|

市場調查報告書

商品編碼

1766365

垂直農業市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vertical Farming Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

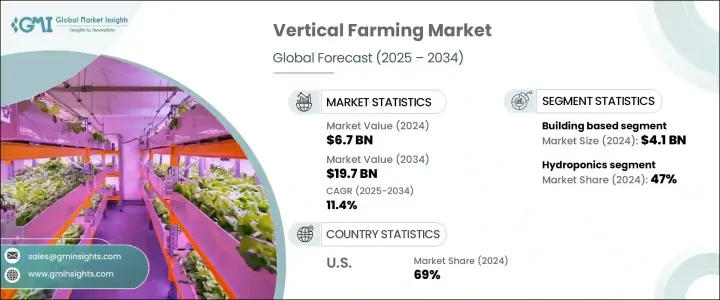

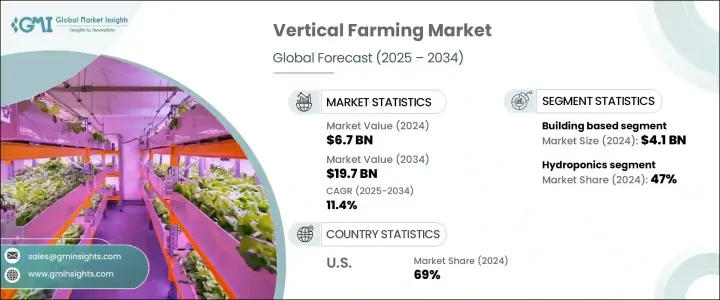

2024年,全球垂直農業市場規模達67億美元,預計2034年將以11.4%的複合年成長率成長,達到197億美元。這一成長主要源於城市人口擴張、對糧食安全的日益重視以及對永續農業實踐日益成長的需求。垂直農業是一種受控環境農業方法,它利用水耕、氣耕和魚菜共生等技術在室內高效種植作物。這些系統可實現全年生產,並透過減少用水量和土地使用量來最大限度地節約資源。

智慧感測器、物聯網、人工智慧和節能LED照明等先進技術進一步提高了作物產量和營運效率。水耕法因其易用性和久經考驗的生產力,仍然是人們的首選方法,其次是其他永續的替代方法。借助氣候控制環境、自動灌溉、水肥一體化和即時監控,垂直農場能夠確保始終如一的品質和產量。消費者對無化學成分、本地種植和新鮮農產品的興趣日益濃厚,也促使農民種植更多作物,包括蔬菜、香草和水果。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 67億美元 |

| 預測值 | 197億美元 |

| 複合年成長率 | 11.4% |

高昂的安裝成本仍然是垂直農業推廣的主要障礙之一。安裝先進的環境控制系統(從LED生長燈到水耕或氣耕系統)的前期費用可能遠高於傳統農業。此外,為支持垂直農業基礎設施而購買或建造建築物或貨櫃也會產生額外成本。

2024年,以建築為基礎的垂直農業領域創造了41億美元的市場規模,這得益於其高效擴展和靈活設計方案的優勢。這些建築物——無論是翻新的倉庫還是專門建造的設施——每平方英尺都能支撐多層種植,從而提高產量密度。它們還能整合照明、氣候和灌溉自動化系統,支援全年穩定生產。靠近城區不僅可以減少運輸時間和成本,還能確保更快地將更新鮮的產品送達消費者。這些優勢正吸引商業種植者大力投資以建築為基礎的垂直農場。

水耕法在2024年佔據了47%的市場佔有率,鞏固了其作為主導方法的地位。該系統使植物能夠在營養豐富的水溶液中茁壯成長,與傳統農業相比,用水量可減少高達90%。它無需化學投入,並支援快速的作物週期和高產量。與氣培法或魚菜共生法等複雜系統相比,水耕法更易於實施和管理,適用於多種作物,尤其是草本植物和綠葉蔬菜,是商業規模運作的理想選擇。

2024年,美國垂直農業市場佔69%的佔有率。對本地種植、永續農產品的需求持續成長,這與消費者對環境影響最小的新鮮食品的期望相符。主要大都市地區因其能夠靠近終端消費者開展垂直農業業務而成為垂直農業中心。美國先進的技術基礎設施正在加速水耕系統、人工智慧氣候控制、LED照明和數據驅動自動化平台等解決方案的部署。這些創新顯著提高了營運的可擴展性和可靠性,使農場即使在不可預測的外部氣候條件下也能持續生產。

垂直農業產業的知名公司包括 Ecopia、Signify、MechaTronix、Panasonic、UNI-TROLL、C-LED srl、飛利浦、AMS OSRAM AG、Tungsram、Nuvege、通用電子、Artechno、LED iBond、Parus 和 Organizzazione Orlandelli。垂直農業市場公司採用的關鍵策略是透過創新、合作和地理擴張來加強市場佔有率。參與者正在大力投資研發節能照明、更智慧的自動化系統和永續的營養輸送模式。許多公司正在與零售商和食品分銷商結成策略聯盟,以確保更好的市場滲透率。一些公司正在探索城市房地產機會,以建立更靠近消費者的農場。此外,該公司正在部署模組化農業單位和可擴展模型,以滿足中小型企業的需求,從而擴大可及性。注重資源最佳化和環保包裝也有助於這些品牌符合消費者期望和監管標準。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業衝擊力

- 成長動力

- 都市化與有限的耕地

- 對新鮮、無農藥農產品的需求

- 政府措施和激勵措施

- 產業陷阱與挑戰

- 初期投資成本高

- 技術複雜性

- 機會

- 技術進步

- 供應鏈最佳化

- 成長動力

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按組件

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依結構,2021 年至 2034 年

- 主要趨勢

- 基於貨櫃

- 基於建築

第6章:市場估計與預測:按工藝,2021 年至 2034 年

- 主要趨勢

- 水耕

- 氣霧栽培

- 水產養殖

第7章:市場估計與預測:按組成部分,2021 年至 2034 年

- 主要趨勢

- 照明系統

- 灌溉和水肥一體化

- 氣候控制

- 感應器

第8章:市場估計與預測:依作物類型,2021 年至 2034 年

- 主要趨勢

- 水果

- 蔬菜

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AMS OSRAM AG

- Artechno

- C-LED srl

- Ecopia

- General Electronics

- LED iBond

- MechaTronix

- Nuvege

- Organizzazione Orlandelli

- Panasonic

- Parus

- Philips

- Signify

- Tungsram

- UNI-TROLL

The Global Vertical Farming Market was valued at USD 6.7 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 19.7 billion by 2034. This growth is largely driven by urban population expansion, the increasing emphasis on food security, and the rising demand for sustainable agricultural practices. Vertical farming, a controlled environment agriculture method, uses techniques like hydroponics, aeroponics, and aquaponics to cultivate crops efficiently indoors. These systems offer year-round production and maximize resource conservation by using less water and land.

Advanced technologies such as smart sensors, IoT, artificial intelligence, and energy-efficient LED lighting have further enhanced crop output and operational efficiency. Hydroponics remains the preferred method due to its ease of use and proven productivity, followed by other sustainable alternatives. With the help of climate-controlled environments, automated irrigation, fertigation, and real-time monitoring, vertical farms ensure consistent quality and quantity. The growing consumer interest in chemical-free, locally grown, and fresh produce is also pushing farmers to diversify crops, including vegetables, herbs, and fruits.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.7 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 11.4% |

High setup costs remain one of the primary barriers to vertical farming adoption. The upfront expenses related to installing advanced environmental control systems-ranging from LED grow lights to hydroponic or aeroponic systems-can be significantly higher than conventional agriculture. Facilities also incur added costs for acquiring or constructing buildings or containers to support vertical farming infrastructure.

In 2024, the building-based vertical farming segment generated USD 4.1 billion, driven by its ability to scale efficiently and offer flexible design options. These structures-whether renovated warehouses or purpose-built facilities-can support multiple growing layers per square foot, enhancing output density. They also accommodate integrated automation systems for lighting, climate, and irrigation, supporting stable production throughout the year. Proximity to urban areas not only reduces transportation time and costs but also ensures quicker delivery of fresher products to consumers. These benefits are attracting commercial growers to invest heavily in building-based vertical farms.

Hydroponics segment accounted for 47% share in 2024, solidifying its position as the dominant method. This system enables plants to thrive in nutrient-enriched water solutions, cutting down water usage by up to 90% compared to traditional farming. It eliminates the need for chemical inputs and supports rapid crop cycles and high yields. Hydroponics is simpler to implement and manage than complex systems like aeroponics or aquaponics, making it suitable for a wide variety of crops-particularly herbs and leafy greens-and ideal for commercial-scale operations.

U.S. Vertical Farming Market held a 69% share in 2024. Demand for locally grown, sustainable produce continues to increase, aligning with consumer expectations for fresh food with minimal environmental impact. Major metropolitan areas emerge as vertical farming hubs due to their ability to host these operations close to end consumers. The country's advanced technology infrastructure is accelerating the deployment of solutions such as hydroponic systems, AI-enabled climate control, LED lighting, and data-driven automation platforms. These innovations have significantly enhanced operational scalability and reliability, allowing farms to produce consistently even amid unpredictable external climates.

Prominent names in the Vertical Farming Industry include Ecopia, Signify, MechaTronix, Panasonic, UNI-TROLL, C-LED srl, Philips, AMS OSRAM AG, Tungsram, Nuvege, General Electronics, Artechno, LED iBond, Parus, and Organizzazione Orlandelli. Key strategies adopted by companies in the vertical farming market focus on strengthening market presence through innovation, partnerships, and geographic expansion. Players are heavily investing in research to develop energy-efficient lighting, smarter automation systems, and sustainable nutrient delivery models. Many are forming strategic alliances with retailers and food distributors to ensure better market penetration. Some firms are exploring urban real estate opportunities to establish farms closer to consumers. In addition, companies are deploying modular farming units and scalable models that cater to small and mid-sized businesses, broadening accessibility. Focus on resource optimization and environmentally responsible packaging is also helping these brands align with consumer expectations and regulatory standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Process

- 2.2.3 Crop Type

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and limited arable land

- 3.2.1.2 Demand for fresh, pesticide-free produce

- 3.2.1.3 Government initiatives and incentives

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment costs

- 3.2.2.2 Technical complexity

- 3.2.3 Opportunities

- 3.2.4 Technological advancements

- 3.2.5 Supply chain optimization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By component

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Structure, 2021 – 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Shipping-container based

- 5.3 Building based

Chapter 6 Market Estimates and Forecast, By Process, 2021 – 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Hydroponics

- 6.3 Aeroponics

- 6.4 Aquaponics

Chapter 7 Market Estimates and Forecast, By Component, 2021 – 2034 ($ Bn)

- 7.1 Key trends

- 7.2 Lighting systems

- 7.3 Irrigation and fertigation

- 7.4 Climate control

- 7.5 Sensors

Chapter 8 Market Estimates and Forecast, By Crop Type, 2021 – 2034 ($ Bn)

- 8.1 Key trends

- 8.2 Fruits

- 8.3 Vegetables

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AMS OSRAM AG

- 10.2 Artechno

- 10.3 C-LED srl

- 10.4 Ecopia

- 10.5 General Electronics

- 10.6 LED iBond

- 10.7 MechaTronix

- 10.8 Nuvege

- 10.9 Organizzazione Orlandelli

- 10.10 Panasonic

- 10.11 Parus

- 10.12 Philips

- 10.13 Signify

- 10.14 Tungsram

- 10.15 UNI-TROLL