|

市場調查報告書

商品編碼

1851323

通報系統系統(MNS):市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)MNS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

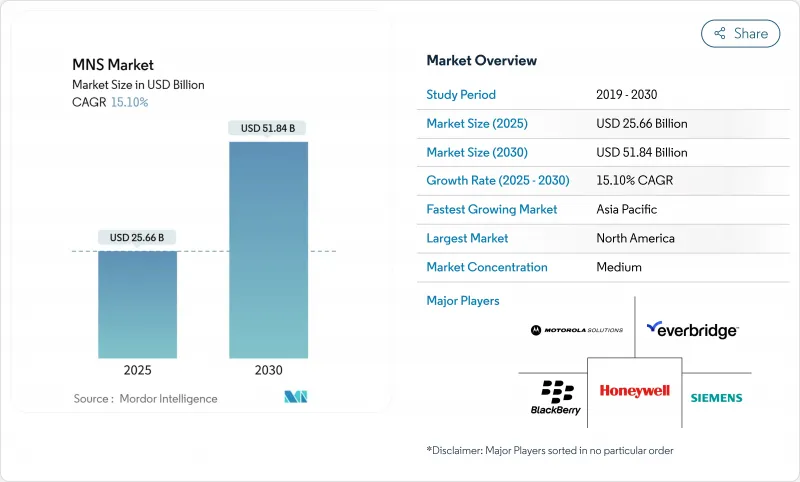

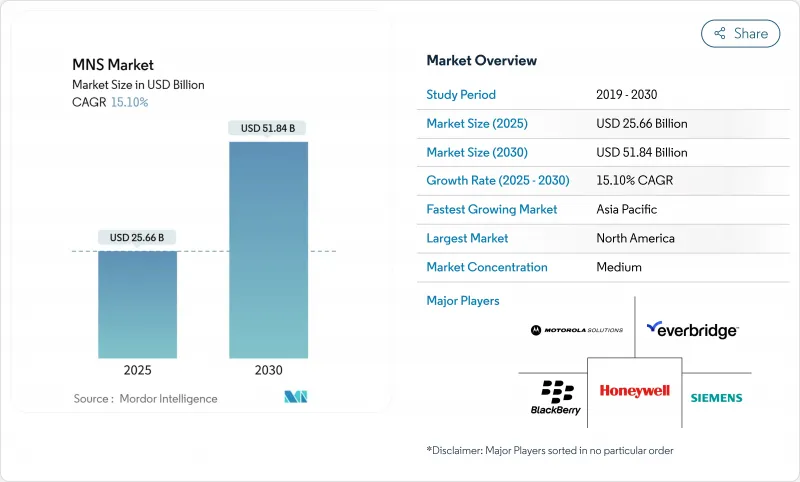

預計到 2025 年,通報系統系統 (MNS) 市場價值將達到 256.6 億美元,到 2030 年將達到 518.4 億美元,年複合成長率為 15.1%。

氣候變遷風險加劇、安全法規日益嚴格、技術進步正在共同推動5G技術的應用。如今,企業期望透過單一平台,利用簡訊、語音、社群媒體、桌面彈窗、公共廣播和物聯網感測器等多種管道觸達用戶,並根據用戶的位置和角色自訂訊息。隨著企業對即時擴展和遠端管理的需求日益成長,雲端部署佔據主導地位;但隨著安全團隊對本地部署控制要求的加強,混合部署模式也在迎頭趕上。隨著支出從政府擴展到醫療保健、教育、公共以及中小企業,擁有5G、分析和與傳統基礎設施整合專業知識的供應商將更有利於贏得新計畫。

全球通報系統系統(MNS)市場趨勢與洞察

加速部署5G技術可實現即時多媒體警報

5G 將帶來Gigabit吞吐量和毫秒延遲,使平台能夠推送高清視訊、樓層平面圖和互動式疏散地圖,而不是文字。日本、韓國和新加坡的都市區已經開始使用基於位置的警報系統,該系統會根據接收者在城市中的移動而自動調整。通訊業者報告稱,在重大事件期間,5G 的連接滿意度比 4G 高出 20%,這對於在堵塞網路環境下進行規劃的緊急管理人員來說是一個令人安心的資料點。能夠整合網路切片和邊緣運算能力的供應商,正憑藉速度、冗餘性和豐富的內容脫穎而出。隨著頻譜競標的持續進行和設備普及率的提高,與 5G 覆蓋目標相關的公共資金預計將在大規模通知系統市場佔據更多佔有率。

歐盟《歐洲經濟共同體公約》第110條促進多通路合規

該法規要求所有27個歐盟成員國必須涵蓋“盡可能多的受影響人群”,並鼓勵各國政府結合使用行動電話廣播、基於位置的簡訊和應用程式警報等多種方式。合規資金正在加速部署支援多語言內容、雙向通訊和跨境互通性的混合平台。商業用戶也在採用相同的架構來簡化業務永續營運通訊,這使得私人投資以超出預期的速度湧入大眾通知系統市場。

非洲碎片化的頻譜政策阻礙了頻譜的採用

區域廣播依賴統一的頻譜指導方針,但非洲54個國家的政策差異很大。供應商需要為每家通訊業者客製化整合方案,這延長了試驗時間並推高了成本。儘管3G和4G覆蓋率已超過90%,但這仍減緩了公共領域的應用。區域整合工作正在進行中,但在整合成熟之前,非洲的成長速度將低於其他新興地區。

細分市場分析

預計到2024年,大規模通知系統解決方案市場規模將達到170億美元,市佔率高達66%,主要得益於機構和企業用指揮中心軟體取代以硬體為中心的傳統方案。該軟體將簡訊、語音、電子郵件、警報器和指示牌整合到一個統一的主機中,從而減少了培訓需求和許可證重複使用的情況。在未來五年,預測收件者行為的分析模組有望促使現有客戶升級,從而維持解決方案銷售額兩位數的成長。服務領域雖然規模較小,但由於整合、客製化和全天候監控需要專業技能,因此預計其複合年成長率將達到18.6%。

閃光燈、壁掛式揚聲器和戶外警報器等硬體設備在關鍵任務型工廠、機場和學校仍然佔據一席之地。但製造商正在這些裝置中內建IP連線功能,使其能夠向中央平台報告狀態。專業服務團隊將評估、法規諮詢和生命週期維護打包到多年合約中,從而為供應商創造可預測的現金流,並減少客戶的意外成本。這種管理模式進一步擴大了此解決方案在群發通知系統市場的優勢。

到2024年,雲端將佔據大規模報表系統市場71%的佔有率,管理者們青睞其即時擴展、計量收費和便利升級等優勢。 SaaS平台也簡化了大型企業跨數十個站點的多租戶管理。這種模式也吸引了IT人員有限的中小型企業,使其客戶淨成長最為顯著。然而,數據主權法規、現場部署的需求以及對供應商鎖定的擔憂,正促使金融服務、公共產業和醫院等行業轉向混合部署模式。混合部署預計將以20.4%的複合年成長率成長,成為所有部署方案中成長最快的。

本地部署規模正在縮小,但不太可能完全消失。關鍵基礎設施擁有者通常會在加固的伺服器上運作本機實例,以確保即使外部連結發生故障,訊息也能正常傳輸。容器化架構現在允許營運商在公共雲端和本地叢集之間遷移工作負載,從而平衡成本和控制。隨著這種彈性逐漸成為主流,在群發通知系統市場中,「雲端」和「本地」之間的界線可能會變得模糊,買家會選擇針對特定工作負載的策略,而不是單一的、包羅萬象的模式。

大眾通知系統市場報告按組件(解決方案、服務、硬體)、部署方式(雲端、本地部署、混合部署)、應用領域(建築內、廣域網路、其他)、解決方案用途(業務永續營運和災害復原、其他)、最終用戶(政府和國防、其他)以及地區對產業進行細分。市場規模和預測均以美元計價。

區域分析

北美地區預計到2024年將維持40%的收入佔有率,反映了該地區成熟的通訊基礎設施、津貼以及極端天氣頻繁的現狀。目前,各市政當局正將大規模警報系統整合到更廣泛的智慧城市平台中,這些平台將交通感測器、洪水監測儀、野火攝影機等設備與自動化訊息連接起來。雲端原生升級也符合該地區對網路安全保險的高要求,確保所有部署都具備資料保護功能。

亞太地區以17.5%的複合年成長率成長,是所有地區中最快的。韓國、日本和澳洲加速推進5G網路部署,使得警報能夠附帶影片剪輯和多語言字幕,從而提高人口密集城市中的資訊理解能力。在菲律賓等颱風頻繁的國家,政府為提高抗災能力獎勵策略,正吸引新的資金流入大眾通知系統市場。同時,中國的特大城市計劃正在將警報系統與監視錄影機和電子錢包超級應用相結合,將公共與日常數位行為融為一體。

歐洲的情況介於這兩個極端之間,但其成長主要受監管合規性驅動。 《歐洲經濟共同體公約》第110條的最後期限促使所有成員國將多通路警報納入預算,而《一般資料保護規範》(GDPR)則鼓勵供應商投資於使用者同意管理和資料最小化。北歐地區對多語言內容的重視雖然延緩了一些計劃的進展,但最終拓寬了產品的出口能力。英國不受歐盟指令的約束,已製定了符合小區廣播最佳實踐的自身標準,從而確保了跨境互通性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速5G部署將協助亞太地區實現即時多媒體警報

- 歐盟強制監管多通路公共警告(《歐洲經濟共同體法》第110條)

- 北美氣候災害日益增多,促使市政當局採取相關措施。

- 快速的校園數位化將有助於高等教育機構創造安全的自帶設備(BYOD)生態系統

- 公用電網現代化計劃尋求融合的OT/IT警報平台

- 市場限制

- 碎片化的頻譜政策阻礙了非洲行動電話廣播的普及。

- 網路保險成本上升導致醫療保健產業雲端行動網路的總擁有成本增加。

- 大型企業因擔心警報疲勞而限制了訊息頻率。

- 多語言內容庫匱乏阻礙了北歐地區的普及。

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 硬體

- 火警警報器控制面板

- 公共廣播及語音疏散系統

- 通知信標數位電子看板

- 解決方案

- 緊急/群發通知軟體

- 事件管理和情境察覺

- 服務

- 專業(諮詢、整合)

- 託管服務

- 硬體

- 透過部署模式

- 本地部署

- 雲

- 混合

- 目的性解決方案

- 業務永續營運和災害復原

- 綜合公共警報和預警

- 可互通應急通訊

- 按組織規模

- 主要企業

- 中小企業

- 透過使用

- 室內

- 廣域

- 分散式接收器

- 按行業

- 政府/國防

- 能源與公共產業

- 衛生保健

- 教育

- 商業和工業

- 運輸/物流

- 資訊科技/通訊

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Everbridge Inc.

- Motorola Solutions Inc.

- Honeywell International Inc.

- Siemens AG

- Blackberry AtHoc Inc.

- Eaton Corp.

- OnSolve LLC

- Singlewire Software LLC

- Alertus Technologies LLC

- xMatters

- AlertMedia Inc.

- F24 AG

- Rave Mobile Safety

- Regroup Mass Notification

- HipLink Software

- Volo(Volo Alert)

- BlackBoard Connect(Anthology)

- Preparis(Agility Recovery)

- Pocketstop RedFlag

- Vecima Networks(Engage IP)

第7章 市場機會與未來展望

The mass notification systems market is valued at USD 25.66 billion in 2025 and is on track to reach USD 51.84 billion by 2030, rising at a 15.1% CAGR.

Heightened climate risks, tougher safety regulations, and technology advances are converging to keep adoption momentum high. Organizations now expect a single platform to reach people through text, voice, social, desktop pop-ups, public address, and IoT sensors, all while tailoring messages to location and role. Cloud deployment dominates because enterprises want immediate scale and remote management, yet the hybrid model is catching up as security teams look for tighter on-premise control. Suppliers that master integration with 5G, analytics, and legacy infrastructure are best positioned to win new projects as spending spreads from government to healthcare, education, utilities, and small businesses.

Global MNS Market Trends and Insights

Accelerated 5G roll-outs enabling real-time multimedia alerting

5G brings gigabit throughput and millisecond latency, allowing platforms to push high-definition video, floor plans, and interactive evacuation maps rather than plain text. Urban centers in Japan, South Korea, and Singapore already use location-based warnings that adapt as recipients move through a city. Operators report 20% higher connectivity satisfaction during large events compared with 4G, a data point that reassures emergency managers planning for congested networks. Vendors able to embed network- slicing and edge-compute features are differentiating on speed, redundancy, and content richness. As spectrum auctions continue and device penetration rises, the mass notification systems market will capture incremental public-safety funding tied to 5G coverage targets.

EU's EECC Article 110 driving multi-channel compliance

The code obliges all 27 EU states to reach "the maximum possible affected population," pushing governments to marry cell broadcast, location-based SMS, and app alerts. Funding streams earmarked for compliance have accelerated roll-outs of hybrid platforms that support multilingual content, two-way messaging, and cross-border interoperability. Commercial users are following the same architecture to streamline business continuity communications, pulling private investment into the mass notification systems market sooner than projected.

Fragmented spectrum policies hampering African adoption

Cell broadcast relies on harmonized spectrum guidelines, yet policies vary widely across 54 African nations. Vendors face custom integrations for each carrier, prolonging pilots and inflating costs, which slows public-safety deployments even as 3G and 4G coverage climbs above 90%. Regional harmonization efforts are underway, but until they mature, growth lags other emerging regions.

Other drivers and restraints analyzed in the detailed report include:

- Escalating climate catastrophes accelerating municipal deployments

- Campus digitization transforming educational safety

- Cyber-insurance premiums elevating cloud TCO in healthcare

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The mass notification systems market size for solutions reached USD 17 billion in 2024, translating to a 66% share as agencies and enterprises replaced hardware-centric setups with command-center software. Software unifies SMS, voice, email, sirens, and signage under one console, reducing training needs and license duplication. In the second half of the decade, analytics modules that predict recipient behavior are expected to prompt upgrades among existing customers, keeping solutions revenue on a double-digit climb. Services, while a smaller slice, are advancing at an 18.6% CAGR because integration, customization, and 24/7 monitoring demand specialist skills.

Hardware retains a foothold in plants, airports, and schools where strobe beacons, wall-mounted speakers, and outdoor sirens remain mission critical. Yet manufacturers are embedding IP connectivity in these devices so they can report status back to the central platform. Professional services teams are packaging assessments, regulatory consulting, and lifecycle maintenance into multi-year contracts, creating predictable cash flow for vendors and lowering surprise costs for clients. Such managed models are further widening the solutions edge within the mass notification systems market.

Cloud captured 71% of the mass notification systems market in 2024 as administrators favored instant scale, pay-as-you-go pricing, and hassle-free upgrades. SaaS platforms also simplified multi-tenant management for large enterprises spanning dozens of sites. That model resonates with SMEs that lack IT staff, fueling the highest net-new logo count. Even so, data-sovereignty rules, the need for on-site survivability, and concerns over vendor lock-in are steering financial services, utilities, and hospitals toward hybrid approaches. Hybrid adoption is forecast to grow at 20.4% CAGR, the fastest rate in deployment choices.

On-premise deployments are shrinking but will not disappear. Critical infrastructure owners often keep a local instance running on hardened servers so messages still flow when external links fail. Containerized architectures now let operators shift workloads between public clouds and local clusters, balancing cost and control. As such flexibility becomes mainstream, the mass notification systems market will likely see blurred lines between "cloud" and "on-premise," with buyers selecting per-workload policies rather than a single blanket model.

Mass Notification Systems Market Report Segments the Industry Into Component (Solution, Services, Hardware), Deployment (Cloud, On-Premise, Hybrid), Application (In-Building, Wide-Area and More), Solution Purpose (Business Continuity and Disaster Recovery, and More), End-User Vertical (Government and Defense, and More), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 40% of 2024 revenue, reflecting mature telecommunications infrastructure, grant funding, and a track record of extreme weather events. Municipalities now embed mass alerting into broader smart-city platforms that tie traffic sensors, flood gauges, and wildfire cameras to automatic outbound messaging. Cloud-native upgrades also coincide with the region's high cyber-insurance requirements, ensuring data protection features are woven into every deployment.

Asia-Pacific is expanding at a 17.5% CAGR, the highest among all regions. Accelerated 5G roll-outs in South Korea, Japan, and Australia let agencies attach video clips and multilingual subtitles to alerts, boosting comprehension in dense cities. Government stimulus for disaster resilience in typhoon-prone nations such as the Philippines is funneling fresh capital into the mass notification systems market. Meanwhile China's mega-city projects integrate alerts with surveillance cameras and e-wallet super-apps, blending public safety with everyday digital behavior.

Europe sits between these extremes, but its growth is dominated by regulatory compliance. The EECC Article 110 deadline drove every member state to budget for multi-channel warnings, while GDPR pushed vendors to invest in consent management and data minimization. The Nordic region's focus on multilingual content slows some projects but ultimately broadens product capability for export. The United Kingdom, operating outside EU directives, is drafting its own standards that still align with cell broadcast best practice, ensuring continued cross-border interoperability.

- Everbridge Inc.

- Motorola Solutions Inc.

- Honeywell International Inc.

- Siemens AG

- Blackberry AtHoc Inc.

- Eaton Corp.

- OnSolve LLC

- Singlewire Software LLC

- Alertus Technologies LLC

- xMatters

- AlertMedia Inc.

- F24 AG

- Rave Mobile Safety

- Regroup Mass Notification

- HipLink Software

- Volo (Volo Alert)

- BlackBoard Connect (Anthology)

- Preparis (Agility Recovery)

- Pocketstop RedFlag

- Vecima Networks (Engage IP)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated 5G roll-outs enabling real-time, multimedia alerting in APAC

- 4.2.2 Mandated multi-channel public-warning regulations in EU (EECC Article 110)

- 4.2.3 Escalating climate-induced catastrophes in North America driving municipal deployments

- 4.2.4 Rapid campus digitization creating BYOD-ready safety ecosystems in Higher-Ed

- 4.2.5 Utilities' grid-modernization projects demanding OT/IT converged alert platforms

- 4.3 Market Restraints

- 4.3.1 Fragmented spectrum policies delaying cell-broadcast adoption in Africa

- 4.3.2 Rising cyber-insurance premiums increasing TCO for cloud MNS in healthcare

- 4.3.3 Alarm fatigue concerns curbing message frequency in large enterprises

- 4.3.4 Limited multilingual content libraries slowing uptake in the Nordics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Fire Alarm Control Panels

- 5.1.1.2 Public Address and Voice Evacuation Systems

- 5.1.1.3 Notification Beacons and Digital Signage

- 5.1.2 Solutions

- 5.1.2.1 Emergency/Mass Notification Software

- 5.1.2.2 Incident Management and Situation Awareness

- 5.1.3 Services

- 5.1.3.1 Professional (Consulting, Integration)

- 5.1.3.2 Managed Services

- 5.1.1 Hardware

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.2.3 Hybrid

- 5.3 By Solution Purpose

- 5.3.1 Business Continuity and Disaster Recovery

- 5.3.2 Integrated Public Alert and Warning

- 5.3.3 Interoperable Emergency Communication

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-size Enterprises (SMEs)

- 5.5 By Application

- 5.5.1 In-Building

- 5.5.2 Wide-Area

- 5.5.3 Distributed Recipient

- 5.6 By End-User Vertical

- 5.6.1 Government and Defense

- 5.6.2 Energy and Utilities

- 5.6.3 Healthcare

- 5.6.4 Education

- 5.6.5 Commercial and Industrial

- 5.6.6 Transportation and Logistics

- 5.6.7 IT and Telecommunications

- 5.6.8 Others

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Rest of Europe

- 5.7.4 Middle East

- 5.7.4.1 GCC

- 5.7.4.2 Turkey

- 5.7.4.3 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Nigeria

- 5.7.5.3 Rest of Africa

- 5.7.6 Asia-Pacific

- 5.7.6.1 China

- 5.7.6.2 Japan

- 5.7.6.3 India

- 5.7.6.4 South Korea

- 5.7.6.5 Southeast Asia

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Everbridge Inc.

- 6.4.2 Motorola Solutions Inc.

- 6.4.3 Honeywell International Inc.

- 6.4.4 Siemens AG

- 6.4.5 Blackberry AtHoc Inc.

- 6.4.6 Eaton Corp.

- 6.4.7 OnSolve LLC

- 6.4.8 Singlewire Software LLC

- 6.4.9 Alertus Technologies LLC

- 6.4.10 xMatters

- 6.4.11 AlertMedia Inc.

- 6.4.12 F24 AG

- 6.4.13 Rave Mobile Safety

- 6.4.14 Regroup Mass Notification

- 6.4.15 HipLink Software

- 6.4.16 Volo (Volo Alert)

- 6.4.17 BlackBoard Connect (Anthology)

- 6.4.18 Preparis (Agility Recovery)

- 6.4.19 Pocketstop RedFlag

- 6.4.20 Vecima Networks (Engage IP)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment