|

市場調查報告書

商品編碼

1851297

手勢姿態辨識:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Gesture Recognition - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

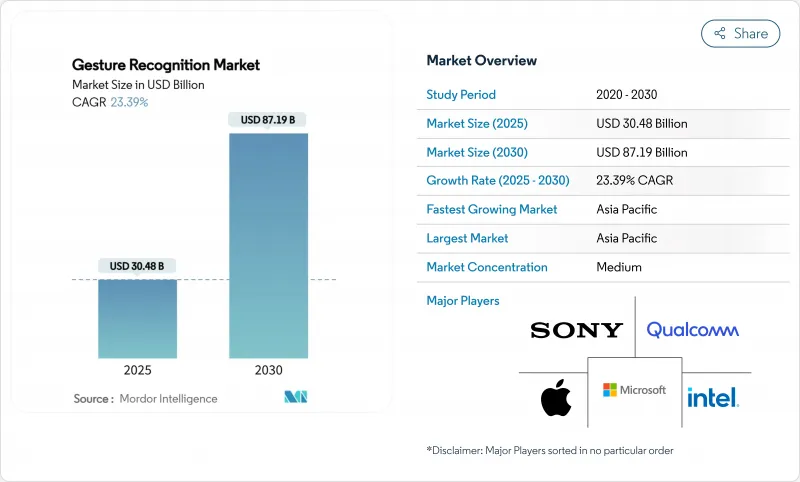

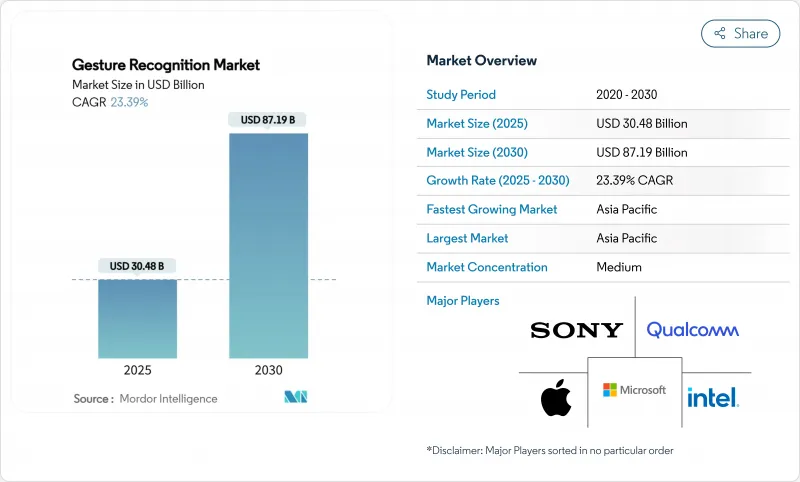

手勢姿態辨識市場規模預計到 2025 年將達到 304.8 億美元,到 2030 年將達到 871.9 億美元,預測期內(2025-2030 年)複合年成長率為 23.39%。

這種持續成長反映了先進毫米波雷達、多區域飛行時間 (ToF) 感測器和邊緣人工智慧演算法的融合,從而在智慧型手機、汽車、醫療設備和工業設備中實現響應迅速、低延遲的人機互動介面。高階行動裝置中感測器出貨量的加速成長、汽車安全系統監管壓力以及醫療保健領域對感染控制的需求,都在刺激著市場需求。同時,手勢姿態辨識市場正經歷價值重心從以硬體為中心的解決方案向軟體和人工智慧堆疊的轉變,這些堆疊能夠實現互動個性化、減少誤報並延長設備壽命。諸如美國《晶片和影像辨識法案》(CHIPS Act) 和歐洲《晶片和影像辨識法案》(CHIPS Act) 等區域性製造激勵措施,正在重塑供應鏈,並為本地零件製造創造新的成本優勢。隨著這些因素的匯聚,垂直整合感測器、軟體和雲端協作層的產業參與企業預計將在手勢姿態辨識市場獲得不成比例的回報。

全球手勢姿態辨識市場趨勢與洞察

毫米波和飛行時間感測器在亞洲旗艦智慧型手機中越來越普及

亞洲行動電話廠商目前正將STMicroelectronics的VL53L7CX等多區域ToF模組整合到手機中,以實現毫米級深度精度,且不受環境光影響,即使在光線不足的情況下也能可靠地進行空中指令輸入。 Ceva的MotionEngine Hex韌體整合了慣性和雷達數據,可實現對使用者介面的空間控制。隨著ToF晶片組在大批量生產中的單價降至1美元以下,手勢控制正從高階差異化功能轉變為手勢姿態辨識市場的標配功能。

汽車製造商採用車載手勢抬頭顯示器以滿足歐洲新車安全評鑑協會(Euro NCAP)的規定

2024年7月生效的「高級駕駛員分心警告」法規要求汽車製造商降低駕駛員的認知負荷,這推動了基於攝影機的手勢識別系統在歐洲車型中的快速整合。 BMW7系列車型獲得L2/L3級認證,標誌著該技術已具備商業性化條件;奧迪的3D駕駛座介面則展示了透過在主機頂部揮動手掌即可選擇多模態資訊娛樂系統。能夠保證回應時間在150毫秒以內且誤報率低於3%的供應商有望贏得專案獎項,從而進一步鞏固手勢姿態辨識市場的成長動能。

在熱帶地區,基於視覺的系統在陽光下會出現較高的誤報率。

以攝影機為中心的演算法難以在明亮的背景下識別手的輪廓,導致戶外自助服務終端和叫車等應用程式中的錯誤率飆升。研究表明,基於雷達的替代方案無論光照強度如何,都能保持90%以上的照度,這迫使系統設計人員在手勢姿態辨識市場中採用多感測器融合技術。

細分市場分析

到2024年,非接觸式解決方案將佔總收入的58.2%,反映出終端市場對衛生、駕駛安全和身臨其境型娛樂的重視。到2030年,非接觸式細分市場將以24.4%的年複合成長率成長,超過整體手勢姿態辨識市場,這主要得益於飛行時間(ToF)、毫米波雷達和超音波陣列等材料成本的降低。相較之下,電容式控制在對成本敏感的消費性電子設備中仍然重要,但其年複合成長率仍處於個位數。京瓷的深度感測器在10公分範圍內實現了100微米的解析度,可用於需要手術級精度的機器人拾取放置和整形外科矯正工具。向環境互動的穩定轉變表明,非接觸式模式最終將比其依賴接觸的領先佔據更大的市場佔有率。

非接觸式技術的興起正在改變供應商格局。過去將晶片產品商品化的感測器供應商,如今開始將人工智慧韌體、數據模型和開發者入口網站捆綁銷售,從中賺取硬體利潤,並收取持續的授權費用。這種重新捆綁銷售模式符合原始設備製造商 (OEM) 對現場可無線升級效能提升的需求,從而支援手勢姿態辨識市場大規模採用非接觸式技術所需的可擴展經濟模式。

到2024年,硬體將佔手勢姿態辨識市場規模的71.5%,這主要受鏡頭、雷達前端和微控制器等固有成本的影響。然而,能夠實現情境感知、使用者自適應和協作學習的軟體平台預計將以23.7%的複合年成長率成長,比硬體成長高出350個基點以上。英飛凌的DEEPCRAFT Ready Models提供針對常見手勢的預訓練神經網路,可將整合時間縮短40%,從而提升公司在價值鏈上的地位。同時,Imagimob基於視覺化圖的機器學習工具可將模型開發週期縮短至數小時,讓中端OEM廠商也能輕鬆進行AI最佳化。

收入結構的轉變為服務捆綁創造了機遇,包括預測性維護、雲端基礎分析以及透過手勢識別實現的應用程式內數位購買。能夠編配晶片、韌體和生命週期服務的供應商預計將在手勢姿態辨識市場中佔據有利地位,因為總體擁有成本 (TCO) 將超過組件價格。

區域分析

亞太地區的領先地位得益於垂直整合的供應鏈、政府資金支持以及龐大的早期用戶裝置量。該地區的行動電話品牌每10-12個月就會推出新款旗艦機型,每款機型都配備高解析度ToF陣列,從而擴大了感測器供應商的手勢姿態辨識市場。日本企業集團正在將基於XR技術的技能轉移平台應用於汽車焊接和半導體微影術,這進一步推動了對高精度手勢辨識模型的需求。韓國的晶圓生產能力確保了零件供應的連續性,而印度智慧電視的普及則讓中等收入家庭也能使用非接觸式遙控器,從而擴大了收入金字塔。

在北美,手術室和診斷中心正利用醫療保健領域的支出優勢來提高單位收入。採用懸浮式顯示器的醫院報告稱,交叉感染事件顯著減少,降低了再入院罰款,並提高了手勢介面的投資回報率。汽車原始設備製造商 (OEM) 正在整合基於手勢的駕駛員監控和駕駛感測器磨損率監測系統,以符合 2024 年後聯邦政府關於分心駕駛的指導方針。

歐洲在監管方面發揮引領作用,Euro NCAP 指令強制要求車輛配備分心駕駛緩解技術,並加速在豪華車和大眾市場車型中推廣應用。德國供應商正與國內汽車製造商合作開發手勢控制模組,儘管硬體採購全球化,但仍鞏固了區域價值獲取。同時,海灣合作理事會 (GCC) 國家正在推進人工智慧主權舉措,為配備非接觸式使用者介面的公共服務亭提供資金,這使得中東地區相比其現有基礎而言,展現出顯著的成長前景。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 毫米波和飛行時間(ToF)感測器在亞洲旗艦智慧型手機中越來越受歡迎。

- 汽車製造商採用車載手勢抬頭顯示器以符合歐洲新車安全評估協會(Euro NCAP)關於防止駕駛員分心的規定

- 美國和德國的醫院要求使用非接觸式人機互動系統,以降低手術室的醫院感染風險。

- 整合到 XR 穿戴式裝置中,可實現 6 自由度控制,用於工業培訓(日本)

- 在價格暴跌的市場中,智慧型電視廠商為了脫穎而出,會將手勢遙控器與電視遙控器捆綁銷售。

- 政府智慧城市撥款促進公共資訊亭手勢使用者介面部署(海灣合作理事會)

- 市場限制

- 在熱帶地區,基於視覺的系統在陽光下假陽性率較高

- 缺乏開放的互通性標準會增加原始設備製造商的整合成本。

- 在10奈米以下製程的移動SoC中,「始終開啟」手勢喚醒詞會消耗大量電量。

- GDPR下車載影片分析的資料隱私合規性障礙

- 監理展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過技術

- 基於觸摸的手勢姿態辨識

- 2D多點觸控面板

- 電容式和電阻式感測器

- 非接觸式手勢姿態辨識

- 基於2D攝影機的

- 3D深度和飛行時間

- 超音波和毫米波雷達

- 基於觸摸的手勢姿態辨識

- 按組件

- 硬體(感測器、控制器、SoC)

- 軟體(機器學習演算法、SDK、中介軟體)

- 透過手勢類型

- 線上動態手勢

- 離線靜態手勢

- 通過認證

- 生物辨識技術(臉部、虹膜、手掌)

- 非生物特徵測量(運動、姿勢)

- 按最終用戶行業分類

- 消費性電子產品

- 智慧型手機和平板電腦

- 智慧電視和機上盒

- 擴增實境/虛擬實境和穿戴式設備

- 車

- 駕駛員監控和資訊娛樂

- 航太/國防

- 衛生保健

- 手術室及診斷室

- 遊戲與娛樂

- 工業機器人

- 其他行業

- 消費性電子產品

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 紐西蘭,澳大利亞

- 亞太其他地區

- 中東和非洲

- 海灣合作理事會(沙烏地阿拉伯、阿拉伯聯合大公國、卡達)

- 土耳其

- 南非

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Intel Corporation

- Qualcomm Technologies Inc.

- Apple Inc.

- Microsoft Corp.

- Sony Group Corp.

- Google LLC

- Meta Platforms Inc.

- Ultraleap Ltd.

- Microchip Technology Inc.

- Infineon Technologies AG

- Synaptics Inc.

- Elliptic Laboratories AS

- GestureTek Inc.

- Cognitec Systems GmbH

- Eyesight Technologies Ltd.

- PointGrab Ltd.

- Omron Corporation

- Jabil Inc.

- Leap Motion

第7章 市場機會與未來展望

The Gesture Recognition Market size is estimated at USD 30.48 billion in 2025, and is expected to reach USD 87.19 billion by 2030, at a CAGR of 23.39% during the forecast period (2025-2030).

This sustained expansion reflects the convergence of advanced millimeter-wave radar, multizone Time-of-Flight (ToF) sensors, and edge-AI algorithms that together enable responsive, low-latency human-machine interfaces across smartphones, vehicles, medical devices, and industrial equipment. Accelerating sensor shipments in premium handsets, regulatory pressure on automotive safety systems, and infection-control imperatives in healthcare are jointly stimulating volume demand. At the same time, the gesture recognition market is witnessing a value shift from hardware-centric solutions toward software and AI stacks that personalize interactions, reduce false positives, and extend device longevity. Regional manufacturing incentives most notably the CHIPS Act in the United States and the European Chips Act are reshaping supply chains and creating new cost advantages for local component production. As these drivers converge, industry participants that integrate vertically across sensor, software, and cloud orchestration layers are positioned to capture disproportionate returns within the gesture recognition market.

Global Gesture Recognition Market Trends and Insights

Proliferation of mm-wave and ToF sensors in flagship smartphones across Asia

Asia-based handset OEMs now embed multizone ToF modules such as STMicroelectronics' VL53L7CX to deliver millimeter-level depth accuracy without ambient-light restrictions, enabling reliable mid-air command input even under harsh illumination. The deployment extends to smart-TV handsets through Ceva's MotionEngine Hex firmware, which integrates inertial and radar data to deliver spatial control of user interfaces. As the cost of ToF chipsets falls below USD 1 per unit in volume lots, gesture control is transitioning from a premium differentiator to a default feature in the gesture recognition market.

Automaker adoption of in-cabin gesture HUDs to meet Euro NCAP mandates

The July 2024 Advanced Driver Distraction Warning regulation obliges OEMs to mitigate cognitive load, propelling rapid integration of camera-based gesture hubs in European models. BMW's Level 2/3 certification on the 7 Series demonstrates commercial readiness, while Audi's 3-D cockpit interface showcases multi-modal infotainment selection using above-console hand sweeps. Suppliers that can guarantee sub-150 ms response times and <3% false-trigger rates stand to win program awards, reinforcing the growth trajectory of the gesture recognition market.

High false-positive rates in sunlight for vision-based systems in tropical regions

Camera-centric algorithms struggle to resolve hand contours against high-lux backgrounds, driving error spikes in outdoor kiosks and ride-hailing vehicles. Research indicates radar-based alternatives maintain >90% precision independent of illumination, prompting system designers to adopt multi-sensor fusion in the gesture recognition market.

Other drivers and restraints analyzed in the detailed report include:

- Hospital demand for touch-free HMI to cut HAI risks in surgical suites

- Integration into XR wearables to unlock 6-DoF control for industrial training

- Absence of open interoperability standards inflating OEM integration cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Touchless solutions generated 58.2% of 2024 revenue, reflecting end-market emphasis on hygiene, driver safety, and immersive entertainment. The touchless sub-segment will compound at 24.4% through 2030, outpacing the broader gesture recognition market as ToF, mm-wave radar, and ultrasonic arrays reduce bill-of-materials cost. In contrast, capacitive touch-based controls retain relevance in cost-sensitive consumer devices, yet their CAGR trails at single-digits. Kyocera's depth sensor demonstrates 100 µm resolution within 10 cm, enabling robotic pick-and-place and orthopedic alignment tools that demand surgical-grade accuracy. The steady migration toward ambient interaction implies touchless modalities will ultimately hold a greater gesture recognition market share than their contact-dependent predecessors.

Touchless expansion is altering supplier power dynamics. Sensor vendors that historically commoditized silicon are now bundling AI firmware, data models, and developer portals, capturing recurring license fees on top of hardware margins. This re-bundling aligns with OEM priorities for field-upgradable over-the-air performance improvements and supports the scalable economics required for high-volume touchless adoption within the gesture recognition market.

Hardware contributed 71.5% of gesture recognition market size in 2024, driven by the intrinsic cost of lenses, radar front-ends, and MCUs. However, software platforms that deliver contextual awareness, user adaptation, and federated learning are forecast at a 23.7% CAGR-more than 350 bps above hardware growth. Infineon's DEEPCRAFT Ready Models supply pre-trained neural networks for common gestures, cutting integration time by 40% and repositioning the firm higher on the value curve. Meanwhile, Imagimob's visual graph-based ML tooling compresses model-development cycles to hours, democratizing AI optimization for mid-tier OEMs.

The revenue mix shift creates opportunities for service bundling: predictive maintenance, cloud-based analytics, and in-app monetization through gesture-initiated digital purchases. Suppliers able to orchestrate silicon, firmware, and lifecycle services are poised to command loyalty in the gesture recognition market as total cost of ownership eclipses component price considerations.

Gesture Recognition Market Report is Segmented by Technology (Touch-Based Gesture Recognition, Touchless Gesture Recognition), Component (Hardware, Software), Gesture Type (Online Dynamic Gestures, Offline Static Gestures), Authentication (Biometric, Non-Biometric), End-User Industry (Consumer Electronics, Automotive, Aerospace and Defense and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific's dominance rests on vertically integrated supply chains, supportive government funding, and an immense installed base of early-adopter consumers. Regional handset brands release new flagship lines every 10-12 months, each iteration embedding higher-resolution ToF arrays, thereby expanding the gesture recognition market size for sensor vendors. Japanese conglomerates employ XR-based skill-transfer platforms in automotive welding and semiconductor lithography, reinforcing demand for high-precision gesture models. South Korea's wafer capacity secures component continuity, while India's smart-TV expansion introduces touchless remotes into middle-income households, broadening the revenue pyramid.

North America leverages healthcare spending power for surgical suites and diagnostic centers, generating premium revenue per unit. Hospitals adopting mid-air displays report significant reductions in cross-contamination incidents, translating into lower readmission penalties and bolstering ROI for gesture interfaces. Automotive OEMs integrate gesture-based driver monitoring to comply with post-2024 federal guidelines on distracted driving, pushing incremental sensor attach rates.

Europe acts as a regulatory pacesetter. Euro NCAP directives mandate distraction-mitigation technologies, accelerating deployment across both luxury and mass-market vehicle classes. German suppliers co-develop gesture modules with domestic automakers, cementing regional value capture despite globalized hardware sourcing. Meanwhile, GCC nations pursue AI sovereignty initiatives that fund public-service kiosks with touchless UIs, giving the Middle East an outsized growth profile relative to its current base.

- Intel Corporation

- Qualcomm Technologies Inc.

- Apple Inc.

- Microsoft Corp.

- Sony Group Corp.

- Google LLC

- Meta Platforms Inc.

- Ultraleap Ltd.

- Microchip Technology Inc.

- Infineon Technologies AG

- Synaptics Inc.

- Elliptic Laboratories AS

- GestureTek Inc.

- Cognitec Systems GmbH

- Eyesight Technologies Ltd.

- PointGrab Ltd.

- Omron Corporation

- Jabil Inc.

- Leap Motion

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of mm-wave and ToF sensors in flagship smartphones across Asia

- 4.2.2 Automaker adoption of in-cabin gesture HUDs to meet Euro NCAP distraction mandates

- 4.2.3 Hospital demand for touch-free HMI to cut HAI risks in surgical suites (US and Germany)

- 4.2.4 Integration into XR wearables to unlock 6-DoF control for industrial training (Japan)

- 4.2.5 Smart-TV vendors bundling air-gesture remotes to differentiate in price-eroding market

- 4.2.6 Government smart-city grants driving public-kiosk gesture UI roll-outs (GCC)

- 4.3 Market Restraints

- 4.3.1 High false-positive rates in sunlight for vision-based systems in tropical regions

- 4.3.2 Absence of open interoperability standards inflating OEM integration cost

- 4.3.3 "Always-on" gesture wake-word draining battery in sub-10 nm mobile SoCs

- 4.3.4 Data-privacy compliance hurdles for in-cabin video analytics under GDPR

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Touch-based Gesture Recognition

- 5.1.1.1 2-D Multi-touch Panels

- 5.1.1.2 Capacitive and Resistive Sensors

- 5.1.2 Touchless Gesture Recognition

- 5.1.2.1 2-D Camera-based

- 5.1.2.2 3-D Depth and ToF

- 5.1.2.3 Ultrasonic and mm-wave Radar

- 5.1.1 Touch-based Gesture Recognition

- 5.2 By Component

- 5.2.1 Hardware (Sensors, Controllers, SoCs)

- 5.2.2 Software (ML Algorithms, SDKs, Middleware)

- 5.3 By Gesture Type

- 5.3.1 Online Dynamic Gestures

- 5.3.2 Offline Static Gestures

- 5.4 By Authentication

- 5.4.1 Biometric (Face, Iris, Palm-vein)

- 5.4.2 Non-biometric (Motion, Pose)

- 5.5 By End-user Industry

- 5.5.1 Consumer Electronics

- 5.5.1.1 Smartphones and Tablets

- 5.5.1.2 Smart-TV and Set-top Boxes

- 5.5.1.3 AR/VR and Wearables

- 5.5.2 Automotive

- 5.5.2.1 Driver Monitoring and Infotainment

- 5.5.3 Aerospace and Defense

- 5.5.4 Healthcare

- 5.5.4.1 Surgical and Diagnostic Rooms

- 5.5.5 Gaming and Entertainment

- 5.5.6 Industrial and Robotics

- 5.5.7 Other Industries

- 5.5.1 Consumer Electronics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 New Zealand and Australia

- 5.6.4.6 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 GCC (Saudi Arabia, UAE, Qatar)

- 5.6.5.2 Turkey

- 5.6.5.3 South Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Intel Corporation

- 6.4.2 Qualcomm Technologies Inc.

- 6.4.3 Apple Inc.

- 6.4.4 Microsoft Corp.

- 6.4.5 Sony Group Corp.

- 6.4.6 Google LLC

- 6.4.7 Meta Platforms Inc.

- 6.4.8 Ultraleap Ltd.

- 6.4.9 Microchip Technology Inc.

- 6.4.10 Infineon Technologies AG

- 6.4.11 Synaptics Inc.

- 6.4.12 Elliptic Laboratories AS

- 6.4.13 GestureTek Inc.

- 6.4.14 Cognitec Systems GmbH

- 6.4.15 Eyesight Technologies Ltd.

- 6.4.16 PointGrab Ltd.

- 6.4.17 Omron Corporation

- 6.4.18 Jabil Inc.

- 6.4.19 Leap Motion

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment