|

市場調查報告書

商品編碼

1850313

行動行銷:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Mobile Marketing Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

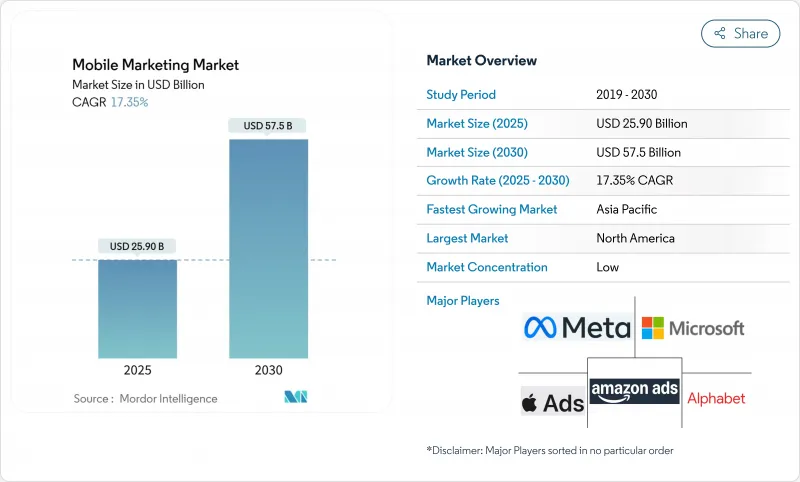

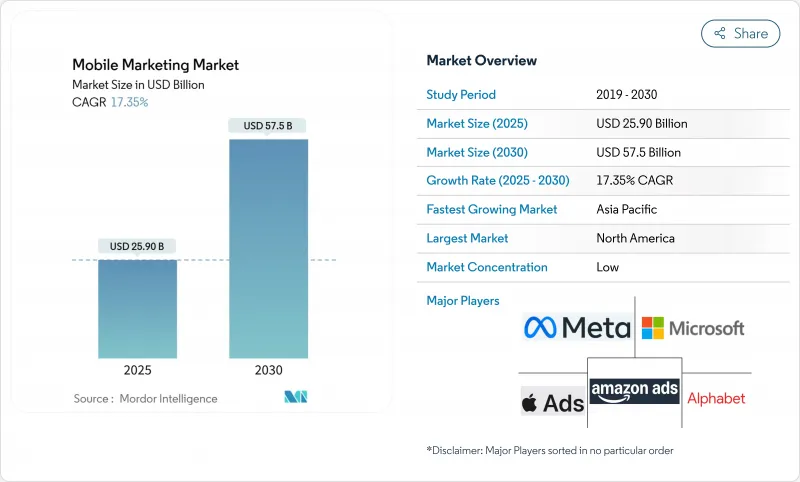

預計到 2025 年,行動行銷市場規模將達到 259 億美元,到 2030 年將成長至 575.3 億美元,預測期內複合年成長率將達到 17.35%。

隨著發現、評估和購買流程不斷向行動裝置轉移,智慧型手機已成為商務、媒體和客戶服務的預設入口。這促使廣告主將預算分配到資料豐富的互動環節,將身分驗證、授權管理和創新自動化整合到單一工作流程中。能夠將這些功能統一到單一使用者介面下的平台提供者正在贏得更多廣告支出,因為品牌團隊無需在不同工具之間切換,即可測試、衡量和最佳化廣告路徑。亞太地區 20% 的複合年成長率反映了 5G 普及、數位錢包和超級應用生態系統的綜合影響,而歐洲嚴格的隱私法規則促使負責人加強其第一方資料資產和閉合迴路衡量。

全球行動行銷市場趨勢與洞察

隱私安全識別碼框架提升北美應用內收益

在美國主要出版商中,伺服器端事件收集和經使用者授權的裝置令牌正在取代瀏覽器層級的 Cookie。採用這些框架的品牌報告稱,匹配率實現了兩位數的提升,從而在遵守州級隱私法規的同時,實現了更豐富的用戶細分。同樣的機制還能自動產生合規報告,並使財務團隊能夠將隱私升級視為技術投資。因此,行銷和風險部門可以基於共用指標進行協作,廣告商即使在監管日益嚴格的情況下也能保持個人化的推廣。這些優勢證明,合規的身份解析正在成為成長的驅動力,而非成本中心。

5G網路的部署使亞洲都市區能夠開展超低延遲的宣傳活動

商用5G網路現已覆蓋亞洲大部分城市,行動影片平均載入時間遠低於100毫秒。負責人正積極回應,推出互動式擴增實境產品展示,讓使用者只需輕按一下即可在結帳前虛擬擺放產品。在首爾舉行的2024年遊戲展上,一場在網路邊緣執行的即時A/B測試,與在4G網路上使用相同創新相比,將放棄率降低了近25%。這項經驗表明,頻寬可以作為創新畫布,激發沉浸式故事敘述,而不僅僅是提升傳輸速度。隨著5G網路的日益普及,行動行銷市場有望迎來更豐富的素材形式和更高的轉換效率。

無 Cookie 策略會擾亂全球跨應用歸因分析

第三方 Cookie 正逐漸從主流瀏覽器中消失,跨裝置圖譜也隨之縮小,迫使行銷人員嘗試機率測量和增量分析。過去依賴使用者級報告的財務經理現在需要使用基於提升率、專注於因果貢獻的儀錶板。雖然學習週期會更長,但隨著機率訊號能夠容忍隱私波動,預算分配將逐步趨於穩定。儘管效果負責人短期內會面臨一些阻力,但這種轉變最終將打造一個更具韌性的規劃流程,並增強行動行銷市場抵禦未來監管波動的能力。

細分市場分析

到2024年,平台軟體將佔總收入的67%,成為行動行銷市場的營運支柱。供應商正在整合低程式碼旅程建立器和隱私儀表板,使品牌團隊能夠在無需工程支援的情況下近乎即時地測試規則。服務線規模雖小,但正隨著企業尋求在無塵室部署、創新自動化和區域法規方面的指導而迅速擴張。諮詢業務的重點正從媒體套利轉向技術賦能,從而建立新的收費體系並重新平衡供應鏈中的價值獲取。展望未來,軟體升級將有助於維持客戶維繫,而服務合約將進一步增強客戶鎖定。

技術服務還負責促成廣告商和發布商之間複雜的資料共用協議,並推動經用戶同意的識別碼的採用。這種對技術和專業知識的雙重需求,使得混合型服務提供者能夠佔據更大的市場佔有率。因此,儘管軟體仍保持其領先的市場佔有率,但與組件服務相關的行動行銷市場規模預計將超過整體市場成長速度。

位置智慧佔據行動行銷市場規模的15%左右,預計到2030年將達到22%的複合年成長率,超過其他解決方案叢集。增強型技術堆疊融合了GPS、藍牙信標和場所Wi-Fi,能夠以亞米級的精度精確定位消費者的停留區域。即時優惠在兌換率和客單價指標上均優於一般優惠券。例如,2025年柏林的一項軟性飲料促銷活動就採用了櫃檯下方的序號,引導消費者立即進入一款獎勵豐厚的手機遊戲。

由於推播通知的開啟率更高,因此仍將至關重要,但編配引擎會根據預測的疲勞程度調整推播頻率,以防止用戶選擇取消訂閱。隨著零售商在這些通知中嵌入富媒體內容,地點訊號將進一步精準定位推播時間,加深用戶互動,並提高用戶單次消費額。將地圖 API、分析工具和創新工具整合到單一介面中的供應商將拓寬競爭優勢,並在更廣泛的行動行銷市場中佔據更大佔有率。

行動行銷市場按組件(平台、服務)、解決方案類型(行動網頁、簡訊和彩信、其他)、分銷管道(社交媒體行銷、聯盟行銷、其他)、公司規模(大型企業、中小企業)、部署類型(雲端、本地部署)、最終用戶產業(零售和電子商務、媒體和娛樂/OTT)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區將佔2024年營收的38%,凸顯其作為廣告科技創新試驗場的地位。各州隱私改革將加速第一方資料項目的推進,從而提高匹配率並建立合規的身份圖譜。在2028年洛杉磯奧運會之前,一個活動層級的定位平台將應運而生,將票務、餐飲和贊助商通訊整合到一個統一的行動流程中。 2024年足球季後賽期間的一項試驗表明,根據餐飲排隊時間客製化的動態優惠提高了人均消費額,且並未減少客流量,這不僅展現了營運效益,也體現了媒體價值。隨著出版商競相整合隱私安全的識別系統,創投依然強勁,為更廣泛的行動行銷市場提供了支持。

亞太地區預計將實現20%的複合年成長率,這反映了5G速度、超級應用生態系統和社交電商規範的綜合影響。 2024年,東南亞一家領先的超級應用上的化妝品宣傳活動擴增實境試妝與聊天結帳相結合,將購買時間縮短至60秒以內,銷量成長了兩倍。在印度,本地語言語音搜尋正在擴大覆蓋範圍,促使平台所有者推出針對低文化水平人群的主導廣告形式。這些創新表明,技術普及不僅取決於技術成熟度,也取決於文化習慣。智慧型手機的快速更換週期和低廉的數據流量費用正在進一步擴大行動行銷市場。

儘管歐洲嚴格的隱私法限制了基於cookie的推廣範圍,零售商們正透過閉合迴路零售媒體網路實現會員忠誠度計畫的獲利。 2025年,一家荷蘭連鎖超市推出了自助服務門戶,供應商可以在此購買贊助商品圖塊並將其部署到該連鎖超市的行動錢包中,從而在幾天內實現端到端的歸因分析。儘管北歐國家規模較小,但其用戶行動端參與度在歐洲大陸最高,證明在贏得消費者信任的前提下,尊重隱私的個人化行銷也能取得成功。監管政策的明確性可能會抑制短期成長,但有助於長期穩定,從而支持全部區域行動行銷市場的穩定擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 注重隱私的識別符框架提升北美應用內行銷投資報酬率

- 5G的推出使亞洲各地能夠開展超低延遲的富媒體宣傳活動。

- 快速商務應用程式的激增推動了拉丁美洲都市區的推播通知支出

- 歐洲零售媒體網路強制要求建立第一方資料夥伴關係。

- 市場限制

- 使用無 cookie 策略進行跨應用程式歸因的裝置圖簡化

- 通訊業者簡訊防火牆升級推高非洲A2P流量成本

- 價值/供應鏈分析

- 監管或技術前景

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 新冠疫情對市場的影響

第5章 市場規模與成長預測

- 按組件

- 平台

- 服務

- 按解決方案類型

- 行動網頁

- 簡訊和彩信

- 基於位置的行銷/地理圍欄

- 應用程式內和遊戲內廣告

- 推播通知與富媒體

- QR碼與近場行銷

- 新興技術(AR/VR、信標、5G邊緣運算)

- 透過分銷管道

- 社群媒體行銷

- 聯盟行銷

- 全通路/零售應用

- 內容行銷和影響者行銷

- 線上公共關係

- 電子郵件和簡訊宣傳活動

- 遊戲內/電子競技

- 按公司規模

- 主要企業

- 小型企業

- 透過部署模式

- 雲

- 本地部署

- 按最終用戶行業分類

- 零售與電子商務

- 媒體與娛樂/OTT

- BFSI

- 醫療保健和生命科學

- 旅遊、觀光和酒店

- 通訊

- 車

- 教育

- 其他(政府、公共產業)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- Alphabet Inc.(Google)

- Meta Platforms Inc.

- Apple Inc.(Apple Advertising)

- Microsoft Corporation

- Amazon.com Inc.(Amazon Ads)

- Twitter/X Corp.

- Snap Inc.

- Pinterest Inc.

- Verizon Communications Inc.(Yahoo Advertising)

- ATandT Inc.

- InMobi Pte Ltd

- AppLovin Corporation

- GroundTruth

- Criteo SA

- Airship

- Adobe Inc.

- Oracle Corporation

- Salesforce Inc.

- Publicis Groupe(Phonevalley)

- AdColony Inc.

- MoPub(AppLovin Exchange)

第7章 市場機會與未來展望

The mobile marketing market size is valued at USD 25.9 billion in 2025 and is forecast to climb to USD 57.53 billion by 2030, advancing at a 17.35% CAGR during the outlook period.

Continuous migration of discovery, evaluation, and purchase to handheld screens has turned smartphones into the default entry point for commerce, media, and customer service. Advertisers are therefore diverting budgets toward data-rich engagement moments where identity resolution, consent management, and creative automation converge inside one workflow. Platform providers that integrate these functions under a single user interface are winning incremental spend, because brand teams can test, measure, and optimise journeys without toggling between tools. Asia-Pacific's 20% CAGR signals the compounding effect of 5G coverage, digital wallets, and super-app ecosystems, while Europe's stringent privacy rules push marketers to fortify first-party data assets and closed-loop measurement.

Global Mobile Marketing Market Trends and Insights

Privacy-safe identifier frameworks lifting in-app returns in North America

Server-side event collection and consented device tokens are replacing browser-level cookies across major United States publishers. Brands embedding these frameworks report doubled-digit improvements in match rates, enabling richer segmentation while meeting state-level privacy mandates. The same mechanisms automate compliance reporting, allowing finance teams to capitalise on privacy upgrades as technology investments. Marketing and risk units, therefore, align on shared metrics, and advertisers can sustain personalised outreach even as regulations tighten. These gains validate that compliant identity resolution is becoming a growth accelerator rather than a cost centre.

5G roll-outs enabling ultra-low-latency campaigns across urban Asia

Commercial 5G networks now serve most tier-one Asian cities, pushing average mobile video load times well below 100 milliseconds. Marketers respond with interactive augmented-reality product demos that let users virtually place items in their environment before one-tap checkout. Live A/B switches executed at the network edge during a 2024 gaming convention in Seoul cut abandonment by nearly 25% versus identical creative on 4G. The experience reveals that bandwidth acts as a creative canvas, spurring immersive storytelling rather than functioning only as a distribution upgrade. As 5G densifies, the mobile marketing market will see richer asset formats and higher conversion efficiency.

Cookieless policies disrupt cross-app attribution worldwide

Third-party cookies are vanishing from mainstream browsers, shrinking cross-device graphs, and forcing marketers toward probabilistic measurement and incrementality experiments. Finance controllers who relied on user-level reports now train on lift-based dashboards focused on causal contribution. Learning cycles lengthen, yet budget allocations gradually stabilise because probabilistic signals tolerate privacy volatility. While performance marketers face near-term friction, the shift ultimately produces more resilient planning processes, cushioning the mobile marketing market against future regulatory swings.

Other drivers and restraints analyzed in the detailed report include:

- Quick-commerce boom drives specialised notification spend in South American capitals

- Retail media networks reshape European campaign supply chains

- Telco SMS firewall upgrades escalate A2P costs in Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Platform software contributed 67% of 2024 revenue, affirming its status as the operating backbone of the mobile marketing market. Vendors embed low-code journey builders and privacy dashboards that let brand teams test rules in near real time without engineering support. Services lines, though smaller, are expanding faster as enterprises seek guidance on clean-room deployment, creative automation and regional regulations. Advisory practices pivot from media arbitrage to technical enablement, carving fresh fee pools and rebalancing value capture along the supply chain. Over the forecast horizon, software upgrades will sustain retention, while service engagements deepen customer lock-in.

Technical services also mediate complex data-sharing agreements between advertisers and publishers, smoothing the adoption of consented identifiers. This dual need for technology and expertise positions hybrid providers to harvest greater wallet share. As a result, the mobile marketing market size tied to component services is projected to outpace overall market growth, even as software retains lead share.

Location intelligence holds a mid-teen fraction of the mobile marketing market size and is poised for a 22% CAGR, eclipsing other solution clusters by 2030. Enhanced stacks blend GPS, Bluetooth beacons, and venue Wi-Fi, pinpointing shopper dwell zones with sub-metre accuracy. Moment-specific offers then outperform generic coupons on redemption and basket value metrics. QR codes re-emerge as bridge technology between shelf and screen; a 2025 soft-drink promotion in Berlin used under-cap serialised codes to funnel consumers into a mobile game with instant rewards.

Push alerts remain indispensable for their superior open rates, but orchestration engines throttle frequency against predicted fatigue to prevent opt-outs. As retailers embed rich media into these alerts, location signals further sharpen timing, deepening engagement, and raising spending per user. Providers that integrate mapping APIs, analytics, and creative tooling within one interface widen their moat and expand their share within the wider mobile marketing market.

Mobile Marketing Market is Segmented by Component (Platform, Services), Solution Type (Mobile Web, SMS and MMS, and More), Distribution Channel (Social Media Marketing, Affiliate Marketing, and More), by Enterprise Size (Large Enterprises, Smes), Deployment Mode (Cloud, On-Premises), by End-User Industry (Retail and E-Commerce, Media and Entertainment / OTT), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38% of 2024 revenue, underscoring its role as a test bed for ad-tech innovation. State privacy amendments accelerate first-party data programs, leading to higher match rates and compliant identity graphs. Event-grade location platforms emerge ahead of the 2028 Los Angeles Olympics, merging ticketing, concessions, and sponsor messaging into unified mobile flows. Trials during the 2024 football playoffs demonstrated that dynamic offers aligned with concession wait times raised per-capita spend without adding foot traffic, showing operational upside beyond media value. Venture investment remains steady as publishers race to integrate privacy-safe IDs, supporting the broader mobile marketing market.

Asia-Pacific is forecast to post a 20% CAGR, reflecting the compounding effect of 5G speed, super-app ecosystems, and social commerce norms. A 2024 cosmetics campaign inside a leading Southeast Asian super-app combined augmented-reality try-ons with in-chat checkout, shrinking purchase journeys to under 60 seconds and tripling unit sales. In India, vernacular voice search expands reach, prompting platform owners to launch speech-driven ad formats for low-literacy segments. These innovations confirm that adoption curves depend on cultural habits as much as technology readiness. Rapid smartphone replacement cycles and low data costs further expand the mobile marketing market.

Europe's stringent privacy statutes restrict cookie-based reach, but retailers counter by monetising loyalty programs through closed-loop retail media networks. A 2025 Dutch grocery chain launched a self-service portal where suppliers buy sponsored product tiles that extend into the chain's mobile wallet, enabling end-to-end attribution within days. Nordic countries, although smaller, record the continent's highest per-user mobile engagement, proving that privacy-respecting personalisation thrives when consumer trust is secured. Regulatory clarity dampens short-term growth yet fosters long-term stability, supporting steady expansion of the mobile marketing market across the region.

- Alphabet Inc. (Google)

- Meta Platforms Inc.

- Apple Inc. (Apple Advertising)

- Microsoft Corporation

- Amazon.com Inc. (Amazon Ads)

- Twitter/X Corp.

- Snap Inc.

- Pinterest Inc.

- Verizon Communications Inc. (Yahoo Advertising)

- ATandT Inc.

- InMobi Pte Ltd

- AppLovin Corporation

- GroundTruth

- Criteo S.A.

- Airship

- Adobe Inc.

- Oracle Corporation

- Salesforce Inc.

- Publicis Groupe (Phonevalley)

- AdColony Inc.

- MoPub (AppLovin Exchange)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Privacy-safe Identifier Frameworks Boosting In-App Marketing ROI in North America

- 4.2.2 5G Roll-outs Enabling Ultra-Low-Latency Rich Media Campaigns Across Asia

- 4.2.3 Surge in Quick-Commerce Apps Fuelling Push Notification Spend in Urban South America

- 4.2.4 Retail Media Networks Mandating First-Party Mobile Data Partnerships in Europe

- 4.3 Market Restraints

- 4.3.1 Cookieless Policies Shrinking Device Graphs for Cross-App Attribution

- 4.3.2 Telco SMS Firewall Upgrades Escalating A2P Traffic Costs in Africa

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

- 4.8 Impact of COVID-19 on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Platform

- 5.1.2 Services

- 5.2 By Solution Type

- 5.2.1 Mobile Web

- 5.2.2 SMS and MMS

- 5.2.3 Location-Based Marketing / Geofencing

- 5.2.4 In-App and In-Game Advertising

- 5.2.5 Push Notification and Rich Media

- 5.2.6 QR-Code and Proximity Marketing

- 5.2.7 Emerging (AR/VR, Beacons, 5G Edge)

- 5.3 By Distribution Channel

- 5.3.1 Social Media Marketing

- 5.3.2 Affiliate Marketing

- 5.3.3 Omni-Channel / Retail Apps

- 5.3.4 Content and Influencer Marketing

- 5.3.5 Online Public Relations

- 5.3.6 Email and SMS Campaigns

- 5.3.7 In-Game / Esports

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Deployment Mode

- 5.5.1 Cloud

- 5.5.2 On-Premises

- 5.6 By End-user Industry

- 5.6.1 Retail and E-commerce

- 5.6.2 Media and Entertainment / OTT

- 5.6.3 BFSI

- 5.6.4 Healthcare and Life Sciences

- 5.6.5 Travel, Tourism and Hospitality

- 5.6.6 Telecommunications

- 5.6.7 Automotive

- 5.6.8 Education

- 5.6.9 Others (Government, Utilities)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 South Africa

- 5.7.5.4 Rest of Middle East and Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Alphabet Inc. (Google)

- 6.3.2 Meta Platforms Inc.

- 6.3.3 Apple Inc. (Apple Advertising)

- 6.3.4 Microsoft Corporation

- 6.3.5 Amazon.com Inc. (Amazon Ads)

- 6.3.6 Twitter/X Corp.

- 6.3.7 Snap Inc.

- 6.3.8 Pinterest Inc.

- 6.3.9 Verizon Communications Inc. (Yahoo Advertising)

- 6.3.10 ATandT Inc.

- 6.3.11 InMobi Pte Ltd

- 6.3.12 AppLovin Corporation

- 6.3.13 GroundTruth

- 6.3.14 Criteo S.A.

- 6.3.15 Airship

- 6.3.16 Adobe Inc.

- 6.3.17 Oracle Corporation

- 6.3.18 Salesforce Inc.

- 6.3.19 Publicis Groupe (Phonevalley)

- 6.3.20 AdColony Inc.

- 6.3.21 MoPub (AppLovin Exchange)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment