|

市場調查報告書

商品編碼

1851479

物聯網安全:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

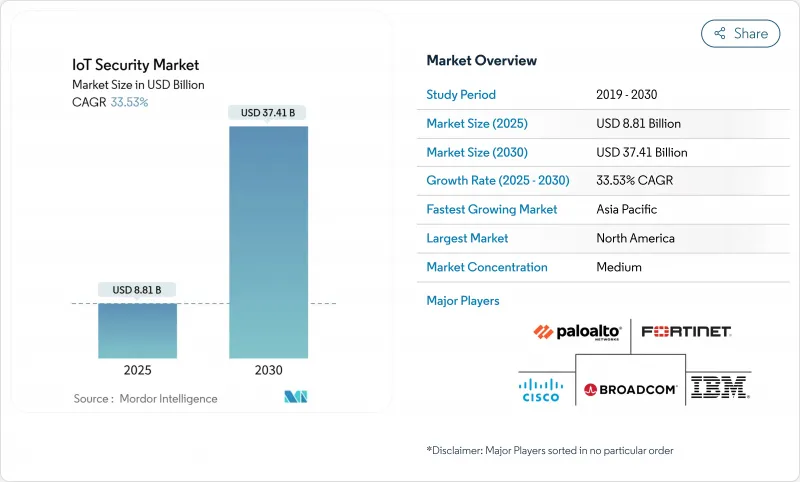

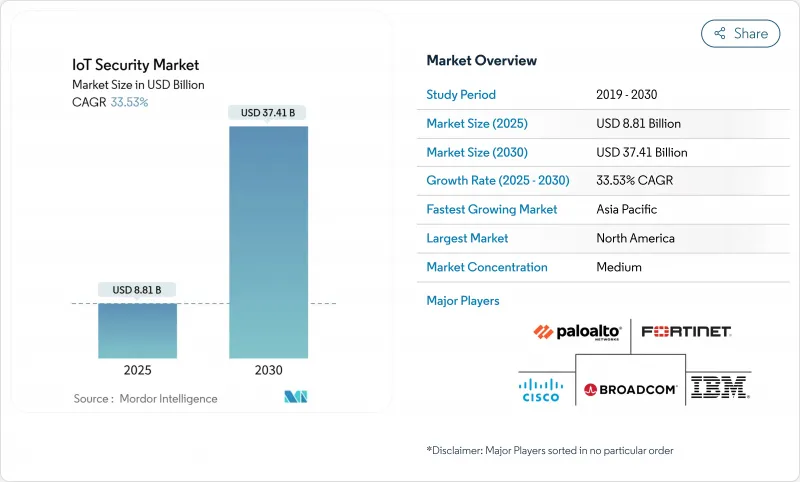

預計到 2025 年,物聯網安全市場規模將達到 88.1 億美元,到 2030 年將達到 374.1 億美元,預測期(2025-2030 年)的複合年成長率為 33.53%。

隨著監管機構強制要求所有連網產品都必須採用安全設計,操作技術正與IT網路融合,人工智慧分析技術能夠對龐大的設備群進行即時偵測,企業正加速加大安全投入。英國的《產品安全和通訊基礎設施法案》以及歐盟的《網路彈性法案》已將安全性從最佳實踐轉變為法律要求,預算也從可自由支配的計劃轉向了強制性合規。儘管隨著數百萬個未託管終端的出現,攻擊面不斷擴大,以邊界為中心的防禦仍然是重中之重,但向雲端交付控制的轉變正在重塑採購標準。供應商的差異化越來越依賴展示基於標準的自動化防禦方案,這些方案能夠從工廠車間擴展到遠端邊緣節點。

全球物聯網安全市場趨勢與洞察

資料外洩主導監管審查

監管機構已從自願性指南轉向懲罰性執法,歐盟《網路安全韌性法案》便是例證,該法案規定,對進入歐盟的不合規設備處以高達1500萬歐元的罰款。英國法案禁止使用預設密碼,強制規定更新窗口,並要求製造商重新設計其韌體流程。美國聯邦通訊委員會(FCC)將於2024年推出的消費者標籤制度將允許買家比較產品的安全成熟度,從而使合規供應商獲得競爭優勢。諸如2025年3月耶魯紐黑文醫療中心遭受的網路攻擊導致550萬份病患記錄外洩等重大事件,凸顯了監管的緊迫性,並加強了審查力度。頂級組裝現在要求組件供應商持有第三方認證,這提高了沒有安全開發流程記錄的公司的進入門檻。

OT + IT 安全堆疊的整合

曾經孤立的操作技術網路如今正連接到企業雲,並支援預測性維護和分析。 2025年第一季,針對北美工廠IT-OT介面的勒索軟體攻擊激增84%,促使採購文件中強制要求整合可見度。 Modbus和DNP3等傳統工業通訊協定需要能夠理解確定性流量和嚴格延遲閾值的安全工具,這促使供應商將深度封包檢測整合到工廠環境中。思科2025會計年度第二季財報顯示,隨著客戶將網路和安全性整合到統一平台上,安全收入增加了一倍以上。部署的複雜性推動了對專業服務的需求,這些服務能夠幫助棕地工廠在不造成長時間停機的情況下完成遷移。隨著整合配置的成熟,首席資訊安全們正在尋求能夠從單一主機關聯過程控制器、企業筆記型電腦和遠端維護鏈路中異常情況的解決方案。

韌體更新生態系統碎片化

對 53,000 個常用微控制器的韌體鏡像進行分析發現,99.43% 的鏡像以明文形式存儲,這使得攻擊者可以直接存取引導程式和金鑰。僅有三分之一的供應商維護自動化的空中升級流程,導致過時的組件平均長達 1.34 年未修補。歐盟法規強制要求自動化更新,並迫使遠端刷寫流程重新設計。更新造成的停機時間每小時可能損失數十萬美元,這促使工業營運商猶豫不決,導致未打補丁的資產長期存在於關鍵基礎設施中。這造成了日益成長的安全隱患,並減緩了高級身份驗證框架的普及速度。

細分市場分析

到2024年,網路安全將佔物聯網安全市場收入的42%,這主要得益於企業將網路邊緣視為單一統一的執法點。防火牆、微隔離和安全SD-WAN策略限制了不同端點之間的東西向流量,但通常缺乏晶片級的安全防護。隨著生產線將傳統可程式邏輯控制器連接到分析雲,檢驗引擎現在除了解析標準IP協定外,還能解析工業通訊協定,這就需要專門的威脅情報來源。此外,FCC要求供應商描述雲端更新路徑的規定也促使買家轉向那些整合防火牆和代理遠端檢測以驗證修補程式狀態的供應商。

隨著平台向安全即服務 (Security as a Service) 模式轉型,預計到 2030 年,雲端/虛擬安全將以 35.45% 的複合年成長率成長。靈活的容量能夠滿足大規模韌體更新推送和視訊感測器回程傳輸突發的需求。企業透過在設備附近實施安全策略,同時將日誌傳輸到集中託管的分析平台進行關聯異常檢測,從而平衡延遲。像 LEA 這樣的輕量級加密套件比 AES-128 功耗低 30%,即使在連結電池供電的標籤上也能實現即時加密。隨著 5G RedCap 擴展工廠頻寬,將雲端策略引擎與本地執行代理結合的供應商有望獲得更多的物聯網安全市場佔有率。

到2024年,諸如加密庫、身分平台和運行時異常檢測代理等解決方案(這些方案通常打包在設備SDK中)將佔據物聯網安全市場58%的佔有率。由於預先認證的軟體堆疊能夠縮短ETSI EN 303 645和ISO 27400合規性審核,買家仍在為符合監管要求的軟體許可分配預算。然而,隨著人才短缺迫使營運商將全天候監控外包,服務(尤其是託管檢測和回應服務)的複合年成長率將達到36.08%。

隨著歐盟於2025年1月開始分階段實施網路彈性法,強制製造商在產品發布前記錄供應鏈風險評估,對專家諮詢的需求日益成長。託管安全服務提供者正在集中工具並在客戶之間共用威脅訊息,使中型公用事業公司也能獲得以往只有全球品牌才能使用的功能。安全營運中心 (SOC) 團隊正在整合人工智慧輔助系統來處理警報,在保持人員規模不變的情況下擴大服務利潤,從而強化了從產品銷售轉向經常性收入模式的結構性轉變。

物聯網 (IoT) 安全市場報告按安全類型(網路安全、端點/設備安全、應用程式安全、雲端/虛擬安全)、元件(解決方案和服務)、最終用戶產業(智慧製造、連線健診醫療、汽車和行動行程、能源和公共產業、其他)、部署模式(本地部署、雲端/SECaaS、混合邊緣)和行動旅遊區進行細分。

區域分析

預計到2024年,北美仍將佔全球收入的35%,這主要得益於聯邦機構的舉措,例如FCC的標籤計劃,該計劃鼓勵那些能夠提供安全更新機製文件的供應商。各公司都在積極採用人工智慧驅動的分析技術,並充分利用其廣泛的雲端基礎設施和成熟的安全營運中心(SOC)團隊。美國國防安全保障部已將外國入侵關鍵基礎設施列為首要風險,並支持聯邦政府津貼監測和測試供水設施和管道。加拿大正在效仿美國的做法,而墨西哥的近岸外包熱潮則要求在跨國物流樞紐中實現安全整合。矽谷和奧斯汀聚集了一批新興企業,它們為財富500強企業的供應鏈提供取得專利的韌體完整性和後量子密碼學解決方案。

亞太地區預計將以35.49%的複合年成長率快速成長,這主要得益於智慧城市的蓬勃發展和消費物聯網的大規模普及。預計到2024年8月,中國的連網設備數量將達到25.7億台,將增強本地通訊業者驗證流量和阻止殭屍網路活動的能力。日本內務部將於2024年發布智慧城市安全指南,以推動地方政府從一開始就採用零信任原則進行採購。韓國的6G研究涵蓋了物聯網終端的抗量子密鑰交換技術,一旦該標準穩定下來,韓國國內供應商預計將贏得出口合約。印尼和越南政府目前已將網路安全審核納入製造業獎勵,並鼓勵外國投資者購買經過認證的安全平台。

歐洲正利用監管的力量而非單純追求銷售。歐盟《網路安全韌性法案》要求所有在歐盟銷售的連網產品必須提供威脅建模、漏洞揭露和生命週期更新策略的文件。非歐洲製造商為了避免被排除在市場之外,也紛紛遵守該法案,從而將監管影響力擴展到全球。英國的《PSTI法案》取消了設備貨架上的預設密碼,並加強了基本的安全韌性。德國的工業4.0計劃強調採用IEC 62443控制措施保障的確定性網路,而法國的都市資料平台則要求邊緣閘道器和集中式分析之間進行端對端加密。歐盟的「數位歐洲計畫」為中小企業採用經認證的安全協議堆疊津貼,從而擴大了託管服務提供者的潛在市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 資料外洩導致監管審查

- OT + IT 安全堆疊的整合

- 左移產品設計準則

- 人工智慧驅動的自適應威脅分析

- 基於衛星的NB-IoT在遠端資產的部署

- 關鍵產業對安全物聯網的需求日益成長

- 市場限制

- 韌體更新生態系統碎片化

- 舊式棕地的更新換代延遲

- 物聯網領域網路安全人才短缺

- 邊緣運算能力在加密方面的局限性

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按證券類型

- 網路安全

- 端點/設備安全

- 應用程式安全

- 雲端/虛擬安全

- 按組件

- 解決方案

- 身分和存取管理 (IAM) 和公鑰基礎設施 (PKI)

- DDoS防護

- IDS/IPS

- 加密和令牌化

- 服務

- 專業服務

- 託管安全服務

- 解決方案

- 按最終用戶行業分類

- 智慧製造

- 互聯醫療

- 汽車與出行

- 能源與公共產業

- BFSI

- 政府與智慧城市

- 零售和物流

- 透過部署模式

- 本地部署

- 雲端/安全即服務

- 混合邊緣

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems

- IBM

- Broadcom(Symantec)

- Palo Alto Networks

- Check Point

- Fortinet

- Microsoft

- Trend Micro

- Armis

- Infineon Technologies

- ATandT Cybersecurity

- Darktrace

- SecureWorks

- Rapid7

- Trustwave

- Thales

- RSA Security

- Qualys

- Kaspersky

- Zscaler

第7章 市場機會與未來展望

The IoT Security Market size is estimated at USD 8.81 billion in 2025, and is expected to reach USD 37.41 billion by 2030, at a CAGR of 33.53% during the forecast period (2025-2030).

Enterprises are accelerating spending because regulators now mandate security-by-design for every connected product, operational technology is converging with IT networks, and AI analytics deliver real-time detection across massive device fleets. The United Kingdom's Product Security and Telecommunications Infrastructure Act and the European Union's Cyber Resilience Act have transformed security from a best practice into a legal requirement, diverting budgets from discretionary projects to mandatory compliance. Perimeter-centric defenses retain priority as millions of unmanaged endpoints widen attack surfaces, yet the move toward cloud-delivered controls is reshaping procurement criteria. Vendor differentiation increasingly depends on evidence of automated, standards-aligned protection that scales from factory floors to remote edge nodes.

Global IoT Security Market Trends and Insights

Data-breach-led Regulatory Scrutiny

Regulators moved from voluntary guidelines to punitive enforcement, exemplified by the EU Cyber Resilience Act that can impose EUR 15 million penalties for non-compliant devices entering the bloc. The United Kingdom's PSTI Act, effective April 2024, bans default passwords and mandates defined update windows, forcing manufacturers to redesign firmware pipelines. Consumer-facing labels introduced by the US Federal Communications Commission in 2024 allow buyers to compare security maturity, shifting competitive advantage toward compliant vendors. High-profile incidents, such as the March 2025 cyberattack that exposed 5.5 million Yale New Haven Health patient records, illustrate regulatory urgency and intensify oversight. Tier-one assemblers now obligate component suppliers to hold third-party certifications, raising entry barriers for firms lacking documented secure-development processes.

Convergence of OT + IT Security Stacks

Operational technology networks that once ran in isolation now connect to corporate clouds to support predictive maintenance and analytics. Ransomware targeting the IT-OT interface surged 84% during Q1 2025 in North American plants, prompting unified visibility mandates in procurement documents. Legacy industrial protocols such as Modbus and DNP3 require security tools that understand deterministic traffic and strict latency thresholds, pushing vendors to integrate deep packet inspection tailored for factory environments. Cisco's security revenue more than doubled in its Q2 FY2025 results as customers consolidated on converged networking and security platforms. Implementation complexity has triggered demand for professional services that can migrate brown-field plants without prolonged downtime. As converged deployments mature, chief information security officers seek solutions that correlate anomalies across process controllers, corporate laptops, and remote maintenance links from a single console.

Fragmented Firmware-Update Ecosystem

Analysis of 53,000 firmware images across common microcontrollers showed 99.43% stored in plaintext, offering attackers direct access to boot loaders and secrets. Only one-third of vendors maintain an automated over-the-air update pipeline, leaving outdated components unpatched for an average of 1.34 years. EU rules now force automatic updates, compelling redesigns of remote-flash processes. Industrial operators hesitate because downtime for updates can cost hundreds of thousands of USD per hour, so unpatched assets persist inside critical infrastructure. The result is a widening security debt that slows the adoption of advanced authentication frameworks.

Other drivers and restraints analyzed in the detailed report include:

- Shift-left Product-design Mandates

- AI-powered Adaptive Threat Analytics

- Legacy Brownfield Device Refresh Lag

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Network Security generated 42% of IoT security market revenue in 2024, driven by enterprises that still treat the network edge as the only uniformly controllable enforcement point. Firewall, micro-segmentation, and secure SD-WAN policies restrict east-west traffic among heterogeneous endpoints that often lack chip-level safeguards. As production lines connect legacy programmable logic controllers to analytics clouds, inspection engines now parse industrial protocols alongside standard IP, demanding specialized threat-intel feeds. Adoption also benefits from the FCC rule requiring vendors to illustrate cloud-enabled update paths, nudging buyers toward providers that integrate firewall and proxy telemetry to verify patch status.

Cloud/Virtual Security is projected for a 35.45% CAGR through 2030 as platforms shift to security-as-a-service. Elastic capacity aligns with bursts from massive firmware-update pushes or backhaul from video sensors. Enterprises balance latency by keeping enforcement near the device while forwarding logs to centrally hosted analytics for correlated anomaly detection. Lightweight cipher suites such as LEA consume 30% less energy than AES-128, allowing real-time encryption even in coin-cell-powered tags. Vendors that fuse cloud policy engines with local enforcement agents are poised to capture additional IoT security market share once 5G RedCap widens bandwidth on factory floors.

Solutions retained a 58% share of the IoT security market size in 2024, spanning encryption libraries, identity platforms, and runtime anomaly detection agents packaged into device SDKs. Pre-certified stacks shorten compliance audits under ETSI EN 303 645 or ISO 27400, so buyers still allocate budget to software licenses that tick regulatory checklists. However, Services, especially managed detection and response, will rise at a 36.08% CAGR because talent shortages push operators to outsource 24X7 monitoring.

Professional consulting demand climbed after the EU began a phased enforcement of the Cyber Resilience Act in January 2025, forcing manufacturers to document supply-chain risk assessments before product launch. Managed Security Services Providers centralize tooling and share threat intel across customers, giving midsize utilities access to capabilities once reserved for global brands. As SOC teams integrate AI co-pilots that triage alerts, service margins expand even while headcount stays flat, reinforcing the structural shift from product sales to recurring revenue models.

The Internet of Things (IoT) Security Market Report is Segmented by Security Type (Network Security, Endpoint/Devices Security, Application Security, and Cloud/Virtual Security), Component (Solutions and Services), End-User Industry (Smart Manufacturing, Connected Healthcare, Automotive and Mobility, Energy and Utilities, and More), Deployment Mode (On-Premise, Cloud/SECaaS, and Hybrid Edge), and Geography.

Geography Analysis

North America retained 35% of global revenue in 2024, anchored by federal initiatives such as the FCC labeling scheme that favor vendors prepared to document secure-update mechanisms. Enterprises adopted AI-enabled analytics early, leveraging extensive cloud infrastructure and mature SOC staffing. The Department of Homeland Security specifically names foreign intrusions into critical infrastructure as a top risk, driving federal grants toward water-utility and pipeline monitoring pilots. Canada mirrors the US approach, while Mexico's near-shoring boom requires integrated security across cross-border logistics hubs. Startups cluster around Silicon Valley and Austin, funneling patented firmware-integrity and post-quantum crypto solutions into Fortune 500 supply chains.

Asia Pacific is the fastest-growing territory, forecast for 35.49% CAGR, propelled by aggressive smart-city rollouts and massive consumer IoT adoption. China reported 2.57 billion connected terminals by August 2024, stretching local operators' capacity to authenticate traffic and block botnet activity. Japan's Ministry of Internal Affairs and Communications issued secure smart-city guidelines in 2024, catalysing municipal procurements that embed zero-trust from the outset. South Korea's 6G research includes quantum-resistant key exchange for IoT endpoints, positioning domestic vendors to capture export contracts once standards stabilize. Governments in Indonesia and Vietnam now bundle cyber-hygiene audits into manufacturing incentives, compelling foreign investors to purchase certified security platforms.

Europe leverages regulatory pull rather than raw volume. The Cyber Resilience Act obliges every connected product sold in the bloc to document threat modeling, vulnerability disclosure, and lifelong update policies. Manufacturers outside Europe comply to avoid market exclusion, exporting the regulation's influence worldwide. The United Kingdom's PSTI Act removes default passwords from consumer electronics shelves, enhancing baseline resilience. Germany's Industrie 4.0 projects emphasize deterministic networking secured by IEC 62443 controls, while France's metropolitan data platforms require end-to-end encryption between edge gateways and centralized analytics. Funding from the EU's Digital Europe Programme subsidizes SME adoption of certified security stacks, broadening the addressable market for managed service providers.

- Cisco Systems

- IBM

- Broadcom (Symantec)

- Palo Alto Networks

- Check Point

- Fortinet

- Microsoft

- Trend Micro

- Armis

- Infineon Technologies

- ATandT Cybersecurity

- Darktrace

- SecureWorks

- Rapid7

- Trustwave

- Thales

- RSA Security

- Qualys

- Kaspersky

- Zscaler

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data-breach?led regulatory scrutiny

- 4.2.2 Convergence of OT + IT security stacks

- 4.2.3 Shift-left product-design mandates

- 4.2.4 AI-powered adaptive threat analytics

- 4.2.5 Satellite-based NB-IoT roll-out in remote assets

- 4.2.6 Increasing Demand for Secure IoT in Critical Industries

- 4.3 Market Restraints

- 4.3.1 Fragmented firmware-update ecosystem

- 4.3.2 Legacy brown-field device refresh lag

- 4.3.3 Shortage of IoT-specific cyber-talent

- 4.3.4 Edge-compute power limits for encryption

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Security Type

- 5.1.1 Network Security

- 5.1.2 Endpoint/Device Security

- 5.1.3 Application Security

- 5.1.4 Cloud/Virtual Security

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.1.1 IAM and PKI

- 5.2.1.2 DDoS Protection

- 5.2.1.3 IDS/IPS

- 5.2.1.4 Encryption and Tokenisation

- 5.2.2 Services

- 5.2.2.1 Professional Services

- 5.2.2.2 Managed Security Services

- 5.2.1 Solutions

- 5.3 By End-user Industry

- 5.3.1 Smart Manufacturing

- 5.3.2 Connected Healthcare

- 5.3.3 Automotive and Mobility

- 5.3.4 Energy and Utilities

- 5.3.5 BFSI

- 5.3.6 Government and Smart Cities

- 5.3.7 Retail and Logistics

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud/SECaaS

- 5.4.3 Hybrid Edge

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 Cisco Systems

- 6.4.2 IBM

- 6.4.3 Broadcom (Symantec)

- 6.4.4 Palo Alto Networks

- 6.4.5 Check Point

- 6.4.6 Fortinet

- 6.4.7 Microsoft

- 6.4.8 Trend Micro

- 6.4.9 Armis

- 6.4.10 Infineon Technologies

- 6.4.11 ATandT Cybersecurity

- 6.4.12 Darktrace

- 6.4.13 SecureWorks

- 6.4.14 Rapid7

- 6.4.15 Trustwave

- 6.4.16 Thales

- 6.4.17 RSA Security

- 6.4.18 Qualys

- 6.4.19 Kaspersky

- 6.4.20 Zscaler

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment