|

市場調查報告書

商品編碼

1911285

中東和北非金融科技市場:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031 年)MENA Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

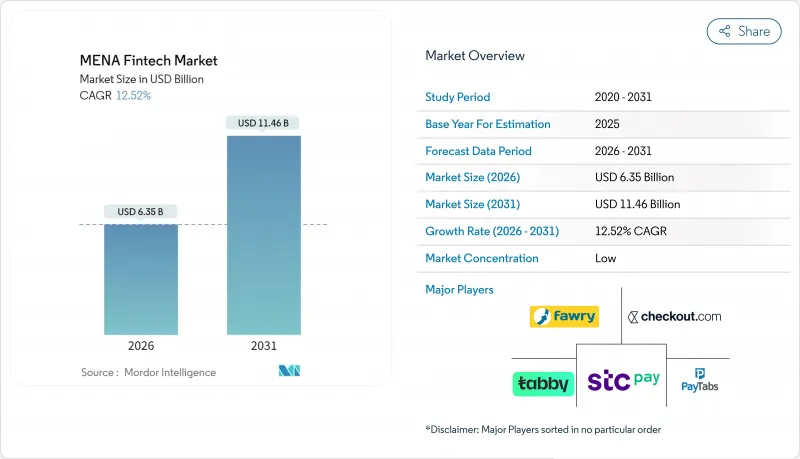

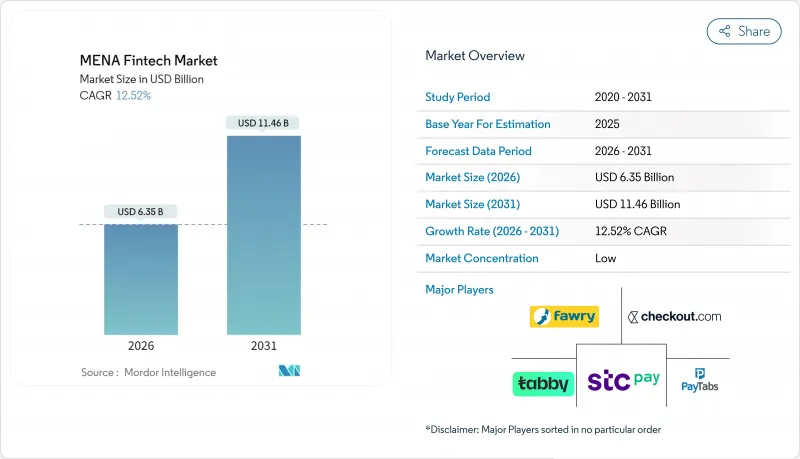

預計到 2026 年,中東和北非的金融科技市場規模將達到 63.5 億美元。

這意味著從 2025 年的 56.5 億美元成長到 2031 年的 114.6 億美元,預計 2026 年至 2031 年的年複合成長率(CAGR)為 12.52%。

無現金支付政策的擴展、智慧型手機普及率的提高以及創業投資的持續流入,正在擴大數位金融服務的目標基本客群。海灣合作理事會(GCC)和埃及的央行數位貨幣(CBDC)試點計畫正在推動支付基礎設施的現代化,而沙烏地阿拉伯、阿拉伯聯合大公國和約旦的監管沙盒則縮短了產品推出週期。同時,電子商務、零工經濟和匯款通道正在推動嵌入式金融應用場景的發展。產業相關人員正透過平台多元化和跨境夥伴關係來應對這些挑戰,從而創造新的收入來源並整合分散的業務。

中東和北非金融科技市場趨勢與洞察

政府的無現金和普惠金融政策加速了對金融科技的需求。

沙烏地阿拉伯的目標是到2030年實現70%的交易無現金化,埃及的目標是到2025年使50%的成年人擁有銀行帳戶,而阿拉伯聯合大公國的目標是到2024年簡化其許可製度。這些目標為推廣應用提供了明確的基準,並降低了私人營運商的市場進入門檻。約旦的監管沙盒進一步降低了監管風險,幫助Start-Ups拓展業務,同時降低監管成本。隨著各國政府推動工資支付和福利金的數位化,消費者越來越親和性電子錢包,降低了獲客成本。這些政策鼓勵零售商採用非接觸式支付並擴展支付網路。這些舉措正在形成良性循環,推動中東和北非金融科技市場的成長。

行動網際網路普及率的快速成長使得行動優先的資金取得成為可能。

在海灣合作理事會(GCC)國家,智慧型手機普及率已超過80%,行動端已成為銀行業務的預設管道。在阿拉伯聯合大公國,數位錢包已佔銷售點消費的18%,預計2027年將達到33%。在埃及和摩洛哥,基於通訊業者的代理模式繞過了分店網點,在降低業務成本的同時擴大了覆蓋範圍。 Z世代用戶透過數位錢包消費佔該地區電子商務消費的23%,並正在養成永續的支付習慣。北非地區4G/5G網路覆蓋範圍的擴展使得遠端客戶身份驗證(KYC)成為可能,從而開拓了新的客戶群。行動優先模式正在推動所有消費群體市場佔有率的快速成長。

按司法管轄區分類的監管措施增加了合規負擔。

19種不同的許可證制度要求金融科技公司為每個市場設立獨立的法律實體,與統一的框架相比,這會使營運成本增加15%至25%。不一致的資本管制和數據本地化規則阻礙了企業獲得許可,並減緩了區域擴張。大型企業可以承擔這些成本,但Start-Ups面臨資源短缺,創新多樣性也受到限制。缺乏相互核准也阻礙了跨境開放API的整合,造成了整合死角。投資者正在將風險因素納入估值考量,並鼓勵企業透過整合來規避跨國擴張。

細分市場分析

到2025年,數位支付將佔中東和北非地區金融科技市場54.12%的佔有率,這主要得益於智慧型手機錢包的普及和積極的商家獲客獎勵。該細分市場新增了QR碼支付和代幣化錢包支付等支付管道,進一步提升了客戶留存率。數位借貸雖然規模較小,但憑藉即時替代數據評分的優勢,正以17.74%的複合年成長率快速成長。 Fawley預計2025年將新增10億埃及鎊的貸款,標誌著該公司正從支付領域擴展到信貸領域。

智慧投顧和保險科技公司正透過API優先的管道擴張,而像STC銀行這樣的新型銀行則在將電子錢包用戶群轉化為全方位服務帳戶。監管沙盒正在推動參數化和基於使用量的保險業務,鼓勵創新實驗。支付品牌正在同一應用程式中添加信貸、投資和保險選項卡,從而創造交叉銷售協同效應並提高用戶終身價值。這種多元化趨勢表明,中東和北非地區金融科技市場的平台融合正在加速。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府強制推行無現金交易和普惠金融

- 行動網際網路普及率快速成長

- 創業投資與資金籌措沙盒發展

- 透過央行數位貨幣試點計畫實現跨境付款基礎

- 電子商務與零工平台蘊含的金融需求

- 即時支付基礎設施支援替代貸款數據

- 市場限制

- 不同司法管轄區的監管碎片化

- 在北非,以現金交易為中心的消費習慣正在推高客戶獲取成本(CAC)。

- 缺乏阿拉伯語人工智慧/機器學習風險評分資料集

- 傳統核心銀行IT系統存在的瓶頸

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過服務提案

- 數位支付

- 數字借貸和資金籌措

- 數位投資

- 保險科技

- 新銀行

- 最終用戶

- 零售

- 公司

- 透過使用者介面

- 行動應用

- 網頁/瀏覽器

- POS/物聯網設備

- 按地區

- GCC

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 巴林

- 科威特

- 阿曼

- 北非

- 埃及

- 摩洛哥

- 阿爾及利亞

- 突尼西亞

- 黎凡特

- 約旦

- 黎巴嫩

- GCC

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

第7章 市場機會與未來展望

MENA fintech market size in 2026 is estimated at USD 6.35 billion, growing from 2025 value of USD 5.65 billion with 2031 projections showing USD 11.46 billion, growing at 12.52% CAGR over 2026-2031.

A surge in cash-lite policy mandates, broad smartphone availability, and growing venture-capital inflows are expanding the addressable base for digital financial services. Central-bank digital-currency (CBDC) pilots in the GCC and Egypt are modernizing payment rails, while regulatory sandboxes in Saudi Arabia, the UAE, and Jordan shorten product launch cycles. At the same time, e-commerce, gig-economy, and remittance corridors are fuelling embedded-finance use cases. Industry participants respond through platform diversification and cross-border partnerships that create new revenue streams and consolidate fragmented positions.

MENA Fintech Market Trends and Insights

Government Cash-Lite & Financial-Inclusion Mandates Accelerate Fintech Demand

Saudi Arabia targets 70% cashless transactions by 2030, Egypt aims to bank 50% of adults by 2025, and the UAE streamlined licensing in 2024. These targets provide clear metrics for adoption and reduce go-to-market friction for private players. Sandboxes in Jordan further cut regulatory risk, helping startups scale without prohibitive compliance spend. As governments digitize payroll and welfare transfers, consumer familiarity with e-wallets rises, lowering acquisition costs. The policy push also incentivizes retailers to deploy contactless acceptance, enlarging acceptance networks. Collectively, mandates create a virtuous circle that widens the MENA fintech market.

Mobile & Internet Penetration Surge Enables Mobile-First Financial Access

Smartphone penetration tops 80% in GCC states, turning mobiles into the default banking channel. The UAE already sees digital wallets covering 18% of POS spend, on track for 33% by 2027. Egypt and Morocco extend reach through telco-based agent models, bypassing branch infrastructure and shrinking operating costs. Gen Z users account for 23% of regional e-commerce spend via digital wallets, establishing lasting payment habits. Growing 4G/5G coverage in rural North Africa enables remote KYC onboarding, unlocking new customer pools. The mobile-first model thus propels rapid share gains across consumer cohorts.

Regulatory Fragmentation Across Jurisdictions Increases Compliance Burden

Nineteen different licensing regimes require fintechs to form market-specific entities, adding 15-25% to overheads versus unified frameworks. Disparate capital and data-localization rules hinder passporting and delay regional scaling. Larger incumbents absorb the cost but startups face resource strain, limiting innovation diversity. Lack of mutual recognition also hampers cross-border open-API linkage, creating integration dead-zones. Investors price the risk into valuations, nudging consolidation as a workaround for multi-country reach.

Other drivers and restraints analyzed in the detailed report include:

- VC Funding & Sandbox Momentum Fuel Startup Formation

- CBDC Pilots Enabling Cross-Border Rails Create Common API Infrastructure

- Cash-Centric Habits Inflate Customer-Acquisition Costs in North Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital payments controlled 54.12% of MENA fintech market share in 2025, underpinned by near-ubiquitous smartphone wallets and aggressive merchant-acquiring incentives. The sub-segment added new rails such as QR and tokenized wallet checkout, further cementing stickiness. Digital lending, though smaller, is growing at an 17.74% CAGR on the strength of real-time alternative-data scoring. Fawry's EGP 1 billion disbursement surge in 2025 illustrates payments-to-credit adjacency.

Robo-advisory and insurtech expand via API-first distribution, while neobanks like STC Bank convert wallet bases into full-service accounts. Regulatory sandboxes allow parametric and usage-based policies, fostering experimentation. Cross-sell synergies emerge as payments brands add credit, investment, and insurance tabs within the same app, stretching user lifetime value. The diversification push points to escalating platform convergence across the MENA fintech market.

The MENA Fintech Market Report is Segmented by Service Proposition (Digital Payments, Digital Lending & Financing, Digital Investments, Insurtech, Neobanking), End-User (Retail, Businesses), User Interface (Mobile Applications, Web/Browser, POS/IoT Devices), and Geography (GCC, North Africa, Levant). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Fawry

- PayTabs

- Checkout.com

- Tabby

- Tamara

- STC Pay

- Paymob

- MNT-Halan

- Geidea

- Network International

- BenefitPay

- Careem Pay

- Lean Technologies

- HyperPay

- YAP

- Telda

- NymCard

- Sarwa

- OPay

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Govt cash-lite and financial-inclusion mandates

- 4.2.2 Mobile & internet penetration surge

- 4.2.3 VC funding & sandbox momentum

- 4.2.4 CBDC pilots enabling cross-border rails

- 4.2.5 Embedded-finance demand from e-commerce and gig platforms

- 4.2.6 Instant-payment rails unlocking alternative lending data

- 4.3 Market Restraints

- 4.3.1 Regulatory fragmentation across jurisdictions

- 4.3.2 Cash-centric habits inflating CAC in North Africa

- 4.3.3 Scarcity of Arabic AI/ML risk-scoring datasets

- 4.3.4 Legacy core-bank IT bottlenecks

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending & Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Geography

- 5.4.1 GCC

- 5.4.1.1 Saudi Arabia

- 5.4.1.2 United Arab Emirates

- 5.4.1.3 Qatar

- 5.4.1.4 Bahrain

- 5.4.1.5 Kuwait

- 5.4.1.6 Oman

- 5.4.2 North Africa

- 5.4.2.1 Egypt

- 5.4.2.2 Morocco

- 5.4.2.3 Algeria

- 5.4.2.4 Tunisia

- 5.4.3 Levant

- 5.4.3.1 Jordan

- 5.4.3.2 Lebanon

- 5.4.1 GCC

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Fawry

- 6.4.2 PayTabs

- 6.4.3 Checkout.com

- 6.4.4 Tabby

- 6.4.5 Tamara

- 6.4.6 STC Pay

- 6.4.7 Paymob

- 6.4.8 MNT-Halan

- 6.4.9 Geidea

- 6.4.10 Network International

- 6.4.11 BenefitPay

- 6.4.12 Careem Pay

- 6.4.13 Lean Technologies

- 6.4.14 HyperPay

- 6.4.15 YAP

- 6.4.16 Telda

- 6.4.17 NymCard

- 6.4.18 Sarwa

- 6.4.19 OPay

7 Market Opportunities & Future Outlook

- 7.1 Cross-border GCC-North Africa remittance corridors via tokenized wallets

- 7.2 Green Islamic fintech products aligned with ESG & Sharia mandates