|

市場調查報告書

商品編碼

1850324

線上廣告:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Online Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

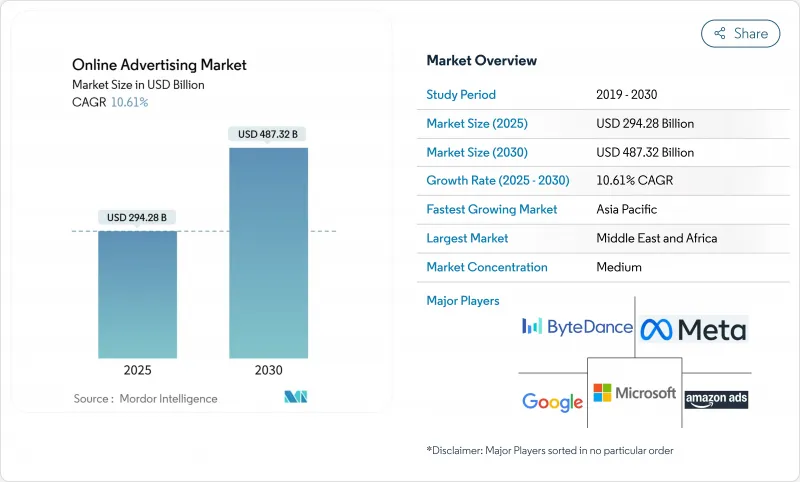

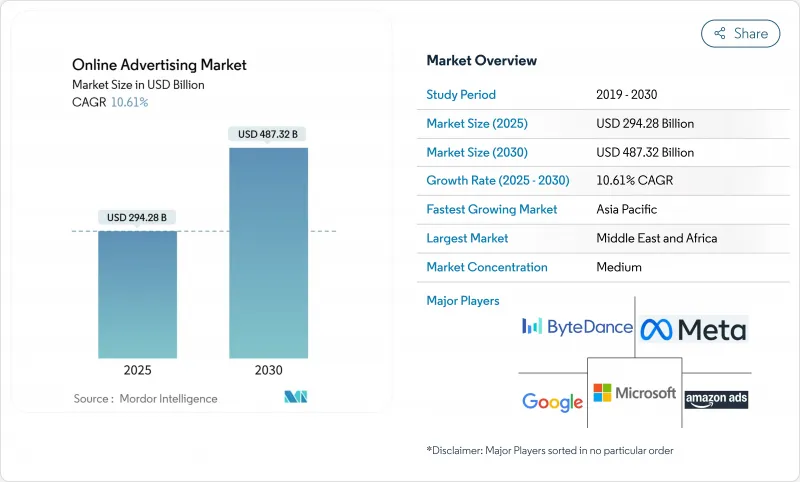

預計到 2025 年,線上廣告市場規模將達到 2,942.8 億美元,到 2030 年將達到 4,873.2 億美元,2025 年至 2030 年的複合年成長率為 10.61%。

儘管隱私法規日益嚴格,宏觀經濟訊號也不穩定,但線上廣告市場仍在不斷拓展新的接點,收益。廣告主維持數位廣告預算,因為廣告曝光率等級的彙報能夠清楚反映營運資金的分配;而發布商則重新調整廣告資源配置,轉向收益較高的短影片和電商展示廣告,即使廣告曝光率趨於穩定,這些廣告形式也能維持收益。此外,越來越多的中型品牌開始使用自助工具進行程式化購買,透過更均衡地分散支出,而非依賴少數幾家跨國公司,從而受益於市場成長。同時,隨著智慧型手機的普及,拉丁美洲和中東及非洲地區的廣告支出不斷成長,區域多元化正在鞏固線上廣告市場,並降低其對單一地區經濟放緩的依賴。

全球線上廣告市場趨勢與洞察

零售媒體網路加速閉合迴路測量

利用經過認證的交易數據,零售商經營內部廣告網路,使消費品品牌能夠直接檢驗銷售成長,從而提升了線上廣告市場的信任度。最大的電商平台在2024年提交的證券文件中指出,平台廣告支出成長速度超過了商品總價值,顯示市場對資料豐富的廣告位有著強烈的需求。一家美國中型連鎖超市部署了一個媒體網路,其廣告支出回報率比開放網路橫幅廣告高出兩位數。由於歸因分析在同一結帳環境中進行,負責人可以快速將預算重新分配給表現優異的SKU,一家專注於會員忠誠度的連鎖藥局計劃在2025年透過類似的贊助搜尋貨架廣告位來擴展其模式。

動態的、人工智慧生成的創新最佳化縮短了生產週期。

2024年,領先的平台將推出即時渲染引擎,讓廣告主上傳核心素材庫,演算法會根據觀眾的屬性重新混音。一家歐洲旗艦航空公司報告稱,在投放個人創新後的四周內,預訂意願顯著提升,隨後該策略被應用於座位升級等提升銷售。 2025年,一家消費性電子品牌表示,基於人工智慧的影片變體使創新產出提高了五倍,同時保持了品牌安全評分。當創新數量不再限制測試時,多餘的響應訊號會為平台建議提供資訊,從而在無需收集新數據的情況下提高相關性。

歐洲因禁用cookie而造成的訊號損失迫使人們重新審視語境。

2024 年 Google Sandbox 的一項測試表明,在展示廣告資源中停用第三方 Cookie 會導致收益損失。德國出版商將廣告投放範圍擴大到 15,000 個上下文細分,並在 2025 年第一季挽回了一半的 CPM 損失。廣告商正轉向語義對齊,重振優質內容環境,並部分扭轉了先前轉向用戶生成內容的趨勢。

細分市場分析

影片廣告目前在網路廣告市場中成長最快,年複合成長率高達10%左右,而其他廣告形式則趨於成熟。短影片和直播中的購物疊加層縮短了用戶在單次觀看過程中從看到廣告到購買的路徑。體育賽事版權擁有者在2024年季後賽中加入了畫中畫投注提示,而數據面板顯示核心粉絲的停留時間增加。當品牌發現影片廣告的觀看完成率高於可跳過廣告形式時,廣告支出就會轉向那些能夠支撐高價位的廣告位。隨著發布商以更低的廣告曝光率量提供更高價值的廣告曝光率,線上廣告市場也從中受益。展示橫幅廣告正在演變為更靜態但程式化的戶外數位體驗,這些體驗會根據天氣和通勤趨勢做出反應,從而在桌面環境之外保持相關性。

搜尋廣告將繼續保持其主導地位,因為它將用戶意圖訊號轉化為實際效果,但隨著查詢量下降,其成長曲線將趨於平緩。此外,2025年初的點擊路徑研究表明,用戶會進行更深層的滾動瀏覽,從而有效地擴大付費廣告的覆蓋範圍。這種調整確保了搜尋仍將是網路廣告市場的重要收入來源,即便展示廣告和社群廣告形式不斷創新。同時,情境展示廣告和戶外的整合也證明,橫幅廣告的演變能夠帶來新的預算,而不是蠶食現有預算。

線上廣告市場按廣告形式(社群媒體、搜尋引擎及其他)、平台(行動裝置、桌上型電腦、筆記型電腦及其他)、終端用戶產業(汽車、零售、電子商務及其他)和地區進行細分。市場預測以美元計價。

區域分析

亞太地區約佔全球廣告支出的34%,這得益於其行動優先的人口結構和超級應用生態系統。中國的直播電商節在同一影片剪輯中實現了數十億次的微互動,進一步鞏固了該地區在線上廣告市場的主導地位。在印度,統一支付介面(UPI)擴展到功能手機,使得先前難以觸及的農村地區也能投放定向廣告。印尼和馬來西亞的通訊業者正在推出分級5G套餐,打造低延遲的廣告資源,在不降低價格分佈的前提下維持成長,使該地區能夠佔據更大的市場佔有率。

北美地區憑藉著先進的競標工具和成熟的混合型電視生態系統,持續維持最高的每用戶收入。串流家庭用戶如今已佔35歲以下觀眾的大多數,而2025年初的收視率調查機構更新已將線性電視和數位電視的覆蓋範圍整合為單一貨幣單位,簡化了跨屏購買流程。零售商正在擴展店內數位顯示螢幕,使其兼具需求端平台(DSP)的終端功能,從而允許廣告商將宣傳活動地理圍欄至特定門店群,並透過會員ID匹配銷售數據。這種融合支撐了高額CPM,並將北美地區定位為線上廣告市場的中心。

儘管起步基數較低,但中東和非洲地區仍保持著兩位數的複合年成長率,這主要得益於人口結構的年輕化和海底光纜的快速擴張。政府支持的智慧城市計劃正在整合程序化廣告牌,這些廣告牌可從中央廣告交易平臺獲取動態創新,從而為該地區打造獨特的定向廣告平台。內容創作者正在使用阿拉伯語、英語和法語進行內容變現,而平台也報告稱,透過多語言定向,廣告相關性得分有所提高。海灣地區的航空公司在2025年初實施了城市特定的重新導向廣告,以填補淡季航線的客流,這充分展現了線上廣告市場的跨境擴展能力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 零售媒體網路收益消費品品牌實現閉合迴路廣告支出報酬率

- 人工智慧驅動的動態創新最佳化降低了北美地區的每次轉換成本 (CPA)。

- 5G賦能的身臨其境型影片廣告將推動東南亞地區的廣告支出。

- 超級應用商務與搜尋整合推動中國與東南亞應用程式內廣告的發展

- 市場限制

- 歐盟第三方 Cookie 禁令導致的訊號損失削弱了定向投放效果。

- 英國和法國的數位服務稅對平台利潤帶來壓力

- 監理展望

- 技術展望(人工智慧、隱私沙箱、無塵室)

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 廣告格式

- 社群媒體

- 搜尋引擎

- 影片

- 電子郵件

- 其他廣告形式

- 按平台

- 移動的

- 桌上型電腦和筆記型電腦

- 其他平台

- 最終用戶

- 車

- 零售與電子商務

- 醫療保健和製藥

- BFSI

- 通訊

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- Google LLC

- Meta Platforms Inc.

- Amazon.com Inc.(Amazon Ads)

- ByteDance Ltd.(TikTok)

- Microsoft Corp.(LinkedIn, Bing Ads)

- Alibaba Group(Alimama)

- Tencent Holdings Ltd.(WeChat, Tencent Ads)

- Baidu Inc.

- Snap Inc.

- Pinterest Inc.

- X Corp.(Twitter)

- Spotify Technology SA

- Roku Inc.

- Comcast Corp.(FreeWheel)

- Samsung Ads

- Verizon Media(Yahoo)

- Adobe Inc.

- Oracle Advertising

- The Trade Desk Inc.

- Magnite Inc.

- Criteo SA

- Taboola Inc.

- PubMatic Inc.

第7章 市場機會與未來展望

The online advertising market size stands at USD 294.28 billion in 2025 and is projected to reach USD 487.32 billion by 2030, reflecting a 10.61% compound annual growth rate (CAGR) over 2025-2030.

The online advertising market continues to monetise emerging touchpoints despite stricter privacy rules and uneven macroeconomic signals. Advertisers keep digital budgets intact because impression-level reporting clarifies working-capital deployment, while publishers rebalance inventory toward higher-yield short-form video and commerce-linked display that sustain revenue even when raw impressions stabilise. Growth also benefits from a rising cohort of medium-sized brands that buy programmatically through self-serve tools, spreading spend more evenly rather than relying on a small group of multinationals. Simultaneously, regional diversification secures the online advertising market because incremental outlay is coming from Latin America, the Middle East, and Africa as smartphone adoption rises, reducing exposure to single-region slowdowns.

Global Online Advertising Market Trends and Insights

Retail media networks accelerate closed-loop measurement

Retailers wielding authenticated transaction data now operate in-house ad networks that let consumer-goods brands verify sales lift directly, raising confidence in the online advertising market. A 2024 securities filing by the largest e-commerce marketplace showed on-platform ad spend climbing faster than gross merchandise volume, signalling a strong appetite for data-rich placements . Mid-tier U.S. grocery chains followed with media networks that delivered double-digit return-on-ad-spend gains versus open-web banners. As attribution occurs inside the same checkout environment, marketers recycle budget rapidly toward top-performing SKUs, and loyalty-centric pharmacy chains plan similar sponsored search shelves in 2025, broadening the model.

AI-generated dynamic creative optimisation compresses production cycles

Major platforms deployed real-time rendering engines in 2024, enabling advertisers to upload a core asset library that algorithms remix according to viewer attributes. A European flag-carrier airline reported measurable booking-intent gains within four weeks of personalised creatives, then applied the tactic to upsell units such as seat upgrades. In 2025 a consumer-electronics brand stated that AI-based video variants multiplied creative output fivefold while matching brand-safety scores. As creative volume ceases to constrain testing, extra response signals feed platform recommendations, improving relevance without new data collection.

European signal loss from cookie deprecation forces contextual renaissance

Google Sandbox tests in 2024 indicated revenue loss when display inventory lacked third-party cookies . A German publisher expanded to 15,000 contextual segments and recovered half the lost CPM by Q1 2025. Advertisers pivot to semantic alignment, reviving premium editorial environments and partly reversing earlier movement toward user-generated content.

Other drivers and restraints analyzed in the detailed report include:

- 5G unlocks immersive video across South-East Asia

- Commerce-search convergence inside super-apps fuels in-app placements

- Digital-services taxes pressure platform and advertiser margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Video advertising currently logs the fastest growth within the online advertising market size, climbing at a mid-teen CAGR while other formats mature. Short-form vertical clips and live-stream shopping overlays shorten the path from impression to purchase in one viewing session. Streaming sports rights holders added picture-in-picture wagering prompts during the 2024 playoffs, and dashboards showed extended dwell times among core fans. As brands observe higher completion rates versus skippable formats, spend shifts toward inventory that justifies premium pricing. The online advertising market benefits because publishers can package fewer but more valuable impressions. Display banners, though steadier, evolve into programmatic digital-out-of-home screens that react to weather or commuter flows, maintaining relevance outside desktop environments.

Search advertising protects its commanding place by converting intent signals into performance, yet its growth curve flattens as query volume decelerates. Engines now embed generative overviews that mix organic answers with sponsored placements, and click-path studies in early 2025 showed deeper scrolling, effectively expanding paid real estate. This adjustment keeps search a cash generator within the online advertising market, even as display and social formats innovate. Meanwhile, contextual display and out-of-home linkages prove that banner evolution can secure new budgets rather than cannibalise existing ones.

Online Advertising Market is Segmented by Advertising Format (Social Media, Search Engine, and More), Platform (Mobile, Desktop and Laptop, and Other Platforms), End-User Vertical (Automotive, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands roughly 34% of global spend, underpinned by mobile-first populations and super-app ecosystems. Live-commerce festivals in China register billions of micro-interactions that convert inside the same short-video clip, reinforcing the region's primacy in the online advertising market. India's extension of the Unified Payments Interface to feature phones promises addressable advertising in rural districts previously out of reach. Indonesian and Malaysian telcos are rolling out tiered 5G packages, creating low-latency inventory that sustains growth without lowering price floors, positioning the region for incremental share.

North America preserves the highest revenue per user, benefitting from sophisticated auction tooling and a mature hybrid-TV ecosystem. Streaming households now form the majority of under-35 viewers, and a ratings-agency update in early 2025 merged linear and digital reach on a single currency line, simplifying cross-screen buys. Retailers extend in-store digital displays that double as demand-side platform endpoints, letting advertisers geofence campaigns around specific store clusters and then reconcile sales via loyalty IDs. This fusion underpins premium CPMs and keeps North America central to the online advertising market.

The Middle East and Africa, while starting from a lower base, shows sustained double-digit CAGR as youthful demographics combine with expanding under-sea fibre. Government-backed smart-city projects integrate programmatic billboards that receive dynamic creative from central ad exchanges, creating an addressable surface unique to the region. Content creators monetise in Arabic, English, and French, and platforms report that multilingual targeting lifts relevance scores. Tourism recovery further boosts hospitality spend; Gulf airlines ran city-specific retargeting flights in early 2025 that filled shoulder-season routes, demonstrating cross-border scalability for the online advertising market.

- Google LLC

- Meta Platforms Inc.

- Amazon.com Inc. (Amazon Ads)

- ByteDance Ltd. (TikTok)

- Microsoft Corp. (LinkedIn, Bing Ads)

- Alibaba Group (Alimama)

- Tencent Holdings Ltd. (WeChat, Tencent Ads)

- Baidu Inc.

- Snap Inc.

- Pinterest Inc.

- X Corp. (Twitter)

- Spotify Technology S.A.

- Roku Inc.

- Comcast Corp. (FreeWheel)

- Samsung Ads

- Verizon Media (Yahoo)

- Adobe Inc.

- Oracle Advertising

- The Trade Desk Inc.

- Magnite Inc.

- Criteo S.A.

- Taboola Inc.

- PubMatic Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Retail Media Networks Monetization Driving Closed-Loop ROAS for CPG Brands

- 4.2.2 AI-Generated Dynamic Creative Optimisation Reducing CPA in North America

- 4.2.3 5G-Enabled Immersive Video Ads Accelerating Spend in South-East Asia

- 4.2.4 Commerce-Search Integration in Super-Apps Fueling In-App Ads Across China and SEA

- 4.3 Market Restraints

- 4.3.1 Signal-Loss from Third-Party-Cookie Deprecation in EU Undermining Targeting

- 4.3.2 Digital-Services Taxes in UK and France Squeezing Platform Margins

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook (AI, Privacy Sandbox, Clean Rooms)

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Advertising Format

- 5.1.1 Social Media

- 5.1.2 Search Engine

- 5.1.3 Video

- 5.1.4 Email

- 5.1.5 Other Advertising Formats

- 5.2 By Platform

- 5.2.1 Mobile

- 5.2.2 Desktop and Laptop

- 5.2.3 Other Platforms

- 5.3 By End-user Vertical

- 5.3.1 Automotive

- 5.3.2 Retail and E-commerce

- 5.3.3 Healthcare and Pharma

- 5.3.4 BFSI

- 5.3.5 Telecom

- 5.3.6 Other Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 South Korea

- 5.4.4.4 India

- 5.4.4.5 Australia

- 5.4.4.6 New Zealand

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Google LLC

- 6.3.2 Meta Platforms Inc.

- 6.3.3 Amazon.com Inc. (Amazon Ads)

- 6.3.4 ByteDance Ltd. (TikTok)

- 6.3.5 Microsoft Corp. (LinkedIn, Bing Ads)

- 6.3.6 Alibaba Group (Alimama)

- 6.3.7 Tencent Holdings Ltd. (WeChat, Tencent Ads)

- 6.3.8 Baidu Inc.

- 6.3.9 Snap Inc.

- 6.3.10 Pinterest Inc.

- 6.3.11 X Corp. (Twitter)

- 6.3.12 Spotify Technology S.A.

- 6.3.13 Roku Inc.

- 6.3.14 Comcast Corp. (FreeWheel)

- 6.3.15 Samsung Ads

- 6.3.16 Verizon Media (Yahoo)

- 6.3.17 Adobe Inc.

- 6.3.18 Oracle Advertising

- 6.3.19 The Trade Desk Inc.

- 6.3.20 Magnite Inc.

- 6.3.21 Criteo S.A.

- 6.3.22 Taboola Inc.

- 6.3.23 PubMatic Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment