|

市場調查報告書

商品編碼

1850134

拉丁美洲的物聯網安全:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Latin America IoT Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

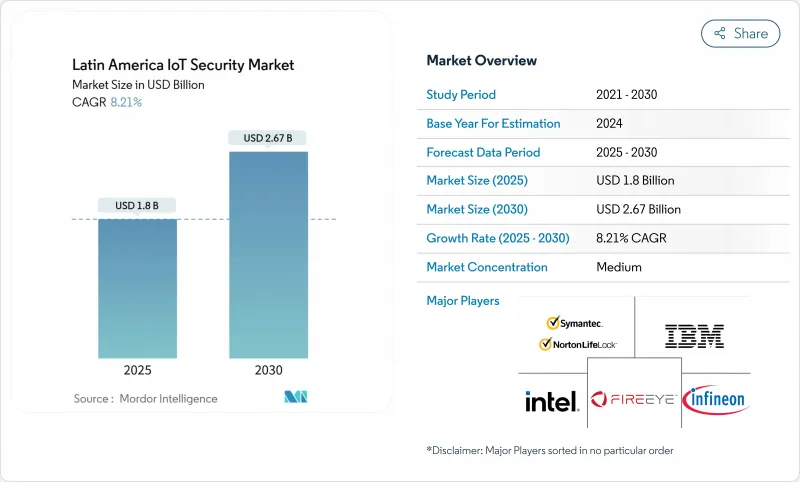

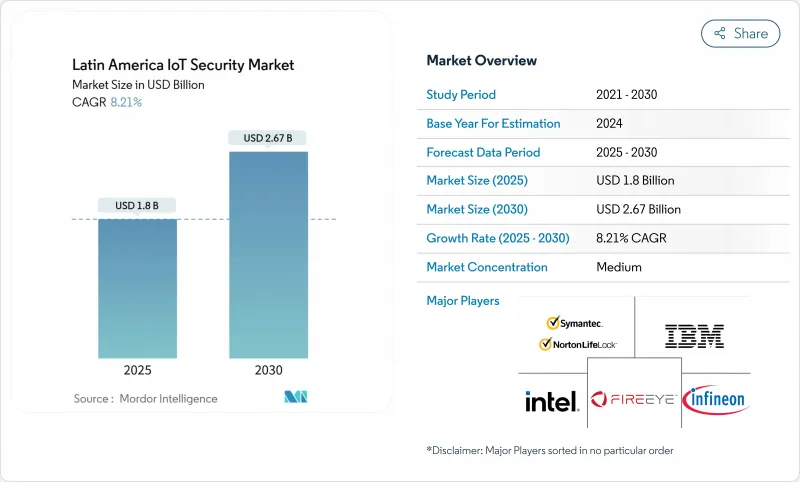

拉丁美洲物聯網安全市場規模預計在 2025 年達到 18 億美元,在 2030 年達到 26.7 億美元,複合年成長率為 8.21%。

巴西智慧城市監控計畫的擴展、智利對關鍵基礎設施強制實施的零信任規則以及墨西哥 5G 的快速推出將推動保護連網型設備的支出。隨著企業面臨創紀錄的醫療保健資料外洩事件,到 2024 年將有 1.824 億人面臨風險,投資將加速成長,而半導體短缺和碎片化的隱私法將在短期內限制部署速度。行動通訊業者增加 NB-IoT 網路增強契約,反映出一種策略轉變,即捆綁安全服務,以實現連接升級的收益。區域製造商也在增加雲端基礎的威脅偵測訂閱,以彌補對硬體級加密所需的加密晶片的有限存取。

拉丁美洲物聯網安全市場趨勢與洞察

智慧監控城市建設(巴西PAC4.0)

巴西的PAC 4.0計畫要求市政當局使用強加密、微分段和基於人工智慧的異常檢測技術來保護視訊感測器和資料湖。該市的採購遵循國際標準,要求供應商對設備進行ISO/IEC 27001認證。鄰近的首都城市正在複製採購模板,以擴大其端點和網路存取控制覆蓋範圍。整合商報告稱,監控合約指定了集中式安全營運儀表板,可以即時關聯OT和IT事件。防篡改審核追蹤的要求正在推動對安全硬體模組的需求,但由於全球加密晶片短缺,這些模組仍然供不應求。

通訊業者NB-IoT 網路強化提升銷售

行動通訊業者現在將反詐騙API、安全引導和SIM卡級加密與每次NB-IoT電路啟動打包在一起,將連線轉變為安全增強型服務。四家墨西哥通訊業者於2024年聯合推出了開放式閘道器安全API,早期採用者的銀行利用這些工具將SIM卡交換詐騙事件減少了兩位數。隨著5G獨立核心網路的上線,哥倫比亞和智利也出現了類似的服務。通訊業者,這些服務可以提高每位用戶平均收益,同時鎖定企業客戶多年。

加密晶片供不應求(FAB轉向AI)

代工廠正在將產能轉向利潤率更高的人工智慧加速器,並限制安全元件的出貨量,這些元件在硬體層面保護物聯網憑證。設備製造商面臨超過40週的前置作業時間,迫使許多製造商交付帶有純軟體密鑰儲存的電路板,而攻擊者可以繞過這些密鑰儲存。可信任平台模組價格上漲高達70%,這推高了材料成本,並擠壓了為市政計劃供貨的本地原始設備製造商的淨利率。由於一些買家推遲部署直到供應穩定,供應商正在推遲累計端點安全的收益。政府正在考慮暫時免除進口關稅,以鼓勵加快從其他地區採購。

細分分析

網路安全,包括邊界防火牆和安全閘道器,仍然是日益成長的設備群的基本保障,預計到2024年將創造6.84億美元的市場規模,佔拉丁美洲物聯網安全市場佔有率的38%。預計2030年,雲端安全市場規模將成長至4.38億美元,複合年成長率為11.20%。混合工作模式也刺激了對整合本地部署和SaaS控制的零信任網路存取解決方案的需求。

雲端原生平台現已將狀態管理、執行時間保護和軟體材料清單掃描捆綁到單一訂閱中,從而減少了工具的無序擴張。微軟的韌體分析預覽強調了跨裝置、網路和雲端的深度程式碼視覺性的轉變。分析師預計,隨著這些整合產品的成熟,拉丁美洲物聯網安全市場將重新平衡,儘管網路設備在雲端覆蓋範圍仍然有限的棕地工業場所可能仍將受到歡迎。

2024年,身分和存取管理工具市場規模將累計4.32億美元,佔拉丁美洲物聯網安全市場規模的24%。這些工具構成了數百萬個連接到企業雲端的感測器的身份驗證基礎。安全和漏洞管理將成為成長最快的細分市場,複合年成長率為12.50%,反映出在備受矚目的勒索軟體事件發生後,董事會層級對持續風險評估的興趣日益濃厚。自動化SBOM產生將成為主流採購標準,確保產品符合歐盟《網路彈性法案》的要求。

入侵防禦系統非常適合需要確定性延遲和即時資料包阻止的生產線。資料遺失保護在醫療保健領域正獲得監管支持,因為洩漏電子健康記錄將面臨巨額罰款。統一威脅管理套件受到中型企業的青睞,因為這些企業無力為每一層防護組成專門的團隊。在合規性要求日益嚴格的背景下,將遙測技術整合到這些模組中的供應商將佔據有利地位,從而獲得交叉銷售收益。

拉丁美洲物聯網安全市場按安全類型(例如網路安全、端點安全)、解決方案(例如身分和存取管理 (IAM)、入侵防禦系統 (IPS))、最終用戶(例如醫療保健、製造業)、部署模式和地區細分。市場預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 智慧監控城市發展(巴西PAC 4.0)

- 面向通訊業者的 NB-IoT 網路增強提升銷售

- 智利關鍵基礎設施法強制實施零信任

- 物聯網保險 - 保費折扣

- Edge——Linux 的開放原始碼SBOM 工具

- 市場限制

- 加密晶片供不應求(從 FAB 到 AI 的轉變)

- 拉丁美洲地區隱私製度碎片化

- 具有不可修補韌體的傳統 3G 設備

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章市場規模及成長預測

- 按安全類型

- 網路安全

- 端點安全

- 應用程式安全

- 雲端安全

- 其他

- 按解決方案

- 身分和存取管理 (IAM)

- 入侵防禦系統(IPS)

- 預防資料外泄(DLP)

- 統一威脅管理 (UTM)

- 安全性和漏洞管理 (SVM)

- 網路安全取證(NSF)

- 其他

- 按部署模型

- 本地部署

- 雲

- 混合

- 按最終用戶

- 衛生保健

- 製造業

- 公用事業

- BFSI

- 零售

- 政府

- 其他

- 按地區

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 其他拉丁美洲地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Cisco Systems Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Kaspersky Lab

- NortonLifeLock Inc.(Symantec)

- FireEye Inc.

- Sophos Group plc

- Infineon Technologies AG

- ARM Ltd.

- Gemalto NV(Thales Group)

- AWS(IoT Device Defender)

- Oracle Corp.(IoT Cloud Security)

- Rapid7 Inc.

- Tenable Inc.

- Telefonica Tech(LA)

- Amrica Mvil IoT Security

- WurldTech(Security for OT)

第7章 市場機會與未來展望

The Latin America IoT security market size is valued at USD 1.8 billion in 2025 and will reach USD 2.67 billion by 2030, advancing at an 8.21% CAGR.

Expanding smart-city surveillance programs in Brazil, mandatory Zero-Trust rules for Chilean critical infrastructure, and rapid 5G rollouts across Mexico propel spending on connected-device protection. Investments accelerate as enterprises confront record healthcare breaches that exposed 182.4 million people in 2024, while semiconductor shortages and fragmented privacy laws temper near-term deployment velocity. Rising NB-IoT network hardening contracts signed by mobile operators reflect a strategic shift toward bundled security services that monetize connectivity upgrades. Regional manufacturers also increase cloud-based threat-detection subscriptions to compensate for limited access to crypto-chips required for hardware-level encryption.

Latin America IoT Security Market Trends and Insights

Roll-out of Smart-Surveillance Cities (Brazil PAC 4.0)

Brazil's PAC 4.0 program obliges municipalities to protect video sensors and data lakes with strong encryption, micro-segmentation, and AI-driven anomaly detection. City procurements reference international standards, prompting vendors to certify devices for ISO / IEC 27001 compliance. Neighbouring capitals replicate procurement templates, enlarging the addressable base for endpoint and network-access controls. Integrators report that surveillance contracts specify centralised security-operations dashboards able to correlate OT and IT events in real time. The requirement for tamper-proof audit trails also drives demand for secure hardware modules that remain scarce due to global crypto-chip shortages.

Telco NB-IoT Network Hardening Upsell

Mobile operators now package fraud-prevention APIs, secure bootstrapping, and SIM-level encryption with every NB-IoT line activation, turning connectivity into a security-enhanced service. Mexico's four carriers jointly unveiled Open Gateway security APIs in 2024, and early adopter banks use these tools to cut SIM-swap fraud incidents by double digits. Similar offerings appear in Colombia and Chile as 5G standalone cores come online. Contract terms increasingly bundle AI-based threat scoring engines that analyse signalling traffic to block botnet formation. For operators, these services raise average revenue per user while locking in enterprise customers for multiyear periods.

Crypto-Chip Supply Crunch (FAB Shift to AI)

Foundries redirect capacity toward high-margin AI accelerators, limiting secure element shipments that protect IoT credentials at hardware level. Device makers face lead-times that exceed 40 weeks, forcing many to ship boards equipped with software-only key storage that attackers can bypass. Price hikes of up to 70% for trusted-platform modules inflate bill-of-materials costs, squeezing margins for local OEMs supplying municipal projects. Some buyers postpone rollouts until supply stabilises, translating into slower endpoint security revenue recognition for vendors. Governments consider temporary import-tariff waivers to encourage rapid sourcing from alternate geographies.

Other drivers and restraints analyzed in the detailed report include:

- Zero-Trust Mandate in Chile Critical-Infra Law

- IoT Insurance-Premium Discounts

- Fragmented Privacy Regimes Across Latin America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Network Security generated USD 684 million in 2024, equal to 38% of the Latin America IoT security market share, as perimeter firewalls and secure gateways remained baseline safeguards for expanding device fleets. The Cloud Security segment is forecast to add USD 438 million by 2030, climbing at an 11.20% CAGR as enterprises migrate workloads and insist on policy consistency across multi-cloud tenancy. Hybrid work models also fuel demand for zero-trust network-access solutions that blend on-premises and SaaS controls.

Cloud-native platforms now bundle posture management, runtime protection, and software bill-of-materials scanning in one subscription, reducing tool sprawl. Microsoft's firmware analysis preview underscores a pivot toward deep code visibility that spans device, network, and cloud layers. As these converged offerings mature, analysts expect the Latin America IoT security market to rebalance, yet network appliances will still sell into brownfield industrial sites where cloud reach remains limited.

Identity and Access Management tools booked USD 432 million in 2024, translating to 24% contribution to the Latin America IoT security market size. They form the authentication backbone for millions of sensors plugging into corporate clouds. Security and Vulnerability Management grows fastest at a 12.50% CAGR, reflecting heightened board-level focus on continuous exposure scoring after high-profile ransomware incidents. Automated SBOM generation enters mainstream procurement criteria, aligning products with forthcoming EU Cyber Resilience Act requirements.

Intrusion Prevention Systems stay relevant for manufacturing lines that demand deterministic latency and immediate packet blocking. Data Loss Protection enjoys regulatory pull in healthcare where electronic patient-record breaches carry steep fines. Consolidated threat-management bundles gain traction among mid-tier firms that cannot staff specialist teams for each protection layer. Vendors that integrate telemetry across these modules position themselves to capture cross-sell revenue streams as compliance obligations tighten.

Latin America IoT Security Market Segmented by Type of Security (Network Security, Endpoint Security and More), Solutions (Identity and Access Management (IAM), Intrusion Prevention System (IPS) and More), End-User (Healthcare, Manufacturing and More), by Deployment Model and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IBM Corporation

- Cisco Systems Inc.

- Microsoft Corporation

- Palo Alto Networks Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Trend Micro Inc.

- Kaspersky Lab

- NortonLifeLock Inc. (Symantec)

- FireEye Inc.

- Sophos Group plc

- Infineon Technologies AG

- ARM Ltd.

- Gemalto NV (Thales Group)

- AWS (IoT Device Defender)

- Oracle Corp. (IoT Cloud Security)

- Rapid7 Inc.

- Tenable Inc.

- Telefonica Tech (LA)

- Amrica Mvil IoT Security

- WurldTech (Security for OT)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Roll-out of Smart-Surveillance Cities (Brazil PAC 4.0)

- 4.2.2 Telco NB-IoT Network Hardening Upsell

- 4.2.3 Zero-Trust Mandate in Chile Critical-Infra Law

- 4.2.4 IoT Insurance-Premium Discounts

- 4.2.5 Open-source SBOM Tooling in Edge-Linux

- 4.3 Market Restraints

- 4.3.1 Crypto-chip Supply Crunch (FAB shift to AI)

- 4.3.2 Fragmented Privacy Regimes across LATAM

- 4.3.3 Legacy 3G Devices with Un-patchable Firmware

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Security

- 5.1.1 Network Security

- 5.1.2 Endpoint Security

- 5.1.3 Application Security

- 5.1.4 Cloud Security

- 5.1.5 Others

- 5.2 By Solutions

- 5.2.1 Identity and Access Management (IAM)

- 5.2.2 Intrusion Prevention System (IPS)

- 5.2.3 Data Loss Protection (DLP)

- 5.2.4 Unified Threat Management (UTM)

- 5.2.5 Security and Vulnerability Management (SVM)

- 5.2.6 Network Security Forensics (NSF)

- 5.2.7 Others

- 5.3 By Deployment Model

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By End-User

- 5.4.1 Healthcare

- 5.4.2 Manufacturing

- 5.4.3 Utilities

- 5.4.4 BFSI

- 5.4.5 Retail

- 5.4.6 Government

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Mexico

- 5.5.3 Argentina

- 5.5.4 Colombia

- 5.5.5 Chile

- 5.5.6 Peru

- 5.5.7 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Microsoft Corporation

- 6.4.4 Palo Alto Networks Inc.

- 6.4.5 Fortinet Inc.

- 6.4.6 Check Point Software Technologies Ltd.

- 6.4.7 Trend Micro Inc.

- 6.4.8 Kaspersky Lab

- 6.4.9 NortonLifeLock Inc. (Symantec)

- 6.4.10 FireEye Inc.

- 6.4.11 Sophos Group plc

- 6.4.12 Infineon Technologies AG

- 6.4.13 ARM Ltd.

- 6.4.14 Gemalto NV (Thales Group)

- 6.4.15 AWS (IoT Device Defender)

- 6.4.16 Oracle Corp. (IoT Cloud Security)

- 6.4.17 Rapid7 Inc.

- 6.4.18 Tenable Inc.

- 6.4.19 Telefonica Tech (LA)

- 6.4.20 Amrica Mvil IoT Security

- 6.4.21 WurldTech (Security for OT)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment