|

市場調查報告書

商品編碼

1851491

資料中心安全:市場佔有率分析、產業趨勢、統計資料和成長預測(2025-2030 年)Data Center Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

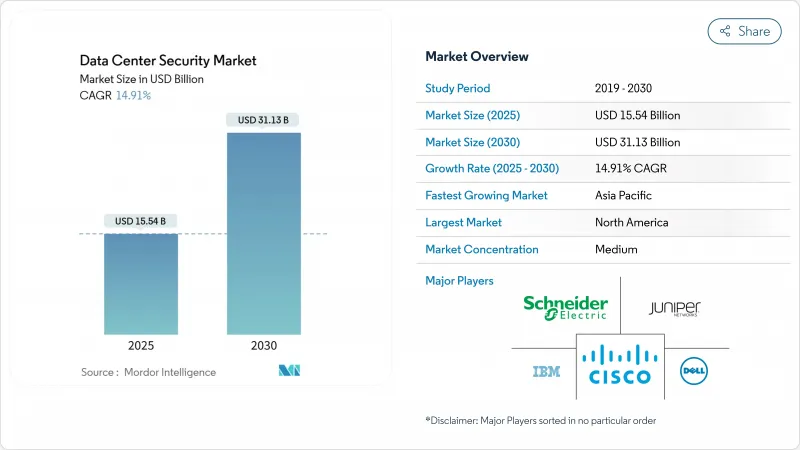

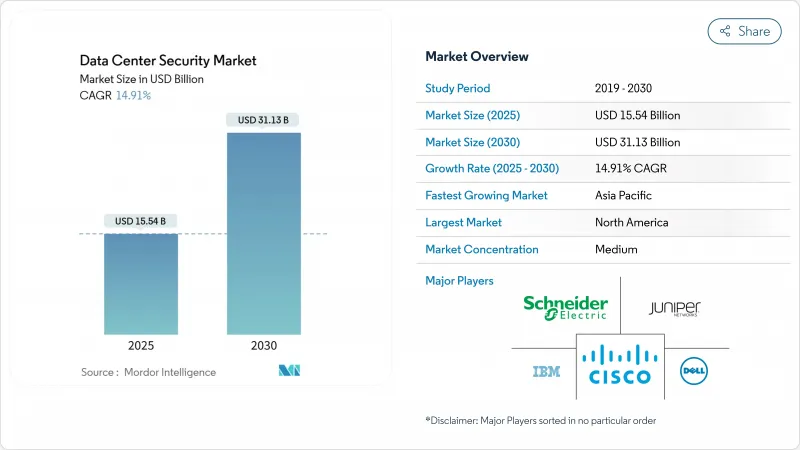

預計到 2025 年,資料中心安全市場規模將達到 155.4 億美元,到 2030 年將達到 311.3 億美元,年複合成長率為 14.91%。

這反映出營運商面臨越來越大的壓力,需要保護支撐人工智慧訓練、邊緣分析和混合雲端工作負載的高密度環境。網路攻擊頻率的上升、超大規模部署的快速發展以及日益嚴格的全球法令遵循,正促使供應商重新設計實體和邏輯控制措施。企業正從邊界防禦轉向以身分為中心的零信任架構,以檢驗每個請求並持續監控設備健康狀況。對人工智慧驅動的威脅搜尋、整合實體和邏輯平台以及安全即服務模式的同步投資,正在重塑採購模式,尤其對於資源受限的企業而言更是如此。

全球資料中心安全市場趨勢與洞察

爆炸性的數據流量和超大規模建設

到2024年,超大規模業者將處理全球76%的AI伺服器出貨量,集中了大量需要嚴密防禦的寶貴資產。到2030年,AI園區電力預算可能超過5GW,這將推動安全區域、無徽章生物識別和AI輔助網路分段的同步升級。供應商目前正在交付模組化安全設備,這些設備能夠處理Terabit加密流量而不會出現延遲峰值;營運商也在整合機器學習感測器,以檢測傳統防火牆無法偵測到的異常東西向流量。這些變化共同推動了資料中心安全市場的持續支出,尤其是在託管、企業和邊緣設施紛紛效仿超大規模最佳實踐的情況下。

日益複雜的網路攻擊

2024年下半年,隨著攻擊者自動化偵察和漏洞利用,企業平均每週將遭受1900次攻擊。零時差攻擊的武器化週期正從數週縮短至數小時,迫使營運商部署無需分析師干預即可自動搜尋和消除威脅的自學習防禦系統。將持續行為分析與自適應策略引擎整合已成為至關重要的環節。對統一端點、工作負載和網路遙測資料的平台進行投資,正在擴大中型企業資料中心安全市場的潛在規模,這些企業先前依賴各自獨立的工具集。

多層安全措施需要較高的資本支出/營運支出

從周界防護到異常偵測,全端式安全防護通常會佔用設施預算的兩位數百分比。到2025年,雲端安全可能佔企業網路安全支出的20%。營運商透過安全即服務協議來抵消成本,將資本支出轉化為可預測的費用,但為舊設備量身定做這些服務會延長整合週期。託管服務提供者正面臨可用性緊張和價格壓力,這導致升級延遲,並阻礙了市場區隔領域的成長。

細分市場分析

以身分感知防火牆、微隔離和人工智慧增強型監控為基準的邏輯安全措施,在2024年佔據了資料中心安全市場55.65%的佔有率。到2030年,該細分市場將以17.2%的複合年成長率成長,這反映出企業越來越迫切地需要檢驗每個會話。企業現在更傾向於使用能夠根據設備狀態、地理位置和行為偏差動態調整權限的策略引擎。

實體安全措施仍然至關重要,尤其是在邊緣機架等盜竊和篡改風險較高的區域。人工智慧攝影機、生物識別旋轉門和機器人技術正與軟體警報系統融合,建構一個統一的指揮中心,透過單一主機即可管理鎖具、警報和資料包流。這種融合以統一平台取代了各自獨立的門禁系統,消除了安全盲區,從而提升了資料中心安全市場的交叉銷售潛力。

2024年,從新一代防火牆到資料中心基礎設施管理(DCIM)嵌入式監控等解決方案將佔據資料中心安全市場67.8%的佔有率。然而,由於複雜性、監管變化和技能缺口等因素,託管服務將以17.74%的複合年成長率成長,超過硬體更新周期。目前,服務提供者正將威脅調查、取證分析和合規性報告整合到基於結果的服務等級協定(SLA)中。

隨著企業根據零信任基準和量子安全藍圖調整架構,諮詢需求也隨之成長。 IBM 的全天候託管服務套件標誌著企業正從保護雲端工作負載轉向在保護雲端工作負載之上疊加事件回應,以應對企業留住員工的挑戰。這一趨勢將帶來新的經常性收入,並擴大全球資料中心安全市場。

資料中心安全市場報告按安全類型(實體安全解決方案及其他)、產品/服務(解決方案、服務)、資料中心類型(超大規模資料中心、企業級資料中心、邊緣資料中心及其他)、垂直產業(IT與通訊、銀行、金融服務及保險及其他)和地區(北美、歐洲及其他)對產業進行分類。市場預測以美元計價。

區域分析

北美將在2024年以37.25%的市佔率引領資料中心安全市場,主要得益於高密度超大規模集群和日益嚴格的監管審查。光是美國就佔該地區支出的77%,雲巨頭紛紛宣布斥資數十億美元部署人工智慧園區,從一開始就採用零信任架構。隨著傳統資料中心面臨日益嚴格的電力限制,迫使營運商在其分散式環境中複製安全控制措施,亞特蘭大和鳳凰城等二線城市也因此吸引了更多成長。

亞太地區年複合成長率高達19.21%,是該地區成長最快的,這主要得益於兩位數的產能成長和對數位銀行的需求。在新加坡,隨著綠色開發禁令的解除,綠色開發許可的發放刺激了對安全待開發區的收購;而東京則利用其嚴格的個人資訊保護法來吸引銀行、金融服務和保險(BFSI)企業入駐。在中國和印度,對加密金鑰本地化的重視推動了對客製化合規模組的需求,進而促進了國內服務提供者的資料中心安全市場發展。三井物產在神奈川縣投資1.18億美元興建超大規模資料中心,凸顯了這個投資趨勢。

在歐洲,義大利、西班牙和法國正在增加對新型人工智慧叢集的安全投資,同時努力平衡GDPR法規的要求和可再生能源目標。拉丁美洲預計到2024年將實現42%的成長,其中巴西和墨西哥將引領這一成長。巴西能源供應的改善與關鍵雲端區域重疊。在中東和非洲,主權雲端服務和經濟特區獎勵措施正在被採用,將資料中心安全市場擴展到杜拜和約翰尼斯堡等待開發區園區。在所有地區,資料主權和出口管制計劃(例如美國資料中心VEU認證)的主題都在增強對防篡改審核追蹤的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 爆炸性的數據流量和超大規模建設

- 日益複雜的網路攻擊

- 嚴格的全球合規性

- 雲和混合IT擴大了攻擊面

- 資料中心內基於人工智慧的零信任架構(鮮為人知)

- 邊緣/模組化資料中心的自主實體安全(隱蔽式)

- 市場限制

- 多層安全措施需要較高的資本支出/營運支出

- 網路技能短缺

- 電力和冷卻預算給安保工作帶來壓力(鮮為人知)

- 資料在地化架構的複雜性(鮮為人知)

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場宏觀經濟趨勢

第5章 市場規模及成長預測(價值,2024-2030 年)

- 按安全類型

- 實體安全

- 邏輯/網路安全

- 報價

- 解決方案

- 服務(諮詢、整合、管理)

- 依資料中心類型

- 超大規模雲端服務商/雲端服務供應商

- 搭配

- 企業和邊緣運算

- 按行業

- 銀行與金融服務 (BFSI)

- 資訊科技和電信

- 醫療保健與生命科學

- 消費品和零售

- 政府和國防部

- 媒體與娛樂

- 其他(能源、教育等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 新加坡

- 澳洲

- 馬來西亞

- 亞太其他地區

- 南美洲

- 巴西

- 智利

- 阿根廷

- 其他南美洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略舉措和 MandA

- 市佔率分析

- 公司簡介

- Cisco Systems Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Symantec(Gen Digital)

- Juniper Networks Inc.

- VMware by Broadcom

- Fortinet Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Dell Technologies

- Hewlett Packard Enterprise

- Citrix Systems

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- Genetec Inc.

- Bosch Security Systems

- Arista Networks

- Cyxtera Technologies

- Hikvision Digital Technology

- Johnson Controls

- NEC Corporation

- Market Opportunities and Future Outlook

- White-space and Unmet-Need Assessment

The data center security market is valued at USD 15.54 billion in 2025 and is projected to reach USD 31.13 billion by 2030, advancing at a 14.91% CAGR.

The expansion reflects mounting pressure on operators to safeguard high-density environments that now power AI training, edge analytics, and hybrid-cloud workloads. Rising cyber-attack frequency, rapid hyperscale build-outs, and tighter global compliance rules are reshaping how vendors design physical and logical controls. Companies are moving from perimeter defenses to identity-centric, zero-trust blueprints that verify every request and continuously monitor device health. Parallel investments in AI-driven threat hunting, converged physical-logical platforms, and security-as-a-service models are reshaping buying patterns, especially among resource-constrained enterprises.

Global Data Center Security Market Trends and Insights

Explosive Data-Traffic and Hyperscale Build-Outs

Hyperscale operators are on track to handle 76% of global AI server shipments in 2024, concentrating valuable assets that demand hard-to-breach defenses. Power budgets for AI campuses could top 5 GW by 2030, prompting parallel upgrades in security zones, badge-less biometrics, and AI-assisted network segmentation.Vendors now ship modular security appliances that process terabits of encrypted traffic without latency spikes. Operators also embed machine-learning sensors that surface anomalous east-west flows invisible to legacy firewalls. Together these shifts stimulate sustained spending, especially across the data center security market as colocation, enterprise, and edge facilities mirror hyperscale best practices.

Escalating Cyber-Attack Sophistication

Organizations endured an average of 1,900 weekly attacks in late 2024, driven by attackers automating reconnaissance and exploit delivery. Zero-day weaponization cycles collapsed from weeks to hours, pressuring operators to deploy self-learning defenses that hunt and neutralize threats without analyst intervention. Integration of continuous behavior analytics and adaptive policy engines is now baseline. Investment gravitates toward unified platforms that converge endpoint, workload, and network telemetry, expanding the addressable data center security market among midsize enterprises that previously relied on siloed toolsets.

High CAPEX/OPEX for Multi-Layer Security

Full-stack protection-from perimeter fencing to anomaly detection-regularly consumes double-digit percentages of facility budgets. Cloud security could absorb 20% of enterprise cyber spend by 2025. Operators offset costs through security-as-a-service contracts that shift capital outlays into predictable fees, yet customizing these services to legacy gear inflates integration timelines. Colocation providers navigate tight vacancy and pricing pressure, delaying upgrades and tempering growth within segments of the data center security market.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Compliance Mandates

- Cloud and Hybrid IT Attack-Surface Expansion

- Cyber-Skills Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Logical safeguards held 55.65% share of the data center security market in 2024 as identity-aware firewalls, micro-segmentation, and AI-enhanced monitoring became baseline. The segment is poised for a 17.2% CAGR through 2030, reflecting heightened urgency to inspect east-west traffic and verify every session. Enterprises now favor policy engines that adjust privileges dynamically, referencing device posture, geolocation, and behavioral deviations.

Physical safeguards remain foundational, particularly across edge racks where theft and tampering risks climb. AI-powered cameras, biometric turnstiles, and robotics converge with software alerts, creating integrated command centers where a single console governs locks, alarms, and packet flows. This convergence lifts cross-sell potential inside the data center security market as buyers replace siloed badge systems with unified platforms that slash blind spots.

Solutions contributed 67.8% to the data center security market size in 2024, ranging from next-gen firewalls to DCIM-embedded surveillance. Yet complexity, regulatory churn, and skills gaps propel managed services to a 17.74% CAGR, outstripping hardware refresh cycles. Providers now bundle threat hunting, forensic analysis, and compliance reporting under outcome-based service-level agreements.

Consulting demand likewise rises as firms recalibrate architectures against zero-trust baselines and quantum-safe roadmaps. IBM's 24/7 managed service suite illustrates the shift, layering incident response on cloud-workload protection for enterprises lacking continuous staff coverage. This trajectory creates fresh recurring revenue and expands the global data center security market.

Data Center Security Market Report Segments the Industry Into Security Type(Physical Security Solutions, and More). Offering (Solutions, Services), Data Center Type(Hyperscalers, Enterprise and Edge, and More), Industry Vertical(IT and Telecom, BFSI and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the data center security market at 37.25% in 2024, underpinned by dense hyperscale clusters and elevated regulatory scrutiny. The United States alone captured 77% of regional spend, with cloud giants announcing multi-billion-dollar AI-campus rollouts that integrate zero-trust blueprints from day one. Secondary metros such as Atlanta and Phoenix attract growth as power caps tighten in legacy hubs, compelling operators to replicate security controls across dispersed footprints.

Asia-Pacific is set for a 19.21% CAGR, the fastest among regions, thanks to double-digit capacity additions and digital-banking demand. Singapore's moratorium-ending green permits spur secure greenfield sites, while Tokyo leverages stringent privacy laws to lure BFSI tenants. China and India emphasize localized encryption keys, prompting bespoke compliance modules and fueling the data center security market across indigenous service providers. Mitsui & Co.'s USD 118 million (JPY 18 billion) stake in a Kanagawa hyperscale facility highlights the investment tide.

Europe intensifies security investments in new AI clusters across Italy, Spain, and France, balancing GDPR mandates with renewable-energy targets. Latin America posted 42% growth in 2024, led by Brazil and Mexico where energy access improvements coincide with marquee cloud regions. The Middle East and Africa adopt sovereign-cloud clauses and SEZ incentives, extending the data center security market to greenfield campuses in Dubai and Johannesburg. Across all regions, data-sovereignty themes and export-control programs such as the U.S. Data Center VEU Authorization reinforce demand for tamper-proof audit trails

- Cisco Systems Inc.

- IBM Corporation

- Check Point Software Technologies Ltd.

- Symantec (Gen Digital)

- Juniper Networks Inc.

- VMware by Broadcom

- Fortinet Inc.

- Palo Alto Networks Inc.

- Trend Micro Inc.

- Dell Technologies

- Hewlett Packard Enterprise

- Citrix Systems

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

- Genetec Inc.

- Bosch Security Systems

- Arista Networks

- Cyxtera Technologies

- Hikvision Digital Technology

- Johnson Controls

- NEC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive data-traffic and hyperscale build-outs

- 4.2.2 Escalating cyber-attack sophistication

- 4.2.3 Stringent global compliance mandates

- 4.2.4 Cloud and hybrid IT attack-surface expansion

- 4.2.5 AI-powered zero-trust fabric inside DC (under-radar)

- 4.2.6 Autonomous physical security for edge/modular DC (under-radar)

- 4.3 Market Restraints

- 4.3.1 High CAPEX/OPEX for multi-layer security

- 4.3.2 Cyber-skills shortage

- 4.3.3 Power and cooling budgets crowd out security (under-radar)

- 4.3.4 Data-localization architecture complexity (under-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Anlaysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (Value, 2024-2030)

- 5.1 By Security Type

- 5.1.1 Physical Security

- 5.1.2 Logical / Cyber Security

- 5.2 By Offering

- 5.2.1 Solutions

- 5.2.2 Services (Consulting, Integration, Managed)

- 5.3 By Data Center Type

- 5.3.1 Hyperscalers/Cloud Service Providers

- 5.3.2 Colocation

- 5.3.3 Enterprise and Edge

- 5.4 By Industry Vertical

- 5.4.1 Banking and Financial Services (BFSI)

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Consumer Goods and Retail

- 5.4.5 Government and Defense

- 5.4.6 Media and Entertainment

- 5.4.7 Others (Energy, Education, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Singapore

- 5.5.3.5 Australia

- 5.5.3.6 Malaysia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Chile

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirate

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves and MandA

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Check Point Software Technologies Ltd.

- 6.4.4 Symantec (Gen Digital)

- 6.4.5 Juniper Networks Inc.

- 6.4.6 VMware by Broadcom

- 6.4.7 Fortinet Inc.

- 6.4.8 Palo Alto Networks Inc.

- 6.4.9 Trend Micro Inc.

- 6.4.10 Dell Technologies

- 6.4.11 Hewlett Packard Enterprise

- 6.4.12 Citrix Systems

- 6.4.13 Schneider Electric SE

- 6.4.14 Siemens AG

- 6.4.15 Honeywell International Inc.

- 6.4.16 Genetec Inc.

- 6.4.17 Bosch Security Systems

- 6.4.18 Arista Networks

- 6.4.19 Cyxtera Technologies

- 6.4.20 Hikvision Digital Technology

- 6.4.21 Johnson Controls

- 6.4.22 NEC Corporation

- 6.5 Market Opportunities and Future Outlook

- 6.5.1 White-space and Unmet-Need Assessment