|

市場調查報告書

商品編碼

1850988

中國金融科技:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)China Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

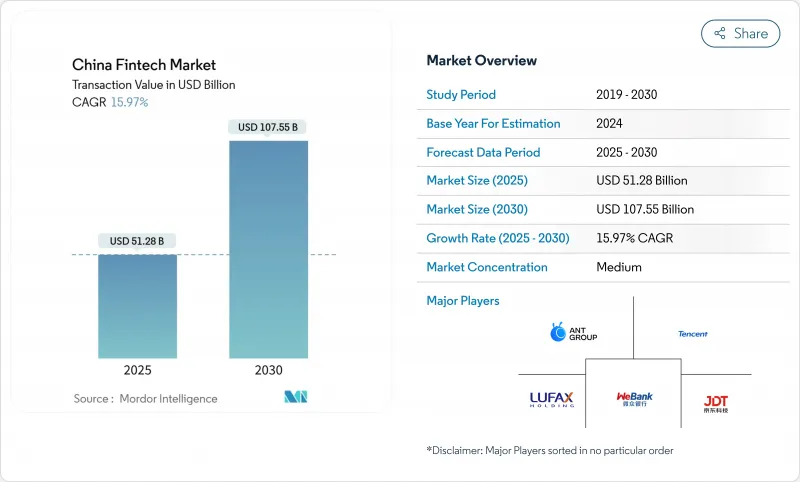

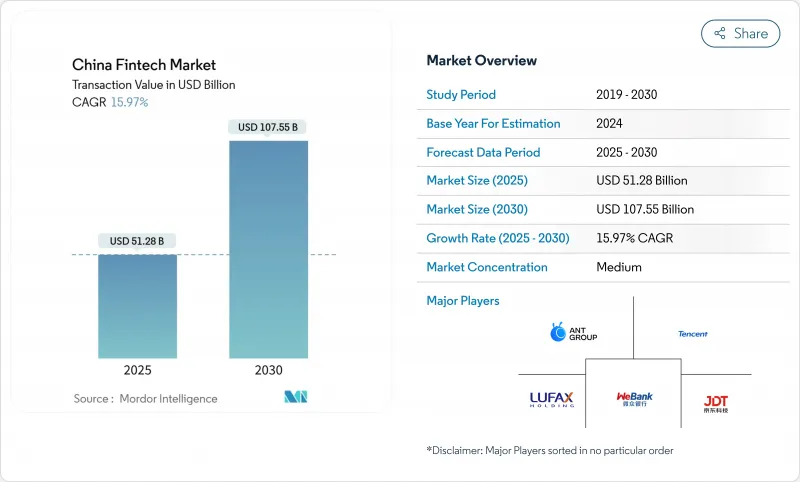

中國金融科技市場預計到 2025 年將達到 512.8 億美元,到 2030 年將達到 1,075.5 億美元,年複合成長率為 15.97%。

這項發展動能主要受以下三個因素驅動:(1) 數位人民幣在全國範圍內的推廣,正在建構超越傳統行動電子錢包的新型支付管道;(2) 現有銀行正轉向雲端原生架構,以確保銀行即服務 (BaaS) 的收入;(3) 監管環境正迅速從以交易量為導向的策略轉向以 API主導的永續成長。競爭壓力正從客戶獲取轉向資料層整合,信用評分、智慧投顧和承保等環節都在轉移到人工智慧引擎。二、三線城市的新興通路正在推動交易量的成長,而無需像以往那樣依賴實體分店網路來擴大其覆蓋範圍。同時,銀聯和萬事達卡之間的國際支付互通性正在擴大中國金融科技市場跨境業務的潛在規模。

中國金融科技市場趨勢與洞察

中國人民銀行電子人民幣的推出加速了數位支付。

截至2024年5月,數位人民幣鏈的交易量呈現顯著成長,較去年同期成長顯著。電子人民幣的分階段推廣設計允許在基礎行動裝置上使用卡片支付,取消了以往電子錢包對智慧型手機的限制。因此,截至2024年4月,15.3%的農村網路用戶表示已使用電子人民幣,開拓了新的消費群。商業銀行正依照中國人民銀行的雙層模式推廣電子人民幣,有效地將傳統分店轉型為金融科技節點,並加強中國金融科技市場的整體數位化。

網聯的強制清算增加了第三方支付量

集中清算將降低商家的接取成本,進而幫助小型服務商發展並提振消費者信心。中國人民銀行數據顯示,到2024年,60歲以上用戶的行動支付普及率將成長46%。統一的詐欺監控規則將使平台能夠將資源集中於附加價值服務而非基礎支付,從而提升中國金融科技市場的錢包吞吐量。

資料安全法加強跨境資料傳輸

將於2025年1月生效的新網路資料安全管理條例規定,對外傳輸資料前必須進行國內安全審查。雖然2024年3月豁免資料量已提高至每年10萬筆記錄,但基於SaaS的金融科技公司仍需對其資料集進行分段並審核。合規成本分散了工程人才,使其無法專注於前端創新,從而降低了中國金融科技市場的短期成長潛力。

細分市場分析

數位支付將佔據中國金融科技市場最大佔有率,預計2024年將達到59.1%。支付寶和微信支付佔據了行動錢包交易的主要佔有率,它們的集中度鞏固了規模經濟。支付寶+跨國擴張已涵蓋70個市場,進一步擴大了其覆蓋範圍。然而,支付寶+在一線城市的滲透率已趨於平緩,同時,將增值型小額保險和投資模組整合到同一錢包的趨勢也日益明顯。

新銀行預計將成為成長最快的領域,到2030年複合年成長率預計將達到19.63%。微眾銀行目前擁有3億帳戶擁有者,同時維持遠低於上市銀行的營運成本資產比率。雲端原生核心加速了新銀行的發展,因為新產品的邊際成本接近零。這種轉變也提高了仍在運作傳統大型主機的區域性銀行的競爭力,促使它們轉向銀行即服務(BaaS)夥伴關係,以此作為在金融科技市場中防禦的手段。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 中國人民銀行推出電子人民幣加速了二、三線城市數位支付的普及

- NetsUnion的支付外包業務增加了第三方支付量

- 中小企業資金籌措缺口推動P2P和供應鏈金融科技借貸平台的發展

- 財富管理互聯計畫促進智慧投顧的普及

- 針對私人醫療保險的稅收優惠將推動保險科技的成長

- 日本銀行升級雲端原生核心以擴充BaaS/API使用

- 市場限制

- 資料安全法將收緊SaaS金融科技領域的跨境資料傳輸。

- 小額信貸不良債務率上升對資本充足率帶來壓力。

- 行動支付飽和度限制了交易量成長

- 價值/供應鏈分析

- 監管或技術前景

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資和資金籌措趨勢分析

第5章 市場規模與成長預測

- 按服務方案

- 數位支付

- 數位借貸和金融

- 數位投資

- 保險科技

- 新銀行

- 最終用戶

- 零售

- 公司

- 透過使用者介面

- 行動應用

- 網頁/瀏覽器

- POS/物聯網設備

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Ant Group(Alipay)

- Tencent Holdings(Tenpay)

- WeBank Co. Ltd.

- Lufax Holding Ltd.

- JD Technology(JD Digits)

- Ping An OneConnect Bank

- ZhongAn Online P&C Insurance

- Futu Holdings Ltd.

- Tiger Brokers(UP Fintech)

- 360 DigiTech Inc.

- LexinFintech Holdings Ltd.

- Qudian Inc.

- Xiaomi Finance

- Lakala Payment Corp.

- UnionPay Merchant Services

- Airwallex

- XTransfer Ltd.

- Du Xiaoman Financial

- Suning Finance

- Wanda Fintech Group

第7章 市場機會與未來展望

The China fintech market is valued at USD 51.28 billion in 2025 and is on track to climb to USD 107.55 billion by 2030, advancing at a 15.97% CAGR.

Momentum comes from three converging forces: (1) nationwide rollout of the digital yuan, which is triggering a new payment rail beyond traditional mobile wallets; (2) a pivot by incumbent banks toward cloud-native architecture that unlocks bank-as-a-service revenue; and (3) fast-maturing regulation that replaced volume-chasing tactics with sustainable, API-driven growth. Competitive pressure is shifting from customer acquisition to data-layer integration such as credit scoring, robo-advice, and underwriting all move onto AI engines. New distribution corridors in tier-2/3 cities are lifting transaction volumes without the physical branch networks that previously capped reach. Meanwhile, international payment interoperability through UnionPay and Mastercard is widening the addressable cross-border pool for the Chinese fintech market.

China Fintech Market Trends and Insights

PBOC e-CNY roll-out accelerating digital payments adoption

Transaction value on the digital yuan chain experienced significant growth by May 2024, showcasing a substantial increase compared to the previous year. The wallet's tiered design permits card-based usage on basic handsets, removing the smartphone requirement that limited earlier wallets. As a result, 15.3% of rural internet users reported e-CNY usage by April 2024, unlocking a fresh cohort of consumers. Commercial banks distribute the currency under a PBOC dual-layer model, effectively converting legacy branches into fintech nodes and reinforcing digitalization throughout the China fintech market.

NetsUnion clearing mandate boosting third-party payment volumes

Centralized clearing lowered merchant integration costs, aiding smaller providers and boosting consumer confidence. PBOC data shows a 46% jump in users aged 60+ adopting mobile payments in 2024. Uniform fraud-monitoring rules now let platforms turn resources toward value-added services rather than basic settlement, lifting overall wallet throughput across the China fintech market.

Data Security Law tightening cross-border data transfers

New Network Data Security Management Regulations, effective January 2025, require domestic security reviews before external data transfers. Although March 2024 adjustments raised exemptions to 100,000 records per year, SaaS fintech's must still segment datasets and stage audits. Compliance overhead diverts engineering talent away from front-end innovation, trimming the near-term growth slope for the China fintech market.

Other drivers and restraints analyzed in the detailed report include:

- SME financing gap driving P2P & supply-chain fintech platforms

- Wealth Management Connect schemes fueling robo-advisor uptake

- Rising NPL ratio in micro-lending elevating capital-adequacy burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital Payments held a 59.1% share of the market in 2024, giving the category the largest stake in the China fintech market size. Alipay and WeChat Pay collectively process a major share of mobile wallet flows, a concentration that cements their scale economics. Cross-border expansion through Alipay+ across 70 markets further extends reach. Nevertheless, penetration in tier-1 cities is flattening, and incremental growth is tilting toward value-added micro-insurance and investment modules housed within the same wallets.

Neobanking is projected to record a 19.63% forecast CAGR through 2030, the fastest in the sector. WeBank now serves 300 million account holders while maintaining an operating cost-to-asset ratio well below joint-stock banks. Cloud-native cores mean the marginal cost of new products approaches zero, accelerating the neobank flywheel. The shift also raises the competitive bar for regional banks that still run legacy mainframes, nudging them toward BaaS partnerships as a defensive posture within the China fintech market.

The China Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ant Group (Alipay)

- Tencent Holdings (Tenpay)

- WeBank Co. Ltd.

- Lufax Holding Ltd.

- JD Technology (JD Digits)

- Ping An OneConnect Bank

- ZhongAn Online P&C Insurance

- Futu Holdings Ltd.

- Tiger Brokers (UP Fintech)

- 360 DigiTech Inc.

- LexinFintech Holdings Ltd.

- Qudian Inc.

- Xiaomi Finance

- Lakala Payment Corp.

- UnionPay Merchant Services

- Airwallex

- XTransfer Ltd.

- Du Xiaoman Financial

- Suning Finance

- Wanda Fintech Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 PBOC e-CNY Roll-out Accelerating Digital Payments Adoption Across Tier-2/3 Cities

- 4.2.2 NetsUnion Clearing Mandate Boosting Third-Party Payment Volumes

- 4.2.3 SME Financing Gap Driving P2P & Supply-Chain Fintech Lending Platforms

- 4.2.4 Wealth Management Connect Schemes Fueling Robo-advisor Uptake

- 4.2.5 Commercial Health Insurance Tax Incentives Propelling InsurTech Growth

- 4.2.6 Cloud-native Core Upgrades by Joint-stock Banks Expanding BaaS/API Consumption

- 4.3 Market Restraints

- 4.3.1 Data Security Law Tightening Cross-border Data Transfers for SaaS Fintechs

- 4.3.2 Rising NPL Ratio in Micro-lending Elevating Capital-adequacy Burdens

- 4.3.3 Saturation of Mobile Payments Limiting Incremental Volume Growth

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Ant Group (Alipay)

- 6.4.2 Tencent Holdings (Tenpay)

- 6.4.3 WeBank Co. Ltd.

- 6.4.4 Lufax Holding Ltd.

- 6.4.5 JD Technology (JD Digits)

- 6.4.6 Ping An OneConnect Bank

- 6.4.7 ZhongAn Online P&C Insurance

- 6.4.8 Futu Holdings Ltd.

- 6.4.9 Tiger Brokers (UP Fintech)

- 6.4.10 360 DigiTech Inc.

- 6.4.11 LexinFintech Holdings Ltd.

- 6.4.12 Qudian Inc.

- 6.4.13 Xiaomi Finance

- 6.4.14 Lakala Payment Corp.

- 6.4.15 UnionPay Merchant Services

- 6.4.16 Airwallex

- 6.4.17 XTransfer Ltd.

- 6.4.18 Du Xiaoman Financial

- 6.4.19 Suning Finance

- 6.4.20 Wanda Fintech Group

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment