|

市場調查報告書

商品編碼

1851520

生物基琥珀酸:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Bio-Based Succinic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

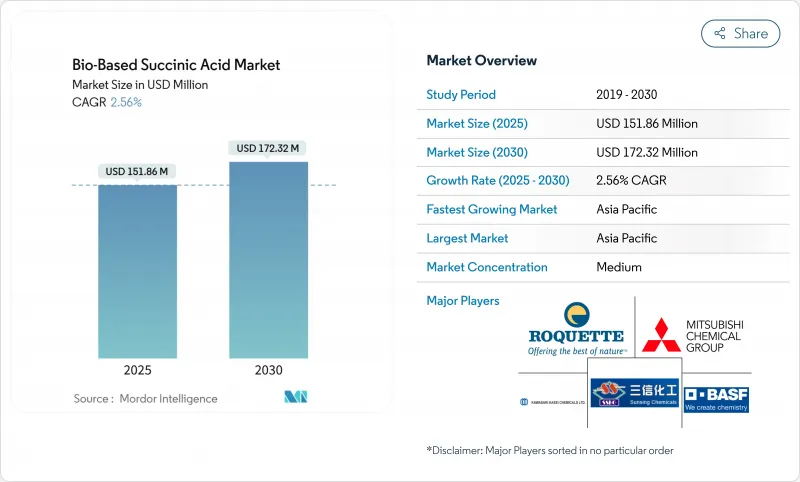

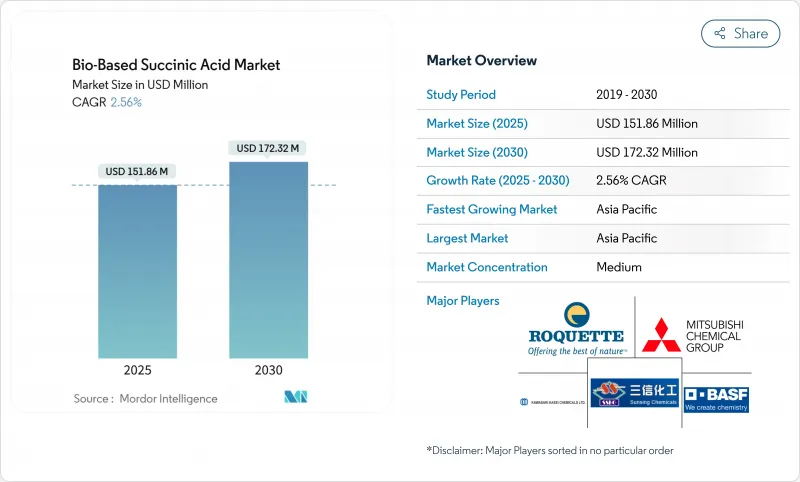

預計到 2025 年,生物基琥珀酸市場規模將達到 1.5186 億美元,到 2030 年將達到 1.7232 億美元,在預測期(2025-2030 年)內複合年成長率為 2.56%。

儘管生物基琥珀酸與油基琥珀酸的價格差距依然存在,但受發酵效率提高、原料選擇多樣化和下游應用範圍擴大等因素的推動,生物基琥珀酸市場需求持續成長。由於琥珀酸在聚丁二酸丁二醇酯(PBS)和聚氨酯鏈中的應用廣泛,工業聚合物製造商仍然是主要買家。區域擴張與政策密切相關:亞太地區受益於中國對生物製造的投資和日本的脫碳藍圖,正在加速發展;而歐洲的成長則得益於碳定價體系,獎勵低碳足跡的中間體。由於目前尚無生產者擁有決定性的成本優勢,市場競爭依然激烈,促使企業開展規模化合作、原料避險以及進行嚴格的認證宣傳活動,以檢驗其永續性聲明。

全球生物基琥珀酸市場趨勢及洞察

工業聚合物中綠色化學品的應用日益增多

工程塑膠、熱固性塑膠和彈性體製造商正持續以經認證的生物基替代品取代化石原料。BASF宣布其60多種產品組合以及一種含有40%可再生的生物基丙烯酸乙酯已獲得ISCC+認證。同時,聚氨酯產業鏈正致力於利用直接從琥珀酸發酵中提取的生物基1,4-丁二醇。該製程由Genomatica公司率先開發,並透過授權給中國製造商進一步擴大規模。由於PBS樹脂本身就是由琥珀酸和1,4-丁二醇合成的,因此琥珀酸產量的任何成長都將對包裝、多層薄膜和一次性家電組件產生連鎖反應。隨著品牌所有者擴大其範圍3脫碳目標,採購團隊更傾向於選擇能夠提供溫室氣體減排證明的供應商,而生物基琥珀酸的市場需求也日益轉向大規模生產的聚合物應用領域。

原油價格波動促使人們轉向生物基路線

原油價格在每桶80美元以上波動時,會週期性地削弱石化產品琥珀酸的成本優勢,迫使加工商簽訂生物基路線的承購協議,以規避原料價格波動的影響。歐盟委員會的工業碳管理計畫透過將資本津貼和稅額扣抵與替代化石中間體的計劃掛鉤,進一步促進了這一經濟成長。日本領先的三菱化學、三井化學和旭化成等公司正在積極應對,在其石腦油裂解裝置中試用生質能石腦油,以降低價格波動,同時履行其國家淨零排放承諾。儘管低原油價格時期可能會暫時抑制市場動能,但採購部門擴大利用機率加權原油價格走勢模型來模擬總擁有成本情景,即使在原油價格預測悲觀的情況下,也能在生物基琥珀酸市場保持戰略優勢。

與石油基琥珀酸相比,生產成本更高

技術經濟模型預測,在目前公用事業收費下,商業生物基琥珀酸的價格下限為每公斤2.5至2.7美元,即使在低油價情境下,也高於石油衍生同類產品的頻寬價格。這一Delta源自於滅菌、多級沉澱等製程的能源需求以及不銹鋼發酵槽的高資本投入。碳附加費和高階市場需求在一定程度上抵消了這一價差,但樹脂和塗料的大批量用戶仍然對價格非常敏感。製程強化-例如連續發酵、原位產品去除和低pH耐受微生物-展現出良好的前景,但實現價格持平的時間取決於能否加快這些技術從試點階段到5萬噸額定產能的轉換。

細分市場分析

至2024年,工業應用將佔生物基琥珀酸市場佔有率的43.18%,主要應用於PBS包裝薄膜、可生物分解地膜和聚氨酯中間體。加工商已簽署多年照付不議協議,以維持工廠產能,因此這些管道的需求預計將如預期般成長,從而穩定整個生物基琥珀酸市場。個人護理領域將呈現最強勁的成長曲線,在預測期內複合年成長率將達到3.79%,這主要得益於免洗祛痘產品、天然除臭劑和溫和去角質產品等特殊劑型的推動。皮膚病學研究表明,1%的琥珀酸凝膠可以抑制痤瘡丙酸桿菌的生長,且不會引起刺激,這使得品牌可以將這種更環保的活性成分與現有的BETA-羥基酸並列銷售。同時,被覆劑製造商正在試驗基於琥珀酸的多元醇,這種多元醇在保持生物分解性的同時,也能提供高固態。

隨著銷售成長,不同終端市場的價格差異也十分顯著。工業樹脂買家在維持穩定銷售的同時,正努力爭取更低的噸價。個人護理和製藥用戶則因微生物純度和可追溯性要求而接受溢價,這為生產商提供了利潤對沖的機會。這種動態促成了雙管道模式的形成:早期採用者將基準產能用於聚合物生產,並使用升級後的發酵槽生產特殊批次產品。隨著下游各產業優先考慮生命週期評估指標,跨領域綜效也隨之顯現。例如,醫藥檢驗能夠增強化妝品功效的可信度,而包裝的機械可回收性測試則能讓消費品所有者確信,產品的最終處置符合循環經濟的承諾。綜上所述,這些模式證實,應用多樣性在提升生物基琥珀酸市場的收入穩定性方面發揮核心作用。

區域分析

亞太地區佔據最大的區域市場佔有率,預計到2024年將佔生物基琥珀酸市場32.75%的佔有率,到2030年複合年成長率將達到3.70%。中國各省政府正向工業產業園區提供低利率貸款,以推動專用於生產琥珀酸和1,4-丁二醇的5萬噸級發酵槽的快速擴建。國家發展和改革委員會已將生質能納入五年規劃獎勵措施,增加稅收優惠以降低現金成本的損益平衡點。日本的「綠色成長策略」旨在實現碳中和,該策略為生質能石腦油共加工提供補貼,鼓勵三菱化學、三井化學和旭化成聯合投資建造以琥珀酸為原料的聚酯裂解試驗裝置。韓國透過其生物戰略技術藍圖支持類似的雄心壯志,而印度則透過擴大其碎米乙醇計畫來專注於原料供應,該計畫可以將糖化液分流至化學發酵槽。總而言之,這些舉措將政策支持與規模經濟相結合,旨在鞏固亞太地區生物基琥珀酸市場的領先地位。

北美憑藉著先進的合成生物學產業叢集、風險接受度強的創業投資資金以及各州層級的無污染燃料激勵措施,維持著強勁的產業活力。美國農業部已在其2025年生質能研發議程中將琥珀酸列為優先產品,並設立了菌株工程和廢棄物流資源化利用的津貼撥款。加州的低碳燃料標準為生物源二氧化碳的利用提供積分倍增機制,發酵公司可以利用此機制在整合碳捕獲設備時獲得額外收入。 Green Plains公司的Clean Sugar子公司已證明,其葡萄糖原料的二氧化碳排放減少了40%,目前內布拉斯加州的一家合約發酵企業正在測試該原料。加拿大為生化設備提供加速折舊政策,墨西哥正在評估生物中間體權益,以促進其北部工業走廊的發展。這些政策和基礎設施共同建構了一個肥沃的生態系統,為該地區生物基琥珀酸市場的穩定擴張提供了強大支撐。

歐洲的發展軌跡取決於加強監管,將每噸石化產品的碳成本納入考量。歐盟委員會的《2040年氣候中和路線藍圖》優先考慮將碳捕獲和利用產品納入公共採購。德國的國家生物經濟策略與研發補貼和原料物流計畫相輔相成,旨在將甘蔗殘渣整合到諸如勒納(Leuna)等化工園區。法國正在試行消費品碳足跡標籤,從而提升對檢驗的低排放中間體的需求。英國的工業碳移除差價合約機制保障了最低支付標準,並鼓勵發酵廠與北海碳封存井毗鄰而建。儘管生產成本高於亞洲平均水平,但品牌所有者的壓力和綠色融資工具的便利性使其保持了競爭力。因此,歐洲已成為生物基琥珀酸的主要高階市場,對高純度等級和特殊規格的需求旺盛,支撐了更高的價格。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 工業聚合物中綠色化學品的應用日益增多

- 原油價格波動促使人們轉向生物基路線

- 政府獎勵和碳定價

- 基因工程微生物可降低下游成本

- 品牌擁有者必須採用循環經濟採購模式

- 市場限制

- 與石油基琥珀酸相比,生產成本更高

- 農產品原物料價格波動

- 與新興的生物己二酸途徑的競爭

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過使用

- 產業

- 製藥

- 個人護理

- 油漆和塗料

- 其他用途

- 按原料來源

- 玉米來源的葡萄糖

- 甘蔗和甜菜蔗糖

- 木質纖維素生質能

- 粗甘油和廢棄物流

- 二氧化碳耦合生物化學路線

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Anhui Sunsing Chemicals Co. Ltd.

- BASF SE

- dsm-firmenich

- Kawasaki Kasei Chemicals Ltd.

- Mitsubishi Chemical Group Corporation

- Reverdia

- Roquette Freres

- Technip Energies NV

第7章 市場機會與未來展望

The Bio-Based Succinic Acid Market size is estimated at USD 151.86 million in 2025, and is expected to reach USD 172.32 million by 2030, at a CAGR of 2.56% during the forecast period (2025-2030).

The bio-based succinic acid market has entered a measured maturation phase in which incremental fermentation efficiencies, diversified feedstock options, and expanding downstream uses keep demand advancing even though price gaps versus petro-routes persist. Industrial polymer makers remain the anchor buyers because polybutylene succinate (PBS) and polyurethane chains incorporate high volumes of the molecule, while personal-care and pharmaceutical formulators are scaling adoption to capture its multifunctional antimicrobial and pH-buffer benefits. Regional expansion is tied closely to policy: Asia-Pacific accelerates on the back of China's biomanufacturing investments and Japan's decarbonization roadmap, whereas Europe's growth stems from carbon-pricing schemes that reward low-footprint intermediates. Competitive intensity stays elevated because no producer yet controls a decisive cost advantage, prompting scale-up collaborations, feedstock hedging, and rigorous certification campaigns to validate sustainability claims.

Global Bio-Based Succinic Acid Market Trends and Insights

Increasing Adoption of Green Chemicals in Industrial Polymers

Manufacturers of engineering plastics, thermoset resins, and elastomers continue to swap fossil building blocks for certified bio-alternatives. BASF secured ISCC+ certification for more than 60 portfolio products and introduced a bio-based ethyl acrylate featuring 40% renewable content that cuts cradle-to-gate emissions by 30%. Parallel initiatives in polyurethane chains rely on bio-1,4-butanediol derived directly from succinic acid fermentations, a pathway pioneered by Genomatica and scaled further through technology licensing to Chinese producers. Because PBS resin is already synthesized from succinic acid and 1,4-butanediol, every incremental gain in succinate output ripples through packaging, mulch film, and single-use appliance parts. As brand owners escalate scope-3 decarbonization targets, procurement teams favor suppliers able to document greenhouse-gas savings, reinforcing the pull on the bio-based succinic acid market toward high-volume polymer applications.

Volatility in Crude-Oil Prices Prompting Switch to Bio-Routes

Oil-price swings above the USD 80 per-barrel threshold regularly erode the cost advantage enjoyed by petrochemical succinic acid, nudging converters to lock in offtake agreements for bio-routes that insulate them from feedstock shocks. The European Commission's industrial carbon-management plan complements this economic push by aligning capital grants and tax credits with projects that displace fossil intermediates. Japanese majors Mitsubishi Chemical, Mitsui Chemicals, and Asahi Kasei have responded by trialing biomass naphtha in naphtha crackers to derisk volatility while meeting national net-zero pledges. Although low oil phases can stall momentum temporarily, purchasing departments increasingly model total-cost-of-ownership scenarios that assign probability-weighted oil trajectories, keeping a strategic wedge for the bio-based succinic acid market even under bearish crude forecasts.

Higher Production Costs Versus Petro-Based Succinic Acid

Techno-economic models place the price floor for commercial bio-based succinic acid between USD 2.5 and 2.7 per kilogram at today's utility tariffs, a band still above the spot price of petro-derived equivalents in low-oil scenarios. The delta stems from sterilization energy demand, multi-step precipitation, and the capital intensity of stainless-steel fermenters. While carbon levies and premium niches partially offset the spread, large-volume users in resins and coatings remain price sensitive. Process intensification-continuous fermentation, in-situ product removal, and low-pH tolerant microbes-holds promise, but the timeline for parity hinges on accelerating these technologies from pilot to 50 kiloton nameplate capacity.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives & Carbon-Pricing Regulations

- Engineered Micro-Organisms Slashing Downstream Costs

- Agricultural Feedstock Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial uses captured 43.18% of the bio-based succinic acid market share in 2024, anchored by PBS packaging films, biodegradable mulch, and polyurethane intermediates that together consume multi-kiloton volumes. Demand in these channels scales predictably because converters sign multi-year take-or-pay contracts that underpin plant-load factors, thereby stabilizing the overall bio-based succinic acid market. Over the forecast horizon, personal care presents the sharpest growth curve at a 3.79% CAGR, lifting contribution from specialty formats such as leave-on acne treatments, natural deodorants, and mild exfoliants. Dermatology studies confirm that 1% succinic acid gels diminish Propionibacterium acnes proliferation without triggering irritation, which allows brands to position greener actives alongside existing beta-hydroxy acids. Pharmaceutical uptake continues steadily as formulators incorporate succinate buffers to maintain pH in controlled-release matrices, while coatings makers experiment with succinate-based polyols that give high-solids content yet ensure biodegradability.

Parallel to volume expansion, price realization differs widely among end markets. Industrial resin buyers negotiate lower per-tonne tariffs yet provide consistent offtake. Personal care and pharmaceutical users accept a premium due to microbiological purity and traceability requirements, creating a margin hedge for producers. These dynamics encourage a dual-channel model in which early adopters allocate baseline capacity to polymers and consume upgraded fermenter runs for specialty batches. Because each downstream sector prioritizes life-cycle-assessment metrics, cross-segment synergies emerge: credentials validated in medicine lend credibility to cosmetic claims, while mechanical recyclability tests in packaging reassure consumer-goods owners that end-of-life outcomes align with circular-economy pledges. Together, these patterns affirm the central role of application diversity in extending revenue stability across the bio-based succinic acid market.

The Bio-Based Succinic Acid Market Report is Segmented by Application (Industrial, Pharmaceuticals, Personal Care, Paints and Coatings, Other Applications), Feedstock Source (Corn-Derived Glucose, Sugarcane & Beet Sucrose, Lignocellulosic Biomass, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific owned the largest regional slice, representing 32.75% of the bio-based succinic acid market in 2024 and cruising toward a 3.70% CAGR through 2030. China's provincial governments funnel low-interest loans into industrial-biotech parks, enabling rapid scale-up of 50 kiloton fermenters dedicated to succinic acid and 1,4-butanediol. The National Development and Reform Commission integrates bio-chemicals into its Five-Year Plan incentives, adding tax holidays that lower cash-cost breakevens. In Japan, the Green Growth Strategy for Carbon Neutrality allocates subsidies for biomass naphtha co-processing, prompting Mitsubishi Chemical, Mitsui Chemicals, and Asahi Kasei to co-invest in pilot crackers that will feed succinate-based polyesters. South Korea supports similar ambitions through its Bio-Strategic Technology blueprint, while India focuses on feedstock supply by expanding broken-rice ethanol programs that could divert saccharified streams into chemical fermenters. Altogether, these initiatives compound policy support with scale economies, reinforcing Asia-Pacific's leadership in the bio-based succinic acid market.

North America sustains robust activity through advanced synthetic-biology clusters, risk-tolerant venture funding, and state-level clean-fuel incentives. The United States Department of Agriculture frames succinic acid as a high-priority product in its 2025 Biomass Research and Development Agenda, unlocking grant pools for strain engineering and waste-stream valorization. California's Low Carbon Fuel Standard awards credit multipliers to biogenic CO2 utilization, a mechanism that fermentation plants leverage for additional revenue when they integrate carbon capture units. Green Plains' clean-sugar subsidiary demonstrated 40% lower carbon footprint dextrose, a feedstock now trialed by contract fermenters in Nebraska. Canada provides accelerated depreciation for equipment deployed in biochemicals, and Mexico evaluates concessions for bio-intermediates to spur northern industrial corridors. Collectively, these policy and infrastructure elements create a fertile ecosystem that underpins steady expansion of the bio-based succinic acid market within the region.

Europe's trajectory hinges on regulatory stringency that embeds carbon costs into every tonne of petrochemical output. The European Commission's 2040 climate-neutral roadmap positions carbon-capture-and-utilization products for priority offtake in public procurement. Germany's National Bioeconomy Strategy supplements R&D grants with feedstock logistics programs to integrate sugar-beet residues into chemical parks such as Leuna. France pilots carbon-footprint labeling on consumer goods, elevating demand for verified low-emission intermediates. The United Kingdom's Contracts for Difference-style mechanism for industrial carbon removal assures payment floors, encouraging fermentation plants to co-locate with sequestration wells in the North Sea. While production costs exceed Asian averages, brand-owner pressure and access to green-finance instruments maintain competitive momentum. Consequently, Europe operates as the principal premium market within the bio-based succinic acid market, absorbing high-purity grades and specialty volumes that justify elevated pricing.

- Anhui Sunsing Chemicals Co. Ltd.

- BASF SE

- dsm-firmenich

- Kawasaki Kasei Chemicals Ltd.

- Mitsubishi Chemical Group Corporation

- Reverdia

- Roquette Freres

- Technip Energies N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of green chemicals in industrial polymers

- 4.2.2 Volatility in crude-oil prices prompting switch to bio-routes

- 4.2.3 Government incentives and carbon-pricing regulations

- 4.2.4 Engineered micro-organisms slashing downstream costs

- 4.2.5 Circular-economy sourcing mandates from brand owners

- 4.3 Market Restraints

- 4.3.1 Higher production costs versus petro-based succinic acid

- 4.3.2 Agricultural feedstock price volatility

- 4.3.3 Competition from emerging bio-adipic acid pathways

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Industrial

- 5.1.2 Pharmaceuticals

- 5.1.3 Personal Care

- 5.1.4 Paints and Coatings

- 5.1.5 Other Applications

- 5.2 By Feedstock Source

- 5.2.1 Corn-derived Glucose

- 5.2.2 Sugarcane and Beet Sucrose

- 5.2.3 Lignocellulosic Biomass

- 5.2.4 Crude Glycerol and Waste Streams

- 5.2.5 CO2-coupled Bio-electrochemical Routes

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anhui Sunsing Chemicals Co. Ltd.

- 6.4.2 BASF SE

- 6.4.3 dsm-firmenich

- 6.4.4 Kawasaki Kasei Chemicals Ltd.

- 6.4.5 Mitsubishi Chemical Group Corporation

- 6.4.6 Reverdia

- 6.4.7 Roquette Freres

- 6.4.8 Technip Energies N.V.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Sustainable Dyes Made from Bio-based Succinic Acid