|

市場調查報告書

商品編碼

1851217

印度金融科技:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)India Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

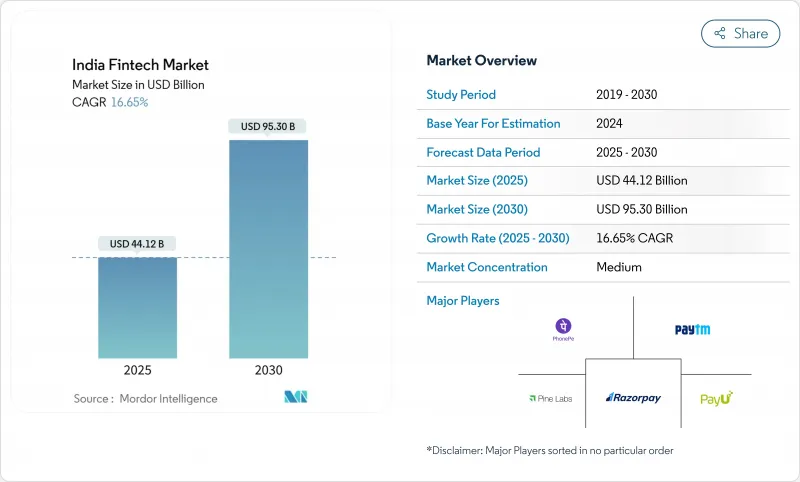

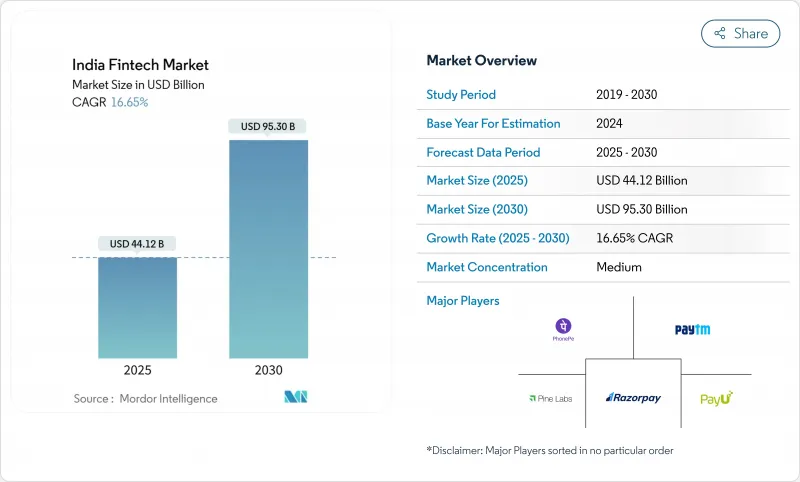

印度金融科技市場預計到 2025 年將達到 441.2 億美元,到 2030 年將擴大到 953 億美元,從 2025 年到 2030 年的複合年成長率將達到 16.65%。

政府的持續支持、價格合理的行動數據以及諸如UPI和Aadhaar等無縫銜接的公共數位基礎設施,正在擴大服務覆蓋範圍、降低交付成本並促進產品創新。智慧型手機的快速普及持續擴大著潛在用戶群體,而千禧世代和Z世代的財富累積則推動了對數位投資和信貸產品的需求。隨著以支付為主導的超級應用拓展至貸款、保險和財富管理領域,競爭依然激烈;同時,專業企業也在高階信貸、零工經濟和跨境支付等領域開闢了盈利的細分市場。來自二、三線城市的競爭者不斷湧入,以及國際UPI整合的日益普及,正在從根本上拓展各個客戶群和地區的成長機會。

印度金融科技市場趨勢與洞察

政府建設的數位公共基礎設施加速了大眾市場的普及。

到2024年11月,UPI月交易量將超過150億筆,交易額達2,800億美元。基於Aadhaar的電子身分驗證(eKYC)已將註冊成本從15-20美元降至0.5美元,使服務提供者能夠為低收入用戶提供更多服務。目前,超過5.08億印度人透過JAM三者(支付、貸款和保險)獲得正規金融服務,擴大了印度在支付、貸款和保險領域的金融科技市場。超過4,270億美元的直接福利轉移已為日常交易搭建了數位化軌道。開放且可互通的架構降低了私人企業的整合阻力,進而促進了產品發布和跨產業合作。

帳戶聚合框架釋放資料主導的信任

自2021年推出以來,AA系統實現了基於用戶同意的檢驗財務記錄共用,使貸款機構能夠對沒有正式信用記錄的借款人進行信用評分。預計到2025年,該系統將為小型企業和零售客戶提供近3000億美元的信貸額度。取得公用事業收費帳單和交易資料的能力縮短了核准時間並降低了違約風險。政策制定者將AA視為未來數位信貸體系的基石,該體系旨在平衡創新與消費者保護。

印度儲備銀行收緊數位貸款和外國貸款開發許可(FLDG)規則將增加合規成本。

2022年頒布、2023年更新的法規強制要求借款人與受監管實體之間進行直接資金流動,詳細揭露年利率,並將貸款組合的貸款損失保障上限設定為5%。合規支出增加了15%至20%,給中小型金融機構帶來了壓力。強制性的冷靜期和資料保留要求促使企業重新評估短期產品,延緩了擴張計劃,並降低了印度金融科技市場的盈利。

細分市場分析

到2024年,數位支付將佔印度金融科技市場佔有率的42.9%,這主要得益於2024會計年度1,310億筆UPI交易的強勁成長。隨著智慧型手機普及率的不斷提高和商家接受度的提升,即使收入模式轉向附加價值服務,該領域預計仍將保持高速成長。產業巨頭正透過整合信貸、保險和財富管理產品來加深客戶互動,從而延長客戶生命週期並提高每位客戶的利潤率。隨著全球科技巨頭、銀行和本土企業競相爭奪每日交易流量,競爭日益激烈。

預計到2030年,在所有提案中,新銀行的複合年成長率將達到19.62%,成為成長最快的領域。純數位銀行正與持牌銀行合作,為自由工作者和小型企業提供全端式行動帳戶、自動化預算和另類貸款服務。隨著法律規範的完善和應用程式介面(API)的標準化,新銀行的服務對象將不再局限於都市區精英,而是擴展到更廣泛的群體,提供本地化的介面和針對特定細分市場的服務。新銀行不斷擴大的基本客群,加上其較低的營運成本,正穩步提升對印度金融科技市場規模的貢獻。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府興建的數位公共基礎設施(UPI、Aadhaar、OCEN)將加速大眾市場的普及。

- 帳戶聚合框架:解鎖資料主導的信用承銷

- 電子商務與零工經濟平台嵌入式的金融需求

- 消費稅實施後,中小企業正規化將催生新的中小企業金融科技需求池。

- 千禧世代和Z世代的財富累積推動了低成本智慧投顧的發展

- 跨境UPI合作(新加坡、阿拉伯聯合大公國等)開闢了新的匯款收入來源。

- 市場限制

- 印度儲備銀行收緊數位借貸和外國貸款開發許可證(FLDG)監管,導致合規成本上升。

- 零商家折扣率政策將壓縮付款閘道的利潤池。

- 網路詐騙案件的不斷增加削弱了消費者信心

- 從2022年起,冬季資金短缺將限制規模化資金的資金籌措。

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資/基金趨勢分析

第5章 市場規模與成長預測

- 按服務方案

- 數位支付

- 數位借貸

- 數位投資

- 保險科技

- 新銀行

- 最終用戶

- 零售

- 商業

- 透過使用者介面

- 行動應用

- 網頁/瀏覽器

- POS/物聯網設備

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Paytm(One97 Communications Ltd)

- PhonePe Pvt Ltd

- Razorpay Software Pvt Ltd

- Pine Labs Pvt Ltd

- PayU Payments Pvt Ltd

- BharatPe(Resilient Innovations Pvt Ltd)

- MobiKwik(One MobiKwik Systems Ltd)

- PolicyBazaar(PB Fintech Ltd)

- Zerodha Broking Ltd

- Upstox(RKSV Securities India Pvt Ltd)

- Groww(Nextbillion Technology Pvt Ltd)

- Cred Financial Technologies Pvt Ltd

- Slice(GaragePreneurs Internet Pvt Ltd)

- KreditBee(Finnov Pvt Ltd)

- Lendingkart Finance Ltd

- Capital Float(Axio Digital)

- NeoGrowth Credit Pvt Ltd

- Navi Technologies Ltd

- Jupiter(Amica Finance Pvt Ltd)

- NIYO Solutions Pvt Ltd

第7章 市場機會與未來展望

The India fintech market is valued at USD 44.12 billion in 2025 and is forecasted to advance to USD 95.30 billion by 2030, translating into a solid 16.65% CAGR during 2025-2030.

Consistent government backing, inexpensive mobile data, and seamless digital public infrastructure such as UPI and Aadhaar are widening access, compressing delivery costs, and encouraging product innovation. Rapid gains in smartphone penetration continue to expand the total addressable population, while millennial and Gen-Z wealth creation fuels demand for investment and credit products that are digital first. Competition remains intense as payments-led super-apps move laterally into lending, insurance, and wealth, and as specialist challengers carve profitable niches in premium credit, gig-worker finance, and cross-border payments. Rising participation from Tier II and Tier III cities, together with international UPI linkages, signals a structural broadening of growth opportunities across customer segments and geographies.

India Fintech Market Trends and Insights

Government-Built Digital Public Infrastructure Accelerating Mass-Market Adoption

Monthly UPI volumes exceeded 15 billion in November 2024, moving USD 280 billion in value. Aadhaar-enabled eKYC has cut onboarding costs from USD 15-20 to USD 0.5, allowing providers to serve low-income users profitably. More than 508 million Indians now access formal financial services through the JAM trinity, enlarging the India fintech market pool for payments, lending, and insurance. Direct benefit transfers delivered over USD 427 billion have entrenched digital rails in everyday transactions. The open, interoperable architecture reduces integration friction for private players, which in turn spurs product launches and cross-sector collaborations.

Account Aggregator Framework Unlocking Data-Driven Credit

Since its launch in 2021, the AA system has enabled consent-based sharing of verified financial records, allowing lenders to score borrowers who lack formal histories. By 2025, it is set to channel credit flows nearing USD 300 billion to MSMEs and retail customers. The ability to pull utility-bill and transaction data cuts approval times and lowers default risk, underpinning the expansion of digital lending platforms within the India fintech market. Policy makers view AA as a cornerstone for future digital credit rails that balance innovation with consumer protection.

RBI's Stricter Digital-Lending & FLDG Norms Raising Compliance Cost

Regulations issued in 2022 and updated in 2023 require direct fund flows between borrowers and regulated entities, detailed APR disclosures, and caps on default-loss guarantees at 5% of loan portfolios. Compliance spending has climbed 15-20%, squeezing smaller lenders. Cooling-off windows and data-storage mandates have prompted revisions to short-term products, slowing expansion plans and trimming profitability in the India fintech market.

Other drivers and restraints analyzed in the detailed report include:

- Embedded-Finance Demand from E-commerce and the Gig Economy

- Formalization of MSMEs Post-GST: Creating New Demand Pools

- Zero-MDR Policy Compressing Payment-Gateway Profit Pools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments accounted for 42.9% of India's fintech market share in 2024, underpinned by 131 billion UPI transactions in FY24. Continued smartphone adoption and merchant acceptance are expected to keep the segment on a high-growth track, even as revenue models shift toward value-added services. Industry incumbents deepen engagement by layering credit, insurance, and wealth products, thereby lengthening user lifecycles and raising per-customer margins. Competitive intensity remains elevated as global tech giants, banks, and home-grown players fight for daily transaction flow.

Neobanking is projected to post a 19.62% CAGR through 2030, the fastest among all propositions. Digital-only challengers partner with licensed banks to offer full-stack mobile accounts, automated budgeting, and alternative lending for freelancers and MSMEs. As regulatory frameworks mature and APIs standardize, neobanks expand beyond urban elites into vernacular interfaces and segment-specific offerings. The widening customer base, combined with low overheads, positions neobanks to steadily lift their contribution to the India fintech market size.

The India Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), and by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Paytm (One97 Communications Ltd)

- PhonePe Pvt Ltd

- Razorpay Software Pvt Ltd

- Pine Labs Pvt Ltd

- PayU Payments Pvt Ltd

- BharatPe (Resilient Innovations Pvt Ltd)

- MobiKwik (One MobiKwik Systems Ltd)

- PolicyBazaar (PB Fintech Ltd)

- Zerodha Broking Ltd

- Upstox (RKSV Securities India Pvt Ltd)

- Groww (Nextbillion Technology Pvt Ltd)

- Cred Financial Technologies Pvt Ltd

- Slice (GaragePreneurs Internet Pvt Ltd)

- KreditBee (Finnov Pvt Ltd)

- Lendingkart Finance Ltd

- Capital Float (Axio Digital)

- NeoGrowth Credit Pvt Ltd

- Navi Technologies Ltd

- Jupiter (Amica Finance Pvt Ltd)

- NIYO Solutions Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-Built Digital Public Infrastructure (UPI, Aadhaar, OCEN) Accelerating Mass-Market Adoption

- 4.2.2 Account Aggregator Framework Unlocking Data-Driven Credit Underwriting

- 4.2.3 Embedded-Finance Demand from E-commerce & Gig-Economy Platforms

- 4.2.4 Formalization of MSMEs post-GST Creating New SME Fintech Demand Pools

- 4.2.5 Millennial & Gen-Z Wealth Creation Driving Low-Cost Robo-Advisory Uptake

- 4.2.6 Cross-Border UPI Linkages (e.g., Singapore, UAE) Opening New Remittance Revenues

- 4.3 Market Restraints

- 4.3.1 RBI's Stricter Digital-Lending & FLDG Norms Raising Compliance Cost

- 4.3.2 Zero-MDR Policy Compressing Payment-Gateway Profit Pools

- 4.3.3 Escalating Cyber-Fraud Incidents Undermining Consumer Trust

- 4.3.4 Post-2022 Funding Winter Constraining Scale-Up Capital

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Paytm (One97 Communications Ltd)

- 6.4.2 PhonePe Pvt Ltd

- 6.4.3 Razorpay Software Pvt Ltd

- 6.4.4 Pine Labs Pvt Ltd

- 6.4.5 PayU Payments Pvt Ltd

- 6.4.6 BharatPe (Resilient Innovations Pvt Ltd)

- 6.4.7 MobiKwik (One MobiKwik Systems Ltd)

- 6.4.8 PolicyBazaar (PB Fintech Ltd)

- 6.4.9 Zerodha Broking Ltd

- 6.4.10 Upstox (RKSV Securities India Pvt Ltd)

- 6.4.11 Groww (Nextbillion Technology Pvt Ltd)

- 6.4.12 Cred Financial Technologies Pvt Ltd

- 6.4.13 Slice (GaragePreneurs Internet Pvt Ltd)

- 6.4.14 KreditBee (Finnov Pvt Ltd)

- 6.4.15 Lendingkart Finance Ltd

- 6.4.16 Capital Float (Axio Digital)

- 6.4.17 NeoGrowth Credit Pvt Ltd

- 6.4.18 Navi Technologies Ltd

- 6.4.19 Jupiter (Amica Finance Pvt Ltd)

- 6.4.20 NIYO Solutions Pvt Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment