|

市場調查報告書

商品編碼

1797809

著色劑和助劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Colorants and Auxiliaries Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

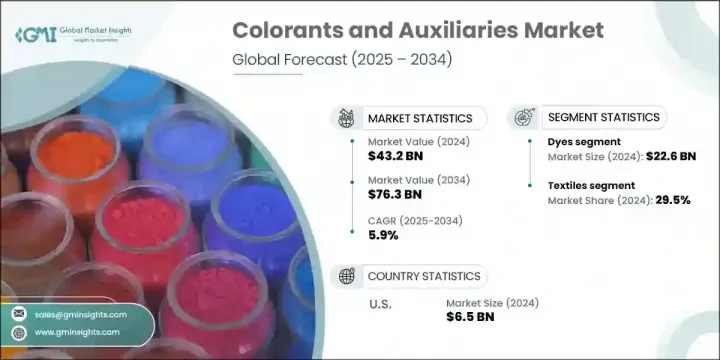

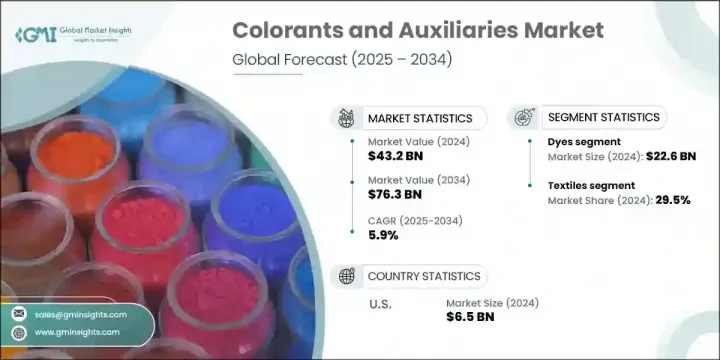

2024年,全球著色劑和助劑市場規模達432億美元,預計到2034年將以5.9%的複合年成長率成長,達到763億美元。著色劑和助劑對於提升汽車、塑膠、建築和紡織等關鍵產業的產品外觀、穩定性和功能性至關重要。這些配方包含染料、顏料、分散劑、紫外線穩定劑和加工助劑等高性能添加劑,所有這些添加劑都有助於提高色彩精度、產品耐久性和生產效率。隨著各行各業面臨越來越大的環保壓力,市場對環保且注重性能的解決方案的需求日益強烈。

製造商越來越重視符合法規合規性和永續發展目標的生物基和低VOC產品線。向先進製造和智慧材料的轉變正在推動該行業的創新,尤其是在數位著色系統和多功能添加劑技術領域。這些進步與注重資源效率和生態影響的全球標準和永續發展計劃相一致。全行業的創新持續加速下一代著色劑的開發,旨在應對現代生產挑戰並滿足消費者偏好。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 432億美元 |

| 預測值 | 763億美元 |

| 複合年成長率 | 5.9% |

2024年,紡織品領域佔了29.5%的市場。在這一領域,著色劑對於在織物處理中創造豐富持久的色調和功能性整理至關重要。這些添加劑在提供紫外線防護、鮮豔外觀和耐磨性方面也發揮著重要作用。在市佔率領先的建築業中,著色劑被廣泛用於提升材料的美觀度和增強表面在環境暴露下的耐久性。汽車產業緊隨其後,該產業高度依賴專用的耐熱顏料和添加劑來獲得卓越的表面光潔度和極端條件下的色彩表現。

2024年,染料市場產值達226億美元,成為全球著色劑和助劑市場最突出的貢獻者之一。由於紡織、皮革、造紙和個人護理等行業對鮮豔持久的色彩應用需求旺盛,該領域持續蓬勃發展。人們對環保和可生物分解染料的日益青睞,以及活性染料和分散染料配方的創新,進一步推動了市場擴張。

2024年,美國著色劑和助劑市場產值達65億美元。美國市場主導地位得益於其完善的製造業基礎、強大的研發生態系統以及先進著色技術的早期應用。食品、塑膠、紡織和汽車等行業的旺盛需求持續推動市場成長。各公司越來越注重永續配方,以降低毒性並實現卓越的色彩表現。創新驅動、安全環保的著色解決方案在美國市場日益受到青睞。

影響全球著色劑和助劑市場的主要行業參與者包括朗盛股份公司、贏創工業股份公司、巴斯夫歐洲公司、杜邦公司、費羅公司、德司達集團、亨斯邁公司、科慕公司、昂高管理有限公司和科萊恩股份公司。為了鞏固競爭地位,著色劑和助劑行業的公司正在投資研發,旨在推出永續的多功能解決方案。他們正在與材料科學創新者和消費品品牌合作,為各種應用客製化高性能添加劑。透過合併、收購和新建生產設施進行策略性地域擴張是有效滿足區域需求的另一個重點。此外,許多參與者正在透過數位著色技術和生物基替代品來增強其產品組合,以符合不斷變化的環境法規和消費者期望。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依材料類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考慮

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 染料市場分析

- 活性染料

- 分散染料

- 酸性染料

- 直接染料

- 還原染料

- 硫化染料

- 鹼性染料

- 其他染料

- 顏料市場分析

- 無機顏料

- 二氧化鈦

- 氧化鐵

- 氧化鉻

- 炭黑

- 其他無機顏料

- 有機顏料

- 偶氮顏料

- 酞菁顏料

- 喹吖啶酮顏料

- 其他有機顏料

- 特種顏料

- 無機顏料

- 助劑市場分析

- 界面活性劑

- 增稠劑

- 分散劑

- 消泡劑

- 潤濕劑

- 流平劑

- 其他輔助材料

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 紡織品

- 棉紡織品

- 合成紡織品

- 羊毛和絲綢

- 技術紡織品

- 油漆和塗料

- 建築塗料

- 汽車塗料

- 工業塗料

- 船舶塗料

- 粉末塗料

- 塑膠和聚合物

- 包裝塑膠

- 汽車塑膠

- 建築塑膠

- 消費品塑膠

- 印刷油墨

- 膠印油墨

- 數位印刷油墨

- 柔版印刷油墨

- 凹印油墨

- 網版印刷油墨

- 食品和飲料

- 飲料

- 糖果

- 烘焙產品

- 乳製品

- 加工食品

- 化妝品和個人護理

- 紙和紙漿

- 皮革

- 其他應用

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 建築業

- 汽車產業

- 包裝產業

- 醫療保健和製藥

- 電子和電氣

- 農業

- 航太和國防

- 海洋產業

- 其他行業

第8章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 液體形式

- 粉狀

- 顆粒

- 糊狀

- 其他形式

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第10章:公司簡介

- BASF SE

- Clariant AG

- DuPont de Nemours, Inc.

- Huntsman Corporation

- Archroma Management GmbH

- DyStar Group

- LANXESS AG

- Evonik Industries AG

- The Chemours Company

- Ferro Corporation

The Global Colorants and Auxiliaries Market was valued at USD 43.2 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 76.3 billion by 2034. Colorants and auxiliary agents are critical to enhancing product appearance, stability, and functionality across key industries such as automotive, plastics, construction, and textiles. These formulations consist of high-performance additives like dyes, pigments, dispersants, UV stabilizers, and processing aids, all of which contribute to improved color precision, product durability, and manufacturing efficiency. With growing pressure on industries to adopt eco-conscious practices, the market is seeing strong demand for environmentally friendly and performance-oriented solutions.

Manufacturers are increasingly prioritizing bio-based and low-VOC product lines that align with regulatory compliance and sustainability targets. The shift toward advanced manufacturing and smart materials is fueling innovation in the sector, particularly in digital coloration systems and multifunctional additive technologies. These advancements align with global standards and sustainability initiatives focused on resource efficiency and ecological impact. Industry-wide innovation continues to accelerate the development of next-generation colorants designed to meet modern production challenges and consumer preferences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.2 Billion |

| Forecast Value | $76.3 Billion |

| CAGR | 5.9% |

In 2024, the textiles segment accounted for a 29.5% share. In this segment, colorants are essential for creating rich, lasting hues and functional finishes in fabric treatments. These additives also play an important role in delivering UV protection, vibrant appearance, and resistance to wear. In the construction industry, which leads in market share, colorants are widely used for enhancing material aesthetics and boosting surface durability against environmental exposure. The automotive sector follows closely, relying heavily on specialized, heat-tolerant pigments and additives for premium surface finishes and color performance under extreme conditions.

The dyes segment generated USD 22.6 billion in 2024, making it one of the most prominent contributors to the global colorants and auxiliaries market. This segment continues to thrive due to high demand from industries such as textiles, leather, paper, and personal care, where vibrant and long-lasting color application is critical. The growing preference for eco-friendly and biodegradable dyes, alongside innovations in reactive and disperse dye formulations, has further supported market expansion.

U.S. Colorants and Auxiliaries Market generated USD 6.5 billion in 2024. The country's dominance is supported by its well-established manufacturing base, robust R&D ecosystem, and early adoption of advanced coloring technologies. High demand from industries such as food, plastics, textiles, and automotive continues to drive growth. Companies are increasingly focused on sustainable formulations that reduce toxicity while delivering high color performance. The trend toward innovation-driven, safe, and eco-friendly coloring solutions is gaining momentum across the U.S. market.

Major industry players influencing the Global Colorants and Auxiliaries Market include LANXESS AG, Evonik Industries AG, BASF SE, DuPont de Nemours, Inc., Ferro Corporation, DyStar Group, Huntsman Corporation, The Chemours Company, Archroma Management GmbH, and Clariant AG. To reinforce their competitive position, companies in the colorants and auxiliaries sector are investing in research and development aimed at introducing sustainable and multifunctional solutions. They are forming collaborations with material science innovators and consumer product brands to tailor high-performance additives for diverse applications. Strategic geographic expansion through mergers, acquisitions, and new production facilities is another key focus to meet regional demand efficiently. Additionally, many players are enhancing their product portfolios with digital coloration technologies and bio-based alternatives to comply with evolving environmental regulations and consumer expectations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Application trends

- 2.2.3 End user trends

- 2.2.4 Form trends

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By material type

- 3.9 Future market trends

- 3.10 Technology and Innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent Landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dyes market analysis

- 5.2.1 Reactive dyes

- 5.2.2 Disperse dyes

- 5.2.3 Acid dyes

- 5.2.4 Direct dyes

- 5.2.5 Vat dyes

- 5.2.6 Sulfur dyes

- 5.2.7 Basic dyes

- 5.2.8 Other dyes

- 5.3 Pigments market analysis

- 5.3.1 Inorganic pigments

- 5.3.1.1 Titanium dioxide

- 5.3.1.2 Iron oxide

- 5.3.1.3 Chrome oxide

- 5.3.1.4 Carbon black

- 5.3.1.5 Other inorganic pigments

- 5.3.2 Organic pigments

- 5.3.2.1 Azo pigments

- 5.3.2.2 Phthalocyanine pigments

- 5.3.2.3 Quinacridone pigments

- 5.3.2.4 Other Organic pigments

- 5.3.3 Specialty pigments

- 5.3.1 Inorganic pigments

- 5.4 Auxiliaries market analysis

- 5.4.1 Surfactants

- 5.4.2 Thickeners

- 5.4.3 Dispersants

- 5.4.4 Defoamers

- 5.4.5 Wetting agents

- 5.4.6 Leveling agents

- 5.4.7 Other auxiliaries

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Textiles

- 6.2.1 Cotton textiles

- 6.2.2 Synthetic textiles

- 6.2.3 Wool and silk

- 6.2.4 Technical textiles

- 6.3 Paints and coatings

- 6.3.1 Architectural coatings

- 6.3.2 Automotive coatings

- 6.3.3 Industrial coatings

- 6.3.4 Marine coatings

- 6.3.5 Powder coatings

- 6.4 Plastics and polymers

- 6.4.1 Packaging plastics

- 6.4.2 Automotive plastics

- 6.4.3 Construction plastics

- 6.4.4 Consumer goods plastics

- 6.5 Printing inks

- 6.5.1 Offset printing inks

- 6.5.2 Digital printing inks

- 6.5.3 Flexographic inks

- 6.5.4 Gravure inks

- 6.5.5 Screen printing inks

- 6.6 Food and beverages

- 6.6.1 Beverages

- 6.6.2 Confectionery

- 6.6.3 Bakery products

- 6.6.4 Dairy products

- 6.6.5 Processed foods

- 6.7 Cosmetics and personal care

- 6.8 Paper and pulp

- 6.9 Leather

- 6.10 Other applications

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Construction industry

- 7.3 Automotive industry

- 7.4 Packaging industry

- 7.5 Healthcare and pharmaceuticals

- 7.6 Electronics and electrical

- 7.7 Agriculture

- 7.8 Aerospace and defense

- 7.9 Marine industry

- 7.10 Other industries

Chapter 8 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Liquid form

- 8.3 Powder form

- 8.4 Granules

- 8.5 Paste form

- 8.6 Other forms

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 BASF SE

- 10.2 Clariant AG

- 10.3 DuPont de Nemours, Inc.

- 10.4 Huntsman Corporation

- 10.5 Archroma Management GmbH

- 10.6 DyStar Group

- 10.7 LANXESS AG

- 10.8 Evonik Industries AG

- 10.9 The Chemours Company

- 10.10 Ferro Corporation