|

市場調查報告書

商品編碼

1851318

紡織化學品:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Textile Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

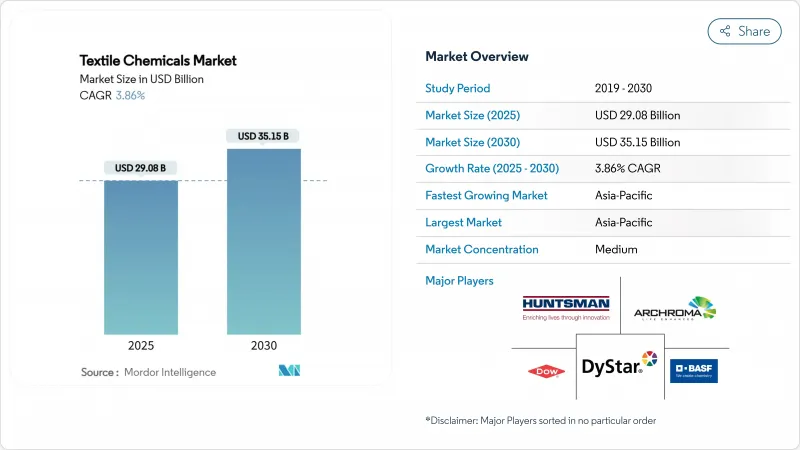

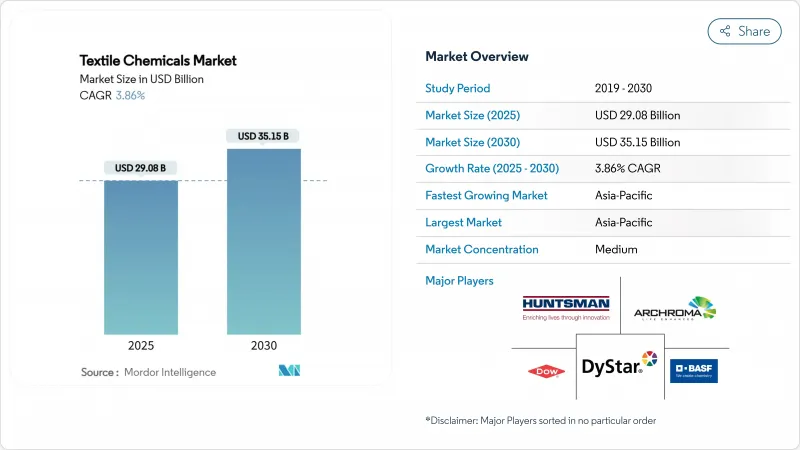

預計到 2025 年,紡織化學品市場規模將達到 290.8 億美元,到 2030 年將達到 351.5 億美元,預測期(2025-2030 年)複合年成長率為 3.86%。

這一溫和成長反映出紡織化學品行業日益成熟,正在適應更嚴格的環境法規和日益成長的永續生產需求。亞太地區的強勁擴張、數位印花技術的日益普及以及對功能性整理劑的日益重視,正在再形成整個紡織化學品市場的競爭格局。儘管PFAS的逐步淘汰和石化產品價格的波動抑制了短期成長勢頭,但對生物酶和水基技術的持續投資有望維持紡織化學品市場的長期成長潛力。

全球紡織化學品市場趨勢與洞察

亞太地區紡織品生產強勁成長

亞太地區紡織化學品市場正受益於產能的快速擴張和政府的支持措施。預計到2024年,中國紡織品出口額將成長5.7%,達到1,419.6億美元,這將支撐塗料、漿料和染色劑等產業的大量化學品消費。印度累計人造纖維推出的1,068.3億盧比的生產連結獎勵計劃,正在塑造對高性能整理加工劑的長期需求。亞太地區集中化的供應鏈促進了生物基和低VOC化學品的快速應用,進一步鞏固了該地區在全球紡織化學品市場中的中心地位。

工業紡織品需求不斷成長

輕量化汽車和醫療衛生領域的要求正在為阻燃、抗菌和耐熱化學品製定新的規範標準。技術紡織品領域以4.11%的複合年成長率成長,凸顯了紡織化學品市場正從大宗商品轉向價格高昂、針對特定應用的配方。奈米技術賦能的整理過程進一步提高了性能閾值,加劇了專業供應商之間的研發競爭。

染色和整理過程中的污染控制成本。

目前,污水處理升級改造正消耗大量資本支出,因為業者都在努力降低化學需氧量(COD)和生物需氧量(BOD)的排放限值。一些規模較小的加工企業無力負擔生物和膜技術改造的費用,因此選擇退出市場或進行合併,並將化學品需求集中到規模更大、符合規範的買家身上。這種整合提高了紡織化學品市場的進入門檻,並增加了轉換成本。

細分市場分析

到2024年,塗層和漿料化學品將佔總收入的28.54%,為織造和針織生產線的加工能力提供支援。它們的廣泛應用確保了穩定的基礎需求,即使在時尚週期放緩時期也能穩定紡織化學品市場。然而,技術創新在整理加工劑最為顯著,預計到2030年,整理劑的複合年成長率將達到4.35%,這主要得益於客戶對集防水、彈性和抗菌功能於一體的整理劑的需求。

環保性能正使產品平臺脫穎而出,多功能矽酮聚合物混合正在取代含氟防水劑,而脫脂劑也轉向可減少污水排放的生物酵素替代品。這些進步在保持核心收入來源的同時,推動了利潤成長,為紡織化學品市場創造了大量機會。

區域分析

預計到2024年,亞太地區將佔據全球71.25%的收入佔有率,這主要得益於中國3011億美元的出口規模以及印度預計到2030年將達到3500億美元的產業規模。區域各國政府持續津貼產能擴張與技術紡織品叢集,支撐全球紡織化學品市場以4.01%的複合年成長率成長。從纖維紡絲到服裝組裝的健全供應鏈,使得新型綠色化學品能夠快速應用,從而確保亞太地區持續保持領先地位。

北美市場佔有率雖小,但戰略意義重大,尤其在防護、航太和醫用紡織品領域,這些領域更注重規格合規性而非單位成本。美國品牌在墨西哥的近岸外包趨勢正在重新激發對當地染廠的投資,並為高價值助劑開闢新的管道。加州和紐約州的 PFAS 法規正在加速水性防水劑的普及,使北美成為紡織化學品市場下一代永續解決方案的試驗場。

歐洲成熟的紡織化學品產業受益於先進的機械設備和強大的法規結構,從而推動了循環經濟發展。對纖維到纖維回收化學品的投資正在不斷成長,德國和義大利率先建造了聚酯解聚合工廠。蓬勃發展的奢侈品和科技業正在資助低影響整理劑的研發,從而保持了歐洲在全球標準中的影響力。南美和中東等新興地區正在擴大生產規模,但仍受制於基礎設施不足,這延緩了它們全面融入紡織化學品市場的進程。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞太地區纖維產量強勁成長

- 技術/工業紡織品需求不斷成長

- 全球監管日益嚴格,有利於低揮發性有機化合物(VOC)化學品。

- 數位紡織印花油墨及助劑的蓬勃發展

- 生物酶加工解決方案的快速應用

- 市場限制

- 染色和加工過程中的污染控制成本

- 石油化工原料價格波動劇烈

- 逐步淘汰 PFAS 和其他物質將增加修復成本。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 供應商的議價能力

第5章 市場規模與成長預測

- 按類型

- 塗料和上漿化學品

- 著色劑和助劑

- 整理加工劑

- 退漿劑

- 其他類型(螺紋潤滑劑、漂白劑等)

- 按原料

- 天然纖維

- 合成纖維

- 生物基

- 特種化學品

- 透過使用

- 服飾

- 家居佈置

- 汽車紡織品

- 技術紡織品

- 其他用途(醫用/衛生紡織品、運動紡織品等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Achitex Minerva SpA

- Albemarle Corporation

- Archroma

- BASF

- Bozzetto Group

- CHT Group

- Clariant AG

- Covestro AG

- Croda International PLC

- Dow Inc.

- DyStar Group

- Evonik Industries AG

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd

- K-Tech(India)Ltd

- LN Chemical Industries

- Nouryon

- Rudolf GmbH

- Sarex

- Sumitomo Chemical Co. Ltd

- Tanatex Chemicals BV

- Wacker Chemie AG

第7章 市場機會與未來展望

The Textile Chemicals Market size is estimated at USD 29.08 billion in 2025, and is expected to reach USD 35.15 billion by 2030, at a CAGR of 3.86% during the forecast period (2025-2030).

This moderate growth reflects a maturing sector that is adapting to stricter environmental regulations and rising demand for sustainable manufacturing. Robust expansion in Asia Pacific, escalating adoption of digital printing, and heightened focus on functional finishes are together reshaping competitive priorities across the textile chemicals market. Ongoing PFAS phase-outs and petrochemical price swings are tempering near-term momentum, yet sustained investment in bio-enzymatic and water-based technologies is expected to preserve long-run growth visibility within the textile chemicals market.

Global Textile Chemicals Market Trends and Insights

Robust Growth in Asia Pacific Textile Production

Rapid capacity additions and supportive government incentives are lifting the textile chemicals market across Asia Pacific. China's 2024 textile exports grew 5.7% to USD 141.96 billion, sustaining large-scale chemical consumption in coating, sizing, and colorant operations. India's Production Linked Incentive program earmarking INR 10,683 crore for man-made fibres is steering long-run demand for high-performance finishes. Concentrated regional supply chains enable swift adoption of bio-based and low-VOC chemistries, reinforcing Asia Pacific's centrality within the global textile chemicals market.

Rising Demand for Technical/Industrial Textiles

Automotive lightweighting and medical hygiene requirements are setting new specification baselines for flame-retardant, antimicrobial, and thermally resilient chemistries. The industrial textiles segment's 4.11% CAGR highlights how the textile chemicals market is transitioning from commodity volumes toward application-specific formulations that command premium pricing. Nanotechnology-enabled finishes are further elevating performance thresholds, intensifying R&D competition among specialty suppliers.

Pollution Control Costs in Dyeing and Finishing

Wastewater treatment upgrades now absorb significant capital outlays as operators strive to meet lower COD and BOD discharge limits. Smaller processors that cannot finance biological and membrane technologies are exiting or merging, consolidating chemical demand among larger, compliance-ready buyers. This restructuring raises entry barriers and raises switching costs within the textile chemicals market.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Global Regulations Favouring Low-VOC Chemistries

- Boom in Digital-Textile Printing Inks and Auxiliaries

- Volatile Petrochemical Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coating and sizing chemicals commanded 28.54% of 2024 revenue, underpinning throughput across weaving and knitting lines. Their ubiquity secures steady baseline demand, stabilising the textile chemicals market even during fashion-cycle downturns. Innovation, however, is most visible in finishing agents, expected to grow at 4.35% CAGR through 2030 as customers request water-repellent, stretch-retentive, and antimicrobial functionalities in a single bath.

Environmental performance is differentiating product pipelines, with multifunctional silicone-polymer hybrids displacing fluorinated repellents. Desizing agents have shifted toward bio-enzymatic alternatives that reduce effluent load. Collectively these advances preserve the revenue core while elevating margins, reinforcing the wealth of opportunity in the textile chemicals market.

The Textile Chemicals Market Report is Segmented by Type (Coating and Sizing Chemicals, Colorants and Auxiliaries, and More), Raw Material (Natural Fibres, Synthetic Fibres, and More), Application (Apparel, Home Furnishing, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captured 71.25% revenue in 2024, supported by China's USD 301.1 billion export base and India's projected USD 350 billion industry by 2030. Regional governments continue to subsidise capacity expansion and technical-textile clusters, maintaining a 4.01% CAGR that anchors the global textile chemicals market. Supply-chain depth, from fibre spinning to garment assembly, allows rapid qualification of new green chemistries, ensuring Asia Pacific's sustained leadership.

North America holds a smaller yet strategically important share, specialising in protective, aerospace, and medical fabrics where specification compliance trumps unit cost. Mexico's near-shoring momentum to US brands is reigniting regional yarn dyehouse investments, opening fresh routes for high-value auxiliaries. California and New York PFAS rules accelerate adoption of water-based repellents, positioning North America as a testbed for next-wave sustainable options within the textile chemicals market.

Europe's mature sector benefits from advanced machinery and a robust regulatory framework that favours circularity. Investment in textile-to-textile recycling chemicals is climbing, with Germany and Italy pioneering polyester depolymerisation plants. Strong luxury and technical segments fund R&D in low-impact finishes, upholding Europe's influence on global standards. Emerging regions in South America and the Middle East are scaling output but remain constrained by infrastructure gaps, delaying their fuller integration into the textile chemicals market.

- Achitex Minerva SpA

- Albemarle Corporation

- Archroma

- BASF

- Bozzetto Group

- CHT Group

- Clariant AG

- Covestro AG

- Croda International PLC

- Dow Inc.

- DyStar Group

- Evonik Industries AG

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd

- K-Tech (India) Ltd

- L. N. Chemical Industries

- Nouryon

- Rudolf GmbH

- Sarex

- Sumitomo Chemical Co. Ltd

- Tanatex Chemicals BV

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust growth in Asia Pacific textile production

- 4.2.2 Rising demand for technical/industrial textiles

- 4.2.3 Stricter global regulations favouring low-VOC chemistries

- 4.2.4 Boom in digital-textile printing inks and auxiliaries

- 4.2.5 Rapid adoption of bio-enzymatic processing solutions

- 4.3 Market Restraints

- 4.3.1 Pollution control costs in dyeing and finishing

- 4.3.2 Volatile petrochemical feedstock prices

- 4.3.3 PFAS and other substance phase-outs raising reformulation costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.1.1 Bargaining Power of Buyers

- 4.5.1.2 Threat of New Entrants

- 4.5.1.3 Threat of Substitutes

- 4.5.1.4 Degree of Competitive Rivalry

- 4.5.1 Bargaining Power of Suppliers

5 Market Size and Growth Forecasts

- 5.1 By Type

- 5.1.1 Coating and Sizing Chemicals

- 5.1.2 Colorants and Auxiliaries

- 5.1.3 Finishing Agents

- 5.1.4 Desizing Agents

- 5.1.5 Other Types (Yarn Lubricant, Bleaching Agents, etc.)

- 5.2 By Raw Material

- 5.2.1 Natural Fibres

- 5.2.2 Synthetic Fibres

- 5.2.3 Bio-Based

- 5.2.4 Speciality Chemicals

- 5.3 By Application

- 5.3.1 Apparel

- 5.3.2 Home Furnishing

- 5.3.3 Automotive Textiles

- 5.3.4 Industrial Textiles

- 5.3.5 Other Applications (Medical and Hygiene Textiles, Sports Textiles, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Achitex Minerva SpA

- 6.4.2 Albemarle Corporation

- 6.4.3 Archroma

- 6.4.4 BASF

- 6.4.5 Bozzetto Group

- 6.4.6 CHT Group

- 6.4.7 Clariant AG

- 6.4.8 Covestro AG

- 6.4.9 Croda International PLC

- 6.4.10 Dow Inc.

- 6.4.11 DyStar Group

- 6.4.12 Evonik Industries AG

- 6.4.13 Huntsman International LLC

- 6.4.14 Kemira Oyj

- 6.4.15 Kiri Industries Ltd

- 6.4.16 K-Tech (India) Ltd

- 6.4.17 L. N. Chemical Industries

- 6.4.18 Nouryon

- 6.4.19 Rudolf GmbH

- 6.4.20 Sarex

- 6.4.21 Sumitomo Chemical Co. Ltd

- 6.4.22 Tanatex Chemicals BV

- 6.4.23 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment