|

市場調查報告書

商品編碼

1850986

金融科技:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

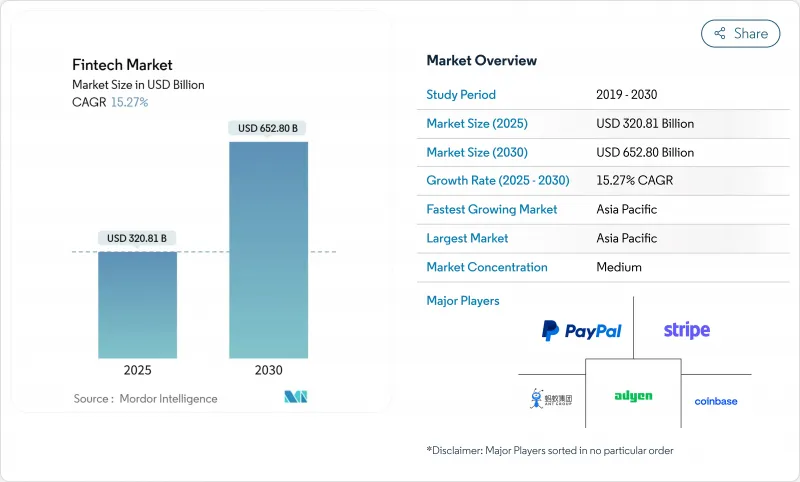

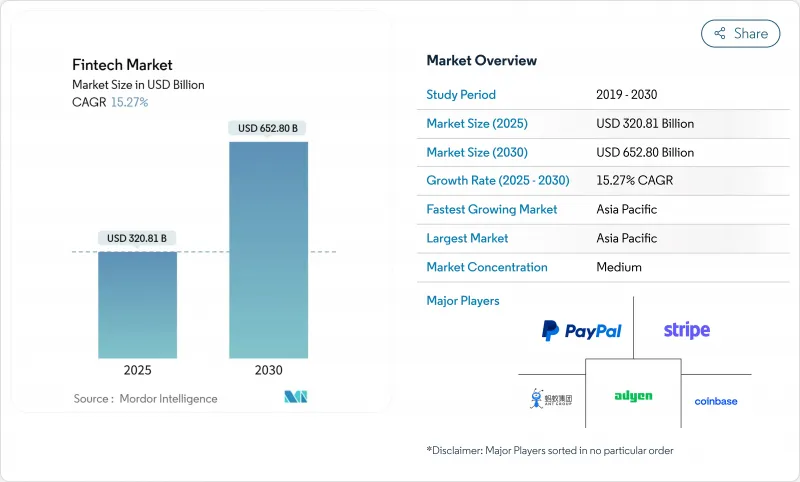

全球金融科技市場預計到 2025 年將達到 3,208.1 億美元,到 2030 年將達到 6,528 億美元。

強勁的利多因素包括:監管協調促進跨境擴張、即時支付管道加速交易流程以及開放銀行數據的更廣泛獲取。隨著平台巨頭將情境化金融融入日常數位體驗,商業與金融服務的落差日益縮小,競爭也日益激烈。用於詐欺預防、信用評估和個人化服務的AI工具正從實驗性試點階段走向大規模部署,這使得擁有深厚數據能力的公司更具優勢。同時,資本市場也重新向盈利的金融科技業者開放,使它們能夠籌集新資金籌措用於產品擴張和策略性收購。

全球金融科技市場趨勢與洞察

強制性即時支付將加速金融科技的普及應用。

美國的FedNow和歐洲的SEPA即時信用轉帳等央行系統正在將支付預期從數小時縮短至數秒。更快的支付方式為資金管理、小額貸款和現金流分析等領域帶來了新的價值提案,幫助金融科技市場拓展先前依賴速度較慢的批量處理的企業客戶。預計到2025年,美國的即時交易量將達到74億筆,中國、英國和香港也將呈現類似的成長動能。整合支付請求、自動對帳和即時貸款等附加服務的供應商可以獲得基於相同支付體系的持續收入來源。監管機構設定明確的過渡期限並更新最終結算規則後,快速普及的速度將最快。儘管支付網路互通性仍然是下一個挑戰,但連接國內快速支付系統的初步試驗已經證明了跨境模式的可行性。

開放銀行和API標準化擴大了資料存取範圍

歐洲的PSD2和巴西的開放金融體系表明,統一的API規範如何能夠大規模地實現帳戶聚合、餘額確認和直接銀行支付。標準化的授權流程將競爭焦點從資料囤積轉向資料利用,從而促進了預測性核保和高度個人化的預算工具的開發。監管機構現在將開放金融視為關鍵的數位基礎設施,其在美洲和亞太部分地區的應用正在加速。將金融科技銀行提供的數據與商家、通訊業者和社交訊號結合的平台建構了更豐富的風險模型,從而降低了違約率並擴大了信貸覆蓋範圍。這種模式正在培育一個可互通的金融科技市場生態系統,在這個生態系統中,規模較小的供應商可以利用第三方分析,並在服務品質而非客戶覆蓋範圍方面與現有企業競爭。

加強對先買後付模式的監管

英國、美國和澳洲的消費者保護機構正在起草相關規則,將「先買後付」(BNPL)產品歸類為信貸產品,並強制要求進行支付能力審核、標準化資訊揭露和困難通訊協定。服務提供者必須整合軟體查詢信用機構,升級爭議解決流程,並調整收入模式,減少對滯納金的依賴。合規成本將會增加,進而推動產業整合,並與已持有貸款執照的受監管金融機構建立合作關係。雖然零售商短期內可能不會迅速採用「先買後付」結帳方式,但透明的條款有望隨著時間的推移擴大其潛在客戶群。一旦統一的框架建立,那些積極整合符合金融科技監管規定的資料欄位和還款分析技術的公司將佔據有利地位。

細分市場分析

新銀行雖然在金融科技市場中所佔佔有率較小,但到2030年將以18.7%的複合年成長率快速成長,標誌著銀行業正從以分店為中心向以應用程式為中心發生決定性轉變。更快的功能、透明的定價和個人化的洞察,使新銀行能夠吸引更年輕、更依賴行動裝置的消費者。傳統金融機構將透過加速建立數位子公司和核心銀行系統現代化來應對,縮小體驗差距,同時增加技術預算。數位支付解決方案仍將是獲取客戶的重要途徑,預計到2024年將佔據金融科技市場佔有率的46.2%。服務提供者正在將詐欺分析、忠誠度整合和營運資金貸款等功能疊加到支付管道中,將低利潤的處理環節轉化為捆綁式加值提案,從而提高客戶終身收入。

除了錢包和銀行卡之外,保險科技 (InsurTech)、財富科技 (WealthTech) 和監管科技 (RegTech) 正在開闢獨特的道路,資料科學和自動化正在顛覆傳統流程。基於使用量的保險和人工智慧驅動的理賠分流正在降低保險公司的賠付率,並吸引保險公司與雲端供應商進行合資合作。在財富管理領域,部分所有權和自動再平衡正在使投資更加民主化,而合規自動化工具則正在將新的報告義務貨幣化。能夠在單一體驗中編配多種服務的提案將決定未來的贏家,金融科技平台正在朝向模組化架構發展,使用戶能夠在支付、信貸、儲蓄和保障之間自由切換。

區域分析

亞太地區將在2024年佔據全球金融科技市場44.86%的佔有率,並在2030年之前以16.02%的複合年成長率成長。中國的超級應用生態系統和印度的UPI支付系統,以及東南亞降低進入門檻的數位銀行牌照項目,都在推動該地區的成長。各國政府正將金融科技視為普惠金融的槓桿,簡化電子KYC規範並建立監理沙盒。區域內的現有企業也紛紛設立策略性創投部門,為新興企業注入資金,利用其創新能力,並對沖顛覆性風險。

儘管用戶滲透率日趨成熟,北美仍是創新強勁的地區。人工智慧驅動的個人化服務、加密資產服務和雲端原生核心銀行系統正在成為差異化服務,監管機構也為穩定幣和數位資產託管提供了明確的指南。吸取了重大網路安全事件的教訓,資金籌措正轉向擁有安全資料交換通訊協定的公司。該地區的金融科技市場持續受益於雄厚的資本市場,這些市場對績效可靠的收入留存率和交叉銷售指標給予獎勵。

歐洲的監理領導力正在塑造金融科技的發展軌跡。 PSD2促進了開放銀行平台的建設,MiCA使加密資產發行更加透明,DORA則制定了嚴格的營運彈性規則。這些框架催生了專業的監管科技供應商和合規即服務產品,從而開闢了新的收入來源。歐洲的新興銀行在多幣種體系下提供在地化服務,並採用跨幣種牌照制度以擴大規模。此外,綠色金融的迫切需求也推動了氣候數據平台的發展,這些平台能夠衡量交易層面的範圍3排放。

南美洲的支付普及率正快速攀升,這主要得益於巴西的PIX即時支付網路。龐大的無銀行帳戶人口和行動優先的消費習慣,使其成為電子錢包提供商、數位貸款機構和微型保險計劃的沃土。監管開放的銀行帳戶測試環境吸引了國際資本,而本土領導企業則透過提供低成本匯款和與公用事業收費帳單記錄掛鉤的信用評分,不斷擴大該地區的規模。隨著基礎設施的日趨成熟,該地區正向其他新興市場輸出人才和產品框架。

中東和非洲蘊藏著多元化的商業機會。波灣合作理事會成員國正在發放數位銀行牌照,扶持政府支持的金融科技加速器,並將國家財富投資於以人工智慧為中心的金融計畫。非洲的行動支付網路在交易量方面保持全球領先地位,匯款通道也正在與僑民電子錢包進行整合。區域金融科技主題包括符合伊斯蘭教法的嵌入式金融、低手續費的跨境匯款以及利用衛星農業數據促進的農業投入融資。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 透過即時支付授權(FedNow、SEPA即時信用轉帳)加速金融科技的普及

- 開放銀行和API標準化(PSD2、巴西開放金融)擴大資料訪問

- 中國和印度的央行數位貨幣試點計畫推動基礎設施升級

- 亞洲電子商務平台嵌入式金融的興起

- 中東、北非和拉丁美洲中小企業信貸缺口推動了數位借貸平台的發展

- 與ESG相關的金融科技解決方案吸引了歐洲綠色投資基金。

- 市場限制

- 加強對先買後付模式的監管

- 複雜的詐騙和深度造假會帶來身分風險。

- 雲濃度過高可能導致單點故障風險

- 冬季資金籌措和估值調整抑制了規模擴張

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資和資金籌措趨勢分析

第5章 市場規模與成長預測

- 按服務方案

- 數位支付

- 數位借貸和金融

- 數位投資

- 保險科技

- 新銀行

- 最終用戶

- 零售

- 公司

- 透過使用者介面

- 行動應用

- 網頁/瀏覽器

- POS/物聯網設備

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比荷盧經濟聯盟(比利時、荷蘭、盧森堡)

- 北歐國家(瑞典、挪威、丹麥、芬蘭、冰島)

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞(新加坡、印尼、馬來西亞、泰國、越南、菲律賓)

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- PayPal Holdings Inc.

- Ant Group Co. Ltd.

- Stripe Inc.

- Block Inc.(Square, Cash App)

- Adyen NV

- Coinbase Global Inc.

- Robinhood Markets Inc.

- Revolut Ltd.

- Klarna Bank AB

- N26 GmbH

- SoFi Technologies Inc.

- Nubank(Nu Holdings)

- Wise plc

- Afterpay Ltd.

- FIS Global

- Fiserv Inc.

- Intuit Inc.

- M-PESA(Vodafone/Safaricom)

- Paytm Digital Payments Ltd.

- Razorpay Software Pvt Ltd.

第7章 市場機會與未來展望

The global fintech market reached USD 320.81 billion in 2025 and is forecasted to climb to USD 652.80 billion by 2030, reflecting a sturdy 15.27% CAGR over the period.

Strong tailwinds include harmonizing regulations that ease cross-border expansion, real-time payment rails that accelerate transaction flows, and widening access to open-banking data. Competitive intensity is heightening as platform giants embed contextual finance into everyday digital journeys, shrinking the gap between commerce and financial services. Artificial-intelligence tools for fraud prevention, credit decisioning, and personalized offers are moving from experimental pilots to scale deployments, tilting the advantage toward firms with deep data capabilities. Simultaneously, capital markets are reopening for profitable fintech operators, enabling fresh funding for product expansion and strategic acquisitions.

Global Fintech Market Trends and Insights

Real-time payments mandates accelerating fintech adoption

Central-bank systems such as FedNow in the United States and SEPA Instant Credit Transfer in Europe are transforming settlement expectations from hours to seconds. Faster clearing underpins new value propositions in treasury management, micro-lending, and cash-flow analytics, helping the fintech market reach enterprise customers that once relied on slower batch processes. In 2025, U.S. real-time transactions are expected to hit 7.4 billion, and similar momentum is visible in China, the United Kingdom, and Hong Kong. Providers that integrate overlay services-request to pay, automated reconciliation, and just-in-time financing-gain sticky revenue streams grounded in the same rails. Adoption is most rapid where regulators set explicit migration deadlines and update settlement finality rules. Payment-network interoperability remains the next hurdle, but pilots linking domestic faster-payment systems already demonstrate viable cross-border models.

Open-banking & API standardization broadening data access

PSD2 in Europe and Brazil's Open Finance regime prove that uniform API specifications can unlock account aggregation, balance verification, and direct-from-bank payments at scale. Standardized consent flows shift competition away from data hoarding toward data utilization, encouraging predictive underwriting and hyper-personalized budgeting tools. Regulators now treat open finance as critical digital infrastructure, prompting adoption across the Americas and parts of Asia-Pacific. Fintech platforms that pair bank-sourced data with merchant, telecom, or social signals create richer risk models, lowering default rates and broadening credit access. The pattern is fostering interoperable fintech market ecosystems where smaller providers tap third-party analytics to compete against incumbents on service quality rather than raw customer reach.

Regulatory clamp-down on BNPL models

Consumer-protection agencies in the United Kingdom, the United States, and Australia are drafting rules that classify BNPL products as credit, mandating affordability checks, standardized disclosures, and hardship protocols. Providers must integrate soft-pull credit bureaus, upgrade dispute-resolution workflows, and adjust revenue models away from late-fee dependency. Compliance costs rise, encouraging consolidation and alliances with regulated lenders that already hold lending licenses. Retailers may experience slower BNPL checkout adoption in the near term, but transparent terms could expand the addressable base over time. Fintech firms that pre-emptively embed regulation-ready data fields and repayment analytics create defensible positions once uniform frameworks crystallize.

Other drivers and restraints analyzed in the detailed report include:

- CBDC pilots in China & India driving infrastructure upgrades

- Rise of embedded finance among Asian e-commerce platforms

- Sophisticated fraud & deepfake-based identity risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Neobanking accounts for a modest slice of the fintech market size yet posts the fastest 18.7% CAGR to 2030, signaling a decisive shift from branch-centric to app-centric banking. Feature velocity, transparent pricing, and personalized insights allow neobanks to capture young, mobile-first consumers. Established lenders react with digital subsidiaries and accelerated core-bank modernization, narrowing the experiential gap but raising technology budgets. Digital-payments solutions hold 46.2% of the fintech market share in 2024 and remain vital gateways for customer acquisition. Providers layer fraud-analytics, loyalty integrations, and working-capital loans onto payment rails, turning low-margin processing into bundled value propositions that lift customer lifetime revenue.

Expanding beyond wallets and cards, insurtech, wealth-tech, and reg-tech carve specialized lanes where data science and automation can upend legacy processes. Usage-based insurance and AI-driven claims triage cut carrier loss ratios, attracting joint ventures between insurers and cloud vendors. In wealth management, fractional ownership and automated rebalancing democratize investing, while compliance-automation tools monetize new reporting mandates. The ability to orchestrate multiple service propositions within a single experience defines future winners, pushing fintech platforms toward modular architectures that let users toggle between payments, credit, savings, and protection.

The Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices), and by Region (North America, South America, Europe, Asia-Pacific, & Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 44.86% of the fintech market in 2024 and is on track for a 16.02% CAGR through 2030. China's super-app ecosystem and India's UPI rails anchor regional growth, joined by Southeast Asian digital-bank license programs that lower entry barriers. Governments treat fintech as a lever for economic inclusion, streamlining e-KYC norms and nurturing sandboxes. Regional incumbents respond with strategic venture arms that inject capital into start-ups, hedging disruption risk while tapping novel capabilities.

North America remains an innovative powerhouse despite maturing user penetration. AI-driven personalization, crypto-asset services, and cloud-native core banking differentiate offerings as regulators provide clearer guidance on stablecoins and digital-asset custody. Venture funding gravitates toward firms with secure data-exchange protocols, reflecting lessons from high-profile cyber incidents. The fintech market in the region continues to benefit from deep capital markets that reward proven revenue retention and cross-selling metrics.

Europe's regulatory leadership shapes its fintech trajectory. PSD2 catalyzed open-banking platforms, MiCA brings clarity to crypto-asset issuance, and DORA sets stringent operational-resilience rules. These frameworks spawn specialized reg-tech vendors and compliance-as-a-service products, adding new revenue layers. Continental neobanks localize services across multi-currency regimes while passporting licenses to scale. Additionally, green-finance imperatives stimulate climate-data fintech platforms that measure scope-3 emissions at the transaction level.

South America showcases rising adoption curves anchored by Brazil's PIX instant-payment network. Large unbanked populations and mobile-first behavior create fertile ground for wallet providers, digital lenders, and micro-insurance schemes. Regulatory openness to sandbox testing attracts international capital, and domestic champions scale regionally by offering low-cost remittances and credit scoring tied to utility-bill histories. As the infrastructure matures, the region exports talent and product frameworks to other emerging markets.

Middle East and Africa present heterogeneous opportunity sets. Gulf Cooperation Council states issue digital-bank licenses, host government-backed fintech accelerators, and invest sovereign wealth in AI-centric finance ventures. Africa's mobile-money rails remain the world leading in transaction volume, and remittance corridors integrate with diaspora wallets abroad. Regional fintech themes include Sharia-compliant embedded finance, low-fee cross-border transfers, and agricultural-input lending facilitated via satellite agronomy data.

List of Companies Covered in this Report:

- PayPal Holdings Inc.

- Ant Group Co. Ltd.

- Stripe Inc.

- Block Inc. (Square, Cash App)

- Adyen N.V.

- Coinbase Global Inc.

- Robinhood Markets Inc.

- Revolut Ltd.

- Klarna Bank AB

- N26 GmbH

- SoFi Technologies Inc.

- Nubank (Nu Holdings)

- Wise plc

- Afterpay Ltd.

- FIS Global

- Fiserv Inc.

- Intuit Inc.

- M-PESA (Vodafone / Safaricom)

- Paytm Digital Payments Ltd.

- Razorpay Software Pvt Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-time Payments Mandates (FedNow, SEPA Instant Credit Transfer) Accelerating Fintech Adoption

- 4.2.2 Open-Banking & API Standardization (PSD2, Brazil Open Finance) Broadening Data Access

- 4.2.3 CBDC Pilots in China & India Driving Fintech Infrastructure Upgrades

- 4.2.4 Rise of Embedded-Finance Among Asian E-commerce Platforms

- 4.2.5 SME Credit Gap in MENA & South America Fueling Digital Lending Platforms

- 4.2.6 ESG-Linked Fintech Solutions Attracting Green-Investment Funds in Europe

- 4.3 Market Restraints

- 4.3.1 Regulatory Clamp-down on BNPL Models

- 4.3.2 Sophisticated Fraud & Deepfake?based Identity Risks

- 4.3.3 Cloud-Concentration Risk Creating Single Points-of-Failure

- 4.3.4 Funding Winter & Valuation Corrections Curbing Scale-ups

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Region

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Colombia

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Benelux (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 Nordics (Sweden, Norway, Denmark, Finland, and Iceland)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 PayPal Holdings Inc.

- 6.4.2 Ant Group Co. Ltd.

- 6.4.3 Stripe Inc.

- 6.4.4 Block Inc. (Square, Cash App)

- 6.4.5 Adyen N.V.

- 6.4.6 Coinbase Global Inc.

- 6.4.7 Robinhood Markets Inc.

- 6.4.8 Revolut Ltd.

- 6.4.9 Klarna Bank AB

- 6.4.10 N26 GmbH

- 6.4.11 SoFi Technologies Inc.

- 6.4.12 Nubank (Nu Holdings)

- 6.4.13 Wise plc

- 6.4.14 Afterpay Ltd.

- 6.4.15 FIS Global

- 6.4.16 Fiserv Inc.

- 6.4.17 Intuit Inc.

- 6.4.18 M-PESA (Vodafone / Safaricom)

- 6.4.19 Paytm Digital Payments Ltd.

- 6.4.20 Razorpay Software Pvt Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment