakers push over-the-air upgrades without refreshing on-board units. Service integrators bundle hardware, cloud dashboards, and analytics, ensuring lower total cost of ownership for clients and reinforcing recurring-revenue visibility.

Outdoor positioning still dominates owing to mature GNSS ecosystems, yet indoor deployments are scaling fast. The location-based services market share for outdoor stood at 68.6% in 2024; indoor positioning is tracking a 28.6% CAGR through 2030, suggesting convergence down the line. Hospitals, malls, and airports deploy BLE and UWB tags to cut asset-search cycles and guide visitors, inching the indoor slice toward parity with outdoor during the forecast horizon.

Hybrid solutions hand-off seamlessly between GPS, 5G, Wi-Fi, and Bluetooth, preserving user experience. Standardisation consortia continue refining accuracy benchmarks, which should trim calibration costs and unlock pent-up demand, expanding the overall location-based services market.

The Location Based Services Market Report is Segmented by Component (Hardware, Software, Services), Location Type (Indoor, Outdoor), Core Technology (GPS/A-GPS, Wi-Fi and WLAN Triangulation, and More), Application (Navigation and Mapping, and More), End-User Industry (Retail and FMCG, Transportation and Logistics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest slice at 36.8% in 2024 on the back of AML-ready smartphone penetration and robust cloud infrastructure. High-value contracts such as HERE Technologies' USD 1 billion AWS alliance illustrate the region's scale. Federal E-911 deadlines ensure continuous operator investment, while automotive OEMs trial lane-level HD maps for Level-3 autonomy.

Asia-Pacific is the fastest-growing at 25.8% CAGR, with unique mobile subscribers on track to hit 2.1 billion by 2030 and contribute USD 880 billion to GDP . Standalone 5G rollouts in China, Korea, and Japan foster network-based positioning APIs; SBAS constellations such as GAGAN complement GNSS for precision farming. Governments champion data-governance frameworks that balance innovation with privacy, encouraging domestic ecosystem formation and enlarging the location-based services market size across the region.

Europe maintains steady momentum through stringent privacy leadership that nurtures consumer trust. AML has been mandatory on all smartphones since 2022, catalyzing backend upgrades among carriers and PSAPs. An emerging crop of privacy-focused startups employs differential-privacy to meet GDPR, enriching service diversity. Southern and Eastern European cities trial U-Space corridors requiring reliable drone positioning, adding a new adjacency.South America and Middle East and Africa remain nascent but promising. Brazil adopts SBAS for aviation, while Gulf smart-city programs deploy BLE m-commerce beacons in mega-malls. African regional aviation bodies collaborate on SatNav-Africa SBAS, sowing foundational infrastructure for future precision-agriculture and transport services. Collectively these initiatives broaden the geographic footprint of the location-based services market.

- Google LLC (Alphabet Inc.)

- Apple Inc.

- Cisco Systems, Inc.

- IBM Corporation

- HERE Global B.V. (Nokia Corporation)

- Microsoft Corporation

- Ericsson AB

- Alcatel-Lucent Enterprise International Limited (ALE International)

- Hewlett Packard Enterprise Company (Aruba Networks)

- Zebra Technologies Corporation

- Maxar Technologies Inc.

- Esri Global Inc.

- Qualcomm Technologies Inc.

- Garmin Ltd.

- TomTom N.V.

- Baidu Inc.

- IndoorAtlas Ltd.

- Sewio Networks s.r.o.

- Ubiquicom S.r.l.

- HID Global Corporation (ASSA ABLOY AB)

- Teldio Corporation

- Creativity Software Ltd.

- GL Communications Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of hyper-local advertising budgets

- 4.2.2 Mandates for e-911 and AML emergency accuracy in OECD markets

- 4.2.3 Rise of indoor positioning via BLE, UWB and sensor fusion

- 4.2.4 5G network slicing enabling sub-meter latency LBS

- 4.2.5 Proliferation of 'digital twin' logistics hubs needing RTLS

- 4.2.6 Satellite-based augmentation (SBAS, multi-GNSS) for cm-grade precision

- 4.3 Market Restraints

- 4.3.1 Heightened consumer push-back on location privacy

- 4.3.2 Regulatory fragmentation (GDPR, CCPA, India DPDP Act)

- 4.3.3 Indoor mapping standardisation lag increases integration cost

- 4.3.4 RF-signal multipath and interference in dense urban cores

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Location Type

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By Core Technology

- 5.3.1 GPS / A-GPS

- 5.3.2 Wi-Fi and WLAN Triangulation

- 5.3.3 Bluetooth Low Energy (BLE)

- 5.3.4 Ultra-Wideband (UWB)

- 5.3.5 RFID and NFC

- 5.4 By Application

- 5.4.1 Navigation and Mapping

- 5.4.2 Location-Based Advertising and Promotion

- 5.4.3 Asset and Fleet Tracking

- 5.4.4 Emergency Services and Public Safety

- 5.4.5 Gaming and Augmented Reality

- 5.4.6 Social Media and Engagement

- 5.5 By End-user Industry

- 5.5.1 Retail and FMCG

- 5.5.2 Transportation and Logistics

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Telecom and IT Services

- 5.5.5 Oil, Gas and Energy

- 5.5.6 Government and Public Sector

- 5.5.7 Manufacturing and Industrial

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Google LLC (Alphabet Inc.)

- 6.4.2 Apple Inc.

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 IBM Corporation

- 6.4.5 HERE Global B.V. (Nokia Corporation)

- 6.4.6 Microsoft Corporation

- 6.4.7 Ericsson AB

- 6.4.8 Alcatel-Lucent Enterprise International Limited (ALE International)

- 6.4.9 Hewlett Packard Enterprise Company (Aruba Networks)

- 6.4.10 Zebra Technologies Corporation

- 6.4.11 Maxar Technologies Inc.

- 6.4.12 Esri Global Inc.

- 6.4.13 Qualcomm Technologies Inc.

- 6.4.14 Garmin Ltd.

- 6.4.15 TomTom N.V.

- 6.4.16 Baidu Inc.

- 6.4.17 IndoorAtlas Ltd.

- 6.4.18 Sewio Networks s.r.o.

- 6.4.19 Ubiquicom S.r.l.

- 6.4.20 HID Global Corporation (ASSA ABLOY AB)

- 6.4.21 Teldio Corporation

- 6.4.22 Creativity Software Ltd.

- 6.4.23 GL Communications Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment