|

市場調查報告書

商品編碼

1849961

零售中的手勢姿態辨識:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Gesture Recognition In Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

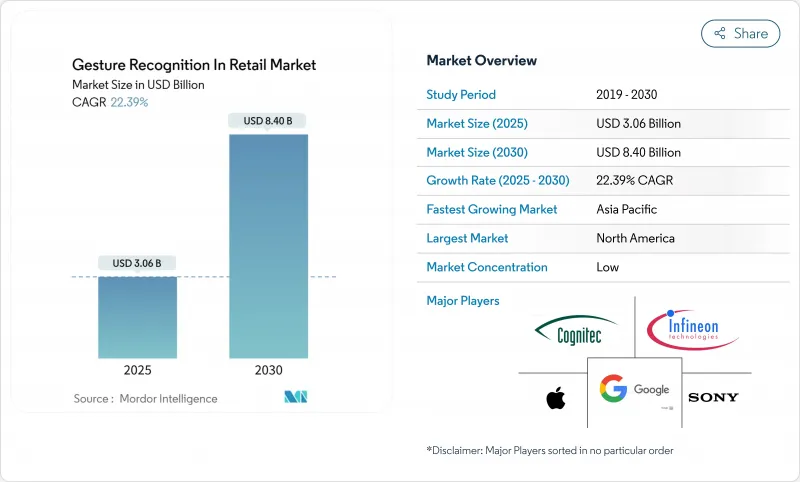

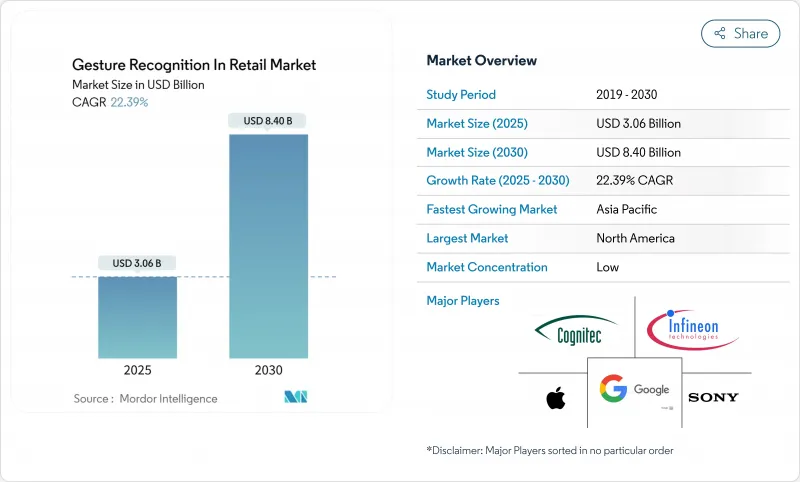

零售手勢姿態辨識市場預計在 2025 年達到 30.6 億美元,到 2030 年將成長到 84 億美元,複合年成長率為 22.4%。

日益嚴重的人手不足、持續成長的非接觸式出行需求,以及邊緣人工智慧 (AI) 與毫米波雷達的結合,使得無需攝影機即可在貨架上進行手勢識別。零售商獲得了更豐富的貨架內分析數據,而消費品品牌則可以將由此產生的行為數據收益。隨著 3D 感測和 AI 晶片組被整合到主流 POS 設備中,硬體成本持續下降。主要市場的監管明確性和日益成熟的隱私保護架構進一步降低了大規模部署的風險。綜合來看,這些動態將使零售手勢姿態辨識市場在未來十年保持兩位數的成長。

全球零售手勢姿態辨識市場趨勢與洞察

非接觸式購物體驗的需求不斷增加

疫情期間的消費行為鞏固了消費者對無接觸購物的期望。一家歐洲大型雜貨店檢驗一家佔地超過1000平方米的全尺寸電腦視覺超級市場。該零售商報告稱,平均結帳時間顯著縮短,顧客吞吐量提升,從而增加了購物量並增加了回頭客。競爭壓力甚至促使中階連鎖店也在評估支援手勢辨識的前端重新設計。隨著越來越多的營運商採用保護隱私的邊緣架構,該技術的普及將在無需額外雲端費用的情況下加速。這些發展增強了手勢姿態辨識在零售市場的短期成長前景。

3D 感測和 AI 晶片在零售設備中的應用日益增多

邊緣晶片如今可在本地執行即時手勢推理,從而消除頻寬限制並降低延遲。近期推出的原型產品將3D深度感測器與專用機器學習核心結合,即使在不同的光照條件下,也能在18個類別中實現99.8%的手勢辨識準確率。憑藉大規模生產,亞洲OEM廠商正將單位成本降至20美元以下,從而進軍本地雜貨店和便利商店。由於擁有成本較低且易於改造現有通道,零售手勢姿態辨識市場正在不斷擴張。此外,晶片供應商和解決方案整合商提供的聯合參考設計,為內部工程資源有限的零售商減少了整合工作量。

即時商店環境中演算法的複雜性和準確性變化

與實驗室結果相比,零售環境中的遮蔽、反射表面和人群密度會降低手勢辨識的準確性。電腦視覺模型仍然存在基於年齡層和移動性的偏差,這引發了包容性方面的擔憂。持續的再訓練和更大的註釋資料集增加了部署成本。商家必須根據每家門市調整感測器佈局以保持可接受的性能,這使得多格式部署變得複雜。在中介軟體平台能夠抽象化這些複雜性之前,一些連鎖店仍持謹慎態度,這限制了零售手勢姿態辨識市場的短期擴張。

細分分析

到2024年,觸控平台將佔據零售手勢姿態辨識市場佔有率的78.1%。然而,預計到2030年,非接觸式平台的複合年成長率將達到24.1%,這標誌著人們將轉向更衛生、無縫整合的購物體驗。一家大型俱樂部在出口處試點使用攝影機辨識技術為會員結帳,這表明非接觸式技術正在取代人工收據檢查。硬體供應商現在正在將雷達感測器與RGB-D攝影機整合,以降低材料成本,並填補曾經青睞觸控面板的精度差距。隨著應用越來越可靠,預計到2030年,零售業中與非接觸式產品相關的手勢姿態辨識市場規模將超過30億美元,是2024年規模的兩倍。

零售商擴大將非接觸式手勢姿態辨識視為提升品牌體驗的差異化因素,尤其是在奢侈品時尚和消費性電子產品展示室等高利潤領域。同時,基於觸控的平台仍然適用於需要精確定位的用例,例如手勢識別和按訂單訂單的自助服務終端。這兩種方式代表著一種共存模式,而非完全替代,這使得供應商能夠定位可根據客戶需求擴展的模組化解決方案。神經處理單元的持續改進將使延遲降低到30毫秒以下,同時保持直覺的互動,並有望進一步滲透零售領域的手勢姿態辨識市場。

手部和手指輸入仍佔據主導地位,佔2024年手勢姿態辨識市場規模的66.8%。然而,到2030年,全身系統的複合年成長率將達到23.4%,因為邊緣盒中的高速GPU可以解碼骨骼運動,以實現身臨其境型顯示牆和過道級分析。以頭部為中心的微手勢技術已在便利商店和加油站率先採用。結合語音和手勢的研究原型在意圖準確度方面取得了更高的分數,這表明零售手勢姿態辨識市場將呈現多模態軌跡。

穿戴式腕帶能夠捕捉神經和肌肉訊號,為身心障礙購物者帶來全新的互動,拓展了無障礙消費者的可及性。零售商正在利用全身熱力圖識別熱點並重新設計貨架,這表明手勢數據可以釋放前端結帳以外的營運價值。用例範圍的不斷擴大凸顯了為什麼儘管需要強大的運算能力,但業界仍在持續投資先進的姿勢估算演算法。

區域分析

到2024年,北美將佔據零售手勢姿態辨識市場規模的36.5%,這得益於早期採用該技術的大型連鎖店和相對寬鬆的生物辨識制度。聯邦指導方針不如歐洲嚴格,允許在全連鎖店範圍內進行試點,一旦投資回報率得到驗證,即可迅速擴大規模。目前,已有超過500家雜貨店採用僅使用攝影機的出口結帳系統,這鞏固了該地區的領先地位。

隨著中國的支付生態系統和日本的無人駕駛營運將手勢姿態辨識融入端到端的門市自動化,到2030年,亞太地區將達到最高的複合年成長率,達到22.8%。政府對數位化的補貼降低了初始成本門檻,同時提高了消費者對生物辨識流程的接受度。本地硬體製造密度的提高將縮短供應鏈並加快迭代周期,從而進一步推動生物辨識技術的普及。

在歐洲,為了滿足歐盟人工智慧立法的要求,人們正在採用融合邊緣處理和加密雲端同步的隱私合規架構。跨國雜貨商正在德國、法國和北歐測試支援手勢識別的大型超市,為在歐盟範圍內推廣提供藍圖。拉丁美洲和中東等新興地區的起步基數較小,但隨著全球供應商推出針對中型超級市場集團的承包方案,預計這些地區的採用率將達到兩位數。這些連鎖效應正在使零售業的手勢姿態辨識市場在地理分佈上更加多樣化。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 非接觸式購物體驗的需求不斷增加

- 零售設備中的 3D 感測和 AI 晶片越來越普遍

- 智慧零售與自主商店模式的興起

- 毫米波和超寬頻雷達的進步使手勢控制成為可能

- 消費品品牌透過過道手勢姿態分析收益

- AR智慧眼鏡整合連接線上和店內購物體驗

- 市場限制

- 實體環境中演算法的複雜性與準確性變化

- 隱私和監管對持續視覺追蹤的強烈反對

- 邊緣網路延遲導致結帳手勢失靈

- 門市物聯網密集部署帶來的電磁干擾

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

- 評估宏觀經濟趨勢對市場的影響

第5章市場規模及成長預測

- 依技術

- 基於觸摸的手勢姿態辨識

- 非接觸式手勢姿態辨識

- 按互動方式

- 手勢和手指

- 頭部/點頭手勢

- 全身手勢

- 多模態(手勢和語音)

- 按功能

- 店內客戶參與展示

- 結帳/銷售點和付款

- 商店營運、庫存和分析

- 按零售形式

- 超級市場和大賣場

- 便利商店

- 服裝和百貨公司

- 專業零售商

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Apple Inc

- Google LLC

- Microsoft Corporation

- Intel Corporation

- Infineon Technologies AG

- Sony Group Corp

- Omron Corporation

- Cognitec Systems GmbH

- Crunchfish AB

- Elliptic Labs ASA

- GestureTek Inc

- Ultraleap Ltd

- Synaptics Incorporated

- Qualcomm Technologies Inc

- PointGrab Ltd

- Neonode Inc

- Cipia Vision Ltd

- Samsung Electronics Co Ltd

- Microchip Technology Inc

- STMicroelectronics NV

第7章 市場機會與未來展望

The gesture recognition in retail market size reached USD 3.06 billion in 2025 and is forecast to climb to USD 8.40 billion by 2030, advancing at a 22.4% CAGR.

Rising labor shortages, sustained demand for contact-free journeys, and the pairing of edge AI with millimeter-wave radar now allow through-shelf gesture detection that works without a direct camera view. Retailers gain richer in-aisle analytics, while consumer packaged goods brands monetize the resulting behavioral data streams. Hardware costs continue to fall as 3-D sensing and AI chipsets integrate into mainstream point-of-sale devices. Regulatory clarity in major markets and maturing privacy-preserving architectures further de-risk large-scale roll-outs. Collectively, these dynamics support sustained double-digit expansion for the gesture recognition in retail market through the decade.

Global Gesture Recognition In Retail Market Trends and Insights

Rising Demand for Contact-Free Shopping Experiences

Pandemic-era behaviors solidified consumer expectations for touchless journeys, and major European grocers have validated full-scale computer-vision supermarkets exceeding 1,000 m2 footprints. Retailers report measurable reductions in average checkout time and greater customer throughput, translating into higher basket sizes and repeat visits. Competitive pressure now pushes even mid-tier chains to evaluate gesture-enabled front-end redesigns. As more operators deploy privacy-preserving edge architectures, adoption accelerates without added cloud fees. These developments reinforce the near-term growth outlook for the gesture recognition in retail market.

Increasing Penetration of 3-D Sensing and AI Chips in Retail Devices

Edge silicon now executes real-time gesture inference locally, removing bandwidth constraints and cutting latency. Recent prototypes pairing 3-D depth sensors with dedicated machine-learning cores showed 99.8% gesture accuracy across 18 classes, even under variable lighting. Asian OEMs leverage scale manufacturing to push unit prices below USD 20, opening access for regional grocers and convenience stores. Lower cost of ownership and ease of retrofitting existing lanes help broaden the reachable base of the gesture recognition in retail market. Joint reference designs from chip suppliers and solution integrators also reduce integration effort for retailers with limited in-house engineering talent.

Algorithmic Complexity and Accuracy Variance in Live-Store Environments

Retail settings introduce occlusions, reflective surfaces, and crowd density that cut gesture accuracy when compared with lab results, particularly for customers carrying bags or wearing gloves. Bias across age groups and body mobility still appears in computer-vision models, raising inclusion concerns. Continuous re-training regimes and larger annotated data sets drive deployment cost upward. Merchants must tune sensor layouts per store to preserve acceptable performance, complicating multi-format roll-outs. Until middleware platforms abstract this complexity, some chains remain cautious, tempering the short-term expansion of the gesture recognition in retail market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Smart-Retail and Autonomous-Store Formats

- Advancements in mm-wave and UWB Radar Enabling Through-Shelf Gestures

- Privacy and Regulatory Push-Back on Continuous Vision Tracking

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Touch-based platforms represented 78.1% of gesture recognition in retail market share in 2024 as retailers favored proven systems bolted onto legacy lanes. Even so, the touch-less segment is set to record a 24.1% CAGR through 2030, underscoring a shift toward hygienic and seamlessly integrated store journeys. Pilots by big-box clubs that clear members via camera recognition at exits illustrate how touch-less can replace manual receipt checks. Hardware vendors now integrate radar sensors alongside RGB-D cameras, trimming bill-of-materials and closing the precision gap that once favored touch-based panels. As deployment confidence rises, the gesture recognition in retail market size tied to touch-less offerings is projected to exceed USD 3 billion by 2030, doubling its 2024 base.

Retailers increasingly view touch-less gesture recognition as a brand differentiator that elevates experience, especially in high-margin segments such as luxury fashion and consumer electronics showrooms. Meanwhile, touch-based platforms remain relevant for use cases that demand pinpoint accuracy, such as signature capture or build-to-order kiosks. Those dual pathways indicate a coexistence model rather than outright substitution, allowing suppliers to position modular solutions that scale with client needs. Continued iterations of neural processing units will likely lower latency to sub-30 milliseconds, preserving intuitive interactions and encouraging further penetration of the gesture recognition in retail market.

Hand and finger inputs dominated, accounting for 66.8% of the gesture recognition in retail market size in 2024, thanks to consumers already conditioned by smartphones. Full-body systems, however, register a 23.4% CAGR to 2030 as faster GPUs in edge boxes decode skeletal movement for immersive display walls and aisle-level analytics. Head-centric micro-gestures found early adoption in convenience stores and petrol marts where hands are busy handling goods. Research prototypes combining voice and gesture score higher for intent accuracy, implying a multimodal trajectory for the gesture recognition in retail market.

Wearable bands that pick up neural or muscle signals bring an additional interaction layer for differently abled shoppers, broadening accessibility. Retailers use full-body heat maps to pinpoint hotspots and redesign aisles, demonstrating that gesture data can unlock operations value beyond front-end checkout. The expanding use-case set underscores why the gesture recognition in retail industry continues to invest in advanced pose estimation algorithms despite the higher compute requirement.

The Gesture Recognition in Retail Market Report is Segmented by Technology (Touch-Based Gesture Recognition and Touch-Less Gesture Recognition), Interaction Mode (Hand and Finger Gestures, Head / Nod Gestures, and More), Function (In-Store Customer Engagement Displays, and More), Retail Format (Supermarkets and Hypermarkets, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with 36.5% share of the gesture recognition in retail market size in 2024, benefits from early adopter big-box chains and a comparatively permissive biometric regime. Federal guidelines remain less restrictive than Europe's, enabling chain-wide pilots that rapidly scale when ROI is proven. Over 500 grocery sites now run camera-only exit checkout, reinforcing the region's leadership.

Asia-Pacific posts the highest 22.8% CAGR through 2030 as Chinese payment ecosystems and Japanese unmanned formats integrate gesture recognition into end-to-end store automation. Government retail-digitization grants lower upfront cost barriers, while consumers show strong acceptance of biometric processes. Local hardware manufacturing density shortens supply chains and accelerates iteration cycles, further catalyzing uptake.

Europe follows with privacy-compliant architectures that blend edge processing and encrypted cloud synchronization to satisfy the EU AI Act. Multinational grocers test gesture-enabled mega-stores across Germany, France, and the Nordics, providing blueprints for pan-EU roll-outs. Emerging regions in Latin America and the Middle East start from smaller bases but see double-digit adoption as global vendors introduce turnkey packages targeted at mid-sized supermarket groups. This cascade effect supports a geographically diversified enlargement of the gesture recognition in retail market.

- Apple Inc

- Google LLC

- Microsoft Corporation

- Intel Corporation

- Infineon Technologies AG

- Sony Group Corp

- Omron Corporation

- Cognitec Systems GmbH

- Crunchfish AB

- Elliptic Labs ASA

- GestureTek Inc

- Ultraleap Ltd

- Synaptics Incorporated

- Qualcomm Technologies Inc

- PointGrab Ltd

- Neonode Inc

- Cipia Vision Ltd

- Samsung Electronics Co Ltd

- Microchip Technology Inc

- STMicroelectronics N.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for contact-free shopping experiences

- 4.2.2 Increasing penetration of 3-D sensing and AI chips in retail devices

- 4.2.3 Expansion of smart-retail and autonomous-store formats

- 4.2.4 Advancements in mm-wave and UWB radar enabling through-shelf gestures

- 4.2.5 Monetisation of in-aisle gesture analytics for CPG brands

- 4.2.6 Integration of AR smart-glasses bridging online and in-store journeys

- 4.3 Market Restraints

- 4.3.1 Algorithmic complexity and accuracy variance in live-store environments

- 4.3.2 Privacy and regulatory push-back on continuous vision tracking

- 4.3.3 Edge-network latency causing gesture misfires at checkout

- 4.3.4 Electromagnetic interference from dense in-store IoT deployments

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Touch-based Gesture Recognition

- 5.1.2 Touch-less Gesture Recognition

- 5.2 By Interaction Mode

- 5.2.1 Hand and Finger Gestures

- 5.2.2 Head / Nod Gestures

- 5.2.3 Full-Body Gestures

- 5.2.4 Multimodal (Gesture and Voice)

- 5.3 By Function

- 5.3.1 In-Store Customer Engagement Displays

- 5.3.2 Checkout / Point-of-Sale and Payments

- 5.3.3 Store Operations, Inventory and Analytics

- 5.4 By Retail Format

- 5.4.1 Supermarkets and Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Apparel and Department Stores

- 5.4.4 Specialty Retailers

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Apple Inc

- 6.4.2 Google LLC

- 6.4.3 Microsoft Corporation

- 6.4.4 Intel Corporation

- 6.4.5 Infineon Technologies AG

- 6.4.6 Sony Group Corp

- 6.4.7 Omron Corporation

- 6.4.8 Cognitec Systems GmbH

- 6.4.9 Crunchfish AB

- 6.4.10 Elliptic Labs ASA

- 6.4.11 GestureTek Inc

- 6.4.12 Ultraleap Ltd

- 6.4.13 Synaptics Incorporated

- 6.4.14 Qualcomm Technologies Inc

- 6.4.15 PointGrab Ltd

- 6.4.16 Neonode Inc

- 6.4.17 Cipia Vision Ltd

- 6.4.18 Samsung Electronics Co Ltd

- 6.4.19 Microchip Technology Inc

- 6.4.20 STMicroelectronics N.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment