|

市場調查報告書

商品編碼

1851505

能源採集系統:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Energy Harvesting Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

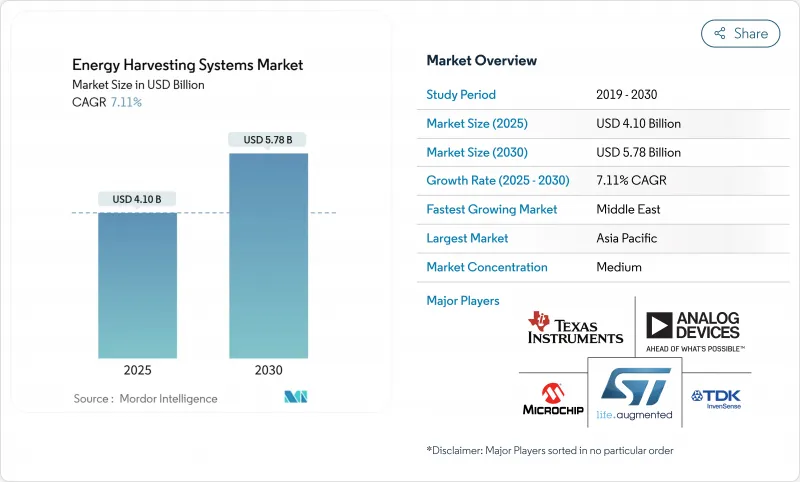

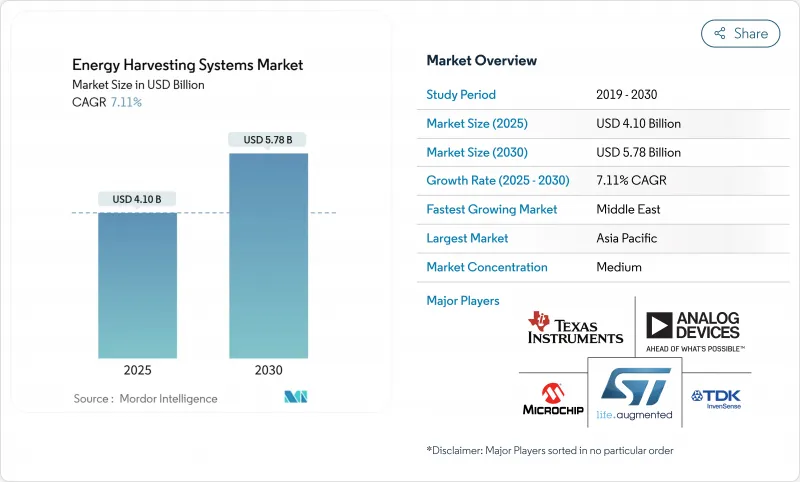

預計到 2025 年,能源採集系統市場規模將達到 41 億美元,到 2030 年將達到 57.8 億美元,年複合成長率為 7.11%。

對無電池物聯網 (IoT) 設備日益成長的需求,以及工業和消費領域超低功耗電子產品的普及,正在推動這一成長。電源管理積體電路的快速小型化是推動這一成長的主要動力,如今,這些積體電路已將複雜的調節功能整合到亞毫米級的尺寸中。同時,減少一次性電池廢棄物的政策壓力也提升了能源採集解決方案的價值提案。生態系統夥伴關係關係也將促進市場發展,加速承包模組和參考設計的上市速度,進一步推動智慧建築、工廠和穿戴式裝置等領域的應用。這些因素共同增強了能源採集系統市場未來十年的發展前景。

全球能源採集系統市場趨勢與洞察

智慧建築中無電池物聯網感測器節點的普及

歐盟生態設計法規2024/1781強制要求商業建築使用節能控制系統,促使建築管理人員轉向使用無電池無線感測器。巴黎和奧維耶多的試點研究表明,透過整合太陽能和射頻供電的感測器,並通訊居住和環境數據,平均可節省36.8千瓦的電力。射頻能量採集器可轉換10%至50%的環境能量,在受控室內區域轉換效率可達70%以上,確保感測器在建築物的整個生命週期內持續運作。業主越來越關注整體擁有成本,並意識到三次電池更換週期的成本超過了感測器的初始硬體成本,因此正在加速向能量採集解決方案轉型。隨著採購團隊將預算從維護轉向支援分析功能的硬體,商業房地產行業對能源採集系統市場的需求持續旺盛。

亞太地區工廠對永續、低功耗自動化的需求

中國、日本和韓國的工業集團已部署能量採集器,以履行企業碳減排承諾並減少因更換電池而導致的非計劃停機時間。西班牙電信技術公司(Telefónica Tech)在石油和氣體純化部署了經ATEX認證的熱電發電機,為振動節點供電,因為這些場所的電池供應受到嚴格限制。韓國科學技術研究院的調查團隊開發了一種混合能量採集器,結合了熱電效應和壓電效應,使重型機械監測的輸出功率提高了50%以上。密集的製造生態系統促進了試點部署,並實現了零件供應商之間的快速回饋循環,從而進一步降低了零件成本。隨著監管審核越來越重視生產工廠的能源基準,經營團隊正日益在多個工廠中標準化能量收集平台,從而形成區域性的發展勢頭。

農村地區環境射頻能量密度低

田間試驗表明,70%的種植者放棄了無線感測器試點計畫。農業技術整合商目前正將小型太陽能瓦片和振動條與灌溉幫浦結合使用,以應對陰天和射頻訊號較弱的問題。然而,混合設計增加了成本,也使維護計畫更加複雜,減緩了成本敏感型農場的廣泛採用。在農村連接基礎設施擴展之前,此限制因素將推動農業和環境監測能源採集系統市場短期內的成長。

細分市場分析

到2024年,基於光的光伏能量採集器將佔據能源採集系統市場42%的佔有率。由於其技術成熟度高、每瓦成本低且晝夜能量變化可預測,光伏技術在建築和戶外裝置領域仍保持領先地位。然而,隨著5G網路的密集部署增加可用於為感測器供電的環境電磁波水平,射頻能量採集技術到2030年的複合年成長率將達到11%。振動和電磁波能量採集器適用於旋轉式高能量機械,而熱席貝克裝置則在汽車廢氣和工業爐等領域找到了應用空間。融合多種模式的混合架構可在光照或運動停滯期間提供持續的能量收集,因此非常適合關鍵任務應用情境。隨著整合商將智慧最大功率點追蹤與自適應儲存相結合,以最佳化波動電源的產量比率效率,能源採集系統市場變得越來越具有韌性。

環境式能量採集系統的展示案例也層出不窮。 Ambient 光電在200勒克斯光照強度下實現了傳統電池三倍的輸出功率,從而為室內遙控器和鍵盤的應用奠定了基礎。同時,韓國科學技術研究院(KIST)報告稱,透過在懸臂梁平台上融合熱電和壓電通道,實現了50%的輸出功率提升。這些進步促使目標商標產品製造商(OEM)在其提案書中指定採用多源設計,因為這種設計可以縮短投資回收期並延長運作保證。隨著射頻能量採集效率的提高和組件價格的下降,能源採集系統市場將出現融合模組,這些模組能夠每隔幾毫秒自動選擇最高效的能量來源,以滿足負載需求。

至2024年,電源管理IC將佔能源採集系統市場規模的38%。隨著設計人員不再侷限於單一電源架構,而是需要專用轉換層,能量採集感測器市場到2030年將以9.5%的複合年成長率成長。薄膜電池和超級電容用於緩衝間歇性能量流,而超低功耗微控制器則負責進行分析,從而驗證感測器部署的合理性。意法半導體(STMicroelectronics)的SPV1050對太陽能和熱電輸入的轉換效率高達99%,凸顯了精密的調節技術如何延長節點壽命。旭化成(Asahi Kasei)的AP4413系列將電池平衡和涓流充電控制整合到1.43mm²的晶粒上,為對成本敏感的消費性電子產品提供能量採集解決方案。

產業發展藍圖正朝著系統晶片晶片封裝(SoC)的方向發展,這種封裝將能量採集前端、降壓轉換器和微控制器整合在單一層壓板中。這種整合消除了板級互連損耗,簡化了認證流程,並拓寬了可應用場景的範圍,從工業自動化到智慧玩具。在預測期內,整合式電源管理積體電路(PMIC)的平均售價將下降,這將進一步鞏固能源採集系統的市場。

能源採集系統市場按技術(光能能源採集、振動能源採集及其他)、組件(能源採集轉換器、電源管理IC及其他)、功率範圍(小於10MW、10-100MW及其他)、應用(消費電子、建築及家庭自動化、工業IoT及自動化及其他)及地區進行細分。市場預測以美元計價。

區域分析

到2024年,亞洲將佔全球銷售額的35%,這得益於中國龐大的物聯網部署以及日本在壓電材料領域的領先地位(例如TDK公司tdk.com)。從首爾到深圳,政府支持的智慧城市計畫正在津貼感測器基礎設施建設,委託製造製造商則提供了經濟高效的組裝方案,縮短了產品週期。韓國的半導體生態系統正在拓展客製化電源管理積體電路(PMIC)製造,新加坡的物流園區正在測試大規模環境物聯網陣列,以展示能量採集器在實際應用中的穩健性。

中東地區將呈現最快的成長軌跡,到2030年年均複合成長率將達到9.2%。沙烏地阿拉伯的「2030願景」將可再生能源置於其特大城市規劃的核心位置,而阿克薩清真寺的室內導航信標正在試用壓電地地板材料,這種地磚可以將朝聖者的腳步轉化為電網電力。波灣合作理事會的電力公司正在將太陽能發電裝置整合到智慧電錶機殼中,從而避免了派遣卡車進行電池維護的需要。以色列和阿拉伯聯合大公國已組成了一個區域研發叢集,將奈米材料研究所與創投基金結合,以加速高效能能量收集器的商業化進程。

北美和歐洲市場對能源產品的需求日趨成熟且強勁,同時法律規範也強調生命週期永續性。美國能源局提案對充電器的待機功率設定更嚴格的限制,引導家電製造商走上綠色能源發展之路。德國和英國正在為工廠的旋轉機械配備振動能量採集器,並指出其在三到五年內可帶來淨現值收益。在這些經濟體中,工程團隊在選擇感測器平台時會量化碳減排量,這使得能源採集系統市場訂單穩定成長,儘管其初始投資較高。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 無電池物聯網感測器節點在智慧建築中的普及(歐洲、北美)

- 亞太地區工廠必須推行永續、低功耗自動化。

- 超低功耗MCU的快速小型化,使其達到亞瓦閾值

- 無線狀態監測技術在鐵路和航空OEM廠商的應用日益廣泛

- 將太陽能收集器整合到穿戴式裝置和醫療貼片中

- 市場限制

- 農村地區環境射頻能量密度低

- 缺乏通用的電源管理標準

- 競爭性的低功耗廣域網路電池減少了對車載能量採集器的需求。

- 交通設施維修的初始設計和整合成本高昂

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 透過技術

- 光能(太陽能/光伏)能源採集

- 振動(壓電和電磁)能源採集

- 熱能(席貝克/熱電)能源採集

- 射頻能源採集

- 混合/多源能源採集

- 按組件

- 能源採集轉換器

- 電源管理積體電路

- 儲能單元(薄膜電池、超級電容)

- 超低功耗感測器和微控制器

- 按輸出範圍

- 小於10微瓦

- 10至100微瓦

- 100微瓦至1毫瓦

- 1~10 mW

- 10毫瓦或以上

- 透過使用

- 消費性電子產品

- 建築和家庭自動化

- 工業IoT和自動化

- 運輸

- 車

- 鐵路

- 航空業

- 醫療保健和穿戴式設備

- 國防與安全

- 農業與環境監測

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家(瑞典、挪威、丹麥、芬蘭)

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東協(新加坡、馬來西亞、泰國、印尼、菲律賓、越南)

- 南美洲

- 巴西

- 阿根廷

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 以色列

- 土耳其

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Microchip Technology Inc.

- STMicroelectronics NV

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- NXP Semiconductors NV

- onsemi(ON Semiconductor Corp.)

- TDK Corporation(InvenSense)

- Powercast Corporation

- Cymbet Corporation

- EnOcean GmbH

- e-peas SA

- ABB Ltd.

- Advanced Linear Devices Inc.

- Cap-XX Limited

- Fujitsu Components America Inc.

- G24 Power Ltd.

- Drayson Technologies Ltd.

- Piezo.com(Mide Technology)

- LORD MicroStrain(Parker Hannifin)

第7章 市場機會與未來展望

The energy harvesting systems market size is USD 4.10 billion in 2025 and is forecast to climb to USD 5.78 billion by 2030, advancing at a 7.11% CAGR.

Rising demand for battery-free Internet-of-Things (IoT) devices and the spread of ultra-low-power electronics across industrial and consumer environments underpin this growth. Momentum stems from rapid miniaturization in power-management integrated circuits that now squeeze sophisticated regulation functions into sub-millimeter footprints, while policy pressure to cut disposable battery waste reinforces the value proposition for energy harvesting solutions. Developers also benefit from ecosystem partnerships that speed time-to-market for turnkey modules and reference designs, further lifting adoption in smart buildings, factories, and wearables. Together, these forces strengthen the energy harvesting systems market outlook during the current decade.

Global Energy Harvesting Systems Market Trends and Insights

Proliferation of Battery-less IoT Sensor Nodes in Smart Buildings

The European Union Ecodesign Regulation 2024/1781 obliges commercial properties to use energy-efficient control systems, which pushes building managers toward battery-free wireless sensors Demonstrations in Paris and Oviedo logged 36.8 kW average power savings after integrating solar and RF-powered sensors that communicate occupancy and environmental data. RF harvesters convert 10-50% of ambient energy and more than 70% in tuned indoor zones, keeping sensors operational for the entire building life cycle. Facility owners increasingly weigh total cost of ownership and find that three battery replacement cycles eclipse initial sensor hardware costs, accelerating migration to harvesting solutions. As procurement teams pivot budgets from maintenance to analytics-ready hardware, the energy harvesting systems market gains sustained demand from the commercial real-estate sector.

Mandates for Sustainable Low-Power Automation in APAC Factories

Industrial groups across China, Japan, and South Korea install harvesters to satisfy corporate carbon pledges and cut unscheduled downtime tied to battery swaps. Telefonica Tech rolled out ATEX-certified thermoelectric generators that power vibration nodes in oil and gas refineries where battery access is tightly restricted. Researchers at the Korea Institute of Science and Technology combined thermoelectric and piezoelectric effects in a hybrid harvester that boosts power output by more than 50% for heavy-machinery monitoring. Dense manufacturing ecosystems allow quick feedback loops between pilot deployments and component suppliers, further trimming bill-of-materials cost. As regulatory audits emphasize energy baselines in production plants, executives increasingly standardize harvesting platforms across multiple factory sites, reinforcing regional momentum.

Low Energy Density of Ambient RF in Rural Installations

Field trials show that 70% of growers abandon wireless sensor pilots because nodes exhaust batteries faster than expected, a gap magnified where RF density dips below harvestable levels. Agritech integrators now blend small solar tiles with vibration strips on irrigation pumps to hedge against cloudy seasons and weak RF signals. Even so, hybrid designs raise costs and complicate maintenance schedules, delaying wide deployment in cost-sensitive farms. Until rural connectivity infrastructure expands, this restraint caps immediate upside for the energy harvesting systems market in agriculture and environmental monitoring.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Miniaturization of Ultra-Low-Power MCUs Enabling Sub-µW Thresholds

- Growing Deployment of Wireless Condition-Monitoring in Rail & Aviation OEMs

- Absence of Universal Power-Management Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Light-based photovoltaic harvesters controlled 42% of the energy harvesting systems market share in 2024. Superior maturity, low cost per watt, and predictable diurnal energy profiles keep photovoltaics in pole position for building and outdoor installations. RF harvesting, however, posts an 11% CAGR to 2030 as dense 5G deployments raise ambient electromagnetic levels that can be scavenged for sensor power. Vibration and electromagnetic harvesters serve machinery where rotational energy is plentiful, while thermal Seebeck devices find niches in automotive exhaust and industrial furnaces. Hybrid architectures that blend multiple modalities deliver continuity during light or motion lulls, appealing to mission-critical use cases. The energy harvesting systems market gains resilience as integrators pair intelligent maximum-power-point tracking with adaptive storage to optimize yield across variable sources.

Hybrid proof points abound. Ambient Photonics records triple the power output in 200 lux compared with legacy cells, unlocking indoor remote controls and keyboards. Meanwhile, the Korea Institute of Science and Technology reports a 50% power bump by merging thermoelectric and piezoelectric channels in a cantilever platform. These advances compress payback periods and extend uptime guarantees, encouraging original-equipment manufacturers to specify multi-source designs in request-for-proposal documents. As RF harvesting efficiency rises and component prices drop, the energy harvesting systems market will witness converged modules that auto-select the most productive source every few milliseconds to sustain load demands.

Power-management ICs captured 38% of the energy harvesting systems market size in 2024 by value because every harvester topology requires accurate voltage regulation and storage orchestration. Energy-harvesting transducers exhibit a 9.5% CAGR to 2030 as designers diversify beyond single-source architectures and need specialized conversion layers. Thin-film batteries and supercapacitors buffer intermittent energy streams, while ultra-low-power microcontrollers perform the analytics that justify sensor deployments. STMicroelectronics' SPV1050 achieves up to 99% conversion efficiency for photovoltaic and thermoelectric inputs, highlighting how sophisticated regulation extends node lifetimes. Asahi Kasei's AP4413 series integrates cell-balancing and trickle-charge control in a 1.43 mm2 die, bringing harvesting solutions to cost-sensitive consumer gadgets.

Industry roadmaps converge on system-on-chip packages that embed harvesting front ends, buck-boost converters, and microcontrollers within a single laminate. This consolidation removes board-level interconnect losses and simplifies certification, expanding addressable use cases from industrial automation to smart toys. Over the forecast window, falling ASPs for integration-ready PMICs will spur volume shipments, further fortifying the energy harvesting systems market.

Energy Harvesting Systems Market is Segmented by Technology (Light Energy Harvesting, Vibration Energy Harvesting, and More), Component (Energy-Harvesting Transducers, Power-Management ICs, and More), Power Range (Less Than 10 MW, 10-100 MW, and More), Application (Consumer Electronics, Building and Home Automation, Industrial IoT and Automation, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia held 35% of 2024 global revenue, benefiting from China's immense IoT roll-outs and Japan's leadership in piezoelectric materials through firms such as TDK Corporation tdk.com. Government-backed smart-city programs from Seoul to Shenzhen subsidize sensor infrastructure, while contract manufacturers in Taiwan and Malaysia offer cost-efficient assembly paths that shorten product cycles. South Korea's semiconductor ecosystem extends bespoke PMIC fabrication, and Singapore's logistics parks test large-scale ambient IoT arrays that showcase real-world harvester robustness.

The Middle East records the fastest trajectory at a 9.2% CAGR to 2030. Saudi Arabia's Vision 2030 positions renewable energy at the center of megacity planning, and indoor navigation beacons at the Al-Haram mosque now trial piezo tile flooring that converts pilgrim footsteps into grid power doi.org. Gulf Cooperation Council utilities integrate photovoltaic harvesters into smart-meter housings to avoid truck rolls for battery service. Israel and the United Arab Emirates anchor regional R&D clusters that pair nano-material labs with venture funds, accelerating commercialization timelines for high-efficiency harvesters.

North America and Europe show mature yet solid demand tied to regulatory frameworks that emphasize lifecycle sustainability. The United States Department of Energy proposes stricter standby limits for chargers, nudging appliance makers toward ambient power paths. Germany and the United Kingdom equip factories with vibration harvesters for rotating machinery, citing net present value gains over three to five years. Across these economies, engineering teams now quantify carbon abatement when selecting sensor platforms, a trend that channels steady orders into the energy harvesting systems market even where initial capital outlay is higher.

- Microchip Technology Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Analog Devices Inc.

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- onsemi (ON Semiconductor Corp.)

- TDK Corporation (InvenSense)

- Powercast Corporation

- Cymbet Corporation

- EnOcean GmbH

- e-peas S.A.

- ABB Ltd.

- Advanced Linear Devices Inc.

- Cap-XX Limited

- Fujitsu Components America Inc.

- G24 Power Ltd.

- Drayson Technologies Ltd.

- Piezo.com (Mide Technology)

- LORD MicroStrain (Parker Hannifin)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Battery-less IoT Sensor Nodes in Smart Buildings (Europe and North America)

- 4.2.2 Mandates for Sustainable Low-Power Automation in APAC Factories

- 4.2.3 Rapid Miniaturization of Ultra-Low-Power MCUs Enabling Sub-W Thresholds

- 4.2.4 Growing Deployment of Wireless Condition-Monitoring in Rail and Aviation OEMs

- 4.2.5 Integration of Photovoltaic Harvesters into Wearables and Medical Patches

- 4.3 Market Restraints

- 4.3.1 Low Energy Density of Ambient RF in Rural Installations

- 4.3.2 Absence of Universal Power-Management Standards

- 4.3.3 Competing LPWAN Batteries Reducing Need for On-Board Harvesters

- 4.3.4 High Up-front Design-Integration Costs for Transportation Retrofits

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Light (Solar/Photovoltaic) Energy Harvesting

- 5.1.2 Vibration (Piezoelectric and Electromagnetic) Energy Harvesting

- 5.1.3 Thermal (Seebeck / Thermoelectric) Energy Harvesting

- 5.1.4 RF (Radio-Frequency) Energy Harvesting

- 5.1.5 Hybrid / Multi-Source Energy Harvesting

- 5.2 By Component

- 5.2.1 Energy-Harvesting Transducers

- 5.2.2 Power-Management ICs

- 5.2.3 Energy-Storage Units (Thin-Film Batteries, Supercapacitors)

- 5.2.4 Ultra-Low-Power Sensors and MCUs

- 5.3 By Power Range

- 5.3.1 Less than 10 micro W

- 5.3.2 10-100 micro W

- 5.3.3 100 micro W-1 mW

- 5.3.4 1-10 mW

- 5.3.5 Greater than 10 mW

- 5.4 By Application

- 5.4.1 Consumer Electronics

- 5.4.2 Building and Home Automation

- 5.4.3 Industrial IoT and Automation

- 5.4.4 Transportation

- 5.4.4.1 Automotive

- 5.4.4.2 Rail

- 5.4.4.3 Aviation

- 5.4.5 Healthcare and Wearables

- 5.4.6 Defense and Security

- 5.4.7 Agriculture and Environmental Monitoring

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics (Sweden, Norway, Denmark, Finland)

- 5.5.2.7 Benelux (Belgium, Netherlands, Luxembourg)

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN (Singapore, Malaysia, Thailand, Indonesia, Philippines, Vietnam)

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Israel

- 5.5.5.4 Turkey

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Kenya

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Microchip Technology Inc.

- 6.4.2 STMicroelectronics N.V.

- 6.4.3 Texas Instruments Incorporated

- 6.4.4 Analog Devices Inc.

- 6.4.5 Renesas Electronics Corporation

- 6.4.6 NXP Semiconductors N.V.

- 6.4.7 onsemi (ON Semiconductor Corp.)

- 6.4.8 TDK Corporation (InvenSense)

- 6.4.9 Powercast Corporation

- 6.4.10 Cymbet Corporation

- 6.4.11 EnOcean GmbH

- 6.4.12 e-peas S.A.

- 6.4.13 ABB Ltd.

- 6.4.14 Advanced Linear Devices Inc.

- 6.4.15 Cap-XX Limited

- 6.4.16 Fujitsu Components America Inc.

- 6.4.17 G24 Power Ltd.

- 6.4.18 Drayson Technologies Ltd.

- 6.4.19 Piezo.com (Mide Technology)

- 6.4.20 LORD MicroStrain (Parker Hannifin)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment