|

市場調查報告書

商品編碼

1850362

自助倉儲:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Self Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

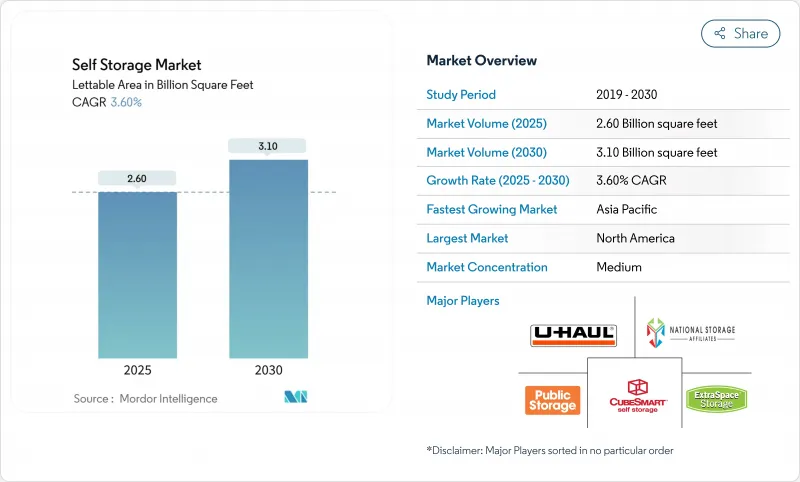

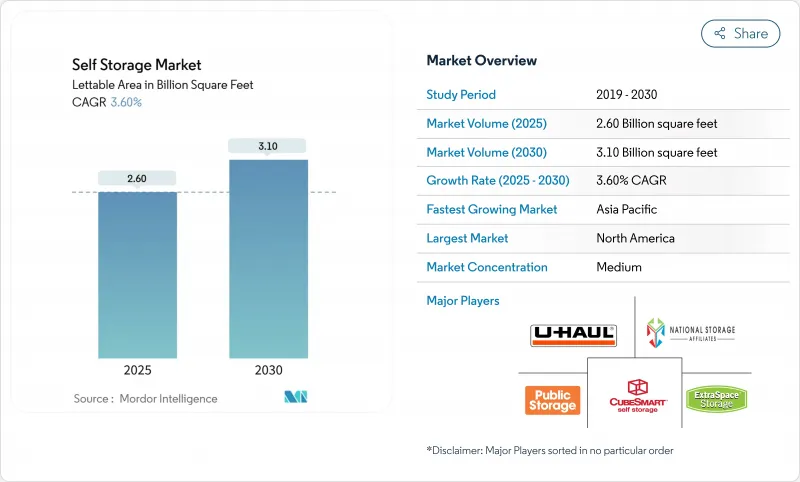

預計到 2025 年,自助倉儲市場面積將達到 26 億平方英尺,到 2030 年將達到 31 億平方英尺,年複合成長率為 3.6%。

目前,自助倉儲市場的成長主要依賴穩健的資產最佳化,而非疫情期間的大規模新建。都市化、電子商務小型企業的蓬勃發展以及對氣候適應型資產的保護,共同支撐著結構性需求;而數位化租賃平台則能為採用智慧門禁系統的企業降低高達25%的營運成本。上市房地產投資信託基金(REITs)的整合擴大了市場規模,同時許多城市的規劃限制也維持了較高的進入門檻,從而自助倉儲了租金市場。溫控倉儲空間目前已佔所有可出租空間的一半以上,且價格彈性最大,因為客戶願意為溫濕度控制支付溢價。整體而言,自助倉儲市場展現出穩健的現金流特徵,即使在極端天氣相關的保險費上漲的情況下,仍持續吸引機構資本的關注。

全球自助倉儲市場趨勢與洞察

都市化與居住空間縮小

大都會圈的快速人口成長是由求職者湧入人口密集的城市所驅動的,而這些城市的平均居住空間卻不斷縮小。預計到2030年,倫敦的人口將達到1000萬,這表明人均居住空間的減少意味著可支配支出正轉向外部存儲,而不是更大的住宅。千禧世代占美國租屋者的40%,他們的流動性越來越強,這表明他們對靈活居住的需求持續存在。雅加達、馬尼拉和墨西哥城也經歷了類似的密集化進程,從而帶動了對自助倉儲的相應需求。這種需求的產生是由於都市區租賃住房的普遍存在,租戶很少能管理自己的儲存空間,而且經常搬家。當住房負擔能力危機對居住空間帶來壓力時,自助倉儲市場就成為城市居住的可行延伸。

電子商務微型商家的激增

低門檻的線上零售模式允許創業者在家辦公,但需要靠近客戶的小型倉庫。因此,微型商家正在將標準儲物櫃改造成低成本的履約中心,從而加速提升其在自助倉儲市場的商業佔有率。營運商現在透過提供專為包裹取件設計的裝卸區、Wi-Fi 和全天候訪問,以及用於保護需要溫控的庫存區域,來實現差異化競爭。這種商業性趨勢提高了每平方英尺的平均收入,並提升了吞吐量,使其超越了傳統的個人儲存模式,成為核心利潤驅動力。這種轉變在人口密集的郊區尤為顯著,因為叫車配送車隊可以在一小時內送達消費者手中。

嚴格的區域分類與土地使用法規

市政當局越來越不鼓勵新建倉庫,而是傾向於發展員工人數更多、運轉率的零售和工業。自2019年以來,美國已有超過15個州頒布了倉庫建設禁令,歐洲一些城市議會也實施了類似的上限措施。雖然現有企業享有較高的入住率和價格優勢,但供應限制阻礙了新企業的進入,並促使棕地選擇對待開發區建築進行改造而非新建。因此,精通合規的開發商將混合用途元素(例如街角咖啡館和共享辦公空間)打包開發,以規避核准障礙,但這增加了計劃流程的複雜性和成本。

細分市場分析

儘管個人用戶仍佔據儲物櫃市場的大多數,但商業子部門的使用量正在不斷成長。商業用戶正以7.9%的複合年成長率快速成長,他們利用儲物櫃進行庫存清理、季節性促銷和文件歸檔,從而推動了最後一公里配送模式的現代化。隨著全通路零售商將庫存集中在更靠近消費者的位置以控制配送成本,商業自助倉儲市場規模將進一步擴大。個人用戶佔自助倉儲市場總量的60%,而諸如結婚、離婚和搬遷等可預見的人生大事是導致租約終止和續約的主要原因。非接觸式訪問的普及提高了兩個細分市場的自動化程度,87%的租戶更傾向於使用智慧型手機進入儲物櫃。

從營運角度來看,小型企業客戶的平均停留時間更長,並且會購買包裹取件等輔助服務,從而帶來更高的每平方英尺可用面積收入。對於個人使用者而言,恆溫儲物櫃因其適合存放傳家寶、電子產品和收藏品而價格更高。因此,營運商制定了混合型商品行銷,將親民的品牌形象與企業級裝卸平台功能結合。這種雙層模式在不稀釋品牌股權的前提下,擴大了可觸及的自助倉儲市場。

溫控倉儲佔庫存的52%,預計將以9.8%的複合年成長率成長,這主要得益於消費者對潮濕損害的日益關注以及電商商家對溫度穩定環境的需求。雖然開發成本在每平方英尺35至70美元之間,但營運商可享有20%至50%的租金回報率和約11%的年利潤率。標準非防風雨儲物櫃仍然是耐用品價格的領導者,但在極端天氣事件中面臨替代風險。可攜式貨櫃倉儲憑藉其門到門的便利性加劇了競爭,但該細分市場中資金較少的營運商往往缺乏土地資產來構建長期的市場准入壁壘。

該領域的經濟效益有利於那些設計便於靈活維修的資產——例如空調升級、太陽能通風系統——從而在氣候變遷預期上升的情況下,降低資本密集度。在高風險地區,保險公司越來越傾向於將抗震性能作為承保條件,這加速了隔熱單元的普及,而這些單元本身就擁有較高的租金。因此,氣候智慧型設計標準正逐漸成為新開發案的必備條件。

自助倉儲市場按使用者類型(個人、企業)、儲存類型(恆溫、非恆溫、可攜式/貨櫃、其他)、租賃期限(短期(小於3個月)、中期(3-12個月)、其他)、單元面積(小型(小於50平方英尺)、中型(50-100平方英尺))和地區進行細分。以上所有細分市場的市場規模和預測均以美元計價。

區域分析

北美將繼續保持主導地位,預計到2024年將佔全球銷售額的45%。成熟的自存倉收益率優於許多其他房地產資產類別,但紐約和波特蘭等城市的規劃限制正在減緩新增供應,並推動將過時的零售空間改造為垂直倉儲。北美自助倉儲市場規模受益於先進的數位平台,但受氣候變遷影響的沿海次級市場面臨著不斷上漲的保險成本。

亞太地區是成長最快的市場,複合年成長率達9.3%。以三菱地所和帕爾瑪(Parma)為代表的日本夥伴關係模式,正將機構資本引入提供非接觸式服務的多層設施。帕爾瑪的業務流程外包(BPO)引擎管理日本約60%的營運商,從而形成網路效應。澳洲的年市場規模達20億美元,入住率接近90%,吸引了貝萊德以4億美元收購StoreLocal,以及Public Storage以19億美元競標Abacus Storage。新加坡和韓國的成長速度相對較慢,但隨著其高密度公寓市場的成熟,非接觸式儲存的普及率也不斷提高。

歐洲正經歷穩定擴張,這得益於其1.5億平方英尺的辦公大樓存量,覆蓋近5億人口。舒爾加德預計2024年營收將達4.067億歐元(4.342億美元),較前一年成長13%。歐洲大陸的營運商正實現高運轉率,充分利用其多元化的用戶群體,包括搬家公司、小型企業和文件儲存公司。外匯收益和與辦公大樓市場週期較低的相關性,對尋求穩定收入的退休基金極具吸引力。

拉丁美洲和中東地區尚處於起步階段,但前景廣闊。墨西哥城和聖保羅的中階不斷壯大,電商經銷商需求旺盛,但所有權分散和機構資本有限阻礙了規模擴張。波灣合作理事會成員國也迎來了早期投資,因為外籍人士需要溫控空間來保護他們的物品免受酷暑侵襲。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 都市化與生活空間縮小

- 小型電子商務企業的崛起

- 住宅房地產價格上漲

- 數位化、非接觸式租賃平台

- 自助倉儲作為微型倉配中心

- 對具有氣候適應能力的資產保護的需求

- 市場限制

- 嚴格的區域分類與土地使用法規

- 成熟都會大都會圈供應過剩地區

- 極端天氣導致保險費上漲

- 智慧設施中的網路安全風險

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依使用者類型

- 個人

- 商業

- 依儲存類型

- 氣候控制

- 沒有空調

- 可攜式/容器為基礎的

- 車輛及特產(房車、船隻、葡萄酒)

- 按租賃期間

- 短期(少於3個月)

- 中期(3-12個月)

- 長期(12個月或以上)

- 按單位大小

- 小型(小於50平方英尺)

- 中等大小(50-100平方英尺)

- 大型(100-200平方英尺)

- 超大(超過 200 平方英尺)

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 亞洲

- 中國

- 日本

- 澳洲

- 印度

- 中東和非洲

- GCC

- 南非

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Public Storage

- Extra Space Storage Inc.

- U-Haul International Inc.

- CubeSmart LP

- National Storage Affiliates Trust

- Life Storage Inc.

- Safestore Holdings PLC

- StorageMart

- Shurgard Self-Storage SA

- Big Yellow Group PLC

- Prime Storage Group

- Metro Storage LLC

- SmartStop Asset Management LLC

- Clutter Inc.

- MakeSpace Inc.

- Kennards Self Storage

- Access Self Storage Ltd.

- Urban Self Storage Inc.

- Global Self Storage Inc.

- World Class Capital Group LLC(Great Value Storage)

- Amsdell Cos./Compass Self Storage

- All Storage

第7章 市場機會與未來展望

第8章 評估閒置頻段和未滿足的需求

The self storage market spans 2.6 billion square feet in 2025 and is forecast to reach 3.1 billion square feet by 2030, expanding at a 3.6% CAGR.

The self storage market now grows through disciplined asset optimization rather than the pandemic-era rush to build new sites. Urbanization, e-commerce micro-merchants, and climate-resilient asset protection underpin structural demand, while digitized leasing platforms trim operating expenses by up to 25% for operators deploying smart-access systems. Consolidation among public REITs raises operational scale, yet zoning limits in many cities keep barriers to entry high, supporting rental rate stability. Climate-controlled capacity-already more than half of total rentable space-shows the strongest price elasticity as customers pay premiums for temperature and humidity safeguards. Overall, the self storage market demonstrates durable cash-flow characteristics that continue to attract institutional capital even amid rising insurance costs linked to extreme weather.

Global Self Storage Market Trends and Insights

Urbanization & Shrinking Living Spaces

Rapid metropolitan population growth stems from job-seekers flocking to dense cities where average apartment footprints trend downward. London's population trajectory toward 10 million by 2030 illustrates how reduced per-capita living space channels discretionary spending into external storage rather than larger accommodation. Millennials-who make up 40% of U.S. renters-exhibit higher mobility, translating into recurring demand for flexible units. Similar densification in Jakarta, Manila, and Mexico City drives parallel storage uptake. Urban rental dominance magnifies this need because tenants rarely control on-site storage, and recurring relocations compound volume requirements. Where housing affordability crises squeeze living space, the self storage market becomes a practical extension of the urban dwelling.

Proliferation of E-commerce Micro-merchants

Low-barrier online retail models enable entrepreneurs to operate from homes yet require mini-warehousing close to customers. Micro-merchants therefore convert standard lockers into low-cost fulfillment nodes, accelerating the commercial share of the self storage market. Operators now differentiate by offering loading bays, Wi-Fi, and 24/7 access designed for shipment pick-ups, while climate-controlled sections protect temperature-sensitive inventory. This commercial pivot lifts average revenue per square foot and pushes throughput higher than traditional personal storage, making the segment a core margin driver. The shift is most visible in dense suburbs where ride-share delivery fleets can reach consumers within one-hour windows.

Stringent Zoning & Land-use Regulations

Municipalities increasingly block new storage construction, preferring retail or industrial developments with higher headcount and tax multipliers. More than 15 U.S. states have enacted moratoria since 2019, and European city councils apply similar caps. Existing operators see occupancy and pricing tailwinds, yet supply constraints hinder new entrants and encourage brownfield conversions over greenfield builds. Compliance-savvy developers thus bundle mixed-use components-street-level cafes, co-working zones-to pass entitlement hurdles, adding complexity and cost to the project pipeline.

Other drivers and restraints analyzed in the detailed report include:

- Rising Residential Real-estate Costs

- Self-storage as Micro-fulfillment Hubs

- Escalating Insurance Premiums from Extreme Weather

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The business sub-sector contributes rising volume even though personal customers still occupy the majority of lockers. Business users, expanding at a 7.9% CAGR, leverage units for inventory spill-over, seasonal promotions, and document archiving, thereby modernizing last-mile economics. Self storage market size for business users is set to accelerate as omnichannel retailers balance stock closer to consumers to suppress delivery costs. The personal segment retains 60% of overall self storage market share, anchored by predictable life-event triggers-marriage, divorce, relocation-that sustain churn and lease renewals. Contactless access means 87% of all renters now prefer smartphone entry, pushing automation across both sub-segment.

Operationally, small-business customers exhibit longer average stay durations and purchase ancillary services such as package acceptance, raising revenue per available square foot. For personal renters, climate-controlled lockers grant premium rates for heirlooms, electronics, and collectibles. Operators therefore engineer hybrid merchandising, combining residential-friendly branding with enterprise-grade dock features. This two-tier model widens the addressable self storage market without diluting brand equity.

Climate-controlled capacity represents 52% of stock and is forecast to grow at 9.8% CAGR, propelled by heightened consumer awareness of humidity damage and by e-commerce merchants seeking temperature-stable conditions. Development costs run USD 35-70 per square foot, yet operators enjoy 20-50% rental premiums and roughly 11% annual profit margins. Standard non-climate lockers remain price leaders for durable goods but face substitution risk where extreme weather intensifies. Portable container storage adds competitive pressure by offering door-to-door convenience; however, capex-light operators in this niche often lack land assets to secure long-term barriers to entry.

Segment economics favor assets engineered for flexible retrofits-HVAC upgrades, solar-powered ventilation-that keep capital intensity manageable as climate expectations rise. In high-risk zones, insurers increasingly condition coverage on resilient construction, accelerating adoption of insulated units that already command premium rents. As a result, climate-ready design standards are becoming table stakes for new developments.

The Self Storage Market Segments Into User Type (Personal, Business), by Storage Type (Climate-Controlled, Non-Climate-Controlled, Portable / Container-Based, and More), by Lease Duration (Short-Term (<3 Months), Mid-Term (3-12 Months) and More), Unit Size (Small (<50 Sq Ft), Medium (50-100 Sq Ft)) and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD) for all the Above Segments.

Geography Analysis

North America maintains leadership with 45% of global revenue in 2024, reflecting deep consumer familiarity and institutional consolidation. Mature yields exceed many real-estate asset classes, but zoning restrictions in cities such as New York and Portland slow new supply, encouraging conversions of obsolete retail into vertical storage. The self storage market size in North America benefits from advanced digital platforms, yet climate-exposed coastal sub-markets face insurance-driven cost inflation.

Asia-Pacific is the fastest-growing theater at 9.3% CAGR. Japan's partnership model-exemplified by Mitsubishi Estate and Palma-channels institutional capital into multi-story facilities offering contactless service, while Palma's BPO engine manages roughly 60% of national operators, creating network effects. Australia, valued at USD 2 billion annually, posts near 90% occupancy, enticing BlackRock's USD 400 million StoreLocal buy-in and Public Storage's USD 1.9 billion bid for Abacus Storage King Singapore and South Korea trail but show rising adoption as dense condo markets mature.

Europe delivers steady expansion underpinned by a 150 million sq ft stock base spread across almost 500 million inhabitants. Shurgard's revenue rose 13% YoY to EUR 406.7 million (USD 434.2 million) in 2024, with the Lok'nStore deal doubling its UK footprint and signaling ongoing consolidation . Continental operators leverage diverse user mixes-personal movers, SMEs, document-archiving firms-to achieve high occupancy. Currency-hedged returns and low correlation to office cycles attract pension funds seeking income stability.

Latin America and the Middle East remain nascent yet promising. Mexico City and Sao Paulo experience strong demand from growing middle classes and e-commerce sellers, but fragmented ownership and limited institutional capital slow scale-up. Gulf Cooperation Council economies witness early-stage investments as expatriate populations search for temperature-controlled space to shield belongings from intense heat.

- Public Storage

- Extra Space Storage Inc.

- U-Haul International Inc.

- CubeSmart LP

- National Storage Affiliates Trust

- Life Storage Inc.

- Safestore Holdings PLC

- StorageMart

- Shurgard Self-Storage SA

- Big Yellow Group PLC

- Prime Storage Group

- Metro Storage LLC

- SmartStop Asset Management LLC

- Clutter Inc.

- MakeSpace Inc.

- Kennards Self Storage

- Access Self Storage Ltd.

- Urban Self Storage Inc.

- Global Self Storage Inc.

- World Class Capital Group LLC (Great Value Storage)

- Amsdell Cos./Compass Self Storage

- All Storage

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urbanization & shrinking living spaces

- 4.2.2 Proliferation of e-commerce micro-merchants

- 4.2.3 Rising residential real-estate costs

- 4.2.4 Digitized, contact-free leasing platforms

- 4.2.5 Self-storage as micro-fulfillment hubs (under-reported)

- 4.2.6 Climate-resilient asset preservation demand (under-reported)

- 4.3 Market Restraints

- 4.3.1 Stringent zoning & land-use regulations

- 4.3.2 Oversupply pockets in mature metros

- 4.3.3 Escalating insurance premiums from extreme weather (under-reported)

- 4.3.4 Cyber-security risks for smart facilities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE & GROWTH FORECASTS

- 5.1 By User Type

- 5.1.1 Personal

- 5.1.2 Business

- 5.2 By Storage Type

- 5.2.1 Climate-controlled

- 5.2.2 Non-climate-controlled

- 5.2.3 Portable / Container-based

- 5.2.4 Vehicle & Specialty (RV, boat, wine)

- 5.3 By Lease Duration

- 5.3.1 Short-term (<3 months)

- 5.3.2 Mid-term (3-12 months)

- 5.3.3 Long-term (>12 months)

- 5.4 By Unit Size

- 5.4.1 Small (<50 sq ft)

- 5.4.2 Medium (50-100 sq ft)

- 5.4.3 Large (100-200 sq ft)

- 5.4.4 Mega (>200 sq ft)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Russia

- 5.5.4 Asia

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 Australia

- 5.5.4.4 India

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Public Storage

- 6.4.2 Extra Space Storage Inc.

- 6.4.3 U-Haul International Inc.

- 6.4.4 CubeSmart LP

- 6.4.5 National Storage Affiliates Trust

- 6.4.6 Life Storage Inc.

- 6.4.7 Safestore Holdings PLC

- 6.4.8 StorageMart

- 6.4.9 Shurgard Self-Storage SA

- 6.4.10 Big Yellow Group PLC

- 6.4.11 Prime Storage Group

- 6.4.12 Metro Storage LLC

- 6.4.13 SmartStop Asset Management LLC

- 6.4.14 Clutter Inc.

- 6.4.15 MakeSpace Inc.

- 6.4.16 Kennards Self Storage

- 6.4.17 Access Self Storage Ltd.

- 6.4.18 Urban Self Storage Inc.

- 6.4.19 Global Self Storage Inc.

- 6.4.20 World Class Capital Group LLC (Great Value Storage)

- 6.4.21 Amsdell Cos./Compass Self Storage

- 6.4.22 All Storage