|

市場調查報告書

商品編碼

1851699

浮體式海上風電:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Floating Offshore Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

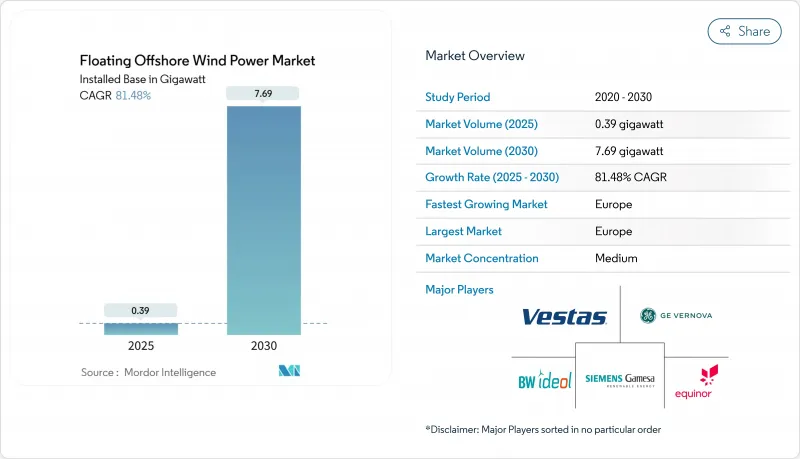

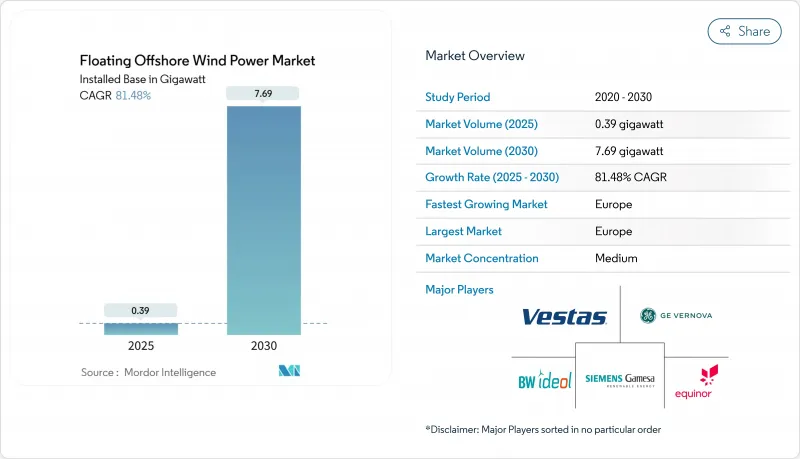

預計浮體式海上風電市場規模將從 2025 年的 0.39 吉瓦成長到 2030 年的 7.69 吉瓦,在預測期(2025-2030 年)內實現 81.48% 的複合年成長率。

這項擴張反映了深水區域的可用性,深水區域擁有全球80%的海上風能資源。同時,成本的快速下降預計在2030年將平準化能源成本降至50-100歐元/兆瓦時。隨著浮體式海上風電市場進入商業化階段,圍繞傳統固定式計劃建構的供應鏈正在重組,以適應半潛式和立柱式平台。這些平台可在碼頭組裝,並拖曳至1000公尺以上的深海。區域政策也在加速推進:歐洲差價合約(CfD)改革正在穩定收入;美國的「浮體式海上風電」項目以及日本和韓國的租賃競標正在釋放資本;而墨西哥灣的油氣平台改造則凸顯了跨行業的協同效應。這些因素,加上新興的氫能共址方案以吸收剩餘電力,將推動浮體式海上風電市場進入蓬勃發展的新十年。

全球浮體式海上風電市場趨勢與洞察

美國和亞太地區深水區租賃活動增加

美國海洋能源管理局正準備在2025年前進行多項海上漂浮式風電專案銷售,目標是在2035年實現15吉瓦的浮體式海上風電裝置容量。聯邦政府的「浮體式海上風電計畫」將這些租賃計畫與旨在降低70%成本的研發活動結合。在亞太地區,韓國1.8兆瓦的競標以及日本參與美國成本削減舉措,凸顯了透過雙邊夥伴關係在全球範圍內構建的2.44兆瓦項目儲備。電力生產商將這些訂單視為從示範電站到多吉瓦級陣列的墊腳石,鼓勵他們儘早投資港口維修、電纜工廠和安裝船。因此,隨著浮體式海上風電市場接近每年吉瓦級新增裝置容量,環太平洋地區持續推行相關政策將確保穩定的收入來源。

透過將渦輪機尺寸快速提升至 15-20MW 等級來降低平準化度電成本

將風力渦輪機的功率從6-10兆瓦提升至15-20兆瓦,可使每兆瓦的基座數量減少高達40%,從而直接降低鋼材和錨碇的使用量。西班牙大西洋海域的一項研究發現,在有利條件下,15兆瓦的風力渦輪機可以將平準化度電成本(LCOE)降低至100歐元/兆瓦時。西門子歌美颯和維斯塔斯等製造商正在加快原型機的研發進度,以確保先發優勢;同時,港口業主也在延長碼頭並加固支架結構,以應對120米長的葉片。目前只有少數新一代風力渦輪機運輸船(WTIV)能夠容納超過1200噸的機艙,而不斷上漲的租賃成本迫使開發商提前數年確定產能。總而言之,風力渦輪機的規模化對於實現國家成本降低目標和維持浮體式海上風電市場的快速成長至關重要。

WTIV 和 FIV 船隻短缺導致日租金超過 45 萬美元

全球僅有10艘船舶能夠處理14兆瓦以上的風力渦輪機,而能夠吊起三排半潛式船體段的船舶則更少。每日費用已超過45萬美元,幾乎是2022年水準的兩倍,訂單情況表明,建造缺口將持續到2028年。由於載員法規限制外國船舶,亞太地區面臨額外的障礙。這意味著日本和韓國的計劃必須在國內建造風力渦輪機吊裝船(WTIV),否則將承擔高昂的調動航次費用。開發人員目前已將船舶可用性條款納入購電協議,推遲最終投資決策,直到產能得到保障。除非流入專業造船廠的資金加快,否則這一瓶頸可能會阻礙浮體式海上風電市場與實際安裝的緊密聯繫。

細分市場分析

水深30公尺至60公尺之間的過渡區域,預計2024年將佔離岸風電裝置總量的55%,浮體式海上風電市場規模約131兆瓦。這些區域可以重複利用固定式離岸風電的部分供應鏈,使開發商能夠以適中的成本檢驗錨碇、SCADA系統和運維策略。蘇格蘭金卡丁和法國地中海沿岸的示範計畫充分體現了這一區域的受歡迎程度,這兩個計畫在2024年的運轉率均超過92%。然而,水深60公尺以上的深水風電正在迅速發展,這得益於強勁的風力條件,與過渡區域相比,深水風電的年發電量可提高高達25%。此外,隨著風力渦輪機額定功率超過15兆瓦,更深的水域還能減少視覺干擾。

預計深水計劃將以88%的複合年成長率成長,到2030年,其在浮體式海上風電市場的佔有率將超過40%。挪威的烏特西拉-諾德區和加州的莫羅灣區展示瞭如何透過連續的1吉瓦區塊來簡化陣列佈局並實現共用出口通道。石油和天然氣巨頭正在提供海底技術以降低海洋風險,而船級社正在將超過25年的設計疲勞係數納入規範。淺水(<30公尺)專案僅限於研發原型,因為海底條件或生態學限制導致固定單樁結構不可行。隨著時間的推移,人們對動態電纜性能和浮體結構冗餘性的信心不斷增強,預計將促使投資轉向水深超過100公尺的區域,從而加強浮體式海上風電行業的深水發展管道。

2024年,採用模組化設計的半潛式船體(例如WindFloat和VolturnUS)可從現有碼頭下水,預計將佔據浮體式海上風電市場57%的佔有率。其吃水淺,無需大規模疏浚即可拖曳,這對造船廠資源有限的國家而言是一項關鍵優勢。錨碇系統採用標準鏈條和聚酯繩索,最大限度地減少了客製化硬體的使用。這種方法確保了穩定性,俯仰運動小於5°,並確保傳動系統的負載保持在6-10兆瓦風力發電機組的保證範圍內。開發商對該平台的適應性讚賞有加,使其能夠部署在從挪威峽灣到加那利群島的各種海域。

預計到2024年,立柱式浮式風電將佔總發電量的31%,其複合年成長率可望達到84%,這主要得益於其每兆瓦材料用量比半潛式平台減少約15%。 Hywind Tampen平台的107公尺長立柱在北海暴風雨期間展現了97%的運轉率。未來計畫進行升級,採用滑模成型技術以縮短製造時間,而混凝土-鋼混合立柱平台可望進一步降低資本支出。張力腿平台在風力發電機機艙高度接近180公尺時具有優異的垂蕩抑制性能,但錨樁的精度要求會增加成本。雖然駁船和混合式平台仍處於小眾市場,但日本3兆瓦的響灘發電廠展示如何在平靜水域中建造低乾舷船體。目前,半潛式平台是金融機構評估浮體式海上風電市場風險的參考設計,但在大規模生產明確最具融資價值的方案之前,不同船體類型之間的競爭可能會持續下去。

浮體式海上風電市場報告按水深(淺水、過渡水、深水)、浮體式平台類型(半潛式、立柱式浮標、其他)、渦輪機容量(小於 5MW、5-10MW、其他)、應用階段(商業試點前、商業公用事業規模、混合風能轉換)和地區(北美、歐洲、亞太、南美、中東和非洲)進行細分。

區域分析

歐洲持續保持在浮體式海上風電市場的主導地位,佔全球部署量的92%,預計2024年將接近220兆瓦。挪威、蘇格蘭和葡萄牙成熟的工程叢集支撐著這一領先地位,而英國50吉瓦海離岸風力發電的宏偉目標(其中5吉瓦必須在2030年前建成浮體式電)也為進一步發展提供了支持。諸如1.6億英鎊的浮體式海上風電製造投資計畫等國家補貼正在引導對葉片、塔筒和錨碇設施的資本投資,並加快交付速度。挪威的Hywind Tampen計畫已透過石油平台的電氣化展示了實際減少二氧化碳排放的效果,鞏固了政府和公眾的支持。法國也正在效仿,其地中海競標傾向於位於福斯濱海和新港的本地製造廠,以擴大其區域工業版圖。

亞太地區是成長最快的地區,年複合成長率高達156%,島國紛紛尋求大陸棚最窄處的深水區域。日本的目標是到2030會計年度實現5.7吉瓦的裝置容量,到2040會計年度實現45吉瓦,而這些目標很大程度上依賴浮體式基礎。海底勘測證實,在風速達10公尺/秒或以上時,理論資源量可達4.24吉瓦。韓國在蔚山附近進行的1.8吉瓦採購可望催生一個專業化的供應基地,包括鏈條、吸力錨和重型裝運船隻。台灣正利用台中港自貿區的稅收優惠政策,將自身定位為葉片和機艙的非中國替代供應商。雖然中國在固定式風電領域佔據主導地位,但從廣東到浙江的地方政府正在規劃水深超過80公尺的浮動式風力發電走廊,以實現沿海負載中心的多元化。

在北美,拜登-哈里斯政府設定了30吉瓦離岸風電和15吉瓦浮體式風電的目標。加州的莫羅灣和洪堡兩個租賃區擁有可供550萬戶家庭使用的電力容量,但北大西洋露脊鯨的《瀕危物種法》延長了太平洋沿岸大片區域的核准週期。墨西哥灣平靜的海況和密集的棕地基礎設施使其成為一個極具吸引力的早期進入點,因為大型石油公司正在將自升式鑽井改造為臨時焊接站。加拿大正在密切關注該行業的擴張,同時等待渦輪機結冰研究的結果,然後再確定其國家配額。同時,墨西哥正在探索政策獎勵,以將浮動式風力發電與下加利福尼亞半島現有的燃氣碼頭用地結合。浮體式海上風電市場預計在2027年後大幅擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 美國和亞太地區深水租賃交易增加

- 快速將風力渦輪機功率提升至15-20兆瓦等級可降低平準化電成本。

- 石油和天然氣平台改革釋放墨西哥灣供應鏈潛力

- 歐盟和英國的差價合約改革將提升銀行融資能力

- 國家氫能發展藍圖催生了對共址裝卸的需求

- 亞洲電纜船建造公司縮短安裝週期

- 市場限制

- WTIV 和 FIV 船舶短缺導致日薪超過 45 萬美元

- 50-100公尺深度高壓動態纜線故障試點研究

- 加州瀕危物種法案對鯨魚的限制導致BOEM許可證發放延遲

- 現貨鋼材價格波動(低於每噸950美元)擾亂了浮式堆場的運作。

- 供應鏈分析

- 監理與技術展望

- 主要計劃資訊

- 主要現有計劃

- 即將進行的計劃

- 最新進展

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按深度

- 淺海(30公尺或更淺)

- 過渡段(30-60公尺)

- 深海(超過60公尺)

- 浮體式平台類型

- 半潛式

- 浮標

- 張力腿平台(TLP)

- 駁船和混合動力概念

- 按渦輪機容量額定值

- 小於5兆瓦

- 5~10 MW

- 11~15 MW

- 15兆瓦或以上

- 按應用階段

- 商業化前試飛

- 商業公用事業規模

- 混合風力發電(氫氣生產、海水淡化)

- 按地區

- 北美洲

- 美國

- 北美其他地區

- 歐洲

- 法國

- 英國

- 西班牙

- 北歐國家

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- GE Vernova(GE Renewable Energy)

- BW Ideol AS

- Equinor ASA

- Orsted A/S

- Principle Power Inc.

- Aker Solutions ASA

- Hexicon AB

- TotalEnergies SE

- Shell plc

- Ocean Winds(EDPR/ENGIE)

- Copenhagen Infrastructure Partners

- RWE AG

- Marubeni Corporation

- MingYang Smart Energy

- Goldwind Science & Technology

- Gazelle Wind Power Ltd.

第7章 市場機會與未來展望

The Floating Offshore Wind Power Market size in terms of installed base is expected to grow from 0.39 gigawatt in 2025 to 7.69 gigawatt by 2030, at a CAGR of 81.48% during the forecast period (2025-2030).

This expansion reflects the sector's ability to tap deeper-water sites that hold 80% of global offshore wind resources, while rapid cost compression is pushing the Levelized Cost of Energy toward €50-100/MWh by 2030 . As the floating offshore wind market enters a commercial phase, supply chains built around conventional fixed-bottom projects are being re-tooled to handle Semi-Submersible and Spar-Buoy platforms that can be assembled quayside and towed to depths exceeding 1,000 m. Developers are also pivoting to turbines above 15 MW to spread foundation and installation costs over larger generation envelopes. Regional policy adds momentum: Europe's revenue-stabilizing Contracts for Difference (CfD) reforms, the United States' "Floating Offshore Wind Shot," and Japan-Korea lease auctions are unlocking capital, while oil-and-gas platform conversions in the Gulf of Mexico highlight cross-sector synergies. These forces, combined with emerging hydrogen co-location schemes that soak up surplus power, position the floating offshore wind market for steep scale-up this decade.

Global Floating Offshore Wind Power Market Trends and Insights

Growing Lease Awards in U.S. & APAC Deep-Water Zones

A surge of deep-water lease auctions is reshaping the floating offshore wind market, with the U.S. Bureau of Ocean Energy Management preparing multiple sales through 2025 and targeting 15 GW of floating capacity by 2035. The federal "Floating Offshore Wind Shot" couples these leases with R&D aimed at 70% cost cuts. In Asia-Pacific, South Korea's 1.8 GW tender and Japan's entry into the U.S. cost-reduction initiative underscore how bilateral partnerships are building a 244 GW global pipeline. Developers see these awards as stepping-stones from demonstration to multi-GW arrays, prompting early investments in port upgrades, cable factories, and installation vessels. Therefore, policy continuity across the Pacific Rim is locking in bankable revenue streams while pushing the floating offshore wind market closer to gigawatt-scale annual additions.

Rapid Turbine Upsizing to 15-20 MW Class Reducing LCOE

Moving from a 6-10 MW baseline to 15-20 MW turbines cuts per-megawatt foundation counts by up to 40%, directly lowering steel and mooring use. Research on Spanish Atlantic sites finds that 15 MW machines can drive LCOE to 100 €/MWh in favorable conditions. Manufacturers such as Siemens Gamesa and Vestas have accelerated prototyping schedules to secure early-mover advantage, while port owners lengthen quays and reinforce cradle structures to handle 120-m blades. The upsizing wave also reshuffles vessel demand: only a handful of next-generation WTIVs can install nacelles weighing over 1,200 t, creating new charter-rate spikes that force developers to lock in capacity years ahead. Overall, turbine scale-up is pivotal to meeting national cost-reduction targets and sustaining the blistering growth of the floating offshore wind market.

WTIV & FIV Vessel Shortage Driving Day Rates Above USD 450k

Only 10 vessels worldwide can handle turbines above 14 MW, and fewer still can lift 3-column Semi-Submersible hull sections. Day rates have already breached USD 450,000, about double 2022 levels, and order books show a construction gap extending into 2028. Asia-Pacific faces extra hurdles from cabotage rules restricting foreign hulls, meaning Japanese and Korean projects must either build domestic WTIVs or absorb costly mobilization voyages. Developers now embed vessel-availability clauses into Power Purchase Agreements, delaying Final Investment Decisions until tonnage slots are secured. This bottleneck risks trimming close-in floating offshore wind market installations unless capital flows into specialized shipyards accelerate.

Other drivers and restraints analyzed in the detailed report include:

- Oil & Gas Platform Conversions Unlocking Gulf of Mexico Supply Chain

- EU & UK CfD Reform Boosting Bankability

- High-Voltage Dynamic Cable Failures in 50-100 m Depth Pilots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transitional zones between 30 m and 60 m accounted for 55% of 2024 installations, equating to a floating offshore wind market size of roughly 131 MW. These locations reuse portions of fixed-bottom supply chains, allowing developers to validate moorings, SCADA, and O&M strategies at modest cost. The segment's popularity is evident in Scotland's Kincardine and France's Mediterranean demonstrators, which collectively logged availability above 92% in 2024. Yet the deep-water segment (above 60 m) is scaling fast, lifted by stronger wind profiles that raise annual energy output by up to 25 % versus transitional sites. As turbine ratings pass 15 MW, deeper waters also reduce visual-impact opposition, a factor especially potent in tourism-heavy coastlines.

Deep-water projects are forecast to post an 88% CAGR, lifting their floating offshore wind market share to just over 40% by 2030. Norway's Utsira-Nord and California's Morro Bay zones illustrate how contiguous 1-GW blocks streamline array layouts and enable shared export corridors. Oil-and-gas majors bring subsea expertise that mitigates met-ocean risks, while classification societies have codified design fatigue factors exceeding 25 years. The shallow (<30 m) category remains confined to R&D prototypes where seabed conditions or ecological constraints make fixed monopiles unviable. Over time, increasing confidence in dynamic cable performance and floater structural redundancy is expected to tilt investment decisively toward water depths beyond 100 m, reinforcing the deep-water pathway for the floating offshore wind industry.

Semi-Submersible hulls dominated with 57% share of the floating offshore wind market in 2024, buoyed by designs such as WindFloat and VolturnUS that can be fabricated in modular sections and launched via existing docks. Their shallow draft facilitates tow-out operations without extensive dredging, a key advantage for shipyard-constrained nations. Mooring spreads use standard chain and polyester rope, minimizing bespoke hardware. The approach reliably delivers stability with pitch motions below 5°, ensuring drivetrain loads stay within warranty envelopes for 6-10 MW turbines. Developers value the platform's adaptability, enabling deployment from Norwegian fjords to the Canary Islands.

Spar-Buoy concepts, although accounting for 31% of 2024 capacity, are on an 84% CAGR trajectory as material usage per MW drops by up to 15% compared with Semi-Subs. Hywind Tampen's 107-m-long columns verified operational uptimes of 97% under North Sea squalls. Future variants plan slip-forming techniques that lower fabrication man-hours, while hybrid concrete-steel spars promise further capex savings. Tension-Leg Platforms offer heave suppression traits attractive for turbine nacelle heights approaching 180 m, but anchor-pile precision raises costs. Barge and hybrid formats remain niche, yet Japan's 3 MW Hibiki-nada plant shows how calm-sea locales can host low-freeboard hulls. Competition among hull types will continue until mass production clarifies the most bankable option, though Semi-Subs currently act as the reference design for lenders appraising floating offshore wind market risk.

The Floating Offshore Wind Market Report is Segmented by Water Depth (Shallow, Transitional and Deep), Floating Platform Type (Semi-Submersible, Spar-Buoy, and Others), Turbine Capacity Rating (Below 5 MW, 5 To 10 MW, and Others), Application Stage (Pre-Commercial Pilot, Commercial Utility-Scale, and Hybrid Wind-To-X), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Europe maintained a commanding 92% share of global deployments in 2024, with a floating offshore wind market size close to 220 MW. Mature engineering clusters in Norway, Scotland, and Portugal underpin this lead, while the UK's 50 GW total offshore wind ambition-5 GW of which must be floating by 2030-anchors forward pipelines. State-backed grants like the GBP 160 million Floating Offshore Wind Manufacturing Investment Scheme funnel capex toward blade, tower, and mooring plants, shortening delivery times. Norway's Hywind Tampen has already demonstrated concrete CO2 savings by electrifying petroleum platforms, solidifying government and public buy-in. France is following with Mediterranean tenders that favor local fabrication yards in Fos-sur-Mer and Port-la-Nouvelle, expanding regional industrial footprints.

Asia-Pacific is the fastest-growing theatre, registering a 156% CAGR as island nations seek deeper-water options where continental shelf widths are minimal. Japan's target of 5.7 GW by fiscal 2030 and 45 GW by 2040 relies heavily on floating foundations; its seabed surveys identify 424 GW of theoretical resource above 10 m/s wind speeds. South Korea's 1.8 GW procurement round near Ulsan promises to ignite a specialized supply base encompassing chains, suction anchors, and heavy-lift barges. Taiwan positions itself as a non-China alternative for blades and nacelles, leveraging tax incentives inside its Port of Taichung free-trade zone. China itself dominates fixed-bottom additions, but provincial authorities from Guangdong to Zhejiang are cataloguing floating wind corridors exceeding 80 m depths to diversify coastal load centers.

North America ramps up under the Biden-Harris Administration's 30 GW offshore wind and 15 GW floating targets. California's twin lease zones at Morro Bay and Humboldt could host enough capacity to power 5.5 million households, but Endangered Species Act safeguards for the North Atlantic right whale prolong permitting cycles along the broader Pacific Coast. The Gulf of Mexico's milder sea states and dense brownfield infrastructure make it an attractive early-mover candidate, with oil majors repurposing jack-up rigs as temporary welding stations. Canada monitors the sector's advance yet waits for turbine icing studies before setting national quotas, while Mexico explores policy incentives to couple floating wind with existing gas-fired peakers on the Baja Peninsula. Collectively, North American projects account for more than 40 GW of auctioned potential, a base that will materially widen the floating offshore wind market after 2027.

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- GE Vernova (GE Renewable Energy)

- BW Ideol AS

- Equinor ASA

- Orsted A/S

- Principle Power Inc.

- Aker Solutions ASA

- Hexicon AB

- TotalEnergies SE

- Shell plc

- Ocean Winds (EDPR/ENGIE)

- Copenhagen Infrastructure Partners

- RWE AG

- Marubeni Corporation

- MingYang Smart Energy

- Goldwind Science & Technology

- Gazelle Wind Power Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Lease Awards in U.S. & APAC Deep-Water Zones

- 4.2.2 Rapid Turbine Upsizing to 15-20 MW Class Reducing LCOE

- 4.2.3 Oil & Gas Platform Conversions Unlocking Gulf of Mexico Supply Chain

- 4.2.4 EU & UK CfD Reform Boosting Bankability

- 4.2.5 National Hydrogen Roadmaps Creating Co-location Demand

- 4.2.6 Asian Cable-Vessel Build-out Shortening Installation Schedules

- 4.3 Market Restraints

- 4.3.1 WTIV & FIV Vessel Shortage Driving Day-rates > US$450k

- 4.3.2 High-Voltage Dynamic Cable Failures in 50-100 m Depth Pilots

- 4.3.3 California ESA Right-Whale Constraints Slowing BOEM Permits

- 4.3.4 Spot Steel Price Volatility (> US$950/t) Disrupting Floater Yards

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Key Projects Information

- 4.6.1 Major Existing Projects

- 4.6.2 Upcoming Projects

- 4.7 Recent Trends & Developments

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Investment Analysis

5 Market Size & Growth Forecasts

- 5.1 By Water Depth

- 5.1.1 Shallow (Below 30 m)

- 5.1.2 Transitional (30 to 60 m)

- 5.1.3 Deep (Above 60 m)

- 5.2 By Floating Platform Type

- 5.2.1 Semi-Submersible

- 5.2.2 Spar-Buoy

- 5.2.3 Tension-Leg Platform (TLP)

- 5.2.4 Barge and Hybrid Concepts

- 5.3 By Turbine Capacity Rating

- 5.3.1 Below 5 MW

- 5.3.2 5 to 10 MW

- 5.3.3 11 to 15 MW

- 5.3.4 Above 15 MW

- 5.4 By Application Stage

- 5.4.1 Pre-Commercial Pilot

- 5.4.2 Commercial Utility-Scale

- 5.4.3 Hybrid Wind-to-X (Hydrogen, Desalination)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 France

- 5.5.2.2 United Kingdom

- 5.5.2.3 Spain

- 5.5.2.4 Nordic Countries

- 5.5.2.5 Italy

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Siemens Gamesa Renewable Energy SA

- 6.4.2 Vestas Wind Systems A/S

- 6.4.3 GE Vernova (GE Renewable Energy)

- 6.4.4 BW Ideol AS

- 6.4.5 Equinor ASA

- 6.4.6 Orsted A/S

- 6.4.7 Principle Power Inc.

- 6.4.8 Aker Solutions ASA

- 6.4.9 Hexicon AB

- 6.4.10 TotalEnergies SE

- 6.4.11 Shell plc

- 6.4.12 Ocean Winds (EDPR/ENGIE)

- 6.4.13 Copenhagen Infrastructure Partners

- 6.4.14 RWE AG

- 6.4.15 Marubeni Corporation

- 6.4.16 MingYang Smart Energy

- 6.4.17 Goldwind Science & Technology

- 6.4.18 Gazelle Wind Power Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment