|

市場調查報告書

商品編碼

1851483

生物分解性塑膠包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Biodegradable Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

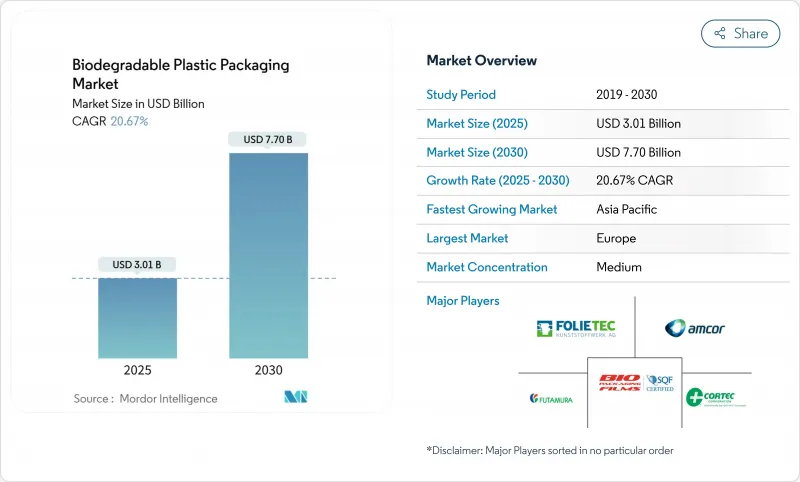

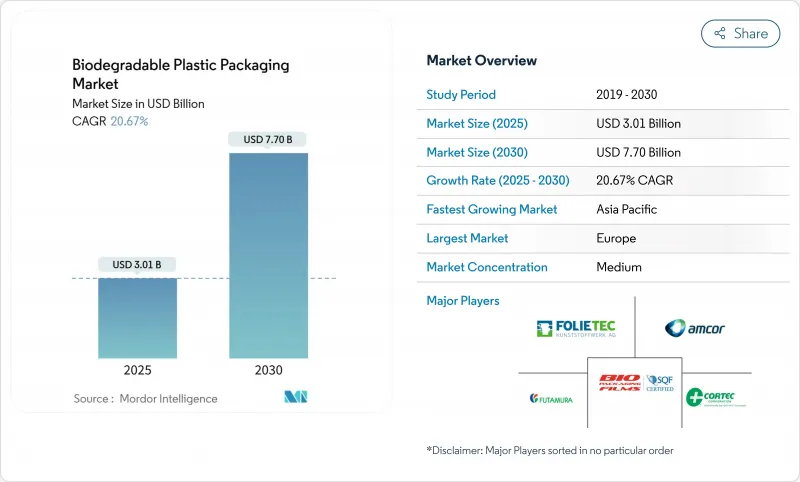

預計到 2025 年,生物分解性塑膠包裝市場規模將達到 30.1 億美元,到 2030 年將達到 77 億美元,年複合成長率為 20.67%。

這一強勁的成長勢頭反映了監管要求、企業碳定價政策以及生物樹脂加工技術的快速發展,所有這些因素都在提升可堆肥包裝的經濟效益。品牌所有者現在更傾向於採用全球通用的包裝規範而非區域性規範,從而能夠簽訂大批量契約,降低單位成本。海洋可分解的PHA和耐熱的PBAT如今均能滿足嚴格的阻隔性和耐溫性要求。同時,市政廢棄物減量目標正推動食品配送和零售業採用經認證的可堆肥解決方案,為樹脂供應商創造了可預測的市場需求。因此,生物分解性塑膠包裝市場擁有清晰的市場需求,有效抵消了農業原料價格波動帶來的影響。

全球生物分解性塑膠包裝市場趨勢及洞察

歐盟和印度加速禁止使用一次性石油基塑膠包裝

歐盟2024年一次性塑膠指令立即提振了對經認證的可堆肥食品接觸包裝的需求,取代了刀叉餐具和泡殼等難以回收的物品。印度的全邦禁令使超過18億消費者面臨同樣的轉變,迫使跨國公司在全球統一規範,並為樹脂工廠釋放規模經濟效益。對生物基材料的懲罰性措施超過了溢價,進一步加速了其應用。澳洲2024年的禁令強化了政策的連鎖效應,使生產者能更了解產量。

北美地區要求使用可堆肥包裝的食品宅配應用程式的興起

大型外送平台正強制要求大都會圈的高檔餐廳使用可堆肥的碗、杯子和刀叉餐具,此舉符合市政垃圾回收目標以及2024年消費者偏好追蹤數據。由於宅配結構掩蓋了材料成本的額外支出,業者更關注品牌知名度和掩埋費的節省。連鎖初步試驗報告稱,處理成本降低了15-20%,更容易遵守市政法規。這項要求正在推廣到雲端廚房網路,從而推動了對靈活包裝醬料和配菜的需求。

西歐以外地區的工業堆肥基礎建設十分困難。

在亞太和拉丁美洲,能夠完全分解生物基樹脂的高溫堆肥廠建設正在快速前進。然而,市政資金籌措限制和授權障礙阻礙了這些設施的運作,而私營營運商則在等待有關接收廢棄物食品和包裝廢棄物的更明確廢棄物。在產能擴大之前,由於缺乏合適的消費後廢棄物處理方案,向這些地區的銷售將受到限制,從而抑制生物分解性塑膠包裝市場的快速擴張。

細分市場分析

按材料類型分類,生物分解性塑膠包裝市場規模主要由聚乳酸(PLA)佔據,預計到2024年將佔市場佔有率的66.45%,而聚羥基烷酯)預計將以25.34%的複合年成長率成長。 PHA在海洋環境中具有生物分解能力,加上沿海地區廢棄物管理法規的加強,使其成為吸管、刀叉餐具以及面向島嶼和港口城市的阻隔性包裝袋的理想選擇。製造商正利用PHA寬廣的熔融窗口來模塑PLA難以加工的厚管瓶和個人護理用品罐。此外,美國和泰國已宣布新增使用農業殘渣而非食品級糖的PLA生產線,保護PLA免受原料價格波動的影響。

在實行工業堆肥的地區,PLA 仍保持著成本競爭力,並在西歐的烘焙薄膜和熱成型沙拉管領域發揮重要作用。持續的研發催生了耐高溫的 Ingeo 等級產品,可承受高達 105°C 的填充溫度,從而縮小了以往的性能差距。 PBAT 和 PBS 則應用於一些特定的耐熱和耐化學腐蝕應用領域,而澱粉混合物則在對價格極其敏感的食品包裝袋市場中佔據主導地位。整體材料格局展現出從第一代成本領先向第二代性能領先轉變的趨勢,進一步鞏固了市場格局的長期多元化發展。

到2024年,軟性包裝將佔據生物分解性塑膠包裝市場58.77%的佔有率,這主要得益於輕便的包裝袋、包裝膜和郵寄袋,它們能最大限度地降低電商和食材自煮包配送的運輸成本。在改造生產線上加工的薄膜可實現適用於生鮮食品的氧氣透過率,無需二次包裝即可延長保存期限。高階零食品牌青睞採用透明PLA的透明窗口,以展現產品的完整性,而添加PBAT的複合材料則能提高抗穿刺性。

硬質容器市場正以23.1%的複合年成長率加速成長,主要得益於咖啡膠囊、熱飲杯內襯和微波爐托盤的普及。 NatureWorks與機械供應商IMA聯合推出了承包膠囊系統,從而開拓了高銷售飲料市場。為了提升業績和品牌股權,連鎖餐廳正逐步從聚苯乙烯泡殼轉向使用PHA內襯纖維碗,這種纖維碗可與工業堆肥機相容。硬質容器市場的快速成長表明,功能性的提升正在削弱傳統優勢,並推動各細分市場整體收入的成長。

生物分解性塑膠包裝市場報告材料類型(澱粉混合物、聚乳酸 (PLA) 及其他)、包裝類型(軟包裝、硬包裝)、終端用戶行業(食品、食品飲料、食品服務及其他)、可堆肥性(家庭可堆肥、工業可堆肥)以及地區(北美、歐洲、亞太、中東和非洲、南美)進行細分。市場預測以美元計價。

區域分析

歐洲成熟的堆肥基礎設施和完善的監管體系將確保其在2024年佔據35.57%的生物分解性塑膠包裝市場。區域樹脂生產商受益於統一的EN標準和生產者延伸責任費所帶來的可預測需求,而加工商則受益於巴黎、柏林和馬德里等城市蓬勃發展的食品配送平台帶來的便利。政府對有機廢棄物分類收集的補貼將進一步促進包裝的普及,鞏固歐洲在短期內的領先地位。

亞太地區將以24.65%的複合年成長率領先,印度、中國和泰國正逐步淘汰難以回收的包裝。中國針對一線城市「不可分解」塑膠的強制令,到2027年將擴大範圍,從購物袋擴展到外帶餐盒,這將催生以木薯和稻殼為原料的社區工廠。儘管印度的各邦法規仍不累積,但累積的人口覆蓋率正促使跨國速食連鎖店採用可堆肥塗層技術。澳洲和紐西蘭也已全面禁止使用一次性塑膠製品,這即時推動了整個大洋洲對替代品的需求。

在北美,財富500強企業正利用食品配送強制規定和內部碳定價機制來推動工業堆肥的應用,但工業堆肥在各地區的普及程度仍不均衡。拉丁美洲的特大城市,如聖保羅和墨西哥城,正在試辦建造堆肥中心,為更廣泛的成長奠定基礎。在中東和非洲,掩埋的短缺和旅遊業主導的塑膠禁令正在創造新的市場機遇,尤其是在波灣合作理事會成員國的旅館業。總體而言,各地區的政策趨勢和基礎設施投資模式共同決定了生物分解性塑膠包裝市場的區域成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟和印度加速禁止使用一次性石油基塑膠包裝

- 北美地區要求使用可堆肥包裝的食品配送應用程式的興起

- 零售商(例如沃爾瑪、家樂福)的「塑膠中和」承諾正在推動需求成長。

- 將現有吹膜生產線改造為生物樹脂生產線(資本支出 15%)

- 品牌轉向在包裝上使用透明碳標籤。

- 引入企業層面的碳定價(高於 70 美元/噸)將有利於生物能源方案。

- 市場限制

- 西歐以外地區工業堆肥基礎設施不堪負荷

- PLA原料價格(玉米、甘蔗)波動

- 消費者對「可堆肥」和「可生物分解」的說法感到困惑

- 美國和日本對機械回收污染行為的處罰規定。

- 供應鏈分析

- 監理與技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 生態系分析

- 生物分解和生物基塑膠包裝的創新

- 比較分析—石油基塑膠與生物分解包裝

- 生質塑膠生產現狀

- 生質塑膠生產統計數據

- 按樹脂類型分割的產量

- 按地區分類的產量

- 食品服務/HoReCa產業的演進趨勢

- 新興產業趨勢

第5章 市場規模與成長預測

- 依材料類型

- 澱粉混合物

- 聚乳酸(PLA)

- 聚己二酸丁二醇酯-對苯二甲酸丁二醇酯(PBAT)

- 聚丁二酸丁二醇酯(PBS)

- 聚羥基烷酯(PHAs)

- 其他成分

- 按包裝類型

- 軟包裝

- 袋子和小袋

- 薄膜和包裝

- 標籤和封套

- 硬包裝

- 餐具

- 托盤和碗

- 食品容器

- 咖啡杯和咖啡膠囊

- 其他硬質包裝

- 軟包裝

- 按最終用途行業分類

- 食物

- 飲料

- 食品服務

- 個人及居家護理

- 製藥

- 其他終端用戶產業

- 透過堆肥

- 家用可堆肥

- 工業可堆肥

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor plc

- BASF SE

- NatureWorks LLC

- Tetra Pak International SA

- Sealed Air Corporation

- Kuraray Co., Ltd.

- Taghleef Industries

- FKuR Kunststoff GmbH

- good natured Products Inc.

- Pactiv Evergreen Inc.

- ALPLA Werke Alwin Lehner GmbH

- Transcontinental Inc.

- Plascon Industries

- Futamura Group

- Cortec Corporation

- BioBag International AS

- Biome Bioplastics

- Bio Packaging Films

- Bio Futura

- Groupe Barbier

- VektoPack

- Singular Solutions Inc.

- Biogreen Biotech

- Plabottles.eu(Global Solutions BV)

第7章 市場機會與未來展望

The biodegradable plastic packaging market size stands at USD 3.01 billion in 2025 and is forecast to reach USD 7.70 billion by 2030, expanding at a 20.67% CAGR.

The strong trajectory reflects simultaneous regulatory mandates, corporate carbon-pricing policies, and rapid advances in bio-resin processing that together improve economic viability for compostable formats. Brand owners now prefer global rather than regional packaging specifications, allowing large volume contracts that lower per-unit costs. Material innovation continues to cut performance gaps with conventional polymers; marine-degradable PHA and heat-resistant PBAT variants now satisfy demanding barrier and temperature requirements. In parallel, municipal waste-diversion targets push food-delivery and retail sectors to adopt certified compost-ready solutions, creating predictable offtake for resin suppliers. The biodegradable plastic packaging market therefore enjoys clear line-of-sight demand that compensates for still-volatile agricultural feedstock pricing.

Global Biodegradable Plastic Packaging Market Trends and Insights

Accelerated bans on single-use petro-plastic packaging across EU and India

The European Union's 2024 Single-Use Plastic Directive immediately raised demand for certified compostable food-contact packs, replacing difficult-to-recycle items such as cutlery and clamshells. India's statewide prohibitions expose more than 1.8 billion consumers to the same shift, forcing multinationals to harmonize global specifications and unlocking scale economies for resin plants. Penalties that exceed the premium on bio-materials further accelerate adoption. Australia's 2024 bans reinforce a cascading policy effect that sustains volume visibility for producers.

Food-delivery app proliferation requiring compost-ready formats in North America

Leading aggregators mandate that restaurants use compostable bowls, cups, and cutlery in top metropolitan areas, aligning with municipal diversion goals and consumer preference tracking recorded in 2024. Delivery fee structures hide the material premium, so operators focus on brand perception and landfill fee savings. Chain pilots report 15-20% lower disposal costs and smoother compliance with city ordinances. The requirement has spilled into cloud kitchen networks, amplifying flexible-pack demand for sauces and sides.

Tight industrial-composting infrastructure outside Western Europe

Adoption in Asia-Pacific and Latin America recently outpaced the build-out of high-temperature composting plants capable of fully degrading bio-resins, risking landfill diversion and methane release that undermine environmental claims . Municipal funding limitations and permitting hurdles delay facility commissioning, while private operators await clearer acceptance rules for mixed food and packaging waste. Until capacity expands, sales into regions without adequate end-of-life options are capped, tempering the otherwise rapid uptake of the biodegradable plastic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Retailer "plastic-neutral" pledges boosting demand

- Re-tooling of existing film-blowing lines to run bio-resins

- Feedstock price volatility for PLA

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The biodegradable plastic packaging market size for material types remained skewed toward Polylactic Acid, which held 66.45% share in 2024, yet Polyhydroxyalkanoates posted the strongest 25.34% CAGR outlook. PHA's ability to biodegrade in marine settings satisfies growing coastal-waste legislation, making it the preferred option for straws, cutlery, and high-barrier pouches targeting island and port cities. Manufacturers exploit its broad melt-flow window to mold thicker pharmaceutical vials and personal-care jars that PLA struggles to handle. The segment also benefits from fresh capacity announcements in the United States and Thailand that leverage agricultural residues instead of food-grade sugar sources, insulating it from feedstock swings.

PLA remains cost-competitive where industrial composting exists, supporting bakery films and thermoformed salad tubs in Western Europe. Continuous R&D produced higher-heat Ingeo grades that withstand 105 °C filling temperatures, narrowing earlier performance gaps. PBAT and PBS serve niche heat-resistant or chemical-contact applications, while starch blends dominate ultra-price-sensitive grocery bag programs. The overall material landscape shows a transition from first-generation cost leadership to second-generation performance leadership, reinforcing the long-term diversification of the biodegradable plastic packaging market.

Flexible formats commanded 58.77% of the biodegradable plastic packaging market share in 2024, underpinned by light-weighted pouches, wraps, and mailers that minimize freight costs for e-commerce and meal-kit delivery. Films processed on retrofitted lines achieve oxygen transmission rates suitable for fresh produce, extending shelf life without secondary wraps. Premium snack brands emphasize transparent windows made from clarified PLA to showcase product integrity, while laminates incorporating PBAT improve puncture resistance.

Rigid formats accelerate at 23.1% CAGR on the back of coffee pods, hot-cup linings, and microwave-ready trays. NatureWorks and machine supplier IMA released a turnkey pod system that meets Keurig and Nespresso specifications and composts in 90 days, opening high-volume beverage channels. Foodservice chains shift from polystyrene clamshells to PHA-lined fiber bowls compatible with industrial composters, satisfying performance and brand-equity goals. The fast-growing rigid segment illustrates how functionality gains erode legacy dominance and broaden total addressable revenue for the biodegradable plastic packaging market.

The Biodegradable Plastic Packaging Market Report is Segmented by Material Type (Starch Blends, Polylactic Acid (PLA), and More), Packaging Type (Flexible Packaging and Rigid Packaging), End-Use Industry (Food, Beverage, Foodservice, and More), Compostability (Home-Compostable and Industrial-Compostable), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts are Provided in Value (USD).

Geography Analysis

Europe's mature composting infrastructure and comprehensive regulatory backdrop secured 35.57% biodegradable plastic packaging market share in 2024. Regional resin producers benefit from cohesive EN standards and predictable demand created by extended-producer-responsibility fees, while converters profit from proximity to high-growth food delivery platforms now ubiquitous in Paris, Berlin, and Madrid. Government subsidies for separate organic waste collection further aid pack adoption, cementing Europe's near-term leadership.

Asia-Pacific generates the strongest 24.65% CAGR as India, China, and Thailand enforce phased bans on difficult-to-recycle packaging formats. Chinese directives targeting "non-degradable" plastics in tier-one cities escalate from carrier bags to takeaway containers by 2027, spawning localized plants using cassava and rice-husk feedstocks. India's state regulations remain fragmented, yet cumulative population coverage draws multinational quick-service restaurants to standardize compostable coating technologies. Australia and New Zealand also adopted comprehensive single-use plastic prohibitions, driving immediate substitution demand throughout Oceania.

North America leverages food-delivery mandates and internal carbon-pricing at Fortune 500 corporations to propel adoption, although regional coverage of industrial composting remains uneven. Latin American megacities such as Sao Paulo and Mexico City deploy pilot composting hubs, setting the stage for broader growth. In the Middle East and Africa, landfill scarcity and tourism-driven plastic bans create niche opportunities, especially in Gulf Cooperation Council hospitality sectors. Overall, jurisdictional policy cadence and infrastructure investment patterns explain divergent regional growth in the biodegradable plastic packaging market.

- Amcor plc

- BASF SE

- NatureWorks LLC

- Tetra Pak International S.A.

- Sealed Air Corporation

- Kuraray Co., Ltd.

- Taghleef Industries

- FKuR Kunststoff GmbH

- good natured Products Inc.

- Pactiv Evergreen Inc.

- ALPLA Werke Alwin Lehner GmbH

- Transcontinental Inc.

- Plascon Industries

- Futamura Group

- Cortec Corporation

- BioBag International AS

- Biome Bioplastics

- Bio Packaging Films

- Bio Futura

- Groupe Barbier

- VektoPack

- Singular Solutions Inc.

- Biogreen Biotech

- Plabottles.eu (Global Solutions BV)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated bans on single-use petro-plastic packaging across EU and India

- 4.2.2 Food-delivery app proliferation requiring compost-ready formats in North America

- 4.2.3 Retailer "plastic-neutral" pledges (e.g., Walmart, Carrefour) boosting demand

- 4.2.4 Re-tooling of existing film-blowing lines to run bio-resins (CAPEX ~15%)

- 4.2.5 Brand shift to transparent carbon-labelling on packs

- 4.2.6 Corporate-level internal carbon-price adoption (>US $70/t) favouring bio-options

- 4.3 Market Restraints

- 4.3.1 Tight industrial-composting infrastructure outside Western Europe

- 4.3.2 Feed-stock price volatility for PLA (corn, sugarcane)

- 4.3.3 Consumer confusion around "compostable" vs "biodegradable" claims

- 4.3.4 Mechanical-recycling stream contamination penalties in US and Japan

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Industry Ecosystem Analysis

- 4.8 Innovations in Biodegradable and Bio-based Plastic Packaging

- 4.9 Comparative Analysis - Petro-plastic vs Biodegradable Packaging

- 4.10 Bioplastics - Production Landscape

- 4.10.1 Production Statistics for Bioplastics

- 4.10.2 Production by Resin Type

- 4.10.3 Production by Region

- 4.11 Evolving Trends in the Foodservice/HoReCa Sector

- 4.12 Emerging Industry Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Starch Blends

- 5.1.2 Polylactic Acid (PLA)

- 5.1.3 Poly(Butylene Adipate-co-Terephthalate) (PBAT)

- 5.1.4 Polybutylene Succinate (PBS)

- 5.1.5 Polyhydroxyalkanoates (PHA)

- 5.1.6 Other Material Types

- 5.2 By Packaging Type

- 5.2.1 Flexible Packaging

- 5.2.1.1 Bags and Pouches

- 5.2.1.2 Films and Wraps

- 5.2.1.3 Labels and Sleeves

- 5.2.2 Rigid Packaging

- 5.2.2.1 Tableware

- 5.2.2.2 Trays and Bowls

- 5.2.2.3 Food Containers

- 5.2.2.4 Coffee Cups and Pods

- 5.2.2.5 Other Rigid Packaging

- 5.2.1 Flexible Packaging

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.2 Beverage

- 5.3.3 Foodservice

- 5.3.4 Personal Care and Home Care

- 5.3.5 Pharmaceutical

- 5.3.6 Other End - Use Industry

- 5.4 By Compostability

- 5.4.1 Home-Compostable

- 5.4.2 Industrial-Compostable

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amcor plc

- 6.4.2 BASF SE

- 6.4.3 NatureWorks LLC

- 6.4.4 Tetra Pak International S.A.

- 6.4.5 Sealed Air Corporation

- 6.4.6 Kuraray Co., Ltd.

- 6.4.7 Taghleef Industries

- 6.4.8 FKuR Kunststoff GmbH

- 6.4.9 good natured Products Inc.

- 6.4.10 Pactiv Evergreen Inc.

- 6.4.11 ALPLA Werke Alwin Lehner GmbH

- 6.4.12 Transcontinental Inc.

- 6.4.13 Plascon Industries

- 6.4.14 Futamura Group

- 6.4.15 Cortec Corporation

- 6.4.16 BioBag International AS

- 6.4.17 Biome Bioplastics

- 6.4.18 Bio Packaging Films

- 6.4.19 Bio Futura

- 6.4.20 Groupe Barbier

- 6.4.21 VektoPack

- 6.4.22 Singular Solutions Inc.

- 6.4.23 Biogreen Biotech

- 6.4.24 Plabottles.eu (Global Solutions BV)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment