|

市場調查報告書

商品編碼

1844355

資料中心安全市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Data Center Security Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

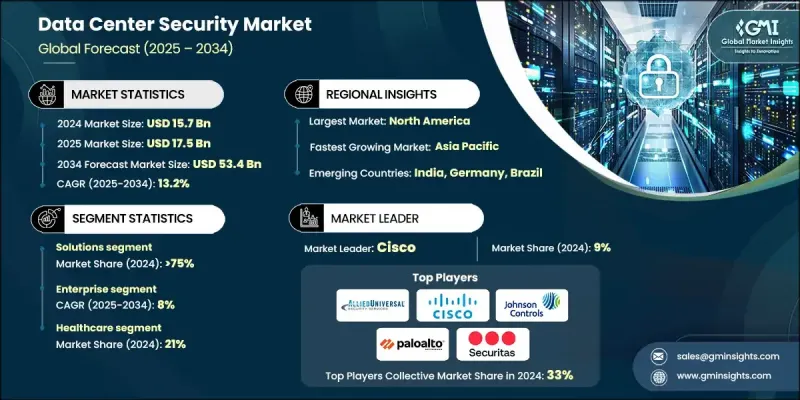

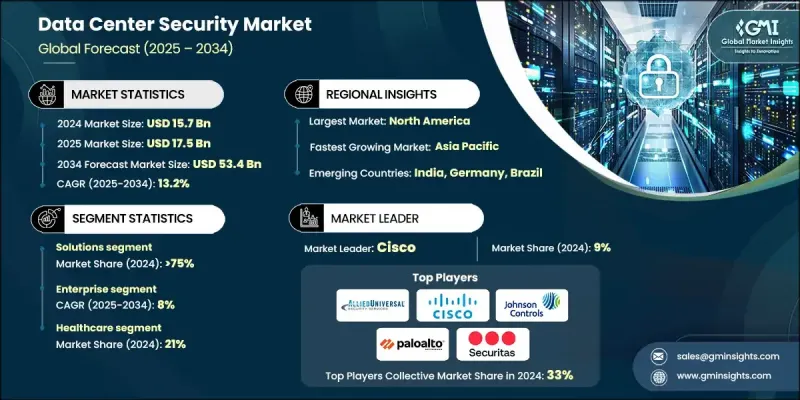

2024 年全球資料中心安全市場價值為 157 億美元,預計將以 13.2% 的複合年成長率成長,到 2034 年達到 534 億美元。

隨著企業持續儲存和管理大量關鍵資料,強大的資料中心安全(包括實體和網路安全)的重要性日益凸顯。如今,全面的保護需要事件回應計劃、風險評估、持續監控和多層防禦系統之間的無縫協調。由於企業不斷面臨保護客戶資料和維持營運連續性的壓力,安全已成為資料中心策略的核心組成部分。遵守 NIST、ISO 等全球標準以及特定地區的法規不僅是必要的,而且是嚴格執行的,這促使企業將治理和安全管理融入日常營運中。如果忽視這些要求,公司將面臨嚴厲的處罰,甚至可能被關閉。當今的資料中心環境需要的不僅僅是獨立的防火牆或攝影機系統;完全統一的安全架構已成為行業規範,包括持續的審計和即時的事件緩解。雲端基礎設施和人工智慧安全技術的日益普及以及對金融、醫療保健和政府營運等關鍵領域的監管力度不斷加強,進一步推動了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 157億美元 |

| 預測值 | 534億美元 |

| 複合年成長率 | 13.2% |

2024年,解決方案部門佔了75%的佔有率。該部門包括一整套在資料中心設施內協同工作的網路安全和實體安全工具。生物識別門禁、運動感測器、圍欄、警報系統和監視攝影機等實體解決方案是防止未經授權的存取和保護邊界安全的關鍵。在網路安全方面,端點偵測和回應 (EDR)、防火牆、入侵偵測和防禦系統 (IDS/IPS)、雲端原生安全平台以及人工智慧驅動的監控解決方案等技術旨在即時偵測和回應威脅。

2025年至2034年間,企業級資料中心的複合年成長率將達到8%。這些企業營運的資料中心是關鍵業務營運的支柱。金融、醫療保健和製造等行業的公司管理的內部設施優先考慮將實體安全措施(例如受控存取和監控)與網路安全系統(包括防火牆、異常檢測和基礎設施監控)相結合。由於保護機密資料和滿足合規性要求至關重要,企業持續大力投資整合的端到端安全解決方案。

由於其廣泛的數位基礎設施,美國資料中心安全市場在2024年創造了47億美元的收入。北維吉尼亞州等地區的資料中心成長已使該地區成為國家級樞紐。然而,在良好的基礎設施和商業環境的推動下,里士滿等新興市場也正在獲得發展動力。

積極影響全球資料中心安全市場的關鍵參與者包括江森自控、霍尼韋爾、Securitas、Genetec、Allied Universal、思科、飛塔、安訊士、派拓網路和亞薩合萊。為了鞏固市場地位,資料中心安全領域的公司正專注於結合實體安全和網路安全的整合解決方案。許多公司正在透過人工智慧驅動的威脅檢測和即時分析來增強其產品供應。策略性收購和合作夥伴關係也有助於擴大其技術組合和市場准入。參與者正在投資研發,以開發專為混合基礎設施量身定做的先進生物識別和雲端原生工具。向新興的二級資料中心市場進行地理擴張是一種常見策略,尤其是在雲端運算採用率和數位基礎設施項目不斷成長的地區。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 初步研究和驗證

- 主要來源

- 預報

- 研究假設和局限性

第 2 章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 實體安全基礎設施投資不斷增加

- 採用綜合網路實體安全解決方案

- 雲端和混合資料中心擴展

- 法規遵從性(ISO、NIST、GDPR)

- 增加內部威脅緩解舉措

- 產業陷阱與挑戰

- 熟練勞動力有限

- 中小企業的預算限制

- 市場機會

- 邊緣資料中心的成長

- 託管安全服務的採用

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術成熟度評估框架

- 當前的技術趨勢

- 新興技術

- 成本結構分析

- 專利分析

- 永續性和 ESG 影響評估

- 環境影響分析和指標

- 社會影響考量與指標

- 治理與合規框架

- ESG 投資含義與財務影響

- 用例和應用

- 最佳情況

- 投資報酬率分析和商業案例框架

- 總擁有成本(TCO)分析

- 風險緩解和安全價值量化

- 營運效率和生產力提升

- 商業案例範本和財務模型

- 資料中心建置活動

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 多邊環境協定

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 創投與私募股權活動

- 基礎建設投資模式

第5章:市場估計與預測:依組件分類,2021 - 2034 年

- 主要趨勢

- 解決方案

- 實體安全

- 邏輯/網路安全

- 威脅情報

- 資料安全

- 服務

- 託管安全

- 諮詢

- 支援與維護

第6章:市場估計與預測:按資料中心,2021 - 2034 年

- 主要趨勢

- 超大規模

- 主機託管

- 企業

- 邊緣

第7章:市場估計與預測:依最終用途,2021 - 2034

- 主要趨勢

- 金融服務業協會

- 衛生保健

- 零售與電子商務

- 媒體與娛樂

- 資訊科技和電信

- 政府和國防

- 其他

第8章:市場估計與預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐人

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 多邊環境協定

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 全球參與者

- ASSA ABLOY

- Axis Communications

- Check Point Software Technologies

- Cisco

- CrowdStrike

- Fortinet

- Genetec

- Honeywell

- Johnson Controls

- Palo Alto Networks

- Securitas

- Siemens

- Tyco International

- Verint Systems

- Zebra Technologies

- Allied Universal

- 區域參與者

- ADT

- Bosch Security Systems

- Brinks Home Security

- Dahua Technology

- Eaton

- Flir Systems

- Hanwha Techwin

- Hikvision

- LenelS2

- Motorola Solutions

- 新興參與者/顛覆者

- Armis Security

- Chainguard

- Cynomi

- Endor Labs

- Koi

The Global Data Center Security Market was valued at USD 15.7 billion in 2024 and is estimated to grow at a CAGR of 13.2% to reach USD 53.4 billion by 2034.

As organizations continue to store and manage vast volumes of critical data, the importance of robust data center security, both physical and cyber, has grown significantly. Comprehensive protection now requires seamless coordination between incident response planning, risk assessments, continuous monitoring, and multi-layered defense systems. With businesses under constant pressure to secure customer data and maintain operational continuity, security has become a core component of data center strategy. Compliance with global standards like NIST, ISO, and region-specific regulations is not only necessary but also heavily enforced, pushing organizations to integrate governance and security management in daily operations. Companies face strict penalties and potential shutdowns if these requirements are ignored. Today's data center environments demand more than isolated firewalls or camera systems; a fully unified security architecture has become the industry norm, involving continuous audits and real-time incident mitigation. Market growth is further supported by rising adoption of cloud infrastructure, AI-enabled security technologies, and increasing regulatory oversight across critical sectors, including finance, healthcare, and government operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.7 Billion |

| Forecast Value | $53.4 Billion |

| CAGR | 13.2% |

In 2024, the solutions segment held a 75% share. This segment includes a full suite of cyber and physical security tools working together inside data center facilities. Physical solutions such as biometric access, motion sensors, fencing, alarm systems, and surveillance cameras are key to preventing unauthorized access and securing perimeter boundaries. On the cyber side, technologies like endpoint detection and response (EDR), firewalls, intrusion detection and prevention systems (IDS/IPS), cloud-native security platforms, and AI-driven monitoring solutions are designed to detect and respond to threats in real time.

The enterprises segment will grow at a CAGR of 8% between 2025 and 2034. These enterprise-run data centers serve as the backbone of critical business operations. Internal facilities managed by companies in sectors like finance, healthcare, and manufacturing prioritize a blend of physical safeguards, such as controlled access and surveillance, with cybersecurity systems that include firewalls, anomaly detection, and infrastructure monitoring. With the stakes high for protecting confidential data and meeting compliance mandates, enterprises continue to invest heavily in integrated, end-to-end security solutions.

US Data Center Security Market generated USD 4.7 billion in 2024, owing to its extensive digital infrastructure. Data center growth in areas like North Virginia has established the region as a national hub. However, newer markets such as Richmond are gaining traction as well, driven by favorable infrastructure and business environments.

Key players actively shaping the Global Data Center Security Market include Johnson Controls, Honeywell, Securitas, Genetec, Allied Universal, Cisco, Fortinet, Axis Communications, Palo Alto Networks, and ASSA ABLOY. To strengthen their foothold, companies in the data center security space are focusing on integrated solutions that combine physical and cybersecurity. Many are enhancing their product offerings through AI-driven threat detection and real-time analytics. Strategic acquisitions and partnerships are also helping expand their technology portfolios and market access. Players are investing in R&D to develop advanced biometric and cloud-native tools tailored for hybrid infrastructure. Geographic expansion into emerging secondary data center markets is a common tactic, especially in regions with rising cloud adoption and digital infrastructure projects.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Data center

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising investment in physical security infrastructure

- 3.2.1.2 Adoption of integrated cyber-physical security solutions

- 3.2.1.3 Cloud and hybrid data center expansion

- 3.2.1.4 Regulatory compliance (ISO, NIST, GDPR)

- 3.2.1.5 Increasing insider threat mitigation initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Limited skilled workforce

- 3.2.2.2 Budget constraints for SMEs

- 3.2.3 Market opportunities

- 3.2.3.1 Edge data centers growth

- 3.2.3.2 Managed security services adoption

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology maturity assessment framework

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost structure analysis

- 3.9 Patent analysis

- 3.10 Sustainability and ESG impact assessment

- 3.10.1 Environmental impact analysis and metrics

- 3.10.2 Social impact considerations and metrics

- 3.10.3 Governance and compliance framework

- 3.10.4 ESG investment implications and financial impact

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 ROI analysis and business case framework

- 3.13.1 Total cost of ownership (TCO) analysis

- 3.13.2 Risk mitigation and security value quantification

- 3.13.3 Operational efficiency and productivity gains

- 3.13.4 Business case templates and financial models

- 3.14 Data Center Construction Activity

- 3.14.1 North America

- 3.14.2 Europe

- 3.14.3 Asia Pacific

- 3.14.4 Latin America

- 3.14.5 Middle East & Africa

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Venture capital and private equity activity

- 4.8 Infrastructure investment patterns

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Physical security

- 5.2.2 Logical/network security

- 5.2.3 Threat intelligence

- 5.2.4 Data security

- 5.3 Services

- 5.3.1 Managed security

- 5.3.2 Consulting

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Hyperscale

- 6.3 Colocation

- 6.4 Enterprise

- 6.5 Edge

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 BFSI

- 7.3 Healthcare

- 7.4 Retail & E-commerce

- 7.5 Media & entertainment

- 7.6 IT & telecommunication

- 7.7 Government & defense

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Players

- 9.1.1 ASSA ABLOY

- 9.1.2 Axis Communications

- 9.1.3 Check Point Software Technologies

- 9.1.4 Cisco

- 9.1.5 CrowdStrike

- 9.1.6 Fortinet

- 9.1.7 Genetec

- 9.1.8 Honeywell

- 9.1.9 Johnson Controls

- 9.1.10 Palo Alto Networks

- 9.1.11 Securitas

- 9.1.12 Siemens

- 9.1.13 Tyco International

- 9.1.14 Verint Systems

- 9.1.15 Zebra Technologies

- 9.1.16 Allied Universal

- 9.2 Regional Players

- 9.2.1 ADT

- 9.2.2 Bosch Security Systems

- 9.2.3 Brinks Home Security

- 9.2.4 Dahua Technology

- 9.2.5 Eaton

- 9.2.6 Flir Systems

- 9.2.7 Hanwha Techwin

- 9.2.8 Hikvision

- 9.2.9 LenelS2

- 9.2.10 Motorola Solutions

- 9.3 Emerging Players / Disruptors

- 9.3.1 Armis Security

- 9.3.2 Chainguard

- 9.3.3 Cynomi

- 9.3.4 Endor Labs

- 9.3.5 Koi