|

市場調查報告書

商品編碼

1851395

軟包裝產業:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Flexible Packaging Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

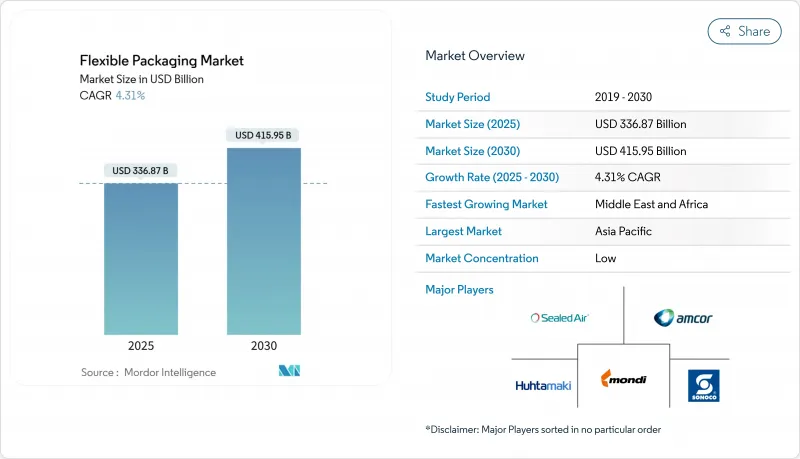

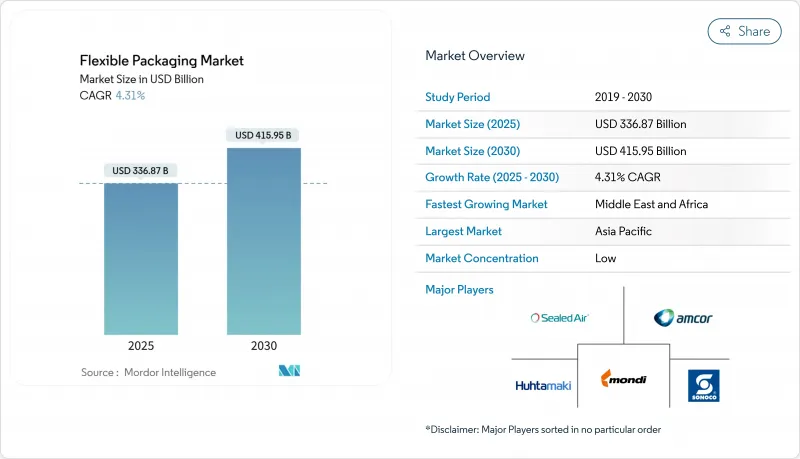

預計到 2025 年,軟質包裝市場規模將達到 3,368.7 億美元,到 2030 年將達到 4,159.5 億美元,年複合成長率為 4.31%。

永續性需求、電子商務的快速發展以及品牌對輕質阻隔性包裝的需求不斷成長,正在為軟包裝市場帶來更多機會。材料科學的突破,尤其是在單一材料結構方面的突破,正在減輕掩埋的壓力,並為加工商開闢新的循環收入來源。數位印刷縮短了小眾產品的上市週期,而準時制工作流程則緩解了聚烯價格波動所帶來的收入波動。從區域來看,亞太地區不斷壯大的中階和日益成長的製造業規模鞏固了其領先地位,而中東和非洲包裝基礎設施的蓬勃發展正在加速其追趕步伐。

全球軟包裝產業市場趨勢與洞察

電子商務對輕型保護性郵寄袋的需求激增

預計到2024年,北美線上銷售額將成長15.4%,這將推動零售商採用軟性氣泡信封,進而降低高達30%的體積重量費用。亞馬遜在印度減少了9,100噸塑膠的使用,並廣泛推廣可回收墊片氣泡袋,這表明企業碳排放承諾正朝著纖維薄膜混合包裝的方向發展。隨著包裝尺寸調整政策的加強,這種趨勢正蔓延至歐洲,亞洲的小包裹網路也正在效仿這些經濟高效的包裝形式。最終結果是,對聚塗層信封的需求持續成長,使軟質包裝市場超越了傳統的快速消費品終端用途。

亞洲快速消費品品牌轉向使用可回收的單一材料薄膜

印度2025年塑膠廢棄物管理規則要求品牌所有者證明其包裝足跡的量化回收利用情況,迫使大型食品和口腔護理產品製造商用純聚烯薄膜取代多層複合材料。例如,Wipf AG的PP基WICOFILM等解決方案可以無縫融入現有的回收流程,同時保持氧氣和香氣阻隔性能。東協個人護理品牌正在積極擁抱這一轉變,利用單一材料包裝袋來確保貨架吸引力,並滿足零售商的回收計劃。供應端的創新正在亞太地區蔓延,協助該地區鞏固其在軟包裝市場45.24%的佔有率。隨著大多數生產者責任延伸(EPR)費率逐年提高,擴大單一材料產能的加工商將更有可能獲得高合約和穩定的利潤率。

聚烯價格波動擠壓轉換器利潤

預計到2024年,原料價格波動幅度將達到兩位數,這將侵蝕採用季度價格合約的加工商的息稅折舊攤銷前利潤(EBITDA)。亞洲地區聚乙烯(PE)和聚丙烯(PP)供應過剩以及運輸中斷加劇了價格波動。為了緩解利潤衝擊,主要加工商正在採用更薄的薄膜規格、實現庫存計劃數位化,並探索生質能基石腦油合約以分散風險。儘管這些市場限制是暫時的,但它們正在加速價格穩定並向可回收材料的轉變,從而間接地推動了軟包裝市場供應鏈的現代化。

細分市場分析

聚乙烯憑藉其低成本和優異的防潮性能,在食品包裝領域佔據核心地位,預計到2024年將佔軟包裝市場佔有率的34.71%。由於樹脂種類繁多且回收管道完善,聚乙烯仍是穀物內襯、冷凍食品薄膜和清潔劑袋等應用的首選材料。然而,隨著零售商推出可家庭堆肥的自有品牌產品線,以及市政當局改進有機廢棄物處理項目,可生物分解和可堆肥聚合物將在2025年至2030年間以7.76%的複合年成長率實現最快成長。這一趨勢將推動研發預算轉向以PLA和PHA為基礎的擠壓樹脂,這些樹脂既能模擬LDPE的韌性,又能在工業廢棄物循環中分解。在對水蒸氣的要求不高的情況下,紙質複合材料也正在重新流行,而鋁箔則在需要近乎零氧氣透過率的場合保持著獨特的地位。 EVOH(乙烯-醋酸乙烯酯共聚物)在無菌肉湯和營養補充品凝膠等領域仍發揮重要作用,儘管目前主要以微層形式存在。總體而言,材料組合正朝著減少範圍 3排放而不犧牲可加工性的解決方案轉變,從而加強了軟性包裝市場的循環經濟重點。

受快速消費品產業脫碳藍圖和掩埋轉移費的推動,可生物分解軟包裝市場預計將從2025年的324億美元成長到2030年的472億美元。儘管聚乙烯目前仍佔據銷售優勢,但隨著消費者對最低再生材料含量標準的提高,其主導地位預計將會下降。雙向拉伸聚丙烯(BOPP)的透明度和剛性使其在零嘴零食領域保持領先地位,而聚氯乙烯(CPP)的熱封可靠性則確保了其在蒸餾袋和扭結包裝中的應用。樹脂生產商正在投資化學回收技術以回收聚丙烯(PP)和聚乙烯(PE)單體,從而實現真正的聚合物-聚合物循環,以保持材料性能。隨著這些努力的擴展,加工商預見到混合產品組合的出現,其中機械、化學和生物分解途徑並存,每種途徑都能滿足軟質包裝市場中不同管道的需求。

2024年,軟包裝袋將佔總銷售額的46.74%,凸顯了其在減少運輸排放方面的優勢。軟包裝袋重量減輕70%,可取代玻璃瓶和易拉罐。立式袋增加了廣告空間,並能促進調味品和寵物食品的衝動性購買。高解析度噴墨印刷機的出現減少了印刷前的浪費,使季節性口味的SKU得以擴展,並支持了直銷品牌和自有品牌的更新換代。薄膜和包裝紙雖然在貨架上不太顯眼,但隨著厚度的減少而又不犧牲抗穿刺性,其複合年成長率高達5.72%,成為成長最快的包裝形式。奈米黏土和二氧化矽阻隔塗層取代了鋁層,提高了分類性和可回收性。

同時,受化肥、水泥和寵物食品等產品需求的推動,軟包裝市場(包括袋裝和包裝袋)規模依然強勁。小袋裝和條狀包裝在單份營養補充劑和即溶飲料領域持續佔據主導地位,尤其是在東南亞地區,該地區的即飲消費正在不斷成長。未來五年,數位印刷、無溶劑運作和電子束固化技術的協同作用可望將前置作業時間從數週縮短至數天,迫使加工商重新思考其工廠佈局。最終,產品組合將有利於那些能夠靈活切換的營運模式,既能滿足食品服務的大量生產需求,又能滿足網紅合作的小批量生產需求的企業。

這份軟質包裝市場報告按材料類型(塑膠、紙張、鋁箔、可生物分解材料)、產品類型(包裝袋、薄膜、其他)、終端用戶行業(食品、食品飲料、醫藥、化妝品、工業、其他)、分銷管道(直接、間接)和地區(北美、歐洲、亞太、南美、中東和非洲)進行細分。市場預測以美元(USD)計價。

區域分析

預計到2024年,亞太地區將繼續維持其在軟包裝市場45.24%的主導地位,這主要得益於都市化、可支配收入的成長以及扶持製造業的政策。中國的智慧工廠投資和印度針對食品加工的生產連結獎勵計畫正在推動國內樹脂和薄膜產能的提升。 UFlex公司將其聚酯切片產量加倍,並運作了一座整合消費後材料的PCR工廠,從而強化了其循環供應鏈提案。本地加工商也率先推出單一材料解決方案,以應對即將實施的生產者責任延伸(EPR)費用,進一步鞏固了該地區的發展勢頭。同時,東南亞國家正利用免稅貿易叢集出口立式袋,活性化區域內貿易往來。

北美是第二大節點,這主要得益於電子商務包裝袋的普及和醫藥低溫運輸的成長。零售商要求使用經How2Recycle認證的包裝袋,推動了PE薄膜可回收性的提升。原始設備製造商(OEM)正在整合數位化檢測技術,以確保符合FDA標準的可追溯性,從而加強市場誠信。歐洲正轉向其歐盟PPWR戰略,投資建造化學回收試點工廠和纖維基軟性產品。 Mondi和Haftamaki分別擴大了其可回收蒸餾線和Blue Loop產品組合,以大規模應用「面向回收的設計」原則。

預計到2030年,中東和非洲將以6.16%的複合年成長率實現最快成長,這主要得益於沙烏地阿拉伯和埃及等外國直接投資支持的食品中心的發展。非洲包裝產業預計在2030年達到545.4億美元,其中軟包裝市場規模到2032年可能超過32.6億美元。現代零售連鎖店需要適用於乾旱氣候的保存期限長的包裝袋,這刺激了阻隔性薄膜的進口。南美洲專門食品咖啡的蓬勃發展增強了對排氣閥包裝袋的需求,而外匯波動則提升了軟質包裝比硬質玻璃和金屬包裝更輕。各地區的通用是,監管主導的回收目標正在促使加工商的研發藍圖趨向單一材料。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 北美地區對輕型防護郵寄袋的電子商務需求激增

- 亞洲快速消費品品牌轉向使用單一材料可回收薄膜以滿足生產者責任延伸制度的要求

- 蒸餾食品在歐洲迅速普及

- 南美洲咖啡和專門食品飲品品牌改用高阻隔薄膜

- 投資數位印刷技術,實現化妝品包裝的大規模客製化

- 低溫運輸生技藥品包裝需求的成長泡殼了藥品軟包裝的發展

- 市場限制

- 聚烯價格波動擠壓轉換器利潤

- 歐盟和美國多層複合材料的回收基礎設施分散

- 加強主要新興國家(如印度、肯亞)對一次性塑膠製品的禁令

- 硬質寶特瓶阻礙了立式袋在中東碳酸飲料市場的滲透。

- 供應鏈分析

- 監理展望

- 技術展望

- 貿易情景(依相關HS編碼)

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 回收與永續性概況

第5章 市場規模與成長預測

- 依材料類型

- 塑膠

- 聚乙烯

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯(CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他軟塑膠

- 紙

- 鋁箔

- 可生物分解和可堆肥材料

- 塑膠

- 依產品類型

- 小袋

- 袋子和麻袋

- 薄膜和包裝

- 其他產品類型

- 按最終用途行業分類

- 食物

- 冷凍食品

- 乳製品

- 肉類和海鮮

- 烘焙點心和糖果甜點

- 生鮮食品

- 其他食物

- 飲料

- 果汁和花蜜

- 乳製品飲料

- 其他飲料

- 製藥

- 化妝品和個人護理

- 工業的

- 其他終端用戶產業

- 食物

- 透過分銷管道

- 直銷通路

- 間接銷售管道

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 亞太地區

- 中國

- 日本

- 印度

- ASEAN

- 韓國

- 澳洲

- 紐西蘭

- 南美洲

- 巴西

- 阿根廷

- 智利

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 市佔率分析

- 公司簡介

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Huhtamaki Oyj

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- ProAmpac LLC

- Coveris Management GmbH

- Uflex Ltd.

- Sigma Plastics Group

- Schur Flexibles Holding

- Wipf AG

- Glenroy Inc.

- Printpack Inc.

- Clondalkin Flexible Packaging

- American Packaging Corporation

- FlexPak Services LLC

- Arabian Flexible Packaging LLC

- Gulf East Paper & Plastic Industries LLC

- Plastipak Packaging Inc.

第7章 市場機會與未來展望

The flexible packaging market size stands at USD 336.87 billion in 2025 and is forecast to reach USD 415.95 billion by 2030, advancing at a 4.31% CAGR.

Rising sustainability mandates, rapid e-commerce expansion, and brand demand for lightweight, high-barrier formats are widening the flexible packaging market opportunity. Material science breakthroughs, particularly in mono-material structures, are reducing landfill pressure and unlocking new circular revenue streams for converters. Digital printing is compressing launch cycles for niche products, while just-in-time workflows mitigate the earnings volatility caused by polyolefin price swings. Regionally, Asia Pacific's expanding middle class and manufacturing scale underpin its leadership, whereas the Middle East and Africa's packaging infrastructure boom is accelerating its catch-up growth.

Global Flexible Packaging Industry Market Trends and Insights

Surge in e-commerce demand for lightweight protective mailers

North American online sales expanded by 15.4% in 2024, pushing retailers to adopt flexible bubble mailers that cut dimensional-weight fees up to 30%. Amazon's removal of 9,100 metric tons of plastic in India and its wider rollout of recyclable paper padded bags illustrate how corporate carbon pledges are steering procurement toward fiber-and-film hybridsConverter order books now favor curbside-recyclable mailers with high recycled-content films, spawning capacity additions across the United States and Mexico. Volumes are also spilling into Europe as right-sizing mandates tighten, while Asian parcel networks replicate these cost-efficient formats. The net effect is a sustained uplift in poly-coated mailer demand that lifts the flexible packaging market beyond traditional FMCG end uses.

Shift of Asian FMCG brands toward mono-material recyclable films

India's Plastic Waste Management Rules in FY 2025 require brand owners to demonstrate quantifiable recycling of their packaging footprints, compelling leading food and oral-care players to replace multilayer laminates with polyolefin-only films. Solutions such as PP-based WICOFILM from Wipf AG preserve oxygen and aroma barriers yet flow seamlessly through existing recycling streams. ASEAN personal-care brands echo this switch, leveraging mono-material pouches to secure shelf appeal while satisfying retailer take-back schemes. Supply-side innovation is spreading across Asia Pacific, helping the region reinforce its 45.24% hold on the flexible packaging market. With most EPR fees escalating annually, converters that scale mono-material capacity are positioned to secure premium contracts and margin resilience.

Volatile polyolefin prices squeezing converter margins

Feedstock volatility reached double-digit spreads in 2024, eroding EBITDA for converters locked into quarterly price agreements. Asian PE and PP oversupply and shipping disruptions amplify the swings. To blunt margin shocks, leading converters deploy thinner gauge films, digitalize inventory planning, and explore biomass-based naphtha contracts to diversify risk exposure. This restraint remains transitory yet accelerates the shift toward materials that provide price stability and recycled content, indirectly modernizing the flexible packaging market supply base.

Other drivers and restraints analyzed in the detailed report include:

- Rapid adoption of retort pouches for ready-to-eat meals

- Coffee and specialty-drink brands' switch to high-barrier films

- Fragmented recycling infrastructure for multilayer laminates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene underpinned 34.71% of flexible packaging market share in 2024, leveraging its low cost and moisture barrier attributes to anchor core food applications. Its wide resin availability and established recycling streams keep it the default choice for cereal liners, frozen food films, and detergent pouches. However, biodegradable and compostable polymers exhibit the fastest 7.76% CAGR from 2025-2030 as retailers introduce home-compostable private-label lines and municipalities upgrade organic waste programs. This momentum realigns R&D budgets toward PLA- and PHA-based coextrusions that mimic LDPE toughness yet break down within industrial composting cycles. Paper laminates also resurge where water vapor requirements are moderate, while aluminum foil defends niche roles that demand near-zero oxygen transmission. EVOH, albeit used in microlayer form, remains critical for aseptic broths and nutraceutical gels. Collectively, the material portfolio is pivoting toward solutions that reduce Scope 3 emissions without forfeiting machinability, reinforcing the flexible packaging market's pivot to circularity.

The flexible packaging market size for biodegradable materials is projected to climb from USD 32.4 billion in 2025 to USD 47.2 billion in 2030, fueled by FMCG decarbonization roadmaps and landfill diversion fees. Polyethylene still commands the volume crown, yet its dominance is expected to edge down as consumer-facing categories impose minimum recycled-content thresholds. BOPP's clarity and stiffness uphold its presence in snack foods, while CPP's heat-seal reliability ensures its inclusion in retort and twist-wrap packs. Resin makers are investing in chemical recycling to recapture PP and PE monomers, enabling true polymer-to-polymer loops that preserve material performance. As these initiatives scale, converters foresee a blended portfolio where mechanical, chemical, and bio-degradation pathways coexist, each serving distinct channel needs within the flexible packaging market.

Pouches generated 46.74% of 2024 revenue, spotlighting their ability to replace glass jars and tins with 70% lighter formats that lower freight emissions. Stand-up pouches enhance billboard space, driving impulse purchases in condiments and pet food. The advent of high-definition inkjet presses slashes make-ready waste and enables SKU proliferation for seasonal flavors, supporting D2C brands and private-label refreshes. Films and wraps, while less visible on shelf, register the sharpest 5.72% CAGR by trimming gauge thicknesses without sacrificing puncture resistance. Nanoclay and silicon oxide barrier coatings now substitute aluminum layers, improving sortability and stream recyclability.

Meanwhile, the flexible packaging market size for bags and sacks holds steady, buoyed by fertilizer, cement, and dog-food demand. Sachets and stick packs continue to penetrate single-serve nutraceuticals and instant beverages, particularly in Southeast Asia where on-the-go consumption is rising. Over the next five years the interplay between digital press uptime, solvent-less lamination, and e-beam curing is expected to compress lead times from weeks to days, pushing converters to rethink plant layouts. The end result is a product mix that rewards agile operations able to toggle between long food-service runs and micro batches for influencer collaborations.

The Flexible Packaging Market Report is Segmented by Material Type (Plastic, Paper, Aluminum Foil, Biodegradable Materials), Product Type (Pouches, Bags, Films, Others), End-Use Industry (Food, Beverage, Pharmaceutical, Cosmetics, Industrial, Others), Distribution Channels (Direct, Indirect), and Geography (North America, Europe, Asia Pacific, South America, MEA). Market Forecasts are in Value (USD).

Geography Analysis

Asia Pacific retained a commanding 45.24% share of the flexible packaging market in 2024 due to urbanization, rising disposable incomes, and pro-manufacturing policies. China's smart-factory investments and India's Production Linked Incentive scheme for food processing underpin domestic resin and film capacity. UFlex doubled polyester chip output and commissioned a PCR plant to integrate post-consumer feedstock, fortifying a circular supply proposition. Local converters also spearhead mono-material rollouts to comply with forthcoming EPR fees, reinforcing the region's trajectory. Meanwhile, Southeast Asian nations leverage duty-free trade clusters to export stand-up pouches, lifting intraregional trade flows.

North America is the second-largest node, propelled by e-commerce mailer adoption and pharmaceutical cold-chain growth. Retailers press for How2Recycle-certified pouches, prompting PE film recyclability upgrades. OEMs integrate digital inspection to guarantee FDA-grade traceability, reinforcing market integrity. Europe anchors its strategy around the EU PPWR, channeling funds into chemical-recycling pilot plants and fiber-based flexibles. Mondi and Huhtamaki expand recyclable retort lines and blueloop portfolios, respectively, embedding design-for-recycling principles at scale.

The Middle East & Africa is forecast to post the fastest 6.16% CAGR to 2030, aided by FDI-backed food hubs in Saudi Arabia and Egypt. Africa's packaging sector is on course to hit USD 54.54 billion by 2030, of which flexible formats could surpass USD 3.26 billion by 2032. Modern retail chains require extended-shelf-life pouches for arid climates, stimulating imports of high-barrier films. South America's specialty coffee boom strengthens demand for degassing valve pouches, while currency volatility makes the lighter flexible packaging market more attractive than rigid glass or metal. Across regions, a common thread is regulatory-driven recycling targets that unify converter R&D roadmaps toward mono-materials.

- Amcor plc

- Sealed Air Corporation

- Mondi plc

- Huhtamaki Oyj

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- ProAmpac LLC

- Coveris Management GmbH

- Uflex Ltd.

- Sigma Plastics Group

- Schur Flexibles Holding

- Wipf AG

- Glenroy Inc.

- Printpack Inc.

- Clondalkin Flexible Packaging

- American Packaging Corporation

- FlexPak Services LLC

- Arabian Flexible Packaging LLC

- Gulf East Paper & Plastic Industries LLC

- Plastipak Packaging Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in e-commerce demand for lightweight protective mailers in North America

- 4.2.2 Shift of Asian FMCG brands toward mono-material recyclable films to meet EPR mandates

- 4.2.3 Rapid adoption of retort pouches for ready-to-eat meals in Europe

- 4.2.4 Coffee and specialty-drink brands' switch to high-barrier films in South America

- 4.2.5 Investments in digital printing enabling mass customization for cosmetics packs

- 4.2.6 Growth in cold-chain biologics blister demand boosting pharma flexible packaging

- 4.3 Market Restraints

- 4.3.1 Volatile polyolefin prices squeezing converter margins

- 4.3.2 Fragmented recycling infrastructure for multilayer laminates in EU and US

- 4.3.3 Stricter single-use plastic bans in key emerging economies (e.g., India, Kenya)

- 4.3.4 Rigid PET bottles limiting stand-up pouch penetration in Middle-East CSD segment

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Trade Scenario (Under Relevant HS Code)

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Recycling and Sustainability Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Biaxially Oriented Polypropylene (BOPP)

- 5.1.1.3 Cast Polypropylene (CPP)

- 5.1.1.4 Polyvinyl Chloride (PVC)

- 5.1.1.5 Ethylene-Vinyl Alcohol (EVOH)

- 5.1.1.6 Other Flexible Plastic

- 5.1.2 Paper

- 5.1.3 Aluminum Foil

- 5.1.4 Biodegradable and Compostable Materials

- 5.1.1 Plastic

- 5.2 By Product Type

- 5.2.1 Pouches

- 5.2.2 Bags and Sacks

- 5.2.3 Films and Wraps

- 5.2.4 Other Product Types

- 5.3 By End-use Industry

- 5.3.1 Food

- 5.3.1.1 Frozen Food

- 5.3.1.2 Dairy Based Products

- 5.3.1.3 Meat and Seafood

- 5.3.1.4 Baked Snacks and Confectionery

- 5.3.1.5 Fresh Produce

- 5.3.1.6 Other Food Products

- 5.3.2 Beverage

- 5.3.2.1 Juice and Nectare

- 5.3.2.2 Dairy Based Drinks

- 5.3.2.3 Other Beverages

- 5.3.3 Pharmaceutical

- 5.3.4 Cosmetics and Personal Care

- 5.3.5 Industrial

- 5.3.6 Other End -Use Industry

- 5.3.1 Food

- 5.4 By Distribution Channels

- 5.4.1 Direct Sales Channel

- 5.4.2 Indirect Sales Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 ASEAN

- 5.5.3.5 South Korea

- 5.5.3.6 Australia

- 5.5.3.7 New Zealand

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Amcor plc

- 6.3.2 Sealed Air Corporation

- 6.3.3 Mondi plc

- 6.3.4 Huhtamaki Oyj

- 6.3.5 Constantia Flexibles Group GmbH

- 6.3.6 Sonoco Products Company

- 6.3.7 ProAmpac LLC

- 6.3.8 Coveris Management GmbH

- 6.3.9 Uflex Ltd.

- 6.3.10 Sigma Plastics Group

- 6.3.11 Schur Flexibles Holding

- 6.3.12 Wipf AG

- 6.3.13 Glenroy Inc.

- 6.3.14 Printpack Inc.

- 6.3.15 Clondalkin Flexible Packaging

- 6.3.16 American Packaging Corporation

- 6.3.17 FlexPak Services LLC

- 6.3.18 Arabian Flexible Packaging LLC

- 6.3.19 Gulf East Paper & Plastic Industries LLC

- 6.3.20 Plastipak Packaging Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment