|

市場調查報告書

商品編碼

1851655

企業影片:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Enterprise Video - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

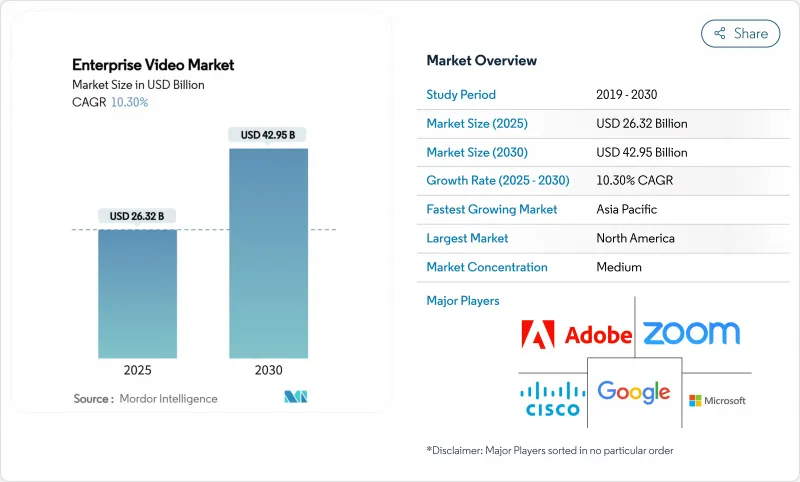

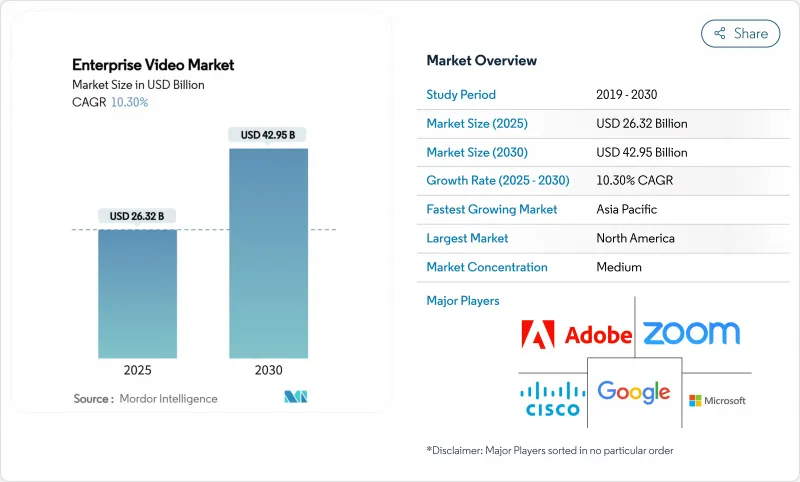

企業視訊市場預計將從 2025 年的 263.2 億美元成長到 2030 年的 429.5 億美元,複合年成長率為 10.3%。

這種擴展反映了視訊應用從單純的會議工具向支援工作流程自動化、數據主導決策和全球協作的關鍵基礎設施的轉變。雲端原生平台、人工智慧驅動的分析和私有5G網路正在提升可擴展性、字幕準確性和低於25毫秒的端到端延遲,所有這些都促使用戶期望獲得始終在線、超快速響應的體驗。以Brightcove收購案為例的供應商整合,預示著一場朝向全端式解決方案邁進的平台競賽。同時,不斷上漲的網路安全保險費和影片工作流程編配技能的短缺,正在阻礙後進企業的普及。

全球企業視訊市場趨勢與洞察

採用雲端優先的影片架構

遷移到雲端原生架構能夠以較低的前期成本實現彈性擴展、API驅動的整合和全球內容傳送。企業透過將運算密集分析遷移到公有雲,同時將敏感歸檔資料保留在本地,從而減少了本地硬體的更新周期。多重雲端路由可以避免廠商鎖定和延遲波動,並允許IT團隊將不同的工作負載匹配到性價比最高的區域。然而,一些企業正在採取「雲端退出」策略,當每月退出費用超過彈性擴展帶來的收益時,他們會將支出轉移到私人基礎設施。

利用人工智慧大幅提升即時字幕準確率

在良好的聲學環境下,自動語音辨識模型的準確率高達 98%,使視訊無障礙功能超越了合規要求,成為提升生產力的關鍵優勢。對 140 種語言的豐富語言支援促進了跨國協作,搜尋的文字記錄則建構了一個持續更新的知識庫。企業可以將這項 AI 字幕功能直接整合到內容管理系統中,從而提升用戶參與度並加速內容在地化。此外,它還使聽障員工能夠即時參與會議,無需第三方負責人,從而促進包容性招聘實踐。

超低延遲基礎設施的總成本很高

追求低於 25 毫秒往返效能的企業必須投資私人 5G 網路、邊緣 CDN 節點和 GPU 加速編碼器。超大規模資料中心營運商計劃在 2025 年投入 750 億美元用於人工智慧和網路骨幹網路建設,而其資本計畫往往超出預算撥款。光是電視牆的成本就高達每平方英尺 380 至 1200 美元,使得大尺寸顯示器只有財力雄厚的企業才能負擔得起。從隨叫隨到的工程師到冗餘電路等持續營運成本,進一步增加了整體擁有成本。

細分市場分析

到2024年,視訊會議領域將創造110.8億美元的收入,佔企業視訊市場佔有率的42.1%。視訊分析雖然目前規模較小,但預計到2030年將為企業視訊市場貢獻超過40億美元的收入,以18.7%的複合年成長率超越所有其他類別。這一成長勢頭源於人工智慧引擎,這些引擎能夠檢測異常情況、提取元資料,並在安防、製造和零售等行業觸發工作流程自動化。

採用模式顯示,曾經各自獨立的類別正在融合。會議供應商將演講者情緒分析功能捆綁銷售,內容管理平台整合直播模組以支援混合型活動。諸如Google Veo 3 之類的 AI 影片產生器,讓非專業人士也能在幾秒鐘內創建品牌素材,從而模糊了製作和分發之間的界限。由此催生了 Mosaic 生態系統,企業傾向於選擇透過開放 API 整合的靈活模組,而不是單一的整體式套件。這種趨勢進一步加速了企業視訊市場的創新週期。

到2024年,軟體產品將維持企業視訊市場51.7%的佔有率,支援會議、串流媒體和存檔功能。然而,服務類別將以14.2%的複合年成長率成長,成為成長最快的類別。外包編配、全天候監控服務等級協定 (SLA) 和人工智慧調優服務對缺乏內部專業知識的企業極具吸引力。雖然硬體對於編碼、會議室終端和邊緣快取仍然至關重要,但價值正在轉移到預先安裝在通用裝置上的軟體定義元件。

捆綁式「視訊即服務」產品正是這種轉變的體現。服務提供者以固定的月費提供託管編碼器機架、轉碼軟體和分析儀表板,並捆綁主動維護和功能更新。這種模式降低了整體擁有成本,並為以前無力組建專門視訊團隊的中小型企業提供了支援。因此,隨著純軟體授權價格的競爭力日益增強,服務供應商正在迅速擴展其諮詢部門、認證專案和託管式eCDN產品組合,以確保其利潤。

該報告涵蓋了全球企業視訊市場的成長情況,並按類型(視訊會議、視訊內容管理、網路直播和即時串流、視訊分析和其他類型)、組件(硬體、軟體和服務)、部署方式(本地部署和雲端部署)、最終用戶垂直行業(銀行、金融服務和保險、醫療保健、IT 和通訊等)、組織規模(中小企業和大型企業)以及地區進行了細分。

區域分析

北美在2024年佔據了34.6%的企業視訊市場佔有率,這主要得益於寬頻普及率的提高、SaaS的早期應用以及聯邦政府對遠程辦公基礎設施的大力投資。隨著大型企業最佳化現有部署,並將人工智慧附加元件和進階分析功能置於新用戶許可之上,市場成長速度有所放緩。儘管如此,二線城市周邊邊緣加速節點正在將低延遲串流服務擴展到服務不足的地區,從而維持了收入成長。

亞太地區是成長最快的地區,年複合成長率達12.8%,主要得益於行動寬頻升級和5G專網試驗的激增。中國的騰訊會議和日本的易用會議室(由伊藤忠商事株式會社支持)正在客製化界面、合規模組和語言包,以滿足當地標準。 [3] 政府數位化計畫和製造業現代化措施正在推動對檢測級視訊分析的需求,進一步鞏固企業視訊市場在亞太地區的普及。

歐洲正穩定地推動GDPR強制合規進程。企業紛紛傾向選擇提供本地資料中心和嚴格隱私認證的供應商,這推動了美國平台與歐盟雲端主機之間的合作。南美和中東/非洲地區是新興的立足點,雲端優先策略正在取代傳統的本地部署方案。與通訊業者夥伴關係,將視訊套件與高速網路連線捆綁銷售,降低了這些地區中型企業採用雲端服務的門檻。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 採用雲端優先視訊架構

- 利用人工智慧大幅提升即時字幕準確率

- 混合辦公和遠距辦公模式的成長

- 自備設備辦公室 (BYOD) 在企業中的普及

- 校園內低延遲5G專用網路

- 合規主導的安全歸檔要求

- 市場限制

- 超低延遲基礎設施的總成本很高。

- 國家間的數據主權壁壘

- IT人員缺乏視訊工作流程編配的技能

- 影像外洩事件導致網路保險費上漲

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員影響評估

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 按類型

- 視訊會議

- 影片內容管理

- 網路直播及現場直播

- 影片分析

- 其他類型

- 按組件

- 硬體

- 軟體

- 服務

- 透過部署模式

- 本地部署

- 雲

- 按最終用戶行業分類

- BFSI

- 衛生保健

- 資訊科技/通訊

- 零售與電子商務

- 教育

- 政府/公共部門

- 製造業

- 媒體與娛樂

- 其他

- 按組織規模

- 中小企業

- 主要企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems, Inc.

- Microsoft Corporation

- Zoom Video Communications, Inc.

- Google LLC

- Adobe Inc.

- Brightcove Inc.

- IBM Corporation

- Kaltura Inc.

- Panopto

- Poly(HP Inc.)

- Avaya Inc.

- Vbrick Systems, Inc.

- Mediaplatform, Inc.

- Vidyo, Inc.

- Vimeo, Inc.

- Qumu Corporation

- Harmonic Inc.

- JW Player

- Lifesize, Inc.

- Ooyala(Telstra)

第7章 市場機會與未來展望

The enterprise video market is valued at USD 26.32 billion in 2025 and is forecast to grow to USD 42.95 billion by 2030, advancing at a 10.3% CAGR.

The expansion reflects the shift from video as a meeting tool to a mission-critical infrastructure that supports workflow automation, data-driven decision making, and global collaboration. Cloud-native platforms, AI-powered analytics, and private 5G networks are improving scalability, caption accuracy, and sub-25 millisecond end-to-end latency, which together elevate user expectations for always-on, ultra-responsive experiences. Rising hybrid-work norms continue to anchor budget allocations for video, while vendor consolidation-illustrated by the Brightcove acquisition-signals a platform race toward full-stack offerings. Concurrently, mounting cybersecurity insurance premiums and skills shortages in video-workflow orchestration temper adoption curves for some late-moving enterprises.

Global Enterprise Video Market Trends and Insights

Cloud-first video architecture adoption

The migration to cloud-native stacks enables elastic scaling, API-driven integrations, and global content distribution at lower upfront cost. Enterprises retain sensitive archives on-premises yet push compute-heavy analytics to public clouds, reducing local hardware refresh cycles. Multi-cloud routing safeguards against vendor lock-in and latency variation, and it lets IT teams match diverse workloads with the optimal cost-performance region. Even so, "cloud-exit" strategies are surfacing as some firms rebalance spend toward private infrastructure when monthly egress fees outweigh elasticity benefits.

AI-powered live-caption accuracy breakthroughs

Automatic speech recognition models now deliver up to 98% precision under favorable acoustics, lifting video accessibility beyond regulatory compliance into a productivity advantage. Rich language support-spanning 140 tongues-facilitates cross-border collaboration while searchable transcripts unlock evergreen knowledge repositories. Enterprises embed these AI captions directly in content management systems to raise engagement metrics and speed content localization. The advance also fuels inclusive hiring practices because Deaf and hard-of-hearing employees access meetings in real time without third-party captioners.

High total cost of ultra-low-latency infrastructure

Enterprises seeking sub-25 millisecond round-trip performance must invest in private 5G, edge CDN nodes, and GPU-accelerated encoders. Capital plans frequently exceed budget allocations, as hyperscalers earmark USD 75 billion in 2025 capex for AI and networking backbones that downstream customers must partially absorb. LED video walls alone range between USD 380 and USD 1,200 per ft2, making large-format displays viable only for cash-rich organizations. Ongoing operational costs-from on-call engineers to redundancy circuits-further widen total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Growth of hybrid and remote workforces

- BYOD proliferation across enterprises

- IT staff skill shortages in video-workflow orchestration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Video Conferencing segment delivered USD 11.08 billion and held 42.1% of enterprise video market share in 2024, reflecting its entrenchment as the default collaboration medium. Video Analytics, though smaller in absolute value, is projected to outpace all other categories at an 18.7% CAGR, adding more than USD 4 billion to enterprise video market size by 2030. This momentum stems from AI engines that detect anomalies, extract metadata, and trigger workflow automations across security, manufacturing, and retail settings.

Adoption patterns reveal convergence between once-distinct categories. Conferencing vendors bundle analytics for speaker sentiment, while content-management platforms embed live-stream modules to support hybrid events. AI video generators, such as Google's Veo 3, blur production and distribution boundaries by enabling non-specialists to create branded assets in seconds. The result is a mosaic ecosystem where enterprises choose flexible modules that integrate through open APIs rather than monolithic suites, a dynamic that further accelerates innovation cycles within the enterprise video market.

Software products retained 51.7% share of enterprise video market size in 2024, underpinning meeting, streaming, and archival functions. Yet the Services category will rise fastest at a 14.2% CAGR. Outsourced orchestration, 24/7 monitoring SLAs, and AI tuning services appeal to organizations lacking in-house expertise. Hardware remains essential for encoding, room endpoints, and edge caching, but value is migrating to software-defined components pre-installed on commodity devices.

Bundled "video-as-a-service" offerings illustrate the shift. Providers supply managed encoder racks, transcoding software, and analytics dashboards under a predictable monthly fee, bundling proactive maintenance and feature updates. This model lowers total cost of ownership and supports SMEs that previously could not justify dedicated video teams. As a result, service providers are rapidly expanding consulting arms, certification programs, and managed eCDN portfolios, defending margins as pure software licensing becomes price-competitive.

The Report Covers the Global Enterprise Video Market Growth and It is Segmented by Type (Video Conferencing, Video Content Management, Webcasting and Live Streaming, Video Analytics, and Other Types), Component (Hardware, Software, and Services), Deployment (On-Premises, and Cloud), End-User Industry (BFSI, Healthcare, IT and Telecommunications, and More), Organization Size (SMEs, and Large Enterprises), and Geography.

Geography Analysis

North America secured 34.6% of enterprise video market share in 2024 on the back of expansive broadband penetration, early SaaS adoption, and robust federal investment in telework infrastructure. Growth is moderating as large enterprises optimize existing deployments, prioritizing AI add-ons and advanced analytics rather than net-new seat licenses. Even so, edge acceleration nodes around tier-2 cities extend low-latency streaming into under-served areas, preserving incremental revenue.

Asia-Pacific is the fastest-growing territory, registering a 12.8% CAGR as mobile broadband upgrades and 5G private-network pilots proliferate. Indigenous champions-Tencent Meeting in China and Itochu-backed EasyRooms in Japan-tailor interfaces, compliance modules, and language packs to local norms[3]. Government digitalization programs and manufacturing modernization efforts underpin demand for inspection-grade video analytics, further bolstering regional uptake within the enterprise video market.

Europe follows a steady trajectory shaped by GDPR compliance mandates. Enterprises gravitate toward vendors offering in-region data centers and stringent privacy certifications, driving cooperation between U.S. platforms and EU-based cloud hosts. South America plus the Middle East and Africa represent emerging footholds where cloud-first strategies leapfrog legacy on-premises rollouts. Telco partnerships that bundle video suites with high-speed connectivity lower adoption hurdles for mid-market firms across these regions.

- Cisco Systems, Inc.

- Microsoft Corporation

- Zoom Video Communications, Inc.

- Google LLC

- Adobe Inc.

- Brightcove Inc.

- IBM Corporation

- Kaltura Inc.

- Panopto

- Poly (HP Inc.)

- Avaya Inc.

- Vbrick Systems, Inc.

- Mediaplatform, Inc.

- Vidyo, Inc.

- Vimeo, Inc.

- Qumu Corporation

- Harmonic Inc.

- JW Player

- Lifesize, Inc.

- Ooyala (Telstra)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first video architecture adoption

- 4.2.2 AI-powered live-caption accuracy breakthroughs

- 4.2.3 Growth of hybrid and remote workforces

- 4.2.4 BYOD proliferation across enterprises

- 4.2.5 Low-latency 5G private networks in campuses

- 4.2.6 Compliance-driven demand for secure archival

- 4.3 Market Restraints

- 4.3.1 High total cost of ultra-low-latency infrastructure

- 4.3.2 Inter-country data-sovereignty barriers

- 4.3.3 IT staff skill shortages in video-workflow orchestration

- 4.3.4 Rising cyber-insurance premiums on video breaches

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video Conferencing

- 5.1.2 Video Content Management

- 5.1.3 Webcasting and Live Streaming

- 5.1.4 Video Analytics

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-Premises

- 5.3.2 Cloud

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecommunications

- 5.4.4 Retail and E-commerce

- 5.4.5 Education

- 5.4.6 Government and Public Sector

- 5.4.7 Manufacturing

- 5.4.8 Media and Entertainment

- 5.4.9 Others

- 5.5 By Organization Size

- 5.5.1 Small and Medium Enterprises (SMEs)

- 5.5.2 Large Enterprises

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Nigeria

- 5.6.4.2.4 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 India

- 5.6.5.3 Japan

- 5.6.5.4 South Korea

- 5.6.5.5 ASEAN

- 5.6.5.6 Australia

- 5.6.5.7 New Zealand

- 5.6.5.8 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Zoom Video Communications, Inc.

- 6.4.4 Google LLC

- 6.4.5 Adobe Inc.

- 6.4.6 Brightcove Inc.

- 6.4.7 IBM Corporation

- 6.4.8 Kaltura Inc.

- 6.4.9 Panopto

- 6.4.10 Poly (HP Inc.)

- 6.4.11 Avaya Inc.

- 6.4.12 Vbrick Systems, Inc.

- 6.4.13 Mediaplatform, Inc.

- 6.4.14 Vidyo, Inc.

- 6.4.15 Vimeo, Inc.

- 6.4.16 Qumu Corporation

- 6.4.17 Harmonic Inc.

- 6.4.18 JW Player

- 6.4.19 Lifesize, Inc.

- 6.4.20 Ooyala (Telstra)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment