|

市場調查報告書

商品編碼

1687189

個人護理包裝:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

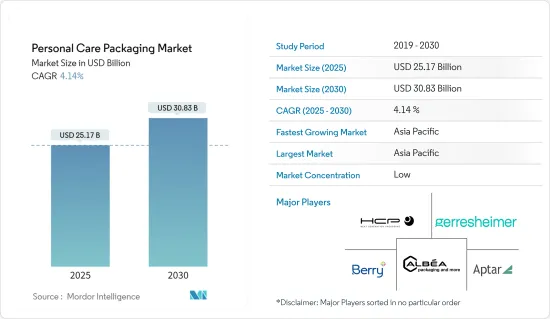

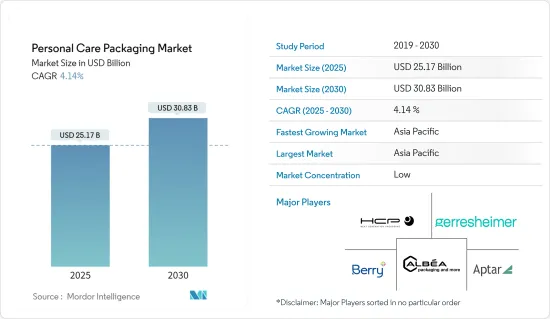

個人護理包裝市場預計在 2025 年價值 251.7 億美元,預計到 2030 年將達到 308.3 億美元,預測期內(2025-2030 年)的複合年成長率為 4.14%。預計市場規模將從 2025 年的 1,851.5 億台成長到 2030 年的 2,216 億台,預測期內(2025-2030 年)的複合年成長率為 3.66%。

關鍵亮點

- 個人護理包裝包括保護個人護理和美容用品免受傷害的包裝,例如沐浴產品、乳液、香水、護膚和化妝品。個人護理產業涵蓋各種消費包裝商品,包括一次性尿布、肥皂和奢華美容產品。增加對個人護理行業的投資以擴大產品範圍預計將為包裝公司創造機會。

- 過去幾年,個人護理包裝產業經歷了顯著的成長。化妝品行業因其多樣化的包裝需求而脫穎而出,並且似乎正在透過創新的包裝解決方案和改進的配方來齊心協力地減少其對環境的影響。特別是在個人保健產品領域,有關包裝中某些材料使用的嚴格規定可能會促使包裝方法的轉變。

- 個人護理包裝的重要性不僅僅在於提供保護。它們對於品牌推廣和行銷也至關重要,可以增強商店上產品的視覺吸引力並影響消費者的購買選擇。傳達產品的健康益處、天然成分和功效的包裝可能會增加需求。隨著對永續性的日益關注,許多化妝品公司正在尋找更天然和環保的成分和乳化劑。 「環保」美容產品的好處不僅僅是一種短暫的潮流。

- 專注於增強軟包裝製造流程以減少原料使用和降低能源成本的技術進步預計將在未來幾年推動市場成長。人們對高階個人護理用品的需求日益成長,以及旅行用緊湊包裝的流行趨勢也在過去的市場擴張中發揮了關鍵作用。消費者對維持健康生活方式的意識不斷提高,推動了對護髮和護膚產品的需求,預計這將進一步推動市場成長。

- 隨著對永續性的日益關注,預計未來幾年 PET 包裝的使用量將大幅增加。 PET 是用於包裝個人保健產品的熱門材料,因為它用途廣泛且可回收。 PET 通常用於製造洗髮精、護髮素、沐浴乳、乳液、護膚和一些化妝品的瓶子。它的耐化學性、耐用性和惰性使其成為容納這些產品的理想選擇。 PET的材料特性使得它適用於多種產品,在確保產品安全衛生的同時,也能確保產品的可視性。

- 個人保健產品需求激增、消費者意識增強、對整裝儀容的關注度增加、費用模式和生活方式的改變以及開發中國家對美容產品的認知不斷提高,這些都是鼓勵公司投資創造創新包裝解決方案的一些因素。此外,男性消費者對護膚品的偏好日益成長以及對抗老化乳霜的高需求也可能進一步促進成長。個人保健產品製造商加大投資,在全國各地建立生產設施,預計也將刺激市場擴張。

- 隨著新冠疫情影響的消退,化妝品產業開始復甦。然而,由於通貨膨脹、經濟不確定性和地緣政治緊張局勢繼續影響消費者信心,美容品牌在 2024 年可能面臨新的挑戰。消費者越來越尋求多功能、經濟高效的美容和個人護理解決方案。疫情過後,消費者將尋求對環境負面影響盡可能小的可回收和永續包裝。由於技術限制和現行法律法規,化妝品行業使用的某些類型的塑膠包裝不使用再生材料。

個人護理包裝市場的趨勢

護膚市場成長

- 有效的護膚產品包裝對於吸引顧客和確保產品的安全性和有效性至關重要。對於護膚品牌來說,選擇正確的包裝對於產生積極的初步印象和提高整體用戶滿意度至關重要。護膚品包裝主要保護產品免受光、空氣和雜質等外部因素的影響。全球對護膚品的需求不斷成長預計將為包裝行業帶來更多機會。

- 護膚品包裝因產品類型而異,但包裝的主要目的保持不變:保護內部內容物。許多公司對護膚產品的需求不斷成長,這是受到人們對抗衰老徵兆的渴望、對護膚方案的認知不斷提高以及社交媒體的影響等因素所推動的。這種不斷成長的需求正在極大地影響護膚包裝製造的市場需求。

- 由於名人的影響力和對高階護膚品日益成長的需求,這些名人代言品牌的激增正在推動全球對護膚品的需求。許多護膚品含有油等光敏成分,這些成分在暴露於光線下時容易與其他物質相互作用。這可能會導致加速分解和不穩定,從而可能使產品失效。為了避免這些問題,遮光護膚包裝變得越來越重要。

- 近年來,各個年齡層的人在護膚方面的支出都有所增加。護膚產業的需求不斷成長,需要客製化解決方案來滿足消費者的多樣化需求。由於人們對天然美容產品的偏好日益成長,客製化護膚品在開發中國家越來越受歡迎。例如,全球主要企業的護膚和化妝品公司雅詩蘭黛報告稱,截至2023年8月,護膚品淨銷售額為82億美元。全球對此類護膚品的需求旺盛,預計將為包裝產業帶來商機,擴大市場機會。

- 消費行為的變化促使委託製造製造商需要生產男士個人護理用品,以滿足男性和女性消費者不斷變化的偏好和需求。契約製造在協助品牌高效開發和生產性別特定產品方面發揮著至關重要的作用。適應消費者需求的能力是推動護膚和特色產品類別契約製造製造業擴張的關鍵因素。天然護膚品的日益普及以及對研發的日益重視,促使製造商推出創新產品。

- 真空幫浦和滴管瓶等創意包裝選擇在保持產品功效和壽命的同時提高清潔度方面發揮關鍵作用。類似2D碼的互動式包裝可以實現虛擬產品試用和客製化提案。此外,人們越來越重視永續性,提供可回收塑膠和由竹子和生物分解性物質等環保材料製成的包裝等選擇。

- 2024 年 3 月,美國永續包裝解決方案供應商 APC Packaging 推出了護膚品的全新解決方案:EcoReady 全塑膠真空幫浦 (EAPP)。該泵採用尖端真空技術製造,僅由頂級耐用塑膠製成。與傳統泵不同,它不依賴金屬彈簧。泵蓋、致動器和瓶子均由聚丙烯 (PP) 材料製成。 EAPP 有 15ml、30ml 和 50ml 三種規格。其真空技術可確保精確、一致的分配,同時保護護膚配方的品質。預計這些關鍵供應商的發展將推動市場成長。

亞太地區可望大幅成長

- 個人護理包裝市場預計將由亞太國家主導。印度、中國、韓國和日本等國家對個人保健產品輕量化包裝的需求不斷增加,推動了該地區個人護理包裝市場的發展,預計在預測期內將繼續佔據主導地位。此外,中產階級的不斷壯大、西方文化的影響力以及收入的提高都推動了亞太市場的發展。

- 例如,預計未來幾年韓國的護膚產業將快速成長。韓國都市區的污染程度不斷上升,大量人群出現皮膚乾燥、發炎和粗糙的現象。預計這種情況將推動對護膚產品的需求,進而促進韓國對個人護理包裝的需求。隨著人們對韓國美容產品的興趣日益濃厚,許多公司推出了韓國製造或受韓國美容傳統影響的護膚產品。

- 高科技抗老美容產品已成為展覽會,尤其是韓國美容展覽會的焦點。 2023年9月,Hy(原名韓國YAKULT)推出Leti7714三重提拉抗老霜,蘊含三種強效抗老成分。為了保持其效力,這些活性成分需要特殊包裝,例如玻璃容器,以防止其暴露在空氣和光線下而氧化。這些化妝品的日益普及預計將推動化妝品包裝材料的擴張。

- 第四屆印度美容展於 2023 年 12 月舉行,是化妝品包裝行業的重要平台,提供了各種成長和進步的機會。展會展示了最新的趨勢和產品發布,讓包裝製造商和化妝品品牌了解不斷變化的消費者偏好和市場需求。這些見解推動了包裝解決方案的創新和改進。此外,這些活動透過將供應商、品牌、零售商、經銷商和行業專業人士等不同的相關人員聚集在一起,促進了交流和合作。

- 此外,日本市場預計將取得重大進展。據日本統計局稱,預計到2024年底,日本化妝品和護膚行業(包括香水和古龍水)的收益將達到181.2億美元,比2023年的176.1億美元成長2.89%。這種不斷成長的需求正在刺激日本個人護理包裝市場的擴張。此外,亞太地區男性對整裝儀容的意識不斷增強、收入水平不斷提高以及各種個人保健產品的消費不斷增加將推動亞太市場的成長。

- 近年來,消費者越來越關注注重「天然」和「無農藥」的美容和個人護理趨勢。人們越來越傾向於使用更永續、更環保的產品以及使用天然成分而非化學物質的產品,這使得此類產品在東南亞國家越來越受歡迎。此外,韓國和中國等國家的網路購物興起對亞太地區個人護理包裝的成長產生了重大影響。

個人護理包裝市場概覽

個人護理包裝市場細分化,許多參與企業在關鍵區域開展業務。由於全球和區域層面存在大量中小型製造商,市場競爭十分激烈。市場也出現了各種合併和聯盟。主要參與企業包括 Gerresheimer AG、Albea SA、HCP Packaging、Berry Global 和 Aptar Group。

- 2024 年 2 月-Aptar 推出一項名為「Aptar Turnkey Solutions」的新整合服務。該服務目前已在歐洲、中東和非洲推出。透過承包解決方案,我們旨在開發有益於客戶的理念和產品。在其最先進的內部實驗室和合作夥伴網路的支持下,該公司旨在為分銷增加新的選擇。

- 2023 年 11 月 - Quadpack 推出五款由單一可回收材料製成的全新口紅產品。這五種產品包括兩種填充用以及由聚丙烯 (PP)、聚乙烯 (PET) 和鋁製成的設計,具有基於 Quadpack 積極影響包裝 (PIP) 分級方法的領先永續性。這些產品的形式、功能和操作多種多樣。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 產業相關人員分析

- 評估近期地緣政治發展對化妝品包裝市場的影響

第5章市場動態

- 市場促進因素

- 化妝品需求穩定成長

- 更重視創新和有吸引力的包裝

- 市場問題

- 歐洲國家塑膠化妝品包裝再利用率低對永續性構成威脅

- 分析世界各地對永續性關注點的變化

- 歐洲化妝品塑膠包裝市場目前使用的聚合物分析

第6章市場區隔

- 依樹脂類型

- 塑膠

- 聚乙烯(高密度聚苯乙烯和低密度聚乙烯)

- 聚丙烯

- 聚對苯二甲酸乙二酯和聚氯乙烯

- 聚苯乙烯(PS)

- 生物基塑膠(生質塑膠)

- 其他塑膠(丙烯腈丁二烯苯乙烯等)

- 玻璃

- 鋁

- 塑膠

- 依產品類型

- 瓶子

- 管棒

- 泵浦和分配器

- 小袋

- 其他

- 按應用

- 護膚

- 護髮

- 口腔護理

- 彩妝產品

- 除臭劑和香水

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Albea Group

- HCP Packaging Co. Ltd

- Gerresheimer AG

- Berry Global

- Aptar Group

- Amcor PLC

- Cosmopak USA LLC

- Quadpack industries SA

- LIBO Cosmetics Company Ltd

- Mpack Poland Sp.zoo

- Politech Sp.zoo

- Huhtamaki OYJ

- Rieke Corp(Trimas Corporation)

- Berlin Packaging LLC

- Mktg Industry SRL

第8章投資分析

第9章:市場的未來

The Personal Care Packaging Market size is estimated at USD 25.17 billion in 2025, and is expected to reach USD 30.83 billion by 2030, at a CAGR of 4.14% during the forecast period (2025-2030). In terms of market size, the market is expected to grow from 185.15 billion units in 2025 to 221.60 billion units by 2030, at a CAGR of 3.66% during the forecast period (2025-2030).

Key Highlights

- Personal care packaging involves packaging personal care and beauty items like bath products, lotions, fragrances, skincare, and cosmetics to safeguard them from harm. The personal care industry encompasses a broad spectrum of consumer packaged goods, including items like diapers, soaps, and luxury beauty products. The growing investments in the personal care industry aimed at expanding product offerings are anticipated to create opportunities for packaging companies.

- The personal care packaging industry has experienced significant growth in the past few years. The cosmetic segment stands out with its diverse packaging needs compared to others, and it appears to be collectively working toward minimizing environmental impact through innovative packaging solutions and improved formulations. Strict regulations concerning the use of specific materials in packaging, particularly in the realm of personal care products, may prompt shifts in packaging approaches.

- The importance of personal care packaging goes beyond just providing protection. It is also essential for branding and marketing, enhancing the visual appeal of products in stores, and impacting consumer buying choices. Packaging that conveys health benefits, natural ingredients, and product effectiveness may experience higher demand. As the focus on sustainability increases, numerous cosmetics companies are looking for more natural and environmentally friendly ingredients and emulsifiers. The benefits of 'green' beauty products are not just temporary trends.

- Technological advancements focused on enhancing the production process of flexible packaging to reduce raw material usage and decrease energy expenses are anticipated to drive the growth of the market in the coming years. The rising desire for premium personal care items, along with the increasing trend of compact packaging for travel purposes, has also played a significant role in boosting market expansion in the past. The increasing need for haircare and skincare products due to the growing awareness among consumers about maintaining a healthy lifestyle is projected to further propel the market's growth.

- The increasing focus on sustainability is projected to lead to a substantial increase in the use of PET packaging in the future. Its versatility and ability to be recycled make it a popular choice for packaging personal care products. PET is commonly used to produce bottles for shampoo, conditioner, body wash, lotions, skincare, and some cosmetics. Its chemical resistance, durability, and inertness make it ideal for containing these products. The material characteristics of PET make it suitable for a variety of products, ensuring their safety and hygiene while also providing visibility of the product.

- The surge in demand for personal care products, growing consumer awareness, rising emphasis on personal grooming, shifting consumption patterns and lifestyles, and the increasing awareness of beauty products in developing nations are all factors pushing companies to invest in creating innovative packaging solutions. Additionally, the rising preference for skincare products among male consumers and the high demand for anti-aging creams will further boost growth. The increasing investments by personal care product companies in setting up production facilities in different countries are anticipated to fuel the market's expansion.

- The cosmetics industry started to recover as the effects of the COVID-19 pandemic dissipated. However, beauty brands might face new challenges in 2024 as inflation, an uncertain economic climate, and geopolitical tensions continue to weigh on consumer confidence. Consumers are increasingly looking for multi-functional and cost-effective beauty and personal care solutions. Post-pandemic, customers seek recycled, sustainable packaging with the least possible adverse environmental effects. Recycled materials are not used in several varieties of plastic packaging the cosmetics industry employs due to technical limitations and current laws.

Personal Care Packaging Market Trends

Skincare Segment to Witness Growth

- Effective skincare product packaging is essential for captivating customers and guaranteeing product safety and effectiveness. For skincare brands, choosing the right packaging is critical in making a favorable initial impact and improving overall user satisfaction. Skincare packaging primarily shields the product from external elements like light, air, and impurities. The growing global demand for skincare products is anticipated to boost opportunities in the packaging industry.

- The packaging of skincare items may vary depending on the type of product, but the main purpose of the packaging remains to protect the contents within. The increasing demand for skincare products from numerous companies is fueled by factors like people's desire to combat aging signs, the growing awareness of skincare regimens, and the impact of social media. This rising demand significantly affects the market demand for skincare packaging production.

- As a result of the impact of famous individuals and the growing need for top-notch skincare items, the surge of these celebrity-endorsed brands is boosting the global demand for skincare products. Many skincare products include light-sensitive ingredients such as oils, which can easily interact with other substances when exposed to light. This can lead to faster breakdown or destabilization, rendering the products ineffective. To avoid these issues, the importance of skincare packaging that can block out light is on the rise.

- Expenditure on skincare has risen across different age demographics in recent times. The skincare industry has seen an increase in demand, necessitating tailored solutions to meet the diverse needs of consumers. Customized skincare items have become popular among individuals in developing nations due to the growing preference for natural beauty products. For example, Estee Lauder, a leading global skincare and cosmetics company, reported net sales of USD 8.2 billion for skincare products as of August 2023. This high demand for skincare products worldwide is projected to boost opportunities in the packaging industry and expand the market's potential.

- The change in consumer behavior has resulted in a rise in the need for contract manufacturers to create male-focused personal care items that cater to the changing preferences and demands of both male and female consumers. Contract manufacturers play a crucial role in assisting brands with the efficient and effective development and production of gender-specific products. Their capacity to adjust to consumer requirements is a key factor driving the expansion of the contract manufacturing industry within the skincare and specialty products categories. The growing focus on research and development, along with the increasing popularity of skincare products based on natural ingredients, has motivated manufacturers to introduce innovative products.

- Creative packaging options, such as airless pumps and dropper bottles, play a crucial role in maintaining the effectiveness and longevity of products, all while promoting cleanliness. Interactive packaging, similar to QR codes, enables virtual product trials and tailored suggestions. Moreover, there is an increasing emphasis on sustainability, offering choices like recyclable plastic or packaging crafted from eco-friendly materials such as bamboo or biodegradable substances.

- In March 2024, APC Packaging, a sustainable packaging solutions provider based in the United States, introduced the EcoReady All Plastic Airless Pump (EAPP), a novel solution for skincare items. This pump is crafted with cutting-edge airless technology and is constructed entirely from top-notch, long-lasting plastic. Unlike traditional pumps, it does not rely on a metal spring. The cap, actuator, and bottle of the pump are all fashioned from polypropylene (PP) material. The EAPP is offered in capacities of 15ml, 30ml, and 50ml. Its airless technology guarantees precise and consistent volume dispensing while safeguarding the quality of skincare formulations. Such significant vendor developments are expected to drive the market's growth.

Asia-Pacific Expected to Register Major Growth

- The personal care packaging market is anticipated to be dominated by Asia-Pacific countries. This dominance is projected to persist over the forecast period due to the increasing need for personal care products with lightweight packaging in countries such as India, China, Korea, and Japan, thereby propelling the personal care packaging market in the region. Additionally, the growth of the middle-income group, Western cultural influences, and rising incomes all contribute to the market's upward trajectory in Asia-Pacific.

- For example, the skincare industry in Korea is projected to experience rapid growth in the upcoming years. With the elevated pollution levels in Korean urban areas, a significant number of individuals are experiencing dry skin, irritation, and skin rashes. These circumstances are anticipated to drive the need for skincare products, consequently contributing to the demand for personal care packaging in Korea. In response to the increasing interest in Korean beauty items, many companies have launched skincare products that are either manufactured in Korea or influenced by Korean beauty traditions.

- High-tech anti-aging beauty products are a key focus at Asian trade shows, particularly at Korean beauty shows. In September 2023, Hy Co. Ltd, formerly known as Korea Yakult, introduced Leti7714 triple lift-up anti-aging cream with three powerful anti-aging ingredients. To preserve the efficacy of these active ingredients, specialized packaging like glass containers is necessary to shield them from oxidation caused by air and light exposure. The increasing popularity of these cosmetics will drive the expansion of packaging materials for cosmetics.

- Cosmoprof India 4th Edition, which occurred in December 2023, was a vital platform for the cosmetic packaging industry, offering various opportunities for growth and advancement. It showcased the latest trends and product launches, enabling packaging manufacturers and cosmetic brands to stay informed about evolving consumer preferences and market demands. Such insights drive innovation and adaptation in packaging solutions. Furthermore, these events foster networking and collaboration by bringing together diverse stakeholders such as suppliers, brands, retailers, distributors, and industry professionals.

- Moreover, there is anticipation of a notable surge in the Japanese market. According to the Statistics Bureau of Japan, the revenue generated by the make-up and skincare industry (including perfume and eau de cologne) in Japan is projected to hit USD 18.12 billion by the end of 2024, marking a 2.89% increase from 2023, when it stood at USD 17.61 billion. This heightened demand is fueling the expansion of the personal care packaging market in Japan. Additionally, the growing awareness of grooming, especially among men, the rise in income levels, and the increasing consumption of various personal care products in the region will drive the growth of the Asia-Pacific market.

- In recent years, consumers have placed a growing emphasis on beauty and personal care trends that prioritize being 'natural' and 'cruelty-free.' This shift toward more sustainable and eco-friendly products, as well as those made with natural ingredients instead of chemicals, has led to a rise in the popularity of such items in Southeast Asian countries. Moreover, the rise in online shopping in nations like Korea and China has significantly influenced the growth of personal care packaging in Asia-Pacific.

Personal Care Packaging Market Overview

The personal care packaging market is fragmented, as many players operate in key regions. The presence of several medium- and small-scale manufacturers on a global and regional level keeps the market in a highly competitive position. The market witnesses various mergers and partnerships as well. Key players include Gerresheimer AG, Albea SA, HCP Packaging Co. Ltd, Berry Global, and Aptar Group.

- February 2024 - Aptar launched its new integrated service, called Turnkey Solutions by Aptar. The service will currently be offered in Europe, the Middle East, and Africa. With Turnkey Solutions, the company aims to develop ideas and products that benefit the customer. The company aims to add new options to its distribution, supported by a state-of-the-art, in-house laboratory and network of partners.

- November 2023 - Quadpack launched five new lipsticks, with each comprising a single, recyclable material. The five items, which include two refill forms and designs made of polypropylene (PP), polyethylene (PET), and aluminum, have an advanced degree of sustainability based on Quadpack's positive-impact packaging (PIP) grading methodology. These products comprise a diverse range of forms, features, and motions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of Recent Geopolitical Developments on the Cosmetic Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Demand for Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Challenge

- 5.2.1 Low Rates of Re-usability of Plastic Packaging for Cosmetic Products in European Countries Have Posed a Threat to Sustainability

- 5.3 Analysis of Change in Focus to Sustainability Across the World

- 5.4 Analysis of Polymers Currently Used in the European Cosmetic Plastic Packaging Market

6 MARKET SEGMENTATION

- 6.1 By Resin Type

- 6.1.1 Plastic

- 6.1.1.1 Polyethylene (High-density Polyethylene & Low-density Polyethylene)

- 6.1.1.2 Polypropylene

- 6.1.1.3 Polyethylene Terephthalate and Polyvinyl Chloride

- 6.1.1.4 Polystyrene (PS)

- 6.1.1.5 Bio-based Plastics (Bioplastics)

- 6.1.1.6 Other Plastics (Acrylonitrile Butadiene Styrene, etc.)

- 6.1.2 Glass

- 6.1.3 Aluminum

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Tubes and Sticks

- 6.2.3 Pumps and Dispensers

- 6.2.4 Pouches

- 6.2.5 Other Product Types

- 6.3 By Application

- 6.3.1 Skin Care

- 6.3.2 Hair Care

- 6.3.3 Oral Care

- 6.3.4 Make-up Products

- 6.3.5 Deodorants & Fragrances

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 South Korea

- 6.4.3.6 Southeast Asia

- 6.4.3.7 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea Group

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 Gerresheimer AG

- 7.1.4 Berry Global

- 7.1.5 Aptar Group

- 7.1.6 Amcor PLC

- 7.1.7 Cosmopak USA LLC

- 7.1.8 Quadpack industries SA

- 7.1.9 LIBO Cosmetics Company Ltd

- 7.1.10 Mpack Poland Sp.z.o.o.

- 7.1.11 Politech Sp.z.o.o.

- 7.1.12 Huhtamaki OYJ

- 7.1.13 Rieke Corp (Trimas Corporation)

- 7.1.14 Berlin Packaging LLC

- 7.1.15 Mktg Industry SRL