|

市場調查報告書

商品編碼

1850203

製造業企業移動性:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Enterprise Mobility In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

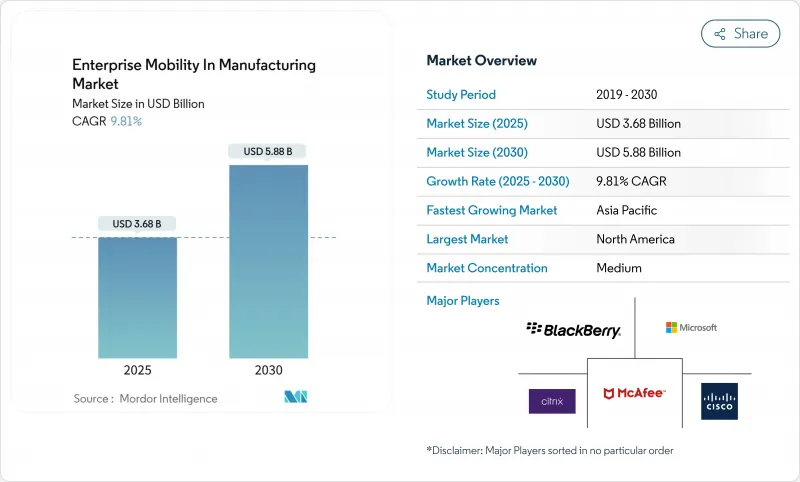

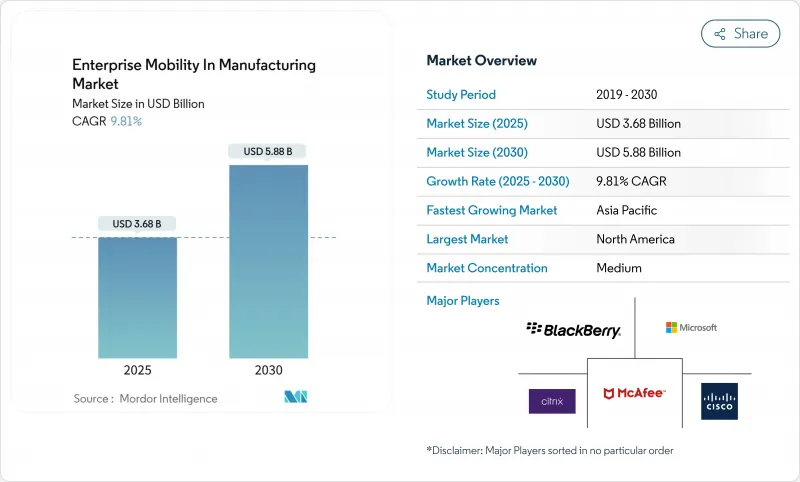

預計到 2025 年製造業企業行動市場規模將達到 36.8 億美元,到 2030 年將達到 58.8 億美元,複合年成長率為 9.8%。

這一成長趨勢反映了向工業 4.0 的快速轉變,其中移動化工作流程縮短了回應時間,提高了資產可視性,並增強了營運韌性。私有 5G 網路的日益普及、行動裝置與製造執行系統 (MES) 整合度的提升,以及基於邊緣的擴增實境應用的廣泛應用,共同拓寬了車間移動化的使用場景。然而,只有 16% 的製造商能夠享受即時生產視覺性,這凸顯了打破長期資訊孤島的數位化工具的巨大潛力。網路實體安全漏洞和資料主權限制阻礙了行動化的採用,迫使供應商轉向零信任架構和針對特定區域的雲端戰略。

全球製造企業移動市場趨勢與洞察

加速工業 4.0 和 IIoT 的採用

製造商正在將其工業物聯網部署從概念驗證計劃擴展到全廠範圍,將感測器、機器和行動端點連接到整合式資料環路。 83% 的製造商計劃到 2024 年將生成式人工智慧納入決策支持,這反映出他們對行動儀表板能夠在邊緣執行複雜分析的信心。這種影響在製程工廠尤為明顯,移動網實整合系統使操作員能夠在幾分鐘內(而不是幾小時)遠端微調參數。亞洲工廠在準備方面處於領先地位,53% 的管理人員計劃在 2040 年實現自主營運,而西方工廠中這一比例不到一半。隨著工業物聯網 (IIoT) 的成熟度不斷提高,對集掃描、可視化和語音功能於一體的堅固耐用型智慧型手機的需求也日益成長,這些智慧型手機旨在簡化維護和品質任務。將硬體與低程式碼應用程式建置器預先整合的供應商可以縮短引進週期並降低 IT 開銷。

BYOD/CYOD 政策擴大了互聯勞動力

工廠政策正在從限制性設備規則轉變為結構化的自選設備和自選設備計劃,以擴大員工對數位工具的存取權限。雖然 63% 的製造商已經允許使用個人設備,但只有 17% 的製造商實施了正式的 BYOD 框架,這表明採用方面存在巨大差距。正式的方案允許新員工使用熟悉的設備,在人手不足期間提高靈活性。三星的八步 CYOD 藍圖強調了高階主管支援、基於風險的細分和用戶培訓的必要性,以在保持生產力的同時保護資料。成功的部署將公司憑證嵌入安全容器中,透過零信任閘道器路由流量,並與 MES 和 ERP 後端同步。與專用的公司硬體設備相比,早期採用者報告班次交接更快,配置成本更低。

網路安全漏洞和行動惡意軟體

IT 與 OT 的整合使生產資產面臨更大風險。去年,93% 的公司記錄了 OT 入侵事件,而只有 13% 的公司享受到整合監控。行動端點擴大了攻擊面,因為傳統的防毒和補丁週期很少與持續營運保持一致。勒索軟體宣傳活動擴大瞄準人機介面平板電腦,導致主管無法控制系統。製造商正在利用微分段、行動威脅防禦代理和嚴格的最小權限策略進行反擊,但雙技能安全專業人員的短缺正在減緩專案的成熟度。保險承保人對此作出回應,要求在續簽網路風險保險之前提供零信任框架的證明,這增加了彌補漏洞的財務壓力。

細分分析

到2024年,該細分市場將佔總收入的48.7%,這證實了智慧型手機是工廠員工的主要行動閘道。一體化掃描、語音和數據功能減少了硬體成本,並減輕了IT配置負擔。在審查期間,供應商改進了外形規格,包括MIL-STD-810H機殼、熱插拔電池和手套操作觸控屏,以適應惡劣的車間環境。操作員青睞內藏相機,用於遠端協助和基於人工智慧的缺陷識別,而主管則利用高解析度顯示器在現場巡查時查看KPI儀表板。

穿戴式裝置細分市場的複合年成長率達 9.9%,這得益於免持揀選、抬頭維護和人體工學負載平衡。智慧眼鏡與數位雙胞胎相結合,透過在工人視野中疊加維修步驟和感測器活動,減少了認知工作量。平板電腦支援品質保證工作台和工程工作單元,其更大的螢幕支援 CAD 圖紙和偏差日誌。筆記型電腦仍停留在利基應用領域,例如模擬和 MES 管理任務,這些任務需要完整的鍵盤。新興的智慧戒指和工業手持設備屬於「其他」類別,這表明我們將繼續嘗試針對特定任務的外形設計,並可能在 2030 年臨近時重構設備層次結構。

2024年,行動裝置管理將佔總收入的46.2%,這反映了其長期以來作為企業自有行動電話合規性支柱的地位。 MDM套件強制執行密碼安全、遠端擦除和應用程式白名單,並符合ISO 27001和NIST CSF指南的審核要求。然而,向包括筆記型電腦、掃描儀和物聯網感測器在內的異質設備群的轉變將推動統一端點管理的複合年成長率達到10.1%。 UEM整合了Windows、Android、iOS和編配的策略擦拭巾和修補程式狀態,減少了冗餘的管理工作。

製造業客戶對 UEM 的自動化鉤子功能感到興奮,當設備跨越地理圍欄或異常流量觸發零信任規則時,該鉤子會觸發糾正措施。行動應用管理功能支援在參與 BYOD 方案時對個人裝置容器化,無需擁有硬體即可隔離公司資料。獨立的行動安全插件添加了基於機器學習的威脅搜尋功能。所有解決方案類型都支援模組化訂閱包,可靈活適應計劃範圍,並整合原生分析主機,從而為財務團隊展示投資回報率。

區域分析

北美將引領製造業企業行動市場,在成熟的自動化文化和資金雄厚的數位化藍圖的推動下,到2024年將佔全球收入的39.1%。美國汽車和航太產業將把現有的行動試點計畫升級到企業級,將5G園區網路覆蓋到棕地PLC上,以支援自主物料輸送和預測服務。加拿大食品加工產業將成為利基市場應用者,利用平板電腦進行過敏原管理和低溫運輸記錄。

歐洲受到德國工業4.0計畫和中小型企業的推動,他們正在用移動儀錶板改裝傳統的機器園區。法國製藥公司正在採用本質安全型智慧型手機來記錄無塵室的文檔,而義大利機械公司則正在部署擴增實境穿戴式設備,用於遠端現場服務。歐盟的《一般資料保護規則》正在推動對設備加密和資料主權雲端選項的需求激增,從而影響整個歐盟的採購標準。

隨著中國、印度和東南亞經濟體逐步取代舊有系統,亞太地區成為成長最快的地區,複合年成長率達 10.4%。領先的中國電子公司正在其大型工廠部署私人 5G 切片,以協調人工和機器人任務。在印度,政府在「生產連結獎勵計畫」下提供的激勵措施正在加速中小企業採用雲端基礎的行動儀表板。新加坡和韓國是先鋒試點區,技術人員配戴智慧眼鏡與託管在主權雲上的數位孿生互動。該地區的發展勢頭表明,隨著工廠採用高密度自動化技術並結合日益成長的行動勞動力,2030 年後收益領先地位可能會發生轉變。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 加速工業 4.0 和 IIoT 的採用

- BYOD/CYOD 政策擴大了互聯勞動力

- 私有 5G 和 Wi-Fi 6 實現低延遲移動性

- 將行動裝置與 MES 和雲端 PLM 整合

- 由邊緣運算驅動的擴增實境數位雙胞胎將推動對堅固型平板電腦的需求

- 無紙化 ESG 合規推動行動電子日誌

- 市場限制

- 網路安全漏洞和行動惡意軟體

- 傳統 OT 整合的複雜性

- 行動雲端中的資料主權障礙

- ATEX認證的本質安全設備供應有限

- 價值鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估宏觀經濟趨勢對市場的影響

第5章市場規模及成長預測

- 依設備類型

- 智慧型手機

- 藥片

- 筆記型電腦

- 穿戴式裝置

- 其他設備類型

- 按解決方案

- 行動裝置管理 (MDM)

- 行動應用程式管理(MAM)

- 行動安全和威脅預防

- 統一端點管理 (UEM)

- 其他解決方案

- 依部署方式

- 本地部署

- 雲

- 按組織規模

- 主要企業

- 小型企業

- 按製造垂直

- 離散製造

- 車

- 電子和半導體

- 航太和國防

- 工業機械

- 其他

- 流程製造

- 食品/飲料

- 製藥和生命科學

- 化學品

- 石油和天然氣

- 金屬和採礦

- 其他

- 離散製造

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 市場集中度分析

- 策略舉措和發展

- 市佔率分析

- 公司簡介

- VMware, Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- Blackberry Limited

- Citrix Systems, Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- Broadcom Inc.(Symantec)

- MobileIron(Ivanti)

- SOTI Inc.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Samsung SDS Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- McAfee, LLC

- Workspot, Inc.

- Tylr Mobile, Inc.

第7章 市場機會與未來展望

The enterprise mobility in manufacturing market size was USD 3.68 billion in 2025 and is forecast to reach USD 5.88 billion by 2030, expanding at a 9.8% CAGR.

The uptrend mirrors the sector's rapid transition toward Industry 4.0, where mobile-enabled workflows shorten response times, elevate asset visibility, and reinforce operational resilience. Growing deployment of private 5G networks, tighter integration between mobile devices and Manufacturing Execution Systems (MES), and the spread of edge-based augmented-reality applications collectively widen use cases for shop-floor mobility. Yet only 16% of manufacturers enjoy real-time production visibility, underscoring the sizeable headroom for digital tools that dissolve long-standing information silos. Cyber-physical security gaps and data-sovereignty constraints temper adoption, pushing vendors toward zero-trust architectures and region-specific cloud strategies.

Global Enterprise Mobility In Manufacturing Market Trends and Insights

Accelerating Industry 4.0 and IIoT adoption

Manufacturers are scaling Industrial Internet of Things deployments from proof-of-concept projects to plant-wide rollouts, linking sensors, machines, and mobile endpoints into unified data loops. Eighty-three percent of producers intend to embed generative AI in decision support during 2024, reflecting confidence that mobile dashboards can operationalize complex analytics at the edge. The pronounced impact shows in process plants where mobile cyber-physical systems let operators tweak parameters remotely in minutes rather than hours. Asian factories lead readiness, with 53% of managers targeting autonomous operations by 2040 compared to under half in Western facilities. Increased IIoT maturity lifts demand for rugged smartphones that merge scanning, visualization, and voice in a single device, streamlining maintenance and quality tasks. Vendors that pre-integrate hardware with low-code app builders shorten deployment cycles and reduce IT overhead.

BYOD/CYOD policies expand connected workforce

Factory policies are shifting from restrictive device rules toward structured Bring-Your-Own-Device and Choose-Your-Own-Device programs that broaden workforce access to digital tools. Sixty-three percent of manufacturers already tolerate personal devices on the floor, yet only 17% run formal BYOD frameworks, signalling a wide adoption gap. Formalized schemes improve agility during labor shortages by allowing new hires to onboard with familiar gear. Samsung's eight-step CYOD blueprint highlights the need for executive sponsorship, risk-based segmentation, and user training to safeguard data while sustaining productivity. Successful rollouts embed enterprise credentials into secure containers, route traffic through zero-trust gateways, and synchronize with MES and ERP back ends. Early adopters report shorter shift handovers and lower provisioning costs relative to a corporate-only hardware fleet.

Cybersecurity vulnerabilities and mobile malware

The fusion of IT and OT domains leaves production assets more exposed, with 93% of firms recording an OT intrusion last year while only 13% enjoy consolidated oversight. Mobile endpoints enlarge the attack surface as legacy antivirus and patch cycles rarely align with continuous operations. Ransomware campaigns increasingly target human-machine interface tablets, locking out supervisors from control systems. Manufacturers counter with micro-segmentation, mobile threat defense agents, and strict least-privilege policies, yet shortages in dual-skilled security professionals slow program maturity. Insurance underwriters respond by demanding proof of zero-trust frameworks before renewing cyber-risk coverage, adding financial pressure to remediate weaknesses.

Other drivers and restraints analyzed in the detailed report include:

- Private 5G and Wi-Fi 6 enable low-latency mobility

- Integration of mobile devices with MES and cloud PLM

- Legacy OT integration complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated 48.7% of total revenue in 2024, confirming smartphones as the primary mobile gateway for factory staff. Their all-in-one scanning, voice, and data functions cut hardware counts and lighten IT provisioning. Over the review period, vendors ruggedized form factors with MIL-STD-810H housings, hot-swappable batteries, and glove-friendly touchscreens, widening suitability for harsh shop-floor conditions. Operators value integrated cameras for remote assistance and AI-driven defect recognition, while supervisors exploit high-resolution displays for KPI dashboards during gemba walks.

The wearables sub-segment nonetheless records a 9.9% CAGR, propelled by hands-free picking, heads-up maintenance, and ergonomic load balancing. Smart glasses paired with digital twins reduce cognitive effort by overlaying repair steps and sensor trends in the worker's line of sight. Tablets anchor quality-assurance benches and engineering work cells where larger screens support CAD drawings and deviation logs. Laptops remain niche-bound to simulation and MES administration tasks that demand full keyboards. Emerging smart rings and industrial handhelds cluster under "other" but signal continual experimentation with task-specific form factors that could reshape device hierarchies as 2030 approaches.

Mobile Device Management held 46.2% revenue in 2024, a reflection of its long tenure as the compliance backbone for corporate-owned phones. MDM suites enforce password hygiene, remote wipe, and application whitelists, aligning with audit mandates under ISO 27001 and NIST CSF guidelines. However, the shift toward heterogenous fleets spanning laptops, scanners, and IoT sensors elevates Unified Endpoint Management to a 10.1% CAGR. UEM consolidates policy orchestration and patch status across Windows, Android, iOS, and Linux, reducing duplicated administrative effort.

Manufacturing clients gravitate to UEM's automation hooks that trigger remedial actions when a device crosses geofences or anomalous traffic trips a zero-trust rule. Mobile Application Management delivers containerization where personal devices participate in BYOD schemes, isolating corporate data without owning the hardware. Stand-alone mobile security plugins add machine-learning-based threat hunts, an asset in plants subject to critical infrastructure standards. Across all solution types, the momentum favors modular subscription bundles that flex with project scope and integrate native analytics consoles to evidence ROI for finance teams.

The Enterprise Mobility in Manufacturing Market is Segmented by Device Type (Smartphones, Tablets, and More), Solution (Mobile Device Management (MDM), and More), Deployment (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Manufacturing Vertical (Discrete Manufacturing and Process Manufacturing), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the enterprise mobility in manufacturing market with 39.1% of 2024 global revenue, benefiting from entrenched automation cultures and well-funded digitization road-maps. United States automotive and aerospace clusters upgrade existing mobility pilots to enterprise scopes, layering 5G campus networks over brownfield PLCs to support autonomous material handling and predictive service. Canada's food-processing sector rises as a niche adopter, harnessing tablets for allergen control and cold-chain documentation.

Europe follows, anchored by Germany's Industry 4.0 program and its Mittelstand champions that retrofit legacy machine parks with mobile dashboards. French pharmaceuticals employ intrinsically safe smartphones for clean-room documentation, while Italian machinery firms deploy augmented-reality wearables for remote field service. EU General Data Protection Regulation drives high demand for on-device encryption and data-sovereign cloud options, shaping procurement criteria across the bloc.

Asia-Pacific is the fastest-growing territory, posting a 10.4% CAGR as China, India and Southeast Asian economies leapfrog legacy systems. Chinese electronics giants deploy private 5G slices across megafactories to coordinate human and robotic tasks. India's government incentives under the Production Linked Incentive scheme accelerate SME adoption of cloud-based mobility dashboards. Singapore and South Korea spearhead pilot zones where smart-glasses equipped technicians interface with digital twins hosted in sovereign clouds. The region's momentum signals a potential shift in revenue leadership beyond 2030 as plants embrace high-density automation paired with mobile workforce augmentation.

- VMware, Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- Blackberry Limited

- Citrix Systems, Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- Broadcom Inc. (Symantec)

- MobileIron (Ivanti)

- SOTI Inc.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Samsung SDS Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- McAfee, LLC

- Workspot, Inc.

- Tylr Mobile, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Industry 4.0 and IIoT adoption

- 4.2.2 BYOD/CYOD policies expand connected workforce

- 4.2.3 Private 5G and Wi-Fi 6 enable low-latency mobility

- 4.2.4 Integration of mobile devices with MES and cloud PLM

- 4.2.5 Edge-powered AR and digital twins boost rugged-tablet demand

- 4.2.6 Paperless ESG compliance drives mobile e-logbooks

- 4.3 Market Restraints

- 4.3.1 Cybersecurity vulnerabilities and mobile malware

- 4.3.2 Legacy OT integration complexity

- 4.3.3 Data-sovereignty barriers to mobile cloud

- 4.3.4 Limited supply of ATEX-certified intrinsically-safe devices

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Smartphones

- 5.1.2 Tablets

- 5.1.3 Laptops

- 5.1.4 Wearables

- 5.1.5 Other Device Types

- 5.2 By Solution

- 5.2.1 Mobile Device Management (MDM)

- 5.2.2 Mobile Application Management (MAM)

- 5.2.3 Mobile Security and Threat Defense

- 5.2.4 Unified Endpoint Management (UEM)

- 5.2.5 Other Solutions

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Manufacturing Vertical

- 5.5.1 Discrete Manufacturing

- 5.5.1.1 Automotive

- 5.5.1.2 Electronics and Semiconductor

- 5.5.1.3 Aerospace and Defense

- 5.5.1.4 Industrial Machinery

- 5.5.1.5 Others

- 5.5.2 Process Manufacturing

- 5.5.2.1 Food and Beverage

- 5.5.2.2 Pharmaceuticals and Life Sciences

- 5.5.2.3 Chemicals

- 5.5.2.4 Oil and Gas

- 5.5.2.5 Metals and Mining

- 5.5.2.6 Others

- 5.5.1 Discrete Manufacturing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 Blackberry Limited

- 6.4.5 Citrix Systems, Inc.

- 6.4.6 IBM Corporation

- 6.4.7 SAP SE

- 6.4.8 Oracle Corporation

- 6.4.9 Broadcom Inc. (Symantec)

- 6.4.10 MobileIron (Ivanti)

- 6.4.11 SOTI Inc.

- 6.4.12 Zebra Technologies Corporation

- 6.4.13 Honeywell International Inc.

- 6.4.14 Samsung SDS Co., Ltd.

- 6.4.15 Infosys Limited

- 6.4.16 Tata Consultancy Services Limited

- 6.4.17 Tech Mahindra Limited

- 6.4.18 McAfee, LLC

- 6.4.19 Workspot, Inc.

- 6.4.20 Tylr Mobile, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment