|

市場調查報告書

商品編碼

1850991

美國垂直農業:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Vertical Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

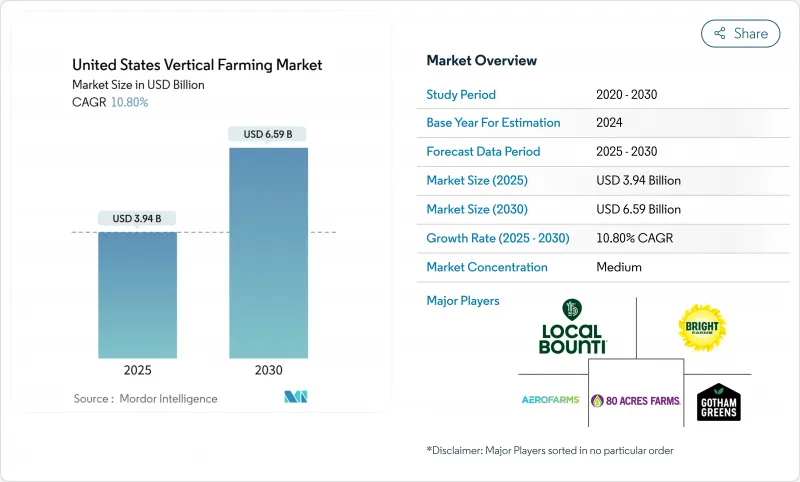

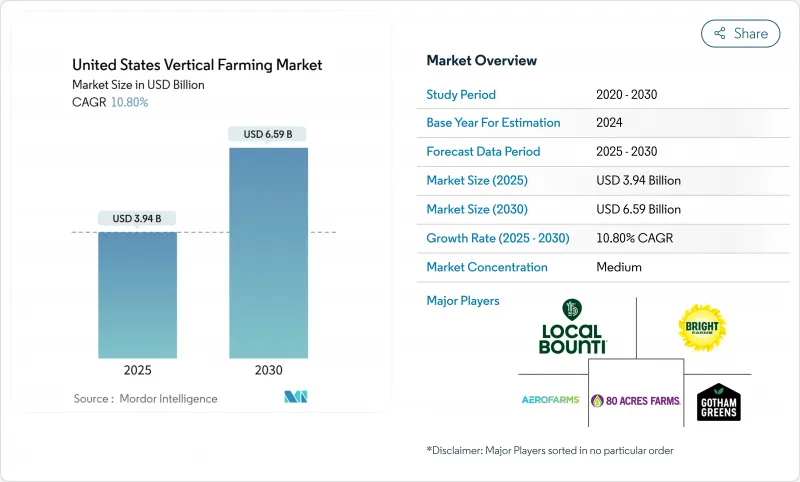

預計到 2025 年,垂直農業市場規模將達到 39.4 億美元,並以 10.8% 的複合年成長率成長,到 2030 年將達到 65.9 億美元。

這一成長率表明,產業成長更依賴技術主導的效率提升,而非激進的產能擴張。 2024 年的市場整合凸顯了這一轉變,大型創投支持的營運商即便籌集了大量資金,也難以涵蓋高昂的營運成本。先進的氣候控制、LED 照明以及採用人工智慧的模組化倉庫改造,能夠降低能耗並縮短計劃,從而為管理規範的營運商帶來成本優勢。聯邦政府對城市農業的補貼、各州鼓勵節水系統的抗旱法規,以及消費者對無農藥農產品的高階需求,都支撐著強勁的需求前景。市場競爭較為溫和,五大企業的市佔率不足總銷售額的一半,使得區域性專業企業得以蓬勃發展。

美國垂直農業市場趨勢與洞察

對本地種植、不含農藥的農產品的需求不斷成長

哥本哈根大學進行的感官研究表明,其口感與有機種植的田間作物不相上下,贏得了消費者的認可。 Gotham Greens 在美國東北部 850 多家超級市場銷售優質綠葉蔬菜,並透過將本地新鮮度與品牌信譽相結合來保持盈利。例如,80 Acres Farms 為中西部 316 家門市供貨,每年運送 1,000 萬份餐食,各大超市都在加深與其的供應協議。企業咖啡簡餐店也順應了零售業的發展動能。 AeroFarms 與 Costco 續簽了 2025 年的生鮮食品供應協議。

城市致力於減少食物里程,保持食物新鮮。

現今,城市正將垂直農場視為保障糧食安全的關鍵資產。位於喬治亞門羅市的Gotham Greens公司佔地21萬平方英尺的溫室,使90%的美國消費者能夠在一天之內透過卡車運輸收到農產品,增強了低溫運輸的韌性。 AutoStore和OnePointOne在亞利桑那州的門市利用高密度機器人技術,在15天內完成從播種到上架的整個農產品配送過程。紐約州核准一座佔地38.5萬平方英尺的“超級農場”,該農場每年將生產800萬磅農產品,並實現碳負排放。

高資本支出和高能耗營運支出

典型的多層農場建設成本約為每平方英尺1000美元,電力費用可佔每月總支出的40%。 Bowery Farming和Plenty在融資總額超過16億美元後申請破產,凸顯了在擴大規模之前延遲降低成本的風險。與批發電價掛鉤的動態照明系統可降低高達18%的電費。像Gotham Greens這樣的營運商透過選擇低成本電力供應地點並在其13個設施中採用標準化設計來維持盈利。

細分市場分析

憑藉成熟的供應鏈和成熟的設計,水耕技術將在2024年佔據垂直農業市場收入的68.0%。儘管基數較小,氣耕到2030年仍將維持18.4%的複合年成長率,因為95%的用水效率目標在乾旱地區引起了監管機構的關注。物聯網營養感測器正在提高兩種系統的施肥精度,並有助於縮小成本差距。

精準影像處理可在數小時內通知種植者作物是否有營養脅迫,進一步減少浪費。因此,種植者將與能夠調節光照、灌溉和收割的整合軟體展開競爭,而不是與栽培基質競爭。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對本地種植、不含農藥的農產品的需求不斷成長

- 一個優先考慮減少食品里程和保證食品新鮮度的城市

- 節水農業在乾旱管理的應用

- 企業與校園永續食品政策

- 稅收優惠和機會區貸款

- 人工智慧驅動的作物建模可降低營運成本

- 市場限制

- 高資本支出和高能耗密集型支出

- 經濟上可行的作物種類仍然有限。

- 電力價格波動對利潤率帶來壓力

- 中歐地區熟練勞動力短缺

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過生長機制

- 氣耕

- 水耕法

- 水耕法

- 按結構

- 建築式垂直農場

- 貨櫃農場

- 倉庫式垂直農場

- 按作物類型

- 綠葉蔬菜

- 香草和微型菜苗

- 水果和漿果

- 花卉和觀賞植物

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AeroFarms

- BrightFarms(Cox Enterprises)

- Gotham Greens

- 80 Acres Farms

- Freight Farms, Inc.

- Altius Farms(Jewish Family Service of Colorado)

- Local Bounti

- Pure Green Farms

- Square Roots

- Oishii

- Eden Green Technology

第7章 市場機會與未來展望

The vertical farming market reached USD 3.94 billion in 2025 and is forecast to grow at a 10.8% CAGR, hitting USD 6.59 billion by 2030.

The expansion rate signals that industry growth now depends on technology-driven efficiency rather than aggressive capacity build-outs. Market consolidation during 2024 underscored this shift, with large, venture-backed operators unable to cover high operating costs despite substantial fundraising. Artificial-intelligence-enabled climate control advanced LED lighting, and modular warehouse conversions are lowering energy use and shortening project timelines, giving disciplined players a cost advantage. Federal grants for urban agriculture, state-level drought regulations that favor water-frugal systems, and premium retail demand for pesticide-free produce together sustain a solid demand outlook. The competitive intensity remains moderate because the largest five firms hold less than half of the total revenue, allowing regional specialists to flourish.

United States Vertical Farming Market Trends and Insights

Rising Demand for Locally-Grown Pesticide-Free Produce

Year-round, pesticide-free food now earns premium shelf prices, and sensory studies from the University of Copenhagen show taste parity with organic field crops, lifting consumer acceptance. Gotham Greens sells premium leafy greens through more than 850 Northeast supermarkets and maintains profitability by pairing local freshness with brand trust. Large grocers deepen supply contracts at 80 Acres Farms, for example, supplies 316 Midwestern stores, shipping 10 million servings annually. Corporate cafeterias echo retail momentum; AeroFarms renewed its Costco fresh-produce program in 2025.

Urban Focus on Food-Mile Reduction and Freshness

Cities now treat vertical farms as critical food security assets. Gotham Greens' 210,000-square-foot Monroe, Georgia greenhouse places 90% of U.S. consumers within a one-day truck reach, strengthening cold-chain resilience. AutoStore and OnePointOne's Arizona site delivers crops in 15 days from seed to shelf using high-density robotics. New York State approved a 385,000-square-foot "GigaFarm" that will output 8 million lb of produce yearly while operating at carbon-negative status.

High CAPEX and Energy-Intensive OPEX

A typical multilevel farm costs about USD 1,000 per ft2 to build, and electricity accounts for up to 40% of monthly expenses. Bowery Farming and Plenty both filed for bankruptcy after raising more than USD 1.6 billion combined, underlining the risk when cost reductions lag scale-up. Dynamic lighting tied to wholesale power prices can trim bills by up to 18%. Operators such as Gotham Greens remain profitable by choosing low-cost power locations and standardizing designs across 13 facilities.

Other drivers and restraints analyzed in the detailed report include:

- Water-Efficient Agriculture Amid Drought Policies

- Corporate and Campus Sustainability Food Mandates

- Economically Viable Crop Range Remains Narrow

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydroponics held 68.0% of the vertical farming market revenue in 2024, supported by mature supply chains and proven designs. Aeroponics, though representing a smaller base, will log an 18.4% CAGR to 2030 as 95% water-efficiency targets catch regulators' attention in drought zones. The IoT nutrient sensors sharpen dosing accuracy across both systems, helping close the cost gap.

Precision imaging now notifies growers of nutrient stress within hours, further reducing waste. Operators, therefore, compete less on growth medium and more on integrated software that orchestrates lighting, fertigation, and harvesting.

The United States Vertical Farming Market Report is Segmented by Growth Mechanism (Aeroponics, Hydroponics, and Aquaponics), by Structure (Building-Based Vertical Farms, Shipping-Container Farms, and More), and by Crop Type (Leafy Greens, Herbs and Microgreens, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AeroFarms

- BrightFarms (Cox Enterprises)

- Gotham Greens

- 80 Acres Farms

- Freight Farms, Inc.

- Altius Farms (Jewish Family Service of Colorado)

- Local Bounti

- Pure Green Farms

- Square Roots

- Oishii

- Eden Green Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for locally-grown pesticide-free produce

- 4.2.2 Urban focus on food-mile reduction and freshness

- 4.2.3 Water-efficient agriculture amid drought policies

- 4.2.4 Corporate and campus sustainability food mandates

- 4.2.5 Tax incentives and Opportunity-Zone financing

- 4.2.6 AI-driven crop modeling lowers OPEX

- 4.3 Market Restraints

- 4.3.1 High CAPEX and energy-intensive OPEX

- 4.3.2 Economically viable crop range remains narrow

- 4.3.3 Electricity-price volatility hurts margins

- 4.3.4 Shortage of CEA-skilled workforce

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Growth Mechanism

- 5.1.1 Aeroponics

- 5.1.2 Hydroponics

- 5.1.3 Aquaponics

- 5.2 By Structure

- 5.2.1 Building-based Vertical Farms

- 5.2.2 Shipping-Container Farms

- 5.2.3 Warehouse-based Vertical Farms

- 5.3 By Crop Type

- 5.3.1 Leafy Greens

- 5.3.2 Herbs and Microgreens

- 5.3.3 Fruits and Berries

- 5.3.4 Flowers and Ornamentals

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AeroFarms

- 6.4.2 BrightFarms (Cox Enterprises)

- 6.4.3 Gotham Greens

- 6.4.4 80 Acres Farms

- 6.4.5 Freight Farms, Inc.

- 6.4.6 Altius Farms (Jewish Family Service of Colorado)

- 6.4.7 Local Bounti

- 6.4.8 Pure Green Farms

- 6.4.9 Square Roots

- 6.4.10 Oishii

- 6.4.11 Eden Green Technology