|

市場調查報告書

商品編碼

1755193

技術紡織品生產設備市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Technical Textile Production Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

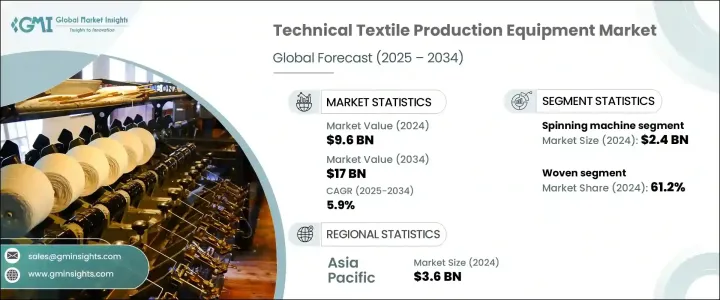

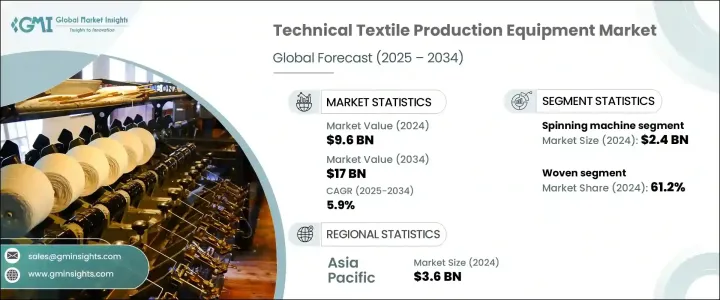

2024 年全球技術紡織品生產設備市場價值為 96 億美元,預計到 2034 年將以 5.9% 的複合年成長率成長,達到 170 億美元。市場成長很大程度上是由汽車、醫療保健、國防、農業和建築等領域對專用紡織品日益成長的需求所驅動。隨著各行各業尋找具有阻燃性、耐用性、高抗張強度和生物相容性的高性能材料,對先進紡織生產機械的需求也日益成長。芳綸纖維、碳纖維和超高分子量聚乙烯纖維等纖維技術的興起,大大拓寬了技術紡織品的應用範圍。此外,對環保和可回收紡織品的需求不斷成長,推動了對更先進製造設備的需求。生產過程中自動化和數位控制系統的發展有助於提高效率、客製化和整體生產力。

2024年,紡紗機市場規模達24億美元,這得益於其在將原纖維轉化為高性能應用所需紗線方面發揮的關鍵作用。這些機器在生產醫療、國防和汽車等關鍵產業所需的紡織品專用紗線方面發揮關鍵作用。隨著碳纖維和芳綸等先進材料需求的不斷成長,對紡紗機的需求也在不斷成長,因為這些機器能夠確保纖維混合、加撚和紗線生產的高精度,從而滿足技術紡織品的嚴格規格要求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 96億美元 |

| 預測值 | 170億美元 |

| 複合年成長率 | 5.9% |

2024年,機織布料領域以61.2%的佔有率領先市場。機織織物因其優異的機械強度、結構完整性以及適應各種高性能應用的能力而備受青睞。其高抗張強度、耐用性和尺寸穩定性使其成為製造工業過濾器、防彈裝備、安全帶和地工布等產品的理想選擇。機織織物能夠透過各種編織圖案和纖維取向進行客製化,使其用途廣泛,並可高度客製化,適用於各種應用。由於機織織物在汽車、航太和建築等行業的廣泛應用,其市場正在不斷擴大。

2024年,亞太地區技術紡織品生產設備市場規模達36億美元,佔37%。該地區的成長得益於工業能力的提升、技術進步以及政府的優惠政策。中國憑藉其發達的基礎設施、較低的勞動力成本以及對紡織自動化的持續投入,在這一成長中發揮著重要作用。此外,印度的進步也受到「生產掛鉤激勵計畫」(PLI)和「國家技術紡織品計畫」(NTTM)等措施的推動,這些措施旨在促進技術紡織品的生產和創新。日本、韓國和越南等國家也為該地區的成長做出了貢獻,推動了技術創新和出口成長。

全球技術紡織品生產設備市場的領導者包括:Andritz、Itema SpA、Dilo Group、BRUCKNER、Trutzschler Group SE、Staubli International AG、Reifenhauser Reicofil、Graute GmbH、Voith GmbH & Co. KGaA、Santex Rimarg、KARL MAYER、Koeith GmbH & Co. KGaA、Santex 燒、KARL MAYER、Koeelcle ZAYER、KoePEer、Kokia、KARL MAYER、Koeelf ZAY、APHA、KJA、K.Ater ZAYER為鞏固市場地位,技術紡織品生產設備產業的公司專注於多種策略。這些包括投資尖端技術和提高生產流程效率,以滿足對先進材料日益成長的需求。企業還與紡織和製造業的主要參與者建立合作夥伴關係,以擴大分銷網路並提高市場滲透率。另一個關鍵方法是投資自動化和數位化,以提高精度、降低成本並為客戶提供高度可自訂的解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 衝擊力

- 成長動力

- 技術紡織品需求不斷成長

- 製造技術的進步

- 汽車產業的成長

- 醫療級紡織品需求增加

- 產業陷阱與挑戰

- 初期投資高

- 原料成本波動

- 成長動力

- 成長潛力分析

- 技術概述

- 定價分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 產業結構與集中度

- 競爭強度評估

- 公司市佔率分析

- 競爭定位矩陣

- 產品定位

- 性價比定位

- 地理分佈

- 創新能力

- 戰略儀表板

- Competitive benchmarking

- Strategic initiatives assessment

- SWOT analysis of key players

- Future competitive outlook

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 擠壓機

- 紡紗機

- 針織機

- 織布機

- 不織布機械

- 塗佈機

- 覆膜機

- 複合及黏合設備

- 其他

第6章:市場估計與預測:依製程類型,2021 - 2034 年

- 主要趨勢

- 編織

- 針織

- 不織布

- 合成的

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 汽車紡織品

- 建築紡織品

- 醫用紡織品

- 運動紡織品

- 工業紡織品

- 農業紡織品

- 防護紡織品

- 其他

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第9章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Andritz

- BRUCKNER

- Dilo Group

- Graute GmbH

- Itema SpA

- KARL MAYER

- Kawanoe Zoki Co Ltd

- Kusters Calico

- Reifenhauser Reicofil

- Santex Rimar Group

- SINCILON

- Staubli International AG

- Trutzschler Group SE

- UMPESL

- Voith GmbH & Co. KGaA

The Global Technical Textile Production Equipment Market was valued at USD 9.6 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 17 billion by 2034. The growth of the market is largely driven by the increasing demand for specialized textiles in sectors like automotive, healthcare, defense, agriculture, and construction. As industries look for high-performance materials that offer flame resistance, durability, high tensile strength, and biocompatibility, there is a growing need for advanced textile production machinery. The rise of fiber technologies, including aramid fiber, carbon fiber, and ultra-high molecular weight polyethylene fibers, is significantly broadening the scope for technical textiles. Furthermore, the growing demand for eco-friendly and recyclable textiles pushes for more sophisticated manufacturing equipment. The development of automation and digital control systems in production processes has helped improve efficiency, customization, and overall productivity.

The spinning machine segment generated USD 2.4 billion in 2024, driven by its crucial role in converting raw fibers into yarns needed for high-performance applications. These machines play a pivotal role in the production of specialized yarns that are required for textiles used in critical sectors such as medical, defense, and automotive industries. With the growing need for advanced materials like carbon and aramid fibers, the demand for spinning machines is rising, as these machines ensure high precision in fiber blending, twisting, and producing yarns that meet the stringent specifications of technical textiles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.6 Billion |

| Forecast Value | $17 Billion |

| CAGR | 5.9% |

In 2024, the woven fabric segment led the market with a share of 61.2%. Woven fabrics are favored for their mechanical strength, structural integrity, and ability to adapt to a wide range of high-performance applications. Their high tensile strength, durability, and dimensional stability make them ideal for manufacturing products such as industrial filters, ballistic gear, seat belts, and geotextiles. The ability to tailor woven textiles through various weave patterns and fiber orientations makes them versatile and highly customizable for diverse applications. The market for woven fabrics is expanding due to their broad usage in industries like automotive, aerospace, and construction.

Asia Pacific Technical Textile Production Equipment Market generated USD 3.6 billion in 2024, holding a 37% share. The region's growth can be attributed to expanding industrial capabilities, technological advancements, and favorable government policies. China plays a significant role in this growth due to its developed infrastructure, lower labor costs, and increased investments in textile automation. Additionally, India's progress is being propelled by initiatives such as the Production Linked Incentive (PLI) Scheme and the National Technical Textiles Mission (NTTM), which focus on boosting production and innovation in technical textiles. Countries like Japan, South Korea, and Vietnam also contribute to this regional growth, helping drive both technological innovation and export growth.

Leading players in the Global Technical Textile Production Equipment Market include: Andritz, Itema SpA, Dilo Group, BRUCKNER, Trutzschler Group SE, Staubli International AG, Reifenhauser Reicofil, Graute GmbH, Voith GmbH & Co. KGaA, Santex Rimar Group, KARL MAYER, Kawanoe Zoki Co Ltd, SINCILON, Kusters Calico, and UMPESL. To strengthen their market position, companies in the technical textile production equipment industry focus on several strategies. These include investing in cutting-edge technology and enhancing the efficiency of production processes to meet the growing demand for advanced materials. Firms are also forming partnerships with key players in the textile and manufacturing sectors to expand their distribution networks and increase market penetration. Another critical approach is investing in automation and digitalization to improve precision, reduce costs, and offer highly customizable solutions for their customers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for technical textiles

- 3.2.1.2 Advancements in manufacturing technologies

- 3.2.1.3 Growth in the automotive industry

- 3.2.1.4 Increased demand for medical-grade textiles

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment

- 3.2.2.2 Fluctuating raw material costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technological overview

- 3.5 Pricing analysis

- 3.6 Regulatory landscape

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Industry structure and concentration

- 4.3 Competitive intensity assessment

- 4.4 Company market share analysis

- 4.5 Competitive positioning matrix

- 4.5.1 Product positioning

- 4.5.2 Price-performance positioning

- 4.5.3 Geographic presence

- 4.5.4 Innovation capabilities

- 4.6 Strategic dashboard

- 4.6.1 Competitive benchmarking

- 4.6.1.1 Manufacturing capabilities

- 4.6.1.2 Product portfolio strength

- 4.6.1.3 Distribution network

- 4.6.1.4 R&D investments

- 4.6.2 Strategic initiatives assessment

- 4.6.3 SWOT analysis of key players

- 4.6.4 Future competitive outlook

- 4.6.1 Competitive benchmarking

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Extrusion machine

- 5.3 Spinning machine

- 5.4 Knitting machine

- 5.5 Weaving machine

- 5.6 Nonwoven machinery

- 5.7 Coating machine

- 5.8 Laminating machine

- 5.9 Composite and bonding equipment

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Process Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Woven

- 6.3 Knitted

- 6.4 Nonwoven

- 6.5 Composite

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automotive textiles

- 7.3 Construction textiles

- 7.4 Medical textiles

- 7.5 Sports textiles

- 7.6 Industrial textiles

- 7.7 Agro textiles

- 7.8 Protective textiles

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Andritz

- 10.2 BRUCKNER

- 10.3 Dilo Group

- 10.4 Graute GmbH

- 10.5 Itema SpA

- 10.6 KARL MAYER

- 10.7 Kawanoe Zoki Co Ltd

- 10.8 Kusters Calico

- 10.9 Reifenhauser Reicofil

- 10.10 Santex Rimar Group

- 10.11 SINCILON

- 10.12 Staubli International AG

- 10.13 Trutzschler Group SE

- 10.14 UMPESL

- 10.15 Voith GmbH & Co. KGaA