|

市場調查報告書

商品編碼

1850147

歐洲物聯網安全:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Europe IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

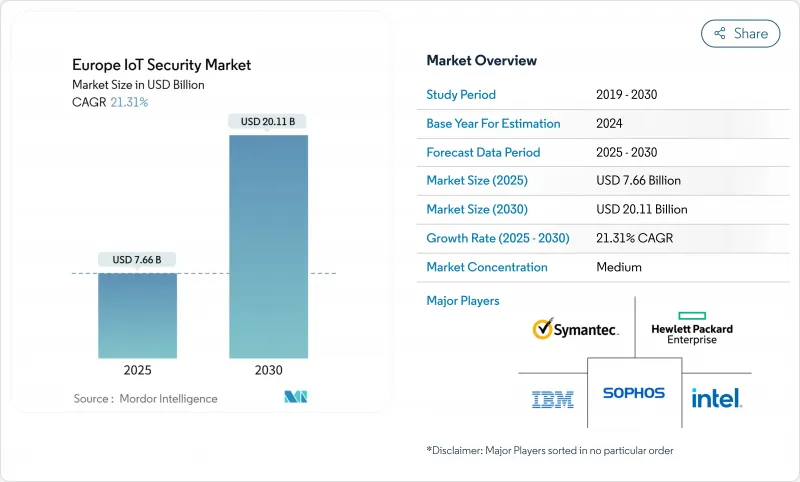

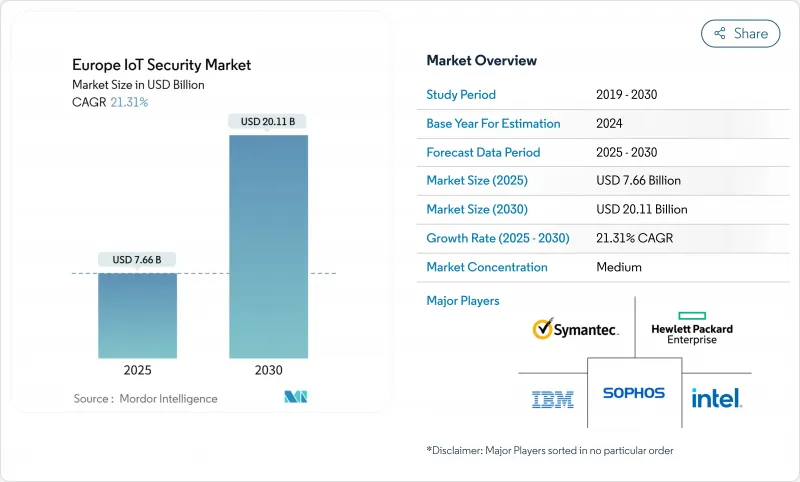

歐洲物聯網安全市場預計到 2025 年將達到 76.6 億美元,到 2030 年將達到 201.1 億美元,複合年成長率為 21.3%。

針對連網型設備的網路攻擊日益增加、監管要求日益嚴格,以及製造業快速採用工業4.0解決方案,都加速了企業對專業安全平台的投入。市場需求集中在以網路為中心的防禦上,旨在保護操作技術;而對量子安全密碼技術的投資則表明,企業已將長期韌性視為首要任務。提供混合雲端邊緣安全分析的供應商正日益受到企業的青睞,因為企業需要在資料主權規則和可擴展威脅情報需求之間取得平衡。來自利基新興企業和半導體廠商日益激烈的競爭,迫使現有企業獲得專業能力,尤其是在人工智慧驅動的偵測和安全元件設計方面。

歐洲物聯網安全市場趨勢與洞察

物聯網終端數量的激增擴大了攻擊面

從現在到2024年,歐洲企業將新增數百萬個感測器、閘道器和機器人單元,將導致針對物聯網的攻擊激增107%。製造業已遭受超過500起勒索軟體攻擊,導致生產線中斷,造成代價高昂的停機。傳統棕地設備與基於IP的網路整合,正在打破傳統的安全邊界,迫使首席資訊安全官(CISO)部署可擴展的零信任代理和安全的設備管理疊加層。這推動了歐洲物聯網安全市場對能夠遠端強制執行韌體完整性並檢測異常行為的終端保護平台的需求。能夠在不影響營運吞吐量的情況下監控異質設備的供應商,將在工業4.0採用者中獲得競爭優勢。

歐盟範圍內的資料保護強制規定推動了安全支出。

NIS2 指令將於 2024 年 10 月生效,將資料外洩報告和風險管理義務擴展至歐洲約 35 萬家機構。同時,《網路韌性法案》的實施要求製造商在產品設計中融入安全理念,並維護軟體材料清單,否則將面臨最高 1,500 萬歐元的罰款。法國醫療機構和通訊業者在 2024 年發生多起數百萬歐元的資料外洩事件後,已接受了法國國家資訊安全局 (ANSSI) 的嚴格審核。合規的緊迫性體現在預算即時分配,用於託管檢測、漏洞管理和供應鏈評估解決方案,從而推動歐洲物聯網安全市場的短期成長。

不同設備間安全標準分散

儘管 ETSI EN 303 645 標準定義了諸如移除預設密碼等基本控制措施,但不同產業和國家認證系統的差異增加了複雜性。即將推出的歐盟網路安全認證計畫雖然基於通用準則,但引入了新的認證等級,導致中小企業面臨重複審計和不斷上漲的諮詢費用。根據 SMESEC計劃,目前 43% 的網路攻擊針對中小企業,而中小企業的設備組合涵蓋消費和工業領域,這阻礙了其大規模安全措施的普及。

細分市場分析

到2024年,網路安全收入將佔總收入的38.6%,這表明其在隔離工業流量和實施最小權限分段方面發揮著至關重要的作用。專為Modbus、PROFINET和OPC UA客製化的深度深度封包檢測引擎可降低IT-OT骨幹網路中的橫向移動風險。在歐洲物聯網安全市場,面向連接防禦的通訊協定感知威脅分析預計將隨著連接工廠車間自主移動機器人的5G專用網路的普及而同步成長。雲端安全雖然目前規模較小,但隨著企業將其資料管道遷移到超大規模和主權區域雲,其複合年成長率將達到21.5%。整合了零信任網路和雲端原生防火牆的安全存取服務邊際(SASE)產品在2025年採購藍圖中排名靠前,有望使雲端安全在2030年之前彌補其收入缺口。

智慧攝影機、穿戴式感測器和微服務的激增,需要持續的軟體完整性檢驗,這推動了對終端和應用安全的需求。此外,在歐洲通用重要計劃(IPCEI)共同資助的半導體專案的推動下,諸如PUF(物理不可複製函數)等嵌入式或晶片級控制技術正被整合到新型汽車和醫療保健設備中。能夠提供涵蓋這些層面的全面產品組合的供應商,預計將在歐洲物聯網安全市場佔據更大的佔有率。

到2024年,軟體支出將佔總支出的66.5%,因為企業更傾向於使用可擴展至數十萬台設備的基於許可的分析引擎。行為異常檢測、韌體更新的安全編配以及加密金鑰生命週期管理等功能正擴大以容器化模組的形式提供,便於在Kubernetes叢集中部署。因此,將威脅情報來源和漏洞掃描器打包到統一主機中的平台供應商在歐洲物聯網安全市場中獲得了很高的續訂率。

然而,由於缺乏內部專家的中小企業將威脅調查、事件回應和合規報告外包,服務類業務的複合年成長率 (CAGR) 最高,達到 22.8%。託管安全服務提供者 (MSSP) 將全天候監控、滲透測試和監管差距評估打包成極具吸引力的訂閱模式,以滿足資金預算緊張的企業的需求。能夠將各種安全控制措施整合到複雜的棕地環境中,並記錄符合網路安全法規的、不偏袒任何廠商的諮詢顧問,預計將在歐洲物聯網安全行業獲得持續的需求。硬體銷售依然強勁,這主要得益於高風險醫療植入和汽車電子控制單元 (ECU) 所強制要求的可信任平台模組和安全元件。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 物聯網終端數量的增加擴大了攻擊面

- 歐盟範圍內的資料保護強制規定加快了安全支出。

- 智慧工廠中工業物聯網的快速應用

- 針對關鍵基礎設施的複雜網路攻擊

- 後量子密碼技術計劃

- 「地平線歐洲」計畫和國家津貼幫助中小企業增強安全性

- 市場限制

- 異構設備間安全標準分散

- 遺留棕地資產整合成本高昂

- 歐洲中小企業物聯網安全人才短缺

- 半導體供應鏈瓶頸減緩了安全元件的部署。

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章 市場規模與成長預測

- 按安全類型

- 網路安全

- 端點安全

- 應用程式安全

- 雲端安全

- 嵌入式/晶片級安全

- 其他小眾安全類型

- 透過解決方案

- 硬體

- 軟體

- 服務

- 透過部署模式

- 本地部署

- 雲

- 按最終用戶行業分類

- 汽車與運輸

- 醫療保健和生命科學

- 政府和國防部

- 製造業和工業

- 能源與公共產業

- 其他終端用戶產業

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems Inc.

- IBM Corporation

- Thales DIS(Gemalto)

- Fortinet Inc.

- Infineon Technologies AG

- Intel Corporation

- Sophos Group PLC

- Palo Alto Networks Inc.

- Hewlett Packard Enterprise Co.

- Broadcom Inc.(Symantec)

- Trend Micro Inc.

- Check Point Software Technologies Ltd.

- Kaspersky Lab

- ARM Ltd.

- Atos SE

- Siemens Digital Industries Software

- Avast PLC

- NXP Semiconductors NV

- Device Authority Ltd.

- Secure Thingz Ltd.

第7章 市場機會與未來展望

The Europe IoT Security market size is valued at USD 7.66 billion in 2025 and is forecast to reach USD 20.11 billion by 2030, registering a 21.3% CAGR.

Rising cyber-attacks on connected devices, stringent regulatory mandates and fast adoption of Industrie 4.0 solutions in manufacturing combine to accelerate spending on specialised security platforms. Demand concentrates on network-centric defences that safeguard operational technology, while quantum-safe cryptography investments signal long-term resilience priorities. Vendors offering hybrid cloud-edge security analytics gain traction as enterprises balance data-sovereignty rules with the need for scalable threat intelligence. Intensifying competition from niche start-ups and semiconductor players is prompting incumbents to acquire specialised capabilities, especially around AI-driven detection and secure-element design.

Europe IoT Security Market Trends and Insights

Proliferation of IoT Endpoints Enlarging Attack Surface

European enterprises added millions of sensors, gateways and robotics units during 2024, driving a 107% spike in IoT-focused attacks. Manufacturing recorded more than 500 ransomware incidents that disrupted discrete production lines and forced costly downtime. Legacy brownfield machinery integrating with IP-based networks dissolves traditional perimeters, compelling CISOs to deploy scalable zero-trust agents and secured device-management overlays. Demand for endpoint protection platforms that remotely enforce firmware integrity and detect anomalous behaviour therefore rises across the Europe IoT Security market. Vendors that can monitor heterogeneous devices without impacting operational throughput gain competitive advantage among Industrie 4.0 adopters.

EU-wide Data-Protection Mandates Accelerating Security Spend

The NIS2 Directive, effective from October 2024, extended breach-reporting and risk-management obligations to about 350,000 European organisations. Parallel enactment of the Cyber Resilience Act compels manufacturers to embed security-by-design and maintain software bills of materials, with fines reaching EUR 15 million. Healthcare and telecom operators in France already face active audits by ANSSI following several multi-million-record breaches during 2024. Compliance urgency is translating into immediate budget reallocations toward managed detection, vulnerability management and supply-chain assessment solutions, fuelling short-term growth across the Europe IoT Security market.

Fragmented Security Standards Across Heterogeneous Devices

While ETSI EN 303 645 defines baseline controls such as removal of default passwords, differing sectoral frameworks and national certification schemes add layers of complexity. The forthcoming EU Cybersecurity Certification Scheme builds on Common Criteria but introduces new assurance classes, leaving SMEs juggling overlapping audits and spiralling consultancy fees. The SMESEC project found that 43% of attacks now target small businesses whose device portfolios span consumer and industrial categories, delaying large-scale security roll-outs.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Industrial-IoT Adoption in Smart Factories

- Sophisticated Cyber-Attacks on Critical Infrastructure

- High Integration Cost for Legacy Brown-Field Assets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Network Security generated 38.6% revenue in 2024, underlining its foundational role in isolating industrial traffic and enforcing least-privilege segmentation. Deep-packet inspection engines tuned for Modbus, PROFINET and OPC UA mitigate lateral movement risks across converged IT-OT backbones. Inside the Europe IoT Security market size for connectivity defences, protocol-aware threat analytics are expected to grow parallel to 5G private networks that connect autonomous mobile robots on factory floors. Cloud Security, although smaller today, grows at 21.5% CAGR as enterprises shift data pipelines to hyperscale and sovereign regional clouds. Secure access service edge (SASE) offerings that converge zero-trust networking and cloud-native firewalls rank high on 2025 procurement roadmaps, positioning Cloud Security to narrow the revenue gap before 2030.

Demand for Endpoint and Application Security follows the proliferation of smart cameras, wearable sensors and micro-services that require continuous software-integrity validation. Embedded or chip-level controls such as physically unclonable functions (PUFs) appear in new automotive and healthcare devices, with semiconductor programmes co-funded under the Important Project of Common European Interest (IPCEI) fuelling uptake. Vendors delivering holistic portfolios across these layers will capture a larger slice of the Europe IoT Security market.

Software accounted for 66.5% of total spending in 2024 because enterprises prefer licence-based analytics engines that scale across hundreds of thousands of devices. Behavioural anomaly detection, secure orchestration of firmware updates and cryptographic key-lifecycle management are increasingly delivered as containerised modules easy to deploy in Kubernetes clusters. Consequently, platform suppliers that package threat intelligence feeds and vulnerability scanners within a unified console retain high renewal rates across the Europe IoT Security market size.

Services, however, post the fastest 22.8% CAGR as SMEs lacking in-house specialists outsource threat hunting, incident response and compliance reporting. Managed security service providers (MSSPs) bundle 24X7 monitoring, penetration testing and regulatory gap assessments into subscription models attractive under tight capital budgets. Vendor-agnostic consultants that can integrate disparate security controls inside complex brownfield environments and document Cyber Resilience Act compliance are poised for sustained demand within the Europe IoT Security industry. Hardware sales remain steadier, anchored by trusted-platform modules and secure elements mandated for high-risk medical implants and automotive ECUs.

The Europe IoT Security Market Report is Segmented by Security Type (Network Security, Endpoint Security, Application Security, and More), Solution (Hardware, Software, and Services), Deployment Mode (On-Premise and Cloud), End-User Industry (Automotive and Transportation, Healthcare and Life Sciences, Government and Defence, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems Inc.

- IBM Corporation

- Thales DIS (Gemalto)

- Fortinet Inc.

- Infineon Technologies AG

- Intel Corporation

- Sophos Group PLC

- Palo Alto Networks Inc.

- Hewlett Packard Enterprise Co.

- Broadcom Inc. (Symantec)

- Trend Micro Inc.

- Check Point Software Technologies Ltd.

- Kaspersky Lab

- ARM Ltd.

- Atos SE

- Siemens Digital Industries Software

- Avast PLC

- NXP Semiconductors N.V.

- Device Authority Ltd.

- Secure Thingz Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of IoT endpoints enlarging attack surface

- 4.2.2 EU-wide data-protection mandates accelerating security spend

- 4.2.3 Rapid industrial-IoT adoption in smart factories

- 4.2.4 Sophisticated cyber-attacks on critical infrastructure

- 4.2.5 Post-quantum-ready cryptography initiatives

- 4.2.6 Horizon Europe and national grants subsidising SME security upgrades

- 4.3 Market Restraints

- 4.3.1 Fragmented security standards across heterogeneous devices

- 4.3.2 High integration cost for legacy brown-field assets

- 4.3.3 Scarcity of IoT-security talent in European SMBs

- 4.3.4 Semiconductor supply-chain bottlenecks delaying secure-element roll-outs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Security Type

- 5.1.1 Network Security

- 5.1.2 Endpoint Security

- 5.1.3 Application Security

- 5.1.4 Cloud Security

- 5.1.5 Embedded/Chip-level Security

- 5.1.6 Other Niche Security Types

- 5.2 By Solution

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By End-User Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Government and Defence

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Energy and Utilities

- 5.4.6 Other End-User Industries

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Thales DIS (Gemalto)

- 6.4.4 Fortinet Inc.

- 6.4.5 Infineon Technologies AG

- 6.4.6 Intel Corporation

- 6.4.7 Sophos Group PLC

- 6.4.8 Palo Alto Networks Inc.

- 6.4.9 Hewlett Packard Enterprise Co.

- 6.4.10 Broadcom Inc. (Symantec)

- 6.4.11 Trend Micro Inc.

- 6.4.12 Check Point Software Technologies Ltd.

- 6.4.13 Kaspersky Lab

- 6.4.14 ARM Ltd.

- 6.4.15 Atos SE

- 6.4.16 Siemens Digital Industries Software

- 6.4.17 Avast PLC

- 6.4.18 NXP Semiconductors N.V.

- 6.4.19 Device Authority Ltd.

- 6.4.20 Secure Thingz Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment